false000005836100000583612024-02-012024-02-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 1, 2024

_______________________________________________________________________________________

LEE ENTERPRISES, INCORPORATED

(Exact name of Registrant as specified in its charter)

_______________________________________________________________________________________

| | | | | | | | |

| Delaware | 1-6227 | 42-0823980 |

| (State of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | |

| 4600 E. 53rd Street, Davenport, Iowa 52807 | |

| (Address of Principal Executive Offices) | |

| | |

| (563) 383-2100 | |

| Registrant’s telephone number, including area code | |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $.01 per share | LEE | The Nasdaq Global Select Market |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Condition.

On February 1, 2024, Lee Enterprises, Incorporated (the “Company”) reported its preliminary results for the first quarter ended December 24, 2024. In connection with the preliminary results, the Company issued a news release, which is attached hereto as Exhibit 99.1 (“News Release”). The Company also prepared presentation materials which were presented by management during the Company’s earnings conference call, which are attached hereto as Exhibit 99.2 and have been made available on the Company’s website, investors.lee.net (“Presentation Materials”). In addition to the information in the News Release, the Presentation Materials include content and financial figures showing its expectation to be sustainable without reliance on print media within five years.

The information furnished by and incorporated by reference in this Item 2.02, including the attached Exhibits, shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 7.01. Regulation FD Disclosure

The disclosure contained in Item 2.02 is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | |

| (d)Exhibits | |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | | LEE ENTERPRISES, INCORPORATED | |

| | | | | |

| | | | | |

| Date: | August 3, 2023 | By: | /s/ Timothy R. Millage | |

| | | | Timothy R. Millage | |

| | | | Vice President, Chief Financial Officer and Treasurer | |

Lee Enterprises reports first quarter Adjusted EBITDA growth and strong digital growth

Adjusted EBITDA(1) growth of 6% YOY

Digital-only subscribers totaled 735,000 (+30% YOY); Revenue +60% YOY(2)

Total Digital Revenue(3) represented 46% of revenue, totaled $71M

DAVENPORT, Iowa (February 1, 2024) — Lee Enterprises, Incorporated (NASDAQ: LEE), a digital-first subscription platform providing high quality, trusted, local news, information and a major platform for advertising in 73 markets, today reported preliminary first quarter fiscal 2024 financial results(4) for the period ended December 24, 2023.

“Our Three Pillar Digital Growth Strategy is driving audience growth, improving consumer engagement, and increasing digital subscribers. We now have 735,000 subscribers to our digital-only products and digital-only subscription revenue grew 60% on a Same-store basis(2)," said Kevin Mowbray, Lee's President and Chief Executive Officer.

“Because of our impressive digital subscription revenue growth combined with solid gains at Amplified Digital, digital revenue reached 46% of total operating revenue in the quarter. We expect digital revenue will exceed print in the back half of the year. This is an important milestone in our digital transformation as it results in the majority of our revenue coming from sustainable and growing sources,” Mowbray added.

"Our first quarter results demonstrate our confidence in Lee's digital transformation. We are on a clear path to becoming sustainable solely from the revenue and cash flow from our digital products. We expect strong digital revenue combined with cost management execution to keep us on track to achieve our overall Adjusted EBITDA guidance for the full year," added Mowbray.

Key First Quarter Highlights:

•Total operating revenue was $156 million.

•Total Digital Revenue was $71 million, an 11% increase over the prior year(2), and represented 46% of our total operating revenue.

•Digital-only subscription revenue increased 60% in the first quarter compared to the same quarter last year(2) due to a 30% increase in digital-only subscribers and a 20% increase in average rates. Digital-only subscribers totaled 735,000 at the end of the quarter.

•Digital advertising and marketing services revenue represented 66% of our total advertising revenue and totaled $46 million.

•Digital services revenue, which is predominantly BLOX Digital, totaled $5 million in the quarter.

•Operating expenses totaled $149 million and Cash Costs(1) totaled $139 million, an 18% decline over the prior year.

•Net income totaled $1 million and Adjusted EBITDA totaled $19 million, a 6% increase over the prior year.

2024 Fiscal Year Outlook (unchanged):

| | | | | |

Total Digital Revenue | $310 million (+13% YOY) - $330 million (+21% YOY) |

| Digital-only subscribers | 771,000 (+7% YOY) |

Adjusted EBITDA | $83 million (-3% YOY) - $90 million (+6% YOY) |

Debt and Free Cash Flow:

The Company has $454 million of debt outstanding under our Credit Agreement(5) with BH Finance. The financing has favorable terms including a 25-year maturity, a fixed annual interest rate of 9.0%, no fixed principal payments, and no financial performance covenants.

As of and for the period ended December 24, 2023:

•The principal amount of debt decreased $2 million in the first quarter and totaled $454 million.

•Cash on the balance sheet totaled $15 million. Debt, net of cash on the balance sheet, totaled $439 million.

•Capital expenditures totaled $1 million for the quarter. We expect $10 million of capital expenditures in FY24.

•We expect cash paid for income taxes to total between $10 million and $15 million in 2024.

•We do not expect any material pension contributions in the fiscal year as our plans are fully funded in the aggregate.

Conference Call Information:

As previously announced, we will hold an earnings conference call and audio webcast today at 9 a.m. Central Time. The live webcast will be accessible at www.lee.net and will be available for replay 24 hours later. Analysts have been invited to ask questions on the call. Questions from other participants may be submitted by participating in the webcast. To participate in the live conference call via telephone, please register here. Upon registering, a dial-in number and unique PIN will be provided to join the conference call.

About Lee:

Lee Enterprises is a major subscription and advertising platform and a leading provider of local news and information, with daily newspapers, rapidly growing digital products and nearly 350 weekly and specialty publications serving 73 markets in 26 states. Year to date, Lee's newspapers have an average daily circulation of 1.0 million, and our legacy websites, including acquisitions, reach more than 33 million digital unique visitors. Lee's markets include St. Louis, MO; Buffalo, NY; Omaha, NE; Richmond, VA; Lincoln, NE; Madison, WI; Davenport, IA; and Tucson, AZ. Lee Common Stock is traded on NASDAQ under the symbol LEE. For more information about Lee, please visit www.lee.net.

FORWARD-LOOKING STATEMENTS — The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking statements. This release contains information that may be deemed forward-looking that is based largely on our current expectations, and is subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those anticipated. Among such risks, trends and other uncertainties, which in some instances are beyond our control, are:

•The long-term or permanent changes the COVID-19 pandemic may have on the publishing industry; which may result in permanent revenue reductions and other risks and uncertainties;

•We may be required to indemnify the previous owners of BH Media or The Buffalo News for unknown legal and other matters that may arise;

•Our ability to manage declining print revenue and circulation subscribers;

•The impact and duration of adverse conditions in certain aspects of the economy affecting our business;

•Changes in advertising and subscription demand;

•Changes in technology that impact our ability to deliver digital advertising;

•Potential changes in newsprint, other commodities and energy costs;

•Interest rates;

•Labor costs;

•Significant cyber security breaches or failure of our information technology systems;

•Our ability to achieve planned expense reductions and realize the expected benefit of our acquisitions;

•Our ability to maintain employee and customer relationships;

•Our ability to manage increased capital costs;

•Our ability to maintain our listing status on NASDAQ;

•Competition; and

•Other risks detailed from time to time in our publicly filed documents.

Any statements that are not statements of historical fact (including statements containing the words "aim", “may”, “will”, “would”, “could”, “believes”, “expects”, “anticipates”, “intends”, “plans”, “projects”, “considers” and similar expressions) generally should be considered forward-looking statements. Statements regarding our plans, strategies, prospects and expectations regarding our business and industry, including statements regarding the impacts that the COVID-19 pandemic and our responses thereto may have on our future operations, are forward-looking statements. They reflect our expectations, are not guarantees of performance and speak only as of the date the statement is made. Readers are cautioned not to place undue reliance on such forward-looking statements, which are made as of the date of this release. We do not undertake to publicly update or revise our forward-looking statements, except as required by law.

Contact:

IR@lee.net

(563) 383-2100

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

| | | | | | | | | | | | | | |

| Three months ended | |

| (Thousands of Dollars, Except Per Common Share Data) | December 24, 2023 | December 25, 2022 | Percent

Change | | | |

| | | | | | |

| Operating revenue: | | | | | | |

| Print advertising revenue | 24,435 | | 41,836 | | (41.6) | % | | | |

| Digital advertising revenue | 46,452 | | 47,749 | | (2.7) | % | | | |

| Advertising and marketing services revenue | 70,887 | | 89,585 | | (20.9) | % | | | |

| Print subscription revenue | 51,872 | | 67,370 | | (23.0) | % | | | |

| Digital subscription revenue | 19,467 | | 12,329 | | 57.9 | % | | | |

| Subscription revenue | 71,339 | | 79,699 | | (10.5) | % | | | |

| Print other revenue | 8,492 | | 11,120 | | (23.6) | % | | | |

| Digital other revenue | 4,960 | | 4,727 | | 4.9 | % | | | |

| Other revenue | 13,452 | | 15,847 | | (15.1) | % | | | |

| Total operating revenue | 155,678 | | 185,131 | | (15.9) | % | | | |

| Operating expenses: | | | | | | |

| Compensation | 59,676 | | 75,446 | | (20.9) | % | | | |

| Newsprint and ink | 4,843 | | 7,432 | | (34.8) | % | | | |

| Other operating expenses | 74,776 | | 86,774 | | (13.8) | % | | | |

| Depreciation and amortization | 7,295 | | 7,886 | | (7.5) | % | | | |

| Assets gain on sales, impairments and other | (1,469) | | (2,563) | | (42.7) | % | | | |

| Restructuring costs and other | 4,265 | | 646 | | NM | | | |

| Total operating expenses | 149,386 | | 175,621 | | (14.9) | % | | | |

| Equity in earnings of associated companies | 1,541 | | 1,668 | | (7.6) | % | | | |

| Operating income | 7,833 | | 11,178 | | (29.9) | % | | | |

| Non-operating income (expense): | | | | | | |

| Interest expense | (10,131) | | (10,408) | | (2.7) | % | | | |

| Pension and OPEB related benefit (cost) and other, net | 186 | | 1,494 | | (87.6) | % | | | |

| Curtailment/Settlement gains | 3,593 | | — | | NM | | | |

| Total non-operating expense, net | (6,352) | | (8,914) | | (28.7) | % | | | |

| Income before income taxes | 1,481 | | 2,264 | | (34.6) | % | | | |

| Income tax expense | 248 | | 440 | | (43.6) | % | | | |

| Net Income | 1,233 | | 1,824 | | (32.4) | % | | | |

| Net income attributable to non-controlling interests | (545) | | (725) | | (24.8) | % | | | |

| Income attributable to Lee Enterprises, Incorporated | 688 | | 1,099 | | (37.4) | % | | | |

| | | | | | |

| Earnings (loss) per common share: | | | | | | |

| Basic | 0.12 | | 0.19 | (36.8) | % | | | |

| Diluted | 0.12 | | 0.19 | (36.8) | % | | | |

DIGITAL / PRINT REVENUE COMPOSITION

(UNAUDITED)

| | | | | | | | | | | | |

| Three months ended | | |

| (Thousands of Dollars) | December 24, 2023 | December 25, 2022 | | | | |

| | | | | | |

| Digital Advertising and Marketing Services Revenue | 46,452 | | 47,749 | | | | | |

| Digital Only Subscription Revenue | 19,467 | | 12,329 | | | | | |

| Digital Services Revenue | 4,960 | | 4,727 | | | | | |

| Total Digital Revenue | 70,879 | | 64,805 | | | | | |

| Print Advertising Revenue | 24,435 | | 41,836 | | | | | |

| Print Subscription Revenue | 51,872 | | 67,370 | | | | | |

| Other Print Revenue | 8,492 | | 11,120 | | | | | |

| Total Print Revenue | 84,799 | | 120,326 | | | | | |

| Total Operating Revenue | 155,678 | | 185,131 | | | | | |

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(UNAUDITED)

The table below reconciles the non-GAAP financial performance measure of Adjusted EBITDA to net income, its most directly comparable U.S. GAAP measure:

| | | | | | | | | | |

| Three months ended | |

| (Thousands of Dollars) | December 24, 2023 | December 25, 2022 | | |

| | | | |

| Net income | 1,233 | | 1,824 | | | |

| Adjusted to exclude | | | | |

| Income tax expense | 248 | | 440 | | | |

| Non-operating expenses, net | 6,352 | | 8,914 | | | |

| Equity in earnings of TNI and MNI | (1,541) | | (1,668) | | | |

| Depreciation and amortization | 7,295 | | 7,886 | | | |

| Restructuring costs and other | 4,265 | | 646 | | | |

| Assets gain on sales, impairments and other, net | (1,469) | | (2,563) | | | |

| Stock compensation | 214 | | 349 | | | |

| Add: | | | | |

Ownership share of TNI(6) and MNI EBITDA(6) (50%) | 2,052 | | 1,791 | | | |

| Adjusted EBITDA | 18,649 | | 17,619 | | | |

The table below reconciles the non-GAAP financial performance measure of Cash Costs to Operating expenses, the most directly comparable U.S. GAAP measure:

| | | | | | | | | | |

| Three months ended | |

| (Thousands of Dollars) | December 24, 2023 | December 25, 2022 | | |

| | | | |

| Operating expenses | 149,386 | | 175,621 | | | |

| Adjustments | | | | |

| Depreciation and amortization | 7,295 | | 7,886 | | | |

| Assets gain on sales, impairments and other, net | (1,469) | | (2,563) | | | |

| Restructuring costs and other | 4,265 | | 646 | | | |

| Cash Costs | 139,295 | | 169,652 | | | |

The table below reconciles the non-GAAP financial performance measure of Same-store Revenues to Operating Revenues, its most directly comparable U.S. GAAP measure:

| | | | | | | | | | | |

| Three months ended |

| (Thousands of Dollars) | December 24,

2023 | December 25,

2022 | Percent Change |

| | | |

Print Advertising Revenue | 24,435 | | 41,836 | | (41.6) | % |

Exited operations | (78) | | (7,916) | | NM |

Same-store, Print Advertising Revenue | 24,357 | | 33,920 | | (28.2) | % |

Digital Advertising Revenue | 46,452 | | 47,749 | | (2.7) | % |

Exited operations | (90) | | (786) | | NM |

Same-store, Digital Advertising Revenue | 46,362 | | 46,963 | | (1.3) | % |

Total Advertising Revenue | 70,887 | | 89,585 | | (20.9) | % |

Exited operations | (168) | | (8,702) | | NM |

Same-store, Total Advertising Revenue | 70,719 | | 80,883 | | (12.6) | % |

Print Subscription Revenue | 51,873 | | 67,370 | | (23.0) | % |

| Exited operations | (174) | | (682) | | NM |

Same-store, Print Subscription Revenue | 51,699 | | 66,688 | | (22.5) | % |

Digital Subscription Revenue | 19,467 | | 12,329 | | 57.9 | % |

| Exited operations | (96) | | (236) | | NM |

Same-store, Digital Subscription Revenue | 19,371 | | 12,093 | | 60.2 | % |

Total Subscription Revenue | 71,339 | | 79,699 | | (10.5) | % |

| Exited operations | (270) | | (918) | | NM |

Same-store, Total Subscription Revenue | 71,069 | | 78,781 | | (9.8) | % |

Print Other Revenue | 8,492 | | 11,120 | | (23.6) | % |

| Exited operations | (1) | | (121) | | NM |

Same-store, Print Other Revenue | 8,491 | | 10,999 | | (22.8) | % |

Digital Other Revenue | 4,960 | | 4,727 | | 4.9 | % |

| Exited operations | — | | — | | NM |

Same-store, Digital Other Revenue | 4,960 | | 4,727 | | 4.9 | % |

Total Other Revenue | 13,452 | | 15,847 | | (15.1) | % |

| Exited operations | (1) | | (121) | | NM |

Same-store, Total Other Revenue | 13,451 | | 15,726 | | (14.5) | % |

Total Operating Revenue | 155,678 | | 185,131 | | (15.9) | % |

| Exited operations | (439) | | (9,741) | | NM |

Same-store, Total Operating Revenue | 155,239 | | 175,390 | | (11.5) | % |

NOTES

(1)The following are non-GAAP (Generally Accepted Accounting Principles) financial measures for which reconciliations to relevant U.S GAAP measures are included in tables accompanying this release:

•Adjusted EBITDA is a non-GAAP financial performance measure that enhances financial statement users overall understanding of the operating performance of the Company. The measure isolates unusual, infrequent or non-cash transactions from the operating performance of the business. This allows users to easily compare operating performance among various fiscal periods and how management measures the performance of the business. This measure also provides users with a benchmark that can be used when forecasting future operating performance of the Company that excludes unusual, nonrecurring or one-time transactions. Adjusted EBITDA is a component of the calculation used by stockholders and analysts to determine the value of our business when using the market approach, which applies a market multiple to financial metrics. It is also a measure used to calculate the leverage ratio of the Company, which is a key financial ratio monitored and used by the Company and its investors. Adjusted EBITDA is defined as net income (loss), plus non-operating expenses, income tax expense, depreciation and amortization, assets loss (gain) on sales, impairments and other, restructuring costs and other, stock compensation and our 50% share of EBITDA from TNI and MNI, minus equity in earnings of TNI and MNI.

•Cash Costs represent a non-GAAP financial performance measure of operating expenses which are measured on an accrual basis and settled in cash. This measure is useful to investors in understanding the components of the Company’s cash-settled operating costs. Periodically, the Company provides forward-looking guidance of Cash Costs, which can be used by financial statement users to assess the Company's ability to manage and control its operating cost structure. Cash Costs are defined as compensation, newsprint and ink and other operating expenses. Depreciation and amortization, assets loss (gain) on sales, impairments and other, other non-cash operating expenses and other expenses are excluded. Cash Costs also exclude restructuring costs and other, which are typically paid in cash.

(2)Same-store revenues is a non-GAAP performance measure based on U.S. GAAP revenues for Lee for the current period, excluding exited operations. Exited operations include (1) business divestitures and (2) the elimination of stand-alone print products discontinued within our markets.

(3)Total Digital Revenue is defined as digital advertising and marketing services revenue (including Amplified Digital®), digital-only subscription revenue and digital services revenue.

(4)This earnings release is a preliminary report of results for the periods included. The reader should refer to the Company's most recent reports on Form 10-Q and on Form 10-K for definitive information.

(5)The Company's debt is the $576 million term loan under a credit agreement with BH Finance LLC dated January 29, 2020 (the "Credit Agreement"). Excess Cash Flow is defined under the Credit Agreement as any cash greater than $20,000,000 on the balance sheet in accordance with U.S. GAAP at the end of each fiscal quarter, beginning with the quarter ending June 28, 2020.

(6)TNI refers to TNI Partners publishing operations in Tucson, AZ. MNI refers to Madison Newspapers, Inc. publishing operations in Madison, WI.

FIRST QUARTER FY2024 EARNINGS FEBRUARY 1, 2024

2 SAFE HARBOR The information provided in this presentation may include forward-looking statements relating to future events or the future financial performance of the Company. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Words such as “aims”, “anticipates,” “plans,” “expects,” “intends,” “will,” “potential,” “hope” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based upon current expectations of the Company and involve assumptions that may never materialize or may prove to be incorrect. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties. Detailed information regarding factors that may cause actual results to differ materially from the results expressed or implied by statements relating to the Company may be found in the Company’s periodic filings with the Commission, including the factors described in the sections entitled “Risk Factors,” copies of which may be obtained from the SEC’s website at www.sec.gov. The Company does not undertake any obligation to update forward-looking statements contained in this presentation.

3 KEY THEMES FOR TODAY THREE PILLAR DIGITAL GROWTH STRATEGY1 2 FIRST QUARTER 2024 RESULTS 3 WELL-POSITIONED TO DRIVE VALUE FOR STAKEHOLDERS

4 LEE’S STRATEGY FOR DIGITAL TRANSFORMATION: THE THREE PILLARS LEE IS RAPIDLY TRANSFORMING FROM A PRINT-CENTRIC TO A DIGITAL-CENTRIC COMPANY PILLAR 1 Expand our audience by providing compelling local content PILLAR 2 Accelerate digital subscription growth PILLAR 3 Diversify and expand offerings for local advertisers Lee expects the Three Pillar Digital Growth Strategy to drive more than $450 million of digital revenue within five years, resulting in a business that is sustainable and vibrant from solely our digital products

5 Digital Sub Revenue Growth Leads Industry Digital Agency Revenue Growth Leads Industry Total Digital Revenue Growing Significantly $68M LTM Digital Sub Revenue $91M LTM Amplified Revenue $279M LTM Total Digital Revenue Industry-leading 53% YOY(1) LTM growth Sep 2023 3-Year CAGR Industry-leading 11% YOY(1) LTM growth Sep 2023 3-Year CAGR Total Digital Revenue up 13% YOY(1) LTM LTM Dec FY24 YOY STRATEGY IS PRODUCING INDUSTRY-LEADING DIGITAL GROWTH $249M $279M LTM Dec '23 LTM Dec '24 (1) Same-store revenues is a non-GAAP performance measure based on U.S. GAAP revenues for Lee for the current period, excluding exited operations. Exited operations include (1) business divestitures and (2) the elimination of stand-alone print products discontinued within our markets.

6 STRATEGY IS TRANSFORMING THE COMPOSITION OF REVENUE Expected to reach inflection point in back half of FY2024 Prior to launch of Three Pillar Digital Growth Strategy Industry-leading digital revenue growth is transforming the mix of revenue FY2020 Q1 FY2024 R E V E N U E M IX % Digital 7% 21% 46%

7 KEY THEMES FOR TODAY THREE PILLAR DIGITAL GROWTH STRATEGY1 2 FIRST QUARTER 2024 RESULTS 3 WELL-POSITIONED TO DRIVE VALUE FOR STAKEHOLDERS

8 FIRST QUARTER 2024 RESULTS Q1 Revenue (1) Same-store revenues is a non-GAAP performance measure based on U.S. GAAP revenues for Lee for the current period, excluding exited operations. Exited operations include (1) business divestitures and (2) the elimination of stand-alone print products discontinued within our markets. (2) Adjusted EBITDA and Cash Costs are non-GAAP financial measures. See appendix. Total Digital Revenue $71M, +11% YOY on a Same-store basis(1) • Digital subscription revenue $19M, +60%(1) • Digital advertising revenue $46M, -1%(1) • Amplified Digital® revenue $21M, +4%(1) Total Print Revenue $85M, -24%(1) Total Operating Revenue $156M, -11%(1) Q1 Cash Costs(2) • Total Cash Costs $139M, -18% Q1 Adjusted EBITDA(2) • Adjusted EBITDA $19M, +6% Continued digital revenue growth Strong cost control of legacy business Investments to drive digital transformation Adj. EBITDA growth

9 LEE EXPECTS TO BE SUSTAINABLE WITHOUT RELIANCE ON PRINT IN 5 YEARS Scaling digital business can sustain long-term outlook Key Transformation Priorities: • Maximize the monetization of O&O products • Retain and grow spending from local advertising partners • Increase ARPU with local advertisers through Amplified • Acquire and retain strategic top agency accounts • Maximize subscription and revenue opportunities in our vast addressable market • Invest and create local content that drives engagement Q1 FY24 Digital Revenue $71M Digital Direct Costs(1) $20M Digital Direct Margin(2) $51M Margin % 72% (1) Digital Direct Costs is a non-GAAP performance measure that includes Cost of Goods Sold (“COGS”) directly tied to digital products. Digital Direct Costs excludes all Selling, General, and Administrative (“SG&A”) costs. (2) Digital Direct Margin is a non-GAAP performance measure calculated as Digital Revenue less Digital Direct Costs. DIGITAL REVENUE, DIRECT COSTS, DIRECT MARGIN

10 STRONG TRACK RECORD OF SUSTAINABLE COST MANAGEMENT KEY TAKEAWAYS • Proficient in driving efficiencies • Current base of $237M of direct costs associated with our legacy revenue streams that will be managed with associated revenue trends • Ongoing initiatives aimed at optimizing manufacturing, distribution, and corporate services • Thoughtful investments in digital future • Significant investments made in talent and technology to fund successful execution of three-pillar strategy • Acquisition and retention of top talent focused on digital subscriber growth and expanding reach of Amplified Digital® • Increase in digital COGS driven by rapid growth in digital revenue $1.0B $705M $693M $615M 2017 2020 2022 2023 Total Cash Costs(1) Managing legacy business & investing in digital future (1) Adjusted EBITDA and Cash Costs are non-GAAP financial measures. See appendix. $615M $570- 590M $45-65M $20M

11 Q2 2020 Q1 2024 DIGITAL TRANSFORMATION: STRENGTHENED BALANCE SHEET • $122M debt reduction since refinancing in March 2020 • Favorable credit agreement with Berkshire Hathaway • 25-year runway w/ no breakage costs or prepayment penalties • Fixed annual interest rate, no financial performance covenants and no fixed amortization • Pension plans now frozen and fully funded in the aggregate with no material pension contributions expected in 2024 • Asset sales of $2M in the quarter • Identified approximately $25M of noncore assets to monetize Achieve long-term leverage target of under 2.5x $576M $454M Significant Gross Debt Reduction

12 2024 OUTLOOK (UNCHANGED) 2023 2024 Outlook Total Digital Revenue $273M $310-$330M YoY(1) 14% 13% to 21% Digital-only subscribers 721,000 771,000 YoY 37% 7% Cash Costs(2) $615M $570-$590M YoY -11% -4% to -7% Adjusted EBITDA(2) $85M $83-$90M YoY -11% -3% to 6% (1) Same-store revenues is a non-GAAP performance measure based on U.S. GAAP revenues for Lee for the current period, excluding exited operations. Exited operations include (1) business divestitures and (2) the elimination of stand-alone print products discontinued within our markets. (2) Adjusted EBITDA and Cash Costs are non-GAAP financial measures. See appendix.

13 KEY THEMES FOR TODAY THREE PILLAR DIGITAL GROWTH STRATEGY1 2 FIRST QUARTER 2024 RESULTS 3 WELL-POSITIONED TO DRIVE VALUE FOR STAKEHOLDERS

14 LEE INVESTMENT THESIS WE BELIEVE OUR THREE PILLAR DIGITAL GROWTH STRATEGY WILL CREATE SUBSTANTIAL VALUE: Increased Shareholder Value Enhanced cash generation Debt reduction drives shareholder value Multiple expansion fueled by increased recurring, high-margin digital revenue Continued Debt Reduction & Strengthened Balance Sheet Expect to reach <2.5x leverage target within five years Execute Three Pillar Digital Growth Strategy Generate long-term sustainable digital revenue growth, margin expansion, and strong free cash flow

16 NON-GAAP RECONCILIATION The Company uses non-GAAP financial performance measures to supplement the financial information presented on a U.S. GAAP basis. These non-GAAP financial measures, which may not be comparable to similarly titled measures reported by other companies, should not be considered in isolation from or as a substitute for the related U.S. GAAP measures and should be read together with financial information presented on a U.S. GAAP basis. The Company defines its non-GAAP measures as follows: Adjusted EBITDA is a non-GAAP financial performance measure that enhances financial statement users overall understanding of the operating performance of the Company. The measure isolates unusual, infrequent or non-cash transactions from the operating performance of the business. This allows users to easily compare operating performance among various fiscal periods and how management measures the performance of the business. This measure also provides users with a benchmark that can be used when forecasting future operating performance of the Company that excludes unusual, nonrecurring or one time transactions. Adjusted EBITDA is a component of the calculation used by stockholders and analysts to determine the value of our business when using the market approach, which applies a market multiple to financial metrics. It is also a measure used to calculate the leverage ratio of the Company, which is a key financial ratio monitored and used by the Company and its investors. Adjusted EBITDA is defined as net income (loss), plus non-operating expenses, income tax expense, depreciation and amortization, assets loss (gain) on sales, impairments and other, restructuring costs and other, stock compensation and our 50% share of EBITDA from TNI and MNI, minus equity in earnings of TNI and MNI. Cash Costs represent a non-GAAP financial performance measure of operating expenses which are measured on an accrual basis and settled in cash. This measure is useful to investors in understanding the components of the Company’s cash-settled operating costs. Periodically, the Company provides forward-looking guidance of Cash Costs, which can be used by financial statement users to assess the Company's ability to manage and control its operating cost structure. Cash Costs are defined as compensation, newsprint and ink and other operating expenses. Depreciation and amortization, assets loss (gain) on sales, impairments and other, other non-cash operating expenses and other expenses are excluded. Cash Costs also exclude restructuring costs and other, which are typically paid in cash. Same-store revenues is a non-GAAP performance measure based on U.S. GAAP revenues for Lee for the current period, excluding exited operations. Exited operations include (1) business divestitures and (2) the elimination of stand-alone print products discontinued within our markets. Direct Costs is a non-GAAP financial performance measure that enhances financial statement users overall understanding of the operating performance of the Company. The measure isolates operating costs that directly support revenue. Depreciation and amortization, assets loss (gain) on sales, impairments and other, net, other non-cash operating expenses, Selling, General, and Administrative (“SG&A”) compensation and SG&A other operating expenses are excluded. TNI and MNI – TNI refers to TNI Partners publishing operations in Tucson, AZ. MNI refers to Madison Newspapers, Inc. publishing operations in Madison, WI. Management’s Use of Non-GAAP Measures These Non-GAAP Measures are not measurements of financial performance under U.S. GAAP and should not be considered in isolation or as an alternative to income from operations, net income (loss), revenues, or any other measure of performance or liquidity derived in accordance with U.S. GAAP. We believe these non-GAAP financial measures, as we have defined them, are helpful in identifying trends in our day-to-day performance because the items excluded have little or no significance on our day-to-day operations. These measures provide an assessment of controllable expenses and afford management the ability to make decisions which are expected to facilitate meeting current financial goals as well as achieve optimal financial performance. We use these Non-GAAP measures of our day-to-day operating performance, which is evidenced by the publishing and delivery of news and other media and excludes certain expenses that may not be indicative of our day-to-day business operating results. Limitations of Non-GAAP Measures Each of our non-GAAP measures have limitations as analytical tools. They should not be viewed in isolation or as a substitute for U.S. GAAP measures of earnings. Material limitations in making the adjustments to our earnings to calculate Adjusted EBITDA using these non-GAAP financial measures as compared to U.S. GAAP net income (loss) include: the cash portion of interest / financing expense, income tax (benefit) provision, and charges related to asset impairments, which may significantly affect our financial results. Management believes these items are important in evaluating our performance, results of operations, and financial position. We use non-GAAP financial measures to supplement our U.S. GAAP results in order to provide a more complete understanding of the factors and trends affecting our business.

17 QUARTERLY REVENUE COMPOSITION (1) Same-store revenues is a non-GAAP performance measure based on U.S. GAAP revenues for Lee for the current period, excluding exited operations. Exited operations include (1) business divestitures and (2) the elimination of stand-alone print products discontinued within our markets. Same-store revenue trends are displayed for year-over-year comparisons. (2) Total Digital Revenue is defined as digital advertising and marketing services revenue (including Amplified), digital-only subscription revenue and digital services revenue. Rounding – Items may not foot due to rounding. (Millions of Dollars) Q1 FY2023 Q2 FY2023 Q3 FY2023 Q4 FY2023 FY 2023 Q1 FY2024 Digital Advertising and Marketing Services 47.7 46.3 49.9 49.3 193.2 46.5 YoY (1) 11.3% 6.2% 7.8% 1.1% 6.4% -1.3% Digital Only Subscription Revenue 12.3 14.0 15.7 18.7 60.7 19.5 YoY (1) 56.2% 38.7% 43.3% 67.5% 51.4% 60.2% Digital Services Revenue 4.7 4.8 4.9 5.0 19.4 5.0 YoY (1) 2.2% 2.1% 12.6% 15.3% 7.8% 4.9% Total Digital Revenue(2) 64.8 65.0 70.5 73.0 273.2 70.9 YoY (1) 16.9% 11.5% 14.4% 13.6% 14.1% 10.8% % of Total Revenue 35.0% 38.1% 41.1% 44.5% 39.5% 45.5% Print Advertising Revenue 41.8 31.5 29.2 23.3 125.8 24.4 YoY (1) -24.3% -23.2% -26.9% -30.2% -26.0% -28.2% Print Subscription Revenue 67.4 64.6 61.8 58.8 252.6 51.9 YoY (1) -15.4% -16.3% -20.7% -25.0% -19.3% -22.5% Other Print Revenue 11.1 9.6 9.8 9.0 39.5 8.5 YoY (1) -2.2% -6.7% -8.3% -14.8% -7.9% -22.8% Total Print Revenue 120.3 105.7 100.8 91.1 417.9 84.8 YoY (1) -17.2% -17.5% -21.4% -25.5% -20.3% -24.2% Total Revenue 185.1 170.7 171.3 164.0 691.1 155.7 YoY (1) -7.4% -8.2% -9.6% -12.1% -9.3% -11.5%

18 RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Adjusted EBITDA is a non-GAAP financial performance measure that enhances financial statement users’ overall understanding of the operating performance of the Company. The measure isolates unusual, infrequent or non- cash transactions from the operating performance of the business. This allows users to easily compare operating performance among various fiscal periods and how management measures the performance of the business. This measure also provides users with a benchmark that can be used when forecasting future operating performance of the Company that excludes unusual, nonrecurring or one time transactions. Adjusted EBITDA is a component of the calculation used by stockholders and analysts to determine the value of our business when using the market approach, which applies a market multiple to financial metrics. It is also a measure used to calculate the leverage ratio of the Company, which is a key financial ratio monitored and used by the Company and its investors. Adjusted EBITDA is defined as net income (loss), plus non-operating expenses, income tax expense, depreciation and amortization, assets loss (gain) on sales, impairments and other, restructuring costs and other, stock compensation and our 50% share of EBITDA from TNI and MNI, minus equity in earnings of TNI and MNI. TNI and MNI – TNI refers to TNI Partners publishing operations in Tucson, AZ. MNI refers to Madison Newspapers, Inc. publishing operations in Madison, WI. Rounding – Items may not visually foot due to rounding. (Millions of Dollars) Q1 FY2024 Net Income 1.2 Adjusted to exclude Income tax expense 0.2 Non-operating expenses, net 6.4 Equity in earnings of TNI and MNI (1.5) Depreciation and amortization 7.3 Restructuring costs and other 4.3 Assets gain on sales, impairments and other, net (1.5) Stock compensation 0.2 Add Ownership share of TNI and MNI EBITDA (50%) 2.1 Adjusted EBITDA 18.6

19 RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Cash Costs represent a non-GAAP financial performance measure of operating expenses which are measured on an accrual basis and settled in cash. This measure is useful to investors in understanding the components of the Company’s cash-settled operating costs. Periodically, the Company provides forward-looking guidance of Cash Costs, which can be used by financial statement users to assess the Company's ability to manage and control its operating cost structure. Cash Costs are defined as compensation, newsprint and ink and other operating expenses. Depreciation and amortization, assets loss (gain) on sales, impairments and other, other non- cash operating expenses and other expenses are excluded. Cash Costs also exclude restructuring costs and other, which are typically paid in cash. Rounding – Items may not visually foot due to rounding. (Millions of Dollars) Q1 FY2024 Q1 FY2023 Operating Expenses 149.4 175.6 Adjusted to exclude Depreciation and amortization 7.3 7.9 Assets gain on sales, impairments and other, net (1.5) (2.6) Restructuring costs and other 4.3 0.6 Cash Costs 139.3 169.7

20 SAME-STORE NON-GAAP REVENUE RECONCILIATION(1) (Millions of Dollars) Q1 FY2024 Q1 FY2023 $ Variance % Variance Print Advertising Revenue 24.4 41.8 (17.4) -41.6% Exited operations (0.1) (7.9) Same-store, Print Advertising Revenue 24.4 33.9 (9.6) -28.2% Digital Advertising Revenue 46.5 47.7 (1.3) -2.7% Exited operations (0.1) (0.8) Same-store, Digital Advertising Revenue 46.4 47.0 (0.6) -1.3% Total Advertising Revenue 70.9 89.6 (8.4) -20.9% Exited operations (0.2) (8.7) Same-store, Total Advertising Revenue 70.7 80.9 (10.2) -12.6% (1) Same-store revenues is a non-GAAP performance measure based on U.S. GAAP revenues for Lee for the periods presented, excluding exited operations. Exited operations include (1) businesses divested and (2) the elimination of stand-alone print products discontinued within our markets. Rounding – Items may not foot due to rounding. (Millions of Dollars) Q1 FY2024 Q1 FY2023 $ Variance % Variance Print Subscription Revenue 51.9 67.4 (15.5) -23.0% Exited operations (0.2) (0.7) Same-store, Print Subscription Revenue 51.7 66.7 (15.0) -22.5% Digital Subscription Revenue 19.5 12.3 7.1 57.9% Exited operations (0.1) (0.2) Same-store, Digital Subscription Revenue 19.4 12.1 7.3 60.2% Total Subscription Revenue 71.3 79.7 (8.4) -10.5% Exited operations (0.3) (0.9) Same-store, Total Subscription Revenue 71.1 78.8 (7.7) -9.8% (Millions of Dollars) Q1 FY2024 Q1 FY2023 $ Variance % Variance Print Other Revenue 8.5 11.1 (2.6) -23.6% Exited operations (0.0) (0.1) Same-store, Print Other Revenue 8.5 11.0 (2.5) -22.8% Digital Other Revenue 5.0 4.7 0.2 4.9% Exited operations -- -- Same-store, Digital Other Revenue 5.0 4.7 0.2 4.9% Total Other Revenue 13.5 15.8 (2.4) -15.1% Exited operations (0.0) (0.1) Same-store, Total Other Revenue 13.5 15.7 (2.3) -14.5% (Millions of Dollars) Q1 FY2024 Q1 FY2023 $ Variance % Variance Total Operating Revenue 155.7 185.1 (29.4) -15.9% Exited operations (0.4) (9.7) Same-store, Total Operating Revenue 155.2 175.4 (20.1) -11.5%

21 SAME-STORE NON-GAAP REVENUE RECONCILIATION(1) (Millions of Dollars) FY2023 FY2022 $ Variance % Variance Print Advertising Revenue 125.8 185.0 (59.2) -32.0% Exited operations (14.6) (34.8) Same-store, Print Advertising Revenue 111.2 150.2 (39.0) -26.0% Digital Advertising Revenue 193.2 181.5 11.7 6.5% Exited operations (1.1) (1.0) Same-store, Digital Advertising Revenue 192.1 180.5 11.6 6.4% Total Advertising Revenue 319.0 366.4 (47.5) -12.9% Exited operations (15.7) (35.7) Same-store, Total Advertising Revenue 303.3 330.7 (27.4) -8.3% (1) Same-store revenues is a non-GAAP performance measure based on U.S. GAAP revenues for Lee for the periods presented, excluding exited operations. Exited operations include (1) businesses divested and (2) the elimination of stand-alone print products discontinued within our markets. Rounding – Items may not foot due to rounding. (Millions of Dollars) FY2023 FY2022 $ Variance % Variance Print Subscription Revenue 252.6 313.5 (60.9) -19.4% Exited operations (0.4) (0.8) Same-store, Print Subscription Revenue 252.2 312.7 (60.5) -19.3% Digital Subscription Revenue 60.7 40.1 20.6 51.3% Exited operations (0.2) (0.1) Same-store, Digital Subscription Revenue 60.5 40.0 20.6 51.4% Total Subscription Revenue 313.3 353.6 (40.3) -11.4% Exited operations (0.5) (1.0) Same-store, Total Subscription Revenue 312.7 352.6 (39.9) -11.3% (Millions of Dollars) FY2023 FY2022 $ Variance % Variance Print Other Revenue 39.5 43.0 (3.5) -8.0% Exited operations (0.0) (0.1) Same-store, Print Other Revenue 39.5 42.9 (3.4) -7.9% Digital Other Revenue 19.4 18.0 1.4 7.8% Exited operations -- -- Same-store, Digital Other Revenue 19.4 18.0 1.4 7.8% Total Other Revenue 58.9 60.9 (2.0) -3.4% Exited operations (0.0) (0.1) Same-store, Total Other Revenue 58.9 60.8 (2.0) -3.2% (Millions of Dollars) FY2023 FY2022 $ Variance % Variance Total Operating Revenue 691.1 781.0 (89.8) -11.5% Exited operations (16.2) (36.8) Same-store, Total Operating Revenue 674.9 744.2 (69.3) -9.3%

22 DIRECT COSTS RECONCILIATION (Millions of Dollars) Q1 FY24 Operating expenses 149.4 Adjusted to exclude Depreciation and amortization 7.3 Assets gain on sales, impairments and other, net (1.5) Restructuring costs and other 4.3 Selling, General, and Administrative compensation 43.9 Selling, General, and Administrative other operating expenses 27.2 Direct Costs 68.1 Direct Costs is a non-GAAP financial performance measure that enhances financial statement users overall understanding of the operating performance of the Company. The measure isolates operating costs that directly support revenue. Depreciation and amortization, assets loss (gain) on sales, impairments and other, net, other non-cash operating expenses, Selling, General, and Administrative (“SG&A”) compensation and SG&A other operating expenses are excluded. Rounding – Items may not visually foot due to rounding. (Millions of Dollars) Q1 FY24 Print Direct Costs 48.5 Digital Direct Costs 19.7 Total Direct Costs 68.1

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

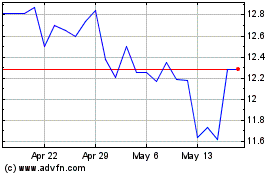

Lee Enterprises (NASDAQ:LEE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lee Enterprises (NASDAQ:LEE)

Historical Stock Chart

From Apr 2023 to Apr 2024