false

0001624326

0001624326

2024-02-09

2024-02-09

0001624326

PAVM:CommonStockParValue0.001PerShareMember

2024-02-09

2024-02-09

0001624326

PAVM:SeriesZWarrantsToPurchaseCommonStockMember

2024-02-09

2024-02-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): February 9, 2024

PAVMED

INC.

(Exact

Name of Registrant as Specified in Charter)

| Delaware |

|

001-37685 |

|

47-1214177 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

| 360

Madison Avenue, 25th

Floor, New

York, New

York |

|

10017 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (917) 813-1828

N/A

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425). |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12). |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)). |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)). |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, Par Value $0.001 Per Share |

|

PAVM |

|

The

Nasdaq Stock Market LLC |

| Series

Z Warrants to Purchase Common Stock |

|

PAVMZ |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

8.01. Other Events.

On

February 9, 2024, PAVmed Inc. (the “Company”) issued an Information Statement relating to its previously announced

distribution to its stockholders of approximately 3,331,771 shares of common stock of Lucid Diagnostics Inc., the Company’s majority

owned subsidiary (“Lucid Diagnostics”), through a special pro rata dividend. The shares being distributed by the Company

represent approximately 6.9% of Lucid Diagnostics’ common stock outstanding. After the distribution, the Company will continue

to own approximately 65.2% of Lucid Diagnostics’ common stock. A copy of the Information Statement is attached hereto as Exhibit

99.1 and is incorporated herein by reference.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits:

| Exhibit

No. |

|

Description |

| 99.1 |

|

Information Statement. |

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

February 9, 2024

| |

PAVMED

INC. |

| |

|

|

| |

By: |

/s/

Dennis M. McGrath |

| |

|

Dennis

M. McGrath |

| |

|

President

and Chief Financial Officer |

Exhibit

99.1

360

Madison Avenue, 25th Floor

New York, New York 10017

February

9, 2024

Dear

PAVmed Inc. Stockholders:

On

November 28, 2023, the board of directors of PAVmed Inc. (NASDAQ: PAVM) (“PAVmed”) approved a distribution

by special dividend to PAVmed’s stockholders of approximately 3,331,771 shares of common stock of Lucid Diagnostics Inc. (NASDAQ:

LUCD) (“Lucid Diagnostics”) held by PAVmed. The Lucid Diagnostics shares being distributed by PAVmed represent

approximately 6.9% of Lucid Diagnostics’ common stock outstanding as of the date hereof. After the distribution, PAVmed will continue

to own approximately 65.2% of Lucid Diagnostics’ common stock.

Owners

of PAVmed’s common stock and preferred stock are entitled to receive Lucid Diagnostics shares in the Distribution. The holder of

PAVmed’s senior convertible notes has waived its right to participate in the Distribution.

Based

on the number of shares of PAVmed’s stock outstanding as of January 15, 2024, the record date, each PAVmed stockholder will be

entitled to receive 0.37709668 of a share of Lucid Diagnostics’ common stock for each share of PAVmed’s common stock held

(in the case of PAVmed’s preferred stock, as if such preferred stock had been converted into common stock) as of 5:00 p.m. Eastern

Time on the record date. PAVmed will not distribute fractional shares of Lucid Diagnostics’ common stock. Instead, PAVmed will

round each PAVmed stockholders’ entitlement to Lucid Diagnostics shares to the nearest whole number of shares. PAVmed will distribute

the Lucid Diagnostics shares on February 15, 2024, the distribution date.

Based

on closing market price on January 15, 2024, the record date, the special dividend reflects a distribution of Lucid Diagnostics shares

with a market value of approximately $0.57 per share of PAVmed’s common stock.

Following

the distribution, Lucid Diagnostics’ common stock will continue to be listed on the Capital Market of The Nasdaq Stock Market LLC

(“Nasdaq”) under the symbol LUCD, and PAVmed’s common stock will continue to be listed on the Nasdaq

Capital Market under the symbol PAVM. You need not take any action to receive your Lucid Diagnostics shares. You do not need to pay any

consideration, or surrender or exchange your PAVmed shares, to receive your distribution of Lucid Diagnostics shares.

The

attached information statement provides you with important information concerning the distribution of the Lucid Diagnostics shares, including

(i) the expected U.S. federal income tax treatment of Lucid Diagnostics shares you will receive; (ii) how we determined the number of

Lucid Diagnostics shares you will receive; and (iii) how fractional shares will be treated.

We

appreciate your continued interest and support.

Sincerely,

PAVmed

Inc.

PAVMED

INC.

