UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

| Check

the appropriate box: |

| ☒ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material Pursuant to §240.14a-12 |

Mass

Megawatts Wind Power, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ |

No fee required. |

| ☐ |

Fee computed on table below per Exchange

Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) |

Title of each class of securities

to which transaction applies: |

| |

|

|

| |

(2) |

Aggregate number of securities to which transaction

applies: |

| |

|

|

| |

(3) |

Per unit price or other underlying value of transaction

computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

|

| |

(4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| |

(5) |

Total fee paid: |

| |

|

|

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Check box if any part of the fee is offset

as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the

previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) |

Amount Previously Paid: |

| |

|

|

| |

(2) |

Form, Schedule, or Registration Statement No.: |

| |

|

|

| |

(3) |

Filing Party: |

| |

|

|

| |

(4) |

Date Filed: |

MASS

MEGAWATTS WIND POWER, INC.

119

Boston Turnpike #290

Shrewsbury,

MA 01545

February

7, 2024

To

the Stockholders of Mass Megawatts Wind Power, Inc.:

Mass

Megawatts Wind Power, Inc. (the “Company”) is pleased to send you the enclosed notice of a Special Meeting of Stockholders

(the “Meeting”) to be held March 18, 2024, at 9 AM at Best Western Royal Plaza Hotel 181 Boston Post Road West Marlborough,

MA 01752, for the following purposes:

To

approve an amendment to our Restated Certificate of Incorporation to effect a reverse stock split

of our Common Stock at a reverse stock split ratio ranging from 1:2 to 1:100, and to authorize the Company’s board of directors

to determine the timing of the amendment at its discretion at any time, if at all, but in any case prior to the one-year anniversary

of the date on which the Reverse Stock Split is approved by the Company’s stockholders at the Special Meeting and the specific

ratio of the reverse stock split (the “Reverse Stock Split Proposal”)

Please

review the Company’s enclosed Proxy Statement carefully. If you have any questions regarding this material, please do not hesitate

to call me at (508) 942-3531.

| |

Sincerely yours, |

| |

|

| |

Mass Megawatts Wind Power, Inc. |

| |

|

|

| Date |

By: |

/s/

Jonathan Ricker |

| |

|

Jonathan Ricker |

| |

|

Chief Executive Officer and President |

IMPORTANT

You

are cordially invited to attend the Special Meeting in person. Even if you plan to be present, please mark, sign, date and return the

enclosed proxy at your earliest convenience in the envelope provided, which requires no postage if mailed in the United States.

MASS

MEGAWATTS WIND POWER, INC.

119

Boston Turnpike #290

Shrewsbury,

MA 01545

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

To

Be Held on March 18, 2024

The

Special Meeting of Stockholders (the “Meeting”) of Mass Megawatts Wind Power, Inc. (the “Company”) will be held

March 18, 2024, at 9 a.m. (EST) at Best Western Royal Plaza Hotel 181 Boston Post Road West Marlborough, MA 01752, for the following

purpose:

To

approve an amendment to our Restated Certificate of Incorporation to effect a reverse stock split

of our Common Stock at a reverse stock split ratio ranging from 1:2 to 1:100, and to authorize the Company’s board of directors

to determine the timing of the amendment at its discretion at any time, if at all, but in any case prior to the one-year anniversary

of the date on which the Reverse Stock Split is approved by the Company’s stockholders at the Special Meeting and the specific

ratio of the reverse stock split (the “Reverse Stock Split Proposal”)

The

Board of Directors has fixed the close of business on February 7, 2024, as the record date (the “Record Date”) for the determination

of stockholders entitled to notice of, and to vote and act at, the Meeting and only stockholders of record at the close of business on

that date are entitled to notice of, and to vote and act at, the Meeting.

For

a period of ten (10) days prior to the Meeting, a stockholders list will be kept at the Company’s office and shall be available

for inspection by stockholders during usual business hours. A stockholders list will also be available for inspection at the Meeting.

Stockholders

are cordially invited to attend the Meeting in person. However, please complete and sign the enclosed proxy card and return it promptly

to assure your representation at the Meeting. If you choose, you may still vote in person at the Meeting even though you previously voted

by submitting a proxy card, by telephone or internet.

| |

By

Order of the Board of Directors, |

| |

|

| |

/s/

Jonathan Ricker |

| |

Chairman |

| Shrewsbury,

Massachusetts |

|

| |

|

| February

7, 2024 |

|

MASS

MEGAWATTS WINDPOWER, INC.

PROXY

STATEMENT

SPECIAL

MEETING OF SHAREHOLDERS

To

be held on March 18,2024

General

Information

This

Proxy Statement and the accompanying proxy card are furnished to the shareholders of Mass Megawatts Wind Power, Inc., a Massachusetts

corporation (the “Company”), in connection with the solicitation by the Company’s Board of Directors (the “Board”)

of proxies for use at the Special Meeting of Shareholders (the “Special Meeting”) to be held March 18,2024 at 9 AM at Best

Western Royal Plaza Hotel 181 Boston Post Road West Marlborough, MA 01752,and at any adjournments or postponements thereof, for the purposes

set forth in the preceding Notice of Special Meeting of Shareholders.

Who

Can Vote, Outstanding Securities

The

securities of the Company entitled to vote at the Special Meeting consist of shares of Common Stock, no par, are sometimes collectively

referred to in this Proxy Statement as the “Common Stock.” At the close 1of business on February 7, 2024 (the “Record

Date”), there were outstanding and entitled to vote 165,964,579 shares of Common Stock. Please refer to the section entitled “Quorum

and Required Vote” for further information on the vote required to approve the proposal to amend the Company’s Restated Articles

of Incorporation.

This

Proxy Statement and the related proxy card are being mailed on or about February 7, 2024, to the holders of our Common Stock on the Record

Date.

How

You Can Vote

Shareholders

of record on the Record Date are eligible to vote at the Special Meeting using one of the following methods:

| |

● |

Voting in Person. To vote

in person, you must attend the Special Meeting and follow the procedures for voting announced at the Special Meeting; or |

| |

|

|

| |

● |

Voting by Mail. To vote by

mail, simply mark the enclosed proxy card, date and sign it, and return it in the postage-paid envelope provided. |

Properly

executed proxies received in time for the Special Meeting will be voted in the manner directed therein. If your proxy card is signed

and returned without specifying choices, the shares represented by the proxy card will be voted “ FOR “ the proposal

to amend the Company’s Restated Articles of Incorporation.

How

You May Revoke or Change Your Vote

If

the enclosed proxy is executed and returned, it may nevertheless be revoked by a later-dated proxy or by written notice filed with the

Secretary of the Company at the Company’s executive offices at any time before the enclosed proxy card is voted. Shareholders attending

the Special Meeting may revoke their prior proxies and vote in person; however, personal attendance at the Special Meeting without voting

or revoking a proxy will not automatically revoke such proxy. The Company’s executive offices are located at 11 Apex Drive Suite

300, Marlborough, MA 01752, and the Company’s mailing address is 119 Boston Turnpike #290, Shrewsbury, MA 01545.

Quorum

and Required Vote

The

inspector of elections appointed for the Special Meeting will tabulate votes cast by proxy or in person at the Special Meeting. The inspector

of elections will also determine whether a quorum is present. The holders of a majority of the aggregate voting power represented by

the shares of Common Stock, issued and outstanding at the close of business on the Record Date, whether present in person or represented

by proxy at the Special Meeting, will constitute a quorum for the transaction of business at the Special Meeting; in addition, the presence,

in person or represented by proxy, of a majority of the shares of the Common Stock entitled to vote at the meeting are also required

to act with respect to the amendment to the Company’s Restated Articles of Incorporation. Shares held by persons attending the

Special Meeting but not voting, shares represented by proxies that reflect abstentions as to a particular proposal and “broker

non-votes” will be counted as present for purposes of determining a quorum. A “broker non-vote” occurs when a nominee

holding shares for a beneficial owner has not received voting instructions from the beneficial owner and does not have discretionary

authority to vote the shares.

The

proposal to amend the Company’s Restated Articles of Incorporation requires the approval of holders of a majority of the aggregate

voting power represented by the shares of Common Stock, entitled to vote at the Special Meeting.

Abstentions

will have the effect of a vote against the proposal to amend the Company’s Restated Articles of Incorporation. Approval of the

proposal to amend the Company’s Restated Articles of Incorporation is a routine matter on which the Company expects that brokers

will be entitled to vote without receiving instructions from the beneficial owner of the applicable shares; however, if a broker submits

a “non-vote,” it will have the same effect as a vote against this proposal.

As

of the Record Date, directors and executive officers of the Company beneficially owned (excluding currently exercisable options) an aggregate

of approximately 51,902,635 shares of Common Stock, entitled to vote on the proposal to amend the Company’s Restated Articles of

Incorporation. The Company believes that the directors and executive officers of the Company currently intend to vote their shares in

favor of such proposal.

Costs

of Solicitation

The

Company will pay the cost of solicitation of proxies. In addition to solicitation by mail, proxies may be solicited by directors, officers,

and employees of the Company, without additional compensation (other than reimbursement of out-of-pocket expenses), by personal interview,

telephone, facsimile, and other electronic means. Upon request, the Company will reimburse brokers, banks or similar entities acting

as nominees for reasonable expenses incurred in forwarding copies of the proxy materials relating to the Special Meeting to the beneficial

owners of our Common Stock.

MATTER

TO COME BEFORE THE SPECIAL MEETING

PROPOSAL

APPROVAL

OF THE REVERSE STOCK SPLIT PROPOSAL

To

approve an amendment to our Restated Certificate of Incorporation to effect a reverse stock split of our Common Stock at a reverse stock

split ratio ranging from 1:2 to 1:100, and to authorize the Company’s board of directors to determine the timing of the amendment

at its discretion at any time, if at all, but in any case prior to the one-year anniversary of the date on which the Reverse Stock Split

is approved by the Company’s stockholders at the Special Meeting and the specific ratio of the reverse stock split.

Summary

Our

Board of Directors recommends that the stockholders approve an amendment to our Restated Certificate of Incorporation, (the “Charter”),

in substantially the form attached in Exhibit A ,(the reverse stock split amendment), to effect a reverse stock split at a ratio

within the range between and including 1:2 to 1:100, with the final decision as to whether to proceed with the Reverse Stock Split and

the exact ratio of the Reverse Stock Split to be determined by our Board upon stockholder approval at any time prior to the one-year

anniversary of the date on which the Reverse Stock Split is approved by the Company’s stockholders at the Special Meeting. If our

stockholders approve the Reverse Stock Split, and the Board decides to implement it, the Reverse Stock Split will become effective upon

the filing of the Reverse Stock Split Amendment with the Secretary of State of the State of Massachusetts. The Reverse Stock Split will

affect all holders uniformly, and no stockholder’s interest in the Company will be diluted as each such stockholder will hold the

same percentage of the shares of Common Stock outstanding immediately following the Reverse Stock Split as that stockholder held immediately

prior to the Reverse Stock Split. The Reverse Stock Split Amendment will not reduce the number of authorized shares of Common Stock (which

will remain at 167,500,000) and will not change the no par value status of the Common Stock.

If

the Reverse Stock Split Proposal is approved by our stockholders and the Board of Directors determines that it is in the best interests

of the Company and its stockholders to effect the Reverse Stock Split, it will determine the ratio of the Reverse Stock Split, based

on factors discussed below.

Advantages

of a Reverse Stock Split

Attract

potential investment. With a high number of issued and outstanding shares of Common Stock, the price per share of our Common

Stock may be too low for the Company to attract investment capital unless we implement a reverse stock split.

Liquidity

of our Common Stock. An increased stock price may also improve the marketability and liquidity of our Common Stock. For example,

many brokerages have policies that prohibit them from investing in low-priced stocks. Additionally, investors may be dissuaded from purchasing

stocks below certain prices because brokers’ commissions, as a percentage of the total transaction value, can be higher for low-priced

stocks. We believe that the Reverse Stock Split may make our Common Stock a more attractive and cost-effective investment for many investors,

which may enhance the liquidity of the holders of our Common Stock.

More

available authorized Common Stock.

The

Reverse Stock Split will also effectively increase the number of authorized shares of our Common Stock for future issuances by the amount

of the reduction in outstanding shares of Common Stock effected by the Reverse Stock Split. These additional shares would be available

if the Board determines that it is necessary or appropriate to provide financial flexibility to raise additional capital through the

sale of equity and for other corporate purposes. Additional funding can be used to raise additional capital through the sale of equity

securities, to acquire another company or its assets, to establish strategic relationships with corporate partners and, to provide equity

incentives to employees and officers.

The

factors with any decision to implement a Reverse Stock Split

This

proposal gives the Board of Directors discretion to determine whether to implement a Reverse Stock Split and, if so implemented, select

a Reverse Stock Split ratio from within a range between and including 1:2 to 1:100, any time prior to the one-year anniversary of the

date on which the Reverse Stock Split is approved by the Company’s stockholders, based on the Board’s then-current assessment

of the factors below, and in order to maximize Company and stockholder interests. In determining whether to implement the Reverse Stock

Split, and which ratio to implement, if any, the Board may consider, among other factors:

| |

● |

the

Common Stock’s historical trading price and volume; |

| |

|

|

| |

● |

the

trading price and trading volume of our Common Stock and the anticipated impact of the Reverse Stock Split; |

| |

|

|

| |

● |

which

Reverse Stock Split ratio would be most cost effective; and |

| |

|

|

| |

● |

prevailing

industry, market, and economic conditions. |

If

the Board of Directors chooses to implement the Reverse Stock Split, a public announcement regarding the determination of the Reverse

Stock Split ratio will be disclosed.

Risks

Associated with a Reverse Stock Split

If

completed, the reverse stock split may not result in the intended benefits described above, the market price of our Common Stock may

not increase (proportionately to the reduction in the number of shares of our Common Stock outstanding after the Reverse Stock Split

or otherwise) following the Reverse Stock Split and the market price of our Common Stock may decrease in the future.

Although,

the number of outstanding Common Stock is reduced through the Reverse Stock Split, it is intended to increase the per share market price

of our Common Stock. The effect of the Reverse Stock Split on our stock price cannot be predicted with any certainty. The history of

reverse stock splits for other companies is varied. Some investors may view a reverse stock split negatively. It is possible that our

stock price after the Reverse Stock Split will not increase in the same proportion as the reduction in the number of shares outstanding,

causing a reduction in the Company’s overall market capitalization. Our stock price may decline due to various market conditions

and company performance among the other matters identified under the heading “Risk Factors” in our Form 10-K and other filings

with the SEC. This percentage decline, as an absolute number and as a percentage of our overall market capitalization, may be greater

than would occur in the absence of the Reverse Stock Split. The proposed Reverse Stock Split may reduce the liquidity of our Common Stock.

The implementation of the Reverse Stock Split would result in an effective increase in the authorized number of shares of Common Stock

available for issuance, which could, under certain circumstances, have anti-takeover implications. The additional shares of Common Stock

available for issuance could be used by the Company to oppose a hostile takeover attempt or to delay or prevent changes in control or

in our management. Although the Reverse Stock Split has been prompted by business and financial considerations, and not by the threat

of any hostile takeover attempt (nor is the Board currently aware of any such attempts directed at the Company), stockholders should

be aware that approval of the Reverse Stock Split could facilitate future efforts by us to deter or prevent changes in control, including

transactions in which stockholders might otherwise receive a premium for their shares over then-current market prices.

Effects

of a Reverse Stock Split

A

reverse stock split refers to a reduction in the number of outstanding shares of Common Stock by combining all of our outstanding

shares of Common Stock into a proportionately smaller number of shares. For example, a stockholder holding 100,000 shares of Common

Stock before the Reverse Stock Split would instead hold 10,000 shares of Common Stock immediately after that Reverse Stock Split if

the Board determined the ratio to be 1-for-10. Each stockholder’s proportionate ownership of outstanding shares of Common

Stock would remain the same, except for immaterial adjustments that may result from the treatment of fractional shares as described

herein. All shares of Common Stock will remain validly issued, fully paid and non-assessable.

Upon

the effectiveness of the Reverse Stock Split:

| |

● |

each 2 to 100 shares of

Common Stock outstanding (depending on the Reverse Stock Split ratio selected by the Board) will be combined, automatically and without

any action on the part of the Company or its stockholders, into one new share of Common Stock; |

| |

|

|

| |

● |

fractional

shares of Common Stock will be issued. There are no stock option programs, warrants or equity compensations programs at the current time

that needs adjustments. However, any other agreements that involved the number of shares in the documents will be adjusted. |

This

will result in approximately the same aggregate price being required to be paid (if any as applicable pursuant to their respective transaction

documents) under such securities upon conversion, and approximately the same value of shares of Common Stock being delivered upon such

conversion, immediately following the Reverse Stock Split as was the case immediately preceding the Reverse Stock Split.

The

following table summarizes, for illustrative purposes only, the approximate number of shares of our Common Stock that would be outstanding

as a result of the potential reverse stock split ratios within the range of this Proposal based on information as of January 26, 2024.,

Contingent

on Stockholders Approval and Board Implementation

| Status | |

Number of Shares of Common Stock Authorized | | |

Number of Shares of Common Stock Issued and Outstanding | |

| Pre-Reverse Stock Split | |

| 167,500,000 | | |

| 165,964,579 | |

| Post-Reverse Stock Split 1:2 | |

| 167,500,000 | | |

| 82,982,270 | |

| Post-Reverse Stock Split 1:10 | |

| 167,500,000 | | |

| 16,596,457 | |

| Post-Reverse Stock Split 1:50 | |

| 167,500,000 | | |

| 8,298,227 | |

| Post-Reverse Stock Split 1:100 | |

| 167,500,000 | | |

| 1,659,645 | |

The

Reverse Stock Split would affect all stockholders uniformly. As of the Effective Date, each stockholder would own a reduced number of

shares of Common Stock. Percentage ownership interests, voting rights and other rights and preferences would not be affected. The Reverse

Stock Split would not affect the registration of our Common Stock under Section 12(b) of the Exchange Act, and we would continue to be

subject to the periodic reporting and other requirements of the Exchange Act. The stock would have a new Committee on Uniform Securities

Identification Procedures (“CUSIP”) number after the Effective Date.

Plan

for Effecting Reverse Stock Split

The

effectiveness of the proposed Reverse Stock Split Amendment if approved by the shareholders is determined by the Board with one year

of the date on which the Reverse Stock Split is approved by the stockholders at the Special Meeting. The text of the proposed form of

the Reverse Stock Split Amendment is attached hereto as Annex A. If approved by stockholders and implemented by the Board, the

Reverse Stock Split will become effective upon the filing of the Reverse Stock Split Amendment with the Secretary of State of the State

of Massachusetts. We will publicly announce the Reverse Stock Split ratio chosen prior to the Effective Date.

Effect

on Beneficial Holders

Stockholders

who hold their shares through a bank, broker or other nominee will be treated in the same manner as registered stockholders who hold

their shares in their names. Shareholders are encouraged to contact their bank, broker, or other nominee with any questions regarding

the procedures for implementing the Reverse Stock Split with respect to their shares.

Effect

on Registered “Book-Entry” Holders

Registered

stockholders hold shares electronically in book-entry form under the direct registration system (i.e., do not have stock certificates

evidencing their share ownership but instead have a statement reflecting the number of shares registered in their accounts) and, as a

result, do not need to take any action to receive post-split shares. If they are entitled to receive post-split shares, they automatically

will receive, at their address of record, a transaction statement indicating the number of post-split shares held following the Effective

Date.

Potential

Impact on U.S. Federal Income Tax

The

following discussion is a general summary of certain U.S. federal income tax consequences relating to the proposed Reverse Stock Split

to us and stockholders. This summary is based on the provisions of the Internal Revenue Code of 1986, as amended (the “Code”),

U.S. Treasury regulations promulgated thereunder, administrative rulings and judicial decisions, all as in effect on the date of this

filing, and all of which are subject to change or differing interpretations, possibly with retroactive effect. Any such change or differing

interpretation could affect the tax consequences described below.

We

have not sought, and will not seek, an opinion of counsel or a ruling from the Internal Revenue Service (the “IRS”) regarding

the U.S. federal income tax consequences of the Reverse Stock Split to us or U.S. holders (as defined below), and there can be no assurance

that the IRS will not challenge the statements and conclusions set forth below or that a court would not sustain any such challenge.

SHAREHOLDERS SHOULD CONSULT WITH THEIR TAX ADVISOR ON POTENTIAL TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT.

This

summary generally only applies to U.S. holders (as defined below) that hold our Common Stock as a “capital asset” within

the meaning of Section 1221 of the Code (generally, property held for investment).

This

summary does not address all tax considerations that may be applicable to a stockholder’s particular circumstances or to stockholders

that may be subject to special tax rules, such as, for example and without limitation, brokers and dealers in securities or commodities,

banks and financial institutions, regulated investment companies, real estate investment trusts, personal holding companies, U.S. holders

(as defined below) whose functional currency is not the U.S. dollar, U.S. expatriates, non-resident alien individuals, tax-exempt entities,

governmental organizations, foreign entities, traders in securities that elect to use a mark-to-market method of accounting for their

securities, certain former citizens or long-term residents of the United States, insurance companies, persons holding shares of our Common

Stock as part of a hedging, integrated or conversion transaction or a straddle or persons deemed to sell shares of our Common Stock under

the constructive sale provisions of the Code, persons that hold more than 5% of our Common Stock, persons that hold our Common Stock

in an individual retirement account, 401(k) plan or similar tax-favored account, grantor trusts, persons who acquired their Common Stock

in connection with employment or other performance of services, or partnerships or other flow-through entities for U.S. federal income

tax purposes and partners, members or investors in such entities. In addition, this summary does not address any aspect of U.S. state

or local tax, non-U.S. tax, the Medicare tax on net investment income, U.S. federal estate and gift tax, the base erosion and anti-abuse

tax, alternative minimum tax or other U.S. federal tax consequences other than U.S. federal income taxation. This summary also does not

address any U.S. federal income tax considerations relating to any other transaction other than the Reverse Stock Split.

For

purposes of this summary, a “U.S. holder” means a beneficial owner of our Common Stock who is any of the following for U.S.

federal income tax purposes:

| |

● |

a

citizen or resident of the United States; |

| |

|

|

| |

● |

a corporation, or other

entity taxable as a corporation for U.S. federal income tax purposes, created or organized in or under the laws of the United States,

any state thereof or the District of Columbia; |

| |

|

|

| |

● |

an estate the income of which is subject to U.S. federal

income taxation regardless of its source; or |

| |

|

|

| |

● |

a trust if (1) the administration

of which is subject to the primary supervision of a court within the United States and one or more “United States persons”

(within the meaning of Section 7701(a)(30) of the Code, and for purposes of this discussion, a “U.S. person”) have the

authority to control all substantial decisions of the trust, or (2) it has a valid election in effect under applicable U.S. Treasury

regulations to be treated as a U.S. person. |

If

an entity (or arrangement) classified as a partnership for U.S. federal income tax purposes holds shares of our Common Stock, the tax

treatment of a partner in the partnership will generally depend upon the status of the partner and the activities of the partnership.

A U.S. holder treated as a partner in a partnership that holds shares of our Common Stock should consult its tax advisor regarding the

U.S. federal income tax consequences of the proposed Reverse Stock Split to it.

THIS

INFORMATION SUMMARY OF CERTAIN U.S. FEDERAL INCOME TAX CONSEQUENCES IS NOT TAX ADVICE. STOCKHOLDERS SHOULD CONSULT THEIR OWN TAX ADVISOR

WITH RESPECT TO THE APPLICATION OF U.S. FEDERAL INCOME TAX LAWS TO THEIR PARTICULAR SITUATION INCLUDING ESTATE AND GIFT LAWS. THE IMPACT

OF TAX LAWS OF ANY STATE, LOCAL, NON-U.S. OR OTHER TAXING JURISDICTION INCLUDING ANY APPLICABLE TAX TREATY SHOULD BE REVIEWED.

Tax

Consequences to the Company

The

proposed Reverse Stock Split is intended to be treated as a tax deferred “recapitalization” for U.S. federal income tax purposes

under Section 368(a)(1)(E) of the Code, and we do not expect to recognize taxable income, gain or loss as a result of the proposed Reverse

Stock Split.

Tax

Consequences to U.S. Shareholders

Assuming

the Reverse Stock Split qualifies as a recapitalization, a U.S. holder generally should not recognize any gain or loss for U.S. federal

income tax purposes upon the Reverse Stock Split. In the aggregate, a U.S. holder’s tax basis in the Common Stock received pursuant

to the Reverse Stock Split should equal the U.S. holder’s tax basis in its Common Stock surrendered in the Reverse Stock Split

in exchange therefor, and the holding period of the U.S. holder’s Common Stock received pursuant to the Reverse Stock Split should

include the holding period of the Common Stock surrendered in the Reverse Stock Split in exchange therefor. U.S. Treasury regulations

promulgated under the Code provide rules for allocating the tax basis and holding period of the shares of the Common Stock received pursuant

to the Reverse Stock Split. U.S. holders of our Common Stock acquired on different dates and at different prices should consult their

tax advisors regarding the allocation of the tax basis and holding period of such shares.

Information

Reporting and Backup Withholding

Information

returns generally will be required to be filed with the IRS with respect to the payment of cash in lieu of a fractional share made pursuant

to the Reverse Stock Split unless such U.S. holder is an exempt recipient and timely and properly establishes with the applicable withholding

agent the exemption. Backup withholding is not an additional tax. Any amounts withheld under the backup withholding rules may be refunded

or credited against the U.S. holder’s U.S. federal income tax liability, if any, provided that the U.S. holder furnishes the required

information in a timely manner to the IRS. U.S. holders should consult their tax advisors regarding their qualification for an exemption

from backup withholding and the procedures for obtaining such an exemption.

Release

No. 34-15230 of the staff of the Securities and Exchange Commission requires disclosure and discussion of the effects of any shareholder

proposal that may be used as an anti-takeover device. The proposed reverse stock split of common stock is not the result of any such

specific effort; rather, as indicated above, one purpose of the reverse stock split of common stock is to provide additional available

authorized stock to the Company’s management resulting in the ability to issue shares for future acquisition, financing and operational

possibilities, and not to construct or enable any anti-takeover defense or mechanism on behalf of the Company. While it is possible that

management could use the additional shares to resist or frustrate a third-party transaction providing an above-market premium that is

favored by a majority of the independent stockholders, the Company has no intent or plan to employ the additional unissued authorized

shares as an anti-takeover device. Consequently, the increase in authorized common stock may make it more difficult for, prevent or deter

a third party from acquiring control of the Company or changing its board of directors and management, as well as inhibit fluctuations

in the market price of the Company’s shares that could result from actual or rumored takeover attempts. The Company currently has

no such provisions in any of its governing documents.

As

summarized below, provisions of the Company’s certificate of incorporation and by-laws and applicable provisions of the Massachusetts

General Corporation Law may have anti-takeover effects, making it more difficult for or preventing a third party from acquiring control

of the Company or changing its board of directors and management. These provisions may also have the effect of deterring hostile takeovers

or delaying changes in the Company’s control or in its management.

Accounting

Consequences

The

net income or loss per share of Common Stock will be increased as a result of the fewer shares of Common Stock outstanding. The Reverse

Stock Split will be reflected retroactively in our consolidated financial statements.

Reservation

of Right to Abandon the Reverse Stock Split

The

Board reserves the right to abandon the Reverse Stock Split without further action by our stockholders at any time before the effectiveness

of the filing with the Secretary of State of the State of Massachusetts of the Certificate of Amendment, even if the authority to effect

the Reverse Stock Split has been approved by our stockholders at the Special Meeting.

Required

Vote and Recommendation of Board of Directors

Approval

of the Proposal requires the affirmative vote of a majority of the votes cast on the Proposal. Abstentions and broker non-votes, if any,

will have no effect on the outcome of this vote. The Proposal is considered “routine”, and thus we do not expect any broker

non-votes for this Proposal.

THE

BOARD RECOMMENDS A VOTE “FOR” THE PROPOSAL TO APPROVE AN AMENDMENT TO OUR RESTATED CERTIFICATE OF INCORPORATION, TO

EFFECT A REVERSE STOCK SPLIT OF OUR COMMON STOCK AT A REVERSE STOCK SPLIT RATIO RANGING FROM 1:2 TO 1:100, AND TO AUTHORIZE THE COMPANY’S

BOARD OF DIRECTORS TO DETERMINE THE TIMING OF THE AMENDMENT AT ITS DISCRETION AT ANY TIME, IF AT ALL, BUT IN ANY CASE PRIOR TO THE ONE-YEAR

ANNIVERSARY OF THE DATE ON WHICH THE REVERSE STOCK SPLIT IS APPROVED BY THE COMPANY’S STOCKHOLDERS AT THE SPECIAL MEETING AND THE

SPECIFIC RATIO OF THE REVERSE STOCK SPLIT.

Dissenter’s

Rights of Appraisal

Under

Massachusetts law, our dissenting stockholders are not entitled to dissenter’s appraisal rights with respect to the proposed amendments

to our articles of organization.

Security

Ownership of Directors, Management and Certain Beneficial Owners

As

of the date of this information statement there are shares of the Company’s Common Stock issued and outstanding. Each share of

Common Stock is entitled to one vote. February 7,2024 is the record date for determining which of our stockholders are entitled to notice

with respect to this information statement and to vote at the special meeting of stockholders.

The

following table sets forth information for each person known to be the beneficial owner of more than ten percent of our Common Stock

and information as of January 26, 2024, concerning the beneficial ownership of the Company’s Common Stock for each of the Company’s

directors, the Company’s Chief Executive Officer and the Company’s directors and Chief Executive Officer as a group.

| NAME

AND ADDRESS OF BENEFICIAL OWNER (1) |

|

AMOUNT

AND NATURE OF BENEFICIAL OWNERSHIP |

|

PERCENT

OF CLASS |

| Jonathan

Ricker, Chairman, |

|

51,902,635

shares |

|

30.5

% |

| President,

Treasurer, Clerk and Director |

|

|

|

|

| |

|

|

|

|

| Directors

and Officers as a group |

|

51,902,635

shares |

|

30.5

% |

(1)

A beneficial owner includes any person who, directly or indirectly, has the power to vote or direct the voting of the Company’s

Common Stock or the power to dispose, or to direct the disposition of such stock.

Miscellaneous

The

Company requests brokers, custodians, nominees and fiduciaries to forward this information statement to the beneficial owners of the

Company’s Common Stock and the Company will, upon request, reimburse such holders for their reasonable expenses in connection therewith.

Conclusion

This

information statement is intended to provide our stockholders with the information required by the rules and regulations of the Securities

Exchange Act of 1934.

OTHER

MATTERS

As

of the date of this Proxy Statement, management does not intend to present any other items of business and other than the one item described

above.

| |

By

Order of the Board of Directors, |

| |

|

| |

/s/

Jonathan Ricker |

| |

|

| |

Chairman |

| |

|

| |

February

7, 2024 |

Exhibit

A

(Contingent

upon shareholder approval)

Form

of Articles of Amendment

to

the

Restated

Articles of Incorporation of Mass Megawatts Wind Power, Inc.

ARTICLE

OF AMENDMENT TO THE

RESTATED

ARTICLES OF INCORPORATION OF

MASS

MEGAWATTS WIND POWER, INC.

Pursuant

to the provisions of Massachusetts Business Corporation Act, Mass Megawatts Wind Power, Inc., a Massachusetts corporation (the “Corporation”),

adopts the following Article of Amendment to the Restated Articles of Incorporation:

The

Restated Articles of Incorporation of the Corporation (Massachusetts General Laws Chapter 156D, Section 10.06; 950 CMR 113.34) are hereby

amended Article Six as an additional paragraph of Article Six, reading in its entirety as follows:

Upon

the effectiveness of the filing of this Certificate of Amendment the Restated Certificate of Incorporation of the Company, as amended

(the “Effective Time”), every [●] shares of Common Stock issued and outstanding or held by the Company in treasury

immediately prior to the Effective Time shall, automatically and without any further action on the part of the Company or the holder

thereof, be combined into [●] ([●]) validly issued, fully paid and non-assessable share of Common Stock (the “Reverse

Stock Split”), subject to the treatment of fractional share interests as described below. No fractional shares shall be issued

as a result of the Reverse Stock Split, and, in lieu thereof, the Company’s transfer agent for the registered holders of shares

of Common Stock shall aggregate all fractional shares of Common Stock and arrange for them to be sold on behalf of such holders whose

shares of Common Stock otherwise would have been combined into a fractional share as a result of the Reverse Stock Split and, after completing

the sale, such holders will receive a cash payment from the transfer agent in an amount equal to their respective pro rata share of the

total net proceeds of such sale. Any stock certificate that, immediately prior to the Effective Time, represented shares of Common Stock

(an “Old Certificate”) shall thereafter, automatically and without the necessity of presenting the same for exchange,

represent that number of shares of Common Stock into which the shares of Common Stock represented by the Old Certificate shall have been

combined.

3.

This amendment has been approved in the manner required by the Commonwealth of Massachusetts and the constituent documents of the Corporation.

4.

These Articles of Amendment to the Restated Articles of Incorporation shall become effective when filed with the Secretary of State of

the Commonwealth of Massachusetts.

Mass

Megawatts Wind Power, Inc., has caused these Amendment to the Restated Articles of Incorporation to be executed on the day of , 2024,

by its duly authorized officer.

| |

MASS

MEGAWATTS WIND POWER, INC. |

| |

|

|

| Date |

By: |

/s/

Jonathan Ricker |

| |

|

Jonathan

Ricker |

| |

|

Chief

Executive Officer |

SPECIAL

MEETING OF SHAREHOLDERS OF

MASS

MEGAWATTS WIND POWER, INC.

March

18,2024

Please

date, sign and mail your proxy card in the envelope provided as soon as possible.

Please

detach along perforated line and mail in the envelope provided.

PLEASE

SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE; PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE: ☒

| (1) |

Proposal

to amend our Restated Certificate of Incorporation to effect a reverse stock split of our Common

Stock at a reverse stock split ratio ranging from 1:2 to 1:100, and to authorize the Company’s board of directors to determine

the timing of the amendment at its discretion at any time, if at all, but in any case prior to the one-year anniversary of the date

on which the Reverse Stock Split is approved by the Company’s stockholders at the Special Meeting and the specific ratio of

the reverse stock split (the “Reverse Stock Split Proposal”) |

| FOR |

|

AGAINST |

|

ABSTAIN |

| |

|

|

|

|

| ☐ |

|

☐ |

|

☐ |

As

more particularly described in the Proxy Statement, dated March 18,2024, relating to such meeting, receipt of which is hereby acknowledged.

The undersigned shareholder also acknowledges receipt of the Notice of Special Meeting of Shareholders.

The

Board of Directors Recommends a Vote FOR the Proposal.

| To

change the address on your account, please check the box and indicate your new address in the space to the right. Please note that

changes to the registered name(s) on the account may not be submitted via this method. |

|

☐ |

| Shareholder

Signature |

|

Date: |

|

Shareholder

Signature |

|

Date: |

|

| Note: |

Please

sign exactly as your name or names appear on this proxy. When shares are held jointly, each holder should sign. When signing as executor,

administrator, attorney, trustee or guardian or in another representative capacity, please give full title as such. If the signer

is a corporation, please sign the full corporate name by a duly authorized officer, giving full title as such. If the signer is a

partnership, please sign in partnership name by an authorized person. |

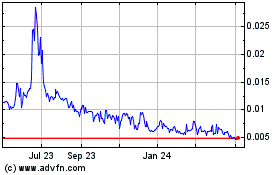

Mass Megawatts Wind Power (PK) (USOTC:MMMW)

Historical Stock Chart

From Mar 2024 to Apr 2024

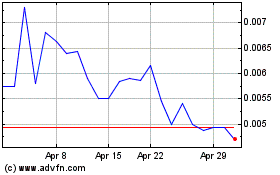

Mass Megawatts Wind Power (PK) (USOTC:MMMW)

Historical Stock Chart

From Apr 2023 to Apr 2024