Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

January 19 2024 - 5:27PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE SECURITIES

EXCHANGE ACT OF 1934

Filed by the Registrant ☒ Filed

by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☒ |

Soliciting Material Pursuant to §240.14a-12

|

SILVERSUN

TECHNOLOGIES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if

Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ |

No fee required. |

| |

|

| ☐ |

Fee paid previously with preliminary materials. |

| |

|

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

The following is a transcript of an interview of Brad Jacobs conducted

on Bloomberg Radio on January 18, 2024. This transcript was prepared by a third party and has not been independently verified and may

contain errors.

Bloomberg Radio transcript

January 18, 2024

| 1. | Carol Massar (Bloomberg): We could probably spend

a whole segment with our next guest just talking about all the things that he has done; the companies he has created and why he’s

not stopping. He’s got a new venture that was announced just last year. And, oh, he’s out with a new book, published this

past week. With us and back with us is Brad Jacobs, founder and chairman of the freight services provider XPO. Customers—a broad

swath of, kind of, the global economy, if you will; some of the world’s largest. So, Boeing, IKEA, Home Depot, Lowe’s, Disney,

Amazon, Walmart, so many more—automakers, as well. |

| 2. | He has started five companies, Brad has. He’s currently,

also, co-founder of United Rentals, former chair of United Waste—another company he started. And I think you might all recall that

last Fall, when we had him on, we reminded him and everyone that he has been described as “a numbers guy, a serial entrepreneur”. |

| 3. | So, it is delighted— We are delighted to have him back.

His new book is called How to Make a Few Billion Dollars. He’s back with us in our Bloomberg Interactive Brokers studio.

I’m rushing, because I do want to get you here. Hello, welcome back, congratulations. |

| 4. | Brad Jacobs: Hello. Thank you and great to be here. |

| 5. | Carol Massar (Bloomberg): It’s great to have

you here. How are you? How does it feel to have this done? And how are you feeling more broadly about, kind of, the world at large? There’s

a lot going on already in 2024. |

| |

6. |

Brad Jacobs: Always is. If you look at any year for the last 50 years, there’s always stuff going on. |

| 7. | Carol Massar (Bloomberg): Is that how you feel as

a leader? |

| 9. | Carol Massar (Bloomberg): Even wars, and people talk

about the hot spots overseas and maybe this being a third world war, if I go kind of to the extreme. You’re just saying, “It’s

another year. We have a lot being thrown at us.” |

| 10. | Brad Jacobs: Yeah. Yeah. And every year it seems like,

“Whoa, this year might be a little bit different.” Or, “We’re close to a nuclear war.” You know, we were

always this close to a nuclear war. That’s not a new thing. |

| 11. | Carol Massar (Bloomberg): Doesn’t change you

in terms of business investment, what you want to do? You just move ahead? |

| 12. | Brad Jacobs: Yes. I try to find business plans that

are not dependent on calling the macro correctly. As long as I don’t get in at the rock bottom of the cycle or the top of the cycle,

I’m okay. |

| 13. | Tim Stenovec (Bloomberg): Where are we in the cycle? |

| 14. | Brad Jacobs: I think we’ve started to see the

economy slowing down, for sure, here and in Europe. I think it’s going to continue to slow down. And, depending on what the Fed

does, it could start picking up. But it depends on what the Fed does. |

| 15. | Carol Massar (Bloomberg): Is that more an issue of

what the Fed does versus the wars overseas. We’re looking at the Red Sea and ships not being able to go through. We’re worried

about, does the supply chain already have some problems in it, and maybe it even gets worse? Is the Fed more important, and really global

central banks? |

| 16. | Brad Jacobs: The Fed is more important than what the

Houthis are doing. The Houthis are driving— The Houthis, if you want to look at it in economic terms, are inflationary, because

they’re driving up shipping costs, which will be passed along to consumers in the end. But the Fed is the overall stimulator or

slower-downer of the economy. |

| 17. | Carol Massar (Bloomberg): So, they’re more important.

Yeah. |

| 18. | Tim Stenovec (Bloomberg): Well, there is a big debate

that we talk about every day: Will they or won’t they, in March, cut rates? You say the economy is dependent on what the Fed does.

What do you think the Fed should do? |

| 19. | Brad Jacobs: I think the Fed should keep looking at

the data and ignore everything else and go by the data. If inflation cools down more, yeah, then it may make sense to start lowering

rates. If inflation continues to rear its ugly head, then it’s not the time to be lowering rates. |

| 20. | Tim Stenovec (Bloomberg): Are you seeing in your various

businesses—what you’re hearing from colleagues, what you’re hearing from associates—is inflation rearing its

ugly head again? Or does the Fed have this tamed? |

| 21. | Brad Jacobs: It’s more slowing down and having

slowed down than inflation coming back. So, I look at wages a lot, since that’s a big part of all of our businesses. Wage growth

has slowed. Input costs are still going up, but they’ve slowed. Rents, leases have gone up, but they’re going up slower.

So, it does feel it’s slowed down quite a bit. |

| 22. | Carol Massar (Bloomberg): Brad, are you holding onto

workers? |

| 23. | Brad Jacobs: Yeah, much more than— Well, first

of all, we couldn’t even find workers a couple of years ago. |

| 24. | Carol Massar (Bloomberg): Right, but I’m just

curious: Are you still worried about losing someone and not being able to, or letting somebody go, if you’re starting to see some

softness? Would you rather hold onto a worker at this point? |

| 25. | Brad Jacobs: Well, you always want to hold onto your

talent. In the book, I talk all about that. |

| 26. | Carol Massar (Bloomberg): You do talk about this. |

| 27. | Brad Jacobs: Your number one assets are your people,

and you’ve got to make sure you’ve got A+— |

| 28. | Carol Massar (Bloomberg): But you know what I’m

saying. When you run a publicly held company and if you’re worried about any kind of slow-down, you’ve got to start to look

at your costs again. |

| 29. | Brad Jacobs: You should be looking at your costs in

every part of the cycle. You should be managing your costs intelligently. |

| 30. | Carol Massar (Bloomberg): Alright, so, having said

that, when you think about capital expenditures, you’re comfortable to move ahead? |

| 31. | Brad Jacobs: Yeah, absolutely. I’m about to

start a new company. |

| 32. | Carol Massar (Bloomberg): You have started a new company. |

| 33. | Brad Jacobs: Yeah. Well, almost. |

| 34. | Carol Massar (Bloomberg): Almost. Well, where are

you in that? Help us out with that, because we’ve talked about it with you last year. We’re talking about QXO. |

| 36. | Carol Massar (Bloomberg): Tell us about where you

are. And you’re looking to buy businesses, from what I understand, it’s all about, kind of, moving businesses, or materials,

around in North America. So, where are you in the process? |

| 37. | Brad Jacobs: North American and Europe. |

| 38. | Carol Massar (Bloomberg): And Europe. |

| 39. | Brad Jacobs: So, I did exactly what I said I was going

to do when I saw you last time. So, we’ve agreed to put a $1 billion PIPE, an equity investment, into a very small-cap company.

We’re then going to spin that company back to its legacy owners, give them a $2.5 million dividend, give them a small, less than

0.5% equity ownership in our new company, QXO. And we’ll have a pure-play called QXO, which will consolidate the $800 billion building

products distribution industry. |

| 40. | Carol Massar (Bloomberg): So, where are you in the

process? |

| 41. | Brad Jacobs: We’re a couple months or so away

from finishing that, depending on various approvals we have to get from the SEC and so forth, and then we’ll be off to the races. |

| 42. | Carol Massar (Bloomberg): So, you haven’t acquired

anything yet? |

| 44. | Carol Massar (Bloomberg): But do you have, like, a

list that you’re ready to go? |

| 45. | Brad Jacobs: Oh yeah, we’re talking to lots

of companies. We have a lot of discussions going on. |

| 46. | Carol Massar (Bloomberg): Privately held, I’m

assuming? Smaller players? Mid-size players? |

| 47. | Brad Jacobs: Well, for right now, because our budget

is only $1 billion, they’re all private. |

| 48. | Tim Stenovec (Bloomberg): How are you going to make

1 + 1 = 3 with these acquisitions? Like, how will you bring operational efficiency? |

| 49. | Brad Jacobs: I’m going to follow the same exact

playbook that I’ve done for the last few decades. I’m going to buy companies that are good companies but can be better. I’m

going to buy companies when you put them together you find synergies, particularly in procurement, which is the biggest line item in

building products distribution. I’m going to apply technology to be the most tech-forward building products distributor in the

world. And I’m going to do all that together and get economies of scale as we get bigger and bigger and bigger. And I’ve

put the numbers out there: I expect to be at at least $1 billion revenue run-rate after year one, at least a $5 billion revenue run-rate— |

| 50. | Carol Massar (Bloomberg): So you’re sticking

to that? |

| 51. | Brad Jacobs: Absolutely. And most importantly, tens

of billions of dollars of revenue over the decade. |

| 52. | Carol Massar (Bloomberg): Why is this such a smart

bet right now, distributing building materials in North America and Europe, you said specifically? What’s the trend that you are

seeing? Is it infrastructure? What is it? |

| 53. | Brad Jacobs: Long term, there are three drivers. In

residential construction, houses are old. The average age of a house is over 40 years, which is old. And there’s repair and remodeling

going on and there’s more construction that will be driven by that. On the non-residential construction, they’re even older.

Non-residential buildings are over 50 years old, on average. On the infrastructure, there’s about $2 trillion of infrastructures

spend that needs to be done over the next 20 years. So, there’s a lot of activity that has to happen here. |

| 54. | Tim Stenovec (Bloomberg): Why not just relax? |

| 55. | Brad Jacobs: I’m relaxed. Do I not look relaxed?

Look at this face: Am I not relaxed? [laughter] |

| 56. | Tim Stenovec (Bloomberg): I mean, what motivates you

to keep doing this. You’ve been successful many times over and over again. |

| 57. | Brad Jacobs: I love the job. I’ve been a CEO

since I’ve been 23 years old. It’s just a fantastic job. You get to be very creative. You get to think big. You get to dream

these large, large business plans. You get to recruit people you love to work with. You design compensation programs so everybody’s

in it to win it. And you come to work every day and you just knock down a list and make it happen. And you create huge amounts of money,

not just for the employees but for the shareholders. You know, our companies over the years have really excelled at shareholder value

creation. If you look at XPO, our initial investors made 32x their money. If you look at United Rentals, we started at $3.50 a share;

today it’s over $550 a share. So, a lot of value’s been created for a lot of people. And I just love that. I take a lot of

pride in that. |

| 58. | Carol Massar (Bloomberg): We’ve just got 30

seconds, then we’ll come back and talk some more, but this value creation of maybe $1 billion, you say, of annual revenue in the

first year and then $5 billion within three years, can you do that if there’s any weakness in the global economy or in the US? |

| 59. | Brad Jacobs: Yeah. I can do this business plan regardless

of what happens in the economy. If it’s strong, if it’s weak, if it’s flat—I can still do this business plan. |

| 60. | Carol Massar (Bloomberg): Why? |

| 61. | Brad Jacobs: Because there are 7,000 distributors

to buy in North America, including Canada. There are 13,000 to buy in Europe. A lot of them are owned by private equity, and private

equity will have a choice. Private equity can dribble out over a number of years through an IPO and the secondary and so forth at a discount,

or they can sell to me on a win-win deal where I can pay them a premium. |

| 62. | Carol Massar (Bloomberg): Alright, sit tight. We’re

going to come back and continue with Brad Jacobs, of course. Chairman of XPO. He’s got a new book out, How to Make a Few Billion

Dollars. |

| 63. | Carol Massar (Bloomberg): We’re back live in

our Bloomberg Interactive Brokers studio, delighted to still have with us Brad Jacobs, founder and chairman at XPO, currently also a

co-founder of United Rentals, former chair of United Waste. He’s also got a new investment vehicle out there that he’s getting

ready to make investments in. And he’s got a new book, How to Make a Few Billion Dollars. I’m not quite sure where

to start. When you wake up in the morning, what is the first thing you think about? |

| 64. | Brad Jacobs: The first thing I think about is how

to get my head in a good place. |

| 65. | Carol Massar (Bloomberg): Okay. |

| 66. | Brad Jacobs: Before I start getting into business.

