false

0001173313

0001173313

2024-02-08

2024-02-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 8, 2024

ABVC BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-40700 |

|

26-0014658 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

44370 Old Warm Springs Blvd.

Fremont, CA |

|

94538 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number including area

code: (510) 668-0881

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

ABVC |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule

12b–2 of the Securities Exchange Act of 1934 (§ 240.12b–2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into Material Definitive Agreements

On February 06, 2024, ABVC BioPharma, Inc. (the

“Company”) entered into a definitive agreement with Shuling Jiang (“Jiang”), pursuant to which Jiang

shall transfer the ownership of certain land she owns located at Taoyuan City, Taiwan (the “Land”) to the Company (the

“Agreement”). Jiang is a director of the Company, is married to TS Jiang, the Company’s Chief Strategic Officer

and owns approximately 10% of the Company’s issued and outstanding shares of common stock. Accordingly, the transaction contemplated

by the Agreement constitutes a related party transaction as defined by Item 404 of Regulation S-K.

In consideration for the Land, the Company shall

pay Jiang (i) 703,495 restricted shares of the Company’s common stock (the “Shares”) at a price of $3.50 per

share and (ii) five-year warrants to purchase up to 1,000,000 shares of the Company’s common stock, with an exercise price of $2.00

per share. Under the Agreement, Jiang will also transfer outstanding liability owed on the Land (approximately $500,000) to the Company.

Thus, the parties value the exchange at approximately $2,962,232.

The Agreement also contains

customary termination provisions, and other obligations and rights of the parties.

The transaction contemplated by the Agreement

is intended to close on or before March 10, 2024, although the parties can negotiate an extension if necessary.

The foregoing description of the Agreement and

Warrants is qualified by reference to the full text of the Agreement and Form of Warrant, both of which are filed as exhibits hereto and

incorporated herein by reference.

Neither this Current Report on Form 8-K, nor any

exhibit attached hereto, is an offer to sell or the solicitation of an offer to buy the Securities described herein. Such disclosure does

not constitute an offer to sell, or the solicitation of an offer to buy nor shall there be any sales of the Company’s securities

in any state in which such an offer, solicitation or sale would be unlawful. The securities mentioned herein have not been registered

under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or

an applicable exemption from the registration requirements under the Securities Act and applicable state securities laws.

Item 3.02 Unregistered Sales of Equity Securities.

The information contained above under Item 1.01,

to the extent applicable, is hereby incorporated by reference herein. The issuance of the Shares and warrants pursuant to the Agreement

was made in reliance on the exemption afforded by Section 4(a)(2) of the Securities Act and Regulation S under the Securities Act and

corresponding provisions of state securities or “blue sky” laws. None of the securities have been registered under the Securities

Act or any state securities laws and may not be offered or sold in the United States absent registration with the SEC or an applicable

exemption from the registration requirements. The sale of the securities did not involve a public offering and was made without general

solicitation or general advertising.

Item 8.01 Other Events.

On February 8, 2024, the Company issued a press

release regarding the land acquisitions. A copy of the press release is filed hereto as Exhibit 99.1, and is incorporated herein by reference.

Item 9.01 Exhibits

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ABVC BioPharma, Inc. |

| |

|

| February 8, 2024 |

By: |

/s/ Uttam Patil |

| |

|

Uttam Patil |

| |

|

Chief Executive Officer |

2

Exhibit 4.1

THIS WARRANT HAS NOT BEEN REGISTERED WITH THE

SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES COMMISSION OF ANY STATE IN RELIANCE UPON AN EXEMPTION FROM REGISTRATION UNDER THE

SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND, ACCORDINGLY, MAY NOT BE OFFERED OR SOLD EXCEPT PURSUANT TO

AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT

TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS AS EVIDENCED BY A LEGAL

OPINION OF COUNSEL TO THE TRANSFEROR TO SUCH EFFECT, THE SUBSTANCE OF WHICH SHALL BE REASONABLY ACCEPTABLE TO THE COMPANY.

The number

of shares of common stock issuable upon exercise of this warrant may be less than the amounts set forth on the face hereof.

This Warrant is issued pursuant to that certain

Definitive Agreement dated February 6, 2024 by and between the Company and the Holder (as defined below) (the “Agreement”).

Capitalized terms used and not otherwise defined herein shall have the meanings set forth for such terms in the Agreement. Receipt of

this Warrant by the Holder shall constitute acceptance and agreement to all of the terms contained herein.

No. [ ]

ABVC

BIOPHARMA, INC.

COMMON STOCK PURCHASE WARRANT

ABVC BioPharma, Inc., a Nevada

corporation (together with any corporation which shall succeed to or assume the obligations of ABVC BioPharma, Inc. hereunder, the “Company”),

hereby certifies that, for value received, [Holder] (the “Holder”), is entitled, subject to the terms set forth below,

to purchase from the Company at any time during the Exercise Period (as defined in Section 9) up to one million (1,000,000)•]

fully paid and non-assessable shares of Common Stock (as defined in Section 9), at a purchase price per share equal to the

Exercise Price (as defined in Section 9). The number of shares of Common Stock for which this Common Stock Purchase Warrant (this

“Warrant”) is exercisable and the Exercise Price are subject to adjustment as provided herein.

1. DEFINITIONS.

Certain terms are used in this Warrant as specifically defined in Section 9.

2. EXERCISE

OF WARRANT.

2.1. Exercise.

This Warrant may be exercised prior to its expiration pursuant to Section 2.5 hereof by the Holder at any time or from time to

time during the Exercise Period, by submitting the form of subscription attached hereto (the “Exercise Notice”) duly

executed by the Holder, to the Company at its principal office, indicating whether the Holder is electing to purchase a specified number

of shares by paying the Aggregate Exercise Price as provided in Section 2.2. On or before the first Trading Day following the date

on which the Company has received the Exercise Notice, the Company shall transmit by electronic mail an acknowledgement of confirmation

of receipt of the Exercise Notice. Subject to Section 2.4, this Warrant shall be deemed exercised for all purposes as of the close

of business on the day on which the Holder has delivered the Exercise Notice to the Company. The Aggregate Exercise Price, if any, shall

be paid by wire transfer to the Company within five (5) Business Days of the date of exercise and prior to the time the Company issues

the certificates evidencing the shares issuable upon such exercise. In the event this Warrant is not exercised in full, the Company may,

at its expense, require the Holder, after such partial exercise, to promptly return this Warrant to the Company and the Company will forthwith

issue and deliver to or upon the order of the Holder a new Warrant or Warrants of like tenor, in the name of the Holder or as the Holder

(upon payment by the Holder of any applicable transfer taxes) may request, calling in the aggregate on the face or faces thereof for the

number of shares of Common Stock equal (without giving effect to any adjustment therein) to the number of such shares called for on the

face of this Warrant minus the number of such shares (without giving effect to any adjustment therein) for which this Warrant shall have

been exercised.

