UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement Under Section 14(d)(1)

or 13(e)(1)

of the Securities Exchange Act of 1934

(Name of Subject Company (Issuer) and Filing

Person (Offeror))

| Options to Purchase Common Stock, $0.0001 par value |

(Title of Class of Securities)

(CUSIP Number of Class of Securities’

Underlying Common Stock)

Daniel Paterson

Chief Executive

Officer

Verastem, Inc.

117 Kendrick

Street, Suite 500

Needham, MA

02494

(781) 292-4200

|

(Name, address and telephone numbers of person

authorized to receive notices and communications on

behalf of filing persons)

Copies to:

Marko Zatylny

Thomas J. Danielski

Ropes & Gray LLP

800 Boylston St.

Boston, MA 02199

(617) 951-7000 |

|

Daniel Calkins

Chief Financial Officer

Verastem, Inc.

117 Kendrick Street, Suite

500

Needham, MA 02494

(781) 292-4200 |

| ¨ |

Check the box if the filing relates solely to preliminary communications made before the commencement

of a tender offer. |

Check the appropriate boxes below to designate any transactions to

which the statement relates:

| ¨ |

third-party tender offer subject to Rule 14d-1. |

| x |

issuer tender offer subject to Rule 13e-4. |

| ¨ |

going-private transaction subject to Rule 13e-3. |

| ¨ |

amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final

amendment reporting the results of the tender offer: ¨

If applicable, check the appropriate box(es)

below to designate the appropriate rule provision(s) relied upon:

¨

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

¨

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

This Tender Offer Statement on Schedule TO relates

to an offer by Verastem, Inc., a Delaware corporation (“Verastem” or the “Company”), to exchange (the “Option

Exchange Program”) certain outstanding options (the “Eligible Options”) to purchase shares of the Company’s common

stock, whether vested or unvested, that (i) as of February 8, 2024, had a weighted average exercise price of $30.65 and a weighted average remaining term of 5.8 years under the Company’s Amended and Restated 2012 Incentive Plan (the “2012 Plan”), the Company’s

Amended and Restated 2021 Equity Incentive Plan (the “2021 Plan”) and inducement awards to certain newly hired employees

under the Company’s Inducement Award Program (the “Inducement Program”) in accordance with Nasdaq Listing Rule 5635(c)(4),

and (ii) are held by Eligible Holders (as defined below) of Verastem, for newly issued stock options to purchase shares of the Company’s

common sock (the “New Options”).

An “Eligible Holder” refers to our

employees, including our executive officers, and non-employee directors, who, as of the commencement date of the exchange period, are

employees or non-employee directors of the Company and hold outstanding options eligible to participate in the Option Exchange Program.

While non-employee directors are eligible to participate in the Option Exchange Program, their eligibility extends only to stock options

received as a result of their service as a member of the Company’s Board of Directors. Any stock options non-employee directors

hold as a result of their prior service to the Company (whether as an employee, executive officer or otherwise) are not Eligible Options

(as defined below) and will therefore be excluded from the Option Exchange Program. An eligible stock option generally includes any outstanding

stock option that has an exercise price equal to or greater than $15.00 per share, that vests based on continued service with us or based

on the achievement of performance milestones (other than stock price hurdles) and that was granted under the 2012 Plan, the 2021 Plan

or the Inducement Program (each, an “Eligible Option” and collectively, the “Eligible Options”). The Eligible

Options which are actually surrendered for exchange in the Option Exchange Program are referred to below as the “Tendered Options.”

The New Options granted in exchange for the Tendered Options will be granted immediately following the closing of the exchange period

(the “Grant Date”).

Eligible Options may be exchanged for the same

number of New Options upon the terms and subject to the conditions set forth in: (i) the Offer to Exchange Certain Outstanding Options

for New Options, dated February 8, 2024 (the “Offering Memorandum”), attached hereto as Exhibit (a)(1)(A); (ii) the Announcement

Email to Eligible Holders, attached hereto as Exhibit (a)(1)(B); and (iii) the Election Form, attached hereto as Exhibit (a)(1)(C). The

following disclosure materials also were or may be made available to Eligible Holders: (i) the Notice of Withdrawal of Election Form,

attached hereto as Exhibit (a)(1)(D); (ii) the Form of Email Confirming Receipt of Election Form, attached hereto as Exhibit (a)(1)(E);

(iii) the Form of Email Confirming Receipt of Notice of Withdrawal of Election Form, attached hereto as Exhibit (a)(1)(F); (iv) the Form

of Reminder Email to Eligible Holders Regarding the

Expiration of the Exchange Offer, attached hereto as Exhibit (a)(1)(G);

(v) the Form of Email to Eligible Holders Confirming Acceptance of Eligible Options, attached hereto as Exhibit (a)(1)(H); (vi) the Form

of Email Notice Regarding Rejection of Options for Exchange, attached hereto as Exhibit (a)(1)(I); and (vii) the Form of Email Notice

Regarding Expiration of Offer Period, attached hereto as Exhibit (a)(1)(J). These documents, as they may be amended or supplemented from

time to time, together constitute the “Disclosure Documents.”

The information in the Disclosure Documents, including

all schedules and exhibits to the Disclosure Documents, is incorporated herein by reference to answer the items required in this Schedule

TO.

| Item 1. |

Summary Term Sheet. |

The information set forth under the caption “Summary

Term Sheet and Questions and Answers” in the Offering Memorandum, attached hereto as Exhibit (a)(1)(A), is incorporated herein

by reference.

| Item 2. |

Subject Company Information. |

(a) Name and Address. Verastem is

the issuer of the securities subject to the Option Exchange Program. The address of the Company’s principal executive office is

117 Kendrick Street, Suite 500, Needham, MA 02494, and the telephone number at that address is (781) 292-4200.

(b) Securities. The subject class

of securities consists of the Eligible Options. As of February 8, 2024, Eligible Holders held outstanding options to purchase a total of 2,201,685 shares under the 2012 Plan, the 2021 Plan, and various inducement grants, of which 616,192 are Eligible Options as described

herein. The actual number of shares of common stock subject to the New Options to be issued in the Option Exchange Program will depend

on the number of shares of common stock subject to the unexercised options tendered by Eligible Holders that are accepted for exchange

and cancelled.

The information set forth in the Offering Memorandum

under the captions “Summary Term Sheet and Questions and Answers,” “Risks of Participating in the

Option Exchange Program,” and the sections under the caption “The Offer” titled “2. Number of New

Options; expiration date,” “6. Acceptance of options for exchange and issuance of New Options,” and “9.

Source and amount of consideration; terms of New Options” is incorporated herein by reference.

(c) Trading Market and Price. The

information set forth in the Offering Memorandum under the caption “The Offer” titled “8. Price range of

shares underlying the options” is incorporated herein by reference.

| Item 3. |

Identity and Background of Filing Person. |

(a) Name and Address. The filing

person is the Company. The information set forth under Item 2(a) above is incorporated herein by reference. Pursuant to General Instruction

C to Schedule TO, the information set forth on Schedule A to the Offering Memorandum is incorporated herein by reference.

| Item 4. |

Terms of the Transaction. |

(a) Material Terms. The information

set forth in the section of the Offering Memorandum under the caption “Summary Term Sheet and Questions and Answers”

and the sections under the caption “The Offer” titled “1. Eligibility,” “2. Number of

New Options; expiration date,” “3. Purposes of the offer,” “4. Procedures for electing to exchange

options,” “5. Withdrawal rights and change of election,” “6. Acceptance of options for exchange and

issuance of New Options,” “7. Conditions of the Offer,” “8. Price range of shares underlying the

options,” “9. Source and amount of consideration; terms of New Options,” “12. Status of options

acquired by us in the Offer; accounting consequences of the Offer,” “13. Legal matters; regulatory approvals,”

“14. Material income tax consequences,” “15. Extension of Offer; termination; amendment” and the

Election Form attached hereto as Exhibit (a)(1)(C) under the heading “Election Terms & Conditions” at Exhibit

(a)(1)(C) is incorporated herein by reference.

(b) Purchases. The information set

forth in the section of the Offering Memorandum under the caption “The Offer” titled “11. Interests of directors

and executive officers; transactions and arrangements concerning the options” is incorporated herein by reference.

| Item 5. |

Past Contacts, Transactions, Negotiations and Arrangements. |

(e) Agreements Involving the Subject Company’s

Securities. The information set forth in the section of the Offering Memorandum under the caption “The Offer”

titled “11. Interests of directors and executive officers; transactions and arrangements concerning the options” is

incorporated herein by reference. The Company’s equity plans and related agreements are incorporated herein by reference hereto

as Exhibits (d)(1)-(40). Other than ordinary course arrangements with respect to equity compensation and indemnification, the Company

is not a party to any agreements with its executive officers, directors or affiliates. The documents incorporated herein

by reference as Exhibits (d)(1)-(40) also contain information regarding agreements relating to securities of the Company.

| Item 6. |

Purposes of the Transaction and Plans or Proposals. |

(a) Purposes. The information set

forth in the section of the Offering Memorandum under the caption “Summary Term Sheet and Questions and Answers” and

the section under the caption “The Offer” titled “3. Purposes of the Offer” is incorporated herein

by reference.

(b) Use of Securities Acquired.

The information set forth in the sections of the Offering Memorandum under the caption “The Offer” titled “6.

Acceptance of options for exchange and issuance of New Options” and “12. Status of options acquired by us in the Offer;

accounting consequences of the Offer” are incorporated herein by reference.

(c) Plans. The information set forth

in the section of the Offering Memorandum under the caption “The Offer” titled “3. Purposes of the Offer”

is incorporated herein by reference.

| Item 7. |

Source and Amount of Funds or Other Consideration. |

(a) Source of Funds. The information

set forth in the section of the Offering Memorandum under the caption “The Offer” titled “9. Source and amount

of consideration; terms of New Options” is incorporated herein by reference.

(b) Conditions. Not applicable.

(d) Borrowed Funds. Not applicable.

| Item 8. |

Interest in Securities of the Subject Company. |

(a) Securities Ownership. The information

set forth in the section of the Offering Memorandum under the caption “The Offer” titled “11. Interests of

directors and executive officers; transactions and arrangements concerning the options” is incorporated herein by reference.

(b) Securities Transactions. The

information set forth in the section of the Offering Memorandum under the caption “The Offer” titled “11.

Interests of directors and executive officers; transactions and arrangements concerning the options” is incorporated herein

by reference.

| Item 9. |

Person/Assets, Retained, Employed, Compensated or Used. |

(a) Solicitations or Recommendations.

Not applicable.

| Item 10. |

Financial Statements. |

(a) Financial Information. The information

set forth in Schedule B of the Offering Memorandum and the sections of the Offering Memorandum under the caption “The Offer”

titled “10. Information concerning the Company,” “17. Additional information” and “18.

Financial information” is incorporated herein by reference.

(b) Pro Forma Information. Not applicable.

| Item 11. |

Additional Information. |

(a) Agreements, Regulatory Requirements

and Legal Proceedings. The information set forth in the sections of the Offering Memorandum under the caption “The Offer”

titled “11. Interests of directors and executive officers; transactions and arrangements concerning the options” and

“13. Legal matters; regulatory approvals” is incorporated herein by reference.

(c) Other Material Information.

Not applicable.

Exhibit

Number |

|

Description |

| (b) |

|

Not applicable. |

| (d)(1) |

|

2010 Equity Incentive Plan (incorporated by reference to Exhibit 10.1 to the

Registration Statement on Form S-1 (File No. 333-177677) filed by the Registrant on November 3, 2011). |

| (d)(2) |

|

Amended and Restated 2012 Incentive Plan (incorporated by reference to Exhibit

10.1 of the Registrant’s Current Report on Form 8-K, filed by the Registrant with the Securities and Exchange Commission on

December 20, 2018). |

| (d)(3) |

|

Form of Incentive Stock Option Agreement under 2012 Incentive Plan (incorporated

by reference to Exhibit 10.3 to Amendment No. 3 to the Registration Statement on Form S-1 (File No. 333-177677) filed by the Registrant

on January 13, 2012). |

| (d)(4) |

|

Form of Incentive Stock Option Agreement under Amended and Restated 2012 Incentive

Plan (incorporated by reference to Exhibit 10.4 of the Registrant’s Annual Report on Form 10-K filed by the Registrant on March

13, 2018). |

| (d)(6) |

|

Form of Nonstatutory Stock Option Agreement under 2012 Incentive Plan (incorporated

by reference to Exhibit 10.4 to Amendment No. 3 to the Registration Statement on Form S-1 (File No. 333-177677) filed by the Registrant

on January 13, 2012). |

| (d)(6) |

|

Form of Nonstatutory Stock Option Agreement under Amended and Restated 2012

Incentive Plan (incorporated by reference to Exhibit 10.6 of the Registrant’s Annual Report on Form 10-K filed by the Registrant

on March 13, 2018). |

| (d)(7) |

|

Form of Restricted Stock Unit Agreement under 2012 Incentive Plan (incorporated

by reference to Exhibit 10.16 to Amendment No. 3 to the Registration Statement on Form S-1 (File No. 333-177677) filed by the Registrant

on January 13, 2012). |

| (d)(8) |

|

Amendment to Form of Restricted Stock Unit Agreement under 2012 Incentive

Plan (incorporated by reference to Exhibit 10.25 to the Annual Report on Form 10-K filed by the Registrant on March 26, 2013). |

| (d)(9) |

|

Form of Restricted Stock Unit Agreement under Amended and Restated 2012 Incentive

Plan (incorporated by reference to Exhibit 10.9 of the Registrant’s Annual Report on Form 10-K filed by the Registrant on March

13, 2018). |

| (d)(10) |

|

Form of Inducement Award Nonstatutory Stock Option Agreement (incorporated

by reference to Exhibit 4.4 to the Registration Statement on Form S-8 filed by the Registrant with the Securities and Exchange Commission

on December 19, 2014). |

| (d)(11) |

|

Form of Inducement Award Nonstatutory Stock Option

Agreement (incorporated by reference to Exhibit 10.11 of the Registrant’s Annual Report on Form 10-K filed by the Registrant

on March 13, 2018). |

| (d)(12) |

|

Form of Inducement

Award Restricted Stock Unit Agreement (incorporated by reference to Exhibit 4.3 of the Registrant’s Quarterly Report on Form

10-Q for the quarter ended September 30, 2018, filed by the Registrant with the Securities and Exchange Commission on November 7,

2018). |

| (d)(13) |

|

2018 Employee Stock

Purchase Plan (incorporated by reference to Exhibit 10.2 of the Registrant’s Current Report on Form 8-K filed by the Registrant

on December 20, 2018). |

| (d)(14) |

|

Amended and Restated

2018 Employee Stock Purchase Plan (incorporated by reference to Exhibit 10.1 of the Registrant’s Quarterly Report on Form 10-Q

filed by the Registrant on August 8, 2023). |

| (d)(15) |

|

Form of Indemnification

Agreement between the Registrant and each director and executive officer (incorporated by reference to Exhibit 10.1 to the Quarterly

Report on Form 10-Q filed by the Registrant on August 8, 2017). |

| (d)(16) |

|

Form of Restricted

Stock Unit Agreement under the 2012 Incentive Plan (incorporated by reference to Exhibit 10.2 to the Quarterly Report on Form 10-Q

filed by the Registrant on May 7, 2020). |

| (d)(17) |

|

Form of Inducement Restricted Stock Unit Agreement

(incorporated by reference to Exhibit 10.3 to the Quarterly Report on Form 10-Q filed by the Registrant on May 7, 2020). |

| (d)(18) |

|

Form of Incentive Stock Option Agreement under the 2012 Incentive Plan (Form

of Restricted Stock Unit Agreement under the 2012 Incentive Plan (incorporated by reference to Exhibit 10.4 to the Quarterly Report

on Form 10-Q filed by the Registrant on May 7, 2020). |

| (d)(19) |

|

Form of Nonstatutory Stock Option Agreement under the 2012 Incentive

Plan (incorporated by reference to Exhibit 10.5 to the Quarterly Report on Form 10-Q filed by the Registrant on May 7, 2020). |

| (d)(20) |

|

Form of Inducement Nonstatutory Stock Option Agreement (incorporated

by reference to Exhibit 10.6 to the Quarterly Report on Form 10-Q filed by the Registrant on May 7, 2020). |

| (d)(21) |

|

Amended and Restated 2012 Incentive Plan (incorporated by reference

to Exhibit 10.1 of the Registrant’s Current Report on Form 8-K, filed by the Registrant with the Securities and Exchange Commission

on May 21, 2020). |

| (d)(22) |

|

Amended and Restated 2012 Incentive Plan.

(incorporated by reference to Exhibit 10.3 to Form 10-Q by the Registrant with the Securities and Exchange Commission on August 8,

2023) |

| (d)(23) |

|

2021 Equity Incentive Plan (incorporated by reference to Appendix A

of the Registrant’s Proxy Statement, filed by the Registrant with the Securities and Exchange Commission on April 8, 2021). |

| (d)(24) |

|

Form of Incentive Stock Option Agreement under

the 2021 Equity Incentive Plan (incorporated by reference to Exhibit 10.2 to the Quarterly Report on Form 10-Q filed by the Registrant

on August 2, 2021). |

| (d)(25) |

|

Form of Nonstatutory Stock Option Agreement

(Employees) under the 2021 Equity Incentive Plan (incorporated by reference to Exhibit 10.3 to the Quarterly Report on Form 10-Q

filed by the Registrant on August 2, 2021). |

| (d)(26) |

|

Form of Nonstatutory Stock Option Agreement

(Non-Employees) under the 2021 Equity Incentive Plan (incorporated by reference to Exhibit 10.4 to the Quarterly Report on Form 10-Q

filed by the Registrant on August 2, 2021). |

| (d)(27) |

|

Form of Restricted Stock Unit Agreement under

the 2021 Equity Incentive Plan (incorporated by reference to Exhibit 10.5 to the Quarterly Report on Form 10-Q filed by the Registrant

on August 2, 2021). |

| (d)(28) |

|

Form of Inducement

Nonstatutory Stock Option Agreement (incorporated by reference to Exhibit 10.6 to the Quarterly Report on Form 10-Q filed by the

Registrant on August 2, 2021). |

| (d)(29) |

|

Form of Inducement Restricted Stock Unit Agreement

(incorporated by reference to Exhibit 10.7 to the Quarterly Report on Form 10-Q filed by the Registrant on August 2, 2021). |

| (d)(30) |

|

Amended and Restated

2021 Equity Incentive Plan (incorporated by reference to Exhibit 10.3 of the Registrant’s

Quarterly Report on Form 10-Q filed by the Registrant on August 8, 2023). |

| (d)(31) |

|

Employment Agreement,

dated August 2, 2023 by and between Verastem, Inc. and Daniel W. Paterson (incorporated by reference to Exhibit 10.1 to the Form

8-K filed by the Registrant with the Securities and Exchange Commission on August 4, 2023). |

| (d)(32) |

|

Employment Agreement,

dated October 24, 2023 by and between Verastem, Inc. and Daniel Calkins (incorporated by reference to Exhibit 10.1 to the Form 8-K

filed by the Registrant with the Securities and Exchange Commission on October 27, 2023). |

| (d)(33) |

|

Employment Agreement

between the Registrant and Brian Stuglik, dated July 29, 2019 (incorporated by reference to Exhibit 10.1 to Current Report on Form

8-K filed by the Registrant on August 1, 2019). |

| (d)(34) |

|

Securities Purchase

Agreement, dated January 24, 2023, by and among Verastem, Inc. and each purchaser party thereto (incorporated by reference to Exhibit

10.1 to the form 8-K filed by the Registrant with the Securities and Exchange Commission on January 25, 2023). |

| (d)(35) |

|

Section 203 Agreement

entered into as of March 28, 2022 by and between Baker Bros. Advisors LP and Verastem, Inc. (incorporated by reference to Exhibit

10.1 to the Form 8-K filed by the Registrant with the Securities and Exchange Commission on March 30, 2022). |

| (d)(36) |

|

Indenture, dated as

of October 17, 2018, by and between the Registrant and Wilmington Trust, National Association (incorporated by reference to Exhibit

4.1 to Form 8-K filed by the Registrant on October 17, 2018). |

| (d)(37) |

|

First Supplemental

Indenture, dated as of October 17, 2018, by and between the Registrant and Wilmington Trust, National Association (incorporated by

reference to Exhibit 4.2 to Form 8-K filed by the Registrant on October 17, 2018). |

| (d)(38) |

|

Sales Agreement, dated

August 2, 2021, by and between the Company and Cantor Fitzgerald & Co. (incorporated by reference to Exhibit 1.2 of the Company’s

Form 3 Registration Statement as filed August 2, 2021). |

| (d)(39) |

|

Certificate of Designation

of Preferences, Rights and Limitations of Series A Convertible Preferred Stock (incorporated by reference to Exhibit 3.1 to the Form

8-K filed by the Registrant with the SEC on November 7, 2022). |

| (d)(40) |

|

Certificate of Designation

of Preferences, Rights and Limitations of Series B Convertible Preferred Stock (incorporated by reference to Exhibit 3.1 to the Form

8-K filed by the Registrant with the SEC on January 25, 2023). |

| (g) |

|

Not applicable. |

| (h) |

|

Not applicable. |

Item 12(b). Filing Fees

* Filed herewith.

Item 13. Information Required by Schedule

13E-3.

Not applicable.

SIGNATURE

After due inquiry and to

the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| VERASTEM, INC. |

| |

| By: |

/s/ Daniel W. Paterson |

| |

Name: |

Daniel W. Paterson |

| |

Title: |

President and Chief Executive Officer |

| |

|

| Date: |

February 8, 2024 |

Exhibit (a)(1)(A)

VERASTEM, INC.

OFFER TO EXCHANGE

CERTAIN OUTSTANDING OPTIONS FOR

NEW OPTIONS

February 8, 2024

VERASTEM, INC.

Offer to Exchange Certain Outstanding Options

for New Options

This offer and withdrawal rights will expire at 11:59 p.m., Eastern Time,

on March 8, 2024, unless we extend the expiration date.

Verastem, Inc., a Delaware corporation (“Verastem,”

the “Company,” “we,” “us,” or “our”) is offering each Eligible Holder (as defined below)

the opportunity to exchange outstanding Eligible Options (as defined below) for an equal number of new options to purchase shares of our

common stock (“New Options”), on the terms and under the conditions set forth in this Offer to Exchange Certain Outstanding

Options for New Options (the “Offering Memorandum”). In this Offering Memorandum, we refer to this offering as the “Offer”

and we refer to the exchange of Eligible Options for New Options in accordance with the terms of the Offer as the “Option Exchange

Program.”

This Offer provides Eligible Holders the opportunity

to cancel and exchange all or none of their Eligible Options for the grant of the same number of New Options. The New Options will have

an exercise price equal to the fair market value (within the meaning of the Company’s Amended and Restated 2021 Equity Incentive

Plan (referred to as the “2021 Plan”)) of our common stock on the Grant Date (as defined below). The Company’s stockholders

approved the implementation of this one-time Offer at its Special Meeting of Stockholders held on January 17, 2024.

If you participate in the Option Exchange Program,

the number of New Options granted to you will equal the number of Eligible Options that you elect to exchange at an exchange ratio of

1:1, or one Eligible Option for one New Option. We will grant New Options in exchange for tendered Eligible Options promptly following

the closing of the exchange period. This date is referred to as the “Grant Date.” If the expiration date of the Offer is extended,

as described in this Offering Memorandum, the Grant Date will also be delayed. The New Options will be granted pursuant to the 2021 Plan.

None of the New Options will be vested as of the

Grant Date. The vesting of the New Options is generally subject to your continued employment or service with us or our subsidiaries through

the applicable vesting date (as well as the achievement of existing performance criteria, for performance-based Eligible Options exchanged

for New Options), as detailed in Section 9 of this Offering Memorandum.

Our common stock is traded on The Nasdaq Capital

Market (“Nasdaq”) under the symbol “VSTM.” On February 7, 2024, the closing price of our common stock was $13.45

per share. You should evaluate the risks related to our business, our common stock and the Offer, and review current market quotes for

our common stock, among other factors, before deciding to participate in the Option Exchange Program.

See “Risks of Participating in the Option Exchange Program” beginning on page 15 for a discussion of risks that you should consider before participating

in the Option Exchange Program.

IMPORTANT

If you choose to participate

in the Offer, you must properly complete, sign and deliver the election form so that we receive it before 11:59 p.m., Eastern Time, on

March 8, 2024 (or such later date as may apply if the Offer is extended) by email (by PDF or similar imaged document file) delivered

to: StockOptionExchange@verastem.com

For subsequent withdrawals

and elections, please deliver the properly completed and signed election form (or Notice of Withdrawal of election form) so that we receive

it before 11:59 p.m., Eastern Time, on March 8, 2024 (or such later date as may apply if the Offer is extended), by email (by PDF

or similar imaged document file) delivered to: StockOptionExchange@verastem.com

You are responsible for

making sure that the election form is delivered as indicated above. You must allow for sufficient time to complete, sign and deliver your

election form to ensure that we receive your election form before the expiration date. We intend to confirm the receipt of your election

form by email within two business days after receiving your election form. If you do not receive a confirmation, it is your responsibility

to confirm that we have timely received your election form.

You do not need to return your stock option agreement(s)

for your Eligible Options to be cancelled and exchanged in the Offer because they will be automatically cancelled effective as of the

expiration date if we accept your Eligible Options for exchange.

Neither the U.S. Securities and Exchange Commission

(the “SEC”) nor any state or non-U.S. securities commission has approved or disapproved of these securities or passed judgment

upon the accuracy or adequacy of this Offering Memorandum. Any representation to the contrary is a criminal offense.

You should direct questions about the Option Exchange

Program and requests for additional copies of this Offering Memorandum and the other Offer documents to:

Daniel Calkins

Email: dcalkins@verastem.com

Phone: (781) 469-1694

Offering Memorandum dated February 8, 2024

You should rely only on the information contained

in this Offering Memorandum or documents to which we have referred in this Offering Memorandum. We have not authorized anyone to provide

you with different information. We are not making an offer to exchange options for new stock options in any jurisdiction in which the

Offer is not permitted. You should not assume that the information provided in this Offering Memorandum is accurate as of any date other

than the date as of which it is shown, or if no date is indicated otherwise, the date of the Offer. This Offering Memorandum summarizes

various documents and other information. These summaries are qualified in their entirety by reference to the documents and information

to which they relate.

TABLE OF CONTENTS

SUMMARY TERM SHEET AND QUESTIONS AND ANSWERS

The following are answers to some of the questions

that you may have about this Option Exchange Program. You should carefully read this entire Offering Memorandum, and the accompanying

launch email, dated February 8, 2024, announcing the Offer, together with its associated instructions. The Offer is made subject to the

terms and conditions of these documents as they may be amended. The information in this summary is not complete. Additional important

information is contained in the remainder of this Offering Memorandum and the other Offer documents. We have included in this summary

references to other sections in this Offering Memorandum to help you find more complete information with respect to these topics.

| |

Q1. |

What is the Option Exchange Program? |

| |

|

|

| |

A1. |

As a result of our stock price decline over the last several years, a substantial number of our employees and non-employee directors who hold outstanding stock options are holding options that are considerably “underwater” (meaning the exercise prices of the stock options are higher than the current market price of our common stock). The Option Exchange Program is a one-time voluntary opportunity for Eligible Holders to surrender certain outstanding underwater stock options in exchange for the same number of new stock options. |

The following are some terms that are frequently used in

this Offering Memorandum:

“2012 Plan” refers to the Company’s Amended

and Restated 2012 Incentive Plan.

“2021 Plan” refers to the Company’s Amended

and Restated 2021 Equity Incentive Plan.

“Board” refers to the Board of Directors of the

Company.

“cancellation date” refers to the date on which

the Tendered Options will be cancelled. This cancellation of Tendered Options will occur after the Offer expires. We expect that the cancellation

date will be March 11, 2024. If the expiration date of the Offer is extended, then the cancellation date will also be delayed.

“common stock” refers to the common stock, par

value $0.0001 per share, of Verastem, Inc.

“Eligible Holder” refers to our employees, including

our executive officers, and non-employee directors, who, as of the Grant Date, are employees or non-employee directors of the Company

and hold outstanding Eligible Options.

“Eligible Option grant” refers to all of the

Eligible Options granted by the Company to an individual that are part of the same grant and subject to the same stock option agreement.

“Eligible Option” refers to an outstanding

vested or unvested stock option that, as of February 8, 2024 had an exercise price equal to or greater than $15.00 per share, that

vests based on continued service with the Company or based on the achievement of performance milestones (other than stock price

hurdles) and that was granted under the 2012 Plan, the 2021 Plan or the Inducement Program; provided that any stock options

non-employee directors hold as a result of their prior service to the Company (whether as an employee, executive officer or

otherwise) are not Eligible Options. For such non-employee directors, Eligible Options only include those stock options that were

granted in respect of their service on the Board.

“exchange period” refers to the period from the

start of the Offer to the expiration date. This period will commence on February 8, 2024, and we expect it to end at 11:59 p.m., Eastern

Time, on March 8, 2024.

“expiration date” refers to the time and date

that the Offer expires. We expect that the expiration date will be March 8, 2024, at 11:59 p.m., Eastern Time. We may extend the Offer

at our sole discretion. If we extend the Offer, the term “expiration date” will refer to the time and date at which the extended

Offer expires.

“Grant Date” refers to the date when New Options

will be granted pursuant to the Option Exchange Program. New Options will be granted promptly following the closing of the exchange period.

If the expiration date of the Offer is extended, then the Grant Date will also be delayed.

“Inducement Program” refers to the Company’s

Inducement Award Program, under which the Company grants inducement awards to certain newly hired employees in accordance with Nasdaq

Listing Rule 5635(c)(4).

“New Options” refers to the options to purchase

shares of common stock to be issued under the 2021 Plan being offered in this Offer.

“Option Exchange Program” refers to the exchange

of Eligible Options for New Options in accordance with the terms of the Offer.

“Offer” refers to this Offer to Exchange Certain

Outstanding Options for New Options.

“options” refers to options to purchase shares

of common stock.

“Stock Plans” refers to the 2012 Plan, the 2021

Plan and the Inducement Program.

“Tendered Options” refers to options to purchase

shares of common stock that are exchanged pursuant to the Option Exchange Program.

| |

Q2. |

What is a stock option? |

| |

|

|

| |

A2. |

A stock option is a right to buy a share of common stock at a set price (known as the exercise price) within a specified period of time. The right to buy the share may continue in the future, but the purchase price is fixed when the stock option is granted. |

| |

Q3. |

Who is eligible to participate in the Option Exchange Program? |

| |

|

|

| |

A3. |

Eligible Holders are eligible to receive New Options pursuant to the Option Exchange Program. The Option Exchange Program will not be open to any former employees or non-employee directors or to consultants. We estimate that approximately 44 employees, including all of our executive officers, and six non-employee directors are eligible to participate in the Option Exchange Program. While our non-employee directors are eligible to participate in the Option Exchange Program, their eligibility extends only to stock options received as a result of their service as a member of the Board. Any stock options non-employee directors hold as a result of their prior service to the Company (whether as an employee, executive officer or otherwise) are not Eligible Options and will therefore be excluded from the Option Exchange. |

| |

Q4. |

Which stock options are eligible for exchange under the Option Exchange Program? |

| |

|

|

| |

A4. |

Eligible Options include the outstanding vested or unvested options to purchase shares of our common stock granted under the

2012 Plan, the 2021 Plan or the Inducement Program that, as of February 8, 2024 had an exercise price equal to or greater than $15.00 per

share and that vest based on continued service with the Company or based on the achievement of performance milestones (other than

stock price hurdles). As of February 8, 2024, Eligible Holders held outstanding options to purchase 2,201,685 shares of common stock

with a weighted-average exercise price of $18.46 per share, of which 45% were underwater, meaning the exercise price of the option

exceeded $13.45 (the closing price of a share of our common stock on February 7, 2024). Of the stock options held by Eligible

Holders, outstanding options to purchase 616,192 shares of common stock had an exercise price equal to or greater than $15.00 per

share and otherwise met the criteria to be considered Eligible Options for purposes of the Option Exchange Program. As of February 8, 2024, the weighted-average exercise price and weighted-average remaining life of the Eligible Options was $30.65 and

5.8 years, respectively. |

The following table sets forth the number of Eligible Options

held by our named executive officers, our non-employee directors that previously served as executive officers, our other non-employee

directors as a group, certain employees holding more than 5% of the total Eligible Options, and our other employees as a group.

| Eligible

Stock Options | |

| Name | |

Unvested

Eligible Options | | |

Vested

Eligible Options | | |

Total | |

| Daniel Paterson(1) | |

| 23,843 | | |

| 144,137 | | |

| 167,980 | |

| Daniel Calkins | |

| 1,175 | | |

| 5,413 | | |

| 6,588 | |

| Brian Stuglik(2) | |

| - | | |

| 11,865 | | |

| 11,865 | |

| Robert Gagnon(3) | |

| - | | |

| - | | |

| - | |

| Other Non-Employee

Directors as a Group(4) | |

| - | | |

| 48,603 | | |

| 48,603 | |

| Jon Pachter(1)(5) | |

| 16,109 | | |

| 71,992 | | |

| 88,101 | |

| Cathy Carew(5) | |

| 14,713 | | |

| 75,407 | | |

| 90,120 | |

| Other

Employees as a Group | |

| 59,258 | | |

| 143,677 | | |

| 202,935 | |

| TOTAL | |

| 115,098 | | |

| 501,094 | | |

| 616,192 | |

| (1) | Excludes certain options to purchase shares of common stock with performance-vesting conditions held by Mr. Paterson and Mr. Pachter

that vest based on the achievement of pre-determined stock price hurdles, which are not Eligible Options for the purposes of the Option

Exchange. Mr. Paterson and Mr. Pachter hold 6,250 and 4,166 such market-based stock options, respectively, which were issued on January

3, 2019. |

| (2) | Mr. Stuglik was formerly the Company’s Chief Executive Officer until July 2023. Mr. Stuglik remains a member of the Board. Excludes

stock options held by Mr. Stuglik as a result of his prior service as an executive of the Company, including 170,691 stock options with

an exercise price equal to or greater than $15.00 per share, as such stock options are not Eligible Options and, as such, would not be

eligible to be exchanged pursuant to the Option Exchange. |

| (3) | Mr. Gagnon was formerly the Company’s Chief Business and Financial Officer until October 2022. Mr. Gagnon is currently a member

of the Board. Excludes 121,269 stock options with an exercise price equal to or greater than $15.00 per share held by Mr. Gagnon as a

result of his prior service as an executive of the Company, as such stock options are not Eligible Options and, as such, would not be

eligible to be exchanged pursuant to the Option Exchange. |

| (4) | Non-employee directors may only exchange stock options granted in respect of their service as members of the Board. Options granted

in respect of other employment with, or other service to, us are not eligible to be exchanged in the Option Exchange. This total excludes

stock options held by Brian Stuglik and Robert Gagnon. |

| (5) | Employees holding greater than 5% of the 616,192 total Eligible Options as of February 8, 2024. |

| Q5. | | |

Can the Option Exchange Program be extended, and if so, how will I be notified if the Option Exchange Program is extended?

|

| | | |

|

| A5. | | |

We may, in our sole discretion, extend the Option Exchange Program at any time, but we do not currently expect to do so. If we extend the Option Exchange Program, we will issue a press release or other public announcement disclosing the extension no later than 11:59 p.m., Eastern Time, on the business day following the scheduled expiration date. |

| | | |

|

| Q6. | | |

How many shares will the New Options I receive be exercisable for? |

| | | |

|

| A6. | | |

The Option Exchange Program is a one-for-one exchange. Thus, each Eligible Option will be replaced by a New Option covering the same number of shares, but with a new exercise price, term, and vesting schedule (except that the performance criteria with respect to performance-vesting options will not change). The overall number of stock options outstanding will remain the same. The new stock options will have an exercise price equal to the fair market value (within the meaning of the 2021 Plan) of our common stock on the Grant Date. |

| | | |

|

| Q7. | | |

Can you provide an example of how the exchange ratios would work? |

| | | |

|

| A7. | | |

Based on the exchange ratio of 1:1, if you hold Eligible Options to purchase 1,000 shares of our common stock and you timely elected to participate in the Option Exchange Program, you would receive New Options to purchase 1,000 shares of our common stock pursuant to the Option Exchange Program. |

| Q8. | | |

What would the new exercise price be? |

| | | |

|

| A8. | | |

The New Options will have an exercise price equal to the closing price of our common stock as reported on Nasdaq on the Grant Date. Each New Option will represent your right to purchase one share for every share covered by the Eligible Options that you agree to exchange. |

| | | |

|

| Q9. | | |

My Eligible Options are already vested. Would my New Options be fully vested? |

| | | |

|

| A9. | | |

No. None of the New Options issued under the Option Exchange Program will be vested on the Grant Date. See Question and Answer 10 below for further detail regarding the applicable vesting schedules of New Options. |

| Q10. | | |

What would the vesting schedule be for the New Options? |

| | | |

|

| A10. | | |

New Options issued in exchange for currently exercisable options will vest in two equal annual installments over a two-year period from the Grant Date, generally subject to the participant’s continued employment or service with us through the applicable vesting date. New Options issued in exchange for unvested time-based options will vest as to 25% of the shares underlying the option beginning one-year following the Grant Date, with the remaining shares vesting in equal quarterly installments over the next three years, generally subject to the participant’s continued employment or service with us through the applicable vesting date. New Options issued in exchange for unvested performance-based options will vest on the later of achievement of the existing performance criteria (i.e., the performance criteria applicable to the stock options will not change) or the first anniversary of the Grant Date, generally subject to the participant’s continued employment or service with us through the applicable vesting date. |

| Q11. | | |

Will the terms and conditions of the New Options be the same as the exchanged Eligible Options? |

| | | |

|

| A11. | | |

No. The terms and conditions of your New Options, including the exercise price, vesting schedule, term and the potential tax treatment of your New Options, will be different than your Tendered Options. The New Options will be granted under and subject to the terms and conditions of the 2021 Plan and a new option agreement between you and Verastem. The 2021 Plan and current form of option agreement for stock option awards granted under the 2021 Plan are incorporated by reference as exhibits to the Tender Offer Statement on Schedule TO with which this Offer to Exchange has been filed with the SEC (the “Schedule TO”) and are available on the SEC website at www.sec.gov. Please see Section 9 of “The Offer” below for a fuller discussion of these differences. In addition, to the extent (i) permissible and available for grant under the 2021 Plan and (ii) allowable under Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”), each New Option will be granted as an incentive stock option (“ISO”) for U.S. federal income tax purposes, and any remaining portion will be treated as a nonqualified stock option (“NSO”). |

| Q12. | | |

If I elect to participate, when would I receive my New Options? |

| | | |

|

| A12. | | |

We will grant the New Options on the Grant Date, which we currently expect to be March 11, 2024. If the expiration date is delayed, the Grant Date will also be delayed. If you are granted New Options, we will provide you with your new option agreement under the 2021 Plan shortly after the Grant Date |

| | | |

|

| Q13. | | |

Do I have to participate in the Option Exchange Program? |

| | | |

|

| A13. | | |

Participation in the Option Exchange Program is completely voluntary. If you chose not to participate, you would keep all your current outstanding stock options, including your Eligible Options. You do not need to do anything if you choose to not participate in the Option Exchange Program.

See Question and Answer 32 below for further detail on the potential implications of not participating in the Option Exchange Program for any Eligible Options currently treated as ISOs. |

| Q14. | | |

How do I tender my Eligible Options for exchange? |

| | | |

|

| A14. | | |

If you are an Eligible Holder, you may tender your Eligible Options for exchange at any time before the expiration date, i.e., 11:59 p.m., Eastern Time, on March 8, 2024 (or such later date as may apply if the Offer is extended). To

validly tender your Eligible Options, you must deliver a properly completed and signed election

form, and any other documents required by the election form, by email (by PDF or similar

imaged document file) to StockOptionExchange@verastem.com. You do not need to return your stock option agreements relating to any Tendered Options as they will be automatically cancelled effective as of the Grant Date if we accept your Eligible Options for exchange. We will separately provide to you the grant documents relating to your New Options for your acceptance following the Grant Date. Your Eligible Options will not be considered tendered until we receive your properly completed and signed election form. We must receive your properly completed and signed election form before 11:59 p.m., Eastern Time, on March 8, 2024 (or such later date as may apply if the Offer is extended). If you miss this deadline, you will not be permitted to participate in the Exchange Offer. We will accept delivery of the signed election form only by email (by PDF or similar imaged document file). You are responsible for making sure that the election form is delivered to the email address indicated above. You must allow for sufficient time to complete and deliver your election form to ensure that we receive your election form before the expiration date. We intend to confirm the receipt of your election form by email within two business days after receiving your election form. If you do not receive a confirmation, it is your responsibility to confirm that we have timely received your election form. We reserve the right to reject any or all tenders of Eligible Options that we determine are not in appropriate form or that we determine would be unlawful to accept. Subject to our rights to extend, terminate and amend the Exchange Offer, we expect to accept all properly tendered Eligible Options on March 11, 2024, following the expiration date. |

See Section 4, “Procedures

for electing to exchange options” for more information.

| Q15. | | |

If I choose to participate in the Option Exchange Program, do I have to exchange all of my Eligible Options? |

| | | |

|

| A15. | | |

Yes. Under the Option Exchange Program, you may choose to participate in the program for all of your Eligible Options or none, and may not choose to exchange portions of Eligible Option grants or some Eligible Option grants and not others. |

| | | |

|

| Q16. | | |

If I choose to participate in the Option Exchange Program, can I partially exchange an option grant? |

| | | |

|

| A16. | | |

We are not accepting partial tenders of Eligible Options. However, you may elect to exchange the remaining portion of any Eligible Option that you previously partially exercised. Accordingly, you must elect to exchange all of the unexercised shares subject to your Eligible Options. |

| | | |

|

| Q17. | | |

Can I exchange shares of common stock that I acquired upon exercise of my existing stock options? |

| | | |

|

| A17. | | |

No. The Option Exchange Program only applies to outstanding stock options that are eligible under the Option Exchange Program (i.e., Eligible Options). You would not be able to exchange shares of common stock that you own outright. |

| Q18. | | |

Will I be required to give up all my rights under the exchanged stock options? |

| | | |

|

| A18. | | |

Yes. On the expiration date of the Option Exchange Program, the Eligible Options you surrender in exchange for New Options will be cancelled and you will no longer have any rights under those surrendered stock options. |

| Q19. | | |

During what period of time may I withdraw options that I previously elected to exchange? |

| | | |

|

| A19. | | |

You may withdraw any Eligible Options that you previously elected to exchange at any time before the Option Exchange Program expires. If we extend the Option Exchange Program, you may withdraw any stock options that you previously elected to exchange at any time before the extended expiration of the Offer. |

| | | |

|

| Q20. | | |

What if I elect to participate and then leave Verastem before the Option Exchange Program ends? |

| | | |

|

| A20. | | |

If you elect to participate in the Option Exchange Program and your employment or service ends for any reason before you receive the New Options, your exchange election will be cancelled and you will not receive the New Options. If this occurs, no changes would be made to the terms of your current stock options and such stock options would be treated as if you had declined to participate in the Option Exchange Program. |

| Q21. | | |

What if I elect to participate and leave Verastem after the New Options are granted? |

| | | |

|

| A21. | | |

If you elect to participate in the Option Exchange Program and your employment or service with Verastem ends for any reason after you receive the New Options, your exchange election will have been processed and your New Options will have the new terms and conditions that apply to such options as described herein. If you leave Verastem prior to the New Options vesting, the unvested portion of the New Options will generally be forfeited. |

| | | |

|

| Q22. | | |

Will I owe taxes if I participate in the Option Exchange Program? |

| | | |

|

| A22. | | |

Neither the acceptance of your Eligible Options for exchange nor the grant of any New Options will be a taxable event for U.S. federal income tax purposes.

You should consult with your tax advisor to determine the personal tax consequences of participating in the Exchange Offer Program. If you are an Eligible Holder who is subject to the tax laws of a country other than the United States or of more than one country, you should be aware that there may be additional or different tax consequences that may apply to you. We advise all Eligible Holders who may consider tendering their Eligible Options for exchange to consult with their own tax advisors with respect to the federal, state, local and foreign tax consequences of participating in the Exchange Offer.

You should refer to Section 14 of this Offering Memorandum for more information regarding the tax aspects of the Exchange Offer. |

| | | |

|

| Q23. | | |

Does Verastem recommend that Eligible Holders participate in the Option Exchange Program? |

| | | |

|

| A23. | | |

Verastem is not making any recommendation as to whether or not an Eligible Holder should participate in the Option Exchange Program. |

The program does carry risk (see “Risks of Participating in the Option Exchange Program” beginning on page 15 for information regarding some of these risks), and there are no

guarantees regarding whether you ultimately would receive greater value from your Eligible Options or from the New Options you will receive

in exchange. You must make your own decision as to whether or not to participate in the Option Exchange Program. For questions regarding

personal tax implications or other investment-related questions, you should talk to your personal legal counsel, accountant, and/or financial

advisor. (See Section 3, “Purposes of the Offer” below).

| Q24. | | |

How should I decide if I should exchange my Eligible Options? |

| | | |

|

| A24. | | |

We are providing substantial information to assist you in making your own informed decision. Please read all the information contained in the various sections of the Offering Memorandum below, including the information in Section 3, “Purposes of the Offer,” Section 8, “Price range of shares underlying the options,” Section 10, “Information concerning the Company,” Section 11, “Interests of directors and executive officers; transactions and arrangements concerning the options,” Section 14, “Material income tax consequences,” and Section 17, “Additional Information” of this Offering Memorandum. You should seek further advice from your legal counsel, accountant and financial advisor. Participation in the Option Exchange Program is entirely your decision and should be made based on your personal circumstances. No one from Verastem is, or will be, authorized to provide you with legal, tax, financial or other advice or recommendations regarding whether you should participate in the Option Exchange Program. |

You should carefully consider the potential tax consequences

of your exchange of Eligible Options for New Options. Please also review “Tax-Related Risks” and other risk factors

that begin on page 16.

| Q25. | | |

Why is the Company making the Offer? |

| | | |

|

| A25. | | |

We have designed the Option Exchange Program to restore equity value, increase retention and motivation in a competitive labor market, provide non-cash compensation incentives and align our employee and stockholder interests for long-term value creation. Underwater stock option awards are of limited benefit in motivating and retaining our key talent. Through the Option Exchange Program, we believe that we will be able to enhance long-term stockholder value by increasing our ability to retain experienced and talented employees, executives, and non-employee directors and by aligning the interests of these individuals more fully with the interests of our stockholders. Previously, we submitted for stockholder approval to implement a one-time stock Option Exchange Program, as described in our definitive proxy statement on Schedule 14A, filed with the SEC on December 19, 2023. The Company’s stockholders approved the implementation of this one-time Offer at its Special Meeting of Stockholders held on January 17, 2024.

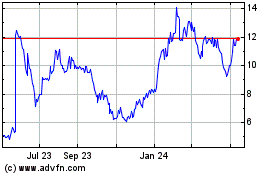

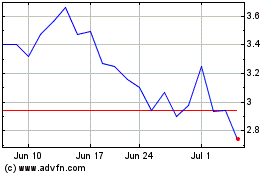

Verastem has historically used stock options to incentivize and retain employees. Option grants serve as a powerful retentive tool based on stock price appreciation. In the last several years we have experienced a significant decline in our stock price causing the vast majority of our outstanding options to have exercise prices that exceed the recent trading prices of our common stock. Since 2019, the closing price of our common stock has fallen from a high of $58.20 per share in June 2021 to a low of $3.54 per share in October 2022. As of December 31, 2023, approximately 51% of outstanding stock options held by Eligible Holders were underwater and 44% have an exercise price of $15.00 per share or higher. This significant decline in the price of our common stock has a meaningful impact on the total compensation actually earned by our employees and non-employee directors. This impact on total compensation negatively affects our ability to retain and motivate our employees, whom we rely on to achieve our business plans and strategic objectives. Similarly, this impact on compensation negatively impacts our ability to retain and appropriately compensate our non-employee directors. |

(See Section 3, “Purposes of the Offer,”

below).

| Q26. | | |

Are there circumstances under which I would not be granted New Options? |

| | | |

|

| A26. | | |

Yes. If, for any reason, you no longer are an employee or non-executive director of the Company or its subsidiaries on the Grant Date, you will not receive any New Options. Instead, you will keep your current Eligible Options and those options will be exercisable and expire in accordance with their original terms. Except as provided by applicable law and/or any employment or other service agreement between you and the Company or its subsidiaries, your employment or other service with the Company or its subsidiaries will remain “at-will” regardless of your participation in the Option Exchange Program and can be terminated by you or Verastem (or entity with which you engage to provide services) at any time with or without cause or notice. (See Section 1, “Eligibility,” below). You

may also expressly reject this Offer by completing the election form accordingly and submitting

to us prior to the expiration date, currently expected to be 11:59 p.m., Eastern Time, on

March 8, 2024. Similarly, you may subsequently withdraw a prior election, or submit a subsequent

new election form rejecting the Offer by delivering the properly completed and signed election

form (or Notice of Withdrawal of election form) so that we receive it before 11:59 p.m.,

Eastern Time, on March 8, 2024 (or such later date as may apply if the Offer is extended),

by email (by PDF or similar imaged document file) delivered to: StockOptionExchange@verastem.com |

Moreover, even if we accept your Eligible Options, we will

not grant New Options to you if we are prohibited from doing so by applicable laws. For example, we could become prohibited from granting

New Options as a result of changes in SEC or Nasdaq rules. We do not anticipate any such prohibitions at this time.

| Q27. | | |

Do I have to pay for my New Options? |

| | | |

|

| A27. | | |

No. You do not have to make any cash payment to us to receive your New Options, but, similar to the exercise process of the Eligible Options, in order to exercise your New Options and purchase any shares of common stock subject to your New Options, you will be required to pay the exercise price of your New Options. Additionally, to the extent that we have a tax withholding obligation with respect to exercise of the New Options, the tax withholding obligations will be satisfied in the manner specified in the 2021 Plan and the option agreement thereunder that will govern the terms of your New Options. (See Section 9, “Source and amount of consideration; terms of New Options,” below). |

| Q28. | | |

When will my Tendered Options be cancelled? |

| | | |

|

| A28. | | |

Your Tendered Options will be cancelled following the expiration of the Offer on the next U.S. calendar day following the expiration date. We refer to this date as the cancellation date. We expect that the cancellation date will be March 11, 2024, unless the exchange period is extended. (See Section 6, “Acceptance of options for exchange and issuance of New Options,” below). |

| | | |

|

| Q29. | | |

Once my Tendered Options are cancelled pursuant to the Option Exchange Program, is there anything I must do to receive the New Options? |

| | | |

|

| A29. | | |

Once your election has been accepted and your Tendered Options have been surrendered and cancelled pursuant to the terms of the Offer, and upon the grant of any New Options to you in the Offer, you will need to follow the same electronic procedures that ordinarily apply to any Verastem option granted in the normal course. We expect that the Grant Date will be March 11, 2024 (subject to any extension to the expiration date of the Offer). In order to vest in the shares of our common stock underlying the New Options. you will generally need to remain an employee or service provider of Verastem or its subsidiaries through the applicable vesting date, as described in Question and Answer 10. (See Section 1, “Eligibility,” below). |

| | | |

|

| Q30. | | |

Do I need to exercise my New Options in order to receive shares of common stock? |

| | | |

|

| A30. | | |

Yes. As with your Eligible Options, you will need to exercise the vested portion of your New Options and pay the purchase price to receive shares of common stock. (See Section 9, “Source and amount of consideration; terms of New Options,” below). |

| | | |

|

| Q31. | | |

Will I be required to give up all of my rights under the cancelled options? |

| | | |

|

| A31. | | |

Yes. Once we have accepted your Tendered Options, your Tendered Options will be cancelled and you will no longer have any rights under those options. We intend to cancel all Tendered Options following the expiration of the Offer on the next U.S. calendar day following the expiration date. We refer to this date as the cancellation date. We expect that the cancellation date will be March 11, 2024 (subject to any extension to the expiration date of the Offer). (See Section 6, “Acceptance of options for exchange and issuance of New Options,” below). |

| | | |

|

| Q32. | | |

What happens to my options if I choose not to participate or if my options are not accepted for exchange? |

| | | |

|

| A32. | | |

If you choose not to participate or your options are not accepted for exchange, your existing options will (a) remain outstanding until they are exercised or cancelled or they expire by their existing terms, (b) retain their current exercise price, (c) retain their current vesting schedule, and (d) retain all of the other terms and conditions as set forth in the relevant agreement related to such option grant. (See Section 6, “Acceptance of options for exchange and issuance of New Options,” below). However, if: (x) any of your Eligible Options are currently treated as ISOs, and (y) we extend the Exchange Offer Program beyond the original expiration date of March 8, 2024, then your Eligible Options may cease to be treated as ISOs as of the original expiration date on March 8, 2024, unless you reject this Offer by the original expiration date on March 8, 2024. If the fair market value of our common stock as of the expiration date is less than the exercise price currently in effect for your Eligible Options, the Board can take action to “retest” your Eligible Options to determine if they can again be treated as ISOs. However, even if they can again be treated as ISOs, your holding period under your Eligible Options (as further described below in the section called “Taxation of Incentive Stock Options”) will start over on the expiration date. Therefore, if you do not plan to tender your Eligible Options in the Exchange Offer Program and you wish to avoid the possible impact on the ISO status of your Eligible Options that would result if we extend the Offer beyond the original expiration date on March 8, 2024, you must reject this Offer by completing and submitting the election form before 11:59 p.m., Eastern Time, on March 8, 2024. We will not accept for exchange any options that are tendered that do not qualify as Eligible Options. If you tender an option that is not accepted for exchange, we will send you a separate email following the expiration date notifying you that your tendered option was not accepted for exchange. |

| Q33. | | |

How does the Company determine whether an Eligible Option has been properly tendered? |

| | | |

|

| A33. | | |

We will determine, in our discretion, all questions about the validity, form, eligibility (including time of receipt) and acceptance of any options. Our determination of these matters will be given the maximum deference permitted by law. However, you have all rights accorded to you under applicable law to challenge such determination in a court of competent jurisdiction. We reserve the right to reject any election of any option tendered for exchange that we determine is not in an appropriate form or that we determine is unlawful to accept. We will accept all properly Tendered Options that are not validly withdrawn, subject to the terms of the Offer. No tender of Eligible Options will be deemed to have been made properly until all defects or irregularities have been cured or waived by us. We have no obligation to give notice of any defects or irregularities in any election and we will not incur any liability for failure to give any such notice. (See Section 4, “Procedures for electing to exchange options,” below). |

| | | |

|

| Q34. | | |

What if the Company is acquired by another company? |

| | | |

|

| A34. | | |

Although we currently are not anticipating a merger or acquisition, if we merge or consolidate with or are acquired by another entity prior to the expiration of the Offer, you may choose to withdraw any Eligible Options that you tendered for exchange and such options will be treated in accordance with the Stock Plan under which they were granted, together with the applicable stock option agreement. Further, if the Company is acquired prior to the expiration of the Offer, we reserve the right to withdraw the Offer, in which case your Eligible Options and your rights under them will remain intact and exercisable for the time period set forth in your stock option agreement and you will receive no New Options in exchange for them. If the Company is acquired prior to the expiration of the Offer but does not withdraw the Offer, before the expiration of the Offer, we (or the successor entity) will notify you of any material changes to the terms of the Offer or the New Options, including any adjustments to the number of shares that will be subject to the New Options. Under such circumstances, we would expect that the type of security and the number of shares covered by your New Options would be adjusted based on the consideration per share given to holders of our common stock in connection with the acquisition. As a result of this adjustment, if made, you may receive stock options covering more or fewer shares of the acquirer’s common stock than the number of shares subject to the Eligible Options that you tendered for exchange or than the number you would have received pursuant to the New Options if no acquisition had occurred. |

If, after the Offer, we subsequently are acquired by or merge

with another company, your Tendered Options might have been worth more than the New Options that you receive in exchange for them.

A transaction involving us, such as a merger or other acquisition,

could have a substantial effect on our stock price, including significantly increasing the price of our common stock. Depending on the

structure and terms of this type of transaction, option holders who elect to participate in the Option Exchange Program may receive less

of a benefit from the appreciation in the price of our common stock resulting from the merger or acquisition. This could result in a greater

financial benefit for those option holders who did not participate in the Option Exchange Program and retained their Eligible Options.

Further, if another company acquires us, that company,

as part of the transaction or otherwise, may decide to terminate some or all of the employees and/or non-employee directors of the

Company or its subsidiaries before the completion of the Option Exchange Program. Termination of your employment or other service

for this or any other reason before the Grant Date means that the tender of your Eligible Options will not be accepted, you will

keep your Tendered Options in accordance with their original terms, and you will not receive any New Options or other benefit for

your Tendered Options.

If we are acquired after your tendered Eligible Options have

been accepted, cancelled, and exchanged for New Options, your New Options will be treated in the acquisition transaction in accordance

with the terms of the transaction agreement or the terms of the 2021 Plan and your stock option agreement. (See Section 9, “Source

and amount of consideration; terms of New Options,” below).

| Q35. | | |

Will I receive a new option agreement if I choose to participate in the Offer? |

| | | |

|

| A35. | | |

Yes. All New Options will be granted under, and subject to, the terms and conditions of the 2021 Plan and a new option agreement between you and Verastem under the 2021 Plan. (See Section 9, “Source and amount of consideration; terms of New Options,” below). |

| | | |

|

| Q36. | | |

Are there any conditions to the Offer? |

| | | |

|

| A36. | | |

Yes. The completion of the Offer is subject to a number of customary conditions that are described in Section 7 of this Offering Memorandum. If any of these conditions is not satisfied, we will not be obligated to accept and exchange properly tendered Eligible Options, though we may do so at our discretion. (See Section 2, “Number of New Options; expiration date,” and Section 7, “Conditions of the Offer,” below). |

| | | |

|

| | | |

|

| Q37. | | |

May I change my mind about whether I want to exchange my Eligible Options? |

| | | |

|

| A37. | | |

Yes, but only before the Offer expires. You may change your mind after you have submitted an election form at any time before the expiration date by completing and submitting a new election form via email. If we extend the expiration date, you may change your election at any time until the extended Offer expires. You may change your mind as many times as you wish, but you will be bound by the last properly submitted election form we receive by the expiration date. Please be sure that any completed and new election form you submit is clearly dated after your last-submitted election form. (See Section 4, “Procedures for electing to exchange options,” and Section 5, “Withdrawal rights and change of election,” below). |

| | | |

|

| Q38. | | |

How do I change my election with respect to my Eligible Options? |

| | | |

|

| A38. | | |

To change an election you previously made with respect to your Eligible Options, you must deliver a valid new election form indicating that you accept or reject the Offer with respect to all of your Eligible Options, by completing the election process outlined below by the expiration date, currently expected to be 11:59 p.m., Eastern Time, on March 8, 2024. |

Your delivery of all documents, including election forms,

is at your own risk. Only election forms that are complete and actually received by the deadline via email will be accepted. If you do

not receive a confirmation, it is your responsibility to confirm that we have received your election form. Election forms submitted by

any other means, including hand delivery, interoffice, U.S. mail (or other post) and Federal Express (or similar delivery service), are

not permitted. We intend to confirm the receipt of your election form by email within two business days after receiving your election

form. See Section 5, “Withdrawal rights and change of election,” below.

| Q39. | | |

What if I withdraw my election and then decide that I do want to participate in the Option Exchange Program? |

| | | |

|

| A39. | | |

If you have withdrawn your election to participate and then again decide to participate in the Option Exchange Program, you may reelect to participate by submitting a new, properly completed election form via email before the expiration date, that is signed (electronically or otherwise) and dated after the date of your previously submitted election form. (See Section 5, “Withdrawal rights and change of election,” below). |

| Q40. | | |

Will my decision to participate in the Option Exchange Program have an impact on my ability to receive options or other equity awards in the future? |

| | | |

|

| A40. | | |

No.

Your election to participate or not to participate in the Option Exchange Program will not have any effect on our making future grants

of options, other equity awards, or any other rights to you or anyone else. (See Section 1, “Eligibility,” below). |

| | | |

|

| Q41. | | |

Whom can I contact if I have questions about the Option Exchange Program, or if I need additional copies of the Offer documents? |

| | | |

|

| A41. | | |

You should direct questions about the Option Exchange Program and requests for printed copies of this Offering Memorandum and the other Offer documents to: |

Daniel Calkins

Email: dcalkins@verastem.com

Phone: (781) 469-1694

(See Section 10, “Information concerning the Company,”

below).

RISKS OF PARTICIPATING IN THE OPTION EXCHANGE

PROGRAM

Participating in the Option Exchange Program

involves a number of risks and uncertainties, including those described below. This list and the risk factors described at “Item

1A - Risk Factors” in our most recent Annual Report on Form 10-K incorporated by reference in this prospectus and in

any subsequent Quarterly Report on Form 10-Q, highlight some of the material risks of participating in this Option Exchange Program. You

should consider these risks carefully and are encouraged to speak with an investment and tax advisor as necessary before deciding whether

to participate in the Offer. In addition, we strongly urge you to read the sections in this Offering Memorandum discussing the tax consequences

of participating in the Option Exchange Program, as well as the rest of this Offering Memorandum for a more in-depth discussion of the

risks that may apply to you.

This Offering Memorandum and our SEC reports

referred herein include “forward-looking statements” including statements regarding our future results of operations and financial

position, business strategy and plans and our objectives for future operations. Generally, the words “believe,” “may,”

“will,” “potentially,” “estimate,” “continue,” “anticipate,” “could,”

“would,” ”should,” “project,” “plan,” “intend,” “expect,” “forecast,”

“target,” the plural of such terms, the negatives of such terms, and other comparable terminology and similar expressions

identify forward-looking statements. These forward-looking statements involve risks and uncertainties, including those described under

the section of this Offering Memorandum entitled “Risks of Participating in the Option Exchange Program,”, those described

under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022, as filed with the

SEC on March 14, 2023 and in any subsequent Quarterly Report on Form 10-Q.

As a result of these and other factors, we may

not achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance