Okeanis Eco Tankers Corp. – Commercial Update

January 22 2024 - 4:30PM

Okeanis Eco Tankers Corp. (the “Company” or “OET” or “Okeanis”)

(NYSE:ECO / OSE:OET), announced the following commercial update:

For Q4 2023, as of the date of this release, the

Company anticipates:

- Estimated fleetwide Daily Time

Charter Equivalent Rate (“Daily TCE Rate”) of approximately $45,300

per operating day.

- Estimated VLCC Daily TCE Rate of

$45,200 per operating day, all vessels trading spot.

- Estimated Suezmax Daily TCE Rate of

$45,500 per operating day, including 147 days fixed on time-charter

on two vessels; Estimated Suezmax Daily TCE Rate of $51,800 per

operating day relating solely to Suezmax spot days.

Thus far in the first quarter of 2024, as of the

date of this release, the Company estimates:

- Approximately 61% of the available

VLCC spot days have been booked at an average Daily TCE Rate of

$76,100 per operating day.

- Approximately 41% of the available

Suezmax spot days have been booked at an average Daily TCE Rate of

$59,300 per operating day.

Daily TCE Rate

reconciliation

The Daily TCE Rate is a measure of the average

daily revenue performance of a vessel. The Company reports its

financial results in accordance with International Financial

Reporting Standards (“IFRS”). The Daily TCE Rate is not a measure

of revenue under U.S. GAAP (i.e., it is a non-GAAP measure) or IFRS

and should not be considered as an alternative to, or superior to,

any measure of revenue and financial performance presented in

accordance with IFRS. We calculate Daily TCE Rate by dividing

revenues (time charter and/or voyage charter revenues), less

commission and voyage expenses, by the number of operating days

during that period. Our calculation of the Daily TCE Rates may not

be comparable to that reported by other companies. The Company has

not provided a reconciliation of forward-looking Daily TCE Rate

because the most directly comparable IFRS measure on a

forward-looking basis is not available to the Company without

unreasonable effort.

Consistent with industry practice, we use the

Daily TCE Rates because it provides a means of comparison between

different types of vessel employment and, therefore, assists in

evaluating their financial performance and in our decision-making

process regarding the deployment and use of our vessels and in

evaluating our financial performance. The Daily TCE rate is a

non-GAAP and non-IFRS measure. We believe the Daily TCE Rate

provides additional meaningful information in conjunction with

vessel operating expenses, the most directly comparable GAAP and

IFRS measure, because it assists our management in making decisions

regarding the deployment and use of our vessels and in evaluating

their financial performance. The Daily TCE Rate is a measure used

to compare period-to-period changes in a company’s performance and

management believes that the Daily TCE Rate provides meaningful

information to our investors.

The following table sets forth our computation

of Daily TCE Rate, including a reconciliation of revenues to the

Daily TCE Rate for Q4 2023:

(in USD million, except per day data):

|

Revenue |

$ |

91.67 |

|

|

Voyage expenses |

$ |

32.23 |

|

|

Commissions |

$ |

1.03 |

|

|

Time charter equivalent revenue |

$ |

58.41 |

|

|

Calendar days |

|

1,288 |

|

|

Off-hire days |

|

- |

|

|

Operating days |

|

1,288 |

|

|

Daily TCE Rate |

$ per day |

45,300 |

|

|

|

|

|

|

The Company has not finalized its financial

statement closing process for the year ended December 31, 2023.

During the course of that process, the Company may identify items

that would require it to make adjustments, which may be material to

the information provided above. As a result, the information above

constitutes forward-looking statements and is subject to risks and

uncertainties, including possible adjustments to the preliminary

results disclosed above.

Contacts

CompanyIraklis Sbarounis, CFO

Tel: +30 210 480 4200 ir@okeanisecotankers.com

Investor Relations / Media

ContactNicolas Bornozis, PresidentCapital Link, Inc.230

Park Avenue, Suite 1540, New York, N.Y. 10169Tel: +1 (212)

661-7566okeanisecotankers@capitallink.com

This information is subject to the disclosure

requirements pursuant to Section 5-12 of the Norwegian Securities

Trading Act.

About OET

OET is a leading international tanker company

providing seaborne transportation of crude oil and refined

products. The Company was incorporated on April 30, 2018 under the

laws of the Republic of the Marshall Islands and is listed on Oslo

Børs under the symbol OET and the New York Stock Exchange under the

symbol ECO. The sailing fleet consists of six modern

scrubber-fitted Suezmax tankers and eight modern scrubber-fitted

VLCC tankers.

Forward-Looking Statements

This communication contains “forward-looking

statements”, including as defined under U.S. federal securities

laws. Forward-looking statements provide the Company’s current

expectations or forecasts of future events. Forward-looking

statements include statements about the Company’s expectations,

beliefs, plans, objectives, intentions, assumptions and other

statements that are not historical facts or that are not present

facts or conditions. Words or phrases such as “anticipate,”

“believe,” “continue,” “estimate,” “expect,” “hope,” “intend,”

“may,” “ongoing,” “plan,” “potential,” “predict,” “project,”

“should,” “will” or similar words or phrases, or the negatives of

those words or phrases, may identify forward-looking statements,

but the absence of these words does not necessarily mean that a

statement is not forward-looking. Forward-looking statements are

subject to known and unknown risks and uncertainties and are based

on potentially inaccurate assumptions that could cause actual

results to differ materially from those expected or implied by the

forward-looking statements. The Company’s actual results could

differ materially from those anticipated in forward-looking

statements for many reasons, including as described in the

Company’s filings with the U.S. Securities and Exchange Commission.

Accordingly, you should not unduly rely on these forward-looking

statements, which speak only as of the date of this communication.

Factors that could cause actual results to differ materially

include, but are not limited to, the Company's operating or

financial results; the Company's liquidity, including its ability

to service its indebtedness; competitive factors in the market in

which the Company operates; shipping industry trends, including

charter rates, vessel values and factors affecting vessel supply

and demand; future, pending or recent acquisitions and

dispositions, business strategy, areas of possible expansion or

contraction, and expected capital spending or operating expenses;

risks associated with operations; broader market impacts arising

from war (or threatened war) or international hostilities; risks

associated with pandemics (including COVID-19), including effects

on demand for oil and other products transported by tankers and the

transportation thereof; and other factors listed from time to time

in the Company's filings with the U.S. Securities and Exchange

Commission. Except to the extent required by law, the Company

expressly disclaims any obligations or undertaking to release

publicly any updates or revisions to any forward-looking statements

contained herein to reflect any change in the Company's

expectations with respect thereto or any change in events,

conditions or circumstances on which any statement is based. You

should, however, review the factors and risks the Company describes

in the reports it files and furnishes from time to time with the

U.S. Securities and Exchange Commission, which can be obtained free

of charge on the U.S. Securities and Exchange Commission’s website

at www.sec.gov.

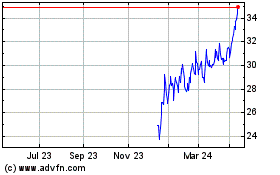

Okeanis Eco Tankers (NYSE:ECO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Okeanis Eco Tankers (NYSE:ECO)

Historical Stock Chart

From Apr 2023 to Apr 2024