UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2024

Commission File Number: 000-55135

POET TECHNOLOGIES INC.

(Translation of registrant's name into English)

120 Eglinton Avenue East, Ste 1107

Toronto, Ontario, M4P 1E2, Canada

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ X ] Form 40-F [ ]

On January 25, 2024, the Registrant issued a press release, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

(c) Exhibit 99.1. Press release dated January 25, 2024

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | POET TECHNOLOGIES INC. |

| | | (Registrant) |

| | | |

| | | |

| Date: January 25, 2024 | | /s/ THOMAS MIKA |

| | | Thomas Mika |

| | | Executive Vice President and Chief Financial Officer |

| | | |

EXHIBIT 99.1

POET Technologies Announces Closing of C$6.2 Million Non-Brokered Private Placement of Units and Reports Preliminary Unaudited Fiscal Fourth Quarter and Fiscal Year 2024 Results

TORONTO, Jan. 25, 2024 (GLOBE NEWSWIRE) -- POET Technologies Inc. ("POET" or the "Corporation") (TSXV:PTK, NASDAQ:POET) is pleased to announce the completion of its non-brokered private placement previously announced on December 11, 2023, pursuant to which an aggregate of 5,098,088 units of the Corporation (the "Units") were issued at a price of $1.22 (US$0.90) per Unit for an aggregate gross proceeds of approximately C$6.2 million (US$4.6 million) (the "Offering").

Each Unit is comprised of one common share in the capital of the Corporation (each, a "Common Share") and one Common Share purchase warrant (each, a "Warrant"), with each Warrant entitling the holder thereof to purchase one additional common share of the Corporation (each, a "Warrant Share") at a price of C$1.52 (US$1.12) per Warrant Share for a period of five years following the date of issuance of such Warrant.

The net proceeds of the Offering are expected to be used for general corporate purposes, including revenue expansion and the development and production of photonic modules for AI and related markets. The securities issued pursuant to the Offering will be subject to certain hold periods under Canadian securities laws, if applicable, including the statutory four-month hold period from the date of closing of the Offering. The Offering remains subject to final acceptance of the TSX Venture Exchange ("TSXV"). The Common Shares and Warrant Shares have been conditionally approved for listing on the TSXV, subject to the final acceptance of the TSXV upon satisfaction by the Corporation of standard listing conditions. The Warrants will not be listed on any exchange.

Certain officers and directors of the Corporation have subscribed for an aggregate of 358,583 Units under the Offering for gross proceeds of approximately C$437,471 (US$322,725). Each subscription by an "insider" is considered to be a "related party transaction" for the purposes of Multilateral Instrument 61-101 – Protection of Minority Security Holders ("MI 61-101"). The Corporation did not file a material change report more than 21 days before the expected closing date of the Offering as the details of the Offering and participation therein by each "related party" of the Corporation were not settled until shortly prior to the closing of the Offering and the Corporation wishes to close the Offering on an expedited basis for sound business reasons. The Corporation is exempt from the formal valuation requirement under section 5.4 of MI 61-101 in reliance on section 5.5(a) of MI 61-101 as the fair market value of the transaction, insofar as it involves interested parties, is not more than 25% of the Corporation's market capitalization. Additionally, the Corporation is exempt from the minority shareholder approval requirement in section 5.6 of MI 61-101 in reliance on section 5.7(1)(a) of MI 61-101 as the fair market value of the transaction, insofar as it involves interested parties, is not more than 25% of the Corporation's market capitalization.

In connection with the Offering, the Corporation will pay an aggregate cash finders' fee of C$43,829 to GloRes Securities Inc. and World Source Securities Inc.

Preliminary Financial Update

The Corporation is providing preliminary financial data in advance of its expected annual reporting on or before March 30, 2024.

Preliminary financial data on an unaudited basis as of December 31, 2023 are as follows (all amounts are approximate and stated in U.S. dollars):

| | As of December 31, 2023 |

| Cash and cash equivalents | $ | 3,000,000 | |

| Working capital | $ | 600,000 | |

Preliminary financial data on an unaudited basis for the three and twelve months ended December 31, 2023 are as follows (all amounts are approximate and stated in U.S. dollars):

| | Three Months | Twelve Months |

| Revenues | $ | 110,000 | | $ | 470,000 | |

| Expenses(1) | $ | (5,570,000 | ) | $ | (20,770,000 | ) |

| Net loss | $ | (5,460,000 | ) | $ | (20,300,000 | ) |

(1) Three months and twelve months expenses include non-cash expenses of $1,700,000 and $6,200,000, respectively.

ATM Quarterly Update

During the fiscal quarter ended December 31, 2023, the Corporation did not issue any shares in its previously announced United States-only "at-the-market" offering program that was established pursuant to an equity distribution agreement dated September 1, 2023 between the Corporation and Craig-Hallum Capital Group LLC and the prospectus supplement dated September 1, 2023 to the Corporation's base prospectus dated August 18, 2023 that was included in the Corporation's U.S. registration statement on Form F-3 (File No. 333-273853) (the "Registration Statement"), which Registration Statement was declared effective by the United States Securities and Exchange Commission on August 18, 2023.

Other Updates

Further to the Corporation's news release on December 4, 2023 announcing the closing of a US$1.6 million public offering of common shares and warrants in the United States, in connection with that closing, the Corporation paid a cash commission of US$112,518, being 7% of the gross proceeds of the public offering, to Maxim Group LLC, which acted as agent in respect of that offering.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any securities in the United States or any other jurisdiction in which such offer, solicitation or sale would be unlawful. No securities may be offered or sold in the United States or in any other jurisdiction in which such offer or sale would be unlawful absent registration under the U.S. Securities Act of 1933, as amended, or an exemption therefrom or qualification under the securities laws of such other jurisdiction or an exemption therefrom.

Caution Regarding Preliminary Financial Data

The preliminary financial data as of December 31, 2023 and for the three and twelve months then ended presented in this press release are preliminary, remain subject to the completion of normal year-end accounting procedures and adjustments and, therefore, are subject to change. Furthermore, the Corporation's independent public accounting firm has not reviewed, audited or performed other procedures with respect to such preliminary results, and their audit or other procedures could result in changes to the preliminary data presented. This preliminary financial data should not be viewed as a substitute for full financial statements prepared in accordance with International Financial Reporting Standards and are not necessarily indicative of the results to be achieved for any future period.

About POET Technologies Inc.

POET is a design and development company offering integration solutions based on the POET Optical Interposer™, a novel platform that allows the seamless integration of electronic and photonic devices into a single multi-chip module using advanced wafer-level semiconductor manufacturing techniques and packaging methods. POET's Optical Interposer eliminates costly components and labor-intensive assembly, alignment, burn-in and testing methods employed in conventional photonics. The cost-efficient integration scheme and scalability of the POET Optical Interposer brings value to any device or system that integrates electronics and photonics, including some of the highest growth areas of computing, such as Artificial Intelligence (AI), the Internet of Things (IoT), autonomous vehicles and high-speed networking for cloud service providers and data centers. POET is headquartered in Toronto, with operations in Allentown, PA, Shenzhen, China and Singapore. More information may be obtained at www.poet-technologies.com.

Company Contact:

Thomas R. Mika, EVP & CFO

tm@poet-technologies.com

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained in this news release may be deemed "forward-looking information" (within the meaning of applicable Canadian securities laws) and "forward-looking statements" (within the meaning of the U.S. Private Securities Litigation Reform Act of 1995) (collectively, the "forward-looking statements"). These forward‐looking statements, by their nature, require the Corporation to make certain assumptions and necessarily involve known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward‐looking statements. Forward‐looking statements are not guarantees of performance. Words such as "may", "will", "would", "could", "expect", "believe", "plan", "anticipate", "intend", "estimate", "continue", or the negative or comparable terminology, as well as terms usually used in the future and the conditional, are intended to identify forward‐looking statements. Information contained in forward‐looking statements, including with respect to the use of proceeds of the Offering, the timing and ability of the Corporation to satisfy the customary listing conditions and obtain final approval of the TSX Venture Exchange (if at all), management's expectations regarding the success of the Corporation's products (including the photonic modules for AI and related markets), the timing and ability of the Corporation to successfully complete of its development and production efforts (if at all), the capabilities of its operations, the ability of the Corporation to generate revenue from operations (or expand such revenue) (if at all), the focus of the Corporation's operations and future production, is based upon certain material assumptions that were applied in drawing a conclusion or making a forecast or projection, including management's perceptions of historical trends, current conditions and expected future developments, industry and general economic conditions as well as other considerations that are believed to be appropriate in the circumstances. The Corporation considers its assumptions to be reasonable based on information currently available, but cautions the reader that their assumptions regarding future events, many of which are beyond the control of the Corporation, may ultimately prove to be incorrect since they are subject to risks and uncertainties that affect the Corporation, and its business.

For additional information with respect to these and other factors and assumptions underlying the forward‐looking statements made in this news release concerning the Corporation, see the public disclosure of the Corporation, including the annual report Form 20-F for the year ended December 31, 2022 and most recent management's discussion and analysis, which is available electronically under the Corporation's issuer profile on SEDAR+ (www.sedarplus.ca) and EDGAR (www.sec.gov). The forward‐looking statements set forth herein concerning the Corporation reflect management's expectations as at the date of this news release and are subject to change after such date. The Corporation disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, other than as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

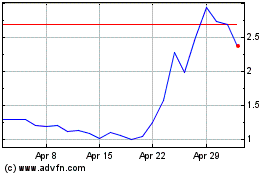

POET Technologies (NASDAQ:POET)

Historical Stock Chart

From Mar 2024 to Apr 2024

POET Technologies (NASDAQ:POET)

Historical Stock Chart

From Apr 2023 to Apr 2024