UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

| | | | | | | | | | | |

| Filed by the Registrant | ☒ | |

| | | |

| Filed by a Party other than the Registrant | ☐ |

| | | | | |

| Check the appropriate box: |

| |

☐ | Preliminary Proxy Statement |

| |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☐ | Definitive Proxy Statement |

| |

☒ | Definitive Additional Materials |

| |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

Rover Group, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | |

Payment of Filing Fee (Check all boxes that apply): |

| |

☒ | No fee required. |

| |

☐ | Fee paid previously with preliminary materials. |

| |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________

FORM 8-K

________________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

February 12, 2024

Date of Report (date of earliest event reported)

________________________________________

Rover Group, Inc.

(Exact name of registrant as specified in its charter)

________________________________________

| | | | | | | | |

Delaware | 001-39774 | 85-3147201 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | |

720 Olive Way, 19th Floor, Seattle, WA | 98101 |

(Address of Principal Executive Offices) | (Zip Code) |

(888) 453-7889

Registrant's telephone number, including area code

(Former name or former address, if changed since last report.)

________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share | ROVR | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 8.01 Other Events.

Supplemental Disclosures

The following supplemental disclosures (which we refer to as the “Supplemental Disclosures”) should be read in conjunction with the definitive proxy statement on Schedule 14A, dated January 22, 2024 (as it may be amended or supplemented from time to time, the “proxy statement”), filed by Rover Group, Inc. (“Rover”). The proxy statement contains information regarding the Agreement and Plan of Merger, dated November 29, 2023 (as it may be amended from time to time, the “Merger Agreement”), by and among Rover, Biscuit Parent, LLC (“Parent”), and Biscuit Merger Sub, LLC ( “Merger Sub”), and the proposed merger of Merger Sub with and into Rover (the “Merger”) pursuant to the Merger Agreement, with Rover continuing as the surviving corporation and a wholly owned direct subsidiary of Parent. Parent and Merger Sub are affiliates of funds managed by affiliates of Blackstone Inc. (“Blackstone”). If the Merger is completed, each share of Rover’s Class A common stock that is outstanding immediately prior to the time at which the Merger will become effective (the “Effective Time”) (other than certain exceptions under the Merger Agreement, as described in the proxy statement), will be cancelled and extinguished and automatically converted into the right to receive $11.00 in cash. Rover’s Class A common stock will no longer be publicly traded and will be delisted from Nasdaq.

The purpose of the Supplemental Disclosures is to provide supplemental information concerning the Merger. Except as described in these Supplemental Disclosures, the information provided in the proxy statement continues to apply. All paragraph headings and page references used herein refer to the headings and pages in the proxy statement before any additions or deletions resulting from the Supplemental Disclosures or any other amendments, and certain capitalized terms used below, unless otherwise defined, have the meanings set forth in the proxy statement. The Supplemental Disclosures are identified below by bold, underlined text. Stricken-through text shows text being deleted from a referenced disclosure in the proxy statement. If information in the Supplemental Disclosures differs from or updates information contained in the proxy statement, then the information in the Supplemental Disclosures is more current and supersedes the different information contained in the proxy statement. THE SUPPLEMENTAL DISCLOSURES SHOULD BE READ IN CONJUNCTION WITH THE PROXY STATEMENT AND THE PROXY STATEMENT SHOULD BE READ IN ITS ENTIRETY.

Explanatory Note

In connection with the Merger Agreement, Rover has received demand letters on behalf of purported stockholders alleging that the proxy statement filed in connection with the Merger omits certain purportedly material information in violation of federal securities laws. These demand letters request additional disclosures in advance of the Special Meeting. Rover believes the demands are without merit.

On January 31, 2024, a purported stockholder of Rover filed a complaint in Washington state court against Rover, members of the Rover board of directors (the “Rover Board”), Parent, Merger Sub, and Blackstone, captioned Garfield v. Clammer et al., Case No. 24-2-02292-9-SEA (the “Garfield Complaint”). The Garfield Complaint asserts claims against the Rover Board for violation of Washington state securities law for issuing false and misleading statements of material facts and omissions of material facts and “control person” liability with respect to such allegedly false and misleading statements of facts and omissions of material facts, and against all defendants for negligent misrepresentation and concealment with respect to such allegedly false and misleading statements of facts and omissions of material facts. The Garfield Complaint seeks, among other relief, to enjoin Rover from proceeding with the Merger unless and until Rover cures certain alleged disclosure deficiencies in the proxy statement and for an award of attorneys’ fees and costs.

