false

0000771999

0000771999

2024-01-18

2024-01-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 18, 2024

DSS,

INC.

(Exact

name of registrant as specified in its charter)

| New

York |

|

001-32146 |

|

16-1229730 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

275

Wiregrass Pkwy,

West

Henrietta, NY |

|

14586 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (585) 325-3610

N/A

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Ticker

symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.02 par value per share |

|

DSS |

|

The

NYSE American LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933

or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

Effective

January 18, 2024, DSS, Inc. (the “Company”) and Impact BioMedical, Inc., a Nevada corporation (“Impact”) entered

into an amendment to the revolving promissory note dated March 1, 2023 (the “Original Note”), whereby the Company loaned

Impact an original amount of up to $12,000,000 (the “Loan”).

Pursuant

to the amendment, the Company has agreed to amend the existing Original Note to (1) extend the maturity date of the Loan to September

30, 2030, (ii) advance funds under the Original Note to fund and pay interest to date, bringing the funded principal balance to $12,859,328.60,

(iii) eliminate any advance feature under the terms of the Original Note, (iv) establish specific repayment terms for the Note balance,

and (v) amend the interest rate to a market rate of interest (the “Amendment”). The Amendment is secured by a blanket first

lien on all assets of Impact including but not limited to, any licenses or patents owned.

Pursuant

to the Amendment, payment of interest and principal will be on demand. If the Company does not make a demand, then Impact will repay

the principal and interest in 60 payments (1) on the last day of each month during the period from February 1, 2024, through and including

January 31, 2026, Impact will pay the Company the outstanding unpaid accrued interest owing; (2) on the last day of each month during

the period from February 1, 2026, through and including August 31, 2030, Impact will pay the Company $126,380.80, being comprised of

both principal and interest payment; and (3) on September 30, 2030, Impact will pay the entire amount of unpaid principal and interest

then outstanding. The Amendment to the Original Note has modified the interest rate to WSJ Prime + 0.50% floating daily, with

an initial interest rate of 9% and the post maturity rate is the lesser of (A) the maximum rate allowed by law or (B) 18.000% per annum

based on a year of 360 days. Impact may pay without penalty all or a portion of the amount owed earlier than it is due.

If

an event of default occurs, other than a default in payment under the Amendment or any other note and/or the filing of bankruptcy, whether

voluntarily or involuntarily, is curable, it may be cured if Impact, after the Company sends written notice demanding cure of such default,

(1) cures the default within ten (10) business days; or (2) if the cure requires more than ten (10) business days, immediately initiates

steps which the Company deems its sole discretion to be sufficient to cure the default and thereafter continues and completes all reasonable

and necessary steps sufficient to produce compliance as soon as reasonably practical.

Impact

has agreed to indemnify the Company and, among others, its members, officers and directors from and against any and all losses, damages,

expenses or liabilities of any kind or nature and from any suits, claims or demands incurred in investigating or defending such claim,

suffered by any of them and caused by, relating to, arising out of, resulting from, or in any way connected with the note, any loan documents

or the transactions contemplated therein.

The

Company is the majority shareholder of DSS, Inc.

The

foregoing description is qualified in its entirety by the full text of the Amendment, a copy of which is filed as Exhibit 10.1 to this

Current Report on Form 8-K and is incorporated herein by reference.

Item

9.01 Financial Statement and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this Current Report on Form 8-K

to be signed on its behalf by the undersigned hereunto duly authorized.

| |

DSS,

INC. |

| |

|

|

| Date:

January 22, 2024 |

By: |

/s/

Frank D. Heuszel |

| |

Name: |

Frank

D. Heuszel |

| |

Title: |

Chief

Executive Officer |

Exhibit

10.1

AMENDED

AND RESTATED PROMISSORY NOTE

| Borrower: |

IMPACT

BIOMEDICAL, INC.

1400

Broadfield Blvd., Suite 130

Houston,

Texas 77084 |

Lender: |

|

DSS,

Inc.

275

Wiregrass Pkwy,

W.

Henrietta, NY 14586 |

| Principal

Amount: $12,859,328.60 |

Date

of Original Note: March 31, 2023 |

| |

Date

Amended: January 18, 2024 |

| |

Maturity

Date: September 30, 2030 |

THIS

AMENDED AND RESTATED PROMISSORY NOTE is effective this 18th day of January, 2024, by and between Impact Biomedical, Inc.,

a Nevada corporation (the, “Borrower” or “Impact”) and DSS, Inc., a New York

corporation (the “Lender” or “DSS”).

RECITALS

WHEREAS,

on March 31, 2023, the Lender made a loan (the “Loan”) in the form of a revolving promissory note in the original

amount of up to $12,000,000, with such Loan being evidenced by that certain Revolving Promissory Note dated March 31, 2023, in the committed

principal amount of up to TWELVE MILLION AND no/100 DOLLARS ($12,000,000.00), together with interest on the unpaid principal balance

(the “Original Note”);

WHEREAS,

the Borrower has requested the Lender to extend the maturity date of the Loan to September 30, 2030, and to establish a repayment

amortization program for the indebtedness;

WHEREAS,

the Lender has agreed to conditionally accommodate the Borrower’s request, and has agreed to amend the existing Original Note

to (1) extend the maturity date of the Loan to September 30, 2030, (ii) advance funds under the Original Note to fund and pay interest

to date bringing the funded principal balance to $12,859,328.60, (iii) eliminate any advance feature under the terms of the Original

Note, (iv) establish specific repayment terms for the Note balance, and (v) amend the interest rate to a market rate of interest;

WHEREAS,

the Borrower has agreed to such changes, and the Borrower and Lender desire to amend and restate the Original Note in order to reflect

the agreed upon changes, and accordingly, Borrower and Lender have agreed to execute and deliver this Note to reflect that agreement;

and

| Loan

No. 2023.03.31 |

AMENDED

AND RESTATED PROMISSORY NOTE

(Continued)

|

Page

2 |

NOW,

THEREFORE, in consideration of the premises, the agreement, and commitments hereinafter set forth and other good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby covenant and agree as follows, effective January

18, 2024:

| |

A.

|

As

of January 18, 2024, the funded unpaid principal and interest balance owing on the Original Note is $12,859,328.60, which

is comprised of $11,627,845.46 in pre- January 17, 2024, principal advances, and $1,231,483.14 in interest funding that was

advanced and posted on January 17, 2024, with such advance being part of the accommodations of the Lender. |

| |

|

|

| |

B.

|

This

Note does not extinguish the outstanding indebtedness evidenced by the Original Note and is not intended to be a substitution or

novation of the original indebtedness or instruments evidencing and securing the same, all of which shall continue in full force

and effectiveness except as specifically amended and restated hereby. |

| |

|

|

| |

C.

|

Borrower

and Lender hereby agree that the Original Note is hereby amended, restated and replaced in its entirety with respect to principal

indebtedness evidenced by this Note to read as follows: |

FOR

VALUE RECEIVED, Borrower:

PROMISES

TO PAY. Impact Biomedical, Inc., a Nevada corporation promises to pay to DSS, Inc. in lawful money of the United

States of America, the principal amount up to TWELVE MILLION EIGHT HUNDRED FIFTY-NINE THOUSAND THREE HUNDRED TWENTY-EIGHT AND 60/100

DOLLARS ($12,859,328.60), together with interest on the unpaid principal balance from the date hereof, calculated as described in

the “INTEREST CALCULATION METHOD” paragraph using an interest rate of WSJ Prime + 0.50% per annum based on a year of 360

days, until maturity. The interest rate may change under the terms and conditions set forth in the “INTEREST RATE” and/or

the “POST MATURITY RATE” section. (Collectively, this instrument to be referred to as the “Note”.)

LOAN

PURPOSE: The purpose of the Note is to provide long-term financing and amortization of previously provided financing for the

Borrower’s working capital needs.

MATURITY

DATE: September 30, 2030.

PAYMENT

OF PRINCIPAL AND INTEREST. On demand. If no demand, then Borrower will repay the principal and interest owing on the loan evidenced

by this Note in 60 payments as follows:

| (1)

|

On

the last day of each month during the period from February 1, 2024, through and including January 31, 2026, Borrower will pay Lender

the outstanding unpaid accrued interest owing on the Note, |

| |

|

| (2)

|

On

the last day of each month during the period from February 1, 2026, through and including August 31, 2030, Borrower will pay Lender

$126,380.80, being comprised of both principal and interest payment, and |

| |

|

| (3)

|

on

September 30, 2030, Borrower will pay the entire amount of unpaid principal and interest then outstanding under the Note. |

Unless

otherwise agreed or required by applicable law, payments will be applied first to any fees or late charges, then to any unpaid collection

costs, then to any accrued unpaid interest, and then to principal. The Borrower will make all payments to the Lender at Lender’s

address shown above or at such other place as Lender may designate in writing.

| Loan

No. 2023.03.31 |

AMENDED

AND RESTATED PROMISSORY NOTE

(Continued)

|

Page

3 |

INTEREST

RATE. The rate per annum interest rate on this Note shall be determined and defined on the basis of the Prime Rate as reported

in the “Money Rates” section of the Wall Street Journal or a substitute source reasonably determined by Lender in the event

such source is no longer available. (the “WSJ Prime Rate”) The WSJ Prime Rate for the Note will initially be the WSJ

Prime Rate as of the date of this Note, (i.e. January 18, 2024, which was quoted at 8.50%) plus 0.50%, or an initial interest

rate of 9.00%. The interest rate then for any one day shall be the WSJ Prime rate in effect on such date plus 0.50%. The effective interest

rate will be adjusted on a daily basis.

INTEREST

CALCULATION METHOD. Interest on this Note is computed on an actual day, 360 basis; that is, by applying the ratio of the interest

rate over a year of 360 days, multiplied by the outstanding principal balance, multiplied by the actual number of days the principal

balance is outstanding, unless such calculation would result in a usurious rate, In which case interest shall be calculated on a per

diem basis of a year of 365 or 366 days, as the case may be. All interest payable under this Note is computed using this method.

ADVANCES.

There are no advance features or options under the terms of this Note. All previous commitments that existed under the terms

of the Original Note are hereby terminated.

PREPAYMENT.

The Borrower may pay without penalty all or a portion of the amount owed earlier than it is due. Prepayment in full shall consist of

payment of the remaining unpaid principal balance together with all accrued and unpaid interest and all other amounts, costs and expenses

for which Borrower is responsible under this Note or any other agreement with Lender pertaining to this Note/loan, and in no event will

Borrower ever be required to pay any unearned interest. Early payments will not, unless agreed to by the Lender in writing, relieve Borrower

of Borrower’s obligation to continue to make payments under the payment schedule. Rather, early payments will reduce the principal

balance due in the inverse order of maturity. Borrower agrees not to send Lender payments marked “paid in full”, “without

recourse”, or similar language. If the Borrower sends such a payment, the Lender may accept it without losing any of Lender’s

rights under this Note, security agreement and/or guaranty(ies), if any, and the Borrower will remain obligated to pay any further amount

owed to Lender. All written communications concerning disputed amounts, including any check or other payment instrument that indicates

that the payment constitutes “payment in full” of the amount owed or that is tendered with other conditions or limitations,

or as full satisfaction of a disputed amount must be mailed or delivered to:

DSS,

Inc.,

Attn.

Todd Macko, CFO

275 Wiregrass Pkwy,

W.

Henrietta, NY1400 14586

YIELD

MAINTENANCE. NOT USED.

POST

MATURITY RATE. The Post Maturity Rate on this Note is the lesser of (A) the maximum rate allowed by law or (B) 18.000% per annum

based on a year of 360 days. The Borrower will pay interest on all sums due after final maturity, whether by acceleration or otherwise,

at that rate.

DEFAULT.

Each of the following shall constitute an event of default (“Event of Default”) under this Note:

Payment

Default. Borrower fails to make any payment when due under this Note.

| Loan No. 2023.03.31 |

AMENDED AND RESTATED PROMISSORY

NOTE

(Continued) |

Page 4 |

Other

Defaults. Borrower fails to comply with or to perform any other term, obligation, covenant or condition contained in this Note or

in any of the related documents or to comply with or to perform any term, obligation, covenant or condition contained in any other agreement

between Lender and Borrower.

Dispute

of Loan Documents. If at any time the Borrower, grantor, and/or guarantor denies the enforceability of any loan documents related

to the Note, in whole or in part, including, but not limited to any loan, extension of credit, guaranty agreement, security agreement,

UCC filing, Control Agreement, Collateral perfection, or any other agreement related to the Note or any extension and renewal thereof.

Default

In Favor of Third Parties. Borrower or any Grantor defaults under any loan, extension of credit, security agreement, purchase or

sales agreement, or any other agreement, in favor of any other creditor or person that may materially affect any of Borrower’s

property or Borrower’s ability to repay this Note or perform Borrower’s obligations under this Note or any of the related

documents.

False

Statements. Any warranty, representation or statement made or furnished to Lender by Borrower or on Borrower’s behalf under

this Note or the related documents is false or misleading in any material respect, either now or at the time made or furnished or becomes

false or misleading at any time thereafter.

Insolvency.

The dissolution or termination of Borrower’s existence as a going business, the insolvency of Borrower, the appointment of a receiver

for any part of Borrower’s property, any assignment for the benefit of creditors, any type of creditor workout, or the commencement

of any proceeding under any bankruptcy or insolvency laws by or against Borrower.

Creditor

or Forfeiture Proceedings. Commencement of foreclosure or forfeiture proceedings, whether by judicial proceeding, self-help, repossession

or any other method, by any creditor of Borrower or by any governmental agency against any collateral securing the loan. This includes

a garnishment of any of Borrower’s accounts, including deposit accounts, with Lender. However, this Event of Default shall not

apply if there is a good faith dispute by Borrower as to the validity or reasonableness of the claim which is the basis of the creditor

or forfeiture proceeding and if Borrower gives Lender written notice of the creditor or forfeiture proceeding and deposits with Lender

monies or a surety bond for the creditor or forfeiture proceeding, in an amount determined by Lender, In Its sole discretion, as being

an adequate reserve or bond for the dispute.

Events

Affecting Guarantor. Any of the preceding events occurs with respect to any Guarantor of any of the indebtedness or any Guarantor

dies or becomes incompetent, or revokes or disputes the validity of, or liability under, any guaranty of the indebtedness evidenced by

this Note.

Change

In Ownership. Any change in ownership of fifty-five percent (55%) or more of the common stock or other voting equity interests of

Borrower.

Adverse

Change. A material adverse change occurs in Borrower’s financial condition, or Lender believes the prospect of payment or performance

of this Note is impaired.

Insecurity.

Lender in good faith believes itself insecure based upon a deemed material adverse change to the Borrower.

| Loan No. 2023.03.31 |

AMENDED AND RESTATED PROMISSORY

NOTE

(Continued) |

Page 5 |

Cure

Provisions. If any default, other than a default in payment under this Note or any other note and/or the filing of bankruptcy, whether

voluntarily or involuntarily, is curable, it may be cured if Borrower, after Lender sends written notice to Borrower demanding cure of

such default; (1) cures the default within ten (10) business days; or (2) if the cure requires more than ten (10) business days, immediately

initiates steps which Lender deems In Lender’s sole discretion to be sufficient to cure the default and thereafter continues and

completes all reasonable and necessary steps sufficient to produce compliance as soon as reasonably practical.

LENDER’S

RIGHTS. Upon default, Lender may declare the entire indebtedness, including the unpaid principal balance under this Note,

all accrued unpaid interest, and all other amounts, costs and expenses for which Borrower is responsible under this Note or any other

agreement with Lender pertaining to this loan, immediately due, without notice, and then Borrower will pay that amount.

ATTORNEYS’

FEES; EXPENSES. Lender may hire an attorney to help collect this Note if Borrower does not pay, and Borrower will pay Lender’s

reasonable attorneys’ fees. Borrower also will pay Lender all other amounts Lender actually incurs as court costs, lawful fees

for filing, recording, releasing to any public office any instrument securing this Note; the reasonable cost actually expended for repossessing,

storing, preparing for sale, and selling any security; and fees for noting a lien on or transferring a certificate of title to any motor

vehicle offered as security for this Note, or premiums or identifiable charges received in connection with the sale of authorized insurance.

JURY

WAIVER. BORROWER AND LENDER EACH HEREBY IRREVOCABLY WAIVES ANY AND ALL RIGHTS TO TRIAL BY JURY WITH REGARDS TO ANY “DISPUTE”

AND ANY ACTION ON SUCH “DISPUTE”, THAT IS RELATED, DIRECTLY OF INDIRECTLY, WITH THE NOTE, ORIGINAL NOTE AND AMENDED NOTE.

THIS WAIVER IS KNOWLINGLY, WILLINGLY AND VOLUNTARILY MADE BY BORRWER AND LENDER, AND BORROWER AND LENDER HEREBY REPRESENTS THAT NO REPRESENTATIONS

OF FACT OR OPINION HAVE BEEN MADE BY ANY PERSON OR ENTITY TO INDUCE THIS WAIVER OF TRIAL BY JURY OR TO IN ANY WAY MODIFY OR NULLIFY ITS

EFFECT. THIS PROVISION IS A MATERIAL INDUCEMENT FOR THE PARTIES ENTERING INTO THES AGREEMENT. BORROWER AND LENDER ARE EACH HEREBY AUTHORIZED

TO FILE A COPY OF THIS SECTION HEREOF IN ANY PROCEEDING AS CONCLUSIVE EVIDENCE OF THIS WAIVER OF JURY TRIAL. BORROWER FURTHER REPRESENT

AND WARRANTS THAT: (1) IT HAS BEEN REPRESENTED IN THE SIGNING OF THIS AGREEMENT AND IN THE MAKING OF THIS WAIVER BY INDEPENDENT LEGAL

COUNSEL, OR (2) HAS HAD THE OPPORTUNITY TO BE REPRESENTED BY INDEPENDENT LEGAL COUNSEL SELCECTED OF ITS OWN FREE WILL, AND EACH HAVE

HAD THE OPPORTUNITY TO DISCUSS THIS WAIVER WITH COUNSEL.

GOVERNING

LAW. This Note will be governed by federal law applicable to Lender and, to the extent not preempted by federal law, the laws

of the State of Texas without regard to its conflicts of law provisions. This Note has been accepted by the Lender in the State of Texas.

CHOICE

OF VENUE, if there is a lawsuit, and as the transaction evidenced by this Note occurred in Harris County, Texas, Borrower

agrees upon Lender’s request to submit to the jurisdiction of the courts of Harris County, State of Texas,

DISHONORED

CHECK CHARGE. Borrower will pay a processing fee of $25.00 if any check given by Borrower to Lender as a payment on this loan

is dishonored.

| Loan No. 2023.03.31 |

AMENDED AND RESTATED PROMISSORY

NOTE

(Continued) |

Page 6 |

RIGHT

OF SETOFF. To the extent permitted by applicable law, Lender does hereby create and/or reserve a contractual right of setoff

and a common law right of set-off against all Borrower’s accounts or against any sums or amounts the Lender may owe or be liable

to the Borrower. Borrower authorizes Lender, to the extent permitted by applicable law, to charge or setoff all sums owing on the indebtedness

against any and all such accounts or amounts due.

COLLATERAL.

The Borrower acknowledges this Note is secured by a blanket first lien on all assets of the Borrower including but limited to any

licenses or patents owned. The Borrower will, upon Lender’s request, execute any document(s), security agreements, or pledge instruments

to effectuate such pledge, immediately upon request. Further, the Borrower authorizes the Lender to execute any document on its behalf

to allow, create or perfect the security interest in any or all of the collateral.

SUCCESSOR

INTERESTS. The terms of this Note shall be binding upon Borrower, and upon Borrower’s heirs, personal representatives,

successors, and assigns, and shall inure to the benefit of Lender and its successors and assigns.

GENERAL

PROVISIONS. NOTICE: Under no circumstances (and notwithstanding any other provisions of this Note) shall the interest charged,

collected, or contracted for on this Note exceed the maximum rate permitted by law. The term “maximum rate permitted by law”

as used in this Note means the greater of (a) the maximum rate of interest permitted under federal or other law applicable to the indebtedness

evidenced by this Note, or (b) the higher, as of the date of this Note, of the “Weekly Ceiling” or the “Quarterly Ceiling”

as referred to in Sections 303.002, 303.003 and 303.006 of the Texas Finance Code. If any part of this Note cannot be enforced, this

fact will not affect the rest of the Note. Borrower does not agree or intend to pay, and Lender does not agree or intend to contract

for, charge, collect, take, reserve or receive (collectively referred to herein as “charge or collect”), any amount in the

nature of interest or in the nature of a fee for this loan, which would in any way or event (including demand, prepayment, or acceleration)

cause Lender to charge or collect more for this loan than the maximum Lender would be permitted to charge or collect by federal law or

the law of the State of Texas (as applicable). Any such excess interest or unauthorized fee shall, instead of anything stated to the

contrary, be applied first to reduce the principal balance of this loan, and when the principal has been paid in full, be refunded to

the Borrower. The right to accelerate maturity of sums due under this Note does not include the right to accelerate any interest which

has not otherwise accrued on the date of such acceleration, and Lender does not intend to charge or collect any unearned interest in

the event of acceleration. All sums paid or agreed to be paid to Lender for the use, forbearance or detention of sums due hereunder shall,

to the extent permitted by applicable law, be amortized, prorated, allocated and spread throughout the full term of the loan evidenced

by this Note until payment in full so that the rate or amount of interest on account of the loan evidenced hereby does not exceed the

applicable usury ceiling. The Lender may delay or forgo enforcing any of its rights or remedies under this Note without losing them.

Each Borrower understands and agrees that, with or without notice to Borrower, Lender may with respect to any other Borrower (a) make

one or more additional secured or unsecured loans or otherwise extend additional credit; (b) alter, compromise, renew, extend, accelerate,

or otherwise change one or more times the time for payment or other terms of any indebtedness, including Increases and decreases of the

rate of interest on the indebtedness; (c) exchange, enforce, waive, subordinate, fail or decide not to perfect, and release any security,

with or without the substitution of new collateral; (d) apply such security and direct the order or manner of sale thereof, including

without limitation, any non- judicial sale permitted by the terms of the controlling security agreements, as Lender in its discretion

may determine; (e) release, substitute, agree not to sue, or deal with any one or more of Borrower’s sureties, endorsers, or other

guarantors on any terms or in any manner Lender may choose; and (f) determine how, when and what application of payments and credits

shall be made on any other indebtedness owing by such other Borrower. Borrower and any other person who signs, guarantees or endorses

this Note, to the extent allowed by law, waive presentment, demand for payment, notice of dishonor, notice of intent to accelerate the

maturity of this Note, and notice of acceleration of the maturity of this Note. Upon any change in the terms of this Note, and unless

otherwise expressly stated in writing, no party who signs this Note, whether as maker, guarantor, accommodation maker or endorser, shall

be released from liability. All such parties agree that Lender may renew or extend (repeatedly and for any length of time) this loan

or release any party or guarantor or collateral; or impair, fail to realize upon or perfect Lender’s security interest in the collateral

without the consent of or notice to anyone. All such parties also agree that Lender may modify this loan without the consent of or notice

to anyone other than the party with whom the modification is made. The obligations under this Note are joint and several.

| Loan No. 2023.03.31 |

AMENDED AND RESTATED PROMISSORY

NOTE

(Continued) |

Page 7 |

GUARANTOR(S).

None

FINANCIAL

& REPORTING COVENANTS. Other than the permitted first lien which the Borrower is granting, and does hereby by grant to the

Lender to secure this Note and any other indebtedness it may owe to Lender, the Borrower shall comply with each of the following financial

covenants (except as permitted under the Note):

Borrower

shall not pledge, grant a security interest in, mortgage, assign, encumber or otherwise create a lien on any of its property (whether

real or personal, tangible or intangible, and now owned or hereafter acquired) in favor of any person or entity other than DSS, except

for those liens, security interests and encumbrances existing on the date hereof and previously disclosed in writing to and approved

by DSS.

The

Borrower shall not create, incur or assume any indebtedness for borrowed money other than existing indebtedness previously disclosed

to and approved by DSS and in the future in connection with equipment leases or purchase financings or trade indebtedness.

Borrower

shall not assume, guarantee, endorse or otherwise become directly or contingently liable for the obligations of any other person or entity

except by endorsement of negotiable instruments for deposit or collection in the ordinary course of business and in the future in connection

with equipment leases or purchase financings or trade indebtedness.

Borrower

will provide reviewed year-end financial statements and audited statements of its dealer-broker subsidiary within 120 days of fiscal

year-end.

Borrower

will provide internally prepared interim financial statements within 30 days upon DSS’s request.

Guarantor

will provide any financial, tax information, governmental compliance, or corporate governance documentation upon Lender’s request.

The

Borrower will maintain a positive net worth at all times as defined by Generally Accepted Accounting Principles.

| Loan No. 2023.03.31 |

AMENDED AND RESTATED PROMISSORY

NOTE

(Continued) |

Page 8 |

BORROWER

WARRANTY.

The

Borrower hereby represents and warrants that it has on behalf of their respective companies, the full legal rights and capacities to

enter into this Note and related loan documents and security agreement, and that the Borrower intends to perform their respective obligations

and that they are not in violation of any laws or any courts. In addition, Borrower affirms and warrants to Lender that:

| |

●

|

There

is no litigation and no noticed or expected litigation against it, except as otherwise disclosed. |

| |

|

|

| |

●

|

The

Borrower is solvent at the time of the loan. |

| |

|

|

| |

●

|

Guarantor

has, or will, receive sufficient consideration from the transaction to make the guarantees fully enforceable. |

INDEMNIFICATION.

Borrower

hereby indemnifies and agrees to protect, defend and hold harmless Lender, and any member, officer, director, official, agent, employee

or attorney of Lender, and their respective heirs, administrators, executors, successors and assigns (collectively, the “Indemnified

Parties”), from and against any and all losses, damages, expenses or liabilities of any kind or nature and from any suits,

claims or demands, including reasonable attorneys’ fees incurred in investigating or defending such claim, suffered by any of them

and caused by, relating to, arising out of, resulting from, or in any way connected with the Note, any loan documents or the transactions

contemplated therein (unless determined by a final judgment of a court of competent jurisdiction to have been caused solely by the gross

negligence or willful misconduct of the Indemnified Parties) including, without limitation: (i) any untrue statement of a material fact

contained in information submitted to Lender by Borrower or Guarantor or the omission of any material fact necessary to be stated therein

in order to make such statement not misleading or incomplete; or (ii) the failure of Borrower or Guarantor to perform any obligations

herein required to be performed by Borrower and/or Guarantor. These provisions shall survive the repayment or other satisfaction of the

Note.

SEVERABILITY

OF PROVISIONS. A determination that any provision of this Agreement is unenforceable or invalid shall not affect the enforceability

or validity of any other provision hereof, and any determination that the application of any provision of this Note to any person or

circumstance is illegal or unenforceable shall not affect the enforceability or validity of such provision or other provisions as it

may apply to any other persons or circumstances.

RELEASE

and WAIVER OF CLAIMS. In consideration of (a) the modifications, renewals, extensions, and/or waivers as herein provided,

and (b) the other benefits received by Borrower hereunder, Borrower hereby RELEASES, RELINQUISHES and forever DISCHARGES Lender, as

well as its predecessors, successors, assigns, agents, officers, directors, employees, representatives, attorneys, insurers,

affiliates, parent corporations and all other persons, entities, associations, partnerships and corporations with whom any of the

former have been, are now or may hereafter be affiliated (collectively, the “Lender Parties”) of and from

any and all claims, demands, obligations, liabilities, actions and causes of action of any and every kind, character or nature

whatsoever, known or unknown, past or present, which Borrower may have against any of the Lender Parties arising out of or with

respect to (i) any right or power to bring any claim against Lender for usury or to pursue any cause of action against Lender based

on any claim of usury, and (ii) any and all transactions and events relating to any loan documents occurring on or

prior to the date hereof, including any loss, cost or damage, of any kind, character or nature whatsoever, arising out of, in any

way connected with, or in any way resulting from the acts, actions, or omissions of any of the Lender Parties, including, but not

limited to, any breach of fiduciary duty, breach of any duty of fair dealing, breach of confidence, breach of funding commitment,

undue influence, duress, economic coercion, conflict of interest, negligence, bad faith, malpractice, intentional or negligent

infliction of mental distress, tortuous interference with contractual relations, tortuous interference with corporate governance or

prospective business advantage, breach of contract, deceptive trade practices, libel, slander or conspiracy, and/or arising out of

any attempt to collect any sums due or claimed to be due to Lender, but in each case only to the extent permitted by applicable

law.

| Loan No. 2023.03.31 |

AMENDED AND RESTATED PROMISSORY

NOTE

(Continued) |

Page 9 |

PRIOR

TO SIGNING THIS NOTE, THE BORROWER HAS READ AND UNDERSTOOD ALL THE PROVISIONS OF THIS NOTE, AND THE BORROWER AGREES TO THE TERMS OF THIS

NOTE.

Executed

and agree to by:

| |

BORROWER: |

| |

|

|

| |

IMPACT

BIOMEDICAL, INC. |

| |

|

|

| |

By: |

. . |

| |

Title: |

Chief

Financial Officer. |

| |

Date: |

January

19, 2024. |

| |

LENDER: |

| |

|

|

| |

DSS,

INC. |

| |

|

|

| |

By: |

. . |

| |

Title: |

Chief

Operating Officer. |

| |

Date: |

January

19, 2024. |

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

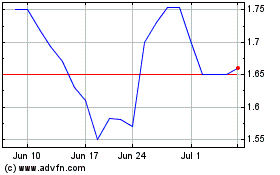

DSS (AMEX:DSS)

Historical Stock Chart

From Mar 2024 to Apr 2024

DSS (AMEX:DSS)

Historical Stock Chart

From Apr 2023 to Apr 2024