2.2. Payment

of Exercise Price by Wire Transfer. If the Holder elects to purchase a specified number of shares by paying the Aggregate Exercise

Price, the Holder shall pay such amount by wire transfer of immediately available funds to the account designated by the Company in its

acknowledgement of receipt of such Exercise Notice pursuant to Section 2.1.

2.3. Intentionally

Omitted.

2.4. Antitrust

Notification. If the Holder determines, in its sole judgment upon the advice of counsel, that the issuance of any Warrant Shares pursuant

to the terms hereof would be subject to the provisions of the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR

Act”), the Company shall file as soon as practicable after the date on which the Company receives notice from the Holder of

the applicability of the HSR Act and a request to so file with the United States Federal Trade Commission and the United States Department

of Justice the notification and report form required to be filed by it pursuant to the HSR Act in connection with such issuance.

2.5. Termination.

This Warrant shall terminate upon the earlier to occur of (i) exercise in full or (ii) the expiration of the Exercise Period.

3. INTENTIONALLY

OMITTED.

4. DELIVERY

OF STOCK CERTIFICATES ON EXERCISE.

4.1. Delivery

of Exercise Shares. As soon as practicable after any exercise of this Warrant and in any event within three (3) Trading Days thereafter

(such date, the “Exercise Share Delivery Date”), the Company shall, at its expense (including the payment by it of

any applicable issue or stamp taxes), cause to be issued in the name of and delivered to the Holder, or as the Holder may direct, a certificate

or certificates evidencing the number of fully paid and non-assessable shares of Common Stock (which number shall be rounded down to the

nearest whole share in the event any fractional share may otherwise be issuable upon such exercise and the Company shall pay a cash adjustment

to the Holder in respect of such final fraction in an amount equal to such fraction multiplied by the Exercise Price) to which the Holder

shall be entitled on such exercise, in such denominations as may be requested by the Holder, which certificate or certificates shall be

free of restrictive and trading legends (except for any such legends as may be required under the Securities Act). In lieu of delivering

physical certificates for the shares of Common Stock issuable upon any exercise of this Warrant, provided the Warrant Shares are not restricted

securities and the Company’s transfer agent is participating in the Depository Trust Company (“DTC”) Fast Automated

Securities Transfer program or a similar program, upon request of the Holder, the Company shall cause its transfer agent to electronically

transmit such shares of Common Stock issuable upon exercise of this Warrant to the Holder (or its designee), by crediting the account

of the Holder’s (or such designee’s) broker with DTC through its Deposit Withdrawal Agent Commission system (provided that

the same time periods herein as for stock certificates shall apply) as instructed by the Holder (or its designee).

4.2. Intentionally

Omitted.

4.3. Charges,

Taxes and Expenses. Issuance of Exercise Shares shall be made without charge to the Holder for any issue or transfer tax or other

incidental expense in respect of the issuance of such Exercise Shares, all of which taxes and expenses shall be paid by the Company, and

such Exercise Shares shall be issued in the name of the Holder or in such name or names as may be directed by the Holder; provided, however,

that in the event Exercise Shares are to be issued in a name other than the name of the Holder, this Warrant when surrendered for exercise

shall be accompanied by the Assignment Form attached hereto (the “Assignment Form”) duly executed by the Holder and

the Company may require, as a condition thereto, the payment of a sum sufficient to reimburse it for any transfer tax incidental thereto.

5. CERTAIN

ADJUSTMENT.

5.1. Stock

Dividends and Splits. If the Company, at any time while this Warrant is outstanding: (a) pays a stock dividend or otherwise makes

a distribution or distributions on shares of its Common Stock or any other equity or equity equivalent securities payable in shares of

Common Stock (which, for avoidance of doubt, shall not include any shares of Common Stock issued by the Company upon exercise of this

Warrant), (b) subdivides outstanding shares of Common Stock into a larger number of shares, (c) combines (including by way of reverse

stock split) outstanding shares of Common Stock into a smaller number of shares, or (d) issues by reclassification of shares of the Common

Stock any shares of capital stock of the Company, then in each case the Exercise Price shall be multiplied by a fraction of which the

numerator shall be the number of shares of Common Stock (excluding treasury shares, if any) outstanding immediately before such event

and of which the denominator shall be the number of shares of Common Stock outstanding immediately after such event and the number of

shares issuable upon exercise of this Warrant shall be proportionately adjusted such that the aggregate Exercise Price of this Warrant

shall remain unchanged. Any adjustment made pursuant to this Section 5.1 shall become effective immediately after the record date

for the determination of stockholders entitled to receive such dividend or distribution and shall become effective immediately after the

effective date in the case of a subdivision, combination or re-classification.

5.2 Pro

Rata Distributions. During such time as this Warrant is outstanding, if the Company shall declare or make any dividend or other distribution

of its assets (or rights to acquire its assets) to holders of shares of Common Stock, by way of return of capital or otherwise (including,

without limitation, any distribution of cash, stock or other securities, property or options by way of a dividend, spin off, reclassification,

corporate rearrangement, scheme of arrangement or other similar transaction) (a “Distribution”), at any time after

the issuance of this Warrant, then, in each such case, the Holder shall be entitled to participate in such Distribution to the same extent

that the Holder would have participated therein if the Holder had held the number of shares of Common Stock acquirable upon complete exercise

of this Warrant (without regard to any limitations on exercise hereof, including without limitation, the Beneficial Ownership Limitation)

immediately before the date of which a record is taken for such Distribution, or, if no such record is taken, the date as of which the

record holders of shares of Common Stock are to be determined for the participation in such Distribution (provided, however, that, to

the extent that the Holder’s right to participate in any such Distribution would result in the Holder exceeding the beneficial ownership

limitation provided for in Section 10, then the Holder shall not be entitled to participate in such Distribution to such extent

(or in the beneficial ownership of any shares of Common Stock as a result of such Distribution to such extent) and the portion of such

Distribution shall be held in abeyance for the benefit of the Holder until such time, if ever, as its right thereto would not result in

the Holder exceeding the beneficial ownership limitation).

