0000889331falseLITTELFUSE INC /DE00008893312024-01-262024-01-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

FORM 8-K

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: January 26, 2024

(Date of earliest event reported)

LITTELFUSE, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 0-20388 | 36-3795742 |

(State of other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

8755 W. Higgins Road, Suite 500, Chicago, IL 60631

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (773) 628-1000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of exchange on which registered |

| Common Stock, par value $0.01 per share | | LFUS | | NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers |

(e) On January 26th, 2024, the Board of Directors (the “Board”) of Littelfuse, Inc. (the “Company”) approved the Littelfuse, Inc. Amended and Restated Annual Incentive Plan (the “Incentive Plan”) to be effective as of January 1, 2024, which amends and restates the previous Littelfuse, Inc. Annual Incentive Plan, dated January 31, 2014 (the “Prior Plan”).

The Incentive Plan amends and restates the Prior Plan to (i) increase the maximum award limit from $2,500,000 to $5,000,000, (ii) remove references to Section 162(m) of the Internal Revenue Code of 1986, as amended, which no longer applies to awards under the Incentive Plan as a result of the enactment of the Tax Cuts and Jobs Act of 2017, which eliminated the performance-based compensation exception under Section 162(m) for tax years beginning on or after January 1, 2018, and make related adjustments to affected provisions, (iii) allow the Compensation Committee of the Board with the discretion to adjust any awards upward, as well as downward, for any plan participant, including Named Executive Officers, and (iv) clarify that payments received under the Incentive Plan are subject to certain “clawback” rights in favor of the Company, including pursuant to the Company’s Compensation Recovery Policy.

The foregoing summary of the Incentive Plan does not purport to be complete and is qualified in its entirety by reference to the full text of the Incentive Plan, a copy of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

| | | | | |

| (d) Exhibits | |

| Exhibit No. | Description |

| Amended and Restated Annual Incentive Plan |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | |

| | Littelfuse, Inc. |

| | |

| | |

| Date: February 1, 2024 | By: /s/ Ryan K. Stafford |

| | Executive Vice President, Mergers & Acquisitions, Chief Legal Officer and Corporate Secretary |

LITTELFUSE, INC. AMENDED & RESTATED ANNUAL INCENTIVE PLAN

restated effective January 1, 2024

1.Establishment. On January 25, 2024, the Board of Directors of Littelfuse, Inc., upon recommendation by the Compensation Committee of the Board of Directors, approved this amended and restated incentive plan for executives and key employees of the Company, to be known as the “Littelfuse, Inc. Amended & Restated Annual Incentive Plan.”

2.Purpose. The purpose of this Plan is to advance the interests of Littelfuse, Inc. and its shareholders by attracting and retaining key employees, and by stimulating the efforts of such employees to contribute to the continued success and growth of the business of the Company.

3.Definitions. When the following terms are used herein with initial capital letters, they shall have the following meanings:

1.1“Award” means a right granted to a Participant to receive a cash incentive payment upon the achievement of certain Performance Factors as set forth in the Plan.

1.2“Base Salary” means a Participant’s annualized base salary as of October 31 of the applicable Performance Period or, if earlier, the date the Participant terminates employment if payment is made under Section 5.2(b) on account of death, disability or retirement.

1.3“Code” means the Internal Revenue Code of 1986, as it may be amended from time to time, and any Treasury Regulations or other authoritative administrative guidance promulgated thereunder.

1.4“Company” means Littelfuse, Inc., a Delaware corporation, and its subsidiaries or affiliates, whether now or hereafter established.

1.5“Compensation Committee” means the Compensation Committee of the Board of Directors of Littelfuse, Inc., or such other committee as may be designated by the Board of Directors to administer the plan.

1.6“Maximum Award” means a dollar amount or a percentage of Base Salary, as determined by the Compensation Committee for each Performance Period, which represents the payment that the Participant will earn if the maximum level of the Participant’s Performance Factors is achieved.

1.7“Participant” means any management or key employee of the Company for whom the Compensation Committee has approved an Award for the applicable Performance Period, which approval may be by name, title, or other classification and will generally occur during the first ninety (90) days of the Performance Period. Directors of the Company who are not also employees of the Company are not eligible to participate in the Plan. A person who is hired by the Company, or promoted to a position in which he is eligible to be a Participant, during a Performance Period will generally only be entitled to an Award if the person’s date of hire or promotion occurs on or prior to October 31, in which event the Performance Period for such Participant shall be the portion of the Performance Period remaining after such date of hire or promotion.

1.8“Performance Factor” means the performance goals designated in the Award for each Participant with respect to each Performance Period, the achievement of which shall determine the amount of the Participant’s Award for the Performance Period. The Performance Factors may be based solely upon one or more of the following business criteria, which may apply to the individual in question, an identifiable business unit, or the Company, as a whole or in reference to another company, peer group, or index, and on an annual or other periodic or cumulative basis:

•sales values,

•margins (including profit, operating profit, or gross margins),

•volume,

•assets,

•cash flow,

•free cash flow,

•stock price,

•market share,

•revenue,

•revenue growth rate,

•revenue ratios (per employee or per customer),

•sales,

•earnings per share (either primary or fully diluted),

•profits,

•net income,

•cash from operations,

•net operating profit after taxes,

•pre-tax earnings,

•operating earnings,

•earnings before interest and taxes,

•earnings before interest, taxes, and depreciation and/or amortization,

•return on equity,

•return on assets (including return on net assets or net tangible assets),

•return on sales,

•return on capital,

•return on invested capital,

•return on capital employed,

•economic value added,

•total shareholder return,

•working capital,

•customer growth,

•dividends,

•internal rate of return,

•attainment of strategic and operational initiatives,

•safety,

•reduction of costs,

•capital expenditures,

•debt level,

•resolution of administrative or judicial proceedings or disputes,

•total market value,

•productivity,

•operating efficiency,

•customer satisfaction,

•reduction of (or limiting increases in) long or short term public or private debt or similar financial obligations (in each case, whether compared to pre-selected peer groups or not), or

•such other business criteria as the Compensation Committee may determine to be appropriate, which may include financial and nonfinancial performance goals that are linked to such individual’s business unit or the Company as a whole or to such individual’s areas of responsibility, and which may include subjective determinations by the Compensation Committee or the Participant’s superiors.

The Compensation Committee shall adjust any Performance Factor to the extent necessary to prevent dilution or enlargement of an Award as a result of extraordinary events or circumstances, as determined by the Compensation Committee in its sole discretion, or to exclude the effects of extraordinary, unusual, or non-recurring items; changes in applicable

laws, regulations, or accounting principles; currency fluctuations; discontinued operations; non- cash items, or reserves; asset impairment; or any recapitalization, restructuring, reorganization, merger, acquisition, divestiture, consolidation, spin-off, split-up, combination, liquidation, dissolution, sale of assets, or other similar corporate transaction.

1.9“Performance Period” means each consecutive twelve-month period commencing on January 1 of each calendar year during the term of this Plan, or a portion of such twelve-month period with respect to a person who becomes a Participant during such period as provided in the last sentence of Section 3.8, or such other period as determined by the Compensation Committee.

1.10“Plan” means this Littelfuse, Inc. Amended & Restated Annual Incentive Plan, as amended or restated from time to time.

1.11“Target Award” means a dollar amount or a percentage of Base Salary determined by the Compensation Committee with respect to each Participant for each Performance Period, which represents the payment that the Participant will earn if the target level of the Participant’s Performance Factors is achieved.

1.12“Threshold Award” means a dollar amount or a percentage of Base Salary, as determined by the Compensation Committee with respect to each Participant for each Performance Period, which represents the payment that the Participant will earn if the threshold level of the Participant’s Performance Factors is achieved.

4.Administration.

1.1Power and Authority of Compensation Committee. The Plan shall be administered by the Compensation Committee. The Compensation Committee shall have full power and authority, subject to all applicable provisions of the Plan and applicable law, to (a) establish, amend, suspend or waive such rules and regulations and appoint such agents as it deems necessary or advisable for the proper administration of the Plan, (b) construe, interpret and administer the Plan and any instrument or agreement relating to the Plan, and (c) make all other determinations and take all other actions necessary or advisable for the administration of the Plan. Unless otherwise expressly provided in the Plan, each determination made and each action taken by the Compensation Committee pursuant to the Plan or any instrument or agreement relating to the Plan (i) shall be within the sole discretion of the Compensation Committee, (ii) may be made at any time and (iii) shall be final, binding and conclusive for all purposes on all persons, including, but not limited to, Participants and employees of the Company, and their legal representatives and beneficiaries.

1.2Delegation. The Compensation Committee may delegate its powers and duties under the Plan, with respect to the eligibility of and Awards to one or more Participants, to one or more officers of the Company or a committee of such officers, subject to such terms, conditions and limitations as the Compensation Committee may establish in its sole discretion; provided, however, that the Compensation Committee shall not delegate its power to make grants to or determinations (including certification pursuant to Section 4.4) regarding executive officers, and provided further, that no such officer shall have been delegated powers with respect to his or her own Award. The Compensation Committee initially delegates its powers and duties under the Plan, with respect to the eligibility of and Awards to Participants who are not officers of the Company, to its Chief Executive Officer, Chief Legal Officer, Chief Financial Officer, and Chief Human Resources Officer, each of whom may exercise such powers individually until such time as the Compensation Committee acts to modify or terminate such delegation.

1.3Determinations at the Outset of Each Performance Period. Generally on or before the ninetieth (90th) day of each Performance Period (except as provided for late entrants in Section 3.8), the Compensation Committee shall approve Awards for such Performance

Period, including the Threshold Award, Target Award and Maximum Award (as applicable), and the Performance Factors and a formula to determine the amount of the Award that will be earned at different levels of achievement of the Performance Factors.

1.4Certification. Following the close of each Performance Period and prior to payment of any amount to any Participant under the Plan, the Compensation Committee must certify in writing which of the applicable Performance Factors for that Performance Period have been achieved and the attainment of all other factors upon which any payments to a Participant for that Performance Period are to be based and the corresponding Award amounts. Such certification shall be made in time to permit payments to be made not later than the fifteenth (15th) day of the third (3rd) calendar month following the end of the Performance Period.

5.Incentive Payment.

1.1Formula. Subject to the provisions of this Plan, each Participant shall receive an incentive payment for each Performance Period in the amount determined by the extent to which his or her Performance Factors have been achieved under the terms of his or her Award.

1.2Limitations.

(a)Discretionary Increase or Reduction. Subject to the provisions of Section 3.9, the Compensation Committee shall retain sole and absolute discretion to increase or reduce the amount of any incentive payment otherwise payable to any Participant under this Plan.

(b)Continued Employment. Except as otherwise provided by the Compensation Committee, no incentive payment under this Plan with respect to a Performance Period shall be paid or owed to a Participant who is not employed in good standing, as determined by the Compensation Committee, on the date payment is made for a Performance Period under Section 6.1. In the event that a Participant dies or becomes permanently disabled within the meaning of the Company’s long-term disability plan, is terminated without cause (as determined by the Committee within its sole discretion) or retires with approval of the Company (as determined by the Company within its sole discretion) during the Performance Period, the Compensation Committee may, but shall not be obligated to, provide for the payment of all or an appropriate pro rata portion (as determined by the Compensation Committee in its sole discretion) of such Participant’s Award for the Performance Period at such time as payments are otherwise made to Participants under Section 6.1. To the extent that any payments are approved by the Compensation Committee for a Participant who is not employed in good standing as of the date Awards are paid for a Performance Period or has otherwise terminated employment prior to such payment date under circumstances that do not qualify for payment on death, disability, termination without cause or retirement under this Section, such payments shall instead be made outside of this Plan.

(c)Maximum Payments. No Participant shall receive a payment under this Plan for any Performance Period of twelve (12) months in excess of Five Million Dollars ($5,000,000). For any Performance Period that is not twelve (12) months, such maximum payment amount shall be proportionately adjusted based on the number of days in the Performance Period.

6.Benefit Payments.

1.1Time and Form of Payments. All payments of Awards pursuant to the Plan shall be made not later than the fifteenth (15th) day of the third (3rd) month following the end of the Performance Period; provided that the Compensation Committee may permit Participants to elect to defer payment of their Awards pursuant to a deferred compensation plan established by the Company that satisfies the requirements of Section 409A of the Code. All such deferral

elections shall be made not later than the last day immediately prior to the commencement of the Performance Period and shall be irrevocable, except as otherwise provided by the terms of such deferred compensation plan and permitted by Section 409A of the Code; provided that the Compensation Committee may permit a deferral election to be made either within thirty (30) days after a Participant first becomes eligible to participate in any elective deferred compensation plan of the Company (in which event the election shall apply only to the portion of the Award earned after the date of the election) or not later than six (6) months prior to the end of the Performance Period if the Compensation Committee determines (taking into account the terms of any employment or other agreement that may affect the payment of the Award) that an Award constitutes qualified performance-based compensation for purposes of Section 409A of the Code.

1.2Nontransferability. Except as otherwise determined by the Compensation Committee, no right to any incentive payment under this Plan, whether payable in cash, shares or other property, shall be transferable by a Participant other than by will or by the laws of descent and distribution; provided, however, that if so determined by the Compensation Committee, a Participant may, in the manner established by the Compensation Committee, designate a beneficiary or beneficiaries to exercise the rights of the Participant and receive any cash, shares or property due under the Participant’s Award upon the death of the Participant. No right to any incentive payment under this Plan may be pledged, attached or otherwise encumbered, and any purported pledge, attachment or encumbrance thereof shall be void and unenforceable against the Company.

1.3Tax Withholding. In order to comply with all applicable federal, state or local income, social security, payroll, withholding or other tax laws or regulations, the Company may establish such policy or policies as it deems appropriate with respect to such laws and regulations, including without limitation, the establishment of policies to ensure that all applicable federal, state or local income, social security, payroll, withholding or other taxes, which are the sole and absolute responsibility of the Participant, are withheld or collected from such Participant.

7.Amendment and Termination; Adjustments. Except to the extent prohibited by applicable law and unless otherwise expressly provided in the Plan:

1.1Amendment and Termination of the Plan. The Board of Directors of Littelfuse, Inc. may amend, alter, suspend, discontinue or terminate the Plan without the approval of the shareholders of the Company, except that no such amendment, alteration, suspension, discontinuation or termination shall be made that, absent such approval, would violate the rules or regulations of the NASDAQ Stock Market or any other securities rules and regulations that are applicable to the Company.

1.2Waivers of Incentive Payment Conditions or Rights. The Compensation Committee may waive, prospectively or retroactively, any conditions to or rights of the Company under any right to an incentive payment under this Plan.

1.3Limitation on Amendments to Incentive Payment Rights. Neither the Compensation Committee, its delegates, nor the Company may amend, alter, suspend, discontinue or terminate, prospectively or retroactively, any rights to an incentive payment without the consent of the applicable Participant or beneficiary, except as otherwise herein provided.

1.4Correction of Defects, Omissions and Inconsistencies. The Compensation Committee may correct any defect, supply any omission or reconcile any inconsistency in the Plan in the manner and to the extent it shall deem desirable to carry the Plan into effect.

1.5Forfeiture & Clawback. Incentive payments received under the Plan are subject to those clawback rights for executive officers described in the Company’s Compensation Recovery Policy, any forfeiture or clawback prescribed by law or Company policies, and any clawback that becomes necessary as a result of adjustments made by the Compensation Committee as described in Section 7.4.

8.Miscellaneous.

1.1Effective Date. This amended and restated Plan was approved by the Board of Directors of Littelfuse, Inc. to be effective as of January 1, 2024.

1.2Term of the Plan. This Plan shall continue indefinitely until otherwise terminated pursuant to Section 7.1. No right to receive an incentive payment shall be granted after the termination of the Plan. However, unless otherwise expressly provided in the Plan, any right to receive an incentive payment theretofore granted may extend beyond the termination of the Plan, and the authority of the Board of Directors and the Compensation Committee and its delegates to amend or otherwise administer the Plan shall extend beyond the termination of the Plan.

1.3Headings. Headings are given to the Sections and subsections of the Plan solely as a convenience to facilitate reference. Such headings shall not be deemed in any way material or relevant to the construction or interpretation of the Plan or any provision thereof.

1.4Applicability to Successors. This Plan shall be binding upon and inure to the benefit of the Company and each Participant, the successors and assigns of the Company, and the beneficiaries, personal representatives and heirs of each Participant. If the Company becomes a party to any merger, consolidation or reorganization, this Plan shall remain in full force and effect as an obligation of the Company or its successors in interest.

1.5Employment Rights and Other Benefit Programs. The provisions of this Plan shall not give any Participant any right to be retained in the employment of the Company. In the absence of any specific agreement to the contrary, this Plan shall not affect any right of the Company, or of any affiliate of the Company, to terminate, with or without cause, any Participant’s employment or service at any time. This Plan shall not replace any contract of employment, whether oral or written, between the Company and any Participant, but shall be considered a supplement thereto. This Plan is in addition to, and not in lieu of, any other employee benefit plan or program in which any Participant may be or become eligible to participate by reason of employment with the Company. No compensation or benefit awarded to or realized by any Participant under the Plan shall be included for the purpose of computing such Participant’s compensation under any compensation-based retirement, disability, or similar plan of the Company, unless required by law or otherwise provided by such other plan. A Participant’s receipt of an Award for any Performance Period shall not entitle the Participant to Awards for any other Performance Period.

1.6No Trust or Fund Created. This Plan shall not create or be construed to create a trust or separate fund of any kind or a fiduciary relationship between the Company or any affiliate and a Participant or any other person. To the extent that any person acquires a right to receive payments from the Company or any affiliate pursuant to this Plan, such right shall be no greater than the right of any unsecured general creditor of the Company or of any affiliate.

1.7Governing Law. The validity, construction and effect of the Plan or any incentive payment payable under the Plan shall be determined in accordance with the laws of the State of Delaware.

1.8Severability. If any provision of the Plan is, becomes, or is deemed to be invalid, illegal or unenforceable in any jurisdiction, such provision shall be construed or deemed amended to conform to applicable laws, or if it cannot be so construed or deemed amended without, in the determination of the Compensation Committee, materially altering the purpose or intent of the Plan, such provision shall be stricken as to such jurisdiction, and the remainder of the Plan shall remain in full force and effect.

1.9Certain Tax Matters. All of the terms and conditions of the Plan shall be interpreted in such a fashion as to qualify all compensation paid to a Participant hereunder so that no payments constitute deferred compensation subject to Section 409A of the Code, unless a Participant elects to defer a payment pursuant to a deferred compensation plan.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

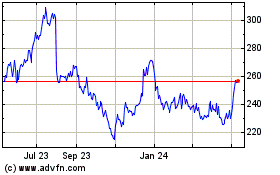

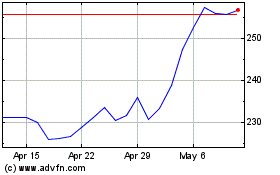

Littelfuse (NASDAQ:LFUS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Littelfuse (NASDAQ:LFUS)

Historical Stock Chart

From Apr 2023 to Apr 2024