0001347178FALSE00013471782024-02-072024-02-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 7, 2024

VANDA PHARMACEUTICALS INC.

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-34186 | | 03-0491827 |

| (State or other jurisdiction of incorporation) | | (Commission File No.) | | (IRS Employer Identification No.) |

2200 Pennsylvania Avenue NW

Suite 300E

Washington, DC 20037

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (202) 734-3400

| | |

| Not Applicable |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | VNDA | The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| | | | | | | | |

| Item 2.02. | | Results of Operations and Financial Condition. |

On February 7, 2024, Vanda Pharmaceuticals Inc. (“Vanda”) issued a press release and is holding a conference call regarding its results of operations and financial condition for the quarter and full year ended December 31, 2023. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

Various statements to be made during the conference call are “forward-looking statements” under the securities laws, including, but not limited to, statements regarding Vanda’s commercial products, plans and opportunities, as well as statements about Vanda’s products in development and the related clinical development and regulatory timelines and commercial potential for such products. Words such as, but not limited to, “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “project,” “target,” “goal,” “likely,” “will,” “would,” and “could,” or the negative of these terms and similar expressions or words, identify forward-looking statements. All statements other than statements of historical fact are statements that could be deemed forward-looking statements. Forward-looking statements are based upon current expectations and assumptions that involve risks, changes in circumstances and uncertainties.

Important factors that could cause actual results to differ materially from those reflected in Vanda’s forward-looking statements include, among others, Vanda’s assumptions regarding the strength of its business in the U.S. and Vanda’s ability to complete the clinical development of, and obtain regulatory approval for, the products in its pipeline. Therefore, no assurance can be given that the actual results or developments anticipated by Vanda will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, Vanda. Forward-looking statements made during the call should be evaluated together with the various risks and uncertainties that affect Vanda’s business and market, particularly those identified in the “Cautionary Note Regarding Forward-Looking Statements”, “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of Vanda’s most recent Annual Report on Form 10-K, as updated by Vanda’s subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings with the U.S. Securities and Exchange Commission, which are available at www.sec.gov.

All written and verbal forward-looking statements attributable to Vanda or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements contained or referred to herein. The information contained in this Current Report on Form 8-K is intended to be considered in the context of Vanda’s filings with the SEC and other public announcements that Vanda makes, by press release or otherwise, from time to time. Vanda cautions investors not to rely too heavily on the forward-looking statements Vanda makes or that are made on its behalf. The information conveyed on the conference call will be provided only as of the date of the call, and Vanda undertakes no obligation, and specifically declines any obligation, to update or revise publicly any forward-looking statements made during the call after the date thereof, whether as a result of new information, future events or otherwise, except as required by law.

The information in Item 2.02 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

| | | | | | | | |

| Item 9.01. | | Financial Statements and Exhibits. |

(d)Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| Dated: | February 7, 2024 | | VANDA PHARMACEUTICALS INC. |

| | | | |

| | | By: | | /s/ Timothy Williams |

| | | Name: | | Timothy Williams |

| | | Title: | | Senior Vice President, General Counsel and Secretary |

Exhibit 99.1

Vanda Pharmaceuticals Reports Fourth Quarter and Full Year 2023 Financial Results

•Full year 2023 revenues were $192.6 million

•PONVORY® acquisition completed in Q4 2023 and transition ongoing

•3 FDA PDUFA target action dates in 2024

•Ended 2023 with approximately $388 million in cash and cash equivalents

WASHINGTON – February 7, 2024 – Vanda Pharmaceuticals Inc. (Vanda) (Nasdaq: VNDA) today announced financial and operational results for the fourth quarter and full year ended December 31, 2023.

“Despite significant external commercial and regulatory challenges, last year was a landmark year for Vanda, as we supported our commercial programs and, through a transformational deal, we added PONVORY® to our portfolio alongside Fanapt® and HETLIOZ®,” said Mihael H. Polymeropoulos, M.D., Vanda’s President, CEO and Chairman of the Board. “At the same time, we advanced our clinical development pipeline with three NDA and sNDA submissions for insomnia, bipolar disorder and gastroparesis. Looking forward to this year, we are committed to advancing our clinical development pipeline and strengthening our commercial presence with a portfolio of innovative products serving unmet patient needs.”

Financial Highlights

Fourth Quarter of 2023

•Total net product sales from HETLIOZ®, Fanapt® and PONVORY® were $45.3 million in the fourth quarter of 2023, a 30% decrease compared to $64.5 million in the fourth quarter of 2022, and a 17% increase compared to $38.8 million in the third quarter of 2023.

•HETLIOZ® net product sales were $21.1 million in the fourth quarter of 2023, a 47% decrease compared to $40.1 million in the fourth quarter of 2022, and a 20% increase compared to $17.5 million in the third quarter of 2023. The decrease relative to the fourth quarter of 2022 was the result of the at-risk launch of generic versions of HETLIOZ® in the U.S.

•Fanapt® net product sales were $22.6 million in the fourth quarter of 2023, a 7% decrease compared to $24.4 million in the fourth quarter of 2022, and a 6% increase compared to $21.3 million in the third quarter of 2023.

•PONVORY® net product sales were $1.6 million in the fourth quarter of 2023. These net product sales reflect the revenue generated during the period between the product acquisition date of December 7, 2023 and December 31, 2023.

•Net loss was $2.4 million in the fourth quarter of 2023 compared to net income of $6.9 million in the fourth quarter of 2022, and net income of $0.1 million in the third quarter of 2023.

•Cash, cash equivalents and marketable securities (Cash) was $388.3 million as of December 31, 2023, representing a decrease to Cash of $101.6 million compared to September 30, 2023. During the period, Vanda completed the acquisition of PONVORY® from Actelion Pharmaceuticals Ltd. (Janssen), a Johnson & Johnson Company, for $100.0 million.

Full Year 2023

•Total net product sales from HETLIOZ®, Fanapt®, and PONVORY® were $192.6 million for the full year 2023, a 24% decrease compared to $254.4 million for the full year 2022.

•HETLIOZ® net product sales were $100.2 million for the full year 2023, a 37% decrease compared to $159.7 million for the full year 2022. The decrease was the result of the at-risk launch of generic versions of HETLIOZ® in the U.S.

•Fanapt® net product sales were $90.9 million for the full year 2023, a 4% decrease compared to $94.7 million for the full year 2022.

•PONVORY® net product sales were $1.6 million for the full year 2023. These net product sales reflect the revenue generated during the period between the product acquisition date of December 7, 2023 and December 31, 2023.

•Net income was $2.5 million for the full year 2023 compared to net income of $6.3 million for the full year 2022.

•Cash, cash equivalents and marketable securities (Cash) was $388.3 million as of December 31, 2023, representing a decrease to Cash of $78.6 million, or 17%, compared to December 31, 2022. During the period, Vanda completed the acquisition of PONVORY® from Janssen for $100.0 million.

Key Operational Highlights

HETLIOZ® (tasimelteon)

•The supplemental New Drug Application (sNDA) for HETLIOZ® in the treatment of insomnia is under review by the U.S. Food and Drug Administration (FDA) with a Prescription Drug User Fee Act (PDUFA) target action date of March 4, 2024. Vanda announced that on February 4, 2024, it received a notification from the FDA stating that the FDA had identified deficiencies that preclude discussion of labeling and postmarketing requirements/commitments at this time. No deficiencies were disclosed by the FDA in the notification, and the FDA stated that the notification does not reflect a final decision on the information under review. On February 6, 2024, Vanda filed suit in the U.S. District Court for the District of Columbia (D.C. District Court) challenging the FDA’s conduct in reviewing the insomnia sNDA. Vanda is asking the D.C. District Court to compel the FDA to adhere to the legally mandated 180-day review period for sNDAs and to declare as unlawful and void the regulations the FDA relies upon to issue complete response letters.

•Vanda is also continuing to pursue FDA approval for HETLIOZ® in the treatment of jet lag disorder. Vanda announced in January 2024 that the D.C. District Court granted Vanda’s motion for summary judgment on its claim against the FDA for unlawfully delaying a hearing on the approvability of Vanda’s sNDA for HETLIOZ® in the treatment of jet lag disorder. The D.C. District Court ordered the FDA to either finally resolve Vanda’s jet lag sNDA or commence a hearing on the sNDA on or before March 5, 2024.

•In January 2024, Vanda filed a petition for a writ of certiorari with the U.S. Supreme Court to review the decision of the U.S. Court of Appeals for the Federal Circuit in Vanda’s HETLIOZ® Abbreviated New Drug Application (ANDA) litigation against Teva Pharmaceuticals USA, Inc. (Teva), Apotex Inc. and Apotex Corp. (collectively, Apotex). Teva and Apotex have waived their opportunity to respond to Vanda’s petition, which is now ripe for decision by the U.S. Supreme Court.

Fanapt® (iloperidone)

•The article “Efficacy and Safety of Iloperidone in Bipolar Mania: A Double-Blind, Placebo-Controlled Study” was published in January 2024 in the Journal of Clinical Psychiatry.1 The findings of this pivotal study have been submitted to the FDA as part of Vanda's sNDA for Fanapt® in the treatment of bipolar I disorder in adults.

•The sNDA for Fanapt® in the treatment of bipolar I disorder in adults is under review by the FDA with a PDUFA target action date of April 2, 2024.

PONVORY® (ponesimod)

•Vanda completed the acquisition of the U.S. and Canadian rights to PONVORY® from Janssen for $100.0 million in December 2023 and the transition is ongoing. PONVORY® is a once-daily oral selective sphingosine-1-phosphate receptor 1 modulator, approved by the FDA and Health Canada to treat adults with relapsing forms of multiple sclerosis, and is a potential therapeutic candidate for the treatment of a diverse group of inflammatory/autoimmune disorders ranging from psoriasis to ulcerative colitis.

•Vanda announced in January 2024 that the U.S. Patent and Trademark Office (USPTO) had issued a notice of allowance for its PONVORY® patent application, 17/962,968, covering methods for reducing clinical management events before or during the treatment of multiple sclerosis and methods for reinstating treatment after missed doses.

When issued, the patent is anticipated to expire on October 10, 2042. Upon issuance, Vanda intends to list this patent in the FDA publication Approved Drug Products with Therapeutic Equivalence Evaluations, commonly known as the Orange Book.

Tradipitant

•The article “The Efficacy of Tradipitant in Patients with Diabetic and Idiopathic Gastroparesis in Phase III Randomized Placebo-Controlled Clinical Trial” was published in January 2024 in the Clinical Gastroenterology and Hepatology Journal.2 The findings of this pivotal study as well as a previously reported positive placebo-controlled study in diabetic and idiopathic gastroparesis have been submitted to the FDA as part of Vanda’s New Drug Application (NDA) for tradipitant in the treatment of symptoms of gastroparesis in adults.3

•In December 2023, Vanda announced that the NDA for tradipitant for the treatment of symptoms of gastroparesis was accepted for filing and is under review by the FDA with a PDUFA target action date of September 18, 2024.

•The second Phase III study of tradipitant in the treatment of motion sickness is over 50% enrolled. In May 2023, Vanda previously announced positive results from its first Phase III study of tradipitant in the treatment of motion sickness. Vanda plans to pursue FDA approval upon completion of the clinical development program.

Early-Stage Programs

•In January 2024, Vanda announced that the FDA had approved the Investigational New Drug (IND) application to evaluate VCA-894A for the treatment of a patient with Charcot-Marie-Tooth disease, axonal, type 2S (CMT2S), an inherited peripheral neuropathy for which there is no available treatment.

•In January 2024, Vanda announced that the FDA had also approved the IND to evaluate VTR-297 for the treatment of onychomycosis, a fungal infection of the nail.

Other Legal Updates

•Vanda announced in January 2024 that the United States Court of Federal Claims denied in part the U.S. government’s motion to dismiss Vanda’s claims against the U.S. for the FDA’s uncompensated taking of Vanda's trade secrets and confidential information, thereby allowing Vanda’s lawsuit to proceed. Vanda is seeking compensation from the U.S. for the takings it contends occurred through the FDA's improper communication and disclosure of trade secrets and confidential information to certain generic drug manufacturers. Vanda now intends to engage in discovery to support its claims.

GAAP Financial Results

Net loss was $2.4 million in the fourth quarter of 2023 compared to net income of $6.9 million in the fourth quarter of 2022. Diluted net loss per share was $0.04 in the fourth quarter of 2023 compared to diluted net income per share of $0.12 in the fourth quarter of 2022.

Net income was $2.5 million for the full year 2023 compared to net income of $6.3 million for the full year 2022. Diluted net income per share was $0.04 for the full year 2023 compared to diluted net income per share of $0.11 for the full year 2022.

2024 Financial Guidance

Given uncertainties surrounding the U.S. market for HETLIOZ® for the treatment of Non-24 as a result of the ongoing HETLIOZ® patent litigation and the at-risk launch of generic versions of HETLIOZ®, Vanda is unable to provide 2024 financial guidance at this time.

Conference Call

Vanda has scheduled a conference call for today, Wednesday, February 7, 2024, at 4:30 PM ET. During the call, Vanda’s management will discuss the fourth quarter and full year 2023 financial results and other corporate activities. Investors can call 1-800-715-9871 (domestic) or 1-646-307-1963 (international) and use passcode number 8053170. A replay of the call will be available on Wednesday, February 7, 2024, beginning at 8:30 PM ET and will be accessible until Wednesday, February 14, 2024 at 11:59 PM ET. The replay call-in number is 1-800-770-2030 for domestic callers and 1-609-800-9909 for international callers. The passcode number is 8053170.

The conference call will be broadcast simultaneously on Vanda’s website, www.vandapharma.com. Investors should click on the Investors tab and are advised to go to the website at least 15 minutes early to register, download, and install any necessary software or presentations. The call will also be archived on Vanda’s website for a period of 30 days.

References

1.Torres R, Czeisler EL, Chadwick SR, et al. Efficacy and safety of iloperidone in bipolar mania: a double-blind, placebo-controlled study. J Clin Psychiatry. https://doi.org/10.4088/JCP.23m14966

2.Carlin, J. L., Polymeropoulos, C., Camilleri, M., Lembo, A., Fisher, M., Kupersmith, C., Madonick, D., Moszczynski, P., Smieszek, S., Xiao, C., Birznieks, G., & Polymeropoulos, M. H. (2024). The efficacy of tradipitant in patients with diabetic and idiopathic gastroparesis in phase III randomized placebo-controlled clinical trial. Clinical Gastroenterology and Hepatology. https://doi.org/10.1016/j.cgh.2024.01.005

3.Carlin, J. L., Lieberman, V. R., Dahal, A., Keefe, M. S., Xiao, C., Birznieks, G., Abell, T. L., Lembo, A., Parkman, H. P., & Polymeropoulos, M. H. (2021). Efficacy and Safety of Tradipitant in Patients with Diabetic and Idiopathic Gastroparesis in a Randomized, Placebo-Controlled Trial. Gastroenterology, 160(1), 76–87.e4. https://doi.org/10.1053/j.gastro.2020.07.029

About Vanda Pharmaceuticals Inc.

Vanda is a leading global biopharmaceutical company focused on the development and commercialization of innovative therapies to address high unmet medical needs and improve the lives of patients. For more on Vanda Pharmaceuticals Inc., please visit www.vandapharma.com and follow us on X @vandapharma.

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

Various statements in this press release, including, but not limited to, statements regarding the advancement of Vanda’s clinical development pipeline and strengthening of its commercial presence, Vanda’s plans for pursuit of FDA approval of HETLIOZ® in the treatments of insomnia and jet lag disorder, Fanapt® in the treatment of bipolar I in adults and tradipitant in the treatment of symptoms of gastroparesis and the treatment of motion sickness, Vanda’s expectations regarding the timing of the FDA’s decisions with respect to the sNDAs for HETLIOZ® and Fanapt® and the NDA for tradipitant, the potential for PONVORY® to treat a diverse group of inflammatory/autoimmune disorders, the USPTO’s plans to issue the new PONVORY® patent, the anticipated life of the patent and Vanda’s intentions to list the patent in the Orange Book are “forward-looking statements” under the securities laws. All statements other than statements of historical fact are statements that could be deemed forward-looking statements. Forward-looking statements are based upon current expectations and assumptions that involve risks, changes in circumstances and uncertainties. Important factors that could cause actual results to differ materially from those reflected in Vanda’s forward-looking statements include, among others, Vanda’s ability to complete the clinical development of the products in its pipeline and obtain regulatory approval and market acceptance of these products, Vanda’s ability to obtain FDA approval of the sNDAs for HETLIOZ® and Fanapt® and the NDA for tradipitant, the FDA’s ability to meet the PDUFA target action dates for the sNDAs for HETLIOZ® and Fanapt® and the NDA for tradipitant, the FDA’s assessment of the sufficiency of the data packages included in Vanda’s regulatory submissions for HETLIOZ®, Fanapt® and tradipitant, Vanda’s ability to complete the clinical program for tradipitant in the treatment of motion sickness, the results of any clinical trials conducted for PONVORY® in the treatment of other inflammatory/autoimmune disorders and Vanda’s ability to obtain regulatory approval of PONVORY® for any such additional indications, the payment by Vanda to the USPTO of all fees required prior to the issuance of the new PONVORY® patent, the ultimate issuance of the patent by the USPTO and Vanda’s ability to protect its intellectual property rights and defend the new PONVORY® patent against any attempt to invalidate it. Therefore, no assurance can be given that the results or developments anticipated by Vanda will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, Vanda. Forward-looking statements in this press release should be evaluated together with the various risks and uncertainties that affect Vanda’s business and market, particularly those identified in the “Cautionary Note Regarding Forward-Looking Statements”, “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of Vanda’s most recent Annual Report on Form 10-K, as updated by Vanda’s subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings with the U.S. Securities and Exchange Commission, which are available at www.sec.gov.

All written and verbal forward-looking statements attributable to Vanda or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements contained or referred to herein. Vanda cautions investors not to rely too heavily on the forward-looking statements Vanda makes or that are made on its behalf. The information in this press release is provided only as of the date of this press release, and Vanda undertakes no obligation, and specifically declines any obligation, to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

VANDA PHARMACEUTICALS INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except for share and per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 31

2023 | | December 31

2022 | | December 31

2023 | | December 31

2022 |

| Revenues: | | | | | | | |

HETLIOZ® net product sales | $ | 21,072 | | | $ | 40,101 | | | $ | 100,167 | | | $ | 159,655 | |

Fanapt® net product sales | 22,599 | | | 24,381 | | | 90,873 | | | 94,727 | |

PONVORY® net product sales | 1,600 | | | — | | | 1,600 | | | — | |

| Total revenues | 45,271 | | | 64,482 | | | 192,640 | | | 254,382 | |

| Operating expenses: | | | | | | | |

| Cost of goods sold excluding amortization | 3,460 | | | 6,238 | | | 14,796 | | | 24,282 | |

| Research and development | 24,339 | | | 18,454 | | | 76,823 | | | 85,770 | |

| Selling, general and administrative | 23,613 | | | 32,782 | | | 112,883 | | | 136,485 | |

| Intangible asset amortization | 953 | | | 379 | | | 2,090 | | | 1,516 | |

| Total operating expenses | 52,365 | | | 57,853 | | | 206,592 | | | 248,053 | |

| Income (loss) from operations | (7,094) | | | 6,629 | | | (13,952) | | | 6,329 | |

| Other income | 5,433 | | | 2,984 | | | 20,291 | | | 4,971 | |

| Income (loss) before income taxes | (1,661) | | | 9,613 | | | 6,339 | | | 11,300 | |

| Provision for income taxes | 739 | | | 2,752 | | | 3,830 | | | 5,025 | |

| Net income (loss) | $ | (2,400) | | | $ | 6,861 | | | $ | 2,509 | | | $ | 6,275 | |

Net income (loss) per share, basic | $ | (0.04) | | | $ | 0.12 | | | $ | 0.04 | | | $ | 0.11 | |

| Net income (loss) per share, diluted | $ | (0.04) | | | $ | 0.12 | | | $ | 0.04 | | | $ | 0.11 | |

Weighted average shares outstanding, basic | 57,532,309 | | | 56,651,984 | | | 57,380,975 | | | 56,461,877 | |

| Weighted average shares outstanding, diluted | 57,532,309 | | | 57,188,551 | | | 57,557,911 | | | 56,983,171 | |

VANDA PHARMACEUTICALS INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

(unaudited)

| | | | | | | | | | | |

| December 31

2023 | | December 31

2022 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 135,821 | | | $ | 135,029 | |

| Marketable securities | 252,443 | | | 331,830 | |

| Accounts receivable, net | 34,155 | | | 33,512 | |

| Inventory | 1,357 | | | 1,194 | |

| Prepaid expenses and other current assets | 9,170 | | | 17,727 | |

| Total current assets | 432,946 | | | 519,292 | |

| Property and equipment, net | 2,037 | | | 2,573 | |

| Operating lease right-of-use assets | 7,103 | | | 8,400 | |

| Intangible assets, net | 121,369 | | | 18,565 | |

| Deferred tax assets | 75,000 | | | 74,039 | |

| Non-current inventory and other | 9,985 | | | 11,378 | |

| Total assets | $ | 648,440 | | | $ | 634,247 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable and accrued liabilities | $ | 38,460 | | | $ | 45,551 | |

| Product revenue allowances | 49,237 | | | 45,885 | |

| | | |

| Total current liabilities | 87,697 | | | 91,436 | |

| Operating lease non-current liabilities | 7,006 | | | 8,813 | |

| Other non-current liabilities | 8,827 | | | 6,800 | |

| Total liabilities | 103,530 | | | 107,049 | |

| Stockholders’ equity: | | | |

| Common stock | 58 | | | 57 | |

| Additional paid-in capital | 700,274 | | | 686,235 | |

| Accumulated other comprehensive loss | (30) | | | (1,193) | |

| Accumulated deficit | (155,392) | | | (157,901) | |

| Total stockholders’ equity | 544,910 | | | 527,198 | |

| Total liabilities and stockholders’ equity | $ | 648,440 | | | $ | 634,247 | |

Corporate Contact:

Kevin Moran

Senior Vice President, Chief Financial Officer and Treasurer

Vanda Pharmaceuticals Inc.

202-734-3400

pr@vandapharma.com

SOURCE Vanda Pharmaceuticals Inc.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

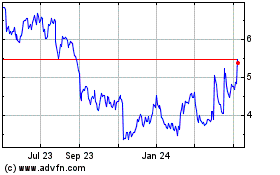

Vanda Pharmaceuticals (NASDAQ:VNDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vanda Pharmaceuticals (NASDAQ:VNDA)

Historical Stock Chart

From Apr 2023 to Apr 2024