UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement |

| |

|

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ¨ |

Definitive Proxy Statement |

| |

|

| x |

Definitive Additional Materials |

| |

|

| ¨ |

Soliciting Material Pursuant to §240.14a-12 |

Consolidated Communications Holdings, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement,

if Other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x |

No fee required |

| |

|

| ¨ |

Fee paid previously with preliminary materials |

| |

|

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Consolidated Communications Holdings, Inc.

2116 South 17th Street

Mattoon, Illinois 61938-5973

SUPPLEMENT TO THE DEFINITIVE PROXY STATEMENT

FOR

THE SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD JANUARY 31, 2024

January 24, 2024

These definitive additional materials (this “Supplement”)

amend and supplement the definitive proxy statement dated December 18, 2023 (the “Definitive Proxy Statement”),

initially mailed to stockholders on or about December 18, 2023 and further supplemented on December 27, 2023, January 3,

2024, January 10, 2024, January 11, 2024, January 19, 2024, January 22, 2024 and January 23, 2024 by Consolidated Communications Holdings, Inc., a Delaware corporation (the

“Company” or “Consolidated”), for the special meeting of stockholders of Consolidated (the “Special

Meeting”) to be held virtually via the Internet on January 31, 2024, at 9:00 a.m. Central Time at http://www.virtualshareholdermeeting.com/CNSL2024SM.

As previously disclosed, on October 15, 2023, Consolidated entered

into an Agreement and Plan of Merger (the “Merger Agreement”), with Condor Holdings LLC, a Delaware limited liability

company (“Parent”) affiliated with certain funds managed by Searchlight Capital Partners, L.P. (“Searchlight”),

and Condor Merger Sub Inc., a Delaware corporation and a wholly owned subsidiary of Parent (“Merger Sub”), pursuant

to which Merger Sub will merge with and into the Company (the “Merger”), with the Company surviving the Merger as a

wholly owned subsidiary of an affiliate of Searchlight (the “Surviving Corporation”).

The Company’s board of directors (the “Company Board”)

formed a special committee (the “Special Committee”) consisting solely of independent and disinterested directors of

the Company Board to, among other things, consider, review, evaluate and negotiate the Merger Agreement and the transactions contemplated

thereby, including the Merger, and any other alternatives available to the Company, including the possibility of not entering into any

transaction or entering into an alternative transaction with another third party, and to provide its recommendations to the Company Board

for its approval.

The Company Board, acting upon the recommendation of the Special

Committee, has approved the Merger Agreement and the transactions contemplated thereby, including the Merger, and recommends that you

vote “FOR” the Merger Agreement Proposal, “FOR” the Advisory Compensation Proposal and “FOR” the Adjournment

Proposal.

If any stockholders have not already submitted a proxy for use at

the Special Meeting, they are urged to do so promptly. No action in connection with this Supplement is required by any stockholder who

has previously delivered a proxy and who does not wish to revoke or change that proxy.

As of January 23, 2024, the Company has received two complaints

that were filed by purported Consolidated stockholders against the Company and its directors related to the Merger, one of which was voluntarily

dismissed.

As described in the Definitive Proxy Statement, one complaint has been

filed in a federal court, which names as defendants the Company and members of the Company Board (the “Federal Court Complaint”).

The Federal Court Complaint alleges, among other things, violations of Section 14(a), Section 20(a) and Rule 14a-9

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The complaint generally alleges that the Definitive

Proxy Statement omits alleged material information with respect to the proposed transaction and the valuation analyses performed by the

Company’s financial advisors regarding the proposed transaction, which renders the Definitive Proxy Statement false and misleading.

The Federal Court Complaint seeks, among other things, (i) injunctive relief preventing the consummation of the proposed transaction,

(ii) rescission, to the extent already implemented, of the proposed transaction, (iii) damages and (iv) plaintiffs’

attorneys’ and experts’ fees and expenses. The Company believes the claims asserted in the Federal Court Complaint are without

merit and intends to vigorously defend against them. The Federal Court Complaint was voluntarily dismissed by the plaintiff on January 4,

2024.

On December 28, 2023, one purported stockholder of the

Company commenced an action, captioned Garfield v. Currey, et al. in the Fifth Judicial Circuit of Illinois, Coles

County, Illinois (the “Circuit Court Complaint”). The Circuit Court Complaint names the Company, the members

of the Company Board, Searchlight, Searchlight III CVL, L.P., British Columbia Investment Management Corporation, Parent and Merger

Sub as defendants. The Circuit Court Complaint asserts claims under the Illinois Securities Act of 1953, as well as claims under

Illinois law for negligent misrepresentation and concealment and negligence, related to the disclosure set forth in the Definitive

Proxy Statement. The Circuit Court Complaint seeks, among other relief, an injunction preventing the parties to the Merger Agreement

from consummating the proposed transaction and an award of attorneys’ fees, interest, expert fees, and other costs.

The Company has received certain demand letters (collectively, the

“Demand Letters”) from purported stockholders of the Company generally alleging that the Definitive Proxy Statement

contains alleged material misstatements and omissions in violation of Section 14(a), Section 20(a) and Rule 14a-9

of the Exchange Act. If additional similar demand letters are received or if additional complaints are filed, absent new or different

allegations that are material, the Company may choose not to announce such additional filings.

While the Company believes that the disclosure set forth in the Definitive

Proxy Statement complies fully with applicable law, in order to moot the plaintiffs’ disclosure claims, avoid nuisance, possible

expense and delay, and provide additional information to our stockholders, the Company has determined, without admitting any liability

or wrongdoing, to voluntarily supplement the Definitive Proxy Statement with the supplemental disclosure set forth below (the “Supplemental

Disclosure”). Nothing in the Supplemental Disclosure shall be deemed an admission of the legal necessity or materiality under

applicable law of any of the disclosure set forth herein or in the Definitive Proxy Statement. To the contrary, the Company specifically

denies all allegations in the Demand Letters, the Federal Court Complaint and the Circuit Court Complaint that any additional disclosure

was or is required.

If you have any questions concerning the Merger, the Merger

Agreement, the proposals, the Special Meeting, this Supplement, the previous supplements filed by the Company on December 27,

2023, January 3, 2024, January 10, 2024, January 11, 2024, January 19, 2024, January 22, 2024 and January 23, 2024, respectively, or the Definitive Proxy Statement, or you

would like an additional copy of this Supplement, the previous supplements filed by the Company on December 27, 2023,

January 3, 2024, January 10, 2024, January 11, 2024, January 19, 2024, January 22, 2024 and January 23, 2024, respectively, or the Definitive Proxy Statement or you need

help submitting your proxy for your shares of Consolidated common stock, please contact the Company’s proxy solicitor in

connection with the Special Meeting:

Morrow Sodali LLC

430 Park Avenue, 14th Floor

New York, NY 10022

Shareholders may call toll-free: (800) 662-5200

or +1 (203) 658-9400 (international)

Banks and brokers may call: (800) 662-5200 or

+1 (203) 658-9400 (international)

Email: CNSL@info.morrowsodali.com

The information contained herein speaks only as of January 23,

2024 unless the information specifically indicates that another date applies.

SUPPLEMENTAL DISCLOSURES TO DEFINITIVE PROXY

STATEMENT

This Supplement should be read in conjunction with the

Definitive Proxy Statement and the previous supplements filed by the Company on December 27, 2023, January 3, 2024,

January 10, 2024, January 11, 2024, January 19, 2024, January 22, 2024 and January 23, 2024, respectively, each of which should be read in its entirety. Defined terms used but

not defined below have the meanings set forth in the Definitive Proxy Statement. All page references in the Supplemental

Disclosure below are to pages in the Definitive Proxy Statement. Paragraph references used herein refer to the Definitive Proxy

Statement before any additions or deletions resulting from the Supplemental Disclosure. Bolded text shows text being added to a

referenced disclosure in the Definitive Proxy Statement, and stricken-through text shows text being deleted from a referenced

disclosure in the Definitive Proxy Statement. The information contained herein speaks only as of January 23, 2024 unless the

information indicates another date applies.

| 1. |

The paragraph under the heading “Special Factors—Background of the Merger” beginning “On April 23, 2023, the Board resolved by unanimous written consent…” on page 20 is hereby amended as follows: |

On April 29, 2023, the Board resolved by unanimous written consent

to establish the Special Committee, comprised of Mr. Currey, Mr. Gerke, Mr. Moore and Ms. Rahe and constituting a

majority of the directors who are not employees of the Company, to analyze, evaluate and negotiate the Potential Transaction, as well

as, unless and until the proposal for the Potential Transaction may be withdrawn, any other strategic alternative to the Potential Transaction,

including, without limitation, (i) a possible sale or other business combination transaction or series of transactions involving

all or substantially all of the Company’s equity or assets on a consolidated basis through any form of transaction, including, without

limitation, merger, stock purchase, asset purchase, recapitalization, reorganization, consolidation, amalgamation or other transaction

or (ii) the Company continuing to operate as an independent company (each of the Potential Transaction and any other such strategic

alternative, a “Strategic Alternative”). Although Ms. Solis had previously served on the 2022 Special Committee, she

was unable to serve on the Special Committee formed on April 29, 2023 due to scheduling conflicts. The Board further resolved,

among other things, to (i) determine that each member of the Special Committee is not affiliated with Searchlight or BCI, does not

have a material interest in the Potential Transaction (other than an interest by virtue of their ownership of capital stock of the Company)

and is disinterested with respect to the Potential Transaction; (ii) delegate to the Special Committee the authority to (a) explore

and consider any Strategic Alternative to determine whether such Strategic Alternative is in the best interests of the Company’s

stockholders and, if applicable, to determine whether such Strategic Alternative is fair (as used in Item 1014(a) of Regulation M-A)

to and in the best interests of the “unaffiliated security holders” of the Company, as defined in Rule 13e-3(a) under

the Exchange Act; (b) consult with Company management, the Company’s financial and legal advisors, the Special Committee’s

professional advisors and, in the Special Committee’s sole discretion, such other persons in connection with such analysis, evaluation

and negotiation of any Strategic Alternative; (c) enter into discussions and negotiations with respect to the terms and conditions

of any Strategic Alternative, including the negotiation on behalf of the Company of any agreements or arrangements deemed necessary, appropriate

or advisable with respect thereto; (d) determine whether to recommend to the full Board the approval of any such Strategic Alternative

or any agreements or arrangements proposed to be entered into by the Company or any of its affiliates directly or indirectly in connection

with any such Strategic Alternative; and (e) determine not to enter into any such Strategic Alternative; (iii) not enter into,

and not approve, the Potential Transaction unless the Special Committee shall have determined that the Potential Transaction is fair to

and in the best interests of the holders of a majority of the shares of Company common stock that are not owned by Searchlight or BCI,

and recommended to the full Board the approval of the Potential Transaction and such recommendation shall not have been revoked or withdrawn;

and (iv) not consummate the Potential Transaction unless the Potential Transaction has been approved by a vote of the holders of

at least a majority of the voting power of the capital stock that is not owned by Searchlight or BCI.

| 2. |

The paragraph under the heading “Special Factors—Background

of the Merger” beginning “On June 19, 2023, following meetings between representatives of Rothschild & Co and

Company management on June 15, 2023 and June 19, 2023…” on page 23 is hereby amended as follows:

|

On June 19, 2023, following meetings between representatives

of Rothschild & Co and Company management on June 15, 2023 and June 19, 2023, Company management shared updated versions

of the May Standalone Plan (the “June Standalone Plan”), the Illustrative Buyer Plan (Including Pre-Closing Capital)

and the Illustrative Buyer Plan (No Pre-Closing Capital) with the Special Committee, which made certain technical corrections to the

May Standalone Plan approved by the Special Committee on June 14, 2023, the Illustrative Buyer Plan (Including Pre-Closing

Capital) and the Illustrative Buyer Plan (No Pre-Closing Capital),and, as a result of such technical corrections, made certain

additional adjustments to,. These technical corrections included (i) an updated Secured Overnight Financing Rate curve,

which rate increase resulted in increased interest expense in the near term and increased anticipated borrowings under the Company’s

existing revolving credit facility and (ii) meaningfully slower near-term build rates arising out of the Company’s projected

liquidity constraints in order to maintain an appropriate minimum liquidity level. As a result of these technical corrections, the June Standalone

Plan reflected, among other things, (1) reduce the (i) a reduced projected fiber build rate pace

in the near term to maintain an appropriate minimum liquidity level and (2) increase

the (ii) an increased projected fiber build rate pace in later years when and

shortened overall length of the Company’s build program, following a projected strengthening in the Company’s liquidity

position was projected to strengthen.

| 3. |

The paragraph under the heading “Special Factors—Background of the Merger” beginning “On September 13, 2023, the Special Committee met, together with…” on page 29 is hereby amended as follows: |

On September 13, 2023, the Special Committee met, together with representatives

of each of Cravath and Rothschild & Co, to discuss the most recent verbal indication of $4.35/share, Rothschild & Co’s updated

preliminary financial analyses that had been reviewed with the Special Committee on September 6, 2023, the Company’s recent operating

performance, the Company’s capital requirements and near-term liquidity position, the opportunities and risks associated with other

Strategic Alternatives, including continuing to operate as a standalone company, and the key terms and conditions reflected in the draft

merger agreement received on September 12, 2023. The Special Committee discussed sensitivities relating to key assumptions relevant to

the Company’s valuation. The Special Committee considered a range of responses to the most recent verbal indication, taking into

account the Special Committee’s discussions regarding valuation that took place on July 14, 2023, and determined in their best judgment

that continuing negotiations with an indication of value from the Special Committee that would induce Searchlight and BCI to offer a higher

indication of value was in the best interests of the Unaffiliated Stockholders, and that providing a counterproposal to Searchlight and

BCI was the best course of action given the lack of other attractive Strategic Alternatives and the risks that the Company would face

if it continued to operate on a standalone public company basis. The Special Committee had not received any proposals or indications

of interest that discussed the retention of Company management in the surviving company or the potential purchase of or participation

in the equity of the surviving company by Company management following the completion of a proposed transaction. Following the discussion

during which the Special Committee determined that inducing Searchlight and BCI to offer a higher indication of value would be the

best course of action, the Special Committee directed representatives of Rothschild & Co to make a counterproposal to Searchlight

of $5.25/share.

| 4. |

The paragraph under the heading “Special Factors—Background of the Merger” on page 31 beginning “On September 26, 2023, representatives of Party A delivered to representatives of Rothschild & Co…” is hereby amended as follows: |

On September 26, 2023, representatives of Party A delivered to

representatives of Rothschild & Co a written proposal regarding the key proposed terms of a financing proposal

for the Company (the “Party A Proposal”). The Party A Proposal contemplated that Party A would provide the Company with

a $350 million first lien term loan maturing in July 2027. The term loan would have an interest rate equal to the Secured Overnight

Financing Rate plus 7.00% and would be secured by certain network assets of the Company. In addition, the Party A Proposal contemplated

that Party A would receive, for no consideration, 10-year warrants with an exercise price of $4.00 per share for 5% of the Company’s

common stock. The all-in cost of capital of the Party A Proposal was estimated to be approximately 15.0%, which assumed a Secured Overnight

Financing Rate of 5.40% and was based on amortizing the aggregate fees payable by the Company to Party A and other participating lenders

at closing of 9.00% over 3.5 years. The estimated cost of capital excluded potential dilution from equity consideration payable by the

Company to Party A in connection with the warrants. Also on September 26, 2023, representatives of Wildcat contacted representatives

of Rothschild & Co to request a meeting to discuss further their perspective on the Potential Transaction. On October 1,

2023, after consultation with representatives of Cravath, and at the direction of the Special Committee, representatives of Rothschild &

Co declined the request, indicating that the Company was in a quiet period in connection with its upcoming quarterly earnings announcement

..

| 5. |

The paragraph under the heading “Special Factors—Background of the Merger” beginning “On October 11, 2023, the Special Committee met, together with representatives of Cravath and Rothschild & Co…” on page 32 is hereby amended as follows: |

On October 11, 2023, the Special Committee met, together with representatives

of each of Cravath and Rothschild & Co, to discuss the status of negotiation of the Potential Transaction. The Special Committee directed

representatives of Cravath to agree to Searchlight and BCI’s proposed treatment of the outstanding equity awards in connection with,

and subject to, Searchlight and BCI’s acceptance of the Special Committee’s proposal on certain other compensation and benefit-related

items. Following the submission of Searchlight and BCI’s proposal and prior to the agreement of the transaction terms, there

was no discussion related to post-transaction employment, directorships, compensation or benefits matters.

| 6. |

The paragraph under the heading “Special Factors—Opinion of Rothschild & Co US Inc.” beginning “EV was calculated as fully diluted equity market value…” on page 52 is hereby amended as follows: |

EV was calculated as fully diluted equity market value based on per

share stock prices, (a) with respect to each of the selected public companies, plus such company’s most recently disclosed

net debt and other adjustments or (b) with respect to the Company, plus the Company’s debt of approximately $2.2 billion,

plus the Company’s net, tax-effected projected benefit obligation (“PBO”) and other post-employment benefits (“OPEB”)

of approximately $94.5 million, less the Company’s cash and cash equivalents of approximately $202.6 million, less

the net present value of the Washington assets (as described above) of approximately $67.7 million, plus preferred stock (at liquidation

preference) of approximately $498.3 million, plus noncontrolling interests of approximately $8.0 million, less investments

of approximately $9.1 million, each as of June 30, 2023 (other than PBO and OPEB, each of which is an annual balance as of

December 31, 2022), and as provided and approved for Rothschild & Co’s use by the management of the Company.

| 7. |

The paragraph under the heading “Special Factors—Opinion of Rothschild & Co US Inc.” beginning “Based on the 2024E EV/Revenue multiples calculated above…” on page 53 is hereby amended as follows: |

Based on the 2024E EV/Revenue multiples calculated above and on Rothschild &

Co’s professional judgment, Rothschild & Co applied an illustrative range of EV/Revenue of 2.25x to 2.75x to the estimated

consolidated revenue of the Company for its fiscal year 2024, as provided in the August Standalone Plan and adjusted to exclude the

impact of the Washington operations assets (as described above), to reach a range of implied EVs for the Company for fiscal year 2024.

Based on the 2024E EV/Adj. EBITDA and 2025E EV/Adj. EBITDA multiples calculated above and on Rothschild & Co’s professional

judgement, Rothschild & Co applied an illustrative range of EV/Adj. EBITDA of 5.5x to 7.0x and 5.5x to 7.0x to the estimated

Adj. EBITDA of the Company for fiscal years 2024 and 2025, respectively, each as provided in the August Standalone Plan and in the

case of 2024, adjusted to exclude the impact of the Washington assets (as described above), to reach a range of implied EVs for the Company

for fiscal years 2024 and 2025. To calculate implied equity values, Rothschild & Co then subtracted from such implied EVs (i) the

amount of the Company’s debt, (ii) the Company’s net, tax-effected PBO and OPEB, (iii) preferred stock (at liquidation

preference), (iv) noncontrolling interest and investments and added the Company’s (v) cash and cash equivalents, each

as provided and approved for Rothschild & Co’s use by the management of the Company and added (vi) the net present

value of the Washington assets (as described above), each of the foregoing (i) - (vi) as of June 30, 2023

(other than (ii) PBO and OPEB, each of which is an annual balance as of December 31, 2022). Rothschild & Co then divided

such implied equity values by the number of fully diluted outstanding shares of Company common stock of approximately 118.5 million,

as provided by the management of the Company and approved for Rothschild & Co’s use, to reach the following implied per

share equity value reference ranges for the Company, rounded to the nearest $0.25, as compared to the merger consideration:

| 8. |

The paragraph under the heading “Special Factors—Opinion of Rothschild & Co US Inc.” beginning “Based on the EV/LTM Adj. EBITDA multiples calculated for the selected transactions…” on page 55 is hereby amended as follows: |

Based on the EV/LTM Adj. EBITDA multiples calculated for the selected

transactions and on Rothschild & Co’s professional judgment, Rothschild & Co applied an illustrative range of

6.0x to 9.4x to the estimated LTM Adj. EBITDA of the Company of $319 million for the period ended June 30, 2023 on a pro forma basis

to exclude certain of the Company’s previous divestitures for consistency with the August Standalone Plan, as provided by the

management of the Company and approved for Rothschild & Co’s use by the Special Committee, and further adjusted to exclude

the impact of the Washington operations’ assets (as described above), to reach a range of implied EVs for the Company. To calculate

implied equity values, Rothschild & Co then subtracted from such implied EVs (i) the amount of the Company’s debt

of approximately $2.2 billion, (ii) the Company’s net, tax-effected PBO and OPEB of approximately $94.5 million,

(iii) preferred stock (at liquidation preference) of approximately $498.3 million, (iv) noncontrolling interest and investments

of approximately $1.1 million and added the Company’s (v) cash and cash equivalents of approximately $202.6 million,

each as provided and approved for Rothschild & Co’s use by the management of the Company, and added (vi) the net present

value of the Washington assets (as described above) of approximately $67.7 million, each of the foregoing (i) - (vi) as

of June 30, 2023 (other than (ii) PBO and OPEB, each of which is an annual balance as of December 31, 2022). Rothschild &

Co then divided such implied equity values by the number of fully diluted outstanding shares of Company common stock of approximately

118.5 million, as provided by the management of the Company and approved for Rothschild & Co’s use, to reach the following

implied per share equity value reference ranges for the Company, rounded to the nearest $0.25, as compared to the merger consideration:

| 9. |

The paragraph under the heading “Special Factors—Opinion of Rothschild & Co US Inc.” beginning “Rothschild & Co performed a discounted cash flow (“DCF”) analysis for the Company…” on page 55 is hereby amended as follows: |

Rothschild & Co performed a discounted cash flow (“DCF”)

analysis for the Company in order to derive an implied per share equity value reference range for the Company if it were to remain an

independent public company, and then compared this implied per share equity value reference range with the merger consideration provided

for in the merger agreement. In this analysis, Rothschild & Co calculated a range of implied EVs by adding (i) the estimated

unlevered, after-tax free cash flows that the Company was forecasted to generate from the six months ended June 30, 2023 through

the end of fiscal year 2031 based on the August Standalone Plan provided by the management of the Company, discounted to present

value, as of June 30, 2023, after the application of a range of illustrative discount rates, which were based on the WACC for the

Company to (ii) the present value, as of June 30, 2023, of the implied terminal value of the Company, after the application

of a range of illustrative discount rates, based on the estimated WACC for the Company and (iii) the estimated federal net operating

losses the Company was forecasted to generate and utilize from the six months ended June 30, 2023 through the end of fiscal year

2031 based on the August Standalone Plan provided by the management of the Company, discounted to present value, as of June 30,

2023, after the application of a range of illustrative discount rates, which were based on the estimated WACC for the Company. Rothschild &

Co estimated the terminal value of the Company by applying an illustrative range of growth rates in perpetuity of 1.5% to 2.5%, which

Rothschild & Co selected using its experience and professional judgment and taking into account the August Standalone

Plan and certain metrics for the U.S. economy and financial markets generally, to the estimated unlevered after-tax free cash flows

included in the August Standalone Plan for the terminal period.

| 10. |

The paragraph under the heading “Special Factors—Opinion of Rothschild & Co US Inc.” beginning “Unlevered, after-tax free cash flows for the terminal period were calculated…” on page 56 is hereby amended as follows: |

Unlevered, after-tax free cash flows for the terminal period were calculated

as net operating profit after taxes after application of the illustrative range of growth rates described above, plus depreciation and

amortization, less capital expenditures, less stock-based compensation, less increases (or plus decreases) in net working capital. Rothschild &

Co used the mid-year discounting convention and applied a range of illustrative discount rates of 9.5% to 10.5%, based on an estimated

WACC, which Rothschild & Co calculated using its professional judgment and experience and based on the traditional capital

asset pricing model (“CAPM”). CAPM requires certain Company-specific inputs, including target capital structure weightings,

the cost of long-term debt, future applicable marginal cash tax rates, and levered and unlevered betas as well as certain financial metrics

for the U.S. financial markets generally.

| 11. |

The paragraph under the heading “Special Factors—Opinion of Rothschild & Co US Inc.” beginning “To calculate implied equity values, Rothschild & Co then subtracted from such implied EVs…” on page 56 is hereby amended as follows: |

To calculate implied equity values, Rothschild & Co then subtracted

from such implied EVs the amount of the Company’s debt of approximately $2.2 billion, the Company’s net, tax-effected

PBO and OPEB of approximately $94.5 million, preferred stock (at liquidation preference) of approximately $498.3 million,

noncontrolling interest and investments of approximately $1.1 million and added the Company’s cash and cash equivalents of

approximately $202.6 million, each as of June 30, 2023 (other than PBO and OPEB, each of which is an annual balance as of December 31,

2022) and as provided and approved for Rothschild & Co’s use by the management of the Company. Rothschild & Co

then divided such implied equity values by the number of fully diluted outstanding shares of Company common stock of approximately

118. 5 million, as provided by the management of the Company and approved for Rothschild & Co’s use, to reach the following

implied per share equity value reference ranges for the Company, rounded to the nearest $0.25, as compared to the merger consideration:

| 12. |

The fourth bullet point beginning “based on information Rothschild & Co obtained from FactSet and Bloomberg…” under the subsection titled “Other Factors” under the heading “Special Factors—Opinion of Rothschild & Co US Inc.” on page 56 is hereby amended as follows: |

based on information Rothschild & Co obtained from FactSet

and Bloomberg, three (3) selected equity analyst per share target prices for shares of Company common stock as of April 12,

2023, noting that the range of these target prices was $2.50 to $4.50;, as shown in the following table:

| Institution | |

Price Target ($) | |

| TD Cowen | |

$ | 4.50 | |

| Citibank | |

$ | 2.50 | |

| Wells Fargo | |

$ | 4.00 | |

| 13. |

The fifth bullet point beginning “based on information Rothschild & Co obtained from FactSet and Bloomberg…” under the subsection titled “Other Factors” under the heading “Special Factors—Opinion of Rothschild & Co US Inc.” on page 57 is hereby amended as follows: |

based on information Rothschild & Co obtained from FactSet

and Bloomberg, three (3) selected equity analyst per share target prices for shares of Company common stock as of October 13,