On February 1, 2024, and February 5, 2024, purported stockholders of Rover filed complaints in the U.S. District Court for the District of Delaware against Rover and the Rover Board, captioned Price v. Rover Group, Inc. et al., Case No. 1:24-cv-00128-JLH and Harrison v. Rover Group, Inc. et al., Case No. 1:24-cv-00150-JLH (together, the “Federal Complaints”). The Federal Complaints assert claims against the defendants under Section 14(a) of the Exchange Act for issuing Rover’s proxy statement with allegedly false and misleading statements of material facts and omissions of material facts and against the Rover Board under Section 20(a) of the Exchange Act for alleged “control person” liability with respect to such allegedly false and misleading statements of material facts and omissions of material facts. The Federal Complaints seek, among other relief, to enjoin Rover from proceeding with the Merger unless and until Rover cures certain alleged disclosure deficiencies in the proxy statement and for an award of attorneys’ fees and costs.

While the Company believes that the disclosures set forth in the proxy statement comply fully with all applicable law and denies the allegations in the pending complaints described above, in order to moot plaintiffs’ disclosure claims, avoid possible expense and nuisance and business delays, and provide additional information to its stockholders, the Company has determined voluntarily to supplement certain disclosures in the proxy statement related to plaintiffs’ claims with the Supplemental Disclosures. Nothing in the Supplemental Disclosures shall be deemed an admission of the legal merit, necessity or materiality under applicable laws of any of the disclosures set forth herein. To the contrary, the Company specifically denies all allegations in the complaints described above that any additional disclosure was or is required or material. The Supplemental Disclosures will not affect the timing of the special meeting.

Supplemental Disclosures to Proxy Statement

The following bolded and underlined language is added to page 49 of the proxy statement in the section with the heading “Background of the Merger.”

From November 29, 2023 through December 29, 2023, Rover was permitted, subject to the provisions of the Merger Agreement, to solicit alternative acquisition proposals from third parties and to provide information to, and participate in discussions and engage in negotiations with, third parties regarding any alternative acquisition proposals. As previously authorized by the Rover Board, representatives of Goldman Sachs contacted 41 potential acquirers, including 17 strategic acquirers and 24 financial sponsors, including Party A, Party B, Party C, Party D and Party E, during such go-shop period, which resulted in six potential bidders, including Party B, entering into confidentiality agreements with Rover, none of which contained a “standstill” provision, and being provided due diligence information regarding Rover, including unaudited prospective financial information for fiscal years 2023 through 2030 included in the November 2023 long-term plan. During this go-shop period, no third party submitted an alternative acquisition proposal to acquire Rover. Except for two potential bidders that communicated that the valuation for Rover was too high for them, potential bidders did not communicate to Rover their reason for not submitting an acquisition proposal. Following the close of market on December 29, 2023, Rover issued a press release announcing that the go-shop period had expired and that no third-party had submitted an alternative acquisition proposal to acquire Rover.

The following bolded and underlined language is added to page 56 of the proxy statement in the section with the heading “Opinion of Goldman Sachs—Illustrative Discounted Cash Flow Analysis.”

Goldman Sachs derived ranges of illustrative enterprise values for Rover by adding the ranges of present values it derived above. Goldman Sachs then added to the range of illustrative enterprise values it derived for Rover the amount of Rover’s cash and cash equivalents of approximately $225 million and investment in affiliates of approximately $3 million, in each case, as prepared by Rover management and approved for Goldman Sachs’ use by Rover management, and added the net present value of cash tax savings from the NOLs reflected in the NOL Forecasts, which net present value Goldman Sachs calculated to be approximately $64 million, as reflected in the NOL Forecasts, to derive a range of illustrative equity values for Rover. Goldman Sachs then divided the range of illustrative equity values it derived by the estimated number of fully diluted outstanding shares of Rover, ranging from approximately 205 million to 206 millionas prepared by Rover management and approved for Goldman Sachs’ use by Rover, calculated using the treasury stock method and data provided by and approved for Goldman Sachs’ use by Rover management, to derive a range of illustrative present values per share ranging from $7.87 to $11.41.

The following bolded and underlined language is added to pages 56-57 of the proxy statement in the section with the heading “Opinion of Goldman Sachs—Illustrative Present Value of Future Share Price Analysis.”

Goldman Sachs then added the amount of Rover’s cash and cash equivalents and investment in affiliates as of December 31, 2024 and December 31, 2025, which were approximately $361 million and $473 million, respectively, for cash and cash equivalents, and $3 million and $3 million, respectively, for investment in affiliates, as prepared by Rover management and approved for Goldman Sachs’ use by Rover, to the respective implied enterprise values in order to derive a range of illustrative equity values for Rover as of December 31, 2024

and December 31, 2025. Goldman Sachs then divided these implied equity values by the projected year-end number of fully diluted outstanding shares of Rover’s common stock as of December 31, 2024 and December 31, 2025, which were approximately 212 million and 215 million respectively, as prepared by Rover management and approved for Goldman Sachs’ use by Rover, to derive a range of implied future values per each share of Rover’s common stock. Goldman Sachs then discounted these implied future equity values per each share of Rover’s common stock to September 30, 2023, using an illustrative discount rate of 13.2%, reflecting an estimate of Rover’s cost of equity. Goldman Sachs derived such discount rate by application of the Capital Asset Pricing Model, which requires certain company-specific inputs, including a beta for the company, as well as certain financial metrics for the United States financial markets generally. This analysis resulted in a range of implied present values of $7.40 to $11.25 per each share of Rover’s common stock.

