false

0001444839

0001444839

2024-02-06

2024-02-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 6, 2024

BRAVO MULTINATIONAL INCORPORATED

(Name of small business in its charter)

| |

|

|

|

|

| Wyoming |

|

000-53505 |

|

85-4068651 |

| (State

or other jurisdiction of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer Identification No.) |

| |

|

|

|

|

(Address

of principal executive offices)

2020 General Booth Blvd., Suite 230

Virginia Beach, VA 23454 |

Registrant’s

telephone number:

757-306-6090

Check

the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒

No

Item

1.01- Entry into a Material Agreement

Pursuant to the binding term sheet executed on December 20,

2023, Bravo Multinational, Inc. (“Bravo”) entered into an Asset Purchase Agreement with Streaming TVEE, Inc.

(“STV”), a Delaware corporation, on February 6, 2024. The Asset Purchase Agreement provides that at a future

closing date (to occur on or before thirty (30) days from the date of the Asset Purchase Agreement) Bravo will acquire certain

streaming assets of STV as more specifically described in

Schedule 2.1.1a and 2.1.1b

to the Asset Purchase Agreement. At the closing, STV will

receive from Bravo the purchase price of $9,760,000, consisting of a promissory note in the amount of $7,760,000 and the assumption

of $2,000,000 in STV debt. Bravo will assume no other debt of STV. The Asset Purchase Agreement contains other

provisions consistent with agreements of a similar nature.

The board of directors of BRAVO approved the Asset Purchase Agreement

as well as the underlying transaction pursuant thereto.

A significant element of the assets to be acquired under the Asset Purchase Agreement is the TVee NOW™ streaming platform, slated for launch in Q1 of 2024. This strategic move enables Bravo to own cutting-edge OTT streaming technology, as well as a hybrid model blending advertising-based Video-on-Demand (AVOD) along with a subscription based Video-on-Demand (SVOD) services. Furthermore, the assets to be acquired include various transferable Letters of Intent (LOIs) for the purpose of partnering with nonprofit organizations to white-label the platform, granting these entities their own applications powered by TVee NOW™. This initiative, if successful, will allow revenue sharing for Bravo and will create a philanthropic opportunity by enabling the Company to give back to the communities it serves. Additionally, the Agreement's inclusion of Streaming TVEE's recent acquisition of MWP Entertainment Group’s video property assets, featuring exclusive rights to premium music and comedy performances, will enhance Bravo's content portfolio, which will include acclaimed artists such as H.E.R., Snoop Dogg, Bill Burr.

Forward-Looking Statements:

Certain statements contained in this current

report on Form 8-K are forward-looking statements and are based on future expectations, plans, and prospects for Bravo’s business

and operations and involve a number of risks and uncertainties. Bravo’s forward-looking statements in this report are made as of

the date hereof and Bravo disclaims any duties to supplement, update or revise such statements on a going forward basis whether as a

result of subsequent developments, change or expectations or otherwise. In connection with the “safe harbor” provision of

the Private Securities Litigation Reform Act of 1995, Bravo is identifying certain forward-looking information regarding, among other

things, the Important factors that could cause further events or results to vary from those addressed in the forward-looking statements,

including, without limitation, risks and uncertainties arising from the ability of Bravo to successfully manage the assets; uncertainties

relating to the ability to realize the expected benefits of the business plan; unanticipated or unfavorable regulatory matters; general

economic conditions in the industry in which the company operates, and other risk factors as discussed in other Bravo filings made from

time to time with the United States Securities and Exchange Commission.

Item

9.01- Financial Statements and Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

|

| Dated:

February 8, 2024 |

BRAVO

MULTINATIONAL INCORPORATED

By: /s/Richard Kaiser

Name:

Richard Kaiser

Title:

Director/CFO |

Exhibit 10.01

ASSET PURCHASE AGREEMENT

This Asset Purchase Agreement (this "Agreement"), dated as of February 6, 2024, is entered into by and among Streaming TVEE, Inc., a Delaware corporation ("STV") (referred to sometimes as the "Seller") and Bravo Multinational, Inc., a Wyoming corporation ("Bravo") (referred to sometimes as the "Buyer") whose stock is traded on the OTC Markets under the symbol ("BRVO").

RECITALS

A. Seller desires and intends to sell to Buyer certain of its operating assets and other rights relating to its streaming audio-visual business at the price and on the terms and conditions herein set forth.

B. Buyer desires and intends to purchase certain of the operating assets and other rights relating to the Business (as defined below), all subject to and in accordance with the provisions of this Agreement.

AGREEMENT

NOW, THEREFORE, in consideration of the covenants and agreements set forth herein, the parties hereby agree as follows:

Section 1. Definitions

As used in this Agreement, the following capitalized terms shall have the meanings set forth below:

"Affiliate" means with respect to any Person, any other Person which directly or indirectly controls, or is controlled by or is under common control with such Person.

"Business" means Seller's business of streaming audio and visual content.

"Claim" means any claim, demand, cause of action, suit, proceeding, arbitration, hearing or investigation.

"Closing" means the consummation of the purchase and sale of the Assets under this Agreement.

"Closing Date" means the date upon which the Closing becomes effective as further described in Section 4.1.

"Encumbrance" means any security interest, mortgage, lien (excluding any lien for current taxes not yet due and payable), license, charge or any other form of third party ownership.

"Governmental Body" means any federal, state or other governmental body.

"Judgment" means any final and nonappealable judgment, order, award, writ, injunction or decree of any Governmental Body or arbitrator.

"Loss(es)" means any loss, damage, Judgment, debt, liability, obligation, fine, penalty, cost or expense (including, but not limited to, any legal and accounting fee or expense).

-1-

"Permit" means any permit, license, approval, certification, endorsement or qualification of any Governmental Body.

"Person" means any individual, corporation, partnership, limited liability company, joint venture, association, joint-stock company, trust, or unincorporated organization.

"Transaction Documents" means any and all ancillary agreements entered into by Buyer and/or Seller in order to consummate the transactions contemplated by this Agreement.

Section 2. Purchase and Sale of Assets

2.1 Purchase and Sale

Subject to the terms and conditions of this Agreement, at the Closing, Seller shall sell, transfer, convey, assign and deliver to Buyer, free and clear of all Encumbrances, and Buyer shall purchase and acquire, the following assets and rights used in or relating to the Business (collectively, the "Assets"):

2.1.1 Streaming Rights

All streaming rights used exclusively by Seller for the operation of its streaming business more specifically described in Schedule 2.1.1a and Schedule 2.1.1b, and all rights received from the manufacturers and distributors of all such property (to the extent transferable by Seller) (the "Contract").

