false000113754700011375472023-10-302023-10-30

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

December 31, 2023

Date of Report (Date of earliest event reported)

UNITED SECURITY BANCSHARES

(Exact Name of Registrant as Specified in its Charter)

California

(State or Other Jurisdiction of Incorporation)

| | | | | | | | |

| 000-32987 | | 91-2112732 |

| (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | |

2126 Inyo Street, Fresno, California | | 93721 |

| (Address of principal executive offices) | | (Zip Code) |

559-490-6261

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, no par value | UBFO | NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On December 31, 2023, the Company issued a press release announcing results for the quarter and year ended December 31, 2023 (the “Press Release”). A copy of the Press Release is furnished as Exhibit 99.1 and incorporated herein by reference. The Press Release contains the non-GAAP measure Core Net Income. The Company believes that the presentation of that non-GAAP measure provides useful information for the understanding of its ongoing operations and, thereby, enhances an investor’s overall understanding of the Company’s current financial performance relative to past performance and provides, along with the nearest GAAP measures, a baseline for modeling future expectations. The non-GAAP measure is reconciled to the comparable GAAP financial measure in the financial tables within the Press Release. The Company cautions that the non-GAAP measure should be considered in addition to, but not as a substitute for, the Company’s reported GAAP results. Additionally, the Company notes that there can be no assurance that the above referenced non-GAAP financial measure is comparable to similarly titled financial measures used by other companies.

The information in Item 2.02 of this Current Report on Form 8-K and the Press Release attached hereto as Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits.

EXHIBIT #

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | United Security Bancshares |

| | | |

| Date: | December 31, 2023 | | By: /s/ David A. Kinross |

| | | David A. Kinross |

| | | Senior Vice President and Chief Financial Officer |

United Security Bancshares Reports 2023 Net Income of $19.8 Million

FRESNO, CA - January 25, 2024. United Security Bancshares (Nasdaq: UBFO) today announced its unaudited financial results for the year ended December 31, 2023. The Company reported record-high net income of $19.8 million, or $1.16 per basic and diluted share, for the year ended December 31, 2023, compared to $15.7 million, or $0.92 per basic and diluted share, for the year ended December 31, 2022.

Fourth Quarter 2023 Highlights (as of, or for, the quarter ended December 31, 2023, except where noted):

▪Net interest margin decreased to 4.08% for the quarter ended December 31, 2023, compared to 4.44% for the quarter ended December 31, 2022.

▪Annualized average cost of deposits was 0.73% for the quarter ended December 31, 2023, compared to 0.22% for the quarter ended December 31, 2022.

▪Net income for the quarter increased 1.1% to $5.4 million, compared to $5.3 million for the quarter ended December 31, 2022.

▪Loan interest income increased $1.2 million as a result of increases in interest rates, compared to the fourth quarter of 2022.

▪The total fair value of the junior subordinated debentures (TRUPs) changed by $240,000 during the quarter ended December 31, 2023. A gain of $826,000 was recorded through the income statement and a loss of $752,000 was recorded through accumulated other comprehensive income.

▪A nontaxable gain of $907,000 was realized on the proceeds of a bank-owned life insurance policy during the quarter ended December 31, 2023.

▪The Company recorded a provision for credit losses of $873,000 for the quarter ended December 31, 2023, compared to $648,000 for the quarter ended December 31, 2022.

▪Net interest income before the provision for credit losses decreased 11.4% to $12.0 million, compared to $13.5 million for the quarter ended December 31, 2022.

▪Annualized return on average assets (ROAA) increased to 1.72%, compared to 1.57% for the quarter ended December 31, 2022.

▪Annualized return on average equity (ROAE) decreased to 18.28%, compared to 19.24% for the quarter ended December 31, 2022.

▪The Company had available secured lines of credit of $532.4 million, unsecured lines of credit of $78.0 million, unpledged investment securities of $98.4 million, and cash and cash equivalents of $40.8 million as of December 31, 2023. Short-term borrowings totaled $62.0 million at December 31, 2023, compared to $142.0 million at September 30, 2023.

▪Total assets decreased 6.8% to $1.21 billion, compared to $1.30 billion at December 31, 2022.

▪Total loans, net of unearned fees, decreased to $920.0 million, compared to $980.2 million at December 31, 2022.

▪Total investments decreased 12.4% to $184.6 million, compared to $210.9 million at December 31, 2022.

▪Total deposits decreased 13.8% to $1.00 billion, compared to $1.17 billion at December 31, 2022.

▪Net charge-offs totaled $968,000 for the quarter ended December 31, 2023, compared to net charge-offs of $465,000 for the quarter ended December 31, 2022.

▪The allowance for credit losses as a percentage of gross loans increased to 1.70%, compared to 1.04% at December 31, 2022. The increase is primarily the result of an accounting adjustment of $6.6 million related to the adoption of a new accounting standard referred to as the Current Expected Credit Loss methodology (CECL) which was adopted on January 1, 2023.

▪Book value per share increased to $7.14, compared to $6.59 at December 31, 2022.

▪Capital position remains well-capitalized with a 11.82% Tier 1 Leverage Ratio compared to 10.10% as of December 31, 2022.