5.3 Fundamental

Transaction. If, at any time while this Warrant is outstanding, (a) the Company effects any merger or consolidation of the Company

with or into another Person, (b) the Company effects any sale of all or substantially all of its assets in one or a series of related

transactions, (c) any tender offer or exchange offer (whether by the Company or another Person) is completed pursuant to which holders

of Common Stock are permitted to tender or exchange their shares for other securities, cash or property, or (d) the Company effects any

reclassification of the Common Stock or any compulsory share exchange pursuant to which the Common Stock is effectively converted into

or exchanged for other securities, cash or property (each, a “Fundamental Transaction”), then, upon the closing of

a Fundamental Transaction and payment of the exercise price therefore, the Holder shall have the right to receive, for each Warrant Share

that would have been issuable upon such exercise immediately prior to the occurrence of such Fundamental Transaction, at the option of

the Holder (without regard to any limitation in Section 10 on the exercise of this Warrant), the number of shares of Common Stock of the

successor or acquiring corporation or of the Company, if it is the surviving corporation, and any additional consideration (the “Alternate

Consideration”) receivable as a result of such Fundamental Transaction by a holder of the number of shares of Common Stock for

which this Warrant is exercisable immediately prior to such Fundamental Transaction (without regard to any limitation in Section 10 on

the exercise of this Warrant). For purposes of any such exercise, the determination of the Exercise Price shall be appropriately adjusted

to apply to such Alternate Consideration based on the amount of Alternate Consideration issuable in respect of one share of Common Stock

in such Fundamental Transaction, and the Company shall apportion the Exercise Price among the Alternate Consideration in a reasonable

manner reflecting the relative value of any different components of the Alternate Consideration. If holders of Common Stock are given

any choice as to the securities, cash or property to be received in a Fundamental Transaction, then the Holder shall be given the same

choice as to the Alternate Consideration it receives upon any exercise of this Warrant following such Fundamental Transaction.

5.4 Intentionally

Omitted.

5.5 Calculations.

All calculations under this Section 5 shall be made to the nearest cent or the nearest 1/100th of a share, as the case may be.

For purposes of this Section 5, the number of shares of Common Stock deemed to be issued and outstanding as of a given date shall

be the sum of the number of shares of Common Stock (excluding treasury shares, if any) issued and outstanding at the close of the Trading

Day on or, if not applicable, most recently preceding, such given date.

5.6 Notice

to Holder.

(a) Adjustment

to Exercise Price. Whenever the Exercise Price is adjusted pursuant to any provision of this Section 5, the Company shall promptly

mail to the Holder a notice setting forth the Exercise Price after such adjustment and setting forth a brief statement of the facts requiring

such adjustment.

(b) Notice

to Allow Exercise by Holder. If (i) the Company shall declare a dividend (or any other distribution in whatever form) on the Common

Stock; (ii) the Company shall declare a special nonrecurring cash dividend on or a redemption of the Common Stock; (iii) the Company shall

authorize the granting to all holders of the Common Stock rights or warrants to subscribe for or purchase any shares of capital stock

of any class or of any rights; (iv) the approval of any stockholders of the Company shall be required in connection with any reclassification

of the Common Stock, any consolidation or merger to which the Company is a party, any sale or transfer of all or substantially all of

the assets of the Company, of any compulsory share exchange whereby the Common Stock is converted into other securities, cash or property;

or (v) the Company shall authorize the voluntary or involuntary dissolution, liquidation or winding up of the affairs of the Company;

then, in each case, the Company shall cause to be mailed to the Holder at its last address as it shall appear upon the Warrant Register

of the Company, at least twenty (20) calendar days prior to the applicable record or effective date hereinafter specified, a notice stating

(x) the date on which a record is to be taken for the purpose of such dividend, distribution, redemption, rights or warrants, or if a

record is not to be taken, the date as of which the holders of the Common Stock of record to be entitled to such dividend, distributions,

redemption, rights or warrants are to be determined or (y) the date on which such reclassification, consolidation, merger, sale, transfer

or share exchange is expected to become effective or close, and the date as of which it is expected that holders of the Common Stock of

record shall be entitled to exchange their shares of the Common Stock for securities, cash or other property deliverable upon such reclassification,

consolidation, merger, sale, transfer or share exchange; provided that the failure to mail such notice or any defect therein or in the

mailing thereof shall not affect the validity of the corporate action required to be specified in such notice. Subject to applicable law,

the Holder is entitled to exercise this Warrant during the period commencing on the date of such notice to the effective date of the event

triggering such notice. Notwithstanding the foregoing, the delivery of the notice described in this Section 5.6 is not intended

to and shall not bestow upon the Holder any voting rights whatsoever with respect to outstanding unexercised Warrants.

6. NO

IMPAIRMENT. The Company will not, by amendment of the Articles of Incorporation or through any reorganization, transfer of assets,

consolidation, merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid the observance or

performance of any of the terms of this Warrant, but will at all times in good faith assist in the carrying out of all such terms and

in taking all such action as may be necessary or appropriate in order to protect the rights of the Holder against impairment. Without

limiting the generality of the foregoing, the Company (a) will not increase the par value of any shares of Common Stock receivable on

the exercise of this Warrant above the amount payable therefor on such exercise and (b) will take all such action as may be necessary

or appropriate in order that the Company may validly and legally issue fully paid and non-assessable shares of stock on the exercise of

this Warrant from time to time outstanding.

7. NOTICES

OF RECORD DATE. In the event of:

(a) any

taking by the Company of a record of the holders of any class of securities for the purpose of determining the holders thereof who are

entitled to receive any dividend or other distribution, or any right to subscribe for, purchase or otherwise acquire any shares of stock

of any class or any other securities or property, or to receive any other right;

(b) any

capital reorganization of the Company, any reclassification or recapitalization of the capital stock of the Company or any transfer of

all or substantially all the assets of the Company to or any consolidation or merger of the Company with or into any other Person or any

other Change of Control; or

(c) any

voluntary or involuntary dissolution, liquidation or winding-up of the Company;

then, and in each such event, the Company will

mail or cause to be mailed to the Holder a notice specifying (i) the date on which any such record is to be taken for the purpose of such

dividend, distribution or right, and stating the amount and character of such dividend, distribution or right, or (ii) the date on which

any such reorganization, reclassification, recapitalization, transfer, consolidation, merger, dissolution, liquidation or winding-up is

anticipated to take place, and the time, if any is to be fixed, as of which the holders of record of Common Stock shall be entitled to

exchange their shares of Common Stock for securities or other property deliverable on such reorganization, reclassification, recapitalization,

transfer, consolidation, merger, dissolution, liquidation or winding-up. Such notice shall be mailed at least fifteen (15) days prior

to the date specified in such notice on which any such action is to be taken.

8. RESERVATION

OF STOCK ISSUABLE ON EXERCISE OF WARRANT; REGULATORY COMPLIANCE.

8.1. Reservation

of Stock Issuable on Exercise of Warrant. The Company shall at all times while this Warrant shall be outstanding, reserve and keep

available out of its authorized but unissued Common Stock, such number of shares of Common Stock as shall from time to time be sufficient

to effect the exercise of all or any portion of the Warrant Shares (disregarding for this purpose any and all limitations of any kind

on such exercise). The Company shall, from time to time in accordance with the Delaware General Corporation Law, increase the authorized

number of shares of Common Stock or take other effective action if at any time the unissued number of authorized shares shall not be sufficient

to satisfy the Company’s obligations under this Section 8.

8.2. Regulatory

Compliance. If any shares of Common Stock to be reserved for the purpose of exercise of the Warrant Shares require registration or

listing with or approval of any Governmental Authority, stock exchange or other regulatory body under any federal or state law or regulation

or otherwise before such shares may be validly issued or delivered upon exercise, the Company shall, at its sole cost and expense, in

good faith and as expeditiously as possible, secure such registration, listing or approval, as the case may be.

9. DEFINITIONS.

As used herein the following terms, unless the context otherwise requires, have the following respective meanings:

“Affiliate”

means a Person that directly, or indirectly through one or more intermediaries, controls or is controlled by, or is under common control

with, the Person specified.

“Aggregate

Exercise Price” means, in connection with the exercise of this Warrant at any time, an

amount equal to the product obtained by multiplying (i) the Exercise Price times (ii) the number of shares of Common Stock for which this

Warrant is being exercised at such time.

“Articles of Incorporation”

means the Company’s Restated Articles of Incorporation as amended to date.

“Business Day”

means any day other than a Saturday, Sunday or any other day on which banks are permitted or required to be closed in New York City.

“Common Stock”

means (i) the Company’s Common Stock, $0.001 par value per share, and (ii) any other securities into which or for which any of the

securities described in clause (i) above have been converted or exchanged pursuant to a plan of recapitalization, reorganization, merger,

sale of assets or otherwise.

“Convertible Securities”

means any debt, equity or other securities that are, directly or indirectly, convertible into or exchangeable for Common Stock.

“Exchange Act”

means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder from time to time in effect.

“Exercise Period”

means the period commencing on the Issue Date and ending 11:59 P.M. (New York City time) on the date that is sixty (60) months from the

Issue Date or earlier closing of a Fundamental Transaction (other than a Fundamental Transaction of the type described in clause (d) of

the definition thereof resulting in the conversion into or exchange for another security of the Company).

“Exercise Price”

means $2.00 per share, as may be adjusted pursuant to the terms hereof.

“Exercise Shares”

means the shares of Common Stock for which this Warrant is then being exercised.

“Fair Market Value”

means, with respect to any security or other property, the fair market value of such security or other property as determined by the Board

of Directors, acting in good faith.

“Governmental Authority”

means the government of the United States or any other nation, or of any political subdivision thereof, whether state or local, and any

agency, authority, instrumentality, regulatory body, court, central bank or other entity exercising executive, legislative, judicial,

taxing, regulatory or administrative powers or functions of or pertaining to government (including any supra-national bodies such as the

European Union or the European Central Bank).

“Issue Date”

means February 6, 2024.

“Person”

means an individual or corporation, partnership, trust, incorporated or unincorporated association, joint

venture, limited liability company, joint stock company, government (or an agency or subdivision thereof) or other entity of any kind.

“Securities Act”

means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder from time to time in effect.

“Subsidiary”

means, as of any time of determination and with respect to any Person, any United States corporation, partnership, limited liability company

or limited liability partnership, all of the stock (or other equity interest) of every class of which, except directors’ qualifying

shares (or any equivalent), shall, at such time, be owned by such Person either directly or through Subsidiaries and of which such Person

or a Subsidiary shall have 100% control thereof, except directors’ qualifying shares. Unless the context otherwise clearly requires,

any reference to a “Subsidiary” is a reference to a Subsidiary of the Company.

“Trading Day”

means a day on which the Common Stock is traded on a Trading Market.

“Trading Market”

means whichever of the New York Stock Exchange, NYSE: Amex Exchange, or the Nasdaq Stock Market (including the Nasdaq Capital Market),

on which the Common Stock is listed or quoted for trading on the date in question.

“VWAP”

means, as of any date, the price determined by the first of the following clauses that applies: (a) if the Common Stock is then listed

or quoted on a Trading Market, the daily volume weighted average price of one share of Common Stock trading in the ordinary course of

business on the applicable Trading Price for such date (or the nearest preceding date) on such Trading Market as reported by Bloomberg

Financial L.P.; (b) if the Common Stock is not then listed on a Trading Market and if the Common Stock is traded in the over-the-counter

market, as reported by the OTC Bulletin Board, the volume weighted average price of one share of Common Stock for such date (or the nearest

preceding date) on the OTC Bulletin Board, as reported by Bloomberg Financial L.P.; (c) if the Common Stock is not then listed or quoted

on the OTC Bulletin Board and if prices for the Common Stock is then reported in the “Pink Sheets” published by the Pink OTC

Markets Inc. (or a similar organization or agency succeeding to its functions of reporting prices), the most recent bid price of one share

of Common Stock so reported, as reported by Bloomberg Financial L.P.; or (d) in all other cases, the fair market value of one share of

Common Stock as determined by an independent appraiser selected in good faith by the Holder and reasonably acceptable to the Company (in

each case rounded to four decimal places).

