false000117115500011711552024-02-082024-02-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 08, 2024 |

RADIANT LOGISTICS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-35392 |

04-3625550 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

Triton Towers Two Seventh Floor 700 S. Renton Village Place |

|

|

Renton, Washington |

|

98057 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 425 462-1094 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.001 Par Value |

|

RLGT |

|

NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 8, 2024, Radiant Logistics, Inc. (the “Company”) issued a press release announcing its financial results for the three and six months ended December 31, 2023. A copy of the press release, dated February 8, 2024, is furnished as Exhibit 99.1 to this Current Report on Form 8‑K.

The attached press release contains information that includes the following non-GAAP financial measures as defined in Regulation G adopted by the Securities and Exchange Commission: adjusted gross profit, adjusted net income, EBITDA, adjusted EBITDA, and adjusted EBITDA margin. The Company’s management believes that presenting such non-GAAP financial measures provides useful information to investors regarding the underlying business trends and performance of the Company’s ongoing operations. These non-GAAP financial measures are used in addition to and in conjunction with results presented in accordance with GAAP and should not be relied upon to the exclusion of GAAP financial measures. Management strongly encourages investors to review the Company’s condensed consolidated financial statements in their entirety and to not rely on any single financial measure. A table providing a reconciliation of Non-GAAP financial measures to the most directly comparable GAAP financial measures is included within the press release furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 2.02 of this Current Report, including Exhibit 99.1 is being furnished and shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the Exchange Act), or otherwise subject to the liabilities of that Section. The information in this Item 2.02 of this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Radiant Logistics, Inc. |

|

|

|

|

Date: February 8, 2024 |

|

|

By: |

|

/s/ Todd Macomber |

|

|

|

|

|

Todd Macomber |

|

|

|

|

|

Senior Vice President and Chief Financial Officer |

Exhibit 99.1

RADIANT LOGISTICS ANNOUNCES RESULTS FOR

THE SECOND fiscal quarter ENDED December 31, 2023

Continues to deliver solid financial results in face of continued market headwinds;

Generated $12.1 million in cash from operations;

Debt free and well positioned for further growth

RENTON, WA February 8, 2024 – Radiant Logistics, Inc. (NYSE American: RLGT), a technology-enabled global transportation and value-added logistics services company, today reported financial results for the three and six months ended December 31, 2023.

Financial Highlights – Three Months Ended December 31, 2023

•Revenues decreased to $201.1 million for the second fiscal quarter ended December 31, 2023, down $77.0 million or 27.7%, compared to revenues of $278.1 million for the comparable prior year period.

•Gross profit decreased to $58.8 million for the second fiscal quarter ended December 31, 2023, down $11.8 million or 16.7%, compared to gross profit of $70.6 million for the comparable prior year period.

•Adjusted gross profit, a non-GAAP financial measure, decreased to $62.0 million for the second fiscal quarter ended December 31, 2023, down $12.0 million or 16.2%, compared to adjusted gross profit of $74.0 million for the comparable prior year period.

•Net income attributable to Radiant Logistics, Inc. decreased to $1.0 million, or $0.02 per basic and fully diluted share for the second fiscal quarter ended December 31, 2023, down $3.8 million or 79.2%, compared to $4.8 million, or $0.10 per basic and fully diluted share for the comparable prior year period.

•Adjusted net income, a non-GAAP financial measure, decreased to $5.5 million, or $0.12 per basic and $0.11 per fully diluted share for the second fiscal quarter ended December 31, 2023, down $5.6 million or 50.5%, compared to adjusted net income of $11.1 million, or $0.23 per basic and fully diluted share for the comparable prior year period. Adjusted net income is calculated by applying a normalized tax rate of 24.5% and excluding other items not considered part of regular operating activities.

•Adjusted EBITDA, a non-GAAP financial measure, decreased to $7.7 million for the second fiscal quarter ended December 31, 2023, down $8.5 million or 52.5%, compared to adjusted EBITDA of $16.2 million for the comparable prior year period.

•Adjusted EBITDA margin (adjusted EBITDA expressed as a percentage of adjusted gross profit), a non-GAAP financial measure, decreased to 12.4% or 950 basis points, for the second fiscal quarter ended December 31, 2023, compared to adjusted EBITDA margin of 21.9% for the comparable prior year period.

Acquisition Update

Effective October 1, 2023, the Company acquired the operations of Daleray Corporation (“Daleray”), a Fort Lauderdale, Florida based, privately held company that has operated under the Company’s Distribution By Air brand since 2014. Daleray is well recognized for its expertise and in-depth knowledge and support of the cruise industry and will transition to operate under the Radiant Global Logistics brand over the balance of 2023 and will anchor the Company’s cruise logistics service offerings in south Florida. The Company structured the transaction similar to its previous transactions, with a portion of the expected purchase price payable in subsequent periods based on the future performance of the acquired operations.

On February 7, 2024, the Company announced that it acquired Select Logistics, Inc. and Select Cartage, Inc. (collectively “Select”), both Doral, Florida based, privately held companies that have operated as part of the Company’s Adcom Worldwide brand since 2007. Select is also well recognized for its expertise and in-depth knowledge and support of the cruise industry and is expected to transition to the Radiant brand and combine with the operations of Daleray to solidify the Company’s cruise logistics service offerings in south Florida. The Company structured the transaction similar to its previous transactions, with a portion of the expected purchase price payable in subsequent periods based on the future performance of the acquired operations.

1

Stock Buy-Back

We purchased 532,401 shares of our common stock at an average cost of $5.79 per share for an aggregate cost of $3.1 million during the six months ended December 31, 2023.

As of December 31, 2023, the Company had 46,921,448 shares outstanding.

CEO Bohn Crain Comments on Results

“Our results for the quarter ended December 31, 2023 continue to reflect the difficult freight markets being experienced by the entire industry as well as our operations.” said Bohn Crain, Founder and CEO of Radiant Logistics. “This extended period of weak freight demand combined with excess capacity continues to negatively impact not only our current results, but also the year-over-year comparison to our record results for prior year period. With that said, we remain optimistic that we are at or near the bottom of this cycle and would expect markets to begin to find their way to more sustainable and normalized levels towards the back half of calendar 2024.”

Mr. Crain continued, “Notwithstanding the tough year over year comparisons, we continue to deliver meaningfully positive results and have generated $16.9 million in adjusted EBITDA and $12.1 million in cash from operations for the six months ended December 31, 2023. In addition, we continue to enjoy a strong balance sheet finishing the quarter with approximately $32.9 million of cash on hand and nothing drawn on our $200.0 million credit facility.

As previously discussed, we believe we are well positioned to navigate through these slower freight markets as we find our way back to more normalized market conditions. At the same time, we remain focused on delivering profitable growth through a combination of organic and acquisition initiatives and thoughtfully re-levering our balance sheet through a combination of agent station conversions, synergistic tuck-in acquisitions, and stock buy-backs. Through this approach we believe, over time, will continue to deliver meaningful value for our shareholders, operating partners, and the end customers that we serve. In this regard, we are very excited about our recent agent station conversions with the acquisition of Daleray and the Select businesses, which will combine to solidify our offering in support of the cruise line industry in South Florida. We launched Radiant in 2006 with the goal of partnering with logistics entrepreneurs who would benefit from our unique value proposition and the built-in exit strategy available to the entrepreneurs participating in our network. We believe these two transactions are representative of a broader pipeline of opportunities inherent in our agent-based network and we look forward to supporting other strategic operating partners when they are ready to begin their transition from an agency to a company-owned location.”

Second Fiscal Quarter Ended December 31, 2023 – Financial Results

For the three months ended December 31, 2023, Radiant reported net income attributable to Radiant Logistics, Inc. of $1.0 million on $201.1 million of revenues, or $0.02 per basic and fully diluted share. For the three months ended December 31, 2022, Radiant reported net income attributable to Radiant Logistics, Inc. of $4.8 million on $278.1 million of revenues, or $0.10 per basic and fully diluted share.

For the three months ended December 31, 2023, Radiant reported adjusted net income, a non-GAAP financial measure, of $5.5 million, or $0.12 per basic and $0.11 per fully diluted share. For the three months ended December 31, 2022, Radiant reported adjusted net income of $11.1 million, or $0.23 per basic and fully diluted share.

For the three months ended December 31, 2023, Radiant reported adjusted EBITDA, a non-GAAP financial measure, of $7.7 million, compared to $16.2 million for the comparable prior year period.

Six Months Ended December 31, 2023 – Financial Results

For the six months ended December 31, 2023, Radiant reported net income attributable to Radiant Logistics, Inc. of $3.6 million on $411.9 million of revenues, or $0.08 per basic and $0.07 per fully diluted share. For the six months ended December 31, 2022, Radiant reported net income attributable to Radiant Logistics, Inc. of $13.3 million on $609.1 million of revenues, or $0.27 per basic and fully diluted share.

For the six months ended December 31, 2023, Radiant reported adjusted net income, a non-GAAP financial measure, of $12.0 million, or $0.26 per basic and $0.25 per fully diluted share. For the six months ended December 31, 2022, Radiant reported adjusted net income of $24.6 million, or $0.51 per basic and $0.49 per fully diluted share.

For the six months ended December 31, 2023, Radiant reported adjusted EBITDA, a non-GAAP financial measure, of $16.9 million, compared to $34.9 million for the comparable prior year period.

2

Earnings Call and Webcast Access Information

Radiant Logistics, Inc. will host a conference call on Thursday, February 8, 2024 at 4:30 PM Eastern to discuss the contents of this release. The conference call is open to all interested parties, including individual investors and press. Bohn Crain, Founder and CEO will host the call.

Conference Call Details

|

|

DATE/TIME: |

Thursday, February 8, 2024 at 4:30 PM Eastern |

DIAL-IN |

US (888) 506-0062; Intl. (973) 528-0011 (Participant Access Code: 241021) |

REPLAY |

February 9, 2024 at 9:30 AM Eastern to February 22, 2024 at 4:30 PM Eastern, US (877) 481-4010; Intl. (919) 882-2331 (Replay ID number: 49820) |

Webcast Details

This call is also being webcast and may be accessed via Radiant’s web site at www.radiantdelivers.com or at https://www.webcaster4.com/Webcast/Page/2191/49820

3

About Radiant Logistics (NYSE American: RLGT)

Radiant Logistics, Inc. (www.radiantdelivers.com) operates as a third-party logistics company, providing technology-enabled global transportation and value-added logistics solutions primarily to customers in the United States and Canada. Through its comprehensive service offerings, Radiant provides domestic and international freight forwarding and freight brokerage services to a diversified account base including manufacturers, distributors and retailers, which it supports from an extensive network of company and agent-owned offices throughout North America and other key markets around the world. Radiant’s value-added logistics services include warehouse and distribution, customs brokerage, order fulfillment, inventory management and technology services.

This report contains “forward-looking statements” within the meaning set forth in United States securities laws and regulations – that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business, financial performance and financial condition, and often contain words such as “anticipate,” “believe,” “estimates,” “expect,” “future,” “intend,” “may,” “plan,” “see,” “seek,” “strategy,” or “will” or the negative thereof or any variation thereon or similar terminology or expressions. These forward-looking statements are not guarantees and are subject to known and unknown risks, uncertainties and assumptions about us that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. We have developed our forward-looking statements based on management’s beliefs and assumptions, which in turn rely upon information available to them at the time such statements were made. Such forward-looking statements reflect our current perspectives on our business, future performance, existing trends and information as of the date of this report. These include, but are not limited to, our beliefs about future revenue and expense levels, growth rates, prospects related to our strategic initiatives and business strategies, along with express or implied assumptions about, among other things: our continued relationships with our strategic operating partners; the performance of our historic business, as well as the businesses we have recently acquired, at levels consistent with recent trends and reflective of the synergies we believe will be available to us as a result of such acquisitions; our ability to successfully integrate our recently acquired businesses; our ability to locate suitable acquisition opportunities and secure the financing necessary to complete such acquisitions; transportation costs remaining in-line with recent levels and expected trends; our ability to mitigate, to the best extent possible, our dependence on current management and certain larger strategic operating partners; our compliance with financial and other covenants under our indebtedness; the absence of any adverse laws or governmental regulations affecting the transportation industry in general, and our operations in particular; the impact of COVID-19 or any other health pandemic or environment event on our operations and financial results; continued disruptions in the global supply chain; higher inflationary pressures particularly surrounding the costs of fuel; labor and other components of our operations; potential adverse legal, reputational and financial effects on the Company resulting from the ransomware incident that we reported in December of 2021 or future cyber incidents and the effectiveness of the Company’s business continuity plans in response to cyber incidents, like the ransomware incident; the commercial, reputational and regulatory risks to our business that may arise as a consequence of our need to restate our financial statements; our longer-term relationship with our senior lenders as a consequence of our need to restate our financial statements; our temporary loss of the use of a Registration Statement on Form S-3 to register securities in the future; any disruption to our business that may occur on a longer-term basis should we be unable to remediate during fiscal year 2024 certain material weaknesses in our internal controls over financial reporting, and such other factors that may be identified from time to time in our Securities and Exchange Commission (“SEC”) filings and other public announcements including those set forth under the caption “Risk Factors” in Part 1 Item 1A of the Company’s Annual Report on Form 10-K for the year ended June 30, 2023. In addition, the global economic climate and additional or unforeseen effects from the COVID-19 pandemic or other unexpected health pandemics, may amplify many of these risks. All subsequent written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the foregoing. Readers are cautioned not to place undue reliance on our forward-looking statements, as they speak only as of the date made. We disclaim any obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

|

|

Investor Contact: Radiant Logistics, Inc. Todd Macomber (425) 943-4541 investors@radiantdelivers.com |

Media Contact: Radiant Logistics, Inc. Jennifer Deenihan (425) 462-1094 communications@radiantdelivers.com |

4

RADIANT LOGISTICS, INC.

Condensed Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

June 30, |

|

(In thousands, except share and per share data) |

|

2023 |

|

|

2023 |

|

|

|

(unaudited) |

|

|

|

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

32,883 |

|

|

$ |

32,456 |

|

Accounts receivable, net of allowance of $3,597 and $2,776, respectively |

|

|

106,297 |

|

|

|

126,725 |

|

Contract assets |

|

|

7,227 |

|

|

|

6,180 |

|

Income tax receivable |

|

|

2,139 |

|

|

|

— |

|

Prepaid expenses and other current assets |

|

|

12,799 |

|

|

|

15,211 |

|

Total current assets |

|

|

161,345 |

|

|

|

180,572 |

|

|

|

|

|

|

|

|

Property, technology, and equipment, net |

|

|

26,327 |

|

|

|

25,389 |

|

|

|

|

|

|

|

|

Goodwill |

|

|

89,251 |

|

|

|

89,203 |

|

Intangible assets, net |

|

|

31,746 |

|

|

|

36,641 |

|

Operating lease right-of-use assets |

|

|

50,042 |

|

|

|

56,773 |

|

Deposits and other assets |

|

|

4,333 |

|

|

|

5,163 |

|

Total other long-term assets |

|

|

175,372 |

|

|

|

187,780 |

|

Total assets |

|

$ |

363,044 |

|

|

$ |

393,741 |

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

71,213 |

|

|

$ |

84,561 |

|

Operating partner commissions payable |

|

|

14,476 |

|

|

|

18,360 |

|

Accrued expenses |

|

|

8,625 |

|

|

|

8,739 |

|

Income tax payable |

|

|

— |

|

|

|

369 |

|

Current portion of notes payable |

|

|

1,826 |

|

|

|

4,107 |

|

Current portion of operating lease liabilities |

|

|

10,535 |

|

|

|

11,273 |

|

Current portion of finance lease liabilities |

|

|

583 |

|

|

|

620 |

|

Current portion of contingent consideration |

|

|

— |

|

|

|

3,886 |

|

Other current liabilities |

|

|

300 |

|

|

|

258 |

|

Total current liabilities |

|

|

107,558 |

|

|

|

132,173 |

|

|

|

|

|

|

|

|

Operating lease liabilities, net of current portion |

|

|

46,119 |

|

|

|

52,120 |

|

Finance lease liabilities, net of current portion |

|

|

704 |

|

|

|

1,121 |

|

Contingent consideration, net of current portion |

|

|

90 |

|

|

|

287 |

|

Deferred tax liabilities |

|

|

1,456 |

|

|

|

2,944 |

|

Total long-term liabilities |

|

|

48,369 |

|

|

|

56,472 |

|

Total liabilities |

|

|

155,927 |

|

|

|

188,645 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity: |

|

|

|

|

|

|

Common stock, $0.001 par value, 100,000,000 shares authorized; 51,762,706 and 51,603,386

shares issued, and 46,921,448 and 47,294,529 shares outstanding, respectively |

|

|

33 |

|

|

|

33 |

|

Additional paid-in capital |

|

|

109,728 |

|

|

|

108,516 |

|

Treasury stock, at cost, 4,841,258 and 4,308,857 shares, respectively |

|

|

(30,148 |

) |

|

|

(27,067 |

) |

Retained earnings |

|

|

129,200 |

|

|

|

125,593 |

|

Accumulated other comprehensive loss |

|

|

(1,936 |

) |

|

|

(2,205 |

) |

Total Radiant Logistics, Inc. stockholders’ equity |

|

|

206,877 |

|

|

|

204,870 |

|

Non-controlling interest |

|

|

240 |

|

|

|

226 |

|

Total equity |

|

|

207,117 |

|

|

|

205,096 |

|

Total liabilities and equity |

|

$ |

363,044 |

|

|

$ |

393,741 |

|

5

RADIANT LOGISTICS, INC.

Condensed Consolidated Statements of Comprehensive Income

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Six Months Ended December 31, |

|

(In thousands, except share and per share data) |

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Revenues |

$ |

201,082 |

|

|

$ |

278,119 |

|

|

$ |

411,880 |

|

|

$ |

609,090 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

Cost of transportation and other services |

|

139,085 |

|

|

|

204,091 |

|

|

|

289,057 |

|

|

|

458,582 |

|

Operating partner commissions |

|

25,818 |

|

|

|

30,512 |

|

|

|

49,601 |

|

|

|

60,617 |

|

Personnel costs |

|

19,760 |

|

|

|

20,641 |

|

|

|

39,387 |

|

|

|

40,412 |

|

Selling, general and administrative expenses |

|

10,595 |

|

|

|

8,667 |

|

|

|

20,069 |

|

|

|

17,437 |

|

Depreciation and amortization |

|

4,364 |

|

|

|

6,914 |

|

|

|

8,890 |

|

|

|

13,693 |

|

Change in fair value of contingent consideration |

|

(204 |

) |

|

|

150 |

|

|

|

(450 |

) |

|

|

310 |

|

Total operating expenses |

|

199,418 |

|

|

|

270,975 |

|

|

|

406,554 |

|

|

|

591,051 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations |

|

1,664 |

|

|

|

7,144 |

|

|

|

5,326 |

|

|

|

18,039 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

621 |

|

|

|

59 |

|

|

|

1,207 |

|

|

|

98 |

|

Interest expense |

|

(291 |

) |

|

|

(742 |

) |

|

|

(593 |

) |

|

|

(1,563 |

) |

Foreign currency transaction gain (loss) |

|

(79 |

) |

|

|

4 |

|

|

|

15 |

|

|

|

471 |

|

Change in fair value of interest rate swap contracts |

|

(531 |

) |

|

|

(104 |

) |

|

|

(733 |

) |

|

|

587 |

|

Other |

|

135 |

|

|

|

24 |

|

|

|

162 |

|

|

|

29 |

|

Total other income (expense) |

|

(145 |

) |

|

|

(759 |

) |

|

|

58 |

|

|

|

(378 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

1,519 |

|

|

|

6,385 |

|

|

|

5,384 |

|

|

|

17,661 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense |

|

(404 |

) |

|

|

(1,460 |

) |

|

|

(1,418 |

) |

|

|

(4,224 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

1,115 |

|

|

|

4,925 |

|

|

|

3,966 |

|

|

|

13,437 |

|

Less: net income attributable to non-controlling interest |

|

(130 |

) |

|

|

(89 |

) |

|

|

(359 |

) |

|

|

(168 |

) |

Net income attributable to Radiant Logistics, Inc. |

$ |

985 |

|

|

$ |

4,836 |

|

|

$ |

3,607 |

|

|

$ |

13,269 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income: |

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation gain (loss) |

|

1,397 |

|

|

|

901 |

|

|

|

269 |

|

|

|

(2,577 |

) |

Comprehensive income |

$ |

2,512 |

|

|

$ |

5,826 |

|

|

$ |

4,235 |

|

|

$ |

10,860 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income per share: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.02 |

