Filed

Pursuant to Rule 424(b)(5)

Registration

No. 333-274083

PROSPECTUS

SUPPLEMENT

(To

the Prospectus Dated August 28, 2023)

Up

to $25,000,000

Common Stock

We

have entered into a Controlled Equity OfferingSM Sales Agreement (the “Sales Agreement”), with Cantor Fitzgerald &

Co. (“Cantor”), relating to shares of our Class A common stock (“common stock”) offered by this prospectus supplement

and the accompanying prospectus. In accordance with the terms of the Sales Agreement, we may offer and sell shares of our common stock

having an aggregate offering price of up to $25,000,000 from time to time through or to Cantor, acting as our sales agent or principal

(the “Sales Agent”), pursuant to this prospectus supplement and the accompanying prospectus. The offering amount is in addition

to the approximately $61,185,567 previously sold under the sales agreement pursuant to our expiring registration statement on Form S-3

(File No. 333-252386) filed with the U.S. Securities and Exchange Commission (“SEC”) on January 22, 2021 and declared effective

on February 2, 2021 (the “Prior Registration Statement”).

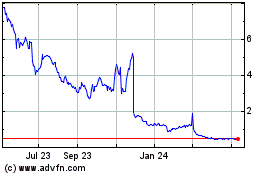

Our

common stock is listed on the Nasdaq Capital Market (the “Nasdaq”) under the symbol “BIVI.” On January 18, 2024,

the last reported sale price of our common stock was $1.24 per share.

Sales

of our common stock, if any, under this prospectus supplement and the accompanying prospectus may be made in sales deemed to be an “at

the market offering” as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended (the “Securities

Act”). The Sales Agent will use its commercially reasonable efforts to sell on our behalf all the shares of common stock requested

to be sold by us, consistent with its normal trading and sales practices, on mutually agreed terms. There is no arrangement for funds

to be received in any escrow, trust or similar arrangement. We provide more information about how the shares of common stock will be

sold in the section entitled “Plan of Distribution.”

The

Sales Agent will receive from us in the aggregate a fixed commission of 3.0% of the gross proceeds of any shares of common stock sold

through them under the Sales Agreement. In connection with the sale of our common stock on our behalf, the Sales Agent will be deemed

to be an “underwriter” within the meaning of the Securities Act and the compensation of the Sales Agent will be deemed to

be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution to the Sales Agent with respect

to certain liabilities, including liabilities under the Securities Act.

Investing

in our common stock involves a high degree of risk. Before buying any common stock, you should review carefully the risks and uncertainties

described under the heading “Risk Factors” beginning on page S-3 of this prospectus supplement, page 5 of the accompanying

prospectus, and in the documents incorporated by reference into this prospectus supplement and the accompanying prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal

offense.

Cantor

The

date of this prospectus supplement is January 19, 2024

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement is a supplement to the accompanying prospectus. This prospectus supplement and the accompanying prospectus are

parts of a registration statement that we filed with the SEC using a shelf registration process. Under this shelf registration process,

we may sell from time to time an unspecified amount of any combination of securities described in the accompanying prospectus in one

or more offers such as this offering. The accompanying prospectus provides you with a general description of the securities we may offer,

some of which may not apply to this offering. This prospectus supplement provides you with specific information about the common stock

we are offering. Both this prospectus supplement and the accompanying prospectus include important information about us and other information

you should know before investing. Generally, when we refer only to the “prospectus,” we are referring to both parts combined,

and when we refer to the “accompanying prospectus” we are referring to the accompanying prospectus.

This

prospectus supplement also adds to, updates and changes information contained in the accompanying prospectus. To the extent the information

in this prospectus supplement is different from that in the accompanying prospectus, you should rely on the information in this prospectus

supplement. You should read both this prospectus supplement and the accompanying prospectus, together with the additional information

described under the caption “Incorporation of Certain Information by Reference” in this prospectus supplement and the accompanying

prospectus, before investing in the common stock.

You

should rely only on the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus,

the documents incorporated by reference herein and any free writing prospectus we provide you. We have not, and the Sales Agent has not,

authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should

not rely on it. We are not, and the Sales Agent is not, making an offer to sell these securities in any jurisdiction where the offer

or sale is not permitted. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus,

the documents incorporated by reference herein and any free writing prospectus we provide to you is accurate only as of the date on those

respective documents. Our business, financial condition, results of operations and prospects may have changed since those dates. You

should read this prospectus supplement and the accompanying prospectus, including the documents incorporated by reference herein and

therein, when making your investment decision. The distribution of this prospectus supplement and the accompanying prospectus and the

offering of the common stock in certain jurisdictions may be restricted by law. Persons outside the United States, or the U.S., who come

into possession of this prospectus supplement and the accompanying prospectus must inform themselves about, and observe any restrictions

relating to, the offering of the common stock and the distribution of this prospectus supplement and the accompanying prospectus outside

the U.S. This prospectus supplement and the accompanying prospectus does not constitute, and may not be used in connection with, an offer

to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the accompanying prospectus by

any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

WHERE

YOU CAN FIND MORE INFORMATION

This

prospectus supplement does not contain all of the information in the registration statement. We have omitted from this prospectus supplement

some parts of the registration statement as permitted by the rules and regulations of the SEC. Statements in this prospectus supplement

concerning any document we have filed as an exhibit to the registration statement or that we otherwise filed with the SEC are not intended

to be comprehensive and are qualified in their entirety by reference to these filings. In addition, we file annual, quarterly and current

reports, proxy statements and other information with the SEC. The SEC maintains an Internet site that contains reports, proxy and information

statements and other information that we file electronically with the SEC, including us. The SEC’s Internet site can be found at

http://www.sec.gov. In addition, we make available on or through our Internet site copies of these reports as soon as reasonably practicable

after we electronically file or furnished them to the SEC. Our Internet site can be found at https://www.bioviepharma.com. Our website

is not a part of this prospectus supplement.

INFORMATION

INCORPORATED BY REFERENCE

We

have elected to incorporate certain information by reference into this prospectus supplement. By incorporating by reference, we can disclose

important information to you by referring you to other documents we have filed or will file with the SEC. The information incorporated

by reference is deemed to be part of this prospectus supplement and the accompanying prospectus, except for information incorporated

by reference that is superseded by information contained in this prospectus supplement. This means that you must look at all of the SEC

filings that we incorporate by reference to determine if any statements in the prospectus supplement, accompanying prospectus or any

document previously incorporated by reference have been modified or superseded. This prospectus supplement incorporates by reference

the documents set forth below that we have previously filed with the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange

Act”):

| |

● |

our

Annual Report on Form 10-K for the fiscal year ended June 30, 2023 filed with the SEC on August 16, 2023 (the “2023 Form 10-K”); |

| |

● |

the

information specifically incorporated by reference into the 2023 Form 10-K from our definitive proxy statement on Schedule 14A relating

to our 2023 Annual Meeting of Stockholders, filed with the SEC on September 29, 2023; |

| |

● |

the

description of our common stock contained in our Registration Statement on Form 8-A12B, filed with the SEC on August 25, 2020, including

any amendment or report filed for the purpose of updating such description; |

| |

● |

our

quarterly report on Form 10-Q for the fiscal quarter ended September 30, 2023, filed with the SEC on November 8, 2023; |

| |

● |

our

current reports on Form 8-K filed with the SEC on October 25, 2023, November 13, 2023 and November 29, 2023; and |

| |

● |

the

description of our securities registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended, filed as Ex.

4.4 of the 2023 Form 10-K. |

All

documents subsequently filed by BioVie Inc. with the SEC pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act prior to

the termination of the offering (except in each case the information contained in such document to the extent “furnish” and

not “filed”) shall be deemed to be incorporated by reference herein and to be a part hereof from the date of filing of such

documents.

Any

statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded

for purposes of this prospectus supplement to the extent that a statement contained herein, or in any other subsequently filed document

which also is incorporated or deemed to be incorporated by reference herein, modifies or supersedes such statement. Any such statement

so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement.

To

obtain copies of documents incorporated by reference herein or in the accompanying prospectus, see “Where You Can Find More Information”

in the accompanying prospectus. In addition, upon written or oral request, we will provide to any person, at no cost to such person,

including any beneficial owner to whom a copy of this prospectus supplement is delivered, a copy of any or all of the information that

has been incorporated by reference in this prospectus supplement or the accompanying prospectus. You may make such a request by writing

or telephoning us at the following address or telephone number:

BioVie

Inc.

680 W Nye Lane, Suite 201

Carson City, NV 89703

Tel: (775) 888-3162

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein contain forward-looking

statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended (the “Securities Act”), and Section

21E of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), that involve substantial risks and uncertainties.

Such forward-looking statements concern our anticipated results and progress of our operations in future periods, planned exploration

and, if warranted, development of our properties, plans related to our business and other matters that may occur in the future. These

statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable

and assumptions of management. All statements contained herein that are not clearly historical in nature are forward-looking, and the

words “anticipate,” “believe,” “expect,” “estimate,” “may,” “will,”

“could,” “leading,” “intend,” “contemplate,” “shall” and similar expressions

are generally intended to identify forward-looking statements. Forward-looking statements are subject to a variety of known and unknown

risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking

statements. Forward-looking statements in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference

herein and therein include, but are not limited to, statements with respect to:

-

our limited operating history and experience in developing and manufacturing drugs;

-

none of our products are approved for commercial sale;

-

our substantial capital needs;

-

product development risks;

-

our lack of sales and marketing personnel;

-

our reliance on third parties to conduct our clinical trials;

-

regulatory, competitive and contractual risks;

-

no assurance that our product candidates will obtain regulatory approval or that the results of clinical studies will be favorable;

-

risks related to our intellectual property rights;

-

the volatility of the market price and trading volume in our common stock;

-

the absence of liquidity in our common stock;

-

the risk of substantial dilution from future issuances of our equity securities; and

-

the other risks set forth herein and in the documents incorporated by reference herein under the caption “Risk Factors.”

You

should not place undue reliance on forward-looking statements, which speak only as of the date that they were made. Moreover, you should

consider these cautionary statements in connection with any written or oral forward-looking statements that we may issue in the future.

We do not undertake any obligation to release publicly any revisions to forward-looking statements after completion of this offering

to reflect later events or circumstances or to reflect the occurrence of unanticipated events. In light of the risks and uncertainties

described above, the forward-looking events and circumstances discussed in this prospectus supplement and the documents incorporated

by reference might not occur, and are not guarantees of future performance.

PROSPECTUS

SUPPLEMENT SUMMARY

The

following summary highlights information contained elsewhere in this prospectus supplement or the documents incorporated by reference

herein. This summary is not complete and does not contain all of the information you should consider before investing in our securities.

You should read the entire prospectus supplement and the accompanying prospectus, including each of the documents incorporated by reference

herein or therein, carefully, including the “Risk Factors” and “Forward-Looking Information” sections of this

prospectus supplement, and “Risk Factors” in our 2023 Form 10-K, as such risk factors may be amended, updated or modified

periodically in our quarterly reports filed on Form 10-Q with the SEC, and any amendment or update thereto reflected in subsequent filings

with the SEC and incorporated herein by reference.

Overview

of the Company

We

are a clinical-stage company developing innovative drug therapies to treat chronic debilitating conditions including liver disease and

neurological and neuro-degenerative disorders.

Neurodegenerative

Disease Program

In

neurodegenerative disease, the Company’s drug candidate NE3107 inhibits activation of inflammatory actions extracellular single-regulated

kinase (“ERK”) and nuclear factor kappa-light-chain-enhancer of activated B cells (“NFκB”) (including interactions

with tumor necrosis factor (“TNF”) signaling and other relevant inflammatory pathways) that lead to neuroinflammation and

insulin resistance. NE3107 does not interfere with their homeostatic functions (e.g., insulin signaling and neuron growth and survival).

Both inflammation and insulin resistance are drivers of Alzheimer’s disease (“AD”) and Parkinson’s disease (“PD”).

The

Company acquired the biopharmaceutical assets of NeurMedix, Inc. (“NeurMedix”) a privately held clinical-stage pharmaceutical

company and a related party in June 2021. The acquired assets included NE3107. NE3107 is an investigational, novel, orally administered

small molecule that is thought to inhibit inflammation-driven insulin resistance and major pathological inflammatory cascades with a

novel mechanism of action. There is emerging scientific consensus that both inflammation and insulin resistance may play fundamental

roles in the development of AD and PD, and NE3107 could, if approved by the FDA, represent an entirely new medical approach to treating

these devastating conditions affecting an estimated 6 million Americans suffering from AD and 1 million Americans suffering from PD.

A.

Alzheimer’s Disease (NCT05083260)

On

November 29, 2023, the Company announced the analysis of its unblinded, topline efficacy data from its Phase 3 clinical trial (NCT04669028)

of NE3107 in the treatment of mild to moderate AD. The study has co-primary endpoints looking at cognition using the Alzheimer’s

Disease Assessment Scale-Cognitive Scale (ADAS-Cog 12) and function using the Clinical Dementia Rating-Sum of Boxes (CDR-SB). Patients

were randomly assigned, 1:1 versus placebo, to receive sequentially 5 mg of NE3107 orally twice a day for 14 days, then 10 mg orally

twice a day for 14 days, followed by 26 weeks of 20 mg orally twice daily.

Upon

trial completion, as the Company began the process of unblinding the trial data, the Company found significant deviation from protocol

and current good clinical practices (“cGCPs”) violations at 15 study sites (virtually all of which were from one geographic

area). This highly unusual level of suspected improprieties led the Company to exclude all patients from these sites and to refer the

sites to the U.S. Food and Drug Administration (“FDA”) Office of Scientific Investigations (“OSI”) for further

action. After the patient exclusions, 81 patients remained in the Modified Intent to Treat population, 57 of whom were in the Per-Protocol

population which included those who completed the trial and were verified to take study drug from pharmacokinetic data.

The

trial was originally designed to be 80% powered with 125 patients in each of the treatment and placebo arms. The unplanned exclusion

of so many patients has left the trial unpowered for the primary endpoints.

In

the Per-Protocol population, which included those patients who completed the trial and who were further verified to have taken study

drug (based on pharmacokinetic data), an observed descriptive change from baseline appeared to suggest a slowing of cognitive loss; these

same patients experienced a mean 4.66-year advantage in age deceleration vs. placebo as measured by DNA epigenetic change (based on the

most complete data as of January 10, 2024). Age deceleration is used by longevity researchers to measure the difference between the patient’s

biological age, in this case as measured by the Horvath DNA methylation Skin Blood Clock, relative to the patient’s actual chronological

age. This test was a non-primary/secondary endpoint, other-outcome measure, done via blood test during the study from baseline and week

30 (end of study). Additional DNA methylation data continues to be collected and analyzed. NE3107 appears to be generally well-tolerated

to date. Interim Safety Data, as of topline data completion, in which an event is present in at least 5.0% of the population, and in

which the observed rate of any event is greater in individuals assigned to NE3107 versus placebo, findings are limited to “headache”

(9.5%) and “blood thyroid stimulating hormone increased” (7.1%).

Based

on the efficacy signal seen in this trial, the Company is exploring (1) a discussion with the FDA to potentially employ the adaptive

trial feature of the protocol to continue enrolling patients to achieve statistical significance; and/or (2) designing a new Phase 3

study of NE3107 that leverages the most recent data and understanding of the potential effect NE3017 may have in helping persons with

AD.

B.

Parkinson’s Disease (NCT05083260)

The

Phase 2 study of NE3107 for the treatment of PD (NCT05083260), completed in December 2022, was a double-blind, placebo-controlled, safety,

tolerability, and pharmacokinetics study in PD participants treated with carbidopa/levodopa and NE3107. Forty-five patients with a defined

L-dopa “off state” were randomized 1:1 to placebo:NE3107 20 mg twice daily for 28 days. This trial was launched with two

design objectives: 1) the primary objective was safety and a drug-drug interaction study as requested by the FDA to demonstrate the absence

of adverse interactions of NE3107 with levodopa; and 2) the secondary objective was to determine if preclinical indications of promotoric

activity and apparent enhancement of levodopa activity could be seen in humans. Both objectives were met. The initiation of trial design

for a Phase 3 study of NE3107 for the treatment of PD is currently on hold, pending additional funding.

C.

NE3017 Synopsis

Neuroinflammation,

insulin resistance, and oxidative stress are common features in the major neurodegenerative diseases, including AD, PD, frontotemporal

lobar dementia, and Amyotrophic lateral sclerosis. NE3107 is an investigational oral small molecule, blood-brain permeable, compound

with potential anti-inflammatory, insulin sensitizing, and ERK-binding properties that may allow it to selectively inhibit ERK-, NFκB-

and TNF-stimulated inflammation. NE3107’s potential to inhibit neuroinflammation and insulin resistance forms the basis for the

Company’s work testing the molecule in AD and PD patients. NE3107 is patented in the United States, Australia, Canada, Europe and

South Korea.

Liver

Disease Program

In

liver disease, our investigational drug candidate BIV201 (continuous infusion terlipressin), which has been granted both FDA Fast Track

designation status and FDA Orphan Drug status, is being evaluated and discussed after receiving guidance from the FDA regarding the design

of Phase 3 clinical testing of BIV201 for the treatment of ascites due to chronic liver cirrhosis. BIV201 is administered as a patent-pending

liquid formulation.

In

June 2021, the Company initiated a Phase 2 study (NCT04112199) designed to evaluate the efficacy of BIV201 (terlipressin, administered

by continuous infusion for two 28-day treatment cycles) combined with standard-of-care (“SOC”), compared to SOC alone, for

the treatment of refractory ascites. The primary endpoints of the study are the incidence of ascites-related complications and change

in ascites fluid accumulation during treatment compared to a pre-treatment period.

In

March 2023, the Company announced enrollment was paused and that data from the first 15 patients treated with BIV201 plus SOC appeared

to show a 34% reduction in ascites fluid during the 28 days after treatment initiation compared to the 28 days prior to treatment (p=0.0046).

This improvement was significantly different from those patients receiving SOC treatment. Patients who completed the treatment with BIV201

experienced a 53% reduction in ascites fluid (p=0.001), which was sustained during the three months after treatment initiation as compared

to the three-month pre-treatment period (43% reduction, p=0.06).

In

June 2023, the Company requested and subsequently received guidance from the FDA regarding the design and endpoints for definitive clinical

testing of BIV201 for the treatment of ascites due to chronic liver cirrhosis. The Company is currently finalizing protocol designs for

the Phase 3 study of BIV201 for the treatment of ascites due to chronic liver cirrhosis.

While

the active agent, terlipressin, is approved in the U.S. and in about 40 countries for related complications of advanced liver cirrhosis,

treatment of ascites is not included in these authorizations. Patients with refractory ascites suffer from frequent life-threatening

complications, generate more than $5 billion in annual treatment costs, and have an estimated 50% mortality rate within 6 to 12 months.

The U.S. FDA has not approved any drug to treat refractory ascites.

The

BIV201 development program was initiated by LAT Pharma LLC. On April 11, 2016, the Company acquired LAT Pharma LLC and the rights to

its BIV201 development program. The Company currently owns all development and marketing rights to this drug candidate. Pursuant to the

Agreement and Plan of Merger entered into on April 11, 2016, between our predecessor entities, LAT Pharma LLC and NanoAntibiotics, Inc.,

BioVie is obligated to pay a low single digit royalty on net sales of BIV201 (continuous infusion terlipressin) to be shared among LAT

Pharma Members, PharmaIn Corporation, and The Barrett Edge, Inc.

Corporate

Information

Our

principal executive offices are located at 680 W Nye Lane, Suite 201, Carson City, Nevada 89703, and our telephone number at that location

is (775) 888-3162. Our website address is www.bioviepharma.com. The information on our website is for informational purposes only

and should not be relied on for investment purposes. The information on our website is not incorporated by reference into either this

prospectus supplement or the accompanying prospectus and should not be considered part of this or any other report filed with the SEC.

Our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, together with amendments

to these reports, are available on the “Investor Relations” section of our website, free of charge, as soon as reasonably

practicable after such material is electronically filed with, or furnished to, the SEC.

THE

OFFERING

| Common

stock offered by us |

Shares

of our common stock having an aggregate offering price of up to $25,000,000. |

| |

|

| Common

stock to be outstanding after this offering |

Up

to 60,005,124 shares of common stock (as more fully described in the notes following this table), assuming sales of 20,161,290 shares

of our common stock in this offering at an offering price of $1.24 per share, which was the last reported sale price of our common

stock on the Nasdaq Capital Market on January 18, 2024. The actual number of shares issued will vary depending on the sales prices

at which shares are sold pursuant to this offering. |

| |

|

| Plan

of distribution |

“At

the market offering” that may be made from time to time through or to our sales agent, Cantor. See the section entitled “Plan

of Distribution” on page S-9 of this prospectus supplement. |

| |

|

| Use

of proceeds |

We

intend to use the net proceeds from the offering, if any, for general corporate purposes. See “Use of Proceeds”

on page S-6 of this prospectus supplement. |

| |

|

| Listing |

Our

common stock is listed on Nasdaq under the symbol “BIVI.” |

| |

|

| Risk

Factors |

Before

deciding to invest in our common stock, you should carefully review “Risk Factors” in our 2023 Form 10-K and our quarterly

reports filed on Form 10-Q, and any amendment or update thereto reflected in subsequent filings with the SEC, which are incorporated

by reference herein as well as “Risk Factors” in this prospectus supplement and other information included and incorporated

by reference in this prospectus supplement and the accompanying prospectus. |

The

number of shares of common stock to be outstanding after this offering is based on 39,843,834 shares of common stock outstanding as of

December 31, 2023 and excludes the following:

| ● | 4,173,325

shares of common stock issuable upon the exercise of outstanding stock options at a weighted

average exercise price of $6.84 per share; |

| ● | 7,770,285

shares of common stock issuable upon the exercise of outstanding and exercisable warrants

at a weighted average exercise price of $2.06 per share; |

| ● | 687,428

shares of common stock issuable upon vesting of restricted stock units issued under our equity

incentive plan; and |

| ● | 4,384

shares of common stock issued pursuant to the Sales Agreement subsequent to December 31,

2023. |

RISK

FACTORS

Investing

in our common stock involves risks. In consultation with your own financial and legal advisors, you should consider carefully, among

other matters, the supplemental risk factors set forth below as well as the risk factors discussed under the caption “Risk Factors”

in our 2023 Form 10-K, as such risks may be amended, updated or modified periodically in our quarterly reports on Form 10-Q filed with

the SEC, and any amendment or update thereto reflected in subsequent filings with the SEC, which are incorporated herein by reference,

before deciding whether an investment in the common stock is suitable for you. See “Incorporation of Certain Information by Reference”

in this prospectus supplement and in the accompanying prospectus. The risks and uncertainties described below and in our 2023 Form 10-K,

quarterly reports on Form 10-Q, and any amendment or update thereto reflected in subsequent filings with the SEC are not the only risks

and uncertainties that we face. Additional risks and uncertainties that are unknown to us or that we currently think are immaterial also

may impair our business operations or the market price of the common stock. This prospectus supplement and the accompanying prospectus

also contain forward-looking statements that involve risks. Our actual results could differ materially from those anticipated in these

forward-looking statements as a result of certain factors, including risks described in this prospectus supplement, the accompanying

prospectus and the documents incorporated by reference herein and therein.

Risks

Relating to Our Business and Industry

We

rely and will continue to rely on third parties to conduct our clinical trials. If these third parties do not successfully carry out

their contractual duties and/or meet expected deadlines and/or do not successfully perform and comply with regulatory requirements, including

but not limited to, the U.S. Food, Drug, and Cosmetics Act (the “FDCA”) and FDA’s implementing regulations, we may

not be able to obtain regulatory approval of or commercialize our product candidates.

We

depend, and will continue to depend, on third parties, including, but not limited to, contract research organizations (“CROs”),

clinical trial sites and clinical trial principal investigators, contract laboratories, IRBs, manufacturers, suppliers, and other third

parties to conduct our clinical trials, including those for our drug candidates NE3107 and BIV201. We rely heavily on these third parties

over the course of our clinical trials, and we control only certain aspects of their activities. Nevertheless, we retain ultimate responsibility

for ensuring that each of our studies is conducted in accordance with the protocol and applicable legal, regulatory, and scientific standards

and regulations, and our reliance on third parties does not relieve us of our regulatory responsibilities. We and these third parties

are required to comply with cGCPs, which are regulations and guidelines enforced by the FDA and comparable foreign regulatory authorities

for the conduct of clinical trials on product candidates in clinical development. Regulatory authorities enforce cGCPs through periodic

inspections and for-cause inspections of clinical trial principal investigators and trial sites. If, due to the failure of either the

Company or a third party, a clinical trial fails to comply with applicable cGCPs, FDA’s Investigational New Drug (“IND”)

requirements, other applicable regulatory requirements, or requirements set forth in the applicable IRB-approved protocol, including

failure to enroll a sufficient number of patients, the Company may be required to conduct additional clinical trials to support our marketing

applications, which would delay the regulatory approval process. Moreover, our business may be implicated if any of these third parties

violates applicable federal, state, or foreign laws and/or regulations, including but not limited to FDA’s IND regulations, fraud

and abuse or false claims laws, healthcare privacy and data security laws, or provide us or government agencies with inaccurate, misleading,

or incomplete data. For example, during routine monitoring of blinded data from our Phase 3 study (NCT04669028) of NE3107, we uncovered

what appears to be potential scientific misconduct and significant deviation from study protocol and GCP violations at fifteen sites,

which resulted in the Company excluding all patients from these sites and referring them to the FDA’s OSI for further action. The

unplanned exclusion of so many patients left our Phase 3 study unpowered for the primary endpoints. These findings of potential scientific

misconduct, significant deviation from protocol and GCP violations may call into question the rigor, robustness and validity of the entire

data set for this study (NCT04669028).

Although

we design the clinical trials for our product candidates, our CROs are tasked with facilitating and monitoring our clinical trials. As

a result, many important aspects of our clinical development programs, including site and investigator selection, and the conduct, timing,

and monitoring of the study, is often outside our direct control, either partially or in whole. Our reliance on third parties to conduct

clinical trials also results in less direct control over the collection, management, and quality of data developed through clinical trials

than would be the case if we were relying entirely upon our own employees. Communicating with third parties can also be challenging,

potentially leading to mistakes as well as difficulties in coordinating activities.

Risks

Related to This Offering

We

will have broad discretion in the use of the net proceeds from this offering and may not use them effectively.

We

currently intend to use the net proceeds from this offering, if any, for general corporate purposes, as further described in the section

of this prospectus supplement entitled “Use of Proceeds”. We will have broad discretion in the application of the net proceeds

in the category of general corporate purposes and investors will be relying on the judgment of our management regarding the application

of the proceeds of this offering.

The

precise amount and timing of the application of these proceeds will depend upon a number of factors, such as the timing and progress

of our product development and commercialization efforts, our funding requirements and the availability and costs of other funds. As

of the date of this prospectus supplement, we cannot specify with certainty all of the particular uses for the net proceeds to us from

this offering. Depending on the outcome of our efforts and other unforeseen events, our plans and priorities may change and we may apply

the net proceeds of this offering, if any, in different manners than we currently anticipated.

The

failure by our management to apply these funds effectively could harm our business, financial condition and results of operations. Pending

their use, we may invest the net proceeds from this offering, if any, in short-term, interest-bearing instruments. These investments

may not yield a favorable return to our stockholders.

You

may experience immediate and substantial dilution.

The

offering price per share in this offering may exceed the pro forma as adjusted net tangible book value per share of our common stock

outstanding prior to this offering. Assuming that an aggregate of 20,161,290 shares of our common stock are sold during the term of the

Sales Agreement with the Sales Agent at a price of $1.24 per share, the last reported sale price of our common stock on the Nasdaq Capital

Market on January 18, 2024, for aggregate gross proceeds of approximately $25,000,000, after deducting commissions and estimated aggregate

offering expenses payable by us, you will experience immediate dilution of $0.61 per share, representing the difference between our as

pro forma adjusted net tangible book value per share as of September 30, 2023 after giving effect to this offering and the assumed offering

price. The exercise of outstanding stock options may result in further dilution of your investment. See the section entitled “Dilution”

below for a more detailed illustration of the dilution you would incur if you participate in this offering.

The

actual number of shares we will issue under the Sales Agreement with the Sales Agent, at any one time or in total, is uncertain.