INFORMATION

STATEMENT

Distribution

of Approximately 3,331,771 Shares of

Lucid Diagnostics Inc. Common Stock

February

9, 2024

We

are sending you this Information Statement because we are distributing by special dividend approximately 3,331,771 shares of common stock

of Lucid Diagnostics Inc. (NASDAQ: LUCD), a Delaware corporation (“Lucid Diagnostics”), held by us (the “Distribution”).

The Lucid Diagnostics shares being distributed by us represent approximately 6.9% of Lucid Diagnostics’ common stock outstanding

as of the date hereof. After the distribution, we will continue to own approximately 65.2% of Lucid Diagnostics’ common stock.

Owners

of the common stock and preferred stock of PAVmed Inc., a Delaware corporation (“PAVmed”), are entitled to

receive Lucid Diagnostics shares in the Distribution. The holder of PAVmed’s senior convertible notes has waived its right to participate

in the Distribution.

Based

on the number of shares of PAVmed’s stock outstanding as of January 15, 2024, the record date (the “Record Date”),

holders of shares of PAVmed stock will be entitled to receive 0.37709668 of a share of Lucid Diagnostics’ common stock for each

share of PAVmed’s common stock held (in the case of PAVmed’s preferred stock, as if such preferred stock had been converted

into common stock) as of 5:00 p.m. Eastern Time on the Record Date. We will not distribute fractional shares of Lucid Diagnostics’

common stock. Instead, we will round each PAVmed stockholders’ entitlement to Lucid Diagnostics shares to the nearest whole number

of shares. The Distribution will be made on February 15, 2024 (the “Distribution Date”).

Based

on closing market price on the Record Date, the special dividend reflects a distribution of Lucid Diagnostics shares with a market value

of approximately $0.57 per share of PAVmed’s common stock.

Because

PAVmed is not expected to have any current or accumulated earnings and profits, the Distribution is expected to be treated as a non-taxable

return of capital to PAVmed’s shareholders. A return of capital is a non-dividend distribution that is not paid out of the earnings

and profits of the issuing corporation. As a result, your receipt of the Distribution should be subject to federal income taxation only

to the extent that the fair market value of the Lucid Diagnostics common stock you receive exceeds the adjusted tax basis in your shares

of PAVmed common stock. A return of capital distribution will reduce your cost basis in your shares of PAVmed common stock, which may

increase your tax liability upon the sale of your shares of PAVmed common stock or upon subsequent distributions in respect of your investment

in PAVmed. For a fuller discussion of the tax consequences of the Distribution to you, see “Federal Income Tax Consequences”

beginning on page 6. You are urged to consult your own tax advisor to determine the particular tax consequences of the Distribution to

you, including the applicability and effect of any U.S. federal, state and local and foreign tax laws.

No

vote of PAVmed stockholders is required in connection with the Distribution. Therefore, you are not required to take any action. We are

sending you this Information Statement, which contains information about the terms of the Distribution, for your information only.

Neither

the Securities and Exchange Commission nor any state securities regulators have approved or disapproved of the Lucid Diagnostics shares

to be distributed to you pursuant to this Distribution or determined if this Information Statement is accurate or adequate. Any representation

to the contrary is a criminal offense.

This

information statement is first being transmitted to PAVmed stockholders on or about February 9, 2024.

QUESTIONS

AND ANSWERS ABOUT THE DISTRIBUTION

1.

I own shares of PAVmed stock. What will I receive as a result of the Distribution?

Owners

of the common stock and preferred stock of PAVmed are entitled to receive Lucid Diagnostics shares in the Distribution. PAVmed will distribute

by special dividend 0.37709668 of a share of Lucid Diagnostics’ common stock for each share of PAVmed’s common stock held

(in the case of PAVmed’s preferred stock, as if such preferred stock had been converted into common stock) as of 5:00 p.m. Eastern

Time on the Record Date. The distribution ratio is based on the total number of Lucid Diagnostics shares to be distributed divided by

the PAVmed shares outstanding (in the case of PAVmed’s preferred stock, as if such preferred stock had been converted into common

stock) at that time. PAVmed will not distribute fractional shares of Lucid Diagnostics’ common stock. Instead, PAVmed will round

each PAVmed stockholders’ entitlement to Lucid Diagnostics shares to the nearest whole number of shares.

2.

How is the number of Lucid Diagnostics shares that I will receive calculated?

For

each share of PAVmed common stock held of record by you (in the case of PAVmed’s preferred stock, as if such preferred stock had

been converted into common stock) at 5:00 p.m. Eastern Time on the Record Date, you will be entitled to receive that number of shares

of Lucid Diagnostics’ common stock equal to the quotient obtained by dividing the total number of shares of Lucid Diagnostics’

common stock to be distributed in the Distribution (or 3,331,771 shares) by the total number of shares of PAVmed’s common stock

outstanding (in the case of PAVmed’s preferred stock, as if such preferred stock had been converted into common stock) at 5:00

p.m. Eastern Time on the Record Date (or 8,835,323 shares). Based on these numbers, you will be entitled to receive 0.37709668 of a share

of Lucid Diagnostics’ common stock for each share of PAVmed’s common stock held of record by you (in the case of PAVmed’s

preferred stock, as if such preferred stock had been converted into common stock) at 5:00 p.m. Eastern Time on the Record Date.

The

number of Lucid Diagnostics shares being distributed by us is equal to the number of shares issued to us by Lucid Diagnostics on or about

January 26, 2024 in satisfaction of certain intercompany obligations. For more information, see “Where You Can Find Additional

Information” on page 10.

3.

How will fractional shares be treated?

PAVmed

will not distribute fractional shares of Lucid Diagnostics’ common stock. Instead, PAVmed will round each PAVmed stockholders’

entitlement to Lucid Diagnostics shares to the nearest whole number of shares.

4.

What is the Record Date for the Distribution, and when will the Distribution occur?

The

Record Date was January 15, 2024, and ownership was determined as of 5:00 p.m. Eastern Time on that date. Shares of Lucid Diagnostics’

common stock will be distributed on February 15, 2024. We refer to this date as the Distribution Date.

5.

What do I have to do to participate in the Distribution and receive my Lucid Diagnostics shares?

You

need not take any action to receive your shares of Lucid Diagnostics’ common stock. You do not need to pay any consideration, or

surrender or exchange your PAVmed shares, to receive your distribution of Lucid Diagnostics shares.

6.

If I sell my shares of PAVmed’s common stock before the Distribution Date, will I still be entitled to receive Lucid Diagnostics

shares in the Distribution?

The

“regular way” market for shares of PAVmed’s common stock is the Capital Market of The Nasdaq Stock Market LLC (“Nasdaq”).

Since January 11, 2024 (the “ex-dividend date”), trades in PAVmed’s common stock in the regular way market

have not included any entitlement to shares of Lucid Diagnostics’ common stock to be distributed pursuant to the Distribution.

Holders of shares of PAVmed’s common stock who sell PAVmed shares in the regular way market after the ex-dividend date retain their

right to receive Lucid Diagnostics shares pursuant to the Distribution.

Shares

of Lucid Diagnostics’ common stock will trade in the same manner that has been in existence since Lucid Diagnostics’ common

stock began trading on Nasdaq. Lucid Diagnostics’ common stock currently trades on the Nasdaq Capital Market under the symbol LUCD.

You

are encouraged to consult with your financial advisors regarding the specific implications of trading PAVmed’s common stock or

Lucid Diagnostics’ common stock before the Distribution Date.

7.

How will the Distribution affect the number of shares of PAVmed I currently hold?

The

number of shares of PAVmed’s common stock held by a stockholder will be unchanged as a result of the Distribution.

8.

What are the tax consequences of the Distribution to PAVmed stockholders?

The

Distribution is expected to be treated as a non-taxable return of capital to PAVmed’s shareholders, because PAVmed is not expected

to have any current or accumulated earnings and profits (although this cannot be definitively determined until PAVmed’s fiscal

year-end). A return of capital is a non-dividend distribution that is not paid out of the earnings and profits of the issuing corporation.

As a result, your receipt of the Distribution should be subject to federal income taxation only to the extent that the fair market value

of the shares of Lucid Diagnostics common stock you receive exceeds the adjusted tax basis in your shares of PAVmed common stock. A return

of capital distribution will reduce your cost basis in your shares of PAVmed common stock which may increase your tax liability upon

the sale of your shares of PAVmed common stock or upon subsequent distributions in respect of your investment in PAVmed. For a fuller

discussion of the tax consequences of the Distribution to you, see “Federal Income Tax Consequences” beginning on

page 6. You are urged to consult your own tax advisor to determine the particular tax consequences of the Distribution to you, including

the applicability and effect of any U.S. federal, state and local and foreign tax laws.

9.

When will I receive my Lucid Diagnostics shares? Will I receive a stock certificate for Lucid Diagnostics shares distributed as a result

of the Distribution?

We

will make the Distribution on February 15, 2024. Registered holders of PAVmed’s common stock who are entitled to receive the Distribution

will receive a book-entry account statement reflecting their ownership of Lucid Diagnostics’ common stock. If you would like to

receive physical certificates evidencing your Lucid Diagnostics shares, please contact Lucid Diagnostics’ transfer agent. See “Lucid

Diagnostics’ Transfer Agent and Registrar” on page 10.

10.

What if I hold my shares through a broker, bank or other nominee?

PAVmed

stockholders who hold their shares through a broker, bank or other nominee will have their brokerage account credited with Lucid Diagnostics

shares. For additional information, those stockholders should contact their broker or bank directly.

11.

What if I have stock certificates representing my shares of PAVmed’s common stock? Should I send them to the transfer agent or

to PAVmed?

No,

you should not send your stock certificates to the transfer agent or to PAVmed. You should retain your PAVmed stock certificates. No

certificates representing your shares of Lucid Diagnostics’ common stock will be mailed to you. Lucid Diagnostics’ common

stock will be issued uncertificated and registered in book-entry form through the direct registration system.

ADDITIONAL

INFORMATION ABOUT THE DISTRIBUTION

The

Distribution

On

November 28, 2023, our board of directors approved the Distribution of 3,331,771 shares (subject to rounding of fractional shares) of

Lucid Diagnostics’ common stock held by us. On the Distribution Date, we will distribute the shares of Lucid Diagnostics’

common stock to our stockholders as a special dividend.

You

will not be required to pay any cash or other consideration for the Lucid Diagnostics shares that will be distributed to you or to surrender

or exchange your PAVmed shares to receive the distribution of Lucid Diagnostics shares. The Distribution will not affect the number of

shares of PAVmed’s common stock that you hold.

Background

and Purpose of the Distribution

PAVmed

acquired the shares of Lucid Diagnostics’ common stock being distributed in May 2018 in connection with the formation of Lucid

Diagnostics. Lucid Diagnostics was formed to acquire and commercialize the technology for both a noninvasive swallowable balloon capsule

catheter device capable of sampling surface esophageal cells (known as EsoCheck) and a bisulfite-converted next-generation sequencing

DNA assay performed on surface esophageal cells to detect esophageal precancer (known as EsoGuard). Lucid Diagnostics completed its initial

public offering in October 2021.

On

November 28, 2023, our board of directors approved the distribution of 3,331,771 shares (subject to rounding of fractional shares) of

Lucid Diagnostics’ common stock held by us to our stockholders on a pro rata basis through the declaration of a special in-kind

dividend. After careful consideration, we believe that the Distribution is consistent with our goal of maximizing long-term value for

our stockholders. We also believe that, in light of market conditions for both us and Lucid Diagnostics, it is in our stockholders’

best interests to allow them to directly hold a portion of Lucid Diagnostics shares in which they would otherwise have an indirect interest

through us.

The

Lucid Diagnostics shares being distributed by us represent approximately 6.9% of Lucid Diagnostics’ common stock outstanding as

of the date hereof. After the distribution, we will continue to own approximately 31,302,420 shares of Lucid Diagnostics’ common

stock, or approximately 65.2% of Lucid Diagnostics’ common stock outstanding.

The

number of Lucid Diagnostics shares being distributed by us is equal to the number shares being issued to us by Lucid Diagnostics in satisfaction

of certain intercompany obligations. For more information, see “Where You Can Find Additional Information” on page

10.

Transferability

of the Shares You Receive

The

shares of Lucid Diagnostics’ common stock distributed to our stockholders will be freely transferable, except for shares received

by persons who may be deemed to be “affiliates” of Lucid Diagnostics under the Securities Act of 1933, as amended (the “Securities

Act”). Persons who may be deemed to be affiliates after the Distribution generally include individuals or entities that

control, are controlled by, or are under common control with Lucid Diagnostics, and include its directors, certain of its officers and

significant stockholders. Lucid Diagnostics’ affiliates will be permitted to sell their shares of Lucid Diagnostics’ common

stock only pursuant to an effective registration statement under the Securities Act or an exemption from the registration requirements

of the Securities Act, such as the exemption afforded by the provisions of Rule 144 thereunder.

When

and How You Will Receive the Shares

We

will pay the special dividend on the Distribution Date by releasing the Lucid Diagnostics shares for distribution by Continental Stock

Transfer & Trust Company, our distribution agent. The distribution agent will cause the shares of Lucid Diagnostics’ common

stock to which you are entitled to be registered in your name or in the “street name” of your bank or brokerage firm.

Registered

Holders. If you are the registered holder of PAVmed’s common stock and hold your PAVmed shares either in physical form or in

book-entry form, the shares of Lucid Diagnostics’ common stock distributed to you will be registered in your name and you will

become the holder of record of that number of shares of Lucid Diagnostics’ common stock.