How do I center myself? |

| 67. | Carol Massar (Bloomberg): Really? |

| 68. | Brad Jacobs: Yeah! I try — I do a series of

meditation exercises to expand my mind and think about very large areas of space. I try to shrink it into very small – down into

atoms. And I have a whole spiritual exercise I do in the morning. |

| 69. | Carol Massar (Bloomberg): I love that. |

| 70. | Brad Jacobs: I get in the zone. I like to get in the

zone. |

| 71. | Tim Stenovec (Bloomberg): Is that different than when

you were 23 and you were a CEO? |

| 72. | Brad Jacobs: A little more now. |

| 73. | Tim Stenovec (Bloomberg): Were you doing it then? |

| 74. | Brad Jacobs: I was doing it then. Yeah. |

| 75. | Tim Stenovec (Bloomberg): That’s interesting.

These days to hear an executive say that is not that surprising. It’s widely accepted that that is a way to — |

| 76. | Brad Jacobs: Sure. I was in the closet when I was

in my twenties on that. |

| 77. | Tim Stenovec (Bloomberg): Okay. |

| 78. | Brad Jacobs: But we kept the meditation stuff quiet. |

| 79. | Carol Massar (Bloomberg): Seriously? |

| 80. | Tim Stenovec (Bloomberg): That’s interesting. |

| 81. | Carol Massar (Bloomberg): Yeah, that is interesting.

Why did you start then? |

| 82. | Brad Jacobs: I started transcendental meditation when

I was a teenager in high school. Then I did that for decades, I did that for a long time. Then I started experimenting with other forms

of meditation. I studied Milton Erickson, Ericksonian neuro hypnotherapy. I studied psychotherapy, the different mindfulness techniques.

The different cognitive therapy techniques. I kind of blended them all together and picked and choosed and made my own thing. |

| 83. | Carol Massar (Bloomberg): But why? |

| 84. | Brad Jacobs: Because I think, as I say in the very

first chapter, you need to rearrange your brain in order to accomplish big stuff. |

| 85. | Tim Stenovec (Bloomberg): But what was the awareness

that you had in high school to actually do that? You don’t meet high schoolers that do this. |

| 86. | Brad Jacobs: I saw a poster of Maharishi Mahesh Yogi

up on a screen that said something like, “Life is bliss.” I said, “That’s interesting, I think I’ll go

to the lecture.” |

| 87. | Carol Massar (Bloomberg): Do you do yoga, too? |

| 88. | Brad Jacobs: I do yoga, yeah. Yeah. |

| 89. | Carol Massar (Bloomberg): Yeah, interesting. That

is really fascinating. I’m like getting my head around that. Love that. |

| 90. | Carol Massar (Bloomberg): So, with this book, and

I know we’ve talked about it before, I mean, what are you trying to inspire in other people, knowing what you’ve done so

far in kind of laying this out. You make it, the title makes it feel like, “Hey, anybody can do this.” I don’t know that

anybody can do it. Are you saying anybody can do this? |

| 91. | Brad Jacobs: It depends what “this” is.

I don’t think anybody can make a few billion dollars, mathematically there are only a few people that can do that. But I think

anybody can rearrange their brain to think in a different way that’s big, that’s confident, that’s strong, that’s

very off the beaten track and accomplish great stuff. That doesn’t have to be making money. That can be all kinds of stuff. That

can be just being a great mom or dad. That can be a great artist, it can be a great musician, it can be a great anything. But yes, I

think what I’ve shared in the book, are the techniques that have worked for me, in order to attract great people, and to organize those

people in a way to accomplish big things. And I think that can be taught. |

| 92. | Carol Massar (Bloomberg): One of the things I think

about, to be fair, we’ll have a lot of leaders in and talk about great people. One of the things I think about is — to be

fair, like a lot, we’ll have a lot of leaders in and talk about great people. But what is it that you think really people have

to understand? What does that mean? Is it allowing them, like we talked about the Smucker CEO, and that company is allowing people to

come to work Tuesday to Thursday every other week? |

| 93. | Brad Jacobs: That’s not my culture at all. |

| 94. | Carol Massar (Bloomberg): But what is it to create

great people? Like what does that mean? How do you do that? |

| 95. | Brad Jacobs: You need to think in your mind very clearly

who you’re trying to attract. What are the traits and qualities and characteristics that you’re looking for? I know what those are very

clearly for me. I look for people who are super smart. They’ve got to be smarter than me. Why do I want to – why do I want to depend

on people less smarter than me? I want to depend on people smarter than me. So always try to get people who are hopefully significantly

smarter than I am. They may not have this — I bring certain business talents and commercial sense to the table, leadership talents.

But in terms of raw IQ, I like smart people. I really, really enjoy that. I want people with grit. I want to be that are hungry, who

want to work really hard, who actually like working. Enjoyable. And then I want people who are honest as the day is long. I definitely

don’t want people who I’m trying to analyze what do they really mean? I want people who are collegial and collaborative and team players

and play well in the sandbox with each other, so that you can create – well, if you’re an ant or you’re a bee, a superorganism!

I talk about that in the book. You want to create a culture that’s a super organism, not just a bunch of people, but a collect—

a highly integrated group of people. |

| 96. | Carol Massar (Bloomberg): Is there a leader you admire? |

| 97. | Brad Jacobs: Oh, lots of people. |

| 98. | Carol Massar (Bloomberg): Is there one that you would

share? |

| 99. | Brad Jacobs: I admire Jeff Bezos. I admire, I admire

Elon Musk, even though, you know, he has certain traits I don’t admire. But I do admire his ability to think huge. |

| 100. | Tim Stenovec (Bloomberg): You brought up Elon Musk,

so I want to go somewhere that Carol and I go each and every day, which is, some people argue the biggest revolution when it comes to

technology right now, and that’s what’s happening with AI. Certainly a lot has changed when it comes to computers and AI

over your career. How do you think about harnessing AI, using it in your businesses and even concerns that you might have about the technology? |

| 101. | Brad Jacobs: I’ve always used technology to my advantage.

All my company has been tech forward, right for the very first one. So, when I was in the oil business, way before the internet, our

main edge was to have a rudimentary technology system to collect information globally about buyers and sellers of crude oil and refined

products. When I was in the waste management business, we were the first ones to pioneer very advanced route optimization software. So

the trucks weren’t just randomly driving around, we were efficiently optimize what the routes were going to be. When I was in the construction

equipment rental business. One of the first acquisitions we made, we made hundreds of acquisitions, was a company called Wind Systems,

which was a way to record where all the equipment is. And we had billions of dollars of equipment. Where everything was at any one point

in time, and to predict it and monitor its utilization so that we could replenish the fleet where we needed it, where there was demand.

And we’d know where to lower prices or raise prices to pay — depending on demand. XPO was all about technology. One of the first

few people I hired was Mario Horik, now the CEO of XPO, who as my CIO. Because the vision was to automate truck brokerage. And fast forward

to today, we’ve spun that off as RXO, Drew Wilkerson runs it. And 98% of their orders are either sourced or covered electronically. That

was 0% when we started the company. So yeah, I’ve always embraced technology, I think it’s really important to do that. |

| 102. | Carol Massar (Bloomberg): We only have about 30 or

40 seconds left here, so I’m going to ask you: You say bigger is better in business most of the time, but not always. And I think

in a world where we’re always, like, wanting more. We even talk about companies, “Look at this market cap! They’re

number one.” Why is this an important concept? And forgive me, Brad, because we only have about 30 seconds. |

| 103. | Brad Jacobs: So, over the last year, I’ve looked

at dozens of industries and hundreds of companies. And I had a check list of everything I wanted: size; growth; fragmentation. One of

them was “bigger is better”. That means there are economies of scale. In the case of QXO, the big economy of scale is purchasing

power, procurement. Because if you if you buy lots of materials, you’re going to get a cheaper price. |

| 104. | Carol Massar (Bloomberg): Promise you’ll come

back and, as you build out your new business? |

| 105. | Brad Jacobs: I always like to come on here because

it seems like it was one minute. |

| 106. | Carol Massar (Bloomberg): I agree, I agree. And we

learned something new about you, which was really fascinating. Brad Jacobs, thank you so much. Good luck with everything. Found and chairman

of XPO. Of course, we’ve talked about his new book, How to Make a Few Billion Dollars. Looking forward already to the future

conversations. |

Cautionary statement regarding forward-looking

statements

This communication contains forward-looking

statements. Statements that are not historical facts, including statements about beliefs or expectations, are forward-looking statements.

These statements are based on plans, estimates, expectations and projections at the time the statements are made, and readers should not

place undue reliance on them. In some cases, readers can identify forward-looking statements by the use of forward-looking terms such

as “may,” “will,” “should,” “expect,” “opportunity,” “intend,”

“plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,”

“target,” “goal,” or “continue,” or the negative of these terms or other comparable terms. Forward-looking

statements involve inherent risks and uncertainties and readers are cautioned that a number of important factors could cause actual results

to differ materially from those contained in any such forward-looking statements. Factors that could cause actual results to differ materially

from those described herein include, among others:

| ● | uncertainties as to the completion of the equity investment, the separation

by SilverSun Technologies, Inc. (the “Company”) of its existing business into SilverSun Technologies Holdings, Inc. (the “spin-off”)

and the other transactions contemplated by the investment agreement by and among Jacobs Private Equity II, LLC, the Company and the other

parties thereto (the “Investment Agreement”), including the risk that one or more of the transactions may involve unexpected

costs, liabilities or delays; |

| ● | the risks associated with the Company’s relatively low public float,

which may result in its common stock experiencing significant price volatility; |

| ● | the possibility that competing transaction proposals may be made; |

| ● | the risks associated with raising additional equity or debt capital from

public or private markets to pursue acquisitions or other strategic investments, including in an amount that may significantly exceed

the initial equity investment, and the effects that raising such capital may have on the Company’s business and the trading price

of the Company’s common stock, including the possibility of substantial dilution; |

| ● | the possibility that additional future financings may not be available to

the Company on acceptable terms or at all; |

| ● | the effects that the announcement, pendency or consummation of the equity

investment, the spin-off and the other transactions contemplated by the Investment Agreement may have on the Company and its current or

future business and on the price of the Company’s common stock; |

| ● | the possibility that an active, liquid trading market for the Company’s

common stock may not develop or, if developed, may not be sustained; |

| ● | the possibility that the warrants, if issued, may not be exercised; |

| ● | the possibility that various closing conditions for the equity investment,

the spin-off and the other transactions contemplated by the Investment Agreement may not be satisfied or waived, or any other required

consents or approvals may not be obtained within the expected timeframe, on the expected terms, or at all, including the possibility that

the Company may fail to obtain stockholder approval for the transactions contemplated by the Investment Agreement; |

| ● | the effects that a termination of the Investment Agreement may have on the

Company, including the risk that the price of the Company’s common stock may decline significantly if the equity investment is not

completed; |

| ● | the risk that the spin-off may be more difficult, time-consuming or costly

than expected or the possibility that the anticipated benefits of the spin-off may not be realized; |

| ● | uncertainties regarding the Company’s focus, strategic plans and other

management actions; |

| ● | the risk that the Company, following the closing of the equity investment,

is or becomes highly dependent on the continued leadership of Jacobs as chairman and chief executive officer and the possibility that

the loss of Jacobs in these roles could have a material adverse effect on the Company’s business, financial condition and results

of operations; |

| ● | the risk that Jacobs’ past performance may not be representative of

future results; |

| ● | the risk that the Company is unable to attract or retain world-class talent;

|

| ● | the risk that the Company may be unable to identify suitable acquisition

candidates or expeditiously consummate any particular acquisition candidate on acceptable terms or at all; |

| ● | the risk that the failure to consummate an acquisition expeditiously, or

at all, could have a material adverse effect on the Company’s business prospects, financial condition, results of operations or

the price of the Company’s common stock; |

| ● | the risk that the Company may fail to satisfy the ongoing requirements of

Nasdaq if it is unable to expeditiously consummate an acquisition following the consummation of the spin-off; |

| ● | the risks associated with cybersecurity and technology, including attempts

by third parties to defeat the security measures of the Company and its business partners, and the loss of confidential information and

other business disruptions; |

| ● | the possibility that new investors in any future financing transactions could

gain rights, preferences, and privileges senior to those of the Company’s existing stockholders; |

| ● | the risks associated with the uncertain nature of the building products distribution

industry in which Jacobs, upon becoming chairman and chief executive officer of the Company, plans to pursue acquisitions after consummation

of the transactions contemplated by the Investment Agreement; |

| ● | the possibility that industry demand may soften or shift substantially due

to the cyclicality and seasonality of the building products distribution industry and its dependence on general economic conditions, including

inflation or deflation, interest rates, consumer confidence, labor and supply shortages, weather and commodity prices; |

| ● | the possibility that regional or global barriers to trade or a global trade

war could increase the cost of products in the building products distribution industry, which could adversely impact the competitiveness

of such products and the financial results of businesses in the industry; |

| ● | the risks associated with potential litigation related to the transactions

contemplated by the Investment Agreement or related to any possible subsequent financing transactions or acquisitions or investments;

|

| ● | uncertainties regarding general economic, business, competitive, legal, regulatory,

tax and geopolitical conditions; and |

| ● | other factors, including those set forth in the Company’s filings with

the U.S. Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and

subsequent Quarterly Reports on Form 10-Q. |

Forward-looking statements herein speak only

as of the date each statement is made. Neither the Company nor any person undertakes any obligation to update any of these statements

in light of new information or future events, except to the extent required by applicable law.

Additional information and where to find

it

In connection with the proposed equity investment,

the Company will prepare a proxy statement to be filed with the U.S. Securities and Exchange Commission (the “SEC”). When

completed, a definitive proxy statement and a form of proxy will be mailed to the stockholders of the Company. THE COMPANY’S STOCKHOLDERS

ARE URGED TO READ THE PROXY STATEMENT REGARDING THE PROPOSED TRANSACTIONS BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. The Company’s

stockholders will be able to obtain, without charge, a copy of the proxy statement (when available) and other relevant documents filed

with the SEC from the SEC’s website at http://www.sec.gov. The Company’s stockholders will also be able to obtain, without

charge, a copy of the proxy statement and other relevant documents (when available) from the Company’s website at https://www.silversuntech.com

or by written request to the Company at 120 Eagle Rock Avenue, East Hanover, New Jersey 07936.

Participants in the solicitation

Jacobs Private Equity II, LLC and the Company

and its directors and officers may be deemed to be participants in the solicitation of proxies from the Company’s stockholders with

respect to the proposed equity investment and the other transactions contemplated by the Investment Agreement. Information about the Company’s

directors and executive officers and their ownership of the Company’s common stock is set forth in the proxy statement for the Company’s

2023 Annual Meeting of Stockholders, which was filed with the SEC on November 27, 2023. The interests of the Company and its directors

and executive officers with regard to the proposed equity investment may differ from the interests of the Company’s stockholders

generally, and stockholders may obtain additional information by reading the proxy statement and other relevant documents regarding the

proposed equity investment and the other transactions contemplated by the Investment Agreement, when filed with the SEC.

10

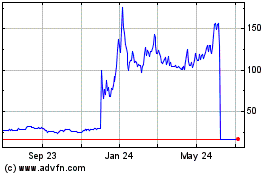

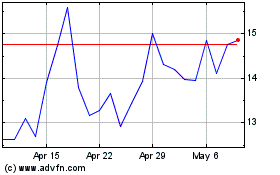

SilverSun Technologies (NASDAQ:SSNT)

Historical Stock Chart

From Mar 2024 to Apr 2024

SilverSun Technologies (NASDAQ:SSNT)

Historical Stock Chart

From Apr 2023 to Apr 2024