2.1.2 Intellectual Property

2.1.2(1) All information (whether or not protectable by patent, copyright or trade secret rights) and intellectual property rights possessed or owned by Seller and used exclusively in Seller's operation of the Business as of the close of business on the Closing Date, including, to the extent used exclusively in Seller’s operation of the Business, all trademarks, copyrights and their registrations and applications and all goodwill associated therewith, all patents and patent applications, if any, and all technology, inventions, know-how, trade secrets, manufacturing processes, drawings, designs, technical manuals, brochures, marketing materials and all documentary evidence thereof, including, without limitation, the intellectual property rights described in Schedule 2.1.2.

2.1.3 Permits

All Permits relating exclusively to Seller's operation of the Business, to the extent transferable or assignable, including, without limitation, those Permits described in Schedule 2.1.3.

2.1.4 Goodwill

All of Seller’s goodwill exclusively related to the Business, including the nonexclusive use and enjoyment of the relationships with customers of the Business.

2.2 No Assumption of Obligations

Except for these debts set forth in Schedule 2.2, Buyer shall not assume or become liable for any obligations of Seller. Seller shall retain and be responsible for all liabilities and obligations of Seller that relate to injuries, actions, omissions, conditions or events arising in connection with the operation of the Business on or prior to the Closing Date, whether based on any act or omission of Seller, including, without limitation, (i) any claims based on negligence, strict liability, (ii) any claim, Judgment, penalty, settlement agreement or other obligation to pay in respect of any Claim that is pending or threatened on or prior to the Closing Date, and (iii) any liabilities for taxes either accruing or relating to the periods on or prior to the Closing Date.

-2-

2.3 Instruments of Sale and Transfer

Seller shall take all reasonable additional steps as may be necessary to put Buyer in possession and operating control of the Assets at the Closing. On or before the Closing Date, Seller shall deliver to Buyer and Buyer shall deliver to Seller, as the case may be, such instruments of sale and assignment as shall, in the reasonable judgment of Buyer, be effective to vest in Buyer on the Closing Date all of Seller's right, title and interest in and to the Assets, including, without limitation a Bill of Sale and Assignment substantially in the form attached hereto as Exhibit B (the "Bill of Sale").

Section 3. Purchase Price

3.1 Purchase Price

The purchase price shall be $9,760,000 and shall be paid by the issuance of a promissory note in the amount of $7,760,000 in the form set forth as Exhibit A and the assumption of $2,000,000 in STV debt set forth in Schedule 2.2. The promissory note shall be convertible into the common stock of Bravo based on the December 19, 2023, closing period, which is $.1525.

Section 4. Closing

4.1 Closing Date

Subject to the terms and conditions of this Agreement (including, without limitation, satisfaction or waiver of the conditions set forth in Sections 8 and 9), the Closing shall take place within thirty (30) days after the execution of this Agreement at such please as shall be mutually agreeable to the parties.

4.2 Closing Deliveries by Seller

At the Closing, Seller shall:

(a) deliver to Buyer, duly executed by Seller, the Bill of Sale;

(b) deliver to Buyer such other instruments of sale, transfer and assignment and other deliveries as Buyer may reasonably request with respect to the consummation of the transactions contemplated by this Agreement.

4.3 Closing Deliveries by Buyer

At the Closing, Buyer shall deliver to Seller:

(a) the Purchase Price in accordance with Section 3; and

(b) such other deliveries as Seller may reasonably request with respect to the consummation of the transactions contemplated by this Agreement.

Section 5. Representations and Warranties of Seller and Shareholders

-3-

Seller and the Shareholder represent and warrant to Buyer, which representations and warranties shall survive the execution and delivery of this Agreement to the extent provided herein, as follows:

5.1 Organization and Good Standing

Seller is a corporation duly organized, validly existing and in good standing under the laws of the jurisdiction of its incorporation. Seller has all requisite corporate power and authority to own, operate and lease its respective properties and assets and to carry on its business as now conducted and as proposed to be conducted.

5.2 Power and Authority; Enforceability

Prior to the Closing, the consummation of the transactions contemplated by this Agreement shall have been duly and validly authorized by all necessary corporate action on the part of Seller and no other proceedings on the part of Seller shall be necessary to authorize the consummation of the transactions contemplated by this Agreement. This Agreement, together with the Transaction Documents, has been, and when executed at the Closing, shall be, duly and validly executed and delivered by Seller and, assuming the due authorization, execution and delivery by Seller, this Agreement constitutes, and when executed at the Closing the Transaction Documents shall constitute, a legal, valid and binding obligation of Seller, enforceable against Seller in accordance with its terms, except as such enforceability may be limited by applicable bankruptcy, insolvency, reorganization or other similar laws affecting creditors' rights generally and by general equitable principles (regardless of whether enforceability is considered in a proceeding in equity or at law) and rules of law governing specific performance, injunctive relief or other equitable remedies.

5.3 No Conflict

Assuming the receipt of the requisite approval of the board of directors and shareholders of Seller, the execution, delivery and performance of this Agreement or the Transaction Documents by Seller and the consummation of the transactions contemplated hereby or thereby shall not (a) violate, conflict with, or result in any breach of, any provision of Seller's certificate of incorporation or by-laws, (b) violate, conflict with, result in any breach of, or constitute a default (or an event that, with notice or lapse of time or both, would constitute a default) under any contract or Judgment to which Seller is a party or by which it is bound or which relates to the Assets, (c) result in the creation of any Encumbrance on any of the Assets, (d) violate any applicable law, statute, rule, ordinance or regulation of any Governmental Body, (e) violate or result in the suspension, revocation, modification, invalidity or limitation of any Permits relating to the Assets, or (f) give any party with rights under any contract, Judgment or other restriction to which Seller is a party or by which it is bound or which relates to the Assets, the right to terminate, modify or accelerate any rights, obligations or performance under such contract, Judgment or restriction.

5.4 Consents and Approvals

Assuming the receipt of the requisite approval of the board of directors and shareholders of the Seller, no notice to or approval by any other Person is required of Seller to consummate the transactions contemplated by this Agreement.

5.5 Tangible Assets

The tangible assets included in the Assets are sold “as is” and without warranty of merchantability, fitness for a particular purpose, or otherwise.

5.6 Claims and Legal Proceedings

There are no Claims pending or, to the knowledge of Seller', threatened against Seller, or any of the Assets or which seek to question, delay or prevent the consummation of or would potentially impair the ability of Seller to consummate the transaction contemplated hereby. There are no outstanding judgments, orders, writs, injunctions, indictments or information, grand jury subpoenas or civil investigative demands, plea agreements, stipulations, awards or decrees of any court, arbitrator or any federal, state, municipal or other governmental department, commission, board, agency or instrumentality which would prevent the Seller from transferring good title to the Assets.

-4-

5.7 Inventory

All Inventory to be transferred to Buyer hereunder is of a quality and quantity that is saleable and/or useable in the ordinary course of the Business as currently conducted by Seller and is appropriate for its intended use.

5.8 No Adverse Events

Neither Seller nor any Shareholder has knowledge of any facts or circumstances that hinder or adversely affect, or in the future are reasonably likely to hinder or adversely affect, the Assets.

5.9 Compliance With Law

Seller has not received any written notice of any alleged violation nor, to Seller's knowledge is there, any basis for any claim of any such violation, of any law, statute, rule, ordinance, regulation or Judgment applicable to the ownership of the Assets or the operation of the Business. To Seller's knowledge, there is no law, statute, rule, ordinance or regulation promulgated by any Governmental Body or any Judgment that materially and adversely affects or is reasonably expected to materially and adversely affect the Business as currently conducted by the Seller.

5.10 Brokerage

Seller has not retained any broker or finder in connection with the transactions contemplated by this Agreement.

5.11 Taxes

Seller has no tax obligations that will either result in a lien, claim or encumbrance on any of the Assets.

5.12 Full Disclosure

Seller has disclosed to Buyer in writing all material facts and information relating to the Assets and the conduct, business, operations, properties, condition and prospects of the Business. No information furnished by Seller in connection with this Agreement is false or misleading in any material respect. In connection with such information and with this Agreement and the transactions contemplated hereby, Seller has not made any untrue statement of material fact or omitted to state any statement of material fact necessary to make the statements made or information delivered, in light of the circumstances in which they were made, not misleading.

Section 6. Representations and Warranties of Buyer

Buyer represents and warrants to Seller, which representations and warranties shall survive the execution and delivery of this Agreement to the extent provided herein, as follows:

6.1 Organization, Good Standing, etc.

Buyer is a corporation duly organized, validly existing and in good standing under the laws of the jurisdiction of its incorporation. Buyer has all requisite power and authority to own, operate and lease its properties and carry on its business as now being conducted.

-5-

6.2 Corporate Authority

Prior to the Closing, the consummation of the transactions contemplated by this Agreement shall have been duly and validly authorized by the Buyer’s board of directors, and, if necessary, the Buyer’s shareholders, and no other proceedings on the part of Buyer shall be necessary to authorize the consummation of the transactions contemplated by this Agreement. This Agreement, together with the Transaction Documents, has been, and when executed at the Closing, shall be, duly and validly executed and delivered by Buyer and, assuming the due authorization, execution and delivery by Buyer, this Agreement constitutes, and when executed at the Closing the Transaction Documents shall constitute, a legal, valid and binding obligation of Buyer, enforceable against Buyer in accordance with its terms, except as such enforceability may be limited by applicable bankruptcy, insolvency, reorganization or other similar laws affecting creditors' rights generally and by general equitable principles (regardless of whether enforceability is considered in a proceeding in equity or at law) and rules of law governing specific performance, injunctive relief or other equitable remedies.

6.3 No Conflict

The execution, delivery and performance of this Agreement or the Transaction Documents by Buyer and the consummation of the transactions contemplated hereby or thereby shall not (a) violate, conflict with, or result in any breach of, any provision of Buyer's organizational documents, or (b) violate, conflict with, result in any breach of, or constitute a default (or an event that, with notice or lapse of time or both, would constitute a default) under any contract or Judgment to which Buyer is a party or by which it is bound or which relates to its assets or business, or (c) violate any applicable law, statute, rule, ordinance or regulation of any Governmental Body.

6.4 Consents and Approvals

Assuming the receipt of the requisite approval of the board of directors and shareholders of Buyer, no notice to or approval by any other Person, firm, or entity, including any Governmental Body, is required of Buyer to consummate the transactions contemplated by this Agreement.

6.5 Brokers

Buyer has not retained any broker or finder in connection with the transactions contemplated by this Agreement.

6.6 Due Diligence

Buyer acknowledges that pursuant to this Agreement it shall have, before the Closing Date, performed all due diligence that it has deemed necessary to perform in order to close the transactions contemplated hereby, and that in making the decision to enter into this Agreement or consummating any of the transactions contemplated by this Agreement, it has relied on its own independent investigation, analysis and evaluation of the Assets and the Business.

Section 7. Pre-Closing Covenants

7.1 Due Diligence

Before Closing, Seller shall give Buyer and its counsel, accountants and other authorized representatives reasonable access to the Assets and the Business and to all other properties, equipment, books, records, documents and other items relating to the Assets and the Business to allow Buyer to conduct its due diligence investigation thereof.

7.2 Conduct of Business Before Closing

From the date of this Agreement to and including the Closing Date, unless Buyer shall otherwise agree in writing, the Business shall be conducted in the ordinary course of business and in a manner consistent with past practice and in accordance with applicable law.

-6-

7.3 Covenants to Satisfy Conditions

Each party shall proceed with all reasonable diligence and use commercially reasonable efforts to satisfy or cause to be satisfied all of the conditions precedent to the other party's obligation to purchase or sell the Assets that are set forth in Section 8 or 9, as the case may be; provided, however, that this provision shall not impose upon any party any obligation to incur unreasonable expenses under the circumstances in order to fulfill any condition contained in such Sections.

Section 8. Conditions Precedent to Obligations of Buyer

The obligation of Buyer to purchase the Assets at the Closing shall be subject to the satisfaction at or before the Closing Date of each of the following conditions, any one or more of which may be waived by Buyer in its sole discretion:

8.1 Consents and Approvals

All consents, approvals, authorizations of, or declarations, filings or registrations with, all Governmental Bodies required for the consummation of the transactions contemplated by this Agreement and the Transaction Documents shall have been obtained or made on terms satisfactory to Buyer and shall be in full force and effect. Furthermore all consents, approvals or authorizations, including, without limitation, the board and directors and/or shareholders of Seller, required for the consummation of the transactions contemplated by this Agreement and the Transaction Documents shall have been obtained or made on terms satisfactory to Buyer and shall be in full force and effect.

8.2 No Adverse Changes

From the date of this Agreement to the Closing Date, there shall not have been any material adverse change in the Assets or the conduct, business, operations, properties, condition (financial or otherwise) or prospects of the Business, and neither Seller nor any Shareholder shall have knowledge of any such change which is threatened.

8.3 No Injunction or Litigation

As of the Closing Date, there shall not be any Claim or Judgment of any nature or type threatened, pending or made by or before any Governmental Body that questions or challenges the lawfulness of the transactions contemplated by this Agreement or the Transaction Documents under any law or regulation or seeks to delay, restrain or prevent such transactions.

8.4 Representations, Warranties and Covenants

(a) The representations and warranties of Seller made in this Agreement or in the Transaction Documents or any certificate furnished pursuant hereto or thereto shall be true, complete and correct on and as of the Closing Date with the same force and effect as though made on and as of the Closing Date.