The following bolded and underlined language is added to page 57 of the proxy statement in the section with the heading “Opinion of Goldman Sachs—Selected Public Company Comparables Analysis.”

Goldman Sachs calculated and compared the EV/NTM EBITDA multiples based on financial and trading data as of November 27, 2023 and information Goldman Sachs obtained from Wall Street Research and public filings. The results of these calculations are summarized as follows:

| | | | | | | | | | | |

| Third Party Service Marketplaces | EV/NTM EBITDA Multiples | | Enterprise Value

($ in billions) |

| Uber Technologies, Inc. | 21.5x | | $122.9 |

| Upwork Inc. | 16.9x | | $1.8 |

| ZipRecruiter, Inc. | 9.9x | | $1.5 |

| Fiverr International Ltd. | 8.8x | | $0.7 |

| | | | | | | | | | | |

| Other Relevant Marketplaces | EV/NTM EBITDA Multiples | | Enterprise Value

($ in billions) |

| Airbnb, Inc. | 20.1x | | $79.4 |

| Etsy, Inc. | 14.0x | | $10.9 |

| Match Group, Inc. | 9.3x | | $ | 12.0 | |

| eBay Inc. | 6.3x | | $ | 20.2 | |

The following bolded and underlined language is added to pages 63-64 of the proxy statement in the section with the heading “Opinion of Centerview Partners—Selected Public Company Analysis.”

The resulting data were as follows:

| | | | | | | | | | | | | | | | | |

| Enterprise Value ($ in billions) | | EV/CY’24 E Revenue | | EV/CY’24E Adj. EBITDA |

| Airbnb, Inc. (NASDAQ: ABNB) | $79.4 | | 7.2x | | 19.8x |

| DoorDash, Inc. (NASDAQ: DASH) | $37.9 | | 3.8x | | 24.0x |

| eBay Inc. (NASDAQ: EBAY) | $20.1 | | 2.0x | | 6.2x |

| Etsy, Inc. (NASDAQ: ETSY) | $10.9 | | 3.8x | | 13.9x |

| Fiverr International Ltd. (NYSE: FVRR) | $0.7 | | 1.7x | | 8.7x |

| Match Group, Inc. (NASDAQ: MTCH) | $12.0 | | 3.3x | | 9.2x |

| | | | | | | | | | | | | | | | | |

| Uber Technologies, Inc. (NYSE: UBER) | $116.7 | | 2.7x | | 19.7x |

| Upwork Inc. (NASDAQ: UPWK) | $1.8 | | 2.4x | | 16.9x |

| Vivid Seats Inc. (NASDAQ: SEAT) | $2.2 | | 2.7x | | 13.0x |

| Zillow Group, Inc. (NASDAQ: ZG) | $8.2 | | 3.8x | | 17.1x |

Median | | | 3.0x | | 15.4x |

Based on its analysis and other considerations that Centerview Partners deemed relevant in its professional judgment and experience, Centerview Partners (1) selected a reference range of enterprise value to projected revenue multiples for the calendar year 2024 of 4.0x to 6.0x and (2) selected a reference range of enterprise value to projected adjusted EBITDA multiples for the calendar year 2024 of 20.0x-25.0x. In selecting these references ranges, Centerview Partners made qualitative judgments based on its experience and professional judgment concerning differences between the business, financial and operational characteristics of Rover and the Selected Company Comparison Companies that could affect their public trading values in order to provide a context in which to consider the results of the quantitative analysis. These qualitative judgments related, among other things, to the differing sizes, growth prospects, and commercial profiles and degree of operational risk between Rover and such comparable companies. Centerview Partners applied (1) the enterprise value to projected revenue multiples for the calendar year 2024 reference range to Rover’s projected revenue for the calendar year 2024 of $278 million, as set forth in the Forecasts, and (2) the enterprise value to projected adjusted EBITDA multiples for the calendar year 2024 reference range to Rover’s projected adjusted EBITDA of $75 million, as set forth in the Forecasts, in each case, to derive a range of implied equity values for Rover. Centerview Partners then divided such implied equity values by the number of fully-diluted shares of Rover’s common stock ranging from 205 million to 206 million (determined using the treasury stock method and taking into account outstanding in-the-money options and restricted stock units (including outstanding unvested earnout shares)) as of November 27, 2023 as set forth in the Forecasts, resulting in an implied per share equity value ranges for common stock of approximately $6.55 to $9.25, and $8.45 to $10.25, respectively (in each case, rounded to the nearest $0.05). Centerview Partners then compared this range to the $11.00 per each share of Rover’s common stock in cash, without interest, proposed to be paid to the stockholders of Rover’s common stock (other than the Excluded Shares) pursuant to the Merger Agreement.

The following bolded and underlined language is added to page 65 of the proxy statement in the section with the heading “Opinion of Centerview Partners—Selected Transaction Analysis.”

The resulting data were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Date Announced | | Acquiror | | Target | | Enterprise Value ($bn) | | EV/LTM Revenue |

| July 2020 | | Uber Technologies, Inc. | | Postmates Inc. | | $2.7 | | 5.8x |

| June 2020 | | Just Eat Takeaway N.V. | | Grubhub Inc. | | $7.4 | | 5.5x |

| December 2019 | | IAC Inc. | | Care.com, Inc. | | $0.5 | | 2.2x |

| December 2019 | | Hellman & Friedman LLC | | Autoscout24 GmbH | | $3.2 | | 15.2x |

| July 2019 | | Takeaway.com N.V. | | Just Eat Ltd. | | $6.9 | | 6.4x |

| September 2018 | | Permira Holdings LLP | | XO Group Inc. | | $0.9 | | 5.7x |

| May 2018 | | Silver Lake Partners | | ZPG Ltd. | | $3.4 | | 8.8x |

Median | | | | | | | | 5.8x |

The following bolded and underlined language is added to pages 65-66 of the proxy statement in the section with the heading “Opinion of Centerview Partners—Discounted Cash Flow Analysis.”

In performing this analysis, Centerview Partners calculated implied enterprise values by discounting to present value as of September 30, 2023 using discount rates ranging from 14% to 15.5% (reflecting Centerview Partners’ analysis of Rover’s weighted average cost of capital based on considerations Centerview Partners deemed relevant in its professional judgment and experience), the forecasted unlevered free cash flows of Rover based on the Forecasts during the period beginning the last quarter of 2023, and ending on December 31, 2033. The

implied terminal value of Rover at the end of the forecast period was estimated by using a multiple of the projected next-twelve-months EBITDA of Rover based on the Forecasts. For purposes of this analysis, stock-based compensation was treated as a cash expense.

Centerview Partners then subtracted from the range of implied enterprise values Rover’s estimated net debt of approximately ($229) million (calculated as debt less cash and investments) as of September 30, 2023 as set forth in the Forecasts, to derive a range of implied enterprise values for Rover.

Centerview Partners then divided this range of implied equity values by the number of fully-diluted outstanding shares of Rover’s common stock ranging from 205 million to 206 million (determined using the treasury stock method and taking into account outstanding in-the-money options and restricted stock units (including outstanding unvested earnout shares)) as set forth in the Internal Data (calculated as of November 27, 2023) to derive a range of implied values of Rover’s common stock of $8.50 to $11.60 per share (rounded to the nearest $0.05). Centerview Partners then compared this range to the $11.00 per each share of Rover’s common stock in cash, without interest, proposed to be paid to the stockholders of Rover’s common stock (other than the Excluded Shares) pursuant to the Merger Agreement.

The following bolded and underlined language is added to page 66 of the proxy statement in the section with the heading “Opinion of Centerview Partners—Other Factors.”

Analyst Price Target Range Analysis: Centerview Partners reviewed stock price targets for Rover’s common stock in 6 publicly available Wall Street research analyst reports as of November 27, 2023, which indicated low and high stock price targets for Rover ranging from $6.75 to $10.00, and a median of $7.50, per each share of common stock.

The following bolded and underlined language is added to page 70 of the proxy statement in the section with the heading “Unaudited Prospective Financial Information.”

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal year ending December 31 |

| (dollars in millions) | 2023E | 2024E | 2025E | 2026E | 2027E | 2028E | 2029E | 2030E | 2031E | 2032E | 2033E |

Revenue | $ | 232 | | $ | 282 | | $ | 334 | | $ | 393 | | $ | 457 | | $ | 521 | | $ | 587 | | $ | 657 | | $ | 730 | | $ | 804 | | $ | 878 | |

Net Income | $ | 20 | | $ | 114 | | $ | 62 | | $ | 85 | | $ | 111 | | $ | 135 | | $ | 160 | | $ | 187 | | $ | 217 | | $ | 247 | | $ | 277 | |

Adjusted EBITDA(1) | $ | 50 | | $ | 80 | | $ | 105 | | $ | 133 | | $ | 165 | | $ | 196 | | $ | 227 | | $ | 260 | | $ | 296 | | $ | 331 | | $ | 366 | |

(1) Adjusted EBITDA is defined as net income (loss) excluding depreciation and amortization (including amortization expense related to capitalized internal use software), stock-based compensation expense, interest expense, interest income, change in fair value, net, other income (expense), net, income tax expense or benefit, certain acquisition and merger-related costs, gain or loss from equity method investments, net of tax, and non-routine items such as goodwill and intangible or investment impairment (if any), restructuring costs (if any), transaction-related expenses (if any), and certain legal settlements (if any).

The following bolded and underlined language is added to page 70 of the proxy statement in the section with the heading “Unaudited Prospective Financial Information.”

The following table presents a summary of the November 2023 long-term plan, including (1) Rover’s estimated Unlevered Free Cash Flow excluding Net Operating Losses for 2023 through 2033 calculated by Rover management based on the November 2023 long term plan, and used by Goldman Sachs, with the approval of the Rover Board, in its financial analyses (as described in more detail in the section of the proxy statement captioned “The Merger— Opinion of Goldman Sachs”) and (2) Rover’s estimated Unlevered Free Cash Flow for 2023 through 2032 calculated by Rover management based on the November 2023 long-term plan, and used by Centerview Partners, with the approval of the Rover Board, in its opinion delivered to the Rover Board as to the fairness, from a financial point of view, of the consideration to be paid to the holders of our common stock and related financial analyses (as described in more detail in the section of the proxy statement captioned “The Merger—Opinion of Centerview Partners”). The November 2023 long-term plan was updated by Rover management to reflect updates and adjustments to Rover’s long-term business plan and Rover management’s then-current estimate of Rover’s

future financial performance, as described in more detail in the section of the proxy statement captioned “—Background of the Merger.” Rover management made various estimates and assumptions when preparing the November 2023 long-term plan, including (1) a compounded annual growth rate of approximately 15% for Rover’s revenue from 2023 to 2033, driven in part by a compounded annual growth rate for new customer acquisition of approximately 8% from 2025 to 2033, year-over-year growth in average booking value of 3% from 2025 to 2033, cancellation rates trending to 11% by 2033 and a U.S. take rate growing to 27.5% in 2032 and 2033; (2) an Adjusted EBITDA margin growing to approximately 42% by 2033, due to contribution margin improvements as a result of increased take rates, improved cancellation rates and increased efficiency of operations from product investments, and continued fixed cost operating leverage; and (3) no impact to Rover’s future financial performance arising from near-term macroeconomic risks or from certain strategic expansion initiatives, including applicable operating expenses and revenue.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal year ending December 31 |

| (dollars in millions) | 2023E | 2024E | 2025E | 2026E | 2027E | 2028E | 2029E | 2030E | 2031E | 2032E | 2033E |

| Revenue | $231 | | $278 | | $338 | | $403 | | $473 | | $545 | | $619 | | $698 | | $782 | | $871 | | $961 | |

Net Income | $20 | | $111 | | $62 | | $87 | | $116 | | $144 | | $171 | | $201 | | $234 | | $268 | | $301 | |

Adjusted EBITDA(1) | $50 | | $75 | | $105 | | $136 | | $172 | | $208 | | $242 | | $280 | | $322 | | $363 | | $404 | |

Stock Based Compensation Expense | $22 | | $24 | | $26 | | $28 | | $31 | | $33 | | $36 | | $39 | | $42 | | $45 | | $49 | |

Cash Tax Expense (Excluding the Impact of Net Operating Losses)(2) | $4 | | $9 | | $17 | | $23 | | $30 | | $35 | | $39 | | $43 | | $48 | | $51 | | $55 | |

Cash Tax Expense (Including the Impact of Net Operating Losses)(3) | — | — | $1 | | $5 | | $11 | | $35 | | $39 | | $43 | | $48 | | $51 | | (5) |

Capital Expenditures | $1 | | $1 | | $1 | | $1 | | $1 | | $2 | | $2 | | $2 | | $2 | | $3 | | $3 | |

Capitalized Internal Use Software | $9 | | $10 | | $12 | | $14 | | $17 | | $20 | | $23 | | $27 | | $31 | | $36 | | $41 | |

Change in Net Working Capital | $3 | | $4 | | $5 | | $5 | | $5 | | $5 | | $6 | | $6 | | $6 | | $7 | | $7 | |

Unlevered Free Cash Flow Excluding Net Operating Losses(24) | $18 | | $35 | | $54 | | $75 | | $99 | | $123 | | $148 | | $175 | | $204 | | $234 | | $264 | |

Unlevered Free Cash Flow(35) | (35) | $44 | | $70 | | $93 | | $118 | | $123 | | $148 | | $175 | | $204 | | $234 | | (35) |

(1) Adjusted EBITDA is defined as net income (loss) excluding depreciation and amortization (including amortization expense related to capitalized internal use software), stock-based compensation expense, interest expense, interest income, change in fair value, net, other income (expense), net, income tax expense or benefit, certain acquisition and merger-related costs, gain or loss from equity method investments, net of tax, and non-routine items such as goodwill and intangible or investment impairment (if any), restructuring costs (if any), transaction-related expenses (if any), and certain legal settlements (if any).

(2) Cash Tax Expense used for purposes of calculating Unlevered Free Cash Flow used by Goldman Sachs, with the approval of the Rover Board, in its financial analyses (as described in more detail in the section of the Proxy Statement captioned “The Merger—Opinion of Goldman Sachs”), which is calculated by Rover management as estimated U.S. federal income taxes for the applicable fiscal year, excluding the impact of cash tax savings from net operating losses.

