false

0000743758

0000743758

2024-01-29

2024-01-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): January

29, 2024

AIADVERTISING, INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

000-13215 |

|

30-0050402 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

IRS Employer

Identification No.) |

321 Sixth Street

San Antonio, TX |

|

78215 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(805) 964-3313

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Tile of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging Growth Company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry

into a Material Definitive Agreement.

On January 29, 2024,

AiAdvertising, Inc. (the “Company”) entered into amendment no. 1 (the “Amendment”) to that certain securities

purchase agreement (the “Purchase Agreement”) with Hexagon Partners, Ltd., (the “Purchaser”), pursuant to which

the Company and the Purchaser amended the terms of the purchase and sale of additional shares of the Company’s Series I Preferred

Stock (the “Series I Preferred Stock”). The Amendment provides for a ten (10) month option from the initial closing of the

Purchase Agreement, to purchase (i) a second tranche consisting of up to 892,857 additional shares of Preferred Stock, at a price equal

to $2.80 per share (the “Tranche B Option”), and (ii) a third tranche consisting of up to 168,269 additional shares of Preferred

Stock, at a price equal to $10.40 per share. On January 30, 2024, the Purchaser exercised the Tranche B Option and the Company sold to

the Purchaser 892,857 shares of Series I Preferred Stock at price of $2.80 per share.

The Amendment also provided

the Purchaser with certain rights of participation in a future financing transaction by the Company.

The foregoing summary of the Amendment is qualified

in its entirety by reference to the Amendment, which is filed as Exhibit 10.1 to this Current Report on Form 8-K, and is incorporated

herein by reference.

Item 1.02 Termination

of a Material Definitive Agreement.

On January 30,

2024, the Company, provided notice of its termination, effective January 30, 2024, of that

certain purchase agreement with GHS Investments, LLC (“GHS”) dated as of March 28, 2022 and amended on July 28, 2022

(the “GHS Purchase Agreement”). As previously reported, pursuant to the GHS Purchase Agreement, the Company could offer

and sell to GHS, in its discretion, up to $10,000,000 of shares of the Company’s common stock. The Company is not subject to

any termination penalties related to the termination of the GHS Purchase Agreement.

Item 7.01 Regulation FD

Disclosure.

On January 31, 2024, the Company issued a press release announcing the completion of the second tranche of the Purchase Agreement and

the termination of the GHS Purchase Agreement. A copy of the press release is attached as Exhibit 99.1 and incorporated herein by reference.

The information furnished

pursuant to Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (“Exchange Act”) or otherwise subject to the liabilities of that section, and shall not be

deemed to be incorporated by reference into any filing made by us under the Exchange Act or Securities Act, regardless of any general

incorporation language in any such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

| |

AIADVERTISING, INC. |

| |

|

|

| Date: February 1, 2024 |

By: |

/s/ Gerard Hug |

| |

|

Name: |

Gerard Hug |

| |

|

Title: |

Chief Executive Officer |

2

Exhibit 10.1

AMENDMENT NO. 1 TO SECURITIES PURCHASE AGREEMENT

This Amendment No. 1 (the

“Amendment”) dated January 29, 2024, to the Securities Purchase Agreement (the “Agreement”), dated

as of April 10, 2023, is entered into by and between AiAdvertising, Inc., a Nevada corporation (the “Company”), and

Hexagon Partners, Ltd., a Texas limited partnership (the “Purchaser” and together with the Company, the “Parties”,

and each, a “Party”).

RECITALS

WHEREAS, the Parties

entered into the Agreement pursuant to which the Company agreed to issue and sell up to 3,000,000 shares of Series I Convertible Preferred

Stock, par value $0.001 per share, with the rights, preferences, powers, restrictions, and limitations set forth in the certificate of

designation of the Company filed with the Secretary of State of Nevada on October 10, 2023 in three tranches, the first of which was Tranche

A which was consummated on April 10, 2023; and

WHEREAS, pursuant to

Section 9.12, the Parties wish to enter into this Amendment to amend the terms of the purchase of Tranche B shares and Tranche C shares

and to consummate the sale of the Tranche B shares to the Purchaser, subject to the terms and conditions set forth herein.

NOW, THEREFORE, in

consideration of the mutual covenants and agreements hereinafter set forth and for other good and valuable consideration, the receipt

and sufficiency of which are hereby acknowledged, the Parties hereto agree as follows:

1. Definitions.

Capitalized terms used and not defined in this Amendment have the respective meanings assigned to them in the Agreement.

2. Amendments

to the Agreement. As of the Effective Date (as defined in Section 3), the Agreement is hereby amended or modified as follows:

| a. | Section 2.01(b) of the Agreement

is hereby amended and restated to read as follows: |

“Tranche

B Option. Subject to the satisfaction of the terms and conditions of this Agreement, the Company grants to Purchaser a ten (10) month

option from the Initial Closing (the “Option Period”) to purchase up to 892,857 additional shares of Series I Preferred

Stock at a purchase price of $2.80 per share of Series I Preferred Stock (the “Tranche B Option” and such Tranche

B purchase price the “Tranche B Purchase Price”)”

| b. | Section 2.01(c) of the Agreement

is hereby amended and restated to read as follows: |

“Tranche

C Option. Subject to the satisfaction of the terms and conditions of this Agreement, the Company grants to Purchaser a ten (10) month

option, during the Option Period that runs concurrently with the Tranche B Option, to purchase up to 168,269 shares of Series I Preferred

Stock at a purchase price of $10.40 per share of Series I Preferred Stock (the “Tranche C Option” and such Tranche

C purchase price the “Tranche C Purchase Price”).”

| c. | Article VI of the Agreement

is hereby amended by inserting at the end of such Article VI the following Section 6.08: |

“Section

6.08 Participation Right. If the Company proposes to sell any of its securities in a financing transaction concurrent with a listing

of the shares of Common Stock of the Company on a major U.S. stock exchange (the “Financing Transaction”), the Purchaser

shall have the right to be the lead investor and participate in such Financing Transaction. The Company shall deliver to the Purchaser

a written notice of its intent to complete the Financing Transaction. If the Purchaser desires to participate in such Financing Transaction,

the Purchaser shall provide prompt notice (but in no event, not later than two (2) Trading Days after receipt of written notice from

the Company) to the Company that such Purchaser is willing to participate in the Financing Transaction.”

3.

Listing and Maintenance Requirements. The Company received notification from the OTC Markets on July 11, 2023, that its common

stock is eligible only for “Unsolicited Quotes”.

3.

Date of Effectiveness; Limited Effect. This Amendment will become effective on the date first written above (the “Effective

Date”). Except as expressly provided in this Amendment, all of the terms and provisions of the Agreement are and will remain

in full force and effect and are hereby ratified and confirmed by the Parties. Without limiting the generality of the foregoing, the

amendments contained herein will not be construed as an amendment to or waiver of any other provision of the Agreement or of any other

Transaction Document or as a waiver of or consent to any further or future action on the part of either Party that would require the

waiver or consent of the other Party. On and after the Effective Date, each reference in the Agreement to “this Agreement,”

“the Agreement,” “hereunder,” “hereof,” “herein,” or words of like import, and each reference

to the Agreement in any other agreements, documents, or instruments executed and delivered pursuant to, or in connection with, the Agreement/Transaction

Documents, will mean and be a reference to the Agreement as amended by this Amendment.

4.

Representations and Warranties. Each Party hereby represents and warrants to the other Party that:

a. It

has the full right, power, and authority to enter into this Amendment and to perform its obligations hereunder and under the Existing

Agreement as amended by this Amendment.

b. The

execution of this Amendment by the individual whose signature is set forth at the end of this Amendment on behalf of such Party, and the

delivery of this Amendment by such Party, have been duly authorized by all necessary action on the part of such Party.

c. This

Amendment has been executed and delivered by such Party and (assuming due authorization, execution, and delivery by the other Party) constitutes

the legal, valid, and binding obligation of such Party, enforceable against such Party in accordance with its terms, except as may be

limited by any applicable bankruptcy, insolvency, reorganization, moratorium, or similar laws and equitable principles related to or affecting

creditors’ rights generally or the effect of general principles of equity.

5.

Miscellaneous.

a.

Headings. The headings

in this Amendment are for reference only and shall not affect the interpretation of this Agreement.

b. Governing

Law; Submission to Jurisdiction; Waiver of Jury Trial. This Amendment shall be governed and subject to Section 9.14 of the Agreement.

c. Entire

Agreement. This Amendment constitute the sole and entire agreement of the parties to this Agreement with respect to the subject matter

contained herein, and supersede all prior and contemporaneous understandings and agreements, both written and oral, with respect to such

subject matter.

d. Counterparts.

This Amendment may be executed in counterparts, each of which shall be deemed an original, but all of which together shall be deemed to

be one and the same agreement. A signed copy of this Amendment delivered by facsimile, e-mail, or other means of electronic transmission

shall be deemed to have the same legal effect as delivery of an original signed copy of this Amendment.

[signature page follows]

IN WITNESS WHEREOF, the parties hereto have caused

this Agreement to be executed as of the date first written above by their respective officers thereunto duly authorized.

|

AIADVERTISING, INC. |

| |

|

| |

By |

/s/ Gerard Hug |

|

Name: |

Gerard Hug |

|

Title: |

Chief Executive Officer |

| |

|

|

HEXAGON PARTNERS, LTD. |

| |

|

|

By: Texas Star Management Company, LLC, its general partner |

| |

|

| |

By: |

/s/ Tim Dunn |

|

Name: |

Tim Dunn |

|

Title: |

Manager |

3

Exhibit

99.1

AIADVERTISING

ANNOUNCES SECOND EQUITY INVESTMENT

TRANCHE OF $2.5 MILLION FROM HEXAGON PARTNERS

JANUARY 31, 2024 7:31AM EST

Capital Will Allow

for Expansion of Sales and Marketing Initiatives

Cancels $10 Million

Securities Purchase Agreement with GHS Investments

Retained ThinkEquity

as Financial Advisor

SAN ANTONIO--(BUSINESS WIRE)-- AiAdvertising,

Inc. (OTC: AIAD), an industry leader in AI-powered advertising solutions, today completed the second tranche of its securities purchase

agreement with Hexagon Partners, Ltd., a Texas-based investment company, for a strategic investment of $2.5 million.

Hexagon Partners Equity Investment

On April 11, 2023, AiAdvertising entered into

a securities purchase agreement with Hexagon Partners, Ltd. for a strategic investment of $5.0 million and potentially up to $9.25 million.

The investment by Hexagon Partners was structured as the purchase of newly designated Series I Preferred Stock of the Company that converts

into AIAD’s common stock at a ratio of 1 to 400. In addition to the initial $5.0 million investment, the transaction provided an

option for two additional tranches totaling another $4.25 million investment, with a total blended underlying as-converted common share

price that represents an aggregate investment at a premium to the closing price of AIAD’s common stock. The $2.5 million second

tranche transaction closed on January 30, 2024, and completes the investment.

Securities Purchase Agreement Terminated

on January, 30 2024

On March 28, 2022, the Company entered into

purchase agreement with GHS Investments, LLC, a Nevada limited liability company, to buy from the Company, up to $10,000,000 worth of

the Company’s registered common stock, $0.001 par value per share from time to time. From March 28, 2022, through January 30, 2024,

the Company sold an aggregate of 259,661,078 shares of common stock at an average price of $0.007 per share for gross proceeds of approximately

$1.79 million under the agreement. On January 30, 2024, the Company terminated the purchase agreement with GHS Investments.

ThinkEquity Hired as Financial Advisor

to list on a National Exchange

On January 12, 2024, AiAdvertising engaged

ThinkEquity LLC, a boutique investment bank, to act as AiAdvertising’s financial advisor to list to a national exchange.

"We are privileged to extend our partnership

with Hexagon Partners, and we celebrate their continued confidence in our company,” said Jerry Hug, CEO of AiAdvertising. “The

new investment will enable us to focus on further development of our AI-powered targeting solutions to generate more engaging, higher-impact

campaigns that drive results for our clients. In addition, with the new investment from Hexagon to propel our sales efforts, we believe

we will reach cashflow breakeven in the near-term. While we have valued our relationship with GHS Investments, we believe our improving

business metrics will allow us to raise capital more efficiently than in the past, and consequently, we have cancelled our $10 million

Purchase Agreement with GHS.

“We are also excited to partner with

ThinkEquity to explore listing our shares on a national exchange, which will represent a significant milestone for the Company. As we

leverage our strong momentum to focus on delivering superior results to our clients, being listed on a national exchange increases corporate

visibility, improves liquidity, and raises awareness of AiAdvertising in the financial markets. We look forward to working with the team

at ThinkEquity for a successful uplisting,” concluded Hug.

About AiAdvertising

AiAdvertising is an AI-powered solutions provider

employing the industry’s most scientifically advanced, patent-pending AI targeting process. Transforming marketing and customer

experiences, allowing marketers to personify client data and scientifically target their ideal customers with hyper-personalized campaigns.

By harnessing artificial intelligence (AI) and machine learning (ML), we empower brands to easily target, predict, create, scale, measure

campaign performance and reduce waste. Our clients gain the intelligence they need to prove advertising’s impact on the bottom line.

This means more engaging, higher-impact campaigns that drive conversions and results.

For more information about the Company, please

visit www.AiAdvertising.com or our LinkedIn or Twitter pages.

Forward-Looking Statements

This press release may contain “forward-looking

statements.” Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based

only on our current beliefs, expectations, and assumptions regarding the future of our business, future plans and strategies, projections,

anticipated events and trends, the economy, and other future conditions. Because forward-looking statements relate to the future, they

are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict and many of which are outside

of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements.

Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial

condition to differ materially from those indicated in the forward-looking statements are included in our filings with the Securities

and Exchange Commission, including the “Risk Factors” section of our annual report on Form 10-K for the year ended December

31, 2022. Any forward-looking statement made by us in this release is based only on information currently available to us and speaks only

as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral,

that may be made from time to time, whether as a result of new information, future developments, or otherwise, except as may be required

under applicable law.

Investor Contact:

Larry Holub/Chris Tyson

312-261-6412

AIAD@mzgroup.us

www.mzgroup.us

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

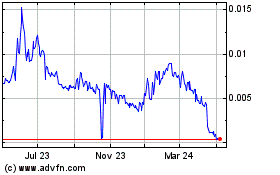

Aiadvertising (CE) (USOTC:AIAD)

Historical Stock Chart

From Mar 2024 to Apr 2024

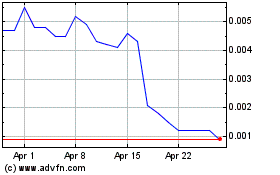

Aiadvertising (CE) (USOTC:AIAD)

Historical Stock Chart

From Apr 2023 to Apr 2024