(b) Seller shall have performed and complied with the covenants and agreements required by this Agreement to be performed and complied with by it on or before the Closing Date.

(c) Seller shall have delivered to Buyer a certificate dated the Closing Date to the foregoing effects, signed by a duly authorized executive officer of Seller.

8.5 Delivery of Assets and Documents

Seller shall have (a) given Buyer possession and control of all Assets at the Closing and (b) delivered the following documents, agreements and supporting papers to Buyer: (i) the Bill of Sale, duly executed by Seller; and (ii) such other documents as Buyer or its counsel may deem necessary or advisable to consummate the transactions contemplated by this Agreement.

-7-

Section 9. Conditions Precedent to Obligations of Seller

The obligation of Seller to sell the Assets to Buyer at the Closing shall be subject to the satisfaction at or before the Closing of each of the following conditions, any one or more of which may be waived by Seller in its sole discretion:

9.1 Consents and Approvals

All consents, approvals or authorizations of, or declarations, filings or registrations with, all Governmental Bodies required for the consummation of the transactions contemplated by this Agreement and the Transaction Documents shall have been obtained or made on terms satisfactory to Seller and shall be in full force and effect. Furthermore all consents, approvals or authorizations, including, without limitation, any required consent of the board of directors and/or the shareholders of the Buyer or the Seller which are required for the consummation of the transactions contemplated by this Agreement and the Transaction Documents shall have been obtained or made on terms satisfactory to Seller and shall be in full force and effect.

9.2 No Injunction or Litigation

As of the Closing Date, there shall not be any Claim or Judgment of any nature or type threatened, pending or made by or before any Governmental Body that questions or challenges the lawfulness of the transactions contemplated by this Agreement or the Transaction Documents under any law or regulation or seeks to delay, restrain or prevent such transactions.

9.3 Representations, Warranties and Covenants

(a) The representations and warranties of Buyer made in this Agreement or in the Transaction Documents or any certificate furnished pursuant hereto or thereto shall be true, complete and correct in all material respects on and as of the Closing Date with the same force and effect as though made on and as of the Closing Date.

(b) Buyer shall have performed and complied in all material respects with the covenants and agreements required by this Agreement to be performed and complied with by it on or before the Closing Date.

(c) Buyer shall have delivered to Seller a certificate dated the Closing Date to the foregoing effects signed by a duly authorized executive officer of Buyer.

9.4 Satisfaction of Conditions

All agreements and other documents required to be delivered by Buyer hereunder on or before the Closing Date shall be satisfactory in the reasonable judgment of Seller and its counsel. Seller shall have received such other agreements, documents and information as it may reasonably request in order to establish satisfaction of the conditions set forth in this Section 9.

Section 10. Post-Closing Covenants

10.1 Further Assurances

After the Closing Date, Seller shall from time to time at Buyer's reasonable request execute and deliver, or cause to be executed and delivered, such further instruments of conveyance, assignment and transfer or other documents, and perform such further acts and obtain such further consents, approvals and authorizations, as Buyer may reasonably require in order to fully effect the conveyance and transfer to Buyer of, or perfect Buyer's right, title and interest in, any of the Assets, to assist Buyer in obtaining possession of any of the Assets, or to otherwise comply with the provisions of this Agreement and consummate the transactions contemplated by this Agreement and the Transaction Documents.

-8-

10.2 Nondisparagement

After the Closing Date, Seller and its officers and directors shall refrain from disparaging Buyer, the Assets, and any of Buyer's shareholders, directors, officers, employees or agents and Buyer shall refrain from disparaging Seller and any of the Seller’s shareholders, directors, officers, employees or agents.

Section 11. Taxes and Costs; Apportionment

11.1 Transfer Taxes

Buyer shall be responsible for the payment of all transfer, sales, use and documentary taxes, filing and recordation fees and similar charges payable to any governmental authority relating to the sale or transfer of the Assets hereunder. The parties shall allocate the Purchase Price among the Assets for tax purposes in the manner set forth on Schedule 11.1.

11.2 Transaction Costs

Each party shall be responsible for its own costs and expenses incurred in connection with the preparation, negotiation and delivery of this Agreement and the Transaction Documents, including but not limited to attorneys' and accountants' fees and expenses.

11.3 Apportionment

Any and all personal property taxes, assessments, and other charges applicable to the Assets shall be pro-rated to the Closing Date, and such taxes and other charges shall be allocated between the parties by adjustment at the Closing, or as soon thereafter as the parties may agree. All such taxes shall be allocated on the basis of the fiscal year of the tax jurisdiction in question.

Section 12. Survival and Indemnification

12.1 Indemnification by Seller

From and after the Closing Date, Seller shall indemnify and hold Buyer harmless from and against, and shall reimburse Buyer for, any and all Loss arising out of or in connection with:

(a) any inaccuracy in any representation or warranty made by Seller in this Agreement or in the Transaction Documents or in any certificate delivered pursuant hereto or thereto;

(b) any failure by Seller to perform or comply with any covenant or agreement by Seller in this Agreement or in any of the Transaction Documents;

(c) any Claim relating to any business or assets of Seller not acquired by Buyer, or any obligations or liabilities of Seller not specifically assumed by Buyer; and

12.2 Indemnification by Buyer

Buyer agrees to indemnify, defend and hold Seller harmless from and against, and shall reimburse Seller for, any and all Loss arising out of or in connection with:

(a) any inaccuracy in any representation or warranty made by Buyer in this Agreement or in the Transaction Documents or in any certificate delivered pursuant hereto or thereto;

(b) any failure of Buyer to perform or comply with any covenant or agreement by Buyer made in this Agreement or any of the Transaction Documents; and

(c) any Claim based on the business operation of the Assets after the Closing.

-9-

12.3 Threshold and Time Limitations

Neither Seller or Buyer shall be entitled to receive any indemnification payment with respect to Claims for indemnification made under Section 12.1(a) or 12.2(a), as the case may be (the "Misrepresentation Claims"), until the aggregate Losses that such party would be otherwise entitled to receive as indemnification with respect to the Misrepresentation Claims exceed Fifteen Thousand Dollars ($15,000.00) (the "Threshold"); provided, however, that once such aggregate Losses exceed the Threshold, such party shall be entitled to receive indemnification payment for the aggregate Losses that they would be entitled to receive without regard to the Threshold. Furthermore, neither Seller nor Buyer shall be entitled to assert any right of indemnification with respect to any Misrepresentation Claim of which neither such party has given written notice to the other party on or prior to the date that is three years (3) from the Closing Date, except that if such party has given written notice of any Misrepresentation Claim to the other party on or prior to the end of such survival period, then they shall continue to have the right to be indemnified with respect to such pending Misrepresentation Claim, notwithstanding the expiration of such survival period.