“Street

Name” Holders. Many of our stockholders have PAVmed shares held in an account with a bank or brokerage firm. If this applies

to you, that bank or brokerage firm (or their nominee) is the registered holder that holds the shares on your behalf. For stockholders

who hold their PAVmed shares in an account with a bank or brokerage firm, the Lucid Diagnostics’ common stock being distributed

will be registered in the “street name” of your bank or broker (or their nominee), who in turn will electronically credit

your account with the shares of Lucid Diagnostics’ common stock that you are entitled to receive in the Distribution. We anticipate

that this may take several days after the Distribution Date. We encourage you to contact your bank or broker if you have any questions

regarding the mechanics of having your shares of Lucid Diagnostics’ common stock credited to your account.

Fractional

Shares. We will not distribute any fractional shares of Lucid Diagnostics’ common stock to our stockholders. Instead, we will

round each PAVmed stockholders’ entitlement to Lucid Diagnostics shares to the nearest whole number of shares.

Direct

Registration System for Registered Holders. Shares of Lucid Diagnostics’ common stock will be issued as uncertificated shares

registered in book-entry form through the direct registration system. No certificates representing the shares of Lucid Diagnostics’

common stock to which you are entitled will be mailed to you. If at any time you want to receive a physical certificate evidencing your

shares of Lucid Diagnostics’ common stock, you may do so by contacting Lucid Diagnostics’s transfer agent and registrar.

See “Lucid Diagnostics’ Transfer Agent and Registrar” on page 10.

Adjustment

of Series Z Warrants

In

connection with the Distribution, the exercise price of PAVmed’s outstanding Series Z Redeemable Warrants (the “Series

Z Warrants”) will be adjusted in accordance with the terms of the warrants. In accordance with Section 4.3 of the Amended

and Restated Series Z Warrant Agreement, dated as of June 8, 2018, by and between PAVmed and the warrant agent, the exercise price of

the Series Z Warrants will be decreased by the fair market value of the special dividend, or $0.57 per share, from $24.00 per share to

$23.43 per share.

No

Appraisal Rights

Stockholders

do not have rights of appraisal with respect to the Distribution described in this Information Statement.

FEDERAL

INCOME TAX CONSIDERATIONS

U.S.

Federal Income Tax Consequences for U.S. Holders

The

following discussion of certain U.S. federal income tax considerations to a “U.S. Holder” (as defined below) of the Distribution

does not address all U.S. federal income tax matters that may be relevant to particular U.S. Holders in light of their particular circumstances,

such as U.S. Holders who are dealers in securities, financial institutions, insurance companies, tax-exempt entities, persons whose functional

currency is not the U.S. dollar, persons subject to the alternative minimum tax, persons who acquired their shares in connection with

compensatory transactions, and persons that hold PAVmed shares as part of a straddle or a hedging or conversion transaction.

The

term “U.S. Holder” as used in this discussion means the following persons who own PAVmed shares as capital

assets:

| |

● |

U.S.

citizens or U.S. residents (as defined for U.S. federal income tax purposes); |

| |

|

|

| |

● |

corporations

(or other entities classified as corporations for U.S. federal income tax purposes) organized under the laws of the U.S. or of any

state or the District of Columbia; |

| |

|

|

| |

● |

an

estate whose income is subject to U.S. federal income taxation regardless of the source of the income, and |

| |

|

|

| |

● |

a

trust, if a U.S. court is able to exercise primary supervision over the administration of the trust and one or more “United

States persons,” as defined for U.S. federal income tax purposes, have the authority to control all substantial decisions of

the trust, or that has elected to be treated as a “United States person” under applicable U.S. Treasury regulations. |

Stockholders

other than U.S. Holders are referred to in this discussion as Non-U.S. Holders.

An

individual may, in certain cases, be treated as a resident of the U.S., rather than a nonresident, among other ways, by virtue of being

present in the U.S. on at least 31 days in that calendar year and for an aggregate of at least 183 days during the three-year period

ending in that calendar year (counting for such purposes all the days present in the current year, one-third of the days present in the

immediately preceding year and one-sixth of the days present in the second preceding year). Residents are generally subject to U.S. federal

income tax as if they were U.S. citizens.

If

a partnership, a pass-through entity treated as a partnership for U.S. federal income tax purposes, or an entity treated as a disregarded

entity for U.S. federal income tax purposes holds common stock, the tax treatment of an owner of such entity will generally depend on

the status of the owner and upon the activities of the entity. Accordingly, such entities which hold PAVmed’s common stock and

owners in these entities are urged to consult their tax advisors.

This

summary is based on the Internal Revenue Code of 1986, as amended (the “Code”), and other legal authorities,

all of which are subject to change, possibly with retroactive effect or subject to different interpretations. This summary is of a general

nature only and is not intended to be, and should not be construed to be, legal, business or tax advice to any stockholder, and no representation

with respect to the tax consequences to any particular stockholder is made. No opinion from legal counsel and no ruling from the Internal

Revenue Service (the “IRS”) has been or will be sought as to the U.S. federal income tax consequences of the

Distribution. The following summary is not binding on the IRS or the courts. The IRS could adopt a contrary position, and that contrary

position could be sustained by a court. Each U.S. Holder should consult such holder’s own tax advisors with respect to the U.S.

federal income tax considerations of the Distribution that are relevant to such holder, having regard to such holder’s particular

circumstances.

Receipt

by a U.S. Holder of the Lucid Diagnostics Shares

The

receipt by a U.S. Holder of shares of Lucid Diagnostics’ common stock is not expected to qualify as a non-recognition event under

Section 355 of the Code.

U.S.

Holders of PAVmed’s stock that receive Lucid Diagnostics shares in the Distribution will be treated as receiving a distribution

from PAVmed in respect of their PAVmed stock in an amount equal to the fair market value of such Lucid Diagnostics common stock on the

Distribution Date. The amount received in the Distribution is expected to be treated as a non-taxable return of capital to such shareholders,

because PAVmed, taking into consideration gain recognized by PAVmed in this Distribution, if any, is not expected to have any current

or accumulated earnings and profits (although this cannot be definitively determined until PAVmed’s fiscal year-end). As a result,

the distribution of Lucid Diagnostics common stock is expected to be a nontaxable return of capital to the extent of each shareholder’s

adjusted tax basis in the PAVmed stock, with any remaining amount being taxed as capital gain, assuming such shareholder has held the

PAVmed common stock as a capital asset. If such shareholder has held the PAVmed common stock for more than one year, the capital gain

will be subject to long-term capital gains rates.

While

it is not expected, in the unlikely event that at fiscal year-end PAVmed has current earnings and profits, the distribution to its shareholders

will be taxable as a dividend to the extent of the fair market value of the Lucid Diagnostics common stock received, not to exceed the

amount of PAVmed’s current earnings and profits. Any amount of the distribution in excess of PAVmed’s current earnings and

profits would be treated as a nontaxable return of capital as described above.

The

U.S. Holder should have a tax basis in the shares of Lucid Diagnostics’ common stock received equal to the fair market value of

such shares at the time distributed. The tax basis in a shareholder’s shares of PAVmed’s common stock after the Distribution

will be reduced by the portion of the distribution, if any, that was treated as a nontaxable return of capital. The U.S. Holder’s

holding period for such shares of Lucid Diagnostics’ common stock would begin the day after the Distribution (or possibly the date

of the Distribution).

U.S.

Information Reporting and Backup Withholding with respect to U.S. Holders

In

general, information regarding the amount of any dividends paid to U.S. Holders is reported to the IRS unless an exception applies. In

addition, backup U.S. federal income tax withholding may apply with respect to the amount of the distribution of Lucid Diagnostics shares

treated as a dividend paid to a U.S. Holder, unless the U.S. Holder provides a correct taxpayer identification number (which, in the

case of an individual, is his or her social security number) and certifies whether such U.S. Holder is subject to backup withholding

of U.S. federal income tax by completing a Form W-9 or otherwise establishes a basis for exemption from backup withholding. Some U.S.

Holders (including, among others, corporations) are not subject to these backup withholding and reporting requirements. U.S. Holders

who fail to provide their correct taxpayer identification numbers and the appropriate certifications or fail to establish an exemption

as described above may be subject to a penalty imposed by the IRS. If there is withholding on a payment to a U.S. Holder and the withholding

results in an overpayment of taxes, a refund may be obtained from the IRS.

U.S.

Federal Income Tax Considerations for Non-United States Stockholders

Non-U.S.

Holders of PAVmed common stock that receive Lucid Diagnostics’ common shares in the Distribution will be treated as receiving a

distribution from PAVmed in respect of their PAVmed stock in an amount equal to the fair market value of such Lucid Diagnostics common

stock on the Distribution Date. The amount received in the Distribution is expected to be treated as a non-taxable return of capital

to such shareholders, since PAVmed, taking into consideration gain recognized by PAVmed in this Distribution, if any, is not expected

to have any current or accumulated earnings and profits (although this cannot be definitively determined until PAVmed’s fiscal

year-end). As a result, the distribution of Lucid Diagnostics common stock is expected to be a nontaxable return of capital to the extent

of each shareholder’s adjusted tax basis in the PAVmed common stock, with any remaining amount being treated as a capital gain,

assuming such shareholder has held the PAVmed common stock as a capital asset.

Generally,

a Non-U.S. Holder will not be subject to United States federal income taxes on any amount which constitutes capital gain upon the Distribution,

unless such Non-U.S. Holder is an individual who is present in the United States for 183 days or more in the taxable year of the disposition

and such gain is derived from sources within the United States. Certain other exceptions may be applicable, and a Non-U.S. Holder should

consult its tax advisor in this regard.

Although

it is not expected, in the unlikely event that at fiscal year-end PAVmed has current earnings and profits, the distribution to its shareholders

will be taxable as a dividend to the extent of the fair market value of the Lucid Diagnostics common stock received, not to exceed the

amount of PAVmed’s current earnings and profits. Any amount of the distribution in excess of PAVmed’s current earnings and

profits would be treated as a nontaxable return of capital as described above.

Generally

speaking, the gross amount of any dividend (to the extent of PAVmed’s current and accumulated earnings and profits – although,

as discussed above, we believe it is unlikely that there will be any) paid to a Non-U.S. Holder will generally be subject to U.S. withholding

tax at a rate of 30% unless the holder is entitled to an exemption from or reduced rate of withholding under an applicable income tax

treaty. To receive a reduced treaty rate, prior to the payment of the dividend a Non-U.S. Holder must provide PAVmed with a properly

completed IRS Form W-8BEN, IRS Form W-8BEN-E, or other appropriate IRS Form W-8 (or successor form) certifying qualification for the

reduced rate. PAVmed may fund any such U.S. withholding tax by reducing the number of Lucid Diagnostics shares distributed to a Non-U.S.

Holder to reflect the amount of that U.S. withholding tax.

Dividends

received by a Non-U.S. Holder that are effectively connected with a U.S. trade or business conducted by the Non-U.S. Holder (or dividends

attributable to a Non-U.S. Holder’s permanent establishment in the U.S. if an income tax treaty applies) are exempt from this withholding

tax. To obtain this exemption, prior to the payment of a dividend, a Non-U.S. Holder must provide PAVmed with a properly completed IRS

Form W-8ECI (or successor form) properly certifying this exemption. Effectively connected dividends (or dividends attributable to a permanent

establishment), although not subject to withholding tax, are subject to U.S. federal income tax at the same graduated rates applicable

to U.S. persons, net of certain deductions and credits. In addition, dividends received by a corporate Non-U.S. Holder that are effectively

connected with a U.S. trade or business of the corporate Non-U.S. Holder (or dividends attributable to a corporate Non-U.S. Holder’s

permanent establishment in the U.S. if an income tax treaty applies) may also be subject to a branch profits tax at a rate of 30% (or

such lower rate as may be specified in an income tax treaty).

A

Non-U.S. Holder of common stock that is eligible for a reduced rate of withholding tax pursuant to an income tax treaty may obtain a

refund of any excess amounts currently withheld if an appropriate claim for refund is timely filed with the IRS.

Withholding

on Payments to Certain Foreign Entities

Sections

1471 through 1474 of the Code and the U.S. Treasury Regulations and administrative guidance issued thereunder, which we refer to as “FATCA,”

impose a 30% withholding tax on payments of dividends if paid to a “foreign financial institution” or a “non-financial

foreign entity” (each as defined in the Code) (including, in some cases, when such foreign financial institution or non-financial

foreign entity is acting as an intermediary), which could include dividends paid to a Non-U.S. Holder that is a “foreign financial

institution” or a non-financial foreign institution” in the form of Lucid Diagnostics shares, unless: (i) in the case of

a foreign financial institution, such institution enters into an agreement with the U.S. government to withhold on certain payments,

and to collect and provide to the U.S. tax authorities substantial information regarding U.S. account holders of such institution (which

includes certain equity and debt holders of such institution, as well as certain account holders that are foreign entities with U.S.

owners); (ii) in the case of a non-financial foreign entity, such entity certifies that it does not have any “substantial United

States owners” (as defined in the Code) or provides the withholding agent with a certification identifying its direct and indirect

substantial United States owners (generally by providing an IRS Form W-8BEN-E); or (iii) the foreign financial institution or non-financial

foreign entity otherwise qualifies for an exemption from these rules and provides appropriate documentation (such as an IRS Form W-8BEN-E).

Foreign financial institutions located in jurisdictions that have an intergovernmental agreement with the United States with respect

to FATCA may be subject to different rules. Under certain circumstances, a beneficial owner of common stock might be eligible for refunds

or credits of such taxes. Under the applicable Treasury Regulations, FATCA withholding generally will apply to all U.S.-source “withholdable

payments” without regard to whether the beneficial owner of the payment would otherwise be entitled to an exemption from imposition

of withholding tax pursuant to an applicable income tax treaty with the United States or U.S. domestic law.

Backup

Withholding and Information Reporting with Respect to Non-U.S. Holders

Generally,

PAVmed must report annually to the IRS the amount of dividends paid, the name and address of the recipient, and the amount, if any, of

tax withheld. A similar report is sent to the holder. Pursuant to income tax treaties or other agreements, the IRS may make its reports

available to tax authorities in the Non-U.S. Holder’s country of residence.

Payments

of distributions that may be characterized as dividends for tax purposes, which is not expected as discussed above, made to a Non-U.S.

Holder may be subject to additional information reporting and backup withholding. Backup withholding will not apply if the Non-U.S. Holder

establishes an exemption, for example, by properly certifying its non-U.S. status on an IRS Form W-8BEN, IRS Form W-8BEN-E or other appropriate

IRS Form W-8 (or successor form). Notwithstanding the foregoing, backup withholding may apply if either PAVmed or PAVmed’s paying

agent has actual knowledge, or reason to know, that the holder is a U.S. person.

Backup

withholding is not an additional tax. Rather, the U.S. income tax liability of persons subject to backup withholding will be reduced

by the amount of tax withheld. If withholding results in an overpayment of U.S. federal income tax, a credit or refund may be obtained,

provided that the required information is furnished to the IRS in a timely manner.

INFORMATION

ABOUT LUCID DIAGNOSTICS

Overview

of Lucid Diagnostics

Lucid

Diagnostics is subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and accordingly, files reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”),

including financial statements. If you would like more information about Lucid Diagnostics and Lucid Diagnostics’ common stock

we urge you to read Lucid Diagnostics’ reports filed with the SEC. See “Where You Can Find Additional Information”

below.

Lucid

Diagnostics’ common stock is traded on the Nasdaq Capital Market under the symbol LUCD.

Transfer

Agent and Registrar of Lucid Diagnostics’ Common Stock

Continental

Stock Transfer & Trust Company, LLC (“CST”) is the transfer agent and registrar for Lucid Diagnostics’

common stock. If you have questions or would like information regarding Lucid Diagnostics’ common stock, please contact CST toll-free

at (800) 509-5586.

WHERE

YOU CAN FIND ADDITIONAL INFORMATION

PAVmed

and Lucid Diagnostics are each subject to the reporting requirements of the Exchange Act and accordingly, each company files reports,

proxy statements and other information with the SEC, including financial statements. You may obtain these reports at the SEC’s

website at http://www.sec.gov.

PAVmed

and Lucid Diagnostics maintain websites that offer additional information about each company.

| |

● |

Visit

PAVmed’s website at http://pavmed.com |

| |

|

|

| |

● |

Visit

Lucid Diagnostics’ website at http://www.luciddx.com |

Information

contained on any website referenced in this Information Statement is not incorporated by reference into this Information Statement.

v3.24.0.1

Cover

|

Feb. 09, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 09, 2024

|

| Entity File Number |

001-37685

|

| Entity Registrant Name |

PAVMED

INC.

|

| Entity Central Index Key |

0001624326

|

| Entity Tax Identification Number |

47-1214177

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

360

Madison Avenue

|

| Entity Address, Address Line Two |

25th

Floor,

|

| Entity Address, City or Town |

New

York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10017

|

| City Area Code |

(917)

|

| Local Phone Number |

813-1828

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Common Stock, Par Value $0.001 Per Share |

|

| Title of 12(b) Security |

Common

Stock, Par Value $0.001 Per Share

|

| Trading Symbol |

PAVM

|

| Series Z Warrants to Purchase Common Stock |

|

| Title of 12(b) Security |

Series

Z Warrants to Purchase Common Stock

|

| Trading Symbol |

PAVMZ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PAVM_CommonStockParValue0.001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PAVM_SeriesZWarrantsToPurchaseCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

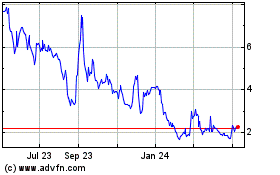

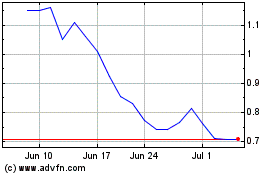

PAVmed (NASDAQ:PAVM)

Historical Stock Chart

From Mar 2024 to Apr 2024

PAVmed (NASDAQ:PAVM)

Historical Stock Chart

From Apr 2023 to Apr 2024