0000040570false--09-30Q120240020000000003800026000007700000000405702023-10-012023-12-310000040570job:UnallocatedExpensesMember2022-10-012022-12-310000040570job:UnallocatedExpensesMember2023-10-012023-12-310000040570us-gaap:ConsolidatedEntitiesMember2022-10-012022-12-310000040570us-gaap:ConsolidatedEntitiesMember2023-10-012023-12-310000040570job:ProfessionalStaffingServicesMember2022-10-012022-12-310000040570job:ProfessionalStaffingServicesMember2023-10-012023-12-310000040570job:IndustrialStaffingServicesMember2022-10-012022-12-310000040570job:IndustrialStaffingServicesMember2023-10-012023-12-310000040570us-gaap:StockOptionMember2023-10-012023-12-310000040570us-gaap:StockOptionMember2022-10-012022-12-310000040570us-gaap:RestrictedStockMember2022-10-012022-12-310000040570job:TwoThousandThirteenIncentiveStockPlanMember2023-10-012023-12-310000040570us-gaap:WarrantMember2022-10-012023-09-300000040570us-gaap:WarrantMember2023-10-012023-12-310000040570job:ShareRepurchaseProgramMember2023-10-012023-12-310000040570job:StockOptionsMember2022-10-012023-09-300000040570job:StockOptionsMember2023-12-310000040570job:StockOptionsMember2023-10-012023-12-310000040570job:StockOptionsMember2023-09-300000040570us-gaap:RestrictedStockMember2023-12-310000040570us-gaap:RestrictedStockMember2023-10-012023-12-310000040570us-gaap:RestrictedStockMember2023-09-300000040570job:SecurityAndGuarantyAgreementMember2022-10-012022-12-310000040570job:SecurityAndGuarantyAgreementMember2023-09-300000040570job:SecurityAndGuarantyAgreementMember2023-12-310000040570job:SecurityAndGuarantyAgreementMember2023-10-012023-12-310000040570job:TradeNameMember2023-09-300000040570job:TradeNameMember2023-12-310000040570job:CustomerRelationshipMember2023-09-300000040570job:CustomerRelationshipMember2023-12-310000040570job:OperatingleasesconsistedMember2022-10-012022-12-310000040570job:OperatingleasesconsistedMember2023-09-300000040570job:OperatingleasesconsistedMember2023-12-310000040570job:OperatingleasesconsistedMember2022-10-012023-09-300000040570job:OperatingleasesconsistedMember2023-10-012023-12-310000040570job:financeleasesconsistedMember2023-09-300000040570job:financeleasesconsistedMember2023-12-310000040570job:financeleasesconsistedMember2022-10-012023-09-300000040570job:financeleasesconsistedMember2023-10-012023-12-310000040570job:OfficeEquipmentFurnitureFixturesAndLeaseholdImprovementsMember2023-09-300000040570job:OfficeEquipmentFurnitureFixturesAndLeaseholdImprovementsMember2023-12-310000040570job:ComputerSoftwareMember2023-09-300000040570job:ComputerSoftwareMember2023-12-310000040570job:AdvertisingExpensesMember2023-10-012023-12-310000040570job:AdvertisingExpensesMember2022-10-012022-12-310000040570job:TreasuryStocksMember2023-12-310000040570us-gaap:RetainedEarningsMember2023-12-310000040570us-gaap:CommonStockMember2023-12-310000040570job:TreasuryStocksMember2023-10-012023-12-310000040570us-gaap:RetainedEarningsMember2023-10-012023-12-310000040570us-gaap:CommonStockMember2023-10-012023-12-310000040570job:TreasuryStocksMember2023-09-300000040570us-gaap:RetainedEarningsMember2023-09-300000040570us-gaap:CommonStockMember2023-09-3000000405702022-12-310000040570job:TreasuryStocksMember2022-12-310000040570us-gaap:RetainedEarningsMember2022-12-310000040570us-gaap:CommonStockMember2022-12-310000040570job:TreasuryStocksMember2022-10-012022-12-310000040570us-gaap:RetainedEarningsMember2022-10-012022-12-310000040570us-gaap:CommonStockMember2022-10-012022-12-3100000405702022-09-300000040570job:TreasuryStocksMember2022-09-300000040570us-gaap:RetainedEarningsMember2022-09-300000040570us-gaap:CommonStockMember2022-09-3000000405702022-10-012022-12-3100000405702023-09-3000000405702023-12-3100000405702024-02-12iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

☒ | QUARTERLY REPORT UNDER SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the quarterly period ended December 31, 2023 |

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 1-05707

GEE GROUP INC. |

(Exact name of registrant as specified in its charter) |

Illinois | | 36-6097429 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

7751 Belfort Parkway, Suite 150, Jacksonville, FL 32256

(Address of principal executive offices)

(630) 954-0400

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, no par value | JOB | NYSE American |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares outstanding of the registrant’s common stock as of February 12, 2024 was 108,771,578.

GEE GROUP INC.

Form 10-Q

For the Quarter Ended December 31, 2023

INDEX

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING STATEMENTS

As a matter of policy, the Company does not provide forecasts of future financial performance. The statements made in this quarterly report on Form 10-Q, which are not historical facts, are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements often contain or are prefaced by words such as "believe", "will" and "expect." These statements are based on current expectations, estimates and projections about our business based, in part, on assumptions made by management. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. As a result of a number of factors, our actual results could differ materially from those set forth in the forward-looking statements. Certain factors that might cause the Company's actual results to differ materially from those in the forward-looking statements include, without limitation, general business conditions, economic uncertainties, changed socioeconomic norms following the Coronavirus Pandemic (“COVID-19”), the demand for the Company's services, competitive market pressures, the ability of the Company to attract and retain qualified personnel for regular full-time placement and contract assignments, the possibility of incurring liability for the Company's business activities, including the activities of its contract employees and events affecting its contract employees on client premises, cyber risks, including network security intrusions and/or loss of information, and the ability to attract and retain qualified corporate and branch management, as well as those risks discussed in the Company's Annual Report on Form 10-K for the year ended September 30, 2023, and in other documents which we file with the Securities and Exchange Commission. Any forward-looking statements speak only as of the date on which they are made, and the Company is under no obligation to (and expressly disclaims any such obligation to) and does not intend to update or alter its forward-looking statements whether as a result of new information, future events or otherwise.

Part I -FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS (unaudited)

GEE GROUP INC.

CONDENSED CONSOLIDATED BALANCE SHEETS (unaudited)

(Amounts in thousands)

| | December 31, 2023 | | | September 30, 2023 | |

ASSETS | | | | | | |

CURRENT ASSETS: | | | | | | |

Cash | | $ | 19,910 | | | $ | 22,471 | |

Accounts receivable, less allowances ($591 and $562, respectively) | | | 15,853 | | | | 18,451 | |

Prepaid expenses and other current assets | | | 1,286 | | | | 847 | |

Total current assets | | | 37,049 | | | | 41,769 | |

Property and equipment, net | | | 780 | | | | 846 | |

Goodwill | | | 61,293 | | | | 61,293 | |

Intangible assets, net | | | 7,686 | | | | 8,406 | |

Deferred tax assets, net | | | 7,064 | | | | 7,064 | |

Right-of-use assets | | | 3,274 | | | | 3,637 | |

Other long-term assets | | | 480 | | | | 596 | |

TOTAL ASSETS | | $ | 117,626 | | | $ | 123,611 | |

| | | | | | | | |

LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | | |

CURRENT LIABILITIES: | | | | | | | | |

Accounts payable | | $ | 2,486 | | | $ | 2,762 | |

Accrued compensation | | | 3,358 | | | | 5,464 | |

Current operating lease liabilities | | | 1,377 | | | | 1,475 | |

Other current liabilities | | | 1,705 | | | | 1,778 | |

Total current liabilities | | | 8,926 | | | | 11,479 | |

Noncurrent operating lease liabilities | | | 2,186 | | | | 2,470 | |

Other long-term liabilities | | | 190 | | | | 361 | |

Total liabilities | | $ | 11,302 | | | $ | 14,310 | |

| | | | | | | | |

Commitments and contingencies (Note 12) | | | | | | | | |

| | | | | | | | |

SHAREHOLDERS' EQUITY: | | | | | | | | |

Common stock, no par value; authorized - 200,000 shares; 114,900 shares issued and 108,772 shares outstanding at December 31, 2023, and 114,900 shares issued and 111,489 shares outstanding at September 30, 2023 | | | 113,068 | | | | 112,915 | |

Accumulated deficit | | | (3,185 | ) | | | (1,630 | ) |

Treasury stock; at cost - 6,128 shares at December 31, 2023 and 3,411 shares at September 30, 2023 | | | (3,559 | ) | | | (1,984 | ) |

Total shareholders' equity | | | 106,324 | | | | 109,301 | |

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | | $ | 117,626 | | | $ | 123,611 | |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

GEE GROUP INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited)

(Amounts in thousands except per share data)

| | Three Months Ended | |

| | December 31, | |

| | 2023 | | | 2022 | |

NET REVENUES: | | | | | | |

Contract staffing services | | $ | 27,576 | | | $ | 35,401 | |

Direct hire placement services | | | 3,055 | | | | 5,747 | |

NET REVENUES | | | 30,631 | | | | 41,148 | |

| | | | | | | | |

Cost of contract services | | | 20,895 | | | | 26,757 | |

GROSS PROFIT | | | 9,736 | | | | 14,391 | |

| | | | | | | | |

Selling, general and administrative expenses | | | 10,606 | | | | 12,808 | |

Depreciation expense | | | 84 | | | | 101 | |

Amortization of intangible assets | | | 720 | | | | 720 | |

INCOME (LOSS) FROM OPERATIONS | | | (1,674 | ) | | | 762 | |

Interest expense | | | (71 | ) | | | (73 | ) |

Interest income | | | 190 | | | | 38 | |

INCOME (LOSS) BEFORE INCOME TAX PROVISION | | | (1,555 | ) | | | 727 | |

Provision for income tax expense | | | - | | | | 73 | |

NET INCOME (LOSS) | | $ | (1,555 | ) | | $ | 654 | |

| | | | | | | | |

BASIC EARNINGS (LOSS) PER SHARE | | $ | (0.01 | ) | | $ | 0.01 | |

DILUTED EARNINGS (LOSS) PER SHARE | | $ | (0.01 | ) | | $ | 0.01 | |

| | | | | | | | |

WEIGHTED AVERAGE SHARES OUTSTANDING: | | | | | | | | |

BASIC | | | 109,907 | | | | 114,450 | |

DILUTED | | | 109,907 | | | | 114,885 | |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

GEE GROUP INC.

CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY (unaudited)

(Amounts in thousands)

| | Common | | | | | | | | | | | | Total | |

| | Stock | | | Common | | | Accumulated | | | Treasury | | | Shareholders' | |

| | Shares | | | Stock | | | Deficit | | | Stock | | | Equity | |

Balance, September 30, 2023 | | | 114,900 | | | $ | 112,915 | | | $ | (1,630 | ) | | $ | (1,984 | ) | | $ | 109,301 | |

Purchase of treasury stock | | | - | | | | - | | | | - | | | | (1,575 | ) | | | (1,575 | ) |

Share-based compensation | | | - | | | | 153 | | | | - | | | | - | | | | 153 | |

Net loss | | | - | | | | - | | | | (1,555 | ) | | | - | | | | (1,555 | ) |

Balance, December 31, 2023 | | | 114,900 | | | $ | 113,068 | | | $ | (3,185 | ) | | $ | (3,559 | ) | | $ | 106,324 | |

| | Common | | | | | | | | | | | | Total | |

| | Stock | | | Common | | | Accumulated | | | Treasury | | | Shareholders' | |

| | Shares | | | Stock | | | Deficit | | | Stock | | | Equity | |

Balance, September 30, 2022 | | | 114,450 | | | $ | 112,051 | | | $ | (11,048 | ) | | $ | - | | | $ | 101,003 | |

Share-based compensation | | | - | | | | 374 | | | | - | | | | - | | | | 374 | |

Net income | | | - | | | | - | | | | 654 | | | | - | | | | 654 | |

Balance, December 31, 2022 | | | 114,450 | | | $ | 112,425 | | | $ | (10,394 | ) | | $ | - | | | $ | 102,031 | |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

GEE GROUP INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (unaudited)

(Amounts in thousands)

| | Three Months Ended | |

| | December 31, | |

| | 2023 | | | 2022 | |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | |

Net income (loss) | | $ | (1,555 | ) | | $ | 654 | |

Adjustments to reconcile net income (loss) to cash used in operating activities: | | | | | | | | |

Depreciation and amortization | | | 804 | | | | 821 | |

Non-cash lease expense | | | 363 | | | | 351 | |

Share-based compensation | | | 153 | | | | 374 | |

Increase (decrease) in allowance for credit losses | | | 65 | | | | (7 | ) |

Deferred income taxes | | | - | | | | 52 | |

Amortization of debt discount | | | 38 | | | | 38 | |

Changes in operating assets and liabilities: | | | | | | | | |

Accounts receivable | | | 2,533 | | | | 2,438 | |

Accounts payable | | | (276 | ) | | | (89 | ) |

Accrued compensation | | | (2,106 | ) | | | (915 | ) |

Other assets | | | (436 | ) | | | (114 | ) |

Other liabilities | | | (502 | ) | | | (3,880 | ) |

Net cash used in operating activities | | | (919 | ) | | | (277 | ) |

| | | | | | | | |

CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | | |

Acquisition of property and equipment | | | (26 | ) | | | (50 | ) |

Net cash used in investing activities | | | (26 | ) | | | (50 | ) |

| | | | | | | | |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | | |

Purchases of treasury stock | | | (1,575 | ) | | | - | |

Payments on finance leases | | | (41 | ) | | | (49 | ) |

Net cash used in financing activities | | | (1,616 | ) | | | (49 | ) |

| | | | | | | | |

Net change in cash | | | (2,561 | ) | | | (376 | ) |

| | | | | | | | |

Cash at beginning of period | | | 22,471 | | | | 18,848 | |

| | | | | | | | |

Cash at end of period | | $ | 19,910 | | | $ | 18,472 | |

| | | | | | | | |

SUPPLEMENTAL CASH FLOW INFORMATION: | | | | | | | | |

| | | | | | | | |

Cash paid for interest | | $ | 32 | | | $ | 35 | |

Cash paid for taxes | | | 25 | | | | - | |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

GEE GROUP INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

(Amounts in thousands except per share data, unless otherwise stated)

1. Basis of Presentation

The accompanying unaudited condensed consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America for interim financial information and with the instructions to Article 8 of Regulation S-X. Accordingly, they do not include all of the information and notes required by accounting principles generally accepted in the United States of America for complete consolidated financial statements. In the opinion of management, all adjustments considered necessary for a fair presentation have been included. Operating results for the three-month period ended December 31, 2023 are not necessarily indicative of the results that may be expected for the year ending September 30, 2024. The unaudited condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and notes thereto included in the Company's Annual Report on Form 10-K for the year ended September 30, 2023 as filed on December 18, 2023.

Certain reclassifications have been made to the prior year’s condensed consolidated financial statements and/or related disclosures to conform to the current year’s presentation.

2. Recent Accounting Pronouncements

Recently Adopted

In June 2016, the FASB issued ASU 2016-13, Financial Instruments-Credit Losses, which contains authoritative guidance amending how entities will measure credit losses for most financial assets and certain other instruments that are not measured at fair value through net income. The guidance requires the application of a current expected credit loss model, which is a new impairment model based on expected losses. The new guidance is effective for fiscal years beginning after December 15, 2022. ASU 2016-13 became effective for the Company on October 1, 2023. The new guidance has been implemented during the quarter ended December 31, 2023, is applicable to the Company’s trade (accounts) receivable and did not have a material impact on our unaudited condensed consolidated financial statements taken as a whole.

Not Yet Adopted

In November 2023, the FASB issued ASU 2023-07, Segment Reporting (Topic 280), which enhances prior reportable segment disclosure requirements in part by requiring entities to disclose significant expenses related to their reportable segments. The guidance also requires disclosure of the Chief Operating Decision Maker's (“CODM”) position for each segment and detail of how the CODM uses financial reporting to assess their segment’s performance. The new guidance is effective for fiscal years beginning after December 15, 2023 and interim periods within fiscal years beginning after December 15, 2024. The Company has not yet determined the potential impact of implementation of the new guidance on its condensed consolidated financial statements taken as a whole.

3. Allowance for Credit Losses and Falloffs

Allowance for Credit Losses

The Company adopted the methodology under Accounting Standards Update (“ASU”) 2016-13, Financial Instruments-Credit Losses (Topic 326), during the quarter ended December 31, 2023. The amendments in ASU 2016-13 replace the probable incurred loss impairment methodology underlying our previous allowance for doubtful accounts with a methodology that reflects expected credit losses and requires consideration of a broader range of reasonable and supportable information to inform credit loss estimates. Under ASU 2016-13, an allowance is recorded with a corresponding charge to bad debt expense for expected credit losses in our accounts receivable including consideration of the effects of past, present and future conditions that may reasonably be expected to impact credit losses. The Company charges off uncollectible accounts against the allowance once the invoices are deemed unlikely to be collectible. The allowance for credit losses is reflected in the condensed consolidated balance sheet as a reduction of accounts receivable. The impact of the adoption of ASU 2016-13 was immaterial to the Company’s unaudited condensed consolidated financial statements.

GEE GROUP INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

(Amounts in thousands except per share data, unless otherwise stated)

As of December 31, 2023 and September 30, 2023 the allowance for credit losses was $591 and $562, respectively.

A summary of changes in this account is as follows:

Allowance for credit losses as of September 30, 2023 | | $ | 562 | |

Provisions for credit losses | | | 65 | |

Accounts receivable write-offs | | | (36 | ) |

Allowance for credit losses as of December 31, 2023 | | $ | 591 | |

Liabilities for Direct Hire Placement Falloffs

Direct hire placement service revenues from contracts with customers are recognized when employment candidates accept offers of employment, less a provision for estimated credits or refunds to customers as the result of applicants not remaining employed for the entirety of the Company’s guarantee period (referred to as “falloffs”). The Company’s guarantee periods for permanently placed employees generally range from 60 to 90 days from the date of hire.

Charges for expected future falloffs are recorded as reductions of revenues for estimated losses due to applicants not remaining employed for the Company’s guarantee period. In connection with the adoption of ASU 2016-13, the Company has reclassified its allowance for falloffs from being combined with the former allowance for doubtful accounts, a contra-asset, to other current liabilities. Liabilities for falloffs and refunds during the period are reflected in the unaudited condensed consolidated balance sheets in the amounts of $115 and $118, as of December 31, 2023, and September 30, 3023, respectively. The corresponding charges included in the condensed consolidated statements of operations as reductions of direct hire placement service revenues were approximately $244 and $165 for the three months ended December 31, 2023 and 2022, respectively.

4. Advertising Expenses

The Company expenses the costs of print and internet media advertising and promotions as incurred and reports these costs in selling, general and administrative expenses. Advertising expenses totaled $541 and $581 for the three months ended December 31, 2023 and 2022, respectively.

5. Earnings per Share

Basic earnings per share are computed by dividing net income attributable to common stockholders by the weighted average common shares outstanding for the period, which is computed using shares issued and outstanding. Diluted earnings per share is computed giving effect to all potentially dilutive common shares. Potentially dilutive common shares may consist of incremental shares issuable upon the vesting of restricted shares granted but unissued, exercise of stock options and warrants. The dilutive effect of the common stock equivalents is reflected in earnings per share by use of the treasury stock method.

The weighted average dilutive incremental shares, or common stock equivalents, included in the calculations of dilutive shares were 435 for the three months ended December 31, 2022. Due to the loss of continuing operations reported for the three months ended December 31, 2023, there were no dilutive incremental shares considered in the calculation of dilutive shares. Common stock equivalents, which are excluded because their effect is anti-dilutive, were approximately 3,682 and 3,373 for the three-month periods ended December 31, 2023 and 2022, respectively.

GEE GROUP INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

(Amounts in thousands except per share data, unless otherwise stated)

6. Property and Equipment

Property and equipment, net consisted of the following:

| | December 31, 2023 | | | September 30, 2023 | |

| | | | | | |

Computer software | | $ | 481 | | | $ | 481 | |

Office equipment, furniture, fixtures and leasehold improvements | | | 3,839 | | | | 3,828 | |

Total property and equipment, at cost | | | 4,320 | | | | 4,309 | |

Accumulated depreciation and amortization | | | (3,540 | ) | | | (3,463 | ) |

Property and equipment, net | | $ | 780 | | | $ | 846 | |

7. Leases

The Company occasionally acquires equipment under finance leases including hardware and software used by our IT department to improve security and capacity, vehicles used by our Industrial Segment, and certain furniture for our offices. Terms for these leases generally range from two to six years.

Supplemental balance sheet information related to finance leases consisted of the following:

| | December 31, 2023 | | | September 30, 2023 | |

Weighted average remaining lease term for finance leases | | 2.6 years | | | 2.8 years | |

Weighted average discount rate for finance leases | | | 6.5 | % | | | | 6.6 | % | |

The table below reconciles the undiscounted future minimum lease payments under non-cancelable finance lease agreements to the total finance lease liabilities recognized on the unaudited condensed consolidated balance sheets, included in other current liabilities and other long-term liabilities, as of December 31, 2023:

Remainder of Fiscal 2024 | | $ | 119 | |

Fiscal 2025 | | | 108 | |

Fiscal 2026 | | | 105 | |

Fiscal 2027 | | | 21 | |

Fiscal 2028 | | | - | |

Less: Imputed interest | | | (33 | ) |

Present value of finance lease liabilities (a) | | $ | 320 | |

(a) Includes current portion of $130 for finance leases.

The Company leases space for all its branch offices, which are generally located either in downtown or suburban business centers, and for its corporate headquarters. Branch offices are generally leased over periods ranging from three to five years. The corporate office lease expires in 2026. The Company’s leases generally provide for payment of basic rent plus a share of building real estate taxes, maintenance costs and utilities.

Operating lease expenses were $530 and $588 for the three-month periods ended December 31, 2023 and 2022, respectively.

Supplemental cash flow information related to operating leases consisted of the following:

| | Three Months Ended December 31, | |

| | 2023 | | | 2022 | |

Cash paid for operating lease liabilities | | $ | 430 | | | $ | 473 | |

Right-of-use assets obtained in exchange for new operating lease liabilities | | | - | | | | 518 | |

GEE GROUP INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

(Amounts in thousands except per share data, unless otherwise stated)

Supplemental balance sheet information related to operating leases consisted of the following:

| | December 31, 2023 | | | September 30, 2023 | |

Weighted average remaining lease term for operating leases | | 1.9 years | | | 2.2 years | |

Weighted average discount rate for operating leases | | | 5.7 | % | | | | 5.7 | % | |

The table below reconciles the undiscounted future minimum lease payments under non-cancelable lease agreements having initial terms in excess of one year to the total operating lease liabilities recognized on the unaudited condensed consolidated balance sheet as of December 31, 2023, including certain closed offices are as follows:

Remainder of Fiscal 2024 | | $ | 1,227 | |

Fiscal 2025 | | | 1,111 | |

Fiscal 2026 | | | 700 | |

Fiscal 2027 | | | 544 | |

Fiscal 2028 | | | 302 | |

Less: Imputed interest | | | (321 | ) |

Present value of operating lease liabilities (a) | | $ | 3,563 | |

(a) Includes current portion of $1,377 for operating leases.

8. Goodwill and Intangible Assets

Goodwill

For purposes of performing its annual goodwill impairment assessment as of September 30, 2023, the Company applied certain valuation techniques and assumptions to its professional and industrial reporting units and considered recent trends in the Company’s stock price, implied control or acquisition premiums, earnings, and other possible factors and their effects on estimated fair value of the Company’s reporting units. Upon completion of the Company’s most recent annual goodwill impairment assessment performed as of September 30, 2023, it was determined that its goodwill was not impaired.

In view of the decline in operating results and net loss experienced in the three-month period ended December 31, 2023, management considered whether these results are representative of a permanent or longer-term change in trend and a triggering event. The Company updated its financial forecast for the December 2023 quarterly results and performed sensitivity tests on the recent annual goodwill impairment analysis completed as of September 30, 2023, using the updated information. The results of the sensitivity testing indicate that the conclusions of the recent annual goodwill assessment would not have changed using the updated financial forecasts and management has concluded that the most recent quarterly results do not indicate a potential impairment of the recorded goodwill of the Company’s reporting units as of December 31, 2023. Accordingly, no impairment charge was recognized during the three-month period ended December 31, 2023.

Intangible Assets

The following tables set forth the costs, accumulated amortization and net book value of the Company’s separately identifiable intangible assets as of December 31, 2023 and September 30, 2023 and estimated future amortization expense.

| | December 31, 2023 | | | September 30, 2023 | |

| | Cost | | | Accumulated Amortization | | | Net Book Value | | | Cost | | | Accumulated Amortization | | | Net Book Value | |

Customer relationships | | $ | 29,070 | | | $ | (21,780 | ) | | $ | 7,290 | | | $ | 29,070 | | | $ | (21,120 | ) | | $ | 7,950 | |

Trade names | | | 8,329 | | | | (7,933 | ) | | | 396 | | | | 8,329 | | | | (7,873 | ) | | | 456 | |

Total | | $ | 37,399 | | | $ | (29,713 | ) | | $ | 7,686 | | | $ | 37,399 | | | $ | (28,993 | ) | | $ | 8,406 | |

GEE GROUP INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

(Amounts in thousands except per share data, unless otherwise stated)

Remainder of Fiscal 2024 | | $ | 2,159 | |

Fiscal 2025 | | | 2,741 | |

Fiscal 2026 | | | 1,870 | |

Fiscal 2027 | | | 916 | |

Fiscal 2028 | | | - | |

| | $ | 7,686 | |

Intangible assets that represent customer relationships are amortized on the basis of estimated future undiscounted cash flows or using the straight-line basis over estimated remaining useful lives of five to ten years. Trade names are amortized on a straight-line basis over their respective estimated useful lives of between five and ten years.

9. Senior Bank Loan, Security and Guarantee Agreement

The Company and its subsidiaries have a Loan, Security and Guaranty Agreement for a $20 million asset-based senior secured revolving credit facility with CIT Bank, N.A. The CIT Facility is collateralized by 100% of the assets of the Company and its subsidiaries who are co-borrowers and/or guarantors. The CIT Facility matures on the fifth anniversary of the closing date (May 14, 2026).

As of December 31, 2023, the Company had no outstanding borrowings and $9,348 available for borrowing under the terms of the CIT Facility. The Company had $370 and $408 in unamortized debt issuance costs associated with the CIT Facility as of December 31, 2023 and September 30, 2023, respectively. The amortization expense of these debt costs totaled $38 for both three-month periods ended December 31, 2023 and 2022. The unused line fees incurred and included in interest expense totaled $26 for both three-month periods ended December 31, 2023 and 2022.

On December 15, 2023, the Company and CIT Bank entered into Amendment No. 2 to the CIT Facility (“Amendment No. 2”), which provides for an increase in the CIT Facility’s concentration limits for certain large clients at the discretion of CIT Bank.

10. Shareholders’ Equity (Share-based Compensation and Share Repurchase Program)

Share-based Compensation

Amended and Restated 2013 Incentive Stock Plan, as amended

As of December 31, 2023, there were vested and unvested shares of restricted stock and stock options outstanding under the Company’s Amended and Restated 2013 Incentive Stock Plan, as amended (“Incentive Stock Plan”). During fiscal 2021, the Incentive Stock Plan was amended to increase the total shares available for restricted stock and stock options by 10,000 to a total of 15,000 (7,500 restricted stock shares and 7,500 stock option shares). The Incentive Stock Plan authorizes the Compensation Committee of the Board of Directors to grant either incentive or non-statutory stock options to employees. Vesting periods are established by the Compensation Committee at the time of grant.

As of December 31, 2023, there were 7,915 shares available to be granted under the Plan (4,021 shares available for restricted stock grants and 3,894 shares available for non-qualified stock option grants).

Restricted Stock

On September 27, 2022, the Company adopted a new annual incentive compensation program (“AICP”) for its executives to be administered under the Company’s Incentive Stock Plan. The AICP includes a long-term incentive (“LTI”) compensation plan in the form of restricted stock awards comprised of two components: one that vests based on future service only, and a second that vests based on future service and performance. Initial awards under both service-only and service plus performance-based components of the AICP LTI plan are determined based on financial performance measures for the immediately preceding fiscal year.

GEE GROUP INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

(Amounts in thousands except per share data, unless otherwise stated)

The Company granted 195 shares of restricted stock under the AICP during the three months ended December 31, 2023. Of the 195 shares granted, 164 were granted based on actual fiscal 2023 results and will cliff vest on December 1, 2026, based on future service only. Of the remaining 31 shares granted which vest based on future service and performance, 5 were granted based on fiscal 2023 results and will cliff vest on December 1, 2026, the third anniversary from their date of grant. The remaining 26 future service and performance-based shares granted were based on fiscal 2022 results and will cliff vest on December 1, 2025, the second anniversary from their date of grant. The 31 service plus performance-based restricted shares are subject to adjustment over their corresponding fiscal 2024 reporting period based on probability of achieving the fiscal 2024 financial targets set by the Company’s Board of Directors. The shares currently reported have been adjusted based on the probable outcome as compared to these financial targets. The final number of fiscal 2023 and 2022 service plus performance-based restricted shares granted will be determined once the actual financial performance of the Company is determined for fiscal 2024.

Share-based compensation expense attributable to restricted stock was $74 and $87 during the three months ended December 31, 2023 and 2022, respectively. As of December 31, 2023, there was approximately $539 of unrecognized compensation expense related to restricted stock outstanding and the weighted average vesting period for those grants was 2.98 years.

| | Number of Shares | | | Weighted Average Fair Value ($) | |

Non-vested restricted stock outstanding as of September 30, 2023 | | | 1,384 | | | | 0.62 | |

Granted | | | 195 | | | | 0.54 | |

Vested | | | - | | | | - | |

Non-vested restricted stock outstanding as of December 31, 2023 | | | 1,579 | | | | 0.61 | |

Warrants

The Company had 77 warrants outstanding as of December 31, 2023 and September 30, 2023 with a weighted average exercise price per share of $2 and a weighted average remaining contractual life of 1.25 and 1.50, respectively. No warrants were granted or expired during the three months ended December 31, 2023.

Stock Options

All stock options outstanding as of December 31, 2023 and September 30, 2023 were non-qualified stock options, had exercise prices equal to the market price on the date of grant, and had expiration dates ten years from the date of grant.

The Company did not grant stock options during the three months ended December 31, 2023. The Company’s stock options previously granted generally vest on annual schedules during periods ranging from two to four years, although some options are fully vested upon grant. Share-based compensation expense attributable to stock options is recognized over their estimated remaining lives and was $79 and $287 for the three months ended December 31, 2023 and 2022, respectively. As of December 31, 2023, there was approximately $792 of unrecognized compensation expense related to unvested stock options outstanding, and the weighted average vesting period for those options was 3.98 years.

GEE GROUP INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

(Amounts in thousands except per share data, unless otherwise stated)

A summary of stock option activity is as follows:

| | Number of Shares | | | Weighted Average Exercise Price per share ($) | | | Weighted Average Fair Value per share ($) | | | Weighted Average Remaining Contractual Life (Years) | | | Total Intrinsic Value of Options ($) | |

Options outstanding as of September 30, 2023 | | | 3,933 | | | | 1.18 | | | | 0.96 | | | | 7.96 | | | | - | |

Granted | | | - | | | | - | | | | - | | | | - | | | | - | |

Forfeited | | | (328 | ) | | | 1.21 | | | | 1.10 | | | | - | | | | - | |

Options outstanding as of December 31, 2023 | | | 3,605 | | | | 1.18 | | | | 0.95 | | | | 7.75 | | | | - | |

| | | | | | | | | | | | | | | | | | | | |

Exercisable as of September 30, 2023 | | | 2,190 | | | | 1.64 | | | | 1.31 | | | | 6.80 | | | | - | |

Exercisable as of December 31, 2023 | | | 2,084 | | | | 1.60 | | | | 1.26 | | | | 6.66 | | | | - | |

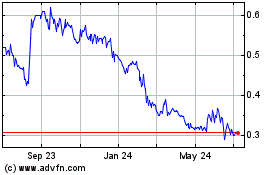

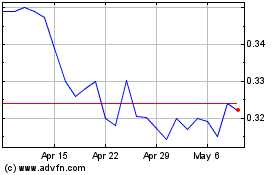

Share Repurchase Program

On April 27, 2023, the Company’s Board of Directors approved a share repurchase program authorizing the Company to purchase up to an aggregate of $20 million of the Company’s currently outstanding shares of common stock. The share repurchase program continued through December 31, 2023. The repurchase program did not obligate the Company to repurchase any number of shares of common stock. The share repurchase program was conducted in accordance with Rules 10b-5 and 10b-18 of the Securities Exchange Act of 1934, as amended. Subject to applicable rules and regulations, shares of common stock were purchased from time to time in the open market transactions and in amounts the Company deemed appropriate, based on factors such as market conditions, legal requirements, and other business considerations.

During the three-month period ended December 31, 2023, the Company repurchased 2,717 shares of its common stock for $1,575, including commissions and fees, at an average price of $0.58 per share excluding these associated costs.

11. Income Tax

The following table presents the provision for income taxes and our effective tax rate for the three-month periods ended December 31, 2023 and 2022:

| | | December 31, | |

| | | 2023 | | | 2022 | |

Provision for income taxes | | | - | | | | 73 | | |

Effective tax rate | | | 2 | % | | | 10 | % | |

No income tax benefit was recognized for the three months ended December 31, 2023 because the Company is forecasting pre-tax income for the full year so the tax benefit is not expected to be realized during the current year in accordance with the provisions of Accounting Standards Codification (“ASC”) Topic 740, Income Taxes. The effective income tax rates presented are based upon the estimated income for the year, and adjustments, if any, in the applicable quarterly periods for the potential tax consequences, benefits, resolutions of tax audits or other tax contingencies.

The effective tax rate for the three months ended December 31, 2023 is lower than the statutory rate primarily due to the effect of federal tax credits and state and local taxes. The effective tax rate for the three months ended December 31, 2022 is lower than the statutory rate primarily due to the effect of the change in valuation allowance on the net deferred tax asset (“DTA”) position.

GEE GROUP INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

(Amounts in thousands except per share data, unless otherwise stated)

12. Commitments and Contingencies

Litigation and Claims

The Company and its subsidiaries are involved in litigation that arises in the ordinary course of business. There are no pending significant legal proceedings to which the Company is a party for which management believes the ultimate outcome would have a material adverse effect on the Company’s financial position.

13. Segment Data

The Company provides the following distinctive services: (a) direct hire placement services, (b) temporary professional services staffing in the fields of information technology, accounting, finance and office, engineering, and medical, and (c) temporary industrial staffing. These services can be divided into two reportable segments: Professional Staffing Services and Industrial Staffing Services. Some selling, general and administrative expenses are not fully allocated among these segments.

Unallocated corporate expenses primarily include certain executive and administrative salaries and related expenses, corporate legal expenses, share-based compensation expenses, consulting expenses, audit fees, corporate rent and facility costs, Board related fees, acquisition, integration and restructuring expenses, and interest expense.

| | Three Months Ended | |

| | December 31, | |

| | 2023 | | | 2022 | |

Industrial Staffing Services | | | | | | |

Contract services revenue | | $ | 2,494 | | | $ | 3,618 | |

Contract services gross margin | | | 16.0% | | | | 15.5% | |

Income (loss) from operations | | $ | (36) | | | $ | 5 | |

Depreciation and amortization | | | 12 | | | | 15 | |

| | | | | | | | |

Professional Staffing Services | | | | | | | | |

Permanent placement revenue | | $ | 3,055 | | | $ | 5,747 | |

Placement services gross margin | | | 100.0% | | | | 100.0% | |

Contract services revenue | | $ | 25,082 | | | $ | 31,783 | |

Contract services gross margin | | | 25.0% | | | | 25.4% | |

Income from operations | | $ | 29 | | | $ | 2,554 | |

Depreciation and amortization | | | 792 | | | | 806 | |

| | | | | | | | |

Unallocated Expenses | | | | | | | | |

Corporate administrative expenses | | $ | 1,287 | | | $ | 1,231 | |

Corporate facility expenses | | | 112 | | | | 110 | |

Share-based compensation expense | | | 153 | | | | 374 | |

Board related expenses | | | 115 | | | | 82 | |

Total unallocated expenses | | $ | 1,667 | | | $ | 1,797 | |

| | | | | | | | |

Consolidated | | | | | | | | |

Total revenue | | $ | 30,631 | | | $ | 41,148 | |

Income (loss) from operations | | | (1,674) | | | | 762 | |

Depreciation and amortization | | | 804 | | | | 821 | |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Overview

GEE Group Inc. and its wholly owned material operating subsidiaries, Access Data Consulting Corporation, Agile Resources, Inc., BMCH, Inc., Paladin Consulting, Inc., Scribe Solutions, Inc., SNI Companies, Inc., Triad Logistics, Inc., and Triad Personnel Services, Inc. are providers of permanent and temporary professional and industrial staffing and placement services in and near several major U.S cities. We specialize in the placement of information technology, accounting, finance, office, and engineering professionals for direct hire and contract staffing for our clients, data entry assistants (medical scribes) who specialize in electronic medical records (EMR) services for emergency departments, specialty physician practices and clinics, and provide temporary staffing services for our industrial clients. The acquisitions of Scribe Solutions, Inc., a Florida corporation (“Scribe”) in April 2015, Agile Resources, Inc., a Georgia corporation (“Agile”) in July 2015, Access Data Consulting Corporation, a Colorado corporation (“Access”) in October 2015, Paladin Consulting Inc. (“Paladin”) in January 2016, and SNI Companies, Inc., a Delaware corporation (“SNI”) in April 2017, expanded our geographical footprint within the professional placement and contract staffing verticals or end markets of information technology, accounting, finance, office, engineering professionals, and medical scribes.

The Company markets its services using the trade names General Employment Enterprises, Omni One, Ashley Ellis, Agile Resources, Scribe Solutions Inc., Access Data Consulting Corporation, Paladin Consulting Inc., SNI Companies (including Staffing Now, Accounting Now, and Certes), Triad Personnel Services and Triad Staffing. As of December 31, 2023, we operated from locations in eleven (11) states, including twenty-six (26) branch offices in downtown or suburban areas of major U.S. cities and four (4) additional U.S. locations utilizing local staff members working remotely. We have offices or serve markets remotely, as follows; (i) one office in each of Connecticut, Illinois, Minnesota, and New Jersey, and one remote local market presence in Virginia; (ii) two offices each in Georgia and Massachusetts; (iii) three offices in Colorado; (iv) two offices and two additional local market presences in Texas; (v) six offices and one additional local market presence in Florida; and (vi) seven offices in Ohio.

Management has implemented a strategy which includes organic and acquisition growth components. Management’s organic growth strategy includes seeking out and winning new client business, as well as expansion of existing client business and on-going cost reduction and productivity improvement efforts in operations. Management’s acquisition growth strategy includes identifying strategic, accretive acquisitions, financed primarily through a combination of cash and debt, including seller financing, the issuance of equity in appropriate circumstances, and the use of earn-outs where efficient to improve the overall profitability and cash flows of the Company.

The Company’s contract and placement services are principally provided under two operating divisions or segments: Professional Staffing Services and Industrial Staffing Services. We believe our current segments and array of businesses and brands within our segments complement one another and position us for future growth.

Results of Operations

Three Months Ended December 31, 2023 Compared to the Three Months Ended December 31, 2022

Summary and Outlook

Results for the first fiscal quarter ended December 31, 2023 declined from those of the comparable first fiscal quarter of 2023, ended December 31, 2022, primarily as the result of economic and labor market uncertainties and instability experienced throughout 2023. These conditions have negatively impacted the number of orders and candidates available to fill orders for placements across our businesses. Likewise, the U.S. Staffing Industry, as a whole, has experienced declines in overall performance at the industry level and the industry outlook is for these conditions to continue during at least the first half of calendar year 2024. We also expect our future near-term results to be similarly impacted, in which case our results for the full fiscal year ending September 30, 2024, also may be expected to be lower than those reported for our most recent fiscal year ended September 30, 2023, accordingly.

Net Revenues

Consolidated net revenues are comprised of the following:

| | Three Months | | | | | | | |

| | Ended December 31, | | | | | | | |

| | 2023 | | | 2022 | | | Change | | | Change | |

Professional contract services | | $ | 25,082 | | | $ | 31,783 | | | $ | (6,701) | | | | -21% | |

Industrial contract services | | | 2,494 | | | | 3,618 | | | | (1,124) | | | | -31% | |

Total professional and industrial contract services | | | 27,576 | | | | 35,401 | | | | (7,825) | | | | -22% | |

| | | | | | | | | | | | | | | | |

Direct hire placement services | | | 3,055 | | | | 5,747 | | | | (2,692) | | | | -47% | |

Consolidated net revenues | | $ | 30,631 | | | $ | 41,148 | | | $ | (10,517) | | | | -26% | |

Contract staffing services contributed $27,576 or approximately 90% of consolidated revenue and direct hire placement services contributed $3,055, or approximately 10%, of consolidated revenue for the three months ended December 31, 2023. This compares to contract staffing services revenue of $35,401, or approximately 86%, of consolidated revenue and direct hire placement revenue of $5,747, or approximately 14%, of consolidated revenue for the three months ended December 31, 2022.

Economic weakness and uncertainties, including persistent inflation and the possibility of recession, continued to negatively impact the Company’s results through the three months ended December 31, 2023. Professional contract staffing services revenues decreased $6,701, or 21%, as compared to the three months ended December 31, 2022. Industrial staffing services for the quarter decreased by $1,124, or 31%, mainly due to decreases in orders from clients and competition for orders and temporary labor to fill orders, accordingly.