12.4 Matters Involving Third Parties

(a) If any third party notifies any party (the "Indemnified Party") with respect to any matter (a "Third Party Claim") that may give rise to a claim for indemnification against any other party hereto (the "Indemnifying Party") under this Section 12, then the Indemnified Party shall promptly notify each Indemnifying Party thereof in writing; provided, however, that no delay on the part of the Indemnified Party in notifying any Indemnifying Party shall relieve the Indemnifying Party from any obligation hereunder unless (and then solely to the extent) the Indemnifying Party is thereby prejudiced.

(b) Any Indemnifying Party shall have the right to defend the Indemnified Party against the Third Party Claim with counsel of its choice reasonably satisfactory to the Indemnified Party so long as (i) the Indemnifying Party notifies the Indemnified Party in writing within fifteen (15) days after the Indemnified Party has given notice of the Third Party Claim that the Indemnifying Party shall indemnify the Indemnified Party from and against the entirety of any Loss the Indemnified Party may suffer resulting from or caused by the Third Party Claim, (ii) the Third Party Claim involves only money damages and does not seek an injunction or other equitable relief, (iii) settlement of, or an adverse judgment with respect to, the Third Party Claim is not, in the good faith judgment of the Indemnified Party, likely to establish a precedential custom or practice materially adverse to the continuing business interests or the reputation of the Indemnified Party, and (iv) the Indemnifying Party conducts the defense of the Third Party Claim actively and diligently (following notice from the Indemnified Party and reasonable opportunity to cure).

(c) So long as the Indemnifying Party is conducting the defense of the Third Party Claim in accordance with Section 12.4(b) above, (i) the Indemnified Party may retain separate co-counsel at its sole cost and expense and participate in the defense of the Third Party Claim, (ii) the Indemnified Party shall not consent to the entry of any judgment on or enter into any settlement with respect to the Third Party Claim without the prior written consent of the Indemnifying Party (not to be unreasonably withheld), and (iii) the Indemnifying Party shall not consent to the entry of any judgment on or enter into any settlement with respect to the Third Party Claim without the prior written consent of the Indemnified Party (not to be unreasonably withheld or delayed).

(d) In the event any of the conditions in Section 12.4(b) above is or becomes unsatisfied, however, (i) the Indemnified Party may defend against, and consent to the entry of any Judgment on or enter into any settlement with respect to, the Third Party Claim in any manner it may reasonably deem appropriate with the prior written consent of the Indemnifying Party, which consent shall not be unreasonably withheld, conditioned or delayed, (ii) the Indemnifying Party shall have the right to participate in the defense of such Third Party Claim at its own expense; (iii) the Indemnifying Parties shall reimburse the Indemnified Party promptly and periodically for the costs of defending against the Third Party Claim (including reasonable attorneys' fees and expenses), and (iv) the Indemnifying Parties shall remain responsible for any Loss the Indemnified Party may suffer resulting from or caused by the Third Party Claim to the fullest extent provided in this Section 12.

-10-

Section 13. Termination

13.1 Termination

This Agreement may be terminated before the Closing:

(a) by Seller, by giving written notice to Buyer at any time, if any of the conditions set forth in Section 9 is not satisfied at the time at which the Closing would otherwise occur, or if the satisfaction of any such condition is or becomes impossible;

(b) by Buyer, by giving written notice to Seller at any time, if any of the conditions set forth in Section 8 is not satisfied at the time at which the Closing would otherwise occur, or if the satisfaction of any such condition is or becomes impossible;

(c) by Seller, by giving written notice to Buyer at any time, if Buyer has breached any representation, warranty, covenant or agreement contained in this Agreement and the same cannot be cured before Closing;

(d) by Buyer, by giving written notice to Seller at any time, if Seller has breached any representation, warranty, covenant or agreement contained in this Agreement and the same cannot be cured before Closing;

(e) by mutual written agreement of Seller and Buyer; or

(f) by Seller or Buyer, by giving written notice to the other if the Closing has not occurred within 30 days of the execution of this Agreement.

13.2 Effect of Termination

In the event of the termination of this Agreement pursuant to Section 13.1 above, (a) each party shall return or destroy all documents containing confidential information of the other party (and, upon request, certify as to the destruction thereof), and (b) no party hereto shall have any liability or further obligation to the other party hereunder, except for obligations of confidentiality and non-use with respect to the other party's confidential information, which shall survive the termination of this Agreement.

Section 14. Miscellaneous

14.1 Confidentiality Obligations of Seller and Buyer Following the Closing

From and after the Closing, Seller, and Buyer shall keep confidential and not use or , except as required by law, disclose to any party any confidential information relating to this Agreement, the Assets, business or affairs of the other which that party may have obtained. The confidentiality and non-use obligations set forth in this Section 14.1 shall not apply to any information which is available to the public through no breach of this Agreement by Seller or Buyer, or is disclosed to Seller or Buyer by third parties who are not under any duty of confidentiality with respect thereto, or is required to be disclosed by Seller or Buyer in connection with pending litigation or investigation; provided, however, that in the event Seller or Buyer becomes required in connection with pending litigation or investigation to disclose any of the confidential information relating to the assets, business or affairs of the other, then Seller or Buyer shall provide the other with reasonable notice so that Seller or Buyer may seek a court order protecting against or limiting such disclosure or any other appropriate remedy; and in the event such protective order or other remedy is not sought, or is sought but not obtained, Seller or Buyer shall furnish only that portion of the information that is required and shall endeavor, at Buyer's or Seller's expense, to obtain a protective order or other assurance that the portion of the information furnished by Seller or Buyer shall be accorded confidential treatment.

-11-

14.2 Public Announcements

Each party agrees not to make, and to direct its representatives not to make, any public announcement in regard to the transactions contemplated by this Agreement and the Transaction Documents without the other party's prior written consent, except as may be required by law, in which case the parties shall use reasonable efforts to coordinate with each other with respect to the timing, form and content of such required disclosures.

14.3 Severability

If any court determines that any part or provision of this Agreement is invalid or unenforceable, the remainder of this Agreement shall not be affected thereby and shall be given full force and effect and remain binding upon the parties. Furthermore, the court shall have the power to replace or reform the invalid or unenforceable part or provision with a provision that accomplishes, to the extent possible, the original business purpose of such part or provision in a valid and enforceable manner. Such replacement shall apply only with respect to the particular jurisdiction in which the adjudication is made.

14.4 Modification and Waiver

This Agreement may not be amended or modified in any manner, except by an instrument in writing signed by each of the parties hereto. The failure of any party to enforce at any time any of the provisions of this Agreement shall in no way be construed to be a waiver of any such provision, or in any way affect the right of such party thereafter to enforce each and every such provision. No waiver of any breach of this Agreement shall be deemed to be a waiver of any other or subsequent breach.

14.5 Notices

All notices and other communications required or permitted to be given under this Agreement shall be in writing and shall be sent by facsimile transmission, or mailed postage prepaid by first-class certified or registered mail, or mailed by a nationally recognized express courier service, or electronic mail or hand-delivered, addressed as follows:

If to Buyer:

Bravo Multinational, Inc.

2020 General Booth Blvd., Suite 230

Virginia Beach, VA 23454

If to Seller:

Streaming TVEE, Inc.

1100 Brickell Bay Drive

Miami, FL 33131

with a copy to:

Jones & Haley, P.C.

750 Hammond Drive

Building 12, Suite 100

Atlanta, Georgia 30328

Attn: Richard W. Jones, Esq.

Fax: (770) 804-8004

Either party may change the persons or addresses to which any notices or other communications to it should be addressed by notifying the other party as provided above. Any notice or other communication, if addressed and sent, mailed or delivered as provided above, shall be deemed given or received three (3) days after the date of mailing as indicated on the certified or registered mail receipt, or on the next business day if mailed by express courier service, or on the date of delivery or transmission if hand-delivered or sent by facsimile transmission.

-12-

14. Captions

The captions and headings used in this Agreement have been inserted for convenience of reference only and shall not be considered part of this Agreement or be used in the interpretation thereof.

14.7 Specific Performance

Each party shall be entitled to obtain an injunction or injunctions to prevent breaches of the provisions of this Agreement, or any other Transaction Agreement and to enforce specifically the terms and provisions hereof and thereof, in each instance without being required to post bond or other security, without being required to prove irreparable harm, and in addition to, and without having to prove the adequacy of, other remedies at law or equity.

14.8Assignment

This Agreement and the rights to receive payments hereunder shall be assignable at any time by the Seller, without the consent or approval of the Buyer.

14.9 No Third-Party Rights

Nothing in this Agreement is intended, nor shall be construed, to confer upon any person or entity other than Buyer and Seller (and only to the extent expressly provided herein, their respective Affiliates) any right or remedy under or by reason of this Agreement.

14.10 Counterparts

This Agreement may be executed in one or more counterparts, each of which shall be deemed to be an original, but all of which shall constitute one agreement.

14.11 Governing Law

This Agreement shall be governed by, and construed in accordance with, the laws of the State of Florida as though made and to be fully performed in that State.

14.12 Entire Agreement

This Agreement constitutes the entire agreement and understanding between the parties with respect to the subject matter hereof and supersedes all prior agreements, understandings, negotiations, representations and statements, whether oral, written, implied or expressed, relating to such subject matter.

IN WITNESS WHEREOF, the parties have caused this Asset Purchase Agreement to be duly executed by their respective representatives hereunto authorized as of the day and year first above written.

BUYER:

BRAVO MULTINATIONAL, INC.

Dated: February 6, 2024

By:/s/ Kayla Slick

Kayla Slick, COO/Director

SELLER:

STREAMING TVEE, INC.

Dated: February 6, 2024

By:/s/ Wayne Jefferies

Wayne Jefferies, CEO

-13-

Schedule 2.1.1a Streaming TVEE, Inc. Assets: Streaming Technology & Materials

1. Licensing to OTT (Over-The-Top) Enterprise Streaming Solution. Includes:

a. Platform Modules: Comprehensive suite of modules tailored for optimal streaming platform operations and transparent breakdown of associated costs for seamless financial management.

b. Servers: Robust server infrastructure ensuring seamless content delivery.

c. Software Maintenance: Ongoing software maintenance to ensure the platform's efficiency and security.

d. Data Analytics: Robust analytics tools for detailed user behavior analysis and platform optimization.

e. Multi-Platform Compatibility: Seamless integration with a variety of devices and platforms for enhanced accessibility.

f. Social Media Integration: Incorporation of social media features for seamless sharing and engagement.

g. Security Protocols: Advanced security measures, including encryption and secure authentication.

h. Scalability: Designed for scalability to accommodate growing user demands and content libraries.

i. Live Streaming / Broadcast Capabilities: Support for live streaming events and real-time broadcasting.

j. Content Monetization: Tools for effective monetization strategies, including ad insertion and pay-per-view options.

k. API Access: Open APIs for seamless third-party integrations and customization.

l. User Analytics Dashboard: Empowering administrators with insights into user engagement and content popularity.

m. Content Recommendation Engine: Intelligent algorithms for personalized content recommendations based on user preferences.

n. Gamification Elements: Integration of gamification elements to enhance user engagement and retention.

o. Cross-Platform Synchronization: Ensuring a consistent user experience across various platforms and devices.

p. Advanced Content Metadata Management: Efficient organization and management of content metadata for enhanced searchability.

q. Dynamic Ad Insertion: Targeted and dynamic ad insertion capabilities for personalized advertising.

r. Interactive User Interface: User-friendly interface with interactive elements to enhance the overall user experience.

s. Smart TV Integration: Seamless integration with smart TV platforms for an optimized viewing experience.

t. Content Curation Tools: Tools for curated content playlists and thematic collections.

u. Quality Assurance: Rigorous quality assurance protocols to uphold industry standards.

v. Unlimited White-Labels for Affiliate Partnerships: Flexibility for affiliate partners to customize and brand the platform.

w. Unlimited Content Storage: Extensive storage capacity for a vast library of multimedia content.

x. Middleware with players for Website and Selected Optional Modules: Middleware integration for website functionality and optional enhancements.

y. 24/7 Ticket System and Support, Ongoing Remote Training: Dedicated support system available around the clock, complemented by remote training.

z. Administrative Management Tools: Powerful back-end administrative tools for efficient management and reporting.

-14-

aa. Internal Management Controls: Comprehensive controls for backend management and operational oversight.

bb. Financial Reporting Dashboards: Intuitive dashboards providing real-time financial insights.

cc. Bandwidth Reports: Detailed reports on bandwidth usage for optimal resource allocation.

dd. Channel Customization: Broad spectrum of channels customization to cater to diverse audience preferences.

ee. Video-On-Demand (VOD) Customization: Broad spectrum of video on demand customization (i.e. categories, tags, etc.) to cater to diverse audience preferences.

ff. Applications: Inclusive management of various packages for seamless cross-device accessibility.

i. Roku Package and Roku Application Management

ii. Apple Package and Application Management

iii. Android Package and Application Management

iv. All upcoming apps and application Management

gg. Features of the Delivered Platform:

i. User Registration: Streamlined registration process with email verification.

ii. Billing Reports and Billing Management: Comprehensive billing features for effective financial management.

iii. Subscription Billing: Flexible subscription models with diverse billing options.

iv. Financial Reporting: Real-time tracking and exportable financial reports.

v. Website Content Management System: Customizable website templates with version control and multilingual support.

vi. Geo-Restriction Control: Geo-restriction tools for targeted access control.

vii. Streaming Services: Support for diverse streaming protocols and playback features.

viii. Closed Captions, Alternative Audio Profiles, Adaptive Bitrates: Inclusive features enhancing user experience.

hh. Customer Support Services:

i. FAQ, Support Ticket System, Automated Notifications and Alerts: Comprehensive customer support infrastructure.

ii. Stream Monitoring Services: Proactive monitoring to detect and address potential issues.

ii. Device Management: Detailed device management system for user accounts.

2. Material Assets:

a. Letters of Intent for Affiliate Agreements: Strategic partnerships with non-profits leveraging co-branded streaming applications.

i. NAMI West LA

ii. Opus Strategy Group (CICE)

iii. Hudson Valley SPCA (in collaboration with Paul Sr. Orange County Choppers)

b. Letters of Intent for Streaming App & Content Development: Commitments for collaborative content development.

i. High Science, LLC

-15-

3. Other Assets

a. Domain Acquisitions and Website Builds Including:

i. Tveenow.com

ii. BingeForCharity.com

iii. StreamWithPurpose.com

b. Marketing Materials: PowerPoints, brochures, and promotional videos.

c. Affiliate Prospecting List: Extensive list of potential affiliate organizations for targeted outreach with complete contact information.

d. Affiliate LOI Templates and Affiliate Agreement Contract Templates: Legal templates ensuring clarity and compliance.

e. Trademarks & Marks: Protection and utilization of any TVee NOW™ and Binge for Charity™ trademarks, marks, logo, etc.

-16-

Schedule 2.1.1b

Seller’s Rights of the MWPEG/Michael William’s Library Including: Title and Interest, including without limitation the Copyrights, Ownership, and Exploitation Rights in and to the Following Concert and Performance Video Properties:

| |

MUSIC ARTIST:

| CATEGORY:

|

Rodrigo Y Gabriela

| Acoustic, Flamenco Neuvo, Instrumentals

|

Cosmos Percussion Orchestra

| Afro-Cuban Funk Rock

|

Ben Harper & Charlie Musselwhite

| Blues

|

Martin Harley

| Blues

|

Charlie Musselwhite

| Blues Harmonica

|

Hells Belles Burlesque

| Burlesque with a rock 'n' roll twist

|

Erin O'Hara

| Composer/Soundtracks/singer/Performer

|

Dwight Yoakam

| Country

|

Kacey Musgraves

| Country

|

Justin Townes Earle

| Country/Blues/Folk Indie Performer

|

The Secret Sisters

| Country/Folk

|

The Whiskey Sisters

| Country/Rock

|

Edward Sharpe and The Magnetic Zeros

| Folk Rock

|

Electric Trio

| Folk Rock

|

Richard Thompson

| Folk Rock

|

Iron & Wine (Samuel "Sam" Ervin Beam)

| Folk/Alternative/Indie

|

Tift Merritt

| Folk/Indie Performer

|

Matt Nathanson

| Folk/Rock Indie Performer

|

Brandi Carlile

| Folk/Rock/Alternative/Country

|

They Went Ghost

| Hard Rock influenced

|

Melissa Etheridge

| Heartland/Blues & Folk Rock

|

Bone Thugs-N-Harmony

| Hip Hop

|

Pretty Ricky

| Hip Hop

|

Street Sweeper Social Club

| Hip Hop

|

Michael Franti and Spearhead

| Hip Hop, Funk, Jazz blending

|

Macklemore and Ryan Lewis

| Hip Hop/Duo

|

Louis Prima Jr.

| Jazz/Swing

|

Brytiago

| Latin Urbano (Puerto Rico)

|

David Archuleta

| Pop

|

Diane Birch

| Pop

|

Imogen Heap

| Pop

|

Train

| Pop

|

Tristan Prettyman

| Pop

|

Girls Against Boys

| Post Hardcore Rock

|

-17-

| |

Bad Religion

| Punk Rock

|

Darkiel

| Raggeton/Latino (Puerto Rico)

|

Ice Cube

| Rap

|

Jon Z

| Rap

|

Kaptn

| Rap

|

Rick Ross

| Rap/Hip Hop

|

Snoop Dogg

| Rap/Hip Hop

|

Violent Femmes

| Rap/Hip Hop

|

Zac Brown Band

| Reggae/Country

|

Bobby Valentino

| Rhythm & Blues

|

Carl Thomas

| Rhythm & Blues

|

Dave Hollister

| Rhythm & Blues

|

H.E.R.

| Rhythm & Blues

|

Jon B

| Rhythm & Blues

|

Lloyd

| Rhythm & Blues

|

Silk

| Rhythm & Blues

|

Tank

| Rhythm & Blues

|

Vintage Trouble

| Rhythm & Blues

|

Mavis Staples

| Rhythm & Blues/Gospel

|

R. Kelly

| Rhythm & Blues/Hip Hop

|

Teddy Riley & Blackstreet

| Rhythm & Blues/Hip Hop

|

Alicia Keys

| Rhythm & Blues/Soul

|

Allen Stone

| Rhythm & Blues/Soul

|

Brian McKnight

| Rhythm & Blues/Soul

|

Eric Benet

| Rhythm & Blues/Soul

|

Raheem DeVaugn

| Rhythm & Blues/Soul

|

Musiq Soulchild

| Rhythm & Blues/Soul/Hip Hop

|

Next

| Rhythm & Blues/Soul/Hip Hop

|

Alabama Shakes

| Rock

|

ALO Animal Liberation Orchestra

| Rock

|

Blues Traveler

| Rock

|

Daughtry

| Rock

|

Delta Spirit

| Rock

|

Dirty Projectors

| Rock

|

Eclectic Approach

| Rock

|

Good Charlotte

| Rock

|

Jane's Addiction

| Rock

|

Joan Jett and the Blackhearts

| Rock

|

Kings of Leon

| Rock

|

Moonalice

| Rock

|

-18-

| |

Primus

| Rock

|

The Avett Brothers

| Rock

|

The Black Crowes

| Rock

|

The Black Keys

| Rock

|

The Flaming Lips

| Rock

|

The Refusers

| Rock

|

The Shins

| Rock

|

Café Tacvba

| Rock (Mexican)

|

Cake

| Rock/Alternative/Country

|

Allah-Las

| Rock/Alternative/Indie

|

Best Coast

| Rock/Alternative/Indie

|

Family of the Year

| Rock/Alternative/Indie

|

Flagship

| Rock/Alternative/Indie

|

Grouplove

| Rock/Alternative/Indie

|

RNDM

| Rock/Alternative/Indie

|

Rogue Wave

| Rock/Alternative/Indie

|

Sharon Van Etten

| Rock/Alternative/Indie

|

The Wallflowers

| Rock/Alternative/Indie

|

X

| Rock/Alternative/Indie

|

Donavon Frankenreiter

| Rock/Blues

|

Andrew Bird

| Rock/Swing Indie

|

Jackson Browne

| Soft Rock

|

Ray Bertolino and The Forget Me Nots

| Soft Rock

|

Brian Setzer

| Swing

|

Steve Lucky and the Rhumba Bums

| Swing

|

Carolina Chocolate Drops

| Traditional Folk/String Band

|

COMEDY ARTISTS:

| CATEGORY:

|

Aasif Mandvi

| Comedian

|

Anthony Jeselnik

| Comedian

|

Bill Burr

| Comedian

|

Demetri Martin

| Comedian

|

Greg Behrendt

| Comedian

|

J Chris Newberg

| Comedian

|

Jim Breur

| Comedian

|

Jim Gaffigan

| Comedian

|

Kristen Schaal

| Comedian

|

Natasha Leggero

| Comedian

|

Nick Rutherford

| Comedian

|

Rob Delaney

| Comedian

|

-19-

| |

Ron Funches

| Comedian

|

Sarah Tiana

| Comedian

|

Tig Notaro

| Comedian

|

Wyatt Cenac

| Comedian

|

Bob's Burgers Live

| Comedy Stage Tour

|

Publishing clearances with the following entities:

- SONY ATV

- Warner Chapel

- Universal Publishing

- BMI

- ASCAP

Agreements:

- Perpetual and Royalty Free License for Microsoft adaptive bit rate code for mobile applications.

- MWPEG will extend, not sell, its streaming rights into China to buyer.

- Billboardlive.com streaming show.

MWPEG (Michael Williams) Excluded Assets & First Right of Refusal:

- Agreement with Michael Jackson Estate

- Agreement with the Elvis Presley Estate

- Contract with the International Olympic Committee

- Shows and concepts created by Michael Williams

With respect to the Excluded Assets, Seller hereby agrees to provide Buyer with a first look at any concepts considered for future development. Such first look shall include the right to negotiate for any streaming opportunities or other interest in such concepts related to the excluded assets, if any. Seller shall provide Buyer 10 days prior written notice prior to attempting to negotiate with any other party with respect to such opportunities, if any.

In the event that Buyer wishes to obtain such streaming rights, or other interest in such future concepts, shows or other opportunities related to the excluded assets, the Parties agree to negotiate terms for such streaming or other participation in good faith for up to 30 days, and Seller agrees that Seller will not shop such opportunity to the market during such negotiation period. If the Parties are unable to reach an agreement on material terms within such 30-day period, then Seller shall have the right to pursue other options.

-20-

Schedule 2.1.2 Intellectual Property

Same as Schedule 2.1.1a and Schedule 2.1.1b.

Schedule 2.1.3 Permits

Not applicable at the moment.

Schedule 2.2 Assumed Debt

$500,000 Convertible Promissory Note Dated December 1, 2023, from Streaming TVEE, Inc. to United Resources, LLC.

$500,000 Convertible Promissory Note Dated December 1, 2023, from Streaming TVEE, Inc. to Timothy Shelburn.

$500,000 Convertible Promissory Note Dated December 1, 2023, from Streaming TVEE, Inc. to Brian Lemke.

$500,000 Convertible Promissory Note Dated December 1, 2023, from Streaming TVEE, Inc. to Wayne Jefferies.

-21-

Exhibit B: Bill of Sale

BILL OF SALE AND ASSIGNMENT AND ASSUMPTION AGREEMENT

This BILL OF SALE AND ASSIGNMENT AND ASSUMPTION AGREEMENT (this “Agreement”) is made, executed, delivered and effective as of February 6, 2024, by and among Bravo Multinational, Inc., a Wyoming corporation (“Purchaser”), and Streaming TVEE, Inc., a Delaware company (“Seller”). Purchaser and Seller are herein individually referred to as a “Party” and collectively referred to as the “Parties.”

WHEREAS, the Purchaser wants to purchase and the Seller wants to sell the Intellectual Property and other assets as described herein; and

WHEREAS, the Parties are entering into this Agreement for Seller to sell, transfer and deliver to Purchaser, and Purchaser to purchase from Seller, the Acquired Assets, upon the terms and subject to the conditions and limitations set forth in this Agreement.

NOW, THEREFORE, for one dollar ($1.00) and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties hereto agree as follows:

Purchased Assets. Effective as of the Closing, Seller hereby sells, transfers and delivers to Purchaser, and Purchaser hereby purchases from Seller all of Seller’ s rights, titles and interests in and to the Acquired Assets, free and clear of all Liens. The Acquired Assets are described and set forth more specifically in Schedule 2.1.1 of the Stock Purchase Agreement executed as of even date herewith.

Further Assurances. At any time and from time to time following the Closing, at the request of any Party hereto and without further consideration, each other Party hereto shall execute and deliver, or cause to be executed and delivered, such further documents and instruments and shall take, or cause to be taken, such further actions as the requesting Party may reasonably request or as otherwise may be necessary or desirable to evidence and make effective the transactions contemplated by this Agreement.

Governing Law. This Agreement shall be governed by, and construed in accordance with, the Laws of the State of Florida without regard to any conflicts of law principles that would require the application of any other Law.

Headings. The headings contained in this Agreement are for convenience of reference only and shall not affect in any way the meaning or interpretation of this Agreement.

Counterparts. This Agreement may be executed in one or more counterparts (including by facsimile transmission, electronic transmission in portable document format (.pdf), electronic mail, DocuSign, or similar electronic means), which when taken together shall constitute one and the same agreement.

IN WITNESS WHEREOF, each Party has caused this Bill of Sale and Assignment and Assumption Agreement to be duly executed and delivered by its authorized representative as of the date first above written.

SELLER:

STREAMING TVEE, INC.

By:/s/Wayne Jefferies

Wayne Jefferies, CEO

PURCHASER:

BRAVO MULTINATIONAL, INC.

By:/s/Kyala Slick

Kayla Slick, COO/Director

-22-

Exhibit A: Promissory Note in the amount of $7,760,000 As part of the purchase price

-23-

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

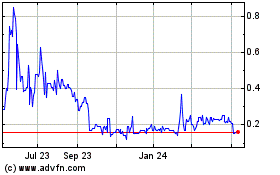

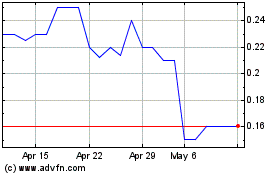

Bravo Multinational (PK) (USOTC:BRVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bravo Multinational (PK) (USOTC:BRVO)

Historical Stock Chart

From Apr 2023 to Apr 2024