Subject

to certain limitations in the Sales Agreement with the Sales Agent and compliance with applicable law, we have the discretion to deliver

placement notices to the Sales Agent at any time throughout the term of the Sales Agreement. The number of shares that are sold by Sales

Agent, if any, after delivering a placement notice will fluctuate based on the market price of the common stock during the sales period

and limits we set with the Sales Agent.

You

may experience future dilution as a result of future equity offerings or if we issue shares subject to options, warrants, stock awards

or other arrangements.

In

order to raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into

or exchangeable for our common stock, including pursuant to the Sales Agreement. We may sell shares or other securities in any other

offering at a price per share that is less than the current market price of our securities, and investors purchasing shares or other

securities in the future could have rights superior to existing stockholders. The sale of additional shares of common stock or other

securities convertible into or exchangeable for our common stock would dilute all of our stockholders, and if such sales of convertible

securities into or exchangeable into our common stock occur at a deemed issuance price that is lower than the current exercise price

of our outstanding warrants sold to Acuitas Group Holdings, LLC (“Acuitas”) in August 2022 (the “Acuitas Warrants”),

the exercise price for those warrants would adjust downward to the deemed issuance price pursuant to price adjustment protection contained

within those warrants.

In

addition, as of December 31, 2023, there were warrants outstanding to purchase an aggregate of 7,770,285 shares of common stock

at exercise prices ranging from $1.82 to $12.50 per share and 4,344,881 shares issuable upon exercise of outstanding options at

exercise prices ranging from $1.69 to $42.09 per share and restricted stock units totaling 687,428. Our Loan Agreement entered into

on November 30, 2021 contains a conversion feature whereby at the option of lender, up to $5 million of the outstanding loan amount may

be converted into shares of common stock at a conversion price of $6.98 per share. We may grant additional options, warrants or equity

awards. To the extent such shares are issued, the interest of holders of our common stock will be diluted.

Moreover,

we are obligated to issue shares of common stock upon achievement of certain clinical, regulatory and commercial milestones with respect

to certain of our drug candidates (i.e., NE3107, NE3291, NE3413, and NE3789) pursuant to the asset purchase agreement, dated April 27,

2021, by and among the Company, NeurMedix, Inc. and Acuitas, as amended on May 9, 2021. The achievement of these milestones could result

in the issuance of up to 18 million shares of our common stock, further diluting the interest of holders of our common stock.

Our

common stock may become the target of a “short squeeze.”

Beginning

in 2021, the securities of several companies have increasingly experienced significant and extreme volatility in stock price due to short

sellers of common stock and buy-and-hold decisions of longer investors, resulting in what is sometimes described as a “short squeeze.”

Short squeezes have caused extreme volatility in those companies and in the market and have led to the price per share of those companies

to trade at a significantly inflated rate that is disconnected from the underlying value of the company. Sharp rises in a company’s

stock price may force traders in a short position to buy the shares to avoid even greater losses. Many investors who have purchased shares

in those companies at an inflated rate face the risk of losing a significant portion of their original investment as the price per share

has declined steadily as interest in those shares have abated. We may be a target of a short squeeze, and investors may lose a significant

portion or all of their investment if they purchase our shares at a rate that is significantly disconnected from our underlying value.

The

common stock offered hereby will be sold in “at the market offerings,” and investors who buy shares

at different times will likely pay different prices.

Investors

who purchase shares in this offering at different times will likely pay different prices, and so they may experience different levels

of dilution and different outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing,

prices, and numbers of shares sold in this offering. In addition, there is no minimum or maximum sales price for shares to be sold in

this offering. Investors may experience a decline in the value of the shares they purchase in this offering as a result of sales made

at prices lower than the prices they paid.

USE

OF PROCEEDS

We

may issue and sell shares of our common stock having aggregate gross sales proceeds of up to $25,000,000 from time to time. Because there

is no minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions and

proceeds to us, if any, are not determinable at this time.

We

will retain broad discretion over the use of the net proceeds from the sale of the securities offered hereby. We currently intend to

use the net proceeds from this offering, if any, for general corporate purposes, including, without limitation, research and development

and clinical development costs to support the advancement of our in-development drug candidates, activities in connection with the launch

of our in-development drug candidates, including hiring and building inventory supply, making acquisitions of assets, businesses, companies

or securities, capital expenditures and for working capital.

This

expected use of our net proceeds from this offering represents our intentions based upon our current plans and business conditions, which

could change in the future as our plans and business conditions evolve. The amounts and timing of our actual expenditures may vary significantly

depending on numerous factors, including the factors described under “Risk Factors” in this prospectus supplement and in

the documents incorporated by reference herein, the progress of our product candidates development, the status of and results from clinical

trials, as well as any collaborations that we may enter into with third parties for our product candidates, and any unforeseen cash needs.

As a result, our management will retain broad discretion over the allocation of the net proceeds from this offering, and investors will

be relying on the judgment of our management regarding the application of the net proceeds from this offering.

Pending

the uses described above, we plan to invest the net proceeds from this offering in short- and intermediate-term, interest-bearing obligations,

investment-grade instruments, certificates of deposit or direct or guaranteed obligations of the U.S. government.

DILUTION

If

you purchase our common stock in this offering, your interest will be diluted to the extent of the difference between the public offering

price per share and the net tangible book value per share of our common stock after this offering.

Our

net tangible book value as of September 30, 2023 was approximately $6.6 million, or $0.18 per share of common stock. Net tangible book

value per share is determined by dividing the net of total tangible assets less total liabilities, by the aggregate number of shares

of common stock outstanding as of September 30, 2023.

After

giving effect to the issuance of 2,900,902 shares of our common stock pursuant to the ATM Agreement with Cantor since September 30, 2023

through December 31, 2023, our pro forma net tangible book value as of September 30, 2023 would have been $14.0 million or $0.35 per

share of common stock.

After

giving further effect to the sale of our common stock during the term of the Sales Agreement with the Sales Agent in the aggregate amount

of $25,000,000 at an assumed offering price of $1.24 per share, the last reported sale price of our common stock on the Nasdaq Capital

Market on January 18, 2024, and after deducting commissions and estimated aggregate offering expenses payable by us, our pro forma as

adjusted net tangible book value as of September 30, 2023 would have been approximately $38.1 million, or $0.63 per share of common stock.

This represents an immediate increase in pro forma net tangible book value of $0.28 per share to our existing stockholders and an immediate

dilution in pro forma net tangible book value of $0.61 per share to new investors purchasing common stock in this offering.

The

following table illustrates this per share dilution:

| Assumed

public offering price per share |

|

|

|

$ |

1.24 |

| Historical

net tangible book value per share as of September 30, 2023 |

|

$ |

0.18 |

|

|

| Pro

forma increase in historical net tangible book value per share attributable to the sales pursuant to the Sales Agreement from September

30, 2023 to December 31, 2023 |

|

$ |

0.17 |

|

|

| Pro

forma net tangible book value per share as of September 30, 2023 |

|

$ |

0.35 |

|

|

| Increase

in net tangible book value per share attributable to new investors in this offering |

|

$ |

0.28 |

|

|

| Pro

forma as adjusted net tangible book value per share as of September 30, 2023, after giving effect to this offering |

|

|

|

$ |

0.63 |

| Dilution

per share to new investors purchasing shares in this offering |

|

|

|

$ |

0.61 |

The

table above assumes for illustrative purposes that an aggregate of 20,616,290 shares of our common stock are sold during the term of

the Sales Agreement with the Sales Agent at a price of $1.24 per share, the last reported sale price of our common stock on the Nasdaq

Capital Market on January 18, 2024, for aggregate gross proceeds of approximately $25,000,000.

The

shares to be sold pursuant to the Sales Agreement with the Sales Agent, if any, will be sold from time to time at various prices. An

increase of $0.50 per share in the price at which the shares are sold from the assumed offering price of $1.24 per share shown in the

table above, assuming all of our common stock in the aggregate amount of $25,000,000 during the term of the Sales Agreement with the

Sales Agent is sold at that price, would increase our pro forma as adjusted net tangible book value per share after the offering to $0.70

per share, and would increase the dilution in net tangible book value per share to new investors in this offering to $1.04 per share,

after deducting commissions and estimated aggregate offering expenses payable by us. A decrease of $0.50 per share in the price at which

the shares are sold from the assumed offering price of $1.24 per share shown in the table above, assuming all of our common stock in

the aggregate amount of $25,000,000 during the term of the Sales Agreement with the Sales Agent is sold at that price, would decrease

our pro forma as adjusted net tangible book value per share after the offering to $0.52 per share, and would decrease the dilution in

net tangible book value per share to new investors in this offering to $0.22 per share, after deducting commissions and estimated aggregate

offering expenses payable by us. This information is supplied for illustrative purposes only.

The

above discussion and table are based on 36,899,880 shares of our common stock issued and outstanding as of September 30, 2023 and excludes

the following:

| ● | 3,952,864

shares of common stock issuable upon the exercise of outstanding stock options at a weighted

average exercise price of $7.10 per share; |

| ● | 7,770,285

shares of common stock issuable upon the exercise of outstanding and exercisable warrants

at a weighted average exercise price of $2.06 per share; |

| ● | 557,727

shares of common stock issuable upon vesting of restricted stock units issued under our equity

incentive plan; and |

| ● | 2,900,902

shares of common stock issued pursuant to the Sales Agreement subsequent to September 30,

2023. |

To

the extent that options or warrants outstanding as of January 18, 2024 have been or are exercised, or other shares are issued, investors

purchasing shares in this offering could experience further dilution. In addition, we may choose to raise additional capital due to market

conditions or strategic considerations, even if we believe we have sufficient funds for our current or future operating plans. To the

extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these securities

could result in further dilution to our stockholders.

Plan

of Distribution

On

August 31, 2022, we entered into a Sales Agreement (the “Sales Agreement”) with Cantor Fitzgerald & Co. (the “Sales

Agent”) and B. Riley Securities, Inc. (under which we may issue and sell shares of our common stock (“common shares”)

having an aggregate gross sales price of up to $25,000,000 from time to time through or to the Sales Agent and B. Riley Securities, Inc.

(“BRS”), acting as agent or principal. On April 6, 2023, the Company and BRS mutually agreed to terminate BRS’s role

as a sales agent under the Sales Agreement. The offering amount is in addition to the approximately $61,185,567 sold under the Sales

Agreement pursuant to the Prior Registration Statement.

Upon

delivery of a placement notice and subject to the terms and conditions of the Sales Agreement, the Sales Agent may sell our common shares

by any method permitted by law deemed to be “at the market distributions” as defined in Rule 415 under the Securities Act.

We may instruct the Sales Agent not to sell common shares if the sales cannot be effected at or above the price designated by us from

time to time. We or the Sales Agent may suspend the offering of common shares upon notice and subject to other conditions.

We

will pay the Sales Agent commissions, in cash, for its services in acting as agent in the sale of our common shares. The Sales Agent

will be entitled to compensation at a fixed commission rate of 3.0% of the gross proceeds from each sale of our common shares. Because

there is no minimum offering amount required as a condition to closing this offering, the actual total public offering amount, commissions

and proceeds to us, if any, are not determinable at this time. We have also agreed to reimburse the Sales Agent for certain specified

expenses, including the fees and disbursements of their legal counsel in an amount not to exceed $75,000, and periodic due diligence

fees not to exceed $5,000 per calendar quarter. We estimate that the total expenses for the offering, excluding compensation and reimbursements

payable to the Sales Agent under the terms of the Sales Agreement, will be approximately $200,000.

Settlement

for sales of common shares will occur on the second business day following the date on which any sales are made, or on some other date

that is agreed upon by us and the Sales Agent in connection with a particular transaction, in return for payment of the net proceeds

to us. Sales of our common shares as contemplated in this prospectus supplement will be settled through the facilities of The Depository

Trust Company or by such other means as we and the Sales Agent may agree upon. There is no arrangement for funds to be received in an

escrow, trust or similar arrangement.

The

Sales Agent will use its commercially reasonable efforts, consistent with its sales and trading practices, to solicit offers to purchase

the common shares under the terms and subject to the conditions set forth in the Sales Agreement. In connection with the sale of the

common shares on our behalf, the Sales Agent will be deemed to be an “underwriter” within the meaning of the Securities Act

and the compensation of the Sales Agent will be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification

and contribution to the Sales Agent against certain civil liabilities, including liabilities under the Securities Act.

The

offering of our common shares pursuant to the Sales Agreement will terminate upon the termination of the Sales Agreement as permitted

therein. We and each Sales Agent may each terminate the Sales Agreement at any time upon ten days’ prior notice or by an Agent

at any time in certain circumstances, including the occurrence of a material and adverse change in our business or financial condition

that makes it impractical or inadvisable to market our common shares or to enforce contracts for the sale of our common shares.

In

the event the Sales Agreement is terminated, any portion of the $25,000,000 of securities included in this prospectus supplement that

is not previously sold or included in an active placement notice pursuant to the Sales Agreement will be available for sales in other

offerings pursuant to the accompanying prospectus, and if no common shares are sold under the Sales Agreement, the full $25,000,000 of

securities may be sold in other offerings pursuant to the accompanying prospectus and a corresponding prospectus supplement.

The

Sales Agent and its affiliates have in the past and may in the future provide various investment banking, commercial banking and other

financial services for us and our affiliates, for which services they may in the future receive customary fees.

This

prospectus supplement in electronic format may be made available on a website maintained by the Sales Agent and the Sales Agent may distribute

this prospectus supplement electronically.

LEGAL

MATTERS

The

validity of the shares of common stock offered hereby will be passed upon for us by Sherman & Howard L.L.C. Certain legal matters

will be passed upon for us by Reed Smith LLP, New York, New York. Certain legal matters will be passed on for the Sales Agent by Duane

Morris LLP, New York, New York.

EXPERTS

The

balance sheets of BioVie Inc. as of June 30, 2023 and 2022 and the related statements of operations, changes in stockholders’ equity,

and cash flows for each of the years then ended have been audited by EisnerAmper LLP, an independent registered public accounting firm

as stated in their report, which is incorporated herein by reference which report includes an explanatory paragraph about the existence

of substantial doubt concerning the Company’s ability to continue as a going concern. Such financial statements have been

incorporated herein by reference in reliance on the report of such firm given their authority as expert in accounting and auditing.

| PROSPECTUS |

Filed

Pursuant to Rule 424(b)(3) |

| |

File

No. 333-274083 |

Primary

Offering of

$300,000,000

Class

A Common Stock

Preferred

Stock

Warrants

Debt

Securities

Rights

Units

and

Secondary

Offering of

Up

to 311,002 Shares of Class A Common Stock Offered by the Selling Stockholders

This

prospectus relates to the offer and sale, from time to time, by BioVie Inc. (“we,” “us,” or the “Company”),

in one or more offerings, any combination of Class A common stock (as defined below), preferred stock, warrants, debt securities, rights

to purchase Class A common stock or other securities or units having a maximum aggregate offering price of $300,000,000. When we decide

to sell a particular class or series of securities, we will provide specific terms of the offered securities in a prospectus supplement.

This

prospectus also relates to the offer and resale, from time to time, by the selling stockholders named under the heading “Selling

Stockholders” in this prospectus (the “Selling Stockholders”), and their donees, pledgees, transferees or other successors-in-interest,

of up to 311,002 shares (the “Shares”) of common stock, par value $0.0001 per share (the “Class A common stock”),

of the Company, issuable upon the exercise of the warrants to purchase 311,002 shares of Class A common stock at an exercise price per

share equal to $5.82 (the “Lender Warrants”) held by the Selling Stockholders. We are registering the offer and sale of the

Shares issuable upon exercise of the Lender Warrants held by the Selling Stockholders to satisfy the registration rights they were granted

by the Company pursuant to the Loan and Security Agreement and the Supplement to the Loan and Security Agreement, each entered into on

November 30, 2021 (together, the “Loan Agreement”) with Avenue Venture Opportunities Fund II, L.P. (“AVOPII”)

and Avenue Venture Opportunities Fund, L.P. (“AVOPI” and, together with AVOPII, the “Lenders”).

Discounts,

concessions, commissions and similar selling expenses attributable to the sale of Shares covered by this prospectus will be borne by

the Selling Stockholders. We will pay all expenses (other than discounts, concessions, commissions and similar selling expenses) relating

to the registration of the Shares with the Securities and Exchange Commission (the “SEC”).

The

prospectus supplements may also add, update or change information contained in or incorporated by reference into this prospectus. However,

no prospectus supplement shall offer a security that is not registered and described in this prospectus at the time of its effectiveness.

You should read this prospectus and any prospectus supplement, as well as the documents incorporated by reference or deemed to be incorporated

by reference into this prospectus, carefully before you invest. This prospectus may not be used to offer or sell our securities unless

accompanied by a prospectus supplement relating to the offered securities.

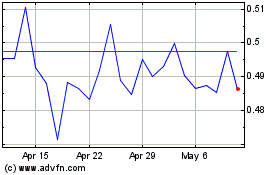

Our

Class A common stock is listed on the Nasdaq Capital Market under the symbol “BIVI.” On August 25, 2023, the closing price

for our Common Stock, as reported on The Nasdaq Capital Market was $3.37 per share. Each prospectus supplement will contain information,

where applicable, as to our listing on the Nasdaq Capital Market or on any other securities exchange of the securities covered by the

prospectus supplement.

These

securities may be sold directly by us, through dealers or agents designated from time to time, to or through underwriters or through

a combination of these methods. Additionally, the Selling Stockholders may sell or otherwise dispose of the Shares covered by this prospectus

in a number of different ways and at varying prices. See “Plan of Distribution” in this prospectus. We may also describe

the plan of distribution for any particular offering of our securities in a prospectus supplement. If any agents, underwriters or dealers

are involved in the sale of any securities in respect of which this prospectus is being delivered, we will disclose their names and the

nature of our arrangements with them in a prospectus supplement. The net proceeds we expect to receive from any such sale will also be

included in a prospectus supplement.

We

will not receive any proceeds from the sales of Shares by the Selling Stockholders. Upon any exercise of the Lender Warrants by payment

of cash, we will receive the cash exercise price paid by the holders of the Lender Warrants. We intend to use those proceeds, if any,

for working capital and general corporate purposes.

An

investment in our securities involves a high degree of risk. Please carefully read the information under the headings “Risk Factors”

beginning on page 5 of this prospectus, the applicable prospectus supplement and “Item 1A – Risk Factors” of our most

recent Annual Report on Form 10-K and in any Quarterly Report on Form 10-Q that is incorporated by reference in this prospectus before

you invest in our securities.

We

may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire

prospectus and any amendments or supplements carefully before you make your investment decision.

Neither

the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful

or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is August 28, 2023

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a Registration Statement that we filed with the SEC using a “shelf” registration process. Under this

shelf registration process, we may offer from time to time securities having a maximum aggregate offering price of $300,000,000. In addition,

the Selling Stockholders may from time to time sell up to an aggregate of 311,002 shares of Class A common stock issuable upon exercise

of the Lender Warrants. Each time we or the Selling Stockholders offer any type or series of securities under this prospectus, we will

prepare and file with the SEC a prospectus supplement that contains more specific information about the terms of that offering. We may

also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. The

prospectus supplement and any related free writing prospectus that we may authorize to be provided to you may also add, update or change

information contained in this prospectus or the documents incorporated herein by reference. You should read carefully both this prospectus,

any prospectus supplement and any related free writing prospectuses we have authorized for use in connection with a specific offering,

together with additional information described below under the caption “Where You Can Find More Information,” before

buying any of the securities being offered.

This

prospectus does not contain all the information provided in the Registration Statement we filed with the SEC. For further information

about us or our securities offered hereby, you should refer to that Registration Statement, which you can obtain from the SEC as described

below under “Where You Can Find More Information.”

Neither

we nor the Selling Stockholders have authorized anyone to provide any information other than that contained or incorporated by reference

in this prospectus or in any applicable prospectus supplement or any applicable free writing prospectus that we have authorized. We take

no responsibility for and can provide no assurance as to the reliability of, any other information that others may give you. The securities

offered hereby are not being offered in any jurisdiction where the offer is not permitted. You should not assume that the information

contained in or incorporated by reference in this prospectus is accurate as of any date other than the respective dates of such document.

Our business, financial condition, results of operations and prospects may have changed since those dates.

We

and the Selling Stockholders may sell securities through underwriters or dealers, through agents, directly to purchasers or through any

combination of these methods. We and our agents reserve the sole right to accept or reject in whole or in part any proposed purchase

of securities. The prospectus supplement, which we will prepare and file with the SEC each time we offer securities, will set forth the

names of any underwriters, agents or others involved in the sale of securities, and any applicable fee, commission or discount arrangements

with them. See “Plan of Distribution.”

Unless

the context otherwise indicates, references in this prospectus to, “BioVie,” “the Company,” “we,”

“our,” or “us” mean BioVie, Inc., a Nevada corporation. The term “Selling Stockholders” refers, collectively,

to the selling stockholders named under the heading “Selling Stockholders” in this prospectus and their donees, pledgees,

transferees or other successors-in-interest.

PROSPECTUS

SUMMARY

This

prospectus summary highlights certain information about our company and other information contained elsewhere in this prospectus or in

documents incorporated by reference. This summary does not contain all of the information that you should consider before making an investment

decision. You should carefully read the entire prospectus, any prospectus supplement, including the matters set forth under the section

of this prospectus entitled “Risk Factors” and the financial statements and related notes and other information that we incorporate

by reference herein, including our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q, before making an investment

decision.

Our

Company

We

are a clinical-stage company developing innovative drug therapies for the treatment of neurological and neurodegenerative disorders and

advanced liver disease.

