0000016058FALSE00000160582024-01-242024-01-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________________________

FORM 8-K

_________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 24, 2024

_________________________________________

CACI International Inc

(Exact name of Registrant as Specified in Its Charter)

_________________________________________

| | | | | | | | |

| Delaware | 001-31400 | 54-1345888 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | |

12021 Sunset Hills Road Reston, Virginia | | 20190 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (703) 841-7800

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

_________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | CACI | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act o

| | | | | | | | |

| ITEM 2.02 | | Results of Operations and Financial Condition |

On January 24, 2024, CACI International Inc released its financial results for the second quarter fiscal year 2024.

A copy of the press release announcing the financial results as well as the schedule for a conference call and webcast on January 25, 2024 is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

| | | | | | | | |

| ITEM 9.01 | | Financial Statements and Exhibits |

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| CACI International Inc |

| | |

Date: January 24, 2024 | By: | s/ J. William Koegel, Jr. |

| | |

| | J. William Koegel, Jr. |

| | Executive Vice President, General Counsel and Secretary |

Exhibit 99.1

CACI Reports Results for Its Fiscal 2024 Second Quarter and

Raises Fiscal Year Guidance

Revenues of $1.8 billion, +11% YoY

Net income of $83.9 million and diluted EPS of $3.74, +2% YoY

Adjusted net income of $97.6 million and adjusted diluted EPS of $4.36, +2% YoY

Contract awards of $2.2 billion and book-to-bill of 1.2x

Raising Fiscal Year 2024 guidance for revenue, adjusted net income, adjusted diluted EPS, and free cash flow

RESTON, Va.--(BUSINESS WIRE)--CACI International Inc (NYSE: CACI), a leading provider of expertise and technology to government customers, announced results today for its fiscal second quarter ended December 31, 2023.

“I’m pleased with how our business is performing, both the near-term conversion of our growing backlog as well as our positioning for future growth,” said John Mengucci, CACI President and Chief Executive Officer. “The first half of Fiscal Year 2024 played out as we expected and we are seeing increasing momentum in the second half of the year. This acceleration enables us to raise our Fiscal Year 2024 guidance. We continue to win in the marketplace by providing differentiated capabilities, investing ahead of customer need, and leveraging our exceptional past performance and business development. We remain confident in our ability to drive long-term growth, increase free cash flow, and generate value for our customers and our shareholders.”

Second Quarter Results

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| (in millions, except earnings per share and DSO) | 12/31/2023 | | 12/31/2022 | | % Change |

| Revenues | $ | 1,833.9 | | | $ | 1,649.4 | | | 11.2% |

| Income from operations | $ | 133.3 | | | $ | 130.9 | | | 1.9% |

| Net income | $ | 83.9 | | | $ | 87.1 | | | -3.7% |

Adjusted net income, a non-GAAP measure1 | $ | 97.6 | | | $ | 101.3 | | | -3.6% |

| Diluted earnings per share | $ | 3.74 | | | $ | 3.68 | | | 1.6% |

Adjusted diluted earnings per share, a non-GAAP measure1 | $ | 4.36 | | | $ | 4.28 | | | 1.9% |

Earnings before interest, taxes, depreciation and amortization (EBITDA), a non-GAAP measure1 | $ | 170.9 | | | $ | 168.4 | | | 1.5% |

Net cash provided by operating activities excluding MARPA1 | $ | 83.2 | | | $ | 22.0 | | | 278.8% |

Free cash flow, a non-GAAP measure1 | $ | 67.8 | | | $ | 9.1 | | | 647.4% |

Days sales outstanding (DSO)2 | 47 | | | 51 | | |

(1)This non-GAAP measure should not be considered in isolation or as a substitute for measures prepared in accordance with GAAP. For additional information regarding this non-GAAP measure, see the related explanation and reconciliation to the GAAP measure included below in this release.

(2)The DSO calculations for three months ended December 31, 2023 and 2022 exclude the impact of the Company's Master Accounts Receivable Purchase Agreement (MARPA), which was 6 days and 8 days, respectively.

Revenues in the second quarter of fiscal year 2024 increased 11.2 percent year-over-year, essentially all organic growth. The increase in income from operations was driven by higher revenues and gross profit. Growth in diluted earnings per share and adjusted diluted earnings per share was driven by higher income from operations, lower tax provision, and share repurchases, partially offset by higher interest expense. The increase in cash from operations, excluding MARPA was driven primarily by higher cash tax payments in the year-ago quarter, including a $47 million payment related to Section 174 of the Tax Cuts and Jobs Act of 2017.

Second Quarter Contract Awards

Contract awards in the second quarter totaled $2.2 billion, with approximately 55 percent for new business to CACI. Awards exclude ceiling values of multi-award, indefinite delivery, indefinite quantity (IDIQ) contracts. Some notable awards during the quarter were:

•CACI was selected for Global Enterprise Network Modernization (GENMOD), a five-year, single-award task order worth up to $526 million to provide network modernization and sustainment technology to the U.S. Army. CACI will deliver vertical integration to create a robust, reliable, and high-speed network modernizing the Army’s enterprise IT infrastructure and facilities across the Pacific and Southwest Asia.

•CACI won a single-award, five-year task order worth up to $382 million to provide technology to the U.S. Army Combat Capabilities Development Command (DEVCOM) Engineering and Systems Integration Directorate (ESID) Trojan Engineering and Systems Integration (ESI) Advancement of Trojan Systems (EATS). CACI will provide advanced software and full life cycle support for the Trojan family of systems across the Army military intelligence enterprise at all echelons.

•CACI was awarded a $239 million task order to provide technology, including commercial solution for classified (CSfC), to modernize a Department of Defense network.

•CACI was awarded a five-year task order valued at up to $64 million to provide complete life cycle hardware and systems engineering for the U.S. Air Force Distributed Common Ground System (DCGS). CACI’s proven mobile technologies deliver scalable, customizable mobile command, control, computers, and communications (C4) capabilities. This technology award will support the Air Force Life Cycle Management Center C2ISR Division under the Program Executive Office (PEO) – Digital Directorate.

Total backlog as of December 31, 2023 was $26.9 billion compared with $26.5 billion a year ago, an increase of 2 percent. Funded backlog as of December 31, 2023 was $3.7 billion compared with $3.2 billion a year ago, an increase of 16 percent.

Additional Highlights

•CACI was named to the Forbes 2023 list of America’s Best Employers for Veterans for the fourth consecutive year. As an employer with a workforce of approximately 23,000 employees, of which 38% are veterans, military spouses, or current members of the National Guard and Reserves, CACI strives to create a welcoming environment that allows veterans to thrive and continue their mission. CACI ranked seventh in Aerospace and Defense and 39th overall.

•CACI received the National Veteran Small Business Coalition’s (NVSBC) Champions Award for exceeding the NVSBC-established goals for subcontracting to service-disabled and veteran-owned small businesses (SD/VOSB’s) during the federal government’s fiscal year 2022.

•CACI hired Tanya M. Skeen, former Assistant Secretary of Defense for Acquisition (Acting), as Senior Vice President of Corporate Strategy and Development. In this role, she will be providing guidance and recommendations on investments to further advance CACI’s capabilities aimed at satisfying our customers’ future mission needs.

Fiscal Year 2024 Guidance

The table below summarizes our fiscal year 2024 guidance and represents our views as of January 24, 2024. Our revenue guidance reflects approximately $200 million of higher-than-expected material purchases by our customers, split evenly between the first and second quarters of fiscal year 2024. Our guidance also reflects lower diluted weighted average shares due to the effect of share repurchases.

| | | | | | | | | | | |

| (in millions, except earnings per share) | Fiscal Year 2024 |

| Current Guidance | | Prior Guidance |

| | |

| Revenues | $7,300 - $7,500 | | $7,200 - $7,400 |

Adjusted net income, a non-GAAP measure1 | $450 - $465 | | $440 - $465 |

Adjusted diluted earnings per share, a non-GAAP measure1 | $19.91 - $20.58 | | $19.38 - $20.48 |

| Diluted weighted average shares | 22.6 | | 22.7 |

Free cash flow, a non-GAAP measure2 | at least $420 | | at least $410 |

(1)Adjusted net income and adjusted diluted earnings per share are defined as GAAP net income and GAAP diluted EPS, respectively, excluding intangible amortization expense and the related tax impact. This non-GAAP measure should not be considered in isolation or as a substitute for measures prepared in accordance with GAAP. For additional information regarding this non-GAAP measure, see the related explanation and reconciliation to the GAAP measure included below in this release.

(2)Free cash flow is defined as net cash provided by operating activities excluding MARPA, less payments for capital expenditures (capex). This non-GAAP measure should not be considered in isolation or as a substitute for measures prepared in accordance with GAAP. Fiscal year 2024 free cash flow guidance assumes approximately $75 million in tax payments related to Section 174 of the Tax Cuts and Jobs Act of 2017. For additional information regarding this non-GAAP measure, see the related explanation and reconciliation to the GAAP measure included below in this release.

Conference Call Information

We have scheduled a conference call for 8:00 AM Eastern Time Thursday, January 25, 2024 during which members of our senior management will be making a brief presentation focusing on second quarter results and operating trends, followed by a question-and-answer session. You can listen to the webcast and view the accompanying exhibits on CACI’s investor relations website at http://investor.caci.com/events/default.aspx at the scheduled time. A replay of the call will also be available on CACI’s investor relations website at http://investor.caci.com/.

About CACI

At CACI International Inc (NYSE: CACI), our 23,000 talented and dynamic employees are ever vigilant in delivering distinctive expertise and differentiated technology to meet our customers’ greatest challenges in national security and government modernization. We are a company of good character, relentless innovation, and long-standing excellence. Our culture drives our success and earns us recognition as a Fortune World's Most Admired Company. CACI is a member of the Fortune 1000 Largest Companies, the Russell 1000 Index, and the S&P MidCap 400 Index. For more information, visit us at www.caci.com.

There are statements made herein that do not address historical facts and, therefore, could be interpreted to be forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. Such statements are subject to risk factors that could cause actual results to be materially different from anticipated results. These risk factors include, but are not limited to, the following: our reliance on U.S. government contracts, which includes general risk around the government contract procurement process (such as bid protest, small business set asides, loss of work due to organizational conflicts of interest, etc.) and termination risks; significant delays or reductions in appropriations for our programs and broader changes in U.S. government funding and spending patterns; legislation that amends or changes discretionary spending levels or budget priorities, such as for homeland security or to address global pandemics like COVID-19; legal, regulatory, and political change from successive presidential administrations that could result in economic uncertainty; changes in U.S. federal agencies, current agreements with other nations, foreign events, or any other events which may affect the global economy, including the impact of global pandemics like COVID-19; the results of government audits and reviews conducted by the Defense Contract Audit Agency, the Defense Contract Management Agency, or other governmental entities with cognizant oversight; competitive factors such as pricing pressures and/or competition to hire and retain employees (particularly those with security clearances); failure to achieve contract awards in connection with re-competes for present business and/or competition for new business; regional and national economic conditions in the United States and globally, including but not limited to: terrorist activities or war, changes in interest rates, currency fluctuations, significant fluctuations in the equity markets, and market speculation regarding our continued independence; our ability to meet contractual performance obligations, including technologically complex obligations dependent on factors not wholly within our control; limited access to certain facilities required for us to perform our work, including during a global pandemic like COVID-19; changes in tax law, the interpretation of associated rules and regulations, or any other events impacting our effective tax rate; changes in technology; the potential impact of the announcement or consummation of a proposed transaction and our ability to successfully integrate the operations of our recent and any future acquisitions; our ability to achieve the objectives of near term or long-term business plans; the effects of health epidemics, pandemics and similar outbreaks may have material adverse effects on our business, financial position, results of operations and/or cash flows; and other risks described in our Securities and Exchange Commission filings.

| | | | | | | | |

Corporate Communications and Media: | | Investor Relations: |

Lorraine Corcoran, Executive Vice President, Corporate Communications | | George Price, Senior Vice President, Investor Relations |

(703) 434-4165, lorraine.corcoran@caci.com | | (703) 841-7818, george.price@caci.com |

CACI International Inc

Consolidated Statements of Operations (Unaudited)

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| 12/31/2023 | | 12/31/2022 | | % Change | | 12/31/2023 | | 12/31/2022 | | % Change |

| Revenues | $ | 1,833,934 | | | $ | 1,649,416 | | | 11.2% | | $ | 3,684,081 | | | $ | 3,255,175 | | | 13.2% |

| Costs of revenues: | | | | | | | | | | | |

| Direct costs | 1,255,251 | | | 1,094,314 | | | 14.7% | | 2,528,169 | | | 2,150,086 | | | 17.6% |

| Indirect costs and selling expenses | 409,355 | | | 388,303 | | | 5.4% | | 813,988 | | | 770,384 | | | 5.7% |

| Depreciation and amortization | 36,023 | | | 35,932 | | | 0.3% | | 71,270 | | | 71,035 | | | 0.3% |

| Total costs of revenues | 1,700,629 | | | 1,518,549 | | | 12.0% | | 3,413,427 | | | 2,991,505 | | | 14.1% |

| Income from operations | 133,305 | | | 130,867 | | | 1.9% | | 270,654 | | | 263,670 | | | 2.6% |

| Interest expense and other, net | 27,519 | | | 19,942 | | | 38.0% | | 53,090 | | | 36,135 | | | 46.9% |

| Income before income taxes | 105,786 | | | 110,925 | | | -4.6% | | 217,564 | | | 227,535 | | | -4.4% |

| Income taxes | 21,916 | | | 23,824 | | | -8.0% | | 47,647 | | | 51,309 | | | -7.1% |

| Net income | $ | 83,870 | | | $ | 87,101 | | | -3.7% | | $ | 169,917 | | | $ | 176,226 | | | -3.6% |

| | | | | | | | | | | |

| Basic earnings per share | $ | 3.76 | | | $ | 3.71 | | | 1.3% | | $ | 7.56 | | | $ | 7.51 | | | 0.7% |

| Diluted earnings per share | $ | 3.74 | | | $ | 3.68 | | | 1.6% | | $ | 7.50 | | | $ | 7.44 | | | 0.8% |

| | | | | | | | | | | |

| Weighted average shares used in per share computations: | | | | | | | | | | | |

| Weighted-average basic shares outstanding | 22,282 | | | 23,506 | | -5.2% | | 22,464 | | 23,463 | | | -4.3% |

| Weighted-average diluted shares outstanding | 22,407 | | | 23,676 | | -5.4% | | 22,650 | | 23,677 | | | -4.3% |

CACI International Inc

Consolidated Balance Sheets (Unaudited)

(in thousands)

| | | | | | | | | | | |

| 12/31/2023 | | 6/30/2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 128,851 | | | $ | 115,776 | |

| Accounts receivable, net | 947,452 | | | 894,946 | |

| Prepaid expenses and other current assets | 227,501 | | | 199,315 | |

| Total current assets | 1,303,804 | | | 1,210,037 | |

| | | |

| Goodwill | 4,106,113 | | | 4,084,705 | |

| Intangible assets, net | 474,964 | | | 507,835 | |

| Property, plant and equipment, net | 190,199 | | | 199,519 | |

| Operating lease right-of-use assets | 309,084 | | | 312,989 | |

| Supplemental retirement savings plan assets | 97,559 | | | 96,739 | |

| Accounts receivable, long-term | 12,409 | | | 11,857 | |

| Other long-term assets | 164,310 | | | 177,127 | |

| Total assets | $ | 6,658,442 | | | $ | 6,600,808 | |

| | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | |

| Current liabilities: | | | |

| Current portion of long-term debt | $ | 61,250 | | | $ | 45,938 | |

| Accounts payable | 298,544 | | | 198,177 | |

| Accrued compensation and benefits | 248,187 | | | 372,354 | |

| Other accrued expenses and current liabilities | 378,145 | | | 377,502 | |

| Total current liabilities | 986,126 | | | 993,971 | |

| | | |

| Long-term debt, net of current portion | 1,713,413 | | | 1,650,443 | |

| Supplemental retirement savings plan obligations, net of current portion | 112,514 | | | 104,912 | |

| Deferred income taxes | 55,293 | | | 120,545 | |

| Operating lease liabilities, noncurrent | 323,919 | | | 329,432 | |

| Other long-term liabilities | 231,553 | | | 177,171 | |

| Total liabilities | 3,422,818 | | | 3,376,474 | |

| | | |

| Total shareholders' equity | 3,235,624 | | | 3,224,334 | |

| Total liabilities and shareholders' equity | $ | 6,658,442 | | | $ | 6,600,808 | |

CACI International Inc

Consolidated Statements of Cash Flows (Unaudited)

(in thousands)

| | | | | | | | | | | |

| Six Months Ended |

| 12/31/2023 | | 12/31/2022 |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | |

| Net income | $ | 169,917 | | | $ | 176,226 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 71,270 | | | 71,035 | |

| Amortization of deferred financing costs | 1,095 | | | 1,126 | |

| | | |

| Non-cash lease expense | 33,835 | | | 34,909 | |

| Stock-based compensation expense | 22,949 | | | 20,196 | |

| Deferred income taxes | (25,770) | | | (48,320) | |

| Changes in operating assets and liabilities, net of effect of business acquisitions: | | | |

| Accounts receivable, net | (50,642) | | | 55,518 | |

| Prepaid expenses and other assets | (28,703) | | | (30,322) | |

| Accounts payable and other accrued expenses | 90,769 | | | 28,157 | |

| Accrued compensation and benefits | (124,640) | | | (59,917) | |

| Income taxes payable and receivable | 2,879 | | | (5,110) | |

| Operating lease liabilities | (38,206) | | | (40,050) | |

| Long-term liabilities | 17,099 | | | 3,642 | |

| Net cash provided by operating activities | 141,852 | | | 207,090 | |

| | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | |

| Capital expenditures | (29,410) | | | (25,670) | |

| Acquisitions of businesses, net of cash acquired | (10,869) | | | — | |

| Other | 1,974 | | | — | |

| Net cash used in investing activities | (38,305) | | | (25,670) | |

| | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | |

| Proceeds from borrowings under bank credit facilities | 1,531,500 | | | 1,101,500 | |

| Principal payments made under bank credit facilities | (1,454,313) | | | (1,269,813) | |

| | | |

| | | |

| Proceeds from employee stock purchase plans | 5,848 | | | 5,288 | |

| Repurchases of common stock | (155,765) | | | (5,286) | |

| Payment of taxes for equity transactions | (18,061) | | | (13,269) | |

| Net cash used in financing activities | (90,791) | | | (181,580) | |

| Effect of exchange rate changes on cash and cash equivalents | 319 | | | 94 | |

| Net change in cash and cash equivalents | 13,075 | | | (66) | |

| Cash and cash equivalents, beginning of period | 115,776 | | | 114,804 | |

| Cash and cash equivalents, end of period | $ | 128,851 | | | $ | 114,738 | |

Revenues by Customer Group (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| (in thousands) | 12/31/2023 | | 12/31/2022 | | $ Change | | % Change |

| Department of Defense | $ | 1,358,509 | | | 74.0% | | $ | 1,160,060 | | | 70.4% | | $ | 198,449 | | | 17.1% |

| Federal Civilian agencies | 389,942 | | | 21.3% | | 399,768 | | | 24.2% | | (9,826) | | | -2.5% |

| Commercial and other | 85,483 | | | 4.7% | | 89,588 | | | 5.4% | | (4,105) | | | -4.6% |

| Total | $ | 1,833,934 | | | 100.0% | | $ | 1,649,416 | | | 100.0% | | $ | 184,518 | | | 11.2% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended |

| (in thousands) | 12/31/2023 | | 12/31/2022 | | $ Change | | % Change |

| Department of Defense | $ | 2,710,815 | | | 73.6% | | $ | 2,255,380 | | | 69.3% | | $ | 455,435 | | | 20.2% |

| Federal Civilian agencies | 797,286 | | | 21.6% | | 823,855 | | | 25.3% | | (26,569) | | | -3.2% |

| Commercial and other | 175,980 | | | 4.8% | | 175,940 | | | 5.4% | | 40 | | | —% |

| Total | $ | 3,684,081 | | | 100.0% | | $ | 3,255,175 | | | 100.0% | | $ | 428,906 | | | 13.2% |

Revenues by Contract Type (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| (in thousands) | 12/31/2023 | | 12/31/2022 | | $ Change | | % Change |

| Cost-plus-fee | $ | 1,102,474 | | | 60.1% | | $ | 953,344 | | | 57.8% | | $ | 149,130 | | | 15.6% |

| Fixed-price | 519,544 | | | 28.3% | | 509,356 | | | 30.9% | | 10,188 | | | 2.0% |

| Time-and-materials | 211,916 | | | 11.6% | | 186,716 | | | 11.3% | | 25,200 | | | 13.5% |

| Total | $ | 1,833,934 | | | 100.0% | | $ | 1,649,416 | | | 100.0% | | $ | 184,518 | | | 11.2% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended |

| (in thousands) | 12/31/2023 | | 12/31/2022 | | $ Change | | % Change |

| Cost-plus-fee | $ | 2,236,909 | | | 60.7% | | $ | 1,888,090 | | | 58.1% | | $ | 348,819 | | | 18.5% |

| Fixed-price | 1,021,621 | | | 27.7% | | 991,129 | | | 30.4% | | 30,492 | | | 3.1% |

| Time-and-materials | 425,551 | | | 11.6% | | 375,956 | | | 11.5% | | 49,595 | | | 13.2% |

| Total | $ | 3,684,081 | | | 100.0% | | $ | 3,255,175 | | | 100.0% | | $ | 428,906 | | | 13.2% |

Revenues by Prime or Subcontractor (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| (in thousands) | 12/31/2023 | | 12/31/2022 | | $ Change | | % Change |

| Prime contractor | $ | 1,636,377 | | | 89.2% | | $ | 1,460,839 | | | 88.6% | | $ | 175,538 | | | 12.0% |

| Subcontractor | 197,557 | | | 10.8% | | 188,577 | | | 11.4% | | 8,980 | | | 4.8% |

| Total | $ | 1,833,934 | | | 100.0% | | $ | 1,649,416 | | | 100.0% | | $ | 184,518 | | | 11.2% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended |

| (in thousands) | 12/31/2023 | | 12/31/2022 | | $ Change | | % Change |

| Prime contractor | $ | 3,285,739 | | | 89.2% | | $ | 2,911,149 | | | 89.4% | | $ | 374,590 | | | 12.9% |

| Subcontractor | 398,342 | | | 10.8% | | 344,026 | | | 10.6% | | 54,316 | | | 15.8% |

| Total | $ | 3,684,081 | | | 100.0% | | $ | 3,255,175 | | | 100.0% | | $ | 428,906 | | | 13.2% |

Revenues by Expertise or Technology (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| (in thousands) | 12/31/2023 | | 12/31/2022 | | $ Change | | % Change |

| Expertise | $ | 849,541 | | | 46.3% | | $ | 741,620 | | | 45.0% | | $ | 107,921 | | | 14.6% |

| Technology | 984,393 | | | 53.7% | | 907,796 | | | 55.0% | | 76,597 | | | 8.4% |

| Total | $ | 1,833,934 | | | 100.0% | | $ | 1,649,416 | | | 100.0% | | $ | 184,518 | | | 11.2% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended |

| (in thousands) | 12/31/2023 | | 12/31/2022 | | $ Change | | % Change |

| Expertise | $ | 1,727,635 | | | 46.9% | | $ | 1,475,823 | | | 45.3% | | $ | 251,812 | | | 17.1% |

| Technology | 1,956,446 | | | 53.1% | | 1,779,352 | | | 54.7% | | 177,094 | | | 10.0% |

| Total | $ | 3,684,081 | | | 100.0% | | $ | 3,255,175 | | | 100.0% | | $ | 428,906 | | | 13.2% |

Contract Awards (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| (in thousands) | 12/31/2023 | | 12/31/2022 | | $ Change | | % Change |

| Contract Awards | $ | 2,199,671 | | | $ | 3,488,834 | | | $ | (1,289,163) | | | -37.0% |

| | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended |

| (in thousands) | 12/31/2023 | | 12/31/2022 | | $ Change | | % Change |

| Contract Awards | $ | 5,268,914 | | | $ | 6,734,457 | | | $ | (1,465,543) | | | -21.8% |

Reconciliation of Net Income to Adjusted Net Income and Diluted EPS to Adjusted Diluted EPS (Unaudited)

Adjusted net income and Adjusted diluted EPS are non-GAAP performance measures. We define Adjusted net income and Adjusted diluted EPS as GAAP net income and GAAP diluted EPS, respectively, excluding intangible amortization expense and the related tax impact as we do not consider intangible amortization expense to be indicative of our operating performance. We believe that these performance measures provide management and investors with useful information in assessing trends in our ongoing operating performance, provide greater visibility in understanding the long-term financial performance of the Company, and allow investors to more easily compare our results to results of our peers. These non-GAAP measures should not be considered in isolation or as a substitute for performance measures prepared in accordance with GAAP.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| (in thousands, except per share data) | Three Months Ended | | Six Months Ended | |

| 12/31/2023 | | 12/31/2022 | | % Change | | 12/31/2023 | | 12/31/2022 | | % Change | |

| Net income, as reported | $ | 83,870 | | | $ | 87,101 | | | -3.7% | | $ | 169,917 | | | $ | 176,226 | | | -3.6% | |

| Intangible amortization expense | 18,426 | | | 19,109 | | | -3.6% | | 36,792 | | | 38,223 | | | -3.7% | |

| Tax effect of intangible amortization1 | (4,699) | | | (4,949) | | | -5.1% | | (9,383) | | | (9,899) | | | -5.2% | |

| Adjusted net income | $ | 97,597 | | | $ | 101,261 | | | -3.6% | | $ | 197,326 | | | $ | 204,550 | | | -3.5% | |

| | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended | |

| | 12/31/2023 | | 12/31/2022 | | % Change | | 12/31/2023 | | 12/31/2022 | | % Change | |

| Diluted EPS, as reported | $ | 3.74 | | | $ | 3.68 | | | 1.6% | | $ | 7.50 | | | $ | 7.44 | | | 0.8% | |

| Intangible amortization expense | 0.82 | | | 0.81 | | | 1.2% | | 1.62 | | | 1.61 | | | 0.6% | |

| Tax effect of intangible amortization1 | (0.20) | | | (0.21) | | | -4.8% | | (0.41) | | | (0.41) | | | —% | |

| Adjusted diluted EPS | $ | 4.36 | | | $ | 4.28 | | | 1.9% | | $ | 8.71 | | | $ | 8.64 | | | 0.8% | |

| | | | | | | | | | | | | |

| | FY24 Guidance Range | | | | | | | |

| (in millions, except per share data) | Low End | | | | High End | | | | | | | |

| Net income, as reported | $ | 396 | | | --- | | $ | 411 | | | | | | | | |

| Intangible amortization expense | 73 | | | --- | | 73 | | | | | | | | |

| Tax effect of intangible amortization1 | (19) | | | --- | | (19) | | | | | | | | |

| Adjusted net income | $ | 450 | | | --- | | $ | 465 | | | | | | | | |

| | | | | | | | | | | | | |

| | FY24 Guidance Range | | | | | | | |

| | Low End | | | | High End | | | | | | | |

| Diluted EPS, as reported | $ | 17.52 | | | --- | | $ | 18.19 | | | | | | | | |

| Intangible amortization expense | 3.23 | | | --- | | 3.23 | | | | | | | | |

| Tax effect of intangible amortization1 | (0.84) | | | --- | | (0.84) | | | | | | | | |

| Adjusted diluted EPS | $ | 19.91 | | | --- | | $ | 20.58 | | | | | | | | |

| | | | | | | | | | | | | |

(1)Calculation uses an assumed full year statutory tax rate of 25.5% and 25.9% on non-GAAP tax deductible adjustments for December 31, 2023 and 2022, respectively.

Note: Numbers may not sum due to rounding.

Reconciliation of Net Income to Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) (Unaudited)

The Company views EBITDA and EBITDA margin, both of which are defined as non-GAAP measures, as important indicators of performance, consistent with the manner in which management measures and forecasts the Company’s performance. EBITDA is a commonly used non-GAAP measure when comparing our results with those of other companies. We define EBITDA as GAAP net income plus net interest expense, income taxes, and depreciation and amortization expense (including depreciation within direct costs). We consider EBITDA to be a useful metric for management and investors to evaluate and compare the ongoing operating performance of our business on a consistent basis across reporting periods, as it eliminates the effect of non-cash items such as depreciation of tangible assets, amortization of intangible assets primarily recognized in business combinations, which we do not believe are indicative of our operating performance. EBITDA margin is divided by revenue. These non-GAAP measures should not be considered in isolation or as a substitute for performance measures prepared in accordance with GAAP.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended | |

| (in thousands) | 12/31/2023 | | 12/31/2022 | | % Change | | 12/31/2023 | | 12/31/2022 | | % Change | |

| Net income | $ | 83,870 | | | $ | 87,101 | | | -3.7% | | $ | 169,917 | | | $ | 176,226 | | | -3.6% | |

| Plus: | | | | | | | | | | | | |

| Income taxes | 21,916 | | | 23,824 | | | -8.0% | | 47,647 | | | 51,309 | | | -7.1% | |

| Interest income and expense, net | 27,519 | | | 19,942 | | | 38.0% | | 53,090 | | | 36,135 | | | 46.9% | |

| Depreciation and amortization expense, including amounts within direct costs | 37,612 | | | 37,582 | | | 0.1% | | 74,501 | | | 74,813 | | | -0.4% | |

| EBITDA | $ | 170,917 | | | $ | 168,449 | | | 1.5% | | $ | 345,155 | | | $ | 338,483 | | | 2.0% | |

| | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended | |

| (in thousands) | 12/31/2023 | | 12/31/2022 | | % Change | | 12/31/2023 | | 12/31/2022 | | % Change | |

| Revenues, as reported | $ | 1,833,934 | | | $ | 1,649,416 | | | 11.2% | | $ | 3,684,081 | | | $ | 3,255,175 | | | 13.2% | |

| EBITDA | 170,917 | | | 168,449 | | | 1.5% | | 345,155 | | | 338,483 | | | 2.0% | |

| EBITDA margin | 9.3 | % | | 10.2 | % | | | | 9.4 | % | | 10.4 | % | | | |

| | | | | | | | | | | | | |

Reconciliation of Net Cash Provided by Operating Activities to Net Cash Provided by Operating Activities Excluding MARPA and to Free Cash Flow (Unaudited)

The Company defines Net cash provided by operating activities excluding MARPA, a non-GAAP measure, as net cash provided by operating activities calculated in accordance with GAAP, adjusted to exclude cash flows from CACI’s Master Accounts Receivable Purchase Agreement (MARPA) for the sale of certain designated eligible U.S. government receivables up to a maximum amount of $250.0 million. Free cash flow is a non-GAAP liquidity measure and may not be comparable to similarly titled measures used by other companies. The Company defines Free cash flow as Net cash provided by operating activities excluding MARPA, less payments for capital expenditures. The Company uses these non-GAAP measures to assess our ability to generate cash from our business operations and plan for future operating and capital actions. We believe these measures allow investors to more easily compare current period results to prior period results and to results of our peers. Free cash flow does not represent residual cash flows available for discretionary purposes and should not be used as a substitute for cash flow measures prepared in accordance with GAAP.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | Three Months Ended | | Six Months Ended | |

| (in thousands) | 12/31/2023 | | 12/31/2022 | | 12/31/2023 | | 12/31/2022 | |

| Net cash provided by operating activities | $ | 71,764 | | | $ | 62,247 | | | $ | 141,852 | | | $ | 207,090 | | |

| Cash used in (provided by) MARPA | 11,478 | | | (40,273) | | | 34,645 | | | (42,177) | | |

| Net cash provided by operating activities excluding MARPA | 83,242 | | | 21,974 | | | 176,497 | | | 164,913 | | |

| Capital expenditures | (15,419) | | | (12,899) | | | (29,410) | | | (25,670) | | |

| Free cash flow | $ | 67,823 | | | $ | 9,075 | | | $ | 147,087 | | | $ | 139,243 | | |

| | | | | | | | | |

| | FY24 Guidance | | | | | |

| (in millions) | Current | | Prior | | | | | |

| Net cash provided by operating activities | $ | 510 | | | $ | 500 | | | | | | |

| Cash used in (provided by) MARPA | — | | | — | | | | | | |

| Net cash provided by operating activities excluding MARPA | 510 | | | 500 | | | | | | |

| Capital expenditures | (90) | | | (90) | | | | | | |

| Free cash flow | $ | 420 | | | $ | 410 | | | | | | |

| | | | | | | | | |

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

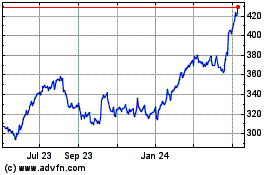

CACI (NYSE:CACI)

Historical Stock Chart

From Mar 2024 to Apr 2024

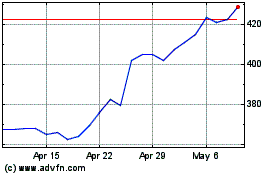

CACI (NYSE:CACI)

Historical Stock Chart

From Apr 2023 to Apr 2024