Direct hire placement revenue for the three months ended December 31, 2023 decreased by $2,692, or approximately 47%, over the three months ended December 31, 2022. Direct hire opportunities tend to be highly cyclical and demand dependent, tending to rise during economic recovery and decline during downturns. Demand for the Company’s direct hire services was higher in the first quarter of fiscal 2023, following record highs in fiscal 2022, driven by post-COVID employment recovery trends at that time, and is down for the three months ended December 31, 2023 due to challenging economic conditions. Management believes that the contract and direct hire services performance challenges experienced by the Company since 2022 are also being experienced in the broader U.S. staffing industry.

Cost of Contract Services

Cost of contract services includes wages and related payroll taxes and employee benefits of the Company's contract services employees, and certain other contract employee-related costs, while working on contract assignments. Cost of contract services for the three months ended December 31, 2023 decreased by approximately 22% to $20,895 compared to $26,757 for the three months ended December 31, 2022. The $5,862 overall decrease in cost of contract services is consistent with the decrease in revenues as discussed above.

Gross Profit percentage by service: | | | | | | |

| | Three Months | |

| | Ended December 31, | |

| | 2023 | | | 2022 | |

Professional contract services | | | 25.0% | | | | 25.4% | |

| | | | | | | | |

Industrial contract services | | | 16.0% | | | | 15.5% | |

| | | | | | | | |

Professional and industrial services combined | | | 24.2% | | | | 24.4% | |

| | | | | | | | |

Direct hire placement services | | | 100.0% | | | | 100.0% | |

| | | | | | | | |

Combined gross profit margin (1) | | | 31.8% | | | | 35.0% | |

(1) Includes gross profit from direct hire placements, for which all associated costs are recorded as selling, general and administrative expenses.

The Company’s combined gross profit margin, including direct hire placement services (recorded at 100% gross margin) for the three-month period ended December 31, 2023 was approximately 31.8% as compared with approximately 35.0% for the three-month period ended December 31, 2022.

In the professional contract staffing services segment, the gross margin (excluding direct placement services) was approximately 25.0% for three-month period ended December 31, 2023 as compared with approximately 25.4% for the three-month period ended December 31, 2022. The decrease in professional contract staffing services gross margin is impacted by the mix of business and respective spreads, and to a lesser extent, increases in contractor pay and other employment costs associated with the recent rise in inflation resulting in some spread compression.

The Company’s industrial staffing services gross margin for the three-month period ended December 31, 2023 was approximately 16.0% versus approximately 15.5% for the three-month period ended December 31, 2022. The increase is mainly attributable to an increase in billing rates enacted to offset increases in contractor payroll, and increase spreads and gross profit in the Industrial Segment.

Selling, General and Administrative Expenses

Selling, general and administrative expenses (“SG&A”) include the following categories:

| · | Compensation and benefits in the operating divisions, which includes salaries, wages and commissions earned by the Company’s employment consultants, recruiters and branch managers on permanent and temporary placements; |

| | |

| · | Administrative compensation, which includes salaries, wages, share-based compensation, payroll taxes, and employee benefits associated with general management and the operation of corporate functions, including principally, finance, human resources, information technology and administrative functions; |

| | |

| · | Occupancy costs, which includes office rent, and other office operating expenses; |

| | |

| · | Recruitment advertising, which includes the cost of identifying and tracking job applicants; and |

| | |

| · | Other selling, general and administrative expenses, which includes travel, bad debt expense, fees for outside professional services and other corporate-level expenses such as business insurance and taxes. |

The Company’s SG&A for the three months ended December 31, 2023 decreased by $2,202 as compared to the three months ended December 31, 2022. SG&A for the three months ended December 31, 2023, as a percentage of revenues, was approximately 34.6% compared to approximately 31.1% for the three months ended December 31, 2022. The increase in SG&A expenses as a percentage of revenues during the three-month period ended December 31, 2023, was primarily attributable to the declines in revenues in relation to the level of fixed SG&A expenses, including fixed personnel-related expenses, occupancy costs, job boards and applicant tracking systems, and to the presence of certain non-cash and/or non-operational and other expenses described below.

SG&A includes certain non-cash costs and expenses incurred related to acquisition, integration, restructuring and other non-recurring activities, such as certain corporate legal and general expenses associated with capital markets activities, that either are not directly associated with core business operations or have been eliminated on a going forward basis. These costs were $548 and $44 for the three months ended December 31, 2023 and 2022, respectively, and include mainly expenses associated with former closed and consolidated locations, and personnel costs associated with eliminated positions, specifically including a separation agreement that includes severance totaling $300 for the three months ended December 31, 2023.

Amortization and Depreciation Expense

Amortization expense was $720 for both three-month periods ended December 31, 2023 and 2022. Depreciation expense was $84 and $101 for the three months ended December 31, 2023, and 2022, respectively.

Income (Loss) from Operations

The income (loss) from operations was $(1,674) and $762 for the three months ended December 31, 2023 and 2022, respectively. This decrease is consistent with the decrease in revenues and gross margins, especially in direct hire placements, as discussed above.

Interest Expense

Interest expense was $71 and $73 for the three months ended December 31, 2023 and 2022, respectively, and is mainly attributable to unused availability and administrative fees on the Company’s CIT Facility.

Interest Income

Interest income earned was $190 and $38 for the three-month periods ended December 31, 2023 and 2022, respectively. Interest income is earned on cash balances held in the Company’s two brokerage accounts.

Provision for Income Taxes

The Company did not recognize an income tax benefit for the three months ended December 31, 2023 because the Company is forecasting pre-tax income for the full year so the tax benefit is not expected to be realized during the current year in accordance with the provisions of ASC Topic 740, Income Taxes. The Company recognized income tax expense of $73 for the three months ended December 31, 2022. Our effective tax rate for the three months ended December 31, 2022 is lower than the statutory rate primarily due to the effect of the change in valuation allowance on the net DTA position.

Net Income (Loss)

The Company’s net income (loss) was $(1,555) and $654 for the three months ended December 31, 2023 and 2022, respectively. The decrease of $2,209 is primarily the result of the decrease in revenues and gross margins for the three months ended December 31, 2023 compared with the three months ended December 31, 2022, as explained in the preceding paragraphs.

Liquidity and Capital Resources

The primary sources of liquidity for the Company are revenues earned and collected from its clients for the placement of contract employees and independent contractors on a temporary basis and permanent employment candidates and borrowings available under its asset-based senior secured revolving credit facility. Uses of liquidity include primarily the costs and expenses necessary to fund operations, including payment of compensation to the Company’s contract and permanent employees, and employment-related expenses, operating costs and expenses, taxes and capital expenditures.

The following table sets forth certain consolidated statements of cash flows data:

| | Three Months | |

| | Ended December 31, | |

| | 2023 | | | 2022 | |

Cash flows used in operating activities | | $ | (919) | | | $ | (277) | |

Cash flows used in investing activities | | | (26) | | | | (50) | |

Cash flows used in financing activities | | | (1,616) | | | | (49) | |

As of December 31, 2023, the Company had $19,910 of cash which was a decrease of $2,561 from $22,471 as of September 30, 2023. The Company reported $919 and $277 in cash flows used in operations for the three-month periods ended December 31, 2023 and 2022, respectively.