(3) Cash Tax Expense used for purposes of calculating Unlevered Free Cash Flow used by Centerview Partners, with the approval of the Rover Board, in its financial analyses (as described in more detail in the section of the Proxy Statement captioned “—Opinion of Centerview Partners”), which is calculated by Rover

management as estimated U.S. federal income taxes for the applicable fiscal year including the impact of cash tax savings from net operating losses.

(42) Unlevered Free Cash Flow used by Goldman Sachs, with the approval of the Rover Board, in its financial analyses (as described in more detail in the section of the proxy statement captioned “The Merger—Opinion of Goldman Sachs”), which is calculated by Rover management as Adjusted EBITDA subtracting stock-based compensation expense, impact of cash taxes (including the impact of depreciation and amortization (including amortization expense related to capitalized internal use software) and excluding the impact of cash tax savings from net operating losses), capital expenditure expense on purchases of property, plant & equipment, and capitalization of internal use software, and adding or subtracting, as applicable, changes in net working capital. The foregoing calculation of Unlevered Free Cash Flow did not take into account the cash tax savings from the utilization of Rover’s net operating losses. Rover management treated stock-based compensation as a cash expense, as the monetary value associated with the issuance of stock-based compensation represents an economic cost to stockholders when the future trading price of Rover’s common stock is unknown. Rover management estimated that the cash tax savings from the utilization of Rover’s net operating losses would be approximately $13 million in fiscal year 2024, approximately $24 million in fiscal year 2025, approximately $34 million in fiscal year 2026 and approximately $16 million in fiscal year 2027, assuming a 100% and 80% maximum annual reduction of U.S. federal tax payments for pre-2018 and post-2018 net operating losses, respectively.

(53) Unlevered Free Cash Flow used by Centerview Partners, with the approval of the Rover Board, in its financial analyses (as described in more detail in the section of the proxy statement captioned “—Opinion of Centerview Partners”), which is calculated by Rover management as Adjusted EBITDA subtracting stock-based compensation expense, impact of cash taxes (including the impact of depreciation and amortization (including amortization expense related to capitalized internal use software) and the impact of cash tax savings from net operating losses), capital expenditure on purchases of property, plant & equipment, capitalization of internal use software, and adding or subtracting, as applicable, changes in net working capital. Rover management treated stock-based compensation as a cash expense, as the monetary value associated with the issuance of stock-based compensation represents an economic cost to stockholders when the future trading price of Rover’s common stock is unknown. For purposes of its financial analyses, Centerview Partners used an estimate of Unlevered Free Cash Flow for the fourth quarter of 2023 of approximately $10 million, and did not use an estimate of Unlevered Free Cash Flow for 2033.

The following bolded and underlined language is added to page 71 of the proxy statement in the section with the heading “Interests of Rover’s Directors and Executive Officers in the Merger—Arrangements with Parent.”

Prior to entering into the Merger Agreement, with the prior approval of the Rover Board, Adam Clammer, one of our directors, who is an affiliate of the True Wind Parties, engaged in preliminary discussions with Parent and its affiliates and representatives regarding a potential “rollover” of a portion of the shares of Rover’s common stock beneficially owned by the True Wind Parties in connection with the Merger, pursuant to which the True Wind Parties would continue to beneficially own a direct or indirect equity interest in the Surviving Corporation following the Merger rather than receiving the Per Share Price in exchange for such shares in the Merger. As of the execution of the Merger Agreement, neither Mr. Clammer nor any of the True Wind Parties had made a determination to participate in, or entered into any arrangement or agreement with Blackstone regarding, any such “rollover” or any equity investment to finance any portion of the Merger. Following the execution of the Merger Agreement, Mr. Clammer and the True Wind Parties and Parent and its affiliates and representatives continued discussions regarding such a “rollover.” The True Wind Parties have expressed interest in and anticipate a potential “rollover” of a material portion of the shares of Rover’s common stock that they beneficially own into a direct or indirect equity interest in the Surviving Corporation, subject to reaching agreement with Parent upon the terms and conditions of such a “rollover” and any rights the True Wind Parties would have in respect of such equity interest following the closing of the Merger. As of February 12, 2024the date of this proxy statement, neither Mr. Clammer nor any of the True Wind Parties has reached any arrangement or agreement with Parent or any of its affiliates with respect to such terms and conditions.

As of February 12, 2024the date of this proxy statement, none of our directors or executive officers or their respective affiliates (other than Mr. Clammer and the True Wind Parties, as described above) has had any discussions or negotiations, or entered into any agreement with Parent or any of its affiliates regarding their individual employment with, or the right to purchase or participate in the equity of, the Surviving Corporation or one or more of its affiliates, nor entered into any agreements with respect to the foregoing. The Merger Agreement does not specifically address the retention of Company management in the Surviving Corporation or their purchase of or participation in the equity of the Surviving Corporation following the completion of the Merger. Pursuant to the Merger Agreement, except as approved by the Rover Board, from the date of the Merger Agreement, to the earlier of the termination of the Merger Agreement or the Effective Time, Parent and Merger Sub will not, and will not permit any of their subsidiaries or respective affiliates to make or enter into, or commit or agree to enter into, any formal or informal arrangements or other understandings (whether or not binding) with any of our directors or executive officers or any of their respective affiliates (1) regarding any continuing employment or consulting relationship with the Surviving Corporation, (2) pursuant to which any such director or executive officer would be entitled to receive consideration of a different amount or nature than our stockholders, or (3) pursuant to which any such director or executive officer (directly or indirectly) would agree to provide an equity investment to finance any portion of the Merger. Following the date of this proxy statement and prior to and following the closing of the Merger, our directors and executive officers or their affiliates may have discussions with, and following the closing of the Merger or as otherwise approved by the Rover Board, may enter into agreements with, Parent or Merger Sub, their subsidiaries or their respective affiliates regarding employment with, or the right to purchase or participate in the equity of, the Surviving Corporation or one or more of its affiliates.

The following bolded and underlined language is added to page 76 of the proxy statement in the section with the heading “Interests of Rover’s Directors and Executive Officers in the Merger—Transaction Committee Compensation.”

On November 28, 2023, the Rover Board approved a one-time cash payment of $10,000 to each member of the Transaction Committee—Mr. Jacobson, Ms. Leslie and Mr. Prusch—that was paid in January 2024. This payment was approved and was made in consideration for the time and effort of each such director’s service as a member of the Transaction Committee, and was not contingent on the Transaction Committee approving or recommending the Merger Agreement or the Merger, the Company’s entry into the Merger Agreement or the consummation of the Merger. As of February 12, 2024, the Transaction Committee has not been disbanded.

The following bolded and underlined language is added to page 86 of the proxy statement in the section with the heading “Potential Litigation Relating to the Merger.”

Rover received demand letters on behalf of purported stockholders alleging that the preliminary proxy statement filed in connection with the Merger omits certain purportedly material information in violation of federal securities laws. These demand letters request additional disclosures in advance of the Special Meeting. Rover believes the demands are without merit.

On January 31, 2024, a purported stockholder of Rover filed a complaint in Washington state court against Rover, members of the Rover Board, Parent, Merger Sub, and Blackstone, captioned Garfield v. Clammer et al., Case No. 24-2-02292-9-SEA (the “Garfield Complaint”). The Garfield Complaint asserts claims against the Rover Board for violation of Washington state securities law for issuing false and misleading statements of material facts and omissions of material facts and “control person” liability with respect to such allegedly false and misleading statements of facts and omissions of material facts, and against all defendants for negligent misrepresentation and concealment with respect to such allegedly false and misleading statements of facts and omissions of material facts. The Garfield Complaint seeks, among other relief, to enjoin Rover from proceeding with the Merger unless and until Rover cures certain alleged disclosure deficiencies in the proxy statement and for an award of attorneys’ fees and costs.

On February 1, 2024, and February 5, 2024, purported stockholders of Rover filed complaints in the U.S. District Court for the District of Delaware against Rover and the Rover Board, captioned Price v. Rover Group, Inc. et al., Case No. 1:24-cv-00128-JLH and Harrison v. Rover Group, Inc. et al., Case No. 1:24-cv-00150-JLH (together, the “Federal Complaints”). The Federal Complaints assert claims against the

defendants under Section 14(a) of the Exchange Act for issuing Rover’s proxy statement with allegedly false and misleading statements of material facts and omissions of material facts and against the Rover Board under Section 20(a) of the Exchange Act for alleged “control person” liability with respect to such allegedly false and misleading statements of material facts and omissions of material facts. The Federal Complaints seek, among other relief, to enjoin Rover from proceeding with the Merger unless and until Rover cures certain alleged disclosure deficiencies in the proxy statement and for an award of attorneys’ fees and costs.

Cautionary Statement Regarding Forward-Looking Statements

This communication may contain forward-looking statements, which include all statements that do not relate solely to historical or current facts, such as statements regarding the Merger, the outcome and impact of the Garfield Complaint, the Federal Complaints and any other claims and litigation arising from or related to the Merger, the expected timing of the closing of the Merger and other statements that concern the Company’s expectations, intentions or strategies regarding the future. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “aim,” “potential,” “continue,” “ongoing,” “goal,” “can,” “seek,” “target” or the negative of these terms or other similar expressions, although not all forward-looking statements contain these words. These forward-looking statements are based on the Company’s beliefs, as well as assumptions made by, and information currently available to, the Company. Because such statements are based on expectations as to future financial and operating results and are not statements of fact, actual results may differ materially from those projected and are subject to a number of known and unknown risks and uncertainties, including, but not limited to: (i) the risk that the Merger may not be completed on the anticipated timeline or at all; (ii) the failure to satisfy any of the conditions to the consummation of the Merger, including the receipt of required approval from the Company’s stockholders and required regulatory approval; (iii) the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the Merger Agreement with private equity funds managed by Blackstone, including in circumstances requiring the Company to pay a termination fee; (iv) the effect of the announcement or pendency of the Merger on the Company’s business relationships, operating results and business generally; (v) risks that the Merger disrupts the Company’s current plans and operations; (vi) the Company’s ability to retain and hire key personnel and maintain relationships with key business partners and customers, and others with whom it does business; (vii) risks related to diverting management’s or employees’ attention during the pendency of the Merger from the Company’s ongoing business operations; (viii) the amount of costs, fees, charges or expenses resulting from the Merger; (ix) potential litigation relating to the Merger; (x) uncertainty as to timing of completion of the Merger and the ability of each party to consummate the Merger; (xi) risks that the benefits of the Merger are not realized when or as expected; (xii) the risk that the price of the Company’s Class A common stock may fluctuate during the pendency of the Merger and may decline significantly if the Merger is not completed; and (xiii) other risks described in the Company’s filings with the U.S. Securities and Exchange Commission (the “SEC”), such as the risks and uncertainties described under the headings “Cautionary Note Regarding Forward-Looking Statements,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and other sections of the Company’s Annual Report on Form 10-K, the Company’s Quarterly Reports on Form 10-Q, and in the Company’s other filings with the SEC. While the list of risks and uncertainties presented here is, and the discussion of risks and uncertainties presented in the definitive proxy statement on Schedule 14A filed by the Company with the SEC on January 22, 2024 (the “Definitive Proxy Statement”) relating to its special meeting of stockholders are, considered representative, no such list or discussion should be considered a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and/or similar risks, any of which could have a material adverse effect on the completion of the Merger and/or the Company’s consolidated financial condition. The forward-looking statements speak only as of the date they are made. Except as required by applicable law or regulation, the Company undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

The information that can be accessed through hyperlinks or website addresses included in this communication is deemed not to be incorporated in or part of this communication.

Additional Information and Where to Find It

This Current Report on Form 8-K is being made in respect of the pending Merger involving the Company and Parent and may be deemed to be soliciting material relating to such transaction. On January 22, 2024, the Company filed the Definitive Proxy Statement with the SEC relating to its special meeting of stockholders and may file or furnish other documents with the SEC regarding the Merger. STOCKHOLDERS ARE URGED TO CAREFULLY READ THE DEFINITIVE PROXY STATEMENT REGARDING THE MERGER (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE THEREIN) AND ANY OTHER RELEVANT DOCUMENTS FILED OR FURNISHED WITH THE SEC IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER. The Company’s stockholders may obtain free copies of the documents the Company files with the SEC from the SEC’s website at www.sec.gov or through the Company’s website at investors.rover.com under the link “Financials” and then under the link “SEC Filings” or by contacting the Company’s Investor Relations department via e-mail at investorrelations@rover.com.

Participants in the Solicitation

The Company and its directors and executive officers, which consist of Adam Clammer, Jamie Cohen, Venky Ganesan, Greg Gottesman, Kristine Leslie, Scott Jacobson, Erik Prusch, Megan Siegler, who are the non-employee members of the Company’s Board of Directors, Aaron Easterly, the Company’s Chief Executive Officer and Chairperson of the Board of Directors, Brent Turner, the Company’s President and Chief Operating Officer, and Charlie Wickers, the Company’s Chief Financial Officer, are participants in the solicitation of proxies from the Company’s stockholders in connection with the Merger. Information regarding the Company’s directors and executive officers, including a description of their direct or indirect interests, by security holdings or otherwise, can be found under the captions “The Merger—Interests of Rover’s Directors and Executive Officers in the Merger” and “Security Ownership of Certain Beneficial Owners and Management” in the Definitive Proxy Statement. To the extent that the Company’s directors and executive officers and their respective affiliates have acquired or disposed of security holdings since the applicable “as of” date disclosed in the Definitive Proxy Statement, such transactions have been or will be reflected on Statements of Change in Ownership on Form 4 or amendments to beneficial ownership reports on Schedules 13D filed with the SEC. Other information regarding the participants in the proxy solicitation and a description of their interests will be contained in other relevant materials to be filed with the SEC in respect of the Merger when they become available. These documents and the Definitive Proxy Statement can be obtained free of charge from the sources indicated above.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| ROVER GROUP, INC. |

| | |

Date: February 12, 2024 | By: | /s/ Charlie Wickers |

| | Charlie Wickers |

| | Chief Financial Officer |

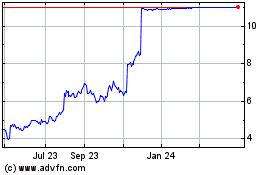

Rover (NASDAQ:ROVR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rover (NASDAQ:ROVR)

Historical Stock Chart

From Apr 2023 to Apr 2024