“Warrant

Shares” means collectively the shares of Common Stock of the Company issuable upon exercise

of the Warrant in accordance with its terms, as such number may be adjusted pursuant to the provisions thereof.

10. LIMITATION

ON BENEFICIAL OWNERSHIP. Notwithstanding anything to the contrary contained herein, the Holder shall not be entitled to receive shares

of Common Stock or other securities (together with Common Stock, “Equity Interests”) upon exercise of this Warrant

to the extent (but only to the extent) that such exercise or receipt would cause the Holder Group to become, directly or indirectly, a

“beneficial owner” (within the meaning of Section 13(d) of the Exchange Act and the rules and regulations promulgated thereunder)

of a number of Equity Interests of a class that is registered under the Exchange Act which exceeds the Maximum Percentage (as defined

below) of the Equity Interests of such class that are outstanding at such time. Any purported delivery of Equity Interests in connection

with the exercise of the Warrant prior to the termination of this restriction in accordance herewith shall be void and have no effect

to the extent (but only to the extent) that such delivery would result in the Holder Group becoming the beneficial owner of more than

the Maximum Percentage of the Equity Interests of a class that is registered under the Exchange Act that is outstanding at such time.

If any delivery of Equity Interests owed to the Holder following exercise of this Warrant is not made, in whole or in part, as a result

of this limitation, the Company’s obligation to make such delivery shall not be extinguished and the Company shall deliver such

Equity Interests as promptly as practicable after the Holder gives notice to the Company that such delivery would not result in such limitation

being triggered or upon termination of the restriction in accordance with the terms hereof. To the extent limitations contained in this

Section 10 apply, the determination of whether this Warrant is exercisable and of which portion of this Warrant is exercisable

shall be the sole responsibility and in the sole determination of the Holder, and the submission of an Exercise Notice shall be deemed

to constitute the Holder’s determination that the issuance of the full number of Warrant Shares requested in the Exercise Notice

is permitted hereunder, and neither the Company nor any Warrant agent shall have any obligation to verify or confirm the accuracy of such

determination. For purposes of this Section 10, (i) the term “Maximum Percentage” shall mean 4.99%; provided,

that if at any time after the date hereof the Holder Group beneficially owns in excess of 4.99% of any class of Equity Interests in the

Company that is registered under the Exchange Act (excluding any Equity Interests deemed beneficially owned by virtue of this Warrant),

then the Maximum Percentage shall automatically increase to 9.99% so long as the Holder Group owns in excess of 4.99% of such class of

Equity Interests (and shall, for the avoidance of doubt, automatically decrease to 4.99% upon the Holder Group ceasing to own in excess

of 4.99% of such class of Equity Interests); and (ii) the term “Holder Group” shall mean the Holder plus any other

Person with which the Holder is considered to be part of a group under Section 13 of the Exchange Act or with which the Holder otherwise

files reports under Sections 13 and/or 16 of the Exchange Act. In determining the number of Equity Interests of a particular class outstanding

at any point in time, the Holder may rely on the number of outstanding Equity Interests of such class as reflected in (x) the Company’s

most recent Annual Report on Form 10-K or Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission, as the case

may be, (y) a more recent public announcement by the Company or (z) a more recent notice by the Company or its transfer agent to the Holder

setting forth the number of Equity Interests of such class then outstanding. For any reason at any time, upon written or oral request

of the Holder, the Company shall, within one (1) Trading Day of such request, confirm orally and in writing to the Holder the number of

Equity Interests of any class then outstanding. The provisions of this Section 10 shall be construed, corrected and implemented

in a manner so as to effectuate the intended beneficial ownership limitation herein contained.

11. REGISTRATION

AND TRANSFER OF WARRANT.

11.1. Registration

of Warrant. The Company shall register and record transfers, exchanges, reissuances and cancellations of this Warrant, upon the records

to be maintained by the Company for that purpose, in the name of the record holder hereof from time to time. The Company may deem and

treat the registered holder of this Warrant as the absolute owner hereof for the purpose of any exercise hereof or any distribution to

the Holder, and for all other purposes, absent actual notice to the contrary. The Company shall be entitled to rely, and held harmless

in acting or refraining from acting in reliance upon, any notices, instructions or documents it believes in good faith to be from an authorized

representative of the Holder.

11.2 Transferability.

This Warrant and all rights hereunder (including, without limitation, any registration rights) are transferable, in whole or in part,

upon surrender of this Warrant at the principal office of the Company or its designated agent, together with a written assignment of this

Warrant substantially in the form of assignment (the “Assignment Notice”) attached hereto duly executed by the Holder

or its agent or attorney. The Company may require the transferor thereof to provide to the Company an opinion of counsel selected by the

transferor, the form and substance of which opinion shall be reasonably satisfactory to the Company, to the effect that such transfer

does not require registration of the transferred Warrant under the 1933 Act. Upon such surrender, the Company shall execute and deliver

a new Warrant or Warrants in the name of the assignee or assignees, as applicable, and in the denomination or denominations specified

in such Assignment Notice, and shall issue to the assignor a new Warrant evidencing the portion of this Warrant not so assigned, and this

Warrant shall promptly be cancelled. This Warrant, if properly assigned in accordance herewith, may be exercised by a new holder for the

purchase of Exercise Shares without having a new Warrant issued.

11.3. New

Warrants. This Warrant may be divided or combined with other Warrants upon presentation hereof at the aforesaid office of the Company,

together with a written notice specifying the names and denominations in which new Warrants are to be issued, signed by the Holder or

its agent or attorney. Subject to compliance with Section 11.2, as to any transfer which may be involved in such division or combination,

the Company shall execute and deliver a new Warrant or Warrants in exchange for this Warrant or Warrants to be divided or combined in

accordance with such notice. All Warrants issued on transfers or exchanges shall be dated the original Issue Date and shall be identical

with this Warrant except as to the number of Exercise Shares issuable pursuant thereto.

12. LOSS,

THEFT, DESTRUCTION OR MUTILATION OF WARRANT. The Company covenants that upon receipt by the Company of evidence reasonably satisfactory

to it of the loss, theft, destruction or mutilation of this Warrant or any stock certificate relating to the Exercise Shares, and in case

of loss, theft or destruction, of indemnity or security reasonably satisfactory to it (which, in the case of this Warrant, shall not include

the posting of any bond), and upon surrender and cancellation of such Warrant or stock certificate, if mutilated, the Company will make

and deliver a new Warrant or stock certificate of like tenor and dated as of such cancellation, in lieu of such Warrant or stock certificate.

13. REMEDIES.

The Company stipulates that the remedies at law of the Holder in the event of any default or threatened default by the Company in the

performance of or compliance with any of the terms of this Warrant are not and will not be adequate, and that such terms may be specifically

enforced by a decree for the specific performance of any agreement contained herein or by an injunction against a violation of any of

the terms hereof or otherwise.

14. NO

RIGHTS AS A STOCKHOLDER. Except as otherwise specifically provided herein, the Holder, solely in such Person’s capacity as a

holder of this Warrant, shall not be entitled to vote or receive dividends or be deemed the holder of share capital of the Company for

any purpose, nor shall anything contained in this Warrant be construed to confer upon the Holder, solely in such Person’s capacity

as the Holder of this Warrant, any of the rights of a stockholder of the Company or any right to vote, give or withhold consent to any

corporate action (whether any reorganization, issue of stock, reclassification of stock, consolidation, merger, conveyance or otherwise),

receive notice of meetings, receive dividends or subscription rights, or otherwise, prior to the issuance to the Holder of the Exercise

Shares.

15. NOTICES.

All notices, requests, demands and other communications that are required or may be given pursuant to the terms of this Warrant shall

be in writing and shall be deemed delivered (i) on the date of delivery when delivered by hand on a Business Day during normal business

hours or, if delivered on a day that is not a Business Day or after normal business hours, then on the next Business Day, (ii) on the

date of transmission when sent by facsimile transmission or email during normal business hours on a Business Day with telephone confirmation

of receipt or, if transmitted on a day that is not a Business Day or after normal business hours, then on the next Business Day, or (iii)

on the second Business Day after the date of dispatch when sent by a reputable courier service that maintains records of receipt. The

addresses for notice shall be as set forth in the Agreement.

16. CONSENT

TO AMENDMENTS. Any term of this Warrant may be amended, and the Company may take any action herein prohibited, or compliance therewith

may be waived, only if the Company shall have obtained the written consent (and not without such written consent) to such amendment, action

or waiver from the Holder. No course of dealing between the Company and the Holder nor any delay in exercising any rights hereunder shall

operate as a waiver of any rights of the Holder.

17. MISCELLANEOUS.

In case any provision of this Warrant shall be invalid, illegal or unenforceable, or partially invalid, illegal or unenforceable, the

provision shall be enforced to the extent, if any, that it may legally be enforced and the validity, legality and enforceability of the

remaining provisions shall not in any way be affected or impaired thereby. If any provision of this Warrant is found to conflict with

the Agreement, the provisions of this Warrant shall prevail. THIS WARRANT SHALL BE CONSTRUED AND ENFORCED IN ACCORDANCE WITH, AND THE

RIGHTS OF THE PARTIES SHALL BE GOVERNED BY, THE INTERNAL LAW OF THE STATE OF NEW YORK EXCLUDING CHOICE-OF-LAW PRINCIPLES OF THE LAW OF

SUCH STATE THAT WOULD PERMIT THE APPLICATION OF THE LAWS OF A JURISDICTION OTHER THAN SUCH STATE. The headings in this Warrant are for

purposes of reference only, and shall not limit or otherwise affect any of the terms hereof.

[Remainder of Page Intentionally Left Blank]

IN WITNESS WHEREOF, the Company

has caused this Warrant to be executed by its duly authorized officer.

Dated as of February 6, 2024

| |

ABVC BIOPHARMA, INC. |

| |

|

| |

By: |

|

| |

Name: |

Uttam Patil |

| |

Title: |

Chief Executive Officer |

FORM OF SUBSCRIPTION

(To be signed only on exercise

of Common Stock Purchase Warrant)

1. The

undersigned Holder of the attached Warrant hereby elects to exercise its purchase right under such Warrant to purchase shares of Common

Stock of ABVC BioPharma, Inc., a Nevada corporation (the “Company”), as follows (check one or more, as applicable):

| ☐ | to exercise the Warrant to purchase __________ shares of Common Stock and to pay the Aggregate Exercise

Price therefor by wire transfer of United States funds to the account of the Company, which transfer has been made prior to or as of the

date of delivery of this Form of Subscription pursuant to the instructions of the Company; |

and/or

2. In

exercising this Warrant, the undersigned Holder hereby confirms and acknowledges that the shares of Common Stock are being acquired solely

for the account of the undersigned and not as a nominee for any other party, and for investment, and that the undersigned shall not offer,

sell or otherwise dispose of any such shares of Common Stock except under circumstances that will not result in a violation of the Securities

Act or any state securities laws. The undersigned hereby further confirms and acknowledges that it is an “accredited investor”,

as that term is defined under the Securities Act.

3. Please

issue a stock certificate or certificates representing the appropriate number of shares of Common Stock in the name of the undersigned

or in such other name(s) as is specified below:

| |

|

|

| (Signature must conform exactly to name of Holder as specified on the face of the Warrant) |

|

Dated: _________________ |

FORM OF ASSIGNMENT

(To be signed only on transfer of Warrant)

For value received, the undersigned

hereby sells, assigns, and transfers unto ________________ the right represented by the within Warrant to purchase

shares of Common Stock of ABVC BioPharma, Inc., a Nevada corporation, to which the within Warrant relates, and appoints _________________

attorney to transfer such right on the books of ABVC BioPharma, Inc., with full power of substitution in the premises.

| |

[insert name of Holder] |

| |

|

| Dated:___________________ |

By: |

|

| |

|

| |

Title: |

|

| |

|

| |

[insert address of Holder] |

Signed in the presence of:

__________________________________

Exhibit 10.1

Definitive

Agreement

This

Definitive Agreement (“Agreement”) is entered into as of February 06, 2024, by and between ABVC BioPharma, Inc. (“ABVC”),

and Shuling Jiang (hereinafter referred to as “Shuling”).

ABVC

and Shuling are sometimes referred to herein individually as a “Party,” and collectively as the “Parties.”

Due

to strategically cooperate and construct an integrated platform for the global development of the healthcare business and the medical,

pharmaceutical, and biotechnology in Taiwan.

Article

1: Subject Matter and Consideration

1.1 Subject Matter: The subject matter of this Agreement includes:

a)

The common shares of ABVC (stock symbol: ABVC) on the Nasdaq Capital Market, with a price of US$3.50 per share.

b)

Shuling’s ownership of a property located at Taoyuan City, Taiwan (hereinafter referred to as The Land or The Property).

As

of December 20, 2023, the valuation of the Land is NT$ 88,866,964 or approximately US$2,962,232 (see Exhibit A).

1.2 Consideration: The consideration for this Agreement shall be as follows:

a)

ABVC shall issue 703,495 common shares to Shuling Jiang at a price of US$3.50 per share.

b)

ABVC agrees to provide 1,000,000 warrants, with an exercise price of US$2.00 per share.

c)

Shuling Jiang shall transfer the NT$15,000,000 or approximately US$500,000 bank liability of the land to ABVC.

d)

Shuling Jiang shall transfer ownership of The Land to ABVC.

1.3

Transfer of Ownership: Upon completion of the transaction, ownership of the ABVC Shares shall be transferred from ABVC to Shuling, and

ownership of The Land shall be transferred from Shuling to ABVC.

Article

2: Exchange of The Land through ABVC Equity Transfer

2.1

Agreement to Exchange The Land: ABVC and Shuling agree to exchange ownership in Shuling’s real estate The Land through an equity

transfer of ABVC shares.

2.2

Value of the Exchange: The value of the exchange is estimated to be approximately US$2,962,232, equivalent to 703,495 shares of ABVC

common stock at US$3.50 per share and $500,000 Bank Loan.

Shuling

agrees the ABVC Shares are restricted securities to be issued in accordance with Regulation S promulgated under the Securities Act of

1933.

2.3

Transfer Process: The transfer of ABVC Shares from ABVC to Shuling shall be executed in accordance with the applicable laws, regulations,

and procedures governing equity transfers, as well as Regulation S promulgated under the Securities Act of 1933.

2.4

Transfer of Ownership: Upon completion of the equity transfer, the ownership stake in Shuling’s real estate The Property shall

be transferred from Shuling to ABVC.

2.5

Representation of Value: Both parties acknowledge and agree that the value of the exchange is based on the estimated value of The Property

and the market value of ABVC shares at the time of the equity transfer.

2.6

Valuation Dispute: In the event of any dispute regarding the valuation or other matters related to the exchange, the parties shall make

good faith efforts to resolve the dispute through negotiation and mediation.

2.7

Taxes and Fees: Any taxes, fees, or other charges arising from the equity transfer and exchange shall be the responsibility of the respective

parties as determined by applicable laws and regulations.

Article

3: Capital Protection Agreement

3.1

Valuation Assessment: In the event of a dispute regarding the valuation or value maintenance, the parties may engage an independent third-party

expert or appraiser to assess the value and provide recommendations for adjustment.

3.2

Amendments to the Agreement: Any amendments or modifications to the definitive agreement necessitated by the value adjustment shall be

made in writing and signed by both parties.

3.3

Force Majeure: The provisions of the definitive agreement shall not apply in cases of force majeure events that are beyond the reasonable

control of either party and that significantly impact the value of The Land or stocks.

3.4

Governing Law and Jurisdiction: This Agreement shall be governed by and construed in accordance with the laws of the jurisdiction in

the State of New York. Any disputes arising from or in connection with this Agreement shall be subject to the exclusive jurisdiction

of the courts in that jurisdiction.

Article

4: Termination, Replacement and Amendment

4.1

Both parties aim to complete the transfer of the target assets by March 10, 2024. If unable to do so, both parties shall negotiate and

determine a subsequent transfer date.

4.2

Composition: Supplementary agreements or appended documents related to assets and equity transfer subsequently signed by both parties

shall constitute valid integral parts of this Agreement. The rights and obligations of both parties shall be subject to the terms and

conditions stipulated in this agreement and in any supplementary agreements or appended documents subsequently signed.

4.3

Amendment: The terms and conditions in this Agreement can be further amended in writing upon the mutual agreement of both parties.

4.4

Termination: This Agreement shall become invalid or terminated and shall no longer have any effect. However, the provisions of Sections

3.6, Sections 4, Sections 5, and Sections 6 shall remain in effect after the termination or invalidation of this Memorandum of Understanding.

Article

5: Confidentiality

5.1

Duty of Care: Both parties agree to exercise due care in maintaining the confidentiality of any relevant data or information. This duty

of confidentiality shall not be affected by the termination or expiration of this Agreement.

5.2

Non-Disclosure Obligation: Both parties shall keep all confidential information received from the other party confidential and shall

not disclose it to any third party without prior written consent, unless required by law or authorized by the disclosing party.

5.3

Return or Destruction of Confidential Information: Upon the expiration, termination, or at the request of either party, the receiving

party shall promptly return to the disclosing party all confidential information received, along with any copies or reproductions thereof.

Alternatively, the receiving party shall follow the instructions of the disclosing party regarding the destruction of such confidential

information.

5.4

Survival of Confidentiality Obligations: The obligations of confidentiality and non-disclosure shall survive the expiration or termination

of this Agreement and shall continue to be binding on both parties.

5.5

Exceptions: The obligations of confidentiality shall not apply to information that: (a) was already known to the receiving party prior

to its disclosure by the disclosing party; (b) is or becomes publicly available without breach of this Agreement; (c) is received from

a third party without breach of any confidentiality obligation; or (d) is independently developed by the receiving party without reference

to the disclosing party’s confidential information.

Article

6: Copies of the Agreement

6.1

Two original copies of this Agreement have been prepared, with each party holding one original copy.

6.2

After signing, each party shall retain the original copy held by them as valid evidence between the parties.

6.3

Copies, reproductions, or electronic files of this Agreement shall have the same legal effect and may be used for communication between

the parties.

Signature

Page

Party A: ABVC BioPharma, Inc

Name:

Uttam Yashwant Patil, Ph.D.

Title: CEO

Address:

Party

B: 蔣淑齡 Shuling Jiang

Address:

Exhibit 99.1

ABVC Acquires $2.96 Million Worth of Land

in Asia with Stocks

Priced at $3.50 per Share

Fremont, CA, February 08, 2024 –

ABVC BioPharma, Inc. (NASDAQ: ABVC) (“Company”), a clinical-stage biopharmaceutical company developing therapeutic solutions

in Oncology/Hematology, Neurology, and Ophthalmology, announced today that it signed a definitive

agreement to acquire real estate in Taoyuan City, Taiwan. The acquisition of real estate assets, estimated at approximately $2.96 million

via an equity transfer of $3.50 per share, is to develop plant factories for ABVC’s botanical pipeline strategically; ABVC hopes

the property will ultimately be used as an integrated platform for the global development of the Asian healthcare business and the medical,

pharmaceutical, and biotechnology industries.

The acquisition aims to establish a base for Good

Agricultural Practices (GAP) fields and an integrated platform for collaboration between researchers and industry leaders. ABVC will issue

the current land owner shares of ABVC common stock at $3.50 per share and a warrant to purchase up to 1,000,000 shares of common stock

in consideration for ownership of the property, which is estimated at $2.96 million by a third-party valuation company. This is a related

party transaction since the seller is one of ABVC’s directors who owns approximately 10% of ABVC’s issued and outstanding shares of common

stock and is married to ABVC’s Chief Strategic Officer.

“We are

pleased to add more value to our shareholders’ equity by executing this acquisition and appreciate the recognition of the stock price

of 150% higher than the current market price. ABVC aims to build on the fastest-growing Asian market for pharmaceutical products, medical

devices, and healthcare services. The Company will use the newly acquired land to serve as the base for plant factories and GAP to grow

the raw materials needed to develop the Company’s botanical new drugs.” said Dr. Uttam Patil, ABVC’s Chief Executive Officer. “We

will work towards developing the fields to cut costs on raw material purchases and continue cooperating and constructing an integrated

platform for the global development of Asian healthcare business and the medical, pharmaceutical, and biotechnology industries. We hope

this will provide a new avenue for collaboration between industry, academia, and research and revitalize Asia’s promotion of innovation,

knowledge exchange, and sustainable development.”

ABVC’s

real estate investment raises the shareholders’ equity and facilitates ABVC’s drug development plan, and ABVC believes

it will help generate revenue in the future. Following the pandemic, life sciences-related real estate in Asia has been considered a

hot spot. 1 According to that same article,

“burgeoning demand for pharmaceuticals from a greying population; government policies to support the industry; a steady flow

of mergers and acquisitions; a rising number of listings; and the expansion of R&D capacity” has led to a demand for life

sciences real estate in Asia Pacific.

| 1 | https://www.scmp.com/presented/business/topics/apac-life-sciences-opportunities/article/3157871/life-sciences-real |

As noted

by Erik Hill, Managing Director and National Sector Lead of Healthcare and Life Science at Partner Valuation Advisory, investors

have come to appreciate the recession-resistant returns offered by healthcare real estate. 2

ABVC urges its shareholders to sign up on the

Company’s website for the latest news alerts.

https://abvcpharma.com/?page_id=17707

About ABVC BioPharma

ABVC BioPharma is a clinical-stage biopharmaceutical

company with an active pipeline of six drugs and one medical device (ABV-1701/Vitargus®) under development. For its drug

products, the Company utilizes in-licensed technology from its network of world-renowned research institutions to conduct proof-of-concept

trials through Phase II of clinical development. The Company’s network of research institutions includes Stanford University, the University

of California at San Francisco, and Cedars-Sinai Medical Center. For Vitargus®, the Company intends to conduct global clinical

trials through Phase III.

Forward-Looking Statements

This press release contains “forward-looking

statements.” The words may precede such statements “intends,” “may,” “will,” “plans,” “expects,”

“anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,”

“potential,” or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions,

and are subject to various known and unknown risks and uncertainties, many of which are beyond the Company’s control, and cannot be predicted

or quantified, and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements.

None of the outcomes expressed herein are guaranteed. Such risks and uncertainties include, without limitation, risks and uncertainties

associated with (i) our inability to manufacture our product candidates on a commercial scale on our own, or in collaboration with third

parties; (ii) difficulties in obtaining financing on commercially reasonable terms; (iii) changes in the size and nature of our competition;

(iv) loss of one or more key executives or scientists; and (v) difficulties in securing regulatory approval to proceed to the next level

of the clinical trials or to market our product candidates. More detailed information about the Company and the risk factors that may

affect the realization of forward-looking statements is set forth in the Company’s filings with the Securities and Exchange Commission

(SEC), including the Company’s Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. Investors are urged to read these documents

free of charge on the SEC’s website at http://www.sec.gov. The Company assumes no obligation to publicly update or revise its forward-looking

statements as a result of new information, future events or otherwise.

Contact:

Leeds Chow

Email: leedschow@ambrivis.com

| 2 | https://www.globest.com/2023/11/13/healthcare-real-estate-opportunities-beyond-medical-offices-and-hospitals/?slreturn=20240105041457 |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

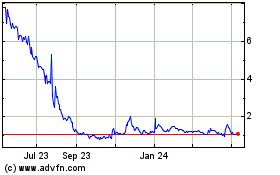

ABVC BioPharma (NASDAQ:ABVC)

Historical Stock Chart

From Mar 2024 to Apr 2024

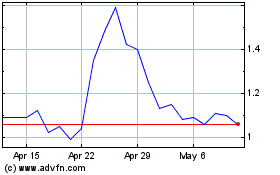

ABVC BioPharma (NASDAQ:ABVC)

Historical Stock Chart

From Apr 2023 to Apr 2024