Neurodegenerative

Disease Program

In

neurodegenerative disease, the Company’s drug candidate NE3107 inhibits inflammatory activation of extracellular single-regulated

kinase (“ERK”) and Nuclear factor kappa-light-chain-enhancer of activated B cells (“NFkB”) (e.g., tumor necrosis

factor (“TNF”) signaling) that leads to neuroinflammation and insulin resistance, but not their homeostatic functions (e.g.,

insulin signaling and neuron growth and survival). Both inflammation and insulin resistance are drivers of Alzheimer’s disease

(“AD”) and Parkinson’s disease (“PD”).

The

Company is conducting a potentially pivotal Phase 3 randomized, double blind, placebo controlled, parallel group, multicenter study to

evaluate NE3107 in patients who have mild to moderate AD (NCT04669028). The study has co-primary endpoints looking at cognition using

the Alzheimer’s Disease Assessment Scale-Cognitive Scale (ADAS-Cog 12) and function using the Alzheimer’s Disease Cooperative

Study-Clinical Global Impression of Change (ADCS-CGIC). The program is fully enrolled and is targeting primary completion in the fourth

quarter of the calendar 2023 year.

In

December 2022, topline results were released from the Company’s Phase 2 study assessing NE3107’s safety and tolerability

and potential pro-motoric impact in PD patients. The NM201 study (NCT05083260) was a double-blind, placebo-controlled, safety, tolerability,

and pharmacokinetics study in PD participants treated with carbidopa/levodopa and NE3107. Forty-five patients with a defined L-dopa “off

state” were randomized 1:1 to placebo:NE3107 20 mg twice daily for 28 days. The trial was launched with two design objectives:

1) the primary objective was safety and a drug-drug interaction study (as requested by the U.S. Food and Drug Administration (“FDA”))

to demonstrate the absence of adverse interactions of NE3107 with levodopa; and 2) the secondary objective was to determine if preclinical

indications of promotoric activity and apparent enhancement of levodopa activity observed in a Parkinson’s disease model in monkeys

can be seen in humans. Both objectives of the study were met. Patients treated with NE3107 experienced greater motor control.

The

Company provided the financial support and the use of our NE3107 formulated drug product for an open-label phase 2, Investigator-Initiated

Trial in mild cognitive impairment (“MCI”) and Mild AD, NCT05227820, conducted by (“The Regenesis Project”) of

Sheldon Jordan. The study received FDA authorization on December 12, 2021, and was designed to measure NE3107’s effect on cognition,

cerebral spinal fluid (“CSF”) and blood biomarkers, and neuro-imagining endpoints. Topline results were released September

7, 2022, and additional data was presented at the Clinical Trial in Alzheimer’s Disease (“CTAD”) annual conference

in December 2022. The data showed that three months of treatment with NE3107 in patients with MCI and mild AD enhanced cognition compared

to baseline, as measured using multiple rating scales, had improvement in daily function and improvements in inflammation correlated

with improved cognition. No drug-related adverse events were observed.

The

Company acquired the biopharmaceutical assets of NeurMedix, Inc. (“NeurMedix”), from a related party privately held clinical-stage

pharmaceutical company, in June 2021. The acquired assets included NE3107, a potentially selective inhibitor of inflammatory ERK signaling

that, based on animal studies and Dr. Jordan’s study, is believed to reduce neuroinflammation. NE3107 is a novel orally administered

small molecule that is thought to inhibit inflammation-driven insulin resistance and major pathological inflammatory cascades with a

novel mechanism of action. There is emerging scientific consensus that both inflammation and insulin resistance may play fundamental

roles in the development of AD and PD, and NE3107 could, if approved by the FDA represent a new medical approach to treating these devastating

conditions affecting an estimated 6 million Americans suffering from AD and 1 million Americans suffering from PD.

Inflammation-driven

insulin resistance is believed to be implicated in a broad range of serious diseases, and we plan to begin exploring these opportunities

in the coming months using NE3107 or related compounds acquired in the NeurMedix asset purchase. NE3107 is patented in the United States

(“U.S.”), Australia, Canada, Europe and South Korea.

Liver

Disease Program

In

liver disease, our Orphan Drug candidate BIV201 (continuous infusion terlipressin), with FDA Fast Track status, has been evaluated in

a U.S. Phase 2b study (NCT04112199) for the treatment of refractory ascites due to liver cirrhosis. BIV201 is administered as a patent-pending

liquid formulation. The study was closed before full enrollment, without clinically meaningful adverse effects associated with BIV201

treatment and data that appeared to show that treatment with BIV201 plus standard-of-care (“SOC”) resulted in a reduction

in ascites fluid accumulation during treatment versus pre-treatment. In June 2023, we requested guidance from the FDA regarding the design

and endpoints for definitive clinical testing of BIV201 for the treatment of ascites due to chronic liver cirrhosis.

While

the active agent, terlipressin, is approved in the U.S. and in about 40 countries for related complications of advanced liver cirrhosis,

treatment of ascites is not included in these authorizations. Patients with refractory ascites suffer from frequent life-threatening

complications, generate more than $5 billion in annual treatment costs, and have an estimated 50% mortality rate within 6 to 12 months.

The U.S. FDA has not approved any drug to treat refractory ascites.

The

BIV201 development program was initiated by LAT Pharma LLC. On April 11, 2016, the Company acquired LAT Pharma LLC and the rights to

its BIV201 development program. The Company currently owns all development and marketing rights to this drug candidate. Pursuant to the

Agreement and Plan of Merger entered into on April 11, 2016, between our predecessor entities, LAT Pharma LLC and NanoAntibiotics, Inc.,

BioVie is obligated to pay a low single digit royalty on net sales of BIV201 (continuous infusion terlipressin) to be shared among LAT

Pharma Members, PharmaIn Corporation, and The Barrett Edge, Inc.

The

Securities We May Offer

This

prospectus is part of a Registration Statement that we filed with the SEC utilizing a shelf registration process. Under this shelf registration

process, we may sell any combination of:

| |

● |

debt

securities, in one or more series; |

| |

● |

right

to purchase common stock or other securities; and/or |

in

one or more offerings up to a total dollar amount of $300,000,000. This prospectus provides you with a general description of the securities

we may offer. Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the

terms of that specific offering and include a discussion of any risk factors or other special considerations that apply to those securities.

The prospectus supplement may also add, update or change information contained in this prospectus. You should read both this prospectus

and any prospectus supplement together with the additional information described under the heading “Where You Can Find More Information.”

Securities

Offered by the Selling Securityholders

This

prospectus also relates to the resale from time to time by the Selling Stockholders identified in this prospectus of up to 311,002 shares

of Class A common stock issuable upon the exercise of the Lender Warrants held by the Selling Stockholders. We are registering the offer

and sale of the Shares to satisfy the registration rights they were granted by the Company pursuant to the Loan Agreement.

On

November 30, 2021 (the “Loan Closing Date”), the Company entered into the Loan Agreement with the Lenders for growth capital

loans in an aggregate principal amount of up to $20,000,000 (the “Loan”), with (i) $15,000,000 funded on the Loan Closing

Date (“Tranche 1”) and (ii) up to $5,000,000 to be made available to the Company on or prior to September 15, 2022, subject

to the Company’s achievement of certain milestones with respect to certain of its ongoing clinical trials. The Loan bears interest