Mullen Capitalizes on First-Mover Advantage in Class 1 EV Cargo Vans and Class 3 EV Trucks

February 01 2024 - 9:10AM

via IBN -- Mullen Automotive Inc. (NASDAQ: MULN) (“Mullen” or the

“Company”), an emerging electric vehicle (“EV”) manufacturer,

announces today the Company continues to capitalize on its

first-mover advantage in the U.S. market with production and

deliveries of its Class 1 and Class 3 commercial EVs.

“While many of the OEMs and new EV companies have launched their

EVs with significant losses, Mullen is out-of-the-gate with a

positive gross profit margin per vehicle. EV growth has slowed in

the retail segment but continues to increase across the commercial

and fleet segments, where we now have a strong vehicle lineup in

the market,” said David Michery, CEO and chairman of Mullen

Automotive.

Mullen began Class 3 vehicle production in August 2023 and first

vehicle deliveries in September 2023. Mullen Class 1 production

began in November 2023 with first vehicle deliveries in December

2023.

The all-electric Mullen ONE Class 1 EV cargo van and Mullen

THREE Class 3 low cab forward EV truck are both purpose-built to

meet the demands of urban last-mile delivery. Mullen recently

announced that its Class 1 and Class 3 commercial vehicles are now

both in receipt of Environmental Protection Agency (“EPA”) and CARB

certifications. Both vehicles are also in full compliance with U.S.

Federal Motor Vehicle Safety Standards. Having received credentials

from CARB and the EPA, Mullen can now sell both the Mullen ONE

and THREE in every state throughout the U.S.

About MullenMullen Automotive (NASDAQ: MULN) is

a Southern California-based automotive company building the next

generation of electric vehicles (“EVs”) that will be manufactured

in its two United States-based assembly plants. Mullen’s EV

development portfolio includes the Mullen FIVE EV Crossover,

Mullen-GO Commercial Urban Delivery EV, Mullen Commercial Class 1-3

EVs and Bollinger Motors, which features both the B1 and B2

electric SUV trucks and Class 4-6 commercial offerings. On Sept. 7,

2022, Bollinger Motors became a majority-owned EV truck company of

Mullen Automotive, and on Dec. 1, 2022, Mullen closed on the

acquisition of Electric Last Mile Solutions’ (“ELMS”) assets,

including all IP and a 650,000-square-foot plant in Mishawaka,

Indiana.

To learn more about the Company, visit www.MullenUSA.com.

Forward-Looking StatementsCertain statements in

this press release that are not historical facts are

forward-looking statements within the meaning of Section 27A of the

Securities Exchange Act of 1934, as amended. Any statements

contained in this press release that are not statements of

historical fact may be deemed forward-looking statements. Words

such as "continue," "will," "may," "could," "should," "expect,"

"expected," "plans," "intend," "anticipate," "believe," "estimate,"

"predict," "potential" and similar expressions are intended to

identify such forward-looking statements. All forward-looking

statements involve significant risks and uncertainties that could

cause actual results to differ materially from those expressed or

implied in the forward-looking statements, many of which are

generally outside the control of Mullen and are difficult to

predict. Examples of such risks and uncertainties include but are

not limited to the demand, sales volume and timing of future

production and deliveries of the Mullen Class 1 and Class 3

vehicles. Additional examples of such risks and uncertainties

include but are not limited to: (i) Mullen’s ability (or inability)

to obtain additional financing in sufficient amounts or on

acceptable terms when needed; (ii) Mullen's ability to maintain

existing, and secure additional, contracts with manufacturers,

parts and other service providers relating to its business; (iii)

Mullen’s ability to successfully expand in existing markets and

enter new markets; (iv) Mullen’s ability to successfully manage and

integrate any acquisitions of businesses, solutions or

technologies; (v) unanticipated operating costs, transaction costs

and actual or contingent liabilities; (vi) the ability to attract

and retain qualified employees and key personnel; (vii) adverse

effects of increased competition on Mullen’s business; (viii)

changes in government licensing and regulation that may adversely

affect Mullen’s business; (ix) the risk that changes in consumer

behavior could adversely affect Mullen’s business; (x) Mullen’s

ability to protect its intellectual property; and (xi) local,

industry and general business and economic conditions. Additional

factors that could cause actual results to differ materially from

those expressed or implied in the forward-looking statements can be

found in the most recent annual report on Form 10-K, quarterly

reports on Form 10-Q and current reports on Form 8-K filed by

Mullen with the Securities and Exchange Commission. Mullen

anticipates that subsequent events and developments may cause its

plans, intentions and expectations to change. Mullen assumes no

obligation, and it specifically disclaims any intention or

obligation, to update any forward-looking statements, whether as a

result of new information, future events or otherwise, except as

expressly required by law. Forward-looking statements speak only as

of the date they are made and should not be relied upon as

representing Mullen’s plans and expectations as of any subsequent

date.

Contact:Mullen Automotive, Inc.+1 (714)

613-1900www.MullenUSA.com

Corporate Communications:InvestorBrandNetwork

(IBN) Los Angeles, California www.InvestorBrandNetwork.com

310.299.1717 Office Editor@InvestorBrandNetwork.com

- To date, Mullen has invoiced over $17M for commercial

vehicles

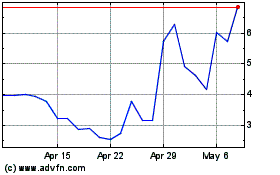

Mullen Automotive (NASDAQ:MULN)

Historical Stock Chart

From Mar 2024 to Apr 2024

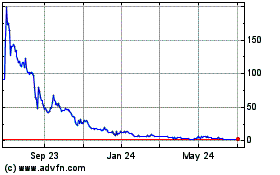

Mullen Automotive (NASDAQ:MULN)

Historical Stock Chart

From Apr 2023 to Apr 2024