As of December 31, 2023, the Company had working capital of $28,123 compared to $30,290 as of September 30, 2023. The decrease in net working capital is mainly attributable to the use of cash to purchase treasury stock and the effects of lower business volume on other components of working capital during the three-months ended December 31, 2023. Cash flows used in operating activities during the three-months ended December 31, 2022 included the second and final installment payment of deferred payroll taxes under the CARES Act from fiscal 2020 of $1,847.

The primary uses of cash for investing activities were for the acquisition of property and equipment, principally information technology equipment, during the three-month periods ended December 31, 2023 and 2022. Investing activities represent capital expenditures and did not include any major capital expenditures or capital improvements during either of the three-month periods ended December 31, 2023 and 2022.

The cash flows used in financing activities were for purchases of treasury stock during the three-months ended December 31, 2023, and payments made on finance leases during the three-month periods ended December 31, 2023 and 2022.

The Company had $9,348 in availability for borrowings under its CIT facility as of December 31, 2023. There were no outstanding borrowings on the CIT Facility as of December 31, 2023, or September 30, 2023, except for certain accrued carrying fees and costs, which are included in other current liabilities in the accompanying unaudited condensed consolidated balance sheets.

On April 27, 2023, the Company’s Board of Directors approved a share repurchase program authorizing the Company to purchase up to an aggregate of $20 million of the Company’s currently outstanding shares of common stock. The share repurchase program continued through December 31, 2023. The repurchase program did not obligate the Company to repurchase any number of shares of common stock. The share repurchase program was conducted in accordance with Rules 10b-5 and 10b-18 of the Securities Exchange Act of 1934, as amended. Subject to applicable rules and regulations, shares of common stock were purchased from time to time in the open market transactions and in amounts the Company deemed appropriate, based on factors such as market conditions, legal requirements, and other business considerations. During the three-months ended December 31, 2023, the Company repurchased 2,717 shares of its common stock at a total cost of $1,575. As of December 31, 2023, the Company repurchased 6,128 shares in aggregate (accounting for approximately 5.4% of our issued and outstanding common shares immediately prior to the program).

All the Company’s office facilities are leased. Minimum lease payments under all the Company’s lease agreements for the twelve-month period commencing after the close of business on December 31, 2023, are approximately $1,541. There are no minimum debt service principal payments due during the twelve-month period commencing after the close of business on December 31, 2023.

Management believes that the Company can generate adequate liquidity to meet its obligations for the foreseeable future and at least for the next twelve months.

Off-Balance Sheet Arrangements

As of December 31, 2023, there were no transactions, agreements or other contractual arrangements to which an unconsolidated entity was a party, under which the Company (a) had any direct or contingent obligation under a guarantee contract, derivative instrument or variable interest in the unconsolidated entity, or (b) had a retained or contingent interest in assets transferred to the unconsolidated entity.

Item 3. Quantitative and Qualitative Disclosures About Market Risk.

Not applicable.

Item 4. Controls and Procedures.

Disclosure Controls and Procedures

As of December 31, 2023, the Company's management evaluated, with the participation of its principal executive officer and its principal financial officer, the effectiveness of the Company's disclosure controls and procedures, as defined in Rules 13a-15(e) and 15d-15(e) of the Securities Exchange Act of 1934, as amended (the Exchange Act"). Based on that evaluation, the Company's principal executive officer and its principal financial officer concluded that the Company's disclosure controls and procedures were effective as of December 31, 2023.

Changes in Internal Control over Financial Reporting

There were no changes in the Company's internal control over financial reporting or in any other factors that could significantly affect these controls, during the Company's three-month period ended December 31, 2023, that have materially affected, or are reasonably likely to materially affect, the Company's internal control over financial reporting.

PART II – OTHER INFORMATION.

Item 1. Legal Proceedings.

None.

Item 1A. Risk Factors.

In evaluating us and our common stock, we urge you to carefully consider the risks and other information in this Quarterly Report on Form 10-Q, as well as the risk factors disclosed in Item 1A. of Part I of our Annual Report on Form 10-K for the fiscal year ended September 30, 2023 (“2023 Form 10-K”) filed with the SEC on December 18, 2023. Any of the risks discussed in this Quarterly Report on Form 10-Q or any of the risks disclosed in Item 1A. of Part I of our 2023 Form 10-K, as well as additional risks and uncertainties not currently known to us or that we currently deem immaterial, could materially and adversely affect our results of operations or financial condition.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

On April 27, 2023, the Company’s Board of Directors approved a share repurchase program authorizing the Company to purchase up to an aggregate of $20 million of the Company’s currently outstanding shares of common stock. The share repurchase program continued through December 31, 2023. The repurchase program did not obligate the Company to repurchase any number of shares of common stock. The share repurchase program was conducted in accordance with Rules 10b-5 and 10b-18 of the Securities Exchange Act of 1934, as amended. Subject to applicable rules and regulations, shares of common stock were purchased from time to time in the open market transactions and in amounts the Company deemed appropriate, based on factors such as market conditions, legal requirements, and other business considerations.

Our purchases of our common stock during the three months ended December 31, 2023 were as follows:

Period | | Total Number of Shares Purchased | | | Average Price Paid Per Share | | | Total Number of Shares Purchased as Part of Publicly Announced Program | | | Dollar Value of Shares that May Yet Be Purchased Under the Program (a) | |

October 1, 2023 - October 31, 2023 | | | 1,272,031 | | | $ | 0.58 | | | | 1,272,031 | | | $ | 17,342,674 | |

November 1, 2023 - November 30, 2023 | | | 774,815 | | | | 0.55 | | | | 774,815 | | | | 16,915,057 | |

December 1, 2023 - December 31, 2023 | | | 670,320 | | | | 0.52 | | | | 670,320 | | | | 16,564,035 | |

| | | 2,717,166 | | | | | | | | 2,717,166 | | | | | |

(a) Excludes brokerage commissions paid by the Company.

As of December 31, 2023, the Company repurchased 6,128,877 shares in aggregate (accounting for approximately 5.4% of our issued and outstanding common shares immediately prior to the program).

Item 3. Defaults Upon Senior Securities.

None.

Item 4. Mine Safety Disclosures.

Not applicable.

Item 5. Other Information.

Item 6. Exhibits

The following exhibits are filed as a part of Part I of this report:

* | Filed herewith |

** | Furnished herewith. This certification is being furnished solely to accompany this report pursuant to 18 U.S.C. Section 1350 and is not being filed for purposes of Section 18 of the Exchange Act of 1934, as amended, and is not to be incorporated by reference into any filings of the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| GEE GROUP INC. | |

| (Registrant) | |

| | | |

Date: February 13, 2024 | By: | /s/ Derek Dewan | |

| | Derek Dewan | |

| | Chief Executive Officer | |

| | (Principal Executive Officer) | |

| | | |

| By: | /s/ Kim Thorpe | |

| | Kim Thorpe | |

| | Senior Vice President and Chief Financial Officer (Principal Financial and Accounting Officer) | |

nullnullnullnull

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an quarterly report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-Q

-Number 240

-Section 308

-Subsection a

| Name: |

dei_DocumentQuarterlyReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate whether the registrant is one of the following: Large Accelerated Filer, Accelerated Filer, Non-accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityFilerCategory |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:filerCategoryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-T

-Number 232

-Section 405

| Name: |

dei_EntityInteractiveDataCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |