Royal Philips NV (NYSE:PHG) – Royal Philips NV

has suspended sales of sleep apnea devices and ventilators in the

US after reaching an agreement with the US Food and Drug

Administration due to quality issues. Philips has set aside 363

million euros in the fourth quarter to cover the costs of the

agreement. The company faces class-action lawsuits and potentially

thousands of individual lawsuits related to defective devices. CEO

Roy Jakobs stated that the company sees “no appreciable harm

caused” by the devices, but the FDA disagrees. Shares dropped up to

6% in pre-market trading on Monday.

Microsoft (NASDAQ:MSFT) – Microsoft’s early

lead in artificial intelligence positions it to potentially surpass

Apple (NASDAQ:AAPL) in market value over the next

five years, according to 13 institutional investors. Microsoft,

with a market value of over $3 trillion, has excelled in generative

AI, while iPhone-dependent Apple faces challenges.

Nvidia (NASDAQ:NVDA) is also seen as a potential

competitor. In other news, Microsoft restored services to Microsoft

Teams on Saturday after an outage that affected access to the

messaging platform. The company identified a network issue and took

mitigation actions to address the problems reported by users.

Microsoft Teams is an important part of the Microsoft 365 software

suite used for online communication and collaboration.

Amazon (NASDAQ:AMZN) – MacKenzie Scott, the

ex-wife of Amazon CEO Jeff Bezos, sold 65.3 million Amazon shares

last year, representing about 25% of her stake in the company and

valued at $10.4 billion. She received shares as part of her divorce

from Bezos in 2019 and is a philanthropist committed to significant

charitable donations.

Spotify (NYSE:SPOT) – Spotify criticized Apple

for its plan to comply with the EU’s Digital Markets Act, calling

it a “complete and utter sham.” While developers can offer

alternative app stores on iPhones, Apple still demands a “basic

technology fee.” Spotify argued it would have to pay a 17%

commission under the new terms, compared to the current rate in the

App Store.

Apple (NASDAQ:AAPL) – An Apple veteran, DJ

Novotney, is joining Rivian Automotive

(NASDAQ:RIVN) as Senior Vice President of Vehicle Programs, marking

another senior departure from Cupertino. Novotney played a key role

in Apple’s product development, including the iPod, iPhone, iPad,

and Apple Watch, and also participated in Apple’s initial efforts

to develop an electric vehicle.

Baidu (NASDAQ:BIDU) – Samsung will feature

Baidu’s Ernie Bot as a highlight in its new Galaxy S24 smartphone

series in China. The partnership aims to offer AI features,

including text summarization, organization, and translation, as

well as support for Samsung’s “circle to search” function.

Uber (NYSE:UBER) – Uber has filed a legal

appeal against restrictions imposed on VTCs (touring cars with

drivers) in Paris, seeking to overturn Mayor Anne Hidalgo’s

decision to exclude them from rue de Rivoli and rue Saint-Antoine,

citing transportation concerns during the summer Olympics.

Toyota (NYSE:TM) – Toyota Motor announced the

suspension of shipments of some models, such as Hilux and Land

Cruiser 300, due to irregularities in diesel engine certification

tests by affiliate Toyota Industries. Ten models are affected

globally, including the Lexus LX500D. Additionally, the Toyota

union is seeking a record annual bonus of 7.6 months’ salary,

surpassing the previous high of 7.2 months, driven by the company’s

projected profits and the need to increase wages. The final

decision is expected by the end of February.

Ferrari (NYSE:RACE) – Ferrari is in talks with

the Italian government to amend a capital market law that could

facilitate its return to Italy from the Netherlands, seeking to

protect the voting rights of its main shareholder, the Agnelli

family, under Dutch law.

Boeing (NYSE:BA) – The first Boeing 737 MAX

delivered to a Chinese airline since 2019 arrived in China on

Saturday, marking the end of a nearly five-year freeze on imports

of these jets. China Southern Airlines received the delivery,

ending the suspension that began after two accidents in 2018 and

2019. This could potentially trigger the delivery of several dozen

MAX jets ordered by China.

Ryanair (NASDAQ:RYAAY) – Ryanair revised its

annual profit forecast downwards due to disruptions in sales by

online travel agents. It now projects a profit between $2 to $2.1

billion, below the previous forecast. In the 3rd quarter, profit

was €15 million. Traffic increased by 7%, and fares rose by 13%.

CEO O’Leary maintains a target of 300 million passengers by 2034,

up from 183.5 million in the current year. Ryanair expressed

interest in purchasing Boeing‘s 737 MAX 10 jets

that U.S. customers may not wish to receive, stating it would

acquire them “at the right price.” The European airline expects the

MAX 10’s certification by the end of the year and flights from

2025.

United Airlines (NASDAQ:UAL) – United Airlines

approached Airbus to buy more A321neo jets due to the delay of the

Boeing 737 MAX 10, while also revisiting the ordered A350s. The

talks are in the early stages, focusing on the availability of the

A321neo. The future of the MAX is uncertain, and Airbus leads the

market with the A321neo. United Airlines resumed using its Boeing

737 MAX 9 jets for passenger flights following approval by U.S.

regulators, after a cabin explosion on an Alaska Airlines flight.

The first operation took place from Newark to Las Vegas. The FAA

lifted its suspension order but imposed new inspections and

maintenance checks.

Alaska Airlines (NYSE:ALK) – Alaska Airlines

completed inspections on its first group of Boeing 737 MAX 9

aircraft after a cabin explosion, allowing the carrier to resume

some operations with the MAX 9.

Lockheed Martin (NYSE:LMT) – Lockheed Martin

plans to cut 1% of its jobs over the year to reduce costs and

improve efficiency. The reductions will affect various areas of the

defense company, including hiring freezes and voluntary

separations. This is part of efforts to optimize the supply chain

and digitally transform the company’s operations as they face

supply chain challenges and anticipate lower-than-expected profits

for 2024.

Shell (NYSE:SHEL) – Shell’s exit from Nigeria’s

onshore oil sector highlights the challenges faced by major oil

companies in the country, but also raises hopes that local

companies can offset the decline in production in the Niger Delta.

The production decline is attributed to these factors and the lack

of investment in onshore assets by major companies. Local companies

could play a significant role in reversing this decline, but face

financial challenges. Additionally, Shell will close its oil

refinery in Wesseling, Germany, by 2025, converting it into a Group

III base oil production unit for lubricants, aiming to reduce

carbon and operational emissions. The change is expected to reduce

about 620,000 tons of carbon emissions per year. The company also

plans to sell its refining unit in Singapore.

Dollar Tree (NASDAQ:DLTR) – Houthi attacks in

the Red Sea are raising concerns about maritime transport costs.

Wells Fargo sees Dollar Tree at greater risk, with estimates of

impact on its profits at 15 to 25 cents per share in 2024.

Farfetch (NYSE:FTCH) – Farfetch, a global

luxury fashion platform, plans to sell its luxury online retail

platform to South Korean company Coupang. Bondholders, representing

more than 50% of Farfetch’s $400 million in convertible notes, seek

to protect their interests and possibly find allies among

convertible debt holders of Richemont and Alibaba Group Holding

(NYSE:BABA). Despite market pessimism, Farfetch still owns an

attractive platform and had significant revenues in 2023.

Willscot Mobile Mini Holdings (NASDAQ:WSC),

McGrath RentCorp (NASDAQ:MGRC) – Willscot Mobile

Mini Holdings is preparing to announce a deal of over $3 billion to

acquire McGrath RentCorp in a partnership of mobile construction

companies. The cash and stock deal is expected to be made official

on Monday, as reported by the Journal.

ResMed (NYSE:RMD) – ResMed’s shares dropped 40%

between July and October, due to concerns about the demand for

CPAPs after the success of weight loss drugs from Novo

Nordisk (NYSE:NVO) and Eli Lilly

(NYSE:LLY). However, the company noted an increase in CPAP

compliance among patients who were also taking GLP-1 medications,

which could indicate a positive impact on treatment adherence. The

company reported a recent increase in sales and profits, boosting

its shares. Eli Lilly is also conducting a clinical study to assess

the impact of GLP-1 medications on sleep apnea.

Archer-Daniels-Midland (NYSE:ADM) –

Archer-Daniels-Midland will delay performance bonus payments to

some executives until its financial statements are audited,

following an investigation into accounting practices in the

nutrition segment. ADM’s long-term compensation was tied to the

profit growth of this unit. The investigation prompted a drop in

ADM shares and the postponement of 2023 financial results.

Morgan Stanley (NYSE:MS) – The asset management

division of Morgan Stanley plans to double its private credit

portfolio to $50 billion in the medium term, pooling funds from

institutional investors and the wealthy. The private credit market

has grown due to strict regulations and higher interest rates,

boosting banking activity in this sector. Morgan Stanley seeks to

expand its presence in this competitive market as traditional banks

become more aggressive.

Deutsche Bank (NYSE:DB) – Douglas Braunstein’s

stake in Deutsche Bank from Hudson Executive Capital has decreased

from 3.18% to 0.92%. Braunstein, a former CFO of JP Morgan

Chase (NYSE:JPM), invested in Deutsche Bank in 2018 but

did not comment on the reason for the reduction. Deutsche Bank

stated that the move was a kind distribution to certain limited

partners.

Blackstone (NYSE:BX) – Blackstone is heavily

investing in data centers to meet the growing demand from

artificial intelligence. The acquisition of QTS and the massive

expansion of these centers are driving the company, but it faces

energy and community challenges.

Holcim – Holcim plans to fully separate its

North American operations and list them on the New York Stock

Exchange (NYSE), with an estimated valuation of about $30 billion.

The new CEO, Miljan Gutovic, will take over in May. The division

aims to increase sales and operating profit in the region by 2030,

while the rest of Holcim’s global business will focus on building

solutions in other regions. Analysts see the listing as a positive

move for the company.

Reddit – Reddit is considering a valuation of

at least $5 billion in its initial public offering, despite private

negotiations indicating values below that. The company plans to

list in March, but IPO market uncertainty may influence the final

outcome.

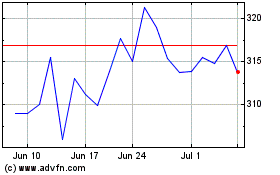

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Mar 2024 to Apr 2024

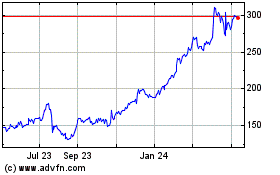

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Apr 2023 to Apr 2024