|

|

$ |

0.10 |

|

|

$ |

0.08 |

|

|

$ |

0.27 |

|

Diluted |

$ |

0.02 |

|

|

$ |

0.10 |

|

|

$ |

0.07 |

|

|

$ |

0.27 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

46,990,818 |

|

|

|

48,243,204 |

|

|

|

47,144,388 |

|

|

|

48,494,260 |

|

Diluted |

|

48,907,452 |

|

|

|

49,427,420 |

|

|

|

48,991,819 |

|

|

|

49,865,216 |

|

6

Reconciliation of Non-GAAP Measures

RADIANT LOGISTICS, INC.

Reconciliation of Gross Profit to Adjusted Gross Profit, Net Income Attributable to Radiant Logistics, Inc.

to Adjusted Net Income, EBITDA, Adjusted EBITDA, and Adjusted EBITDA Margin

(unaudited)

As used in this report adjusted gross profit, adjusted net income, EBITDA, adjusted EBITDA, and adjusted EBITDA margin are not measures of financial performance or liquidity under United States Generally Accepted Accounting Principles (“GAAP”). Adjusted gross profit, adjusted net income, EBITDA, adjusted EBITDA, and adjusted EBITDA margin are presented herein because they are important metrics used by management to evaluate and understand the performance of the ongoing operations of Radiant’s business. For adjusted net income, management uses a 24.5% tax rate to calculate the provision for income taxes to normalize Radiant’s tax rate to that of its competitors and to compare Radiant’s reporting periods with different effective tax rates. In addition, in arriving at adjusted net income, the Company adjusts for certain non-cash charges and significant items that are not part of regular operating activities. These adjustments include income taxes, depreciation and amortization, net interest expense, share-based compensation, change in fair value of contingent consideration, transition costs, lease termination costs, acquisition related costs, ransomware related costs, litigation costs, change in fair value of interest rate swap contracts, and gain on foreign currency transaction.

We commonly refer to the term “adjusted gross profit” when commenting about our Company and the results of operations. Adjusted gross profit is a non-GAAP measure calculated as revenues less directly related operations and expenses attributed to the Company’s services. Adjusted gross profit is calculated as GAAP gross profit exclusive of depreciation and amortization, which are reported separately. We believe adjusted gross profit is a better measurement than are total revenues when analyzing and discussing the effectiveness of our business and is used as a portion of a key metric the Company uses to discuss its progress.

EBITDA is a non-GAAP measure of income and does not include the effects of interest, taxes, and the “non-cash” effects of depreciation and amortization on long-term assets. Companies have some discretion as to which elements of depreciation and amortization are excluded in the EBITDA calculation. We exclude all depreciation charges related to property, technology, and equipment and all amortization charges (including amortization of leasehold improvements). We then further adjust EBITDA to exclude share-based compensation expense, changes in fair value of contingent consideration, expenses specifically attributable to acquisitions, ransomware incident related costs, changes in fair value of interest rate swap contracts, restatement costs, transition and lease termination costs, foreign currency transaction gains and losses, extraordinary items, litigation expenses unrelated to our core operations, and other non-cash charges. While management considers EBITDA and adjusted EBITDA useful in analyzing our results, it is not intended to replace any presentation included in our condensed consolidated financial statements.

We believe that these non-GAAP financial measures, as presented, represent a useful method of assessing the performance of our operating activities, as they reflect our earnings trends without the impact of certain non-cash charges and other non-recurring charges. These non-GAAP financial measures are intended to supplement the GAAP financial information by providing additional insight regarding results of operations to allow a comparison to other companies, many of whom use similar non-GAAP financial measures to supplement their GAAP results. However, these non-GAAP financial measures will not be defined in the same manner by all companies and may not be comparable to other companies. Adjusted gross profit, adjusted net income, EBITDA, adjusted EBITDA, and adjusted EBITDA margin should not be considered in isolation or as a substitute for any of the condensed consolidated statements of comprehensive income prepared in accordance with GAAP, or as an indication of Radiant’s operating performance or liquidity.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(In thousands) |

Three Months Ended December 31, |

|

|

Six Months Ended December 31, |

|

Reconciliation of adjusted gross profit to GAAP gross profit |

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Revenues |

$ |

201,082 |

|

|

$ |

278,119 |

|

|

$ |

411,880 |

|

|

$ |

609,090 |

|

Cost of transportation and other services (exclusive of depreciation

and amortization, shown separately below) |

|

(139,085 |

) |

|

|

(204,091 |

) |

|

|

(289,057 |

) |

|

|

(458,582 |

) |

Depreciation and amortization |

|

(3,205 |

) |

|

|

(3,469 |

) |

|

|

(6,538 |

) |

|

|

(6,816 |

) |

GAAP gross profit |

$ |

58,792 |

|

|

$ |

70,559 |

|

|

$ |

116,285 |

|

|

$ |

143,692 |

|

Depreciation and amortization |

|

3,205 |

|

|

|

3,469 |

|

|

|

6,538 |

|

|

|

6,816 |

|

Adjusted gross profit |

$ |

61,997 |

|

|

$ |

74,028 |

|

|

$ |

122,823 |

|

|

$ |

150,508 |

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP gross margin (GAAP gross profit as a percentage of revenues) |

|

29.2 |

% |

|

|

25.4 |

% |

|

|

28.2 |

% |

|

|

23.6 |

% |

Adjusted gross profit percentage (adjusted gross profit as a percentage of revenues) |

|

30.8 |

% |

|

|

26.6 |

% |

|

|

29.8 |

% |

|

|

24.7 |

% |

7

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(In thousands) |

Three Months Ended December 31, |

|

|

Six Months Ended December 31, |

|

Reconciliation of GAAP net income to adjusted EBITDA |

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Net income attributable to Radiant Logistics, Inc. |

$ |

985 |

|

|

$ |

4,836 |

|

|

$ |

3,607 |

|

|

$ |

13,269 |

|

Income tax expense |

|

404 |

|

|

|

1,460 |

|

|

|

1,418 |

|

|

|

4,224 |

|

Depreciation and amortization (1) |

|

4,479 |

|

|

|

7,142 |

|

|

|

9,118 |

|

|

|

13,921 |

|

Net interest expense |

|

(330 |

) |

|

|

683 |

|

|

|

(614 |

) |

|

|

1,465 |

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA |

|

5,538 |

|

|

|

14,121 |

|

|

|

13,529 |

|

|

|

32,879 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

|

695 |

|

|

|

679 |

|

|

|

1,575 |

|

|

|

1,288 |

|

Change in fair value of contingent consideration |

|

(204 |

) |

|

|

150 |

|

|

|

(450 |

) |

|

|

310 |

|

Acquisition related costs |

|

252 |

|

|

|

22 |

|

|

|

321 |

|

|

|

49 |

|

Litigation costs |

|

741 |

|

|

|

247 |

|

|

|

1,105 |

|

|

|

366 |

|

Transition, lease termination, and other costs |

|

76 |

|

|

|

30 |

|

|

|

76 |

|

|

|

30 |

|

Change in fair value of interest rate swap contracts |

|

531 |

|

|

|

104 |

|

|

|

733 |

|

|

|

(587 |

) |

Restatement costs |

|

— |

|

|

|

854 |

|

|

|

— |

|

|

|

1,007 |

|

Foreign currency transaction loss (gain) |

|

79 |

|

|

|

(4 |

) |

|

|

(16 |

) |

|

|

(471 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

$ |

7,708 |

|

|

$ |

16,203 |

|

|

$ |

16,873 |

|

|

$ |

34,871 |

|

Adjusted EBITDA margin (adjusted EBITDA as a % of adjusted gross profit) |

|

12.4 |

% |

|

|

21.9 |

% |

|

|

13.7 |

% |

|

|

23.2 |

% |

(1)Depreciation and amortization for the purposes of calculating adjusted EBITDA, a non-GAAP financial measure, includes depreciation expenses recognized on certain computer software as a service.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(In thousands, except share and per share data) |

Three Months Ended December 31, |

|

|

Six Months Ended December 31, |

|

Reconciliation of GAAP net income to adjusted net income |

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

GAAP net income attributable to Radiant Logistics, Inc. |

$ |

985 |

|

|

$ |

4,836 |

|

|

$ |

3,607 |

|

|

$ |

13,269 |

|

Adjustments to net income: |

|

|

|

|

|

|

|

|

|

|

|

Income tax expense |

|

404 |

|

|

|

1,460 |

|

|

|

1,418 |

|

|

|

4,224 |

|

Depreciation and amortization |

|

4,364 |

|

|

|

6,914 |

|

|

|

8,890 |

|

|

|

13,693 |

|

Change in fair value of contingent consideration |

|

(204 |

) |

|

|

150 |

|

|

|

(450 |

) |

|

|

310 |

|

Acquisition related costs |

|

252 |

|

|

|

22 |

|

|

|

321 |

|

|

|

49 |

|

Litigation costs |

|

741 |

|

|

|

247 |

|

|

|

1,105 |

|

|

|

366 |

|

Transition, lease termination, and other costs |

|

76 |

|

|

|

30 |

|

|

|

76 |

|

|

|

30 |

|

Change in fair value of interest rate swap contracts |

|

531 |

|

|

|

104 |

|

|

|

733 |

|

|

|

(587 |

) |

Restatement costs |

|

— |

|

|

|

854 |

|

|

|

— |

|

|

|

1,007 |

|

Amortization of debt issuance costs |

|

130 |

|

|

|

140 |

|

|

|

255 |

|

|

|

250 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net income before income taxes |

|

7,279 |

|

|

|

14,757 |

|

|

|

15,955 |

|

|

|

32,611 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes at 24.5% |

|

(1,783 |

) |

|

|

(3,615 |

) |

|

|

(3,909 |

) |

|

|

(7,990 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net income |

$ |

5,496 |

|

|

$ |

11,142 |

|

|

$ |

12,046 |

|

|

$ |

24,621 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net income per common share: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.12 |

|

|

$ |

0.23 |

|

|

$ |

0.26 |

|

|

$ |

0.51 |

|

Diluted |

$ |

0.11 |

|

|

$ |

0.23 |

|

|

$ |

0.25 |

|

|

$ |

0.49 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

46,990,818 |

|

|

|

48,243,204 |

|

|

|

47,144,388 |

|

|

|

48,494,260 |

|

Diluted |

|

48,907,452 |

|

|

|

49,427,420 |

|

|

|

48,991,819 |

|

|

|

49,865,216 |

|

8

v3.24.0.1

Document And Entity Information

|

Feb. 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 08, 2024

|

| Entity Registrant Name |

RADIANT LOGISTICS, INC.

|

| Entity Central Index Key |

0001171155

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-35392

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

04-3625550

|

| Entity Address, Address Line One |

Triton Towers Two

|

| Entity Address, Address Line Two |

700 S. Renton Village Place

|

| Entity Address, Address Line Three |

Seventh Floor

|

| Entity Address, City or Town |

Renton

|

| Entity Address, State or Province |

WA

|

| Entity Address, Postal Zip Code |

98057

|

| City Area Code |

425

|

| Local Phone Number |

462-1094

|

| Entity Information, Former Legal or Registered Name |

N/A

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 Par Value

|

| Trading Symbol |

RLGT

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

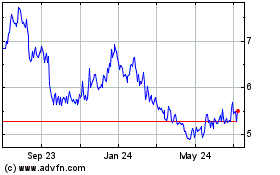

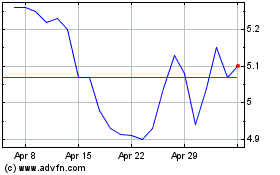

Radiant Logistics (AMEX:RLGT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Radiant Logistics (AMEX:RLGT)

Historical Stock Chart

From Apr 2023 to Apr 2024