Dennis Woods, President and Chief Executive Officer, stated, “Our 2023 earnings were the highest in our 35-year history. The fourth quarter net income was positively impacted by the nontaxable life insurance gain, the TRUPs gain, and a reduction in our short-term borrowings. We are pleased with our ability to maintain our net interest margin above four percent as we held our cost of total deposits relatively flat compared to the trailing quarter. This year we also made progress in decreasing our non-performing loan balances. Our team is focused on gathering deposits and serving the banking needs of our local communities.”

Provided at the end of this Press Release is a reconciliation of Core Net Income, as a non-GAAP measure, to Net Income. This reconciliation excludes Non-Core items such as the Fair Value Adjustment for TRUPs. Management believes that financial results are more comparative excluding the impact of such non-core items.

Results of Operations

Quarter Ended December 31, 2023:

For the quarter ended December 31, 2023, the Company reported net income of $5.4 million and earnings per basic and diluted share of $0.31, compared to net income of $5.3 million and $0.31 per basic and diluted share for the quarter ended December 31, 2022. Net income for the quarter ended September 30, 2023 was $3.9 million and $0.22 per basic and diluted share.

Net interest income, before the provision for credit losses, was $12.0 million for the quarter ended December 31, 2023, representing a $1.5 million, or 11.4%, decrease from the $13.5 million reported at December 31, 2022. The decrease in net interest income was driven by increases in interest expense on deposits and short-term borrowings, offset by increases in loan-interest income. The Company’s net interest margin decreased from 4.44% to 4.08% between the quarters ended December 31, 2022 and December 31, 2023, respectively. The decrease in the net interest margin was due to increases in average rates paid on deposits as well as increases in short-term borrowings and was partially offset by increases in yields on loans and investment securities. Net interest income during the quarter ended December 31, 2023 increased $30,000 from the $11.9 million reported during the quarter ended September 30, 2023. This was primarily due to increases in loan interest income and decreases in interest expense on deposits, and was partially offset by increases in short-term borrowing expense.

Noninterest income for the quarter ended December 31, 2023 totaled $3.0 million, an increase of $1.9 million from the $1.0 million in non-interest income reported for the quarter ended December 31, 2022. The increase is primarily attributed to a $907,000 nontaxable gain on proceeds from bank-owned life insurance and an $826,000 gain on the fair value of TRUPs recorded during the fourth quarter. Noninterest income increased $2.9 million from the $114,000 reported for the quarter ended September 30, 2023. This was primarily due to the gain on the fair value of TRUPS and the gain on proceeds from life insurance realized during the fourth quarter compared to a loss on the fair value of TRUPs of $811,000 recorded during the third quarter.

Noninterest expense for the quarter ended December 31, 2023 totaled $6.9 million, reflecting a $503,000 increase over the $6.4 million reported for the quarter ended December 31, 2022, and a $247,000 increase from the $6.6 million reported for the quarter ended September 30, 2023. The increase between the quarters ended December 31, 2023 and 2022, resulted partially from increases of $295,000 in professional fees and $178,000 in salaries and employee benefits. Professional fees increased due to increases in expenses on service contracts and were partially offset by decreases in consulting fees. Salaries and employee benefits increased due to increases in salary expense and group insurance expenses. The increase over the third quarter was related to increases in professional fees, offset by decreases in salaries and employee benefit expense.

The Company recorded an income tax provision of $1.8 million for the quarter ended December 31, 2023, compared to $2.2 million for the quarter ended December 31, 2022, and $1.6 million for the quarter ended September 30, 2023. The effective tax rate for the quarter ended December 31, 2023 was 25.0%, compared to 28.9% and 28.8% for the quarters ended December 31, 2022 and September 30, 2023, respectively. The decreased rate for the fourth quarter is primarily due to a nontaxable gain realized on proceeds from bank-owned life insurance.

Year Ended December 31, 2023:

Net income for the year ended December 31, 2023 increased 26.2% to $19.8 million, compared to the year ended December 31, 2022. The increase is primarily the result of an increase of $11.1 million in loan interest income and fees, an increase of $1.3 million in investment income, and a $2.8 million decrease in the loss on the fair value of TRUPs, partially offset by a $3.9 million increase in interest on deposits, a $3.9 million increase in interest on short-term borrowings, and a $1.3 million increase in the provision for income taxes. ROAE for the year ended December 31, 2023 was 17.05%, compared to 13.75% for the year ended December 31, 2022. ROAA was 1.57% for the year ended December 31, 2023, compared to 1.16% for the year ended December 31, 2022.

The annualized average cost of deposits was 0.64% for the year ended December 31, 2023, compared to 0.23% for the year ended December 31, 2022. Average interest-bearing deposits decreased 10.6% between the periods ended December 31, 2022 and 2023, from $728.1 million to $651.1 million, respectively.

Net interest income before the provision for credit losses, for the year ended December 31, 2023, totaled $49.3 million, an increase of $3.3 million, or 7.1%, from the $46.1 million reported for the same period ended December 31, 2022. The impact of the increase in interest rates over the past year is reflected in the increase in net interest income. The Company’s net interest

margin increased from 3.69% for the year ended December 31, 2022 to 4.24% for the year ended December 31, 2023. The increase in the net interest margin is due to increases in yields on investment securities, yields on loans, and yields on interest-bearing deposits at the Federal Reserve Bank, partially offset by increases in average deposit costs and short-term borrowing costs. Loan yields increased from 4.66% to 5.67% between the two periods while the cost of interest-bearing liabilities increased from 0.43% to 1.52% between the two periods.

Noninterest income for the year ended December 31, 2023 totaled $5.6 million, an increase of $3.7 million when compared to the $1.8 million reported for the year ended December 31, 2022. This increase resulted primarily due to a $907,000 nontaxable gain in proceeds from bank-owned life insurance and a $2.8 million change in the gain on fair value of TRUPs. For the year ended December 31, 2023, a gain on the fair value of TRUPs of $274,000 was recorded, compared to a loss of $2.5 million for the same period in 2022. The change in the fair value of TRUPs reflected in noninterest income was caused by fluctuations in the Secured Overnight Financing Rate (SOFR) yield curve. Other noninterest income decreased $352,000 between the two periods, primarily as the result of $566,000 in income from a limited partnership recognized during the previous year.

For the year ended December 31, 2023, noninterest expense totaled $26.0 million, an increase of $1.8 million compared to $24.2 million for the year ended December 31, 2022. On a year-over-year comparative basis, noninterest expense increased due to increases of $1.3 million in salaries and employee benefits, $308,000 in professional fees, and $272,000 in occupancy expense. Salaries and employee benefits expense increased due to increases in salaries, group insurance costs, and bonus expense. Professional fees increased due to increases in service contract expense. Occupancy expense increased due to increased depreciation expense, utility costs, and building services expense.

The efficiency ratio for the year ended December 31, 2023 improved to 47.3%, compared to 50.1% for the year ended December 31, 2022. This improvement is due to an increase in interest and non-interest income income partially offset by an increase in non-interest expense.

The Company recorded an income tax provision of $7.7 million for the year ended December 31, 2023, compared to $6.4 million for the same period in 2022. The effective tax rate for the year ended December 31, 2023 was 28.0%, compared to 28.9% for the year ended December 31, 2022.

Balance Sheet Review

Total assets decreased $88.1 million, or 6.8%, between December 31, 2022 and December 31, 2023. Gross loan balances decreased $60.4 million, investment securities decreased $26.2 million, and overnight balances held at the Federal Reserve Bank decreased $6.7 million. Decreases in gross loans included decreases of $25.4 million in real estate mortgage loans, $24.4 million in real estate construction and development loans, $6.7 million in commercial and industrial loans, $3.0 million in agricultural loans, and $2.3 million in installment loans. Declines in the investment portfolio were the result of the maturity of $17.5 million in treasury securities and $12.1 million in paydowns, partially offset by a decrease in unrealized losses of $2.8 million between the two periods. Total cash and cash equivalents increased $2.2 million between December 31, 2022 and December 31, 2023. Unfunded loan commitments decreased from $190.2 million at December 31, 2022 to $183.5 million at December 31, 2023. OREO balances totaled $4.6 million at December 31, 2022 and December 31, 2023.

Total deposits decreased $161.0 million, or 13.8%, to $1.0 billion during the year ended December 31, 2023. This was due to decreases of $82.6 million in interest bearing deposits and decreases of $78.4 million in noninterest-bearing deposits. NOW and money market accounts decreased $93.0 million, savings accounts decreased $3.4 million, and time deposits increased $13.8 million. In total, NOW, money market and savings accounts decreased 15.4% to $529.4 million at December 31, 2023, compared to $625.8 million at December 31, 2022. Noninterest bearing deposits decreased 16.3% to $403.2 million at December 31, 2023, compared to $481.6 million at December 31, 2022. Core deposits, which are comprised of noninterest bearing deposits, NOW, money market, savings accounts, and time deposits less than $250,000, decreased $169.6 million.

Shareholders’ equity at December 31, 2023 totaled $122.5 million, an increase of $10.1 million from the $112.5 million reported at December 31, 2022. The increase in equity was the result of $19.8 million in net income and a decrease of $2.5 million in accumulated other comprehensive loss, partially offset by a $4.7 million, net of tax, accounting adjustment to retained earnings related to the adoption of CECL, and $8.1 million in dividend payments. At December 31, 2023, accumulated other comprehensive loss totaled $15.0 million, compared to $17.5 million at December 31, 2022. The decrease in accumulated other comprehensive loss was primarily the result of a decrease in net unrealized losses on investment securities of $2.9 million and an increase of $383,000 in the fair value of TRUPs caused by a change in market credit spreads during the year ended December 31, 2023. Changes in unrealized losses on the investment portfolio are attributed to changes in interest rates, not credit quality. The Company does not intend to sell, and it is more likely than not that it will not be required to sell, any securities held with an unrealized loss.

The Board of Directors of United Security Bancshares declared a cash dividend on common stock of $0.12 per share on December 18, 2023. The dividend was payable on January 19, 2024, to shareholders of record as of January 3, 2024. No assurances can be provided as to the amount and/or declaration and payment of future dividends, if any. The Company continues to be well-capitalized and expects to maintain adequate capital levels.

Credit Quality

On January 1, 2023, the Company adopted the Current Expected Credit Loss (CECL) methodology, recognizing a $6.6 million increase to the allowance for credit losses and a $4.7 million reduction to retained earnings, net of tax. CECL is a forward-looking model that broadens the range of data to include the use of economic forecasts to estimate credit losses over the life of the loan portfolio in addition to the use of historical loss data and current conditions. This new approach may result in a lack of comparability between the current and previous year. The Company recorded a provision for credit losses of $1.5 million for the year ended December 31, 2023, compared to $1.6 million provision for the year ended December 31, 2022. The provisions recorded during 2022 and 2023 were primarily driven by charge-offs within the student loan portfolio and were partially offset by decreases in the loan portfolio in total. Net loan charge-offs totaled $2.3 million for the year ended December 31, 2023, compared to $953,000 for the year ended December 31, 2022, and related primarily to student loans for both periods.

The Company’s allowance for credit losses totaled 1.70% of the loan portfolio at December 31, 2023, compared to 1.04% at December 31, 2022. The increase in the allowance for credit losses as a percentage of gross loans is primarily the result of additions to the reserve as a result of the adoption of CECL. Management considers the allowance for credit losses at December 31, 2023 to be adequate.

Non-performing assets, comprised of nonaccrual loans, loan modifications, other real estate owned through foreclosure (OREO), and loans more than 90 days past due and still accruing interest, decreased $3.3 million between December 31, 2022 and December 31, 2023 to $16.0 million. As a percentage of total assets, non-performing assets decreased from 1.50% at December 31, 2022 to 1.32% at December 31, 2023. The decrease in non-performing assets is primarily attributed to a decrease of $3.1 million in nonaccrual loans. OREO balances remained at $4.6 million at December 31, 2023 and December 31, 2022.

About United Security Bancshares

United Security Bancshares (NASDAQ: UBFO) is the holding company for United Security Bank, which was founded in 1987. United Security Bank is headquartered in Fresno and operates 12 full-service branch offices in Fresno, Bakersfield, Campbell, Caruthers, Coalinga, Firebaugh, Mendota, Oakhurst, San Joaquin, and Taft, California. Additionally, United Security Bank operates Commercial Real Estate Construction, Commercial Lending, and Consumer Lending departments. For more information, please visit www.unitedsecuritybank.com.

Non-GAAP Financial Measures

This press release and the accompanying financial tables contain a non-GAAP financial measure (net income before non-Core) within the meaning of the Securities and Exchange Commission’s Regulation G. In the accompanying financial table, the Company has provided a reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure. The Company’s management believes that this non-GAAP financial measure provides useful information about the Company’s results of operations and/or financial position to both investors and management. The Company provides this non-GAAP financial measure to investors to assist them in performing their analysis of its historical operating results. The non-GAAP financial measure shows the Company’s operating results before consideration of certain adjustments and, consequently, this non-GAAP financial measure should not be construed as an alternative to net income as an indicator of the Company’s operating performance, as determined in accordance with GAAP. The Company may calculate this non-GAAP financial measure differently than other companies.

Forward-Looking Statements

This press release may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and the Company intends such statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and often include the words “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” or words of similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “could,” or “may.” Forward-looking statements are based on

management’s knowledge and belief as of today and are not guarantees of future performance, nor should they be relied upon as representing management’s views as of any subsequent date. Forward-looking statements are subject to risks and uncertainties and actual results may differ materially from those presented. Factors that might cause such differences, some of which are beyond the Company’s ability to control or predict, include, but are not limited to: (1) adverse developments with respect to U.S. or global economic conditions and other uncertainties, including the impact of supply chain disruptions, inflationary pressures, labor shortages, and global conflict and unrest; (2) changes in general economic and financial market conditions, either nationally or locally; (3) fiscal policies of the U.S. government, including interest rate policies of the Board of Governors of the Federal Reserve System; (4) changes in banking laws or regulations including the implementation of increased capital requirements for financial institutions; (5) increased competition in the Company’s markets, impacting the ability to execute its business plans; (6) loss of or inability to attract key personnel; (7) unanticipated deterioration in our loan portfolio, credit losses, and the sufficiency of our allowance for credit losses; (8) drought, earthquakes, floods or other natural disasters impacting the local economy and/or the condition of real estate collateral; (9) the impact of technological changes and the ability to develop and maintain secure and reliable electronic systems including failures in or breaches of the Company’s operational and/or security systems or infrastructure; (10) the failure to maintain effective controls over our financial reporting; (11) the quality and quantity of our deposits; (12) adverse developments in the financial services industry generally such as the bank failures in 2023 and any related impact on depositor behavior or investor sentiment; (13) risks related to the sufficiency of liquidity; (14) the possibility that our recorded goodwill could become impaired which may have an adverse impact on our earnings and capital, (15) changes in accounting policies or procedures; and (16) the continuing adverse impact on the U.S. economy, including the markets in which we operate due to the lingering effects of the COVID-19 global pandemic.

The Company does not undertake (and expressly disclaims) any obligation to publicly revise or update these forward-looking statements to reflect subsequent events or circumstances except as may be required by law. For a more complete discussion of these risks and uncertainties, see the Company’s Annual Report on Form 10-K, for the year ended December 31, 2022, and particularly the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Readers should carefully review all disclosures the Company files from time to time with the Securities and Exchange Commission.

| | | | | | | | | | | | | | | | |

| United Security Bancshares | | | | | | |

| Consolidated Balance Sheets (unaudited) | | | | | | |

| (In thousands, except share data) | | December 31, 2023 | | December 31, 2022 | | |

| Assets | | | | | | |

| Cash and non-interest-bearing deposits in other banks | | $ | 40,577 | | | $ | 31,650 | | | |

| Deposits in Federal Reserve Bank (FRB) | | 207 | | | 6,945 | | | |

| | | | | | |

| Cash and cash equivalents | | 40,784 | | | 38,595 | | | |

| | | | | | |

| | | | | | |

| Investment securities (at fair value) | | | | | | |

| Available-for-sale (AFS) securities | | 181,266 | | | 207,545 | | | |

| Marketable equity securities | | 3,354 | | | 3,315 | | | |

| Total investment securities | | 184,620 | | | 210,860 | | | |

| Loans | | 921,341 | | | 981,772 | | | |

| Unearned fees and unamortized loan origination costs - net | | (1,299) | | | (1,594) | | | |

| Allowance for credit losses | | (15,658) | | | (10,182) | | | |

| Net loans | | 904,384 | | | 969,996 | | | |

| Premises and equipment - net | | 9,098 | | | 9,770 | | | |

| Accrued interest receivable | | 7,928 | | | 8,489 | | | |

| Other real estate owned (OREO) | | 4,582 | | | 4,582 | | | |

| Goodwill | | 4,488 | | | 4,488 | | | |

| Deferred tax assets - net | | 14,054 | | | 12,825 | | | |

| | | | | | |

| Cash surrender value of life insurance - net | | 21,954 | | | 22,893 | | | |

| Investment in limited partnerships | | 3,200 | | | 2,800 | | | |

| Operating lease right-of-use assets | | 1,338 | | | 1,984 | | | |

| Other assets | | 14,615 | | | 11,911 | | | |

| Total assets | | $ | 1,211,045 | | | $ | 1,299,193 | | | |

| | | | | | |

| Liabilities and Shareholders’ Equity | | | | | | |

| Deposits | | | | | | |

| Noninterest-bearing | | $ | 403,225 | | | $ | 481,629 | | | |

| Interest-bearing | | 601,252 | | | 683,855 | | | |

| Total deposits | | 1,004,477 | | | 1,165,484 | | | |

| Short-term borrowings | | 62,000 | | | — | | | |

| Operating lease liabilities | | 1,437 | | | 2,093 | | | |

| Other liabilities | | 9,376 | | | 8,270 | | | |

| Junior subordinated debentures (at fair value) | | 11,213 | | | 10,883 | | | |

| Total liabilities | | 1,088,503 | | | 1,186,730 | | | |

| Shareholders’ Equity | | | | | | |

Common stock, no par value; 20,000,000 shares authorized; issued and outstanding: 17,167,895 at December 31, 2023 and 17,067,253 at December 31, 2022 | | 60,585 | | | 60,030 | | | |

| Retained earnings | | 76,995 | | | 69,928 | | | |

| Accumulated other comprehensive loss, net of tax | | (15,038) | | | (17,495) | | |

| Total shareholders’ equity | | 122,542 | | 112,463 | | |

| Total liabilities and shareholders’ equity | | $ | 1,211,045 | | | $ | 1,299,193 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| United Security Bancshares | | | | | | | | | | |

| Consolidated Statements of Income (unaudited) | | Three Months Ended | | Twelve Months Ended |

| (In thousands, except share and per-share data) | | December 31, 2023 | | September 30, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| Interest Income: | | | | | | | | | | |

| Interest and fees on loans | | $ | 13,891 | | | $ | 13,763 | | | $ | 12,676 | | | $ | 54,183 | | | $ | 43,039 | |

| Interest on investment securities | | 1,378 | | 1,491 | | 1,496 | | 5,870 | | 4,613 |

| Interest on deposits in FRB | | 136 | | 74 | | 582 | | 324 | | 1,605 |

| | | | | | | | | | |

| Total interest income | | 15,405 | | | 15,328 | | | 14,754 | | | 60,377 | | | 49,257 | |

| Interest Expense: | | | | | | | | | | |

| Interest on deposits | | 1,630 | | 1,841 | | 1,113 | | 6,758 | | 2,815 |

| Interest on other borrowed funds | | 1,824 | | 1,566 | | 156 | | 4,298 | | 380 |

| Total interest expense | | 3,454 | | 3,407 | | 1,269 | | 11,056 | | 3,195 |

| Net Interest Income | | 11,951 | | 11,921 | | 13,485 | | 49,321 | | 46,062 |

| Provision for Credit Losses | | 873 | | $ | — | | | 648 | | 1,460 | | 1,638 |

| Net Interest Income after Provision for Credit Losses | | 11,078 | | 11,921 | | 12,837 | | 47,861 | | 44,424 |

| Noninterest Income: | | | | | | | | | | |

| Customer service fees | | 731 | | 686 | | 699 | | 2,918 | | 3,027 |

| Increase in cash surrender value of bank-owned life insurance | | 151 | | | 102 | | | 213 | | | 557 | | | 555 |

| Unrealized gain (loss) on fair value of marketable equity securities | | 138 | | (92) | | 28 | | 39 | | (429) |

| Gain on proceeds from bank-owned life insurance | | 907 | | | — | | | | | 907 | | | — | |

| Gain (loss) on fair value of junior subordinated debentures (TRUPS) | | 826 | | (811) | | (64) | | 274 | | (2,533) |

| | | | | | | | | | |

| Gain on sale of investment securities | | — | | | — | | | — | | | — | | | 30 | |

| Loss on sale of assets | | — | | | — | | | (10) | | | — | | | (10) | |

| Other | | 244 | | 229 | | 183 | | 874 | | 1,198 |

| Total noninterest income | | 2,997 | | 114 | | 1,049 | | 5,569 | | 1,838 |

| Noninterest Expense: | | | | | | | | | | |

| Salaries and employee benefits | | 3,220 | | 3,376 | | 3,042 | | 13,157 | | 11,833 |

| Occupancy expense | | 936 | | 984 | | 916 | | 3,739 | | 3,467 |

| Data processing | | 201 | | 204 | | 211 | | 784 | | 686 |

| Professional fees | | 1,397 | | 1,177 | | 1,102 | | 4,366 | | 4,058 |

| Regulatory assessments | | 173 | | 169 | | 164 | | 727 | | 794 |

| Director fees | | 117 | | 106 | | 105 | | 438 | | 452 |

| | | | | | | | | | |

| Correspondent bank service charges | | 23 | | 20 | | 18 | | 80 | | 93 |

| | | | | | | | | | |

| Net cost of operation of OREO | | 74 | | 30 | | 75 | | 201 | | 102 |

| Other | | 731 | | 559 | | 736 | | 2,462 | | 2,718 |

| Total noninterest expense | | 6,872 | | 6,625 | | 6,369 | | 25,954 | | 24,203 |

| Income Before Provision for Taxes | | 7,203 | | 5,410 | | 7,517 | | 27,476 | | 22,059 |

| Provision for Taxes on Income | | 1,803 | | 1,557 | | 2,175 | | 7,680 | | 6,373 |

| Net Income | | $ | 5,400 | | $ | 3,853 | | $ | 5,342 | | $ | 19,796 | | | $ | 15,686 | |

| | | | | | | | | | |

| Basic earnings per common share | | $ | 0.31 | | | $ | 0.22 | | | $ | 0.31 | | | $ | 1.16 | | | $ | 0.92 | |

| Diluted earnings per common share | | $ | 0.31 | | | $ | 0.22 | | | $ | 0.31 | | | $ | 1.16 | | | $ | 0.92 | |

| Weighted average basic shares for EPS | | 17,144,563 | | 17,132,080 | | 17,051,442 | | 17,114,214 | | 17,040,241 |

| Weighted average diluted shares for EPS | | 17,154,476 | | 17,140,204 | | 17,072,499 | | 17,125,186 | | 17,061,833 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| United Security Bancshares | | | | | | | | | | |

| Average Balances and Rates (unaudited) | | Three Months Ended | | Twelve Months Ended |

| (In thousands) | | December 31, 2023 | | September 30, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| Average Balances: | | | | | | | | | | |

| Loans (1) | | $ | 947,725 | | | $ | 958,861 | | | $ | 966,042 | | | $ | 955,435 | | | $ | 924,280 | |

| Investment securities | | 185,639 | | | 203,516 | | | 210,816 | | | 201,958 | | | 201,723 | |

| | | | | | | | | | |

| Interest-bearing deposits in FRB | | 9,663 | | | 5,876 | | | 65,799 | | | 6,187 | | | 122,575 | |

| Total interest-earning assets | | 1,143,027 | | | 1,168,253 | | | 1,242,657 | | | 1,163,580 | | | 1,248,578 | |

| Allowance for credit losses | | (15,253) | | | (15,817) | | | (10,085) | | | (15,759) | | | (9,708) | |

| Cash and due from banks | | 33,929 | | | 33,172 | | | 37,009 | | | 34,811 | | | 36,689 | |

| Other real estate owned | | 4,582 | | | 4,582 | | | 4,580 | | | 4,582 | | | 4,579 | |

| Other non-earning assets | | 80,830 | | | 76,454 | | | 75,480 | | | 77,646 | | | 71,044 | |

| Total average assets | | $ | 1,247,115 | | | $ | 1,266,644 | | | $ | 1,349,641 | | | $ | 1,264,860 | | | $ | 1,351,182 | |

| | | | | | | | | | |

| Interest-bearing deposits | | $ | 612,629 | | | $ | 598,737 | | | $ | 727,095 | | | $ | 651,099 | | | $ | 728,084 | |

| Junior subordinated debentures | | 10,847 | | | 10,615 | | | 10,260 | | | 10,793 | | | 10,682 | |

| Short-term borrowings | | 110,942 | | | 99,854 | | | — | | | 63,183 | | | — | |

| Total interest-bearing liabilities | | 734,418 | | | 709,206 | | | 737,355 | | | 725,075 | | | 738,766 | |

| Noninterest-bearing deposits | | 383,563 | | | 423,180 | | | 491,462 | | | 410,673 | | | 488,053 | |

| Other liabilities | | 11,614 | | | 16,857 | | | 10,387 | | | 12,715 | | | 10,010 | |

| Total liabilities | | 1,129,595 | | | 1,149,243 | | | 1,239,204 | | | 1,148,463 | | | 1,236,829 | |

| Total equity | | 117,520 | | | 117,401 | | | 110,437 | | | 116,397 | | | 114,353 | |

| Total liabilities and equity | | $ | 1,247,115 | | | $ | 1,266,644 | | | $ | 1,349,641 | | | $ | 1,264,860 | | | $ | 1,351,182 | |

| | | | | | | | | | |

| Average Rates: | | | | | | | | | | |

| Loans (1) | | 5.82 | % | | 5.69 | % | | 5.21 | % | | 5.67 | % | | 4.66 | % |

| Investment securities | | 2.94 | % | | 2.91 | % | | 2.82 | % | | 2.91 | % | | 2.29 | % |

| | | | | | | | | | |

| Interest-bearing deposits in FRB | | 5.58 | % | | 5.00 | % | | 3.51 | % | | 5.24 | % | | 1.31 | % |

| Earning assets | | 5.35 | % | | 5.21 | % | | 4.71 | % | | 5.19 | % | | 3.95 | % |

| Interest bearing deposits | | 1.19 | % | | 1.22 | % | | 0.37 | % | | 1.04 | % | | 0.39 | % |

| Total deposits | | 0.73 | % | | 0.71 | % | | 0.22 | % | | 0.64 | % | | 0.23 | % |

| Short-term borrowings | | 5.76 | % | | 5.39 | % | | — | % | | 5.54 | % | | — | % |

| Junior subordinated debentures | | 7.64 | % | | 7.81 | % | | 6.03 | % | | 7.40 | % | | 3.56 | % |

| Total interest-bearing liabilities | | 1.98 | % | | 1.91 | % | | 0.45 | % | | 1.52 | % | | 0.43 | % |

| Net interest margin (2) | | 4.08 | % | | 4.05 | % | | 4.44 | % | | 4.24 | % | | 3.69 | % |

| | | | | | | | | | |

(1) Loan amounts include nonaccrual loans, but the related interest income has been included only if collected for the period prior to the loan being placed on a nonaccrual basis.

(2) Net interest margin is computed by dividing annualized net interest income by average interest-earning assets.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| United Security Bancshares | | | | | | | | |

| Condensed - Consolidated Balance Sheets (unaudited) | | | | |

| | |

| (In thousands) | | December 31, 2023 | | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 |

| Cash and cash equivalents | | $ | 40,784 | | | $ | 35,297 | | | $ | 58,403 | | | $ | 45,153 | | | $ | 38,595 | |

| Investment securities | | 184,620 | | | 187,857 | | | 205,521 | | | 208,914 | | | 210,860 | |

| Loans net of unearned fees and unamortized loan origination costs | | 920,042 | | | 972,871 | | | 960,121 | | | 942,727 | | | 980,178 | |

| Allowance for credit losses | | (15,658) | | (10,063) | | (15,649) | | | (16,110) | | | (15,622) | | | (10,182) | |

| Net loans | | 904,384 | | | 957,222 | | | 944,011 | | | 927,105 | | | 969,996 | |

| Other assets | | 81,257 | | | 92,716 | | | 80,884 | | | 80,022 | | | 79,742 | |

| Total assets | | $ | 1,211,045 | | | $ | 1,273,092 | | | $ | 1,288,819 | | | $ | 1,261,194 | | | $ | 1,299,193 | |

| | | | | | | | | | |

| Non-interest-bearing deposits | | $ | 403,225 | | | $ | 386,258 | | | $ | 476,387 | | | $ | 394,745 | | | $ | 481,629 | |

| Interest-bearing deposits | | 601,252 | | | 601,373 | | | 570,167 | | | 716,387 | | | 683,855 | |

| Total deposits | | 1,004,477 | | | 987,631 | | | 1,046,554 | | | 1,111,132 | | | 1,165,484 | |

| Other liabilities | | 84,026 | | | 170,433 | | | 126,585 | | | 37,154 | | | 21,246 | |

| Total liabilities | | 1,088,503 | | | 1,158,064 | | | 1,173,139 | | | 1,148,286 | | | 1,186,730 | |

| Total shareholders’ equity | | 122,542 | | | 115,028 | | | 115,680 | | | 112,908 | | | 112,463 | |

| Total liabilities and shareholder’s equity | | $ | 1,211,045 | | | $ | 1,273,092 | | | $ | 1,288,819 | | | $ | 1,261,194 | | | $ | 1,299,193 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| United Security Bancshares | | | | | | | | |

| Condensed - Consolidated Statements of Income (unaudited) | | | | |

| | For the Quarters Ended: |

| (In thousands) | | December 31, 2023 | | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 |

| Total interest income | | $ | 15,405 | | | $ | 15,328 | | | $ | 15,086 | | | $ | 14,559 | | | $ | 14,754 | |

| Total interest expense | | 3,454 | | | 3,407 | | | 2,582 | | | 1,614 | | | 1,269 | |

| Net interest income | | 11,951 | | | 11,921 | | | 12,504 | | | 12,945 | | | 13,485 | |

| Provision (reversal) for credit losses | | 873 | | | — | | | 1,087 | | | (500) | | | 648 | |

| Net interest income after provision (reversal) for credit losses | | 11,078 | | | 11,921 | | | 11,417 | | | 13,445 | | | 12,837 | |

| Total non-interest income | | 2,997 | | | 114 | | | 1,011 | | | 1,448 | | | 1,049 | |

| Total non-interest expense | | 6,872 | | | 6,625 | | | 6,211 | | | 6,247 | | | 6,369 | |

| Income before provision for taxes | | 7,203 | | | 5,410 | | | 6,217 | | | 8,646 | | | 7,517 | |

| Provision for taxes on income | | 1,803 | | | 1,557 | | | 1,800 | | | 2,521 | | | 2,175 | |

| Net income | | $ | 5,400 | | | $ | 3,853 | | | $ | 4,417 | | | $ | 6,125 | | | $ | 5,342 | |

| | | | | | | | | | | | | | | | |

| United Security Bancshares | | | | | | |

| Nonperforming Assets (unaudited) | | | | | | |

| (Dollars in thousands) | | December 31, 2023 | | December 31, 2022 | | |

| | | | | | |

| | | | | | |

| Real estate - construction and development | | $ | 11,403 | | | $ | 14,436 | | | |

| Agricultural | | 45 | | | 108 | | | |

| | | | | | |

| Total nonaccrual loans | | 11,448 | | | 14,544 | | | |

| Loans past due 90 days and still accruing | | 426 | | | 252 | | | |

| Restructured Loans | | — | | | 141 | | | |

| | | | | | |

| Total nonperforming loans | | 11,874 | | | 14,937 | | | |

| Other real estate owned | | 4,582 | | | 4,582 | | | |

| Total nonperforming assets | | $ | 16,456 | | | $ | 19,519 | | | |

| | | | | | |

| Nonperforming loans to total gross loans | | 1.24 | % | | 1.52 | % | | |

| Nonperforming assets to total assets | | 1.32 | % | | 1.50 | % | | |

| Allowance for credit losses to nonperforming loans | | 136.77 | % | | 68.17 | % | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| United Security Bancshares | | | | | | | | |

| Selected Financial Data (unaudited) | | | | | | | | |

| | Three months ended December 31, | | Year Ended December 31, |

| (Dollars in thousands, except per share amounts) | | 2023 | | 2022 | | 2023 | | 2022 |

| Return on average assets | | 1.72 | % | | 1.57 | % | | 1.57 | % | | 1.16 | % |

| Return on average equity | | 18.28 | % | | 19.24 | % | | 17.05 | % | | 13.75 | % |

| Efficiency ratio (1) | | 46.40 | % | | 43.91 | % | | 47.32 | % | | 50.11 | % |

| Annualized net charge-offs to average loans | | 0.41 | % | | 0.19 | % | | 0.24 | % | | 0.10 | % |

| | | | | | | | |

| | | | | | December 31, 2023 | | December 31, 2022 |

| Shares outstanding - period end | | | | | | 17,167,895 | | | 17,067,253 | |

| Book value per share | | | | | | $ | 7.14 | | | $ | 6.59 | |

| Tangible book value per share | | | | | | $ | 6.88 | | | $ | 6.33 | |

| Individually evaluated loans | | | | | | $ | 11,828 | | | $ | 15,629 | |

| Net loan-to-deposit ratio | | | | | | 90.04 | % | | 83.23 | % |

| Allowance for credit losses to total loans | | | | | | 1.70 | % | | 1.04 | % |

| Tier 1 capital to adjusted average assets (leverage ratio): | | | | | | | | |

| Company | | | | | | 11.82 | % | | 10.10 | % |

| Bank | | | | | | 11.83 | % | | 9.64 | % |

(1) Efficiency ratio is total noninterest expense divided by net interest income before provision for credit losses plus total noninterest income.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| United Security Bancshares | | | | | | | | |

| Net Income before Non-Core Reconciliation | | | | | | | | |

| Non-GAAP Information (unaudited) | | | | | | | | |

| | Year Ended December 31, | | | | |

| (Dollars in thousands) | | 2023 | | 2022 | | Change $ | | Change % |

| Net income | | $ | 19,796 | | | $ | 15,686 | | | $ | 4,110 | | | 26.2 | % |

Junior subordinated debenture (TRUPs) fair value adjustment (1) | | 274 | | | (2,533) | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Income tax effect | | (79) | | | 735 | | | | | |

| Non-core items net of taxes | | 195 | | | (1,798) | | | | | |

| Non-GAAP core net income | | $ | 19,601 | | | $ | 17,484 | | | $ | 2,117 | | | 12.1 | % |

(1)Junior subordinated debenture fair value adjustment is not part of core income and depending upon market rates, can add to or subtract from core income and mask non-GAAP core income change.

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

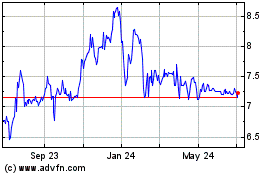

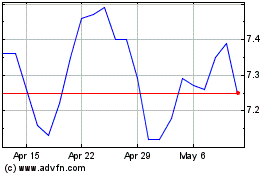

United Security Bancshares (NASDAQ:UBFO)

Historical Stock Chart

From Mar 2024 to Apr 2024

United Security Bancshares (NASDAQ:UBFO)

Historical Stock Chart

From Apr 2023 to Apr 2024