Mullen Is Making Great Strides in the Commercial EV Segment and Development of US-Made Battery Capabilities

February 05 2024 - 9:20AM

via IBN -- Mullen Automotive Inc. (NASDAQ: MULN) (“Mullen” or the

“Company”), an emerging electric vehicle (“EV”) manufacturer,

continues to make great strides with production and deliveries of

Class 1 and Class 3 commercial EVs. Its subsidiary, Mullen Advanced

Energy, LLC ("Mullen Advanced Energy"), is advancing with battery

pack production line installation at its new 122,000-square-foot

high-energy facility in Fullerton, California.

“We are steadfastly focused on production, production,

production,” said David Michery, CEO and chairman of Mullen

Automotive. “We are working through active purchase orders and

strengthening our supply chain to make sure we are meeting customer

needs. Unlike the consumer EV space, we have not experienced any

slowdown in demand for our vehicle lineup in the commercial EV

space. We continue to make deliveries of our Class 1 and Class 3

commercial EVs as fast as they come out of our production line. We

are fully committed to increasing our production capacity to meet

the growing demand.”

Michery continued, “We believe bringing the production of

state-of-the-art battery technologies and manufacturing process

in-house will enable us to reduce battery cost, limit our supply

chain dependency and improve our gross profit margin per vehicle

produced.”

In November 2023, Mullen announced a new high-energy facility in

Fullerton, California, expanding the Company’s overall U.S.

footprint, including EV battery development and production

capabilities. This new Southern California facility is dedicated to

producing next-generation American-made EV battery components,

modules and packs, a key focus to the Company’s commitment to zero

emissions and less reliance on foreign-made battery components.

About MullenMullen Automotive (NASDAQ: MULN) is

a Southern California-based automotive company building the next

generation of electric vehicles (“EVs”) that will be manufactured

in its two United States-based assembly plants. Mullen’s EV

development portfolio includes the Mullen FIVE EV Crossover,

Mullen-GO Commercial Urban Delivery EV, Mullen Commercial Class 1-3

EVs and Bollinger Motors, which features both the B1 and B2

electric SUV trucks and Class 4-6 commercial offerings. On Sept. 7,

2022, Bollinger Motors became a majority-owned EV truck company of

Mullen Automotive, and on Dec. 1, 2022, Mullen closed on the

acquisition of Electric Last Mile Solutions’ (“ELMS”) assets,

including all IP and a 650,000-square-foot plant in Mishawaka,

Indiana.

To learn more about the Company, visit www.MullenUSA.com.

Forward-Looking StatementsCertain statements in

this press release that are not historical facts are

forward-looking statements within the meaning of Section 27A of the

Securities Exchange Act of 1934, as amended. Any statements

contained in this press release that are not statements of

historical fact may be deemed forward-looking statements. Words

such as "continue," "will," "may," "could," "should," "expect,"

"expected," "plans," "intend," "anticipate," "believe," "estimate,"

"predict," "potential" and similar expressions are intended to

identify such forward-looking statements. All forward-looking

statements involve significant risks and uncertainties that could

cause actual results to differ materially from those expressed or

implied in the forward-looking statements, many of which are

generally outside the control of Mullen and are difficult to

predict. Examples of such risks and uncertainties include but are

not limited to whether the Company will achieve its anticipated

capacity and timing for future vehicle production and deliveries,

whether demand for the vehicles will continue and whether bringing

the battery production in-house will result in the projected cost

efficiencies, increased profit margins and supply chain

independence. Additional examples of such risks and uncertainties

include but are not limited to: (i) Mullen’s ability (or inability)

to obtain additional financing in sufficient amounts or on

acceptable terms when needed; (ii) Mullen's ability to maintain

existing, and secure additional, contracts with manufacturers,

parts and other service providers relating to its business; (iii)

Mullen’s ability to successfully expand in existing markets and

enter new markets; (iv) Mullen’s ability to successfully manage and

integrate any acquisitions of businesses, solutions or

technologies; (v) unanticipated operating costs, transaction costs

and actual or contingent liabilities; (vi) the ability to attract

and retain qualified employees and key personnel; (vii) adverse

effects of increased competition on Mullen’s business; (viii)

changes in government licensing and regulation that may adversely

affect Mullen’s business; (ix) the risk that changes in consumer

behavior could adversely affect Mullen’s business; (x) Mullen’s

ability to protect its intellectual property; and (xi) local,

industry and general business and economic conditions. Additional

factors that could cause actual results to differ materially from

those expressed or implied in the forward-looking statements can be

found in the most recent annual report on Form 10-K, quarterly

reports on Form 10-Q and current reports on Form 8-K filed by

Mullen with the Securities and Exchange Commission. Mullen

anticipates that subsequent events and developments may cause its

plans, intentions and expectations to change. Mullen assumes no

obligation, and it specifically disclaims any intention or

obligation, to update any forward-looking statements, whether as a

result of new information, future events or otherwise, except as

expressly required by law. Forward-looking statements speak only as

of the date they are made and should not be relied upon as

representing Mullen’s plans and expectations as of any subsequent

date.

Contact:Mullen Automotive, Inc.+1 (714)

613-1900www.MullenUSA.com

Corporate Communications:InvestorBrandNetwork

(IBN) Los Angeles, California www.InvestorBrandNetwork.com

310.299.1717 Office Editor@InvestorBrandNetwork.com

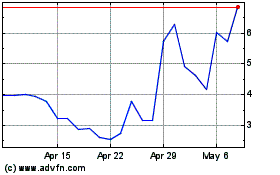

Mullen Automotive (NASDAQ:MULN)

Historical Stock Chart

From Mar 2024 to Apr 2024

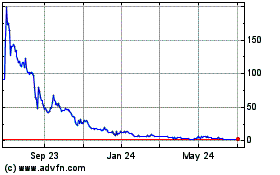

Mullen Automotive (NASDAQ:MULN)

Historical Stock Chart

From Apr 2023 to Apr 2024