2023, noting that the range of these target prices was $3.75 to $4.00, as shown in the table below; and

| Institution | |

Price Target ($) | |

| TD Cowen | |

$ | 4.00 | |

| Citibank | |

$ | 3.75 | |

| Wells Fargo | |

$ | 4.00 | |

| 14. |

The sixth bullet point beginning “based on information Rothschild & Co obtained from Wall Street equity research reports…” under the subsection titled “Other Factors” under the heading “Special Factors—Opinion of Rothschild & Co US Inc.” on page 57 is hereby amended as follows: |

based

on information Rothschild & Co obtained from Wall Street equity research reports, three (3) selected equity analyst

per share target prices based on DCF-based valuations for shares of Company common stock as of October 13, 2023, noting that the

range of these target prices was $3.94 to $4.72, as shown in the table below.

| Institution | |

Price Target ($) | |

| TD Cowen | |

$ | 3.94 | |

| Citibank | |

$ | 4.72 | |

| Wells Fargo | |

$ | 4.00 | |

| 15. |

The paragraph under the heading “Special Factors—Opinion of Rothschild & Co US Inc.” beginning “During the two-year period ending on October 15, 2023, Rothschild & Co…” on page 60 is hereby amended as follows: |

During the two-year period ending on October 15, 2023,

Rothschild & Co did not provide financial advisory services to the Company, Parent, Searchlight, BCI or any of their

respective affiliates other than, (a) in the case of the Company, Rothschild & Co’s financial advisory services

to the Special Committee in connection with the evaluation of the potential sale, merger or other business/strategic combination

involving the Company, including, without limitation, with respect to the merger contemplated by the merger agreement and

(b) in the case of certain affiliates and/or portfolio companies of Searchlight, with respect to Rothschild &

Co’s and/or its affiliates’ financial advisory services, in connection with

matters unrelated to the merger, including an affiliate of Rothschild & Co representing an affiliate of Searchlight

in connection with an acquisition of Gresham House plc, for which. Subsequent to October 15, 2023, in

connection with an affiliate of Rothschild & Co’s representation of an affiliate of Searchlight in connection with an

acquisition of Gresham House plc, such affiliate of Rothschild & Co and its affiliates accrued did

not, but has not yet received may, receive, fees for its services of approximately

£3.0 million. Rothschild & Co and its affiliates are engaged in a wide range of financial advisory and investment

banking activities. In addition, in the ordinary course of their asset management, merchant banking and other business activities,

Rothschild & Co’s affiliates may trade in the securities of the Company, Parent, Searchlight, BCI or any of their

respective affiliates, for their own accounts or for the accounts of their affiliates and customers, and may at any time hold a long

or short position in such securities. Rothschild & Co or its affiliates may in the future provide financial services to the

Company, Parent, Searchlight, BCI and/or their respective affiliates in the ordinary course of their businesses from time to time

and may receive fees for the rendering of such services.

| 16. |

The paragraph under the heading “Special Factors—Interests of the Company’s Directors and Executive Officers in the Merger” beginning “Prior to the effective time, the Company’s directors or executive officers may enter into discussions…” on page 79 is hereby amended as follows: |

Prior to the effective time, the Company’s directors or executive

officers may enter into discussions with Parent or its affiliates regarding future compensation arrangements. As of the date of

this proxy statement, One of the Searchlight Directors received $275,000 from Searchlight for advisory services provided by

such director to Searchlight in connection with the 2020 Investment. Additionally, in October 2020, in connection with such director

joining the Company Board, Searchlight granted such director a deferred equity grant equivalent to 200,000 shares of Company common stock.

Such director is not a member of the Special Committee. Aside from the aforementioned director, none of the Company’s directors

or executive officers has entered into any such agreement, arrangement or understanding with Parent or any of its affiliates regarding

employment, or providing for any compensation or benefits, following the effective time, and the merger is not conditioned upon any such

agreement, arrangement or understanding being entered into.

—END OF SUPPLEMENT TO DEFINITIVE PROXY

STATEMENT—

Additional Information and Where to Find It

This communication is being made in respect of the Merger involving

the Company and Parent, an affiliate of Searchlight. In connection with the proposed transaction, the Company filed with the Securities

and Exchange Commission (the “SEC”) a Definitive Proxy Statement on December 18, 2023, which was supplemented

on December 27, 2023, January 3, 2024, January 10, 2024, January 11, 2024, January 19, 2024, January 22, 2024 and January 23, 2024. Promptly after filing its Definitive

Proxy Statement with the SEC, the Company mailed the Definitive Proxy Statement and a proxy card to each stockholder of the Company entitled

to vote at the special meeting relating to the Merger. This communication is not a substitute for the Definitive Proxy Statement or any

other document that the Company has filed or may file with the SEC or send to its stockholders in connection with the proposed transaction.

INVESTORS AND STOCKHOLDERS OF THE COMPANY ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER RELEVANT MATERIALS BEFORE MAKING

ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED TRANSACTION BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY

AND THE PROPOSED TRANSACTION. The materials filed by the Company are available to the Company’s investors and stockholders at no

expense to them and copies may be obtained free of charge by directing a request to the Company at 2116 South 17th Street,

Mattoon, IL 61938, Attention: Investor Relations or at tel: +1 (844) 909-2675. In addition, all of those materials are available

at no charge on the SEC’s website at www.sec.gov.

Participants in the Solicitation

The Company and certain of its directors, executive officers and other

members of management and employees may be deemed to be participants in the solicitation of proxies from its stockholders in connection

with the Merger. Information regarding the persons who may, under the rules of the SEC, be considered to be participants in the solicitation

of the Company’s stockholders in connection with the Merger is set forth in the Definitive Proxy Statement. Additional information

regarding these individuals and any direct or indirect interests they may have in the Merger is set forth in the Definitive Proxy Statement

and other relevant documents that are filed or will be filed with the SEC in connection with the Merger. You may obtain free copies of

these documents using the sources indicated above.

Additional information regarding the interests of such individuals

in the proposed acquisition of the Company are included in the Definitive Proxy Statement. These documents may be obtained free of charge

at the SEC’s website at www.sec.gov.

Cautionary Statement on Forward-Looking Statements

This communication contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, each as

amended, including all statements other than statements of historical fact contained in this communication and includes, without

limitation, statements regarding the transaction and anticipated closing date. These statements identify prospective information and

may include words such as “expects,” “intends,” “continue,” “plans,”

“anticipates,” “believes,” “estimates,” “predicts,” “projects,”

“potential,” “should,” “may,” “will,” or the negative version of these words,

variations of these words and comparable terminology. These forward-looking statements are based on information available to the

Company as of the date of this communication and are based on management’s current views and assumptions. These

forward-looking statements are conditioned upon and also involve a number of known and unknown risks, uncertainties, and other

factors that could cause actual results, performance or events to differ materially from those anticipated by these forward-looking

statements. Such risks, uncertainties, and other factors may be beyond the Company’s control and may pose a risk to the

Company’s operating and financial condition. Such risks and uncertainties include, but are not limited to, the following

risks: (i) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger

agreement; (ii) the risk that the Company’s stockholders may not approve the proposed transaction;

(iii) inability to complete the proposed transaction because, among other reasons, conditions to the closing of the proposed

transaction may not be satisfied or waived; (iv) uncertainty as to the timing of completion of the proposed

transaction; (v) potential adverse effects or changes to relationships with customers, employees, suppliers or other

parties resulting from the announcement or completion of the proposed transaction; (vi) potential litigation relating to

the proposed transaction that could be instituted against the Company, Parent or their respective directors and officers, including

the effects of any outcomes related thereto; or (vii) possible disruptions from the proposed transaction that could harm

the Company’s or Parent’s business, including current plans and operations. Information concerning additional risks,

uncertainties and other factors that could cause results to differ materially from the expectations described in this communication

is contained in the Company’s filings with the SEC, including its annual report on Form 10-K filed with the SEC on

March 6, 2023, its quarterly reports on Form 10-Q filed with the SEC on May 5, 2023, August 9, 2023 and

November 7, 2023, and other documents the Company may file with or furnish to the SEC from time to time such as annual reports

on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. These forward-looking statements should

not be relied upon as representing the Company’s views as of any subsequent date and the Company undertakes no obligation to

update forward-looking statements to reflect events or circumstances after the date they were made. The information contained in, or

that can be accessed through, the Company’s website and social media channels are not part of this communication.

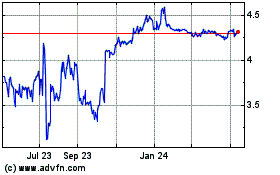

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Mar 2024 to Apr 2024

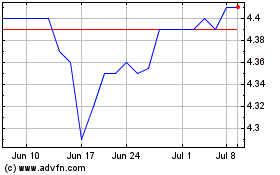

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Apr 2023 to Apr 2024