false

0001605331

0001605331

2024-01-26

2024-01-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January

26, 2024

AB International

Group Corp.

(Exact name of registrant as specified in its charter)

| Nevada |

000-55979 |

37-1740351 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

144

Main Street,

Mt. Kisco, NY |

10549 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (914) 202-3108

|

______________________

(Former name or former address, if changed since last

report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| [ ] |

Written communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| |

|

| [ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| [ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| [ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. [ ]

Item 1.01 Entry into a Material Definitive Agreement.

On January 26, 2024, AB International Group Corp. (the “Company”)

entered into Repurchase Agreements with six shareholders, all non-affiliates of the Company, pursuant to which the Company agreed to repurchase

shares of their Common Stock, $0.001 par value, amounting to 45,173,980 shares for cancellation. The price to be paid by the Company under

the Repurchase Agreements is $112,935, which will be funded with cash on hand.

The description of the Form of Share Repurchase Agreement in this report

is qualified in its entirety by reference to the full text of the Repurchase Agreement, which is filed as Exhibit 10.1 to this Current

Report on Form 8-K and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits

| Exhibit No. |

Description |

| 10.1 |

Form of Share Repurchase Agreement |

| 104 |

Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL Document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

AB International Group Corp.

/s/ Chiyuan Deng

Chiyuan Deng

President

Date: January 29, 2024

REPURCHASE AGREEMENT

This Repurchase Agreement is entered into as of this

___th day of January 2024, by and among AB International Group Corp. a Nevada corporation (the "Company"), and _________(the "Stockholder").

BACKGROUND

Stockholder owns ___________ shares of Common Stock

of the Company (the "Shares") and the Company is willing to repurchase the Shares for the Purchase Price (as defined below)

upon the terms and subject to the conditions set forth in this Agreement.

AGREEMENT

NOW, THEREFORE, the Stockholder and the Company agree

as follows:

SECTION 1

REPURCHASE AND SALE OF SHARES

1.1 Repurchase and Sale of Shares. On the terms and

subject to the conditions set forth in this Agreement, the Company agrees to purchase from the Stockholder and the Stockholder agrees

to sell, transfer, convey and deliver to the Company the Shares for the Purchase Price (as defined below).

1.2 Payment for Shares. The total purchase price for

the Shares shall be __________ United States Dollars ($_____ USD) (the "Purchase Price"). Upon receipt of the Purchase Price,

the Stockholder irrevocably appoints any officer, employee or agent of the Company as his attorney to cancel or transfer the Shares on

the books of the Company with full power of substitution. The Stockholder shall deliver to the Company, if applicable, all stock certificates

representing the Shares for cancellation and a stock power, duly signed by the Stockholder and medallion guaranteed.

SECTION 2

REPRESENTATIONS AND WARRANTIES

2.1 Representations and Warranties of the Stockholder.

The Stockholder represents and warrants to the Company as follows:

2.1.1 Power and Authority. The Stockholder

has the power and authority to execute and deliver this Agreement and consummate the transactions contemplated hereby.

2.1.2 Validity; Enforceability. This Agreement

and all other instruments or documents executed by the Stockholder in connection herewith have been duly executed by the Stockholder,

and constitute legal, valid and binding obligations of the Stockholder, enforceable in accordance with their respective terms.

2.1.3 No Encumbrances, Etc. The Stockholder

is the owner of record of all right, title and interest (legal and beneficial), free and clear of all liens, in and to the Shares. Upon

delivery of certificates representing the Shares to be sold by the Stockholder to the Company hereunder and payment therefor pursuant

to this Agreement, good, valid and marketable title to such Shares, free and clear of all liens, encumbrances, equities, claims, liabilities

or obligations, whether absolute, accrued, contingent or otherwise, will be transferred to the Company.

2.1.4 Knowledge; Access. The Stockholder

has such knowledge and experience in financial and business matters and has been furnished access to such information and documents concerning

the Company that it is capable of evaluating the merits and risks of accepting the Purchase Price in exchange for the Shares and the other

terms and conditions of this Agreement. The Stockholder has had an opportunity to ask questions and receive answers concerning the terms

and conditions of this repurchase and to obtain additional information regarding the Company's plans and future prospects.

2.1.5 Accredited Investor Status. The Stockholder

is an "accredited investor" as such term is defined in Rule 501(a) of Regulation D promulgated under the Securities Act of 1933,

as amended.

2.2 Representations and Warranties of the Company.

The Company represents and warrants to the Stockholder as follows:

2.2.1 Power and Authority. The Company has

the power and authority to execute and deliver this Agreement and consummate the transactions contemplated hereby.

2.2.2 Organization and Qualification. The

Company is a corporation, duly organized, validly existing and in good standing under the laws of the jurisdiction of its organization.

2.2.3 Validity; Enforceability. This Agreement

and all other instruments or documents executed by the Company in connection herewith have been duly executed by the Company, and constitute

legal, valid and binding obligations of the Company, enforceable in accordance with their respective terms, except as enforceability may

be limited by applicable bankruptcy, insolvency, reorganization, moratorium or similar laws affecting the enforcement of creditors' rights

generally and general principles of equity (whether considered in an action at law or in equity). The terms of this Agreement and the

underlying transaction comply with all applicable laws of the United States of America and of any applicable state thereof and no consent,

approval, order or authorization of, or registration, qualifications, designation, declaration or filing with, any federal, state or local

governmental authority on the part of the Company is required in connection with the consummation of the repurchase of Shares contemplated

by this Agreement.

SECTION 3

MISCELLANEOUS

3.2 Successors and Assigns. This Agreement shall be

binding upon and inure to the benefit of the parties hereto and their respective permitted successors and assigns.

3.3 Entire Agreement, Amendment. This Agreement constitutes

the entire agreement between the Company and Stockholder with respect to the transactions contemplated hereby and thereby; supersedes

all prior or contemporaneous negotiations, communications, discussions and correspondence concerning the subject matter hereof; and may

be amended or modified only with the written consent of the Company and the Stockholder.

3.4 Severability of Provisions. If any provision of

this Agreement shall be prohibited by or invalid under applicable law, such provision shall be ineffective only to the extent of such

prohibition or invalidity without invalidating the remainder of such provision or any remaining provisions of this Agreement, and the

parties shall use their respective best efforts to negotiate and enter into an amendment to this Agreement whereby such provision will

be modified in a manner that is consistent with the intended economic consequences of the invalid provision and that, as modified, is

legal and enforceable.

3.5 Governing Law. This agreement shall be governed

by and construed in accordance with the internal laws of the State of Nevada without giving effect to any choice of law or conflict, provision

or rule (whether of the State of Nevada or any other jurisdiction) that would cause the laws of any jurisdiction other than the State

of Nevada to be applied.

3.6 Counterparts. This Agreement may be executed in

separate counterparts, either of which, when so executed, shall be deemed to be an original and both of which, when taken together, shall

constitute but one and the same agreement.

3.7 Survival. The representations, warranties, covenants

and agreements made herein shall survive the execution and delivery of this Agreement and the consummation of the transactions contemplated

hereby, notwithstanding any investigation made by either party.

3.8 Further Assurances. Each party shall at any time

and from time to time after the date hereof take whatever actions the other party or its affiliates or agents reasonably request to effectuate,

record, evidence or perfect its transfer of the Shares to the Company pursuant to this Agreement or to otherwise effectuate or consummate

any of the transactions contemplated hereby.

3.9 Indemnification.

Each party shall indemnify the other against any loss, cost or damages (including reasonable attorney’s fees and expenses) incurred

as a result of such party’s breach of any representation, warranty, covenant or agreement in this Agreement.

IN WITNESS WHEREOF, the parties hereto have caused

this Agreement to be executed the day and year first written above.

|

The Company

AB International Group Corp.

______________________

By: Chiyuan Deng

Its: Chief Executive Officer

|

The Stockholder

________________________

|

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

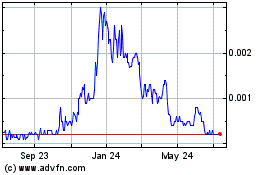

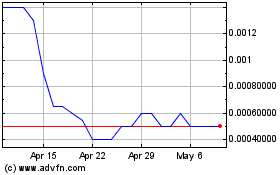

AB (PK) (USOTC:ABQQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

AB (PK) (USOTC:ABQQ)

Historical Stock Chart

From Apr 2023 to Apr 2024