FALSE000176650200017665022024-01-182024-01-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): January 18, 2024

CHEWY, INC.

(Exact Name of Registrant as Specified in Its Charter) | | | | | | | | |

| Delaware | 001-38936 | 90-1020167 |

(State or Other Jurisdiction

of Incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

| | | | | | | | |

7700 West Sunrise Boulevard, Plantation, Florida | | 33322 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(786) 320-7111

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange

on which registered |

| Class A Common Stock, par value $0.01 per share | | CHWY | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

As previously announced on October 30, 2023, Chewy, Inc. (“Chewy” or the “Company”) entered into certain transactions (the “Transactions”) with affiliates of BC Partners Advisors LP pursuant to an Agreement and Plan of Merger. The Transactions resulted in, among other things, Chewy Pharmacy KY, LLC (“Chewy Pharmacy KY”) becoming an indirect wholly-owned subsidiary of the Company.

The Company is filing this Current Report on Form 8-K (this “Form 8-K”), including Exhibit 99.1, which is incorporated herein by reference, solely to recast certain financial information to reflect the operations of Chewy Pharmacy KY as part of its consolidated financial statements included in the Company’s Annual Report on Form 10-K for the fiscal year ended January 30, 2022 originally filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 29, 2022 (the “2021 Form 10-K”), the Company’s Annual Report on Form 10-K for the fiscal year ended January 29, 2023 originally filed with the SEC on March 22, 2023 (the “2022 Form 10-K”) and the Company’s Quarterly Reports on Form 10-Q for the quarterly periods ended April 30, 2023, July 30, 2023 and October 29, 2023 originally filed with the SEC on May 31, 2023, August 30, 2023 and December 6, 2023, respectively (collectively, the “2023 Form 10-Qs” and together with the 2021 Form 10-K and 2022 Form 10-K, the “Previous Reports”). The Company has also included in Exhibit 99.1 certain recasted non-GAAP financial measures which reflect the operations of Chewy Pharmacy KY. See “Non-GAAP Financial Measures” in Exhibit 99.1 to this Form 8-K for additional information.

The recasted financial information contained in Exhibit 99.1 to this Form 8-K does not represent a restatement of previously issued financial statements. This Form 8-K does not reflect other events occurring after the filing dates of the Previous Reports, except as otherwise reflected in Exhibit 99.1. This Form 8-K should be read in conjunction with the Previous Reports and the other SEC filings made by the Company.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. | | | | | | | | |

| Exhibit No. | | Description |

| | Recasted historical unaudited condensed consolidated financial information of the Company reflecting Chewy Pharmacy KY’s operations. |

| 104 | | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | | | | |

| | | CHEWY, INC. |

| | | |

| Date: | January 18, 2024 | By: | /s/ Stacy Bowman |

| | | Stacy Bowman |

| | | Interim Chief Financial Officer and Chief Accounting Officer |

| | | |

CHEWY, INC.

SUPPLEMENTAL FINANCIAL INFORMATION

(Unaudited)

Overview

On October 30, 2023, Chewy, Inc. (“Chewy” or the “Company”) entered into certain transactions (the “Transactions”) with affiliates of BC Partners Advisors LP pursuant to an Agreement and Plan of Merger. The Transactions resulted in such affiliates restructuring their ownership interests in the Company and Chewy Pharmacy KY, LLC (“Chewy Pharmacy KY”) becoming an indirect wholly-owned subsidiary of the Company.

In this Exhibit 99.1, the Company has provided certain recast historical unaudited financial information prepared in accordance with GAAP reflecting the operations of Chewy Pharmacy KY as part of its consolidated financial statements, as well as certain non-GAAP financial measures reflecting the operations of Chewy Pharmacy KY. See “Non-GAAP Financial Measures” in Exhibit 99.1 to this Form 8-K for additional information.

CHEWY, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEET

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | |

| As of | | |

| October 29,

2023 | | October 29,

2023 | | $ Change |

| Assets | (As Filed) | | (Restated) | | |

| Current assets: | | | | | |

| Cash and cash equivalents | $ | 469,409 | | | $ | 469,909 | | | $ | 500 | |

| Marketable securities | 487,772 | | | 487,772 | | | — | |

| Accounts receivable | 160,980 | | | 161,405 | | | 425 | |

| Inventories | 712,053 | | | 714,851 | | | 2,798 | |

| Prepaid expenses and other current assets | 52,713 | | | 52,850 | | | 137 | |

| Total current assets | 1,882,927 | | | 1,886,787 | | | 3,860 | |

| Property and equipment, net | 514,701 | | | 514,795 | | | 94 | |

| Operating lease right-of-use assets | 473,529 | | | 473,595 | | | 66 | |

| Goodwill | 39,442 | | | 39,442 | | | — | |

| Other non-current assets | 25,883 | | | 25,924 | | | 41 | |

| Total assets | $ | 2,936,482 | | | $ | 2,940,543 | | | $ | 4,061 | |

| Liabilities and stockholders’ equity | | | | | |

| Current liabilities: | | | | | |

| Trade accounts payable | $ | 1,078,429 | | | $ | 1,081,939 | | | $ | 3,510 | |

| Accrued expenses and other current liabilities | 886,259 | | | 883,361 | | | (2,898) | |

| Total current liabilities | 1,964,688 | | | 1,965,300 | | | 612 | |

| Operating lease liabilities | 526,994 | | | 527,019 | | | 25 | |

| Other long-term liabilities | 51,633 | | | 51,634 | | | 1 | |

| Total liabilities | 2,543,315 | | | 2,543,953 | | | 638 | |

| Stockholders’ equity: | | | | | |

Preferred stock, $0.01 par value per share, 5,000,000 shares authorized, no shares issued and outstanding as of October 29, 2023 | — | | | — | | | — | |

Class A common stock, $0.01 par value per share, 1,500,000,000 shares authorized, 119,950,022 shares issued and outstanding as of October 29, 2023 | 1,199 | | | 1,199 | | | — | |

Class B common stock, $0.01 par value per share, 395,000,000 shares authorized, 311,188,356 shares issued and outstanding as of October 29, 2023 | 3,112 | | | 3,112 | | | — | |

| Additional paid-in capital | 2,345,082 | | | 2,399,817 | | | 54,735 | |

| Accumulated deficit | (1,956,226) | | | (2,007,538) | | | (51,312) | |

| | | | | |

| Total stockholders’ equity | 393,167 | | | 396,590 | | | 3,423 | |

| Total liabilities and stockholders’ equity | $ | 2,936,482 | | | $ | 2,940,543 | | | $ | 4,061 | |

CHEWY, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEET

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | |

| As of | | |

| July 30,

2023 | | July 30,

2023 | | $ Change |

| Assets | (As Filed) | | (Restated) | | |

| Current assets: | | | | | |

| Cash and cash equivalents | $ | 457,103 | | | $ | 458,435 | | | $ | 1,332 | |

| Marketable securities | 448,323 | | | 448,323 | | | — | |

| Accounts receivable | 162,681 | | | 164,456 | | | 1,775 | |

| Inventories | 738,204 | | | 742,974 | | | 4,770 | |

| Prepaid expenses and other current assets | 48,080 | | | 48,217 | | | 137 | |

| Total current assets | 1,854,391 | | | 1,862,405 | | | 8,014 | |

| Property and equipment, net | 511,755 | | | 511,866 | | | 111 | |

| Operating lease right-of-use assets | 434,805 | | | 434,881 | | | 76 | |

| Goodwill | 39,442 | | | 39,442 | | | — | |

| Other non-current assets | 63,621 | | | 63,662 | | | 41 | |

| Total assets | $ | 2,904,014 | | | $ | 2,912,256 | | | $ | 8,242 | |

| Liabilities and stockholders’ equity | | | | | |

| Current liabilities: | | | | | |

| Trade accounts payable | $ | 1,119,316 | | | $ | 1,123,629 | | | $ | 4,313 | |

| Accrued expenses and other current liabilities | 880,072 | | | 880,979 | | | 907 | |

| Total current liabilities | 1,999,388 | | | 2,004,608 | | | 5,220 | |

| Operating lease liabilities | 488,767 | | | 488,802 | | | 35 | |

| Other long-term liabilities | 51,230 | | | 51,233 | | | 3 | |

| Total liabilities | 2,539,385 | | | 2,544,643 | | | 5,258 | |

| Stockholders’ equity: | | | | | |

Preferred stock, $0.01 par value per share, 5,000,000 shares authorized, no shares issued and outstanding as of July 30, 2023 | — | | | — | | | — | |

Class A common stock, $0.01 par value per share, 1,500,000,000 shares authorized, 118,530,123 shares issued and outstanding as of July 30, 2023 | 1,185 | | | 1,185 | | | — | |

Class B common stock, $0.01 par value per share, 395,000,000 shares authorized, 311,188,356 shares issued and outstanding as of July 30, 2023 | 3,112 | | | 3,112 | | | — | |

| Additional paid-in capital | 2,280,748 | | | 2,335,482 | | | 54,734 | |

| Accumulated deficit | (1,920,416) | | | (1,972,166) | | | (51,750) | |

| | | | | |

| Total stockholders’ equity | 364,629 | | | 367,613 | | | 2,984 | |

| Total liabilities and stockholders’ equity | $ | 2,904,014 | | | $ | 2,912,256 | | | $ | 8,242 | |

| | | | | |

CHEWY, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEET

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | |

| As of | | |

| April 30,

2023 | | April 30,

2023 | | $ Change |

| Assets | (As Filed) | | (Restated) | | |

| Current assets: | | | | | |

| Cash and cash equivalents | $ | 408,685 | | | $ | 410,204 | | | $ | 1,519 | |

| Marketable securities | 394,487 | | | 394,487 | | | — | |

| Accounts receivable | 151,719 | | | 152,776 | | | 1,057 | |

| Inventories | 731,376 | | | 732,265 | | | 889 | |

| Prepaid expenses and other current assets | 47,345 | | | 47,477 | | | 132 | |

| Total current assets | 1,733,612 | | | 1,737,209 | | | 3,597 | |

| Property and equipment, net | 474,764 | | | 474,890 | | | 126 | |

| Operating lease right-of-use assets | 447,581 | | | 447,666 | | | 85 | |

| Goodwill | 39,442 | | | 39,442 | | | — | |

| Other non-current assets | 42,945 | | | 42,986 | | | 41 | |

| Total assets | $ | 2,738,344 | | | $ | 2,742,193 | | | $ | 3,849 | |

| Liabilities and stockholders’ equity | | | | | |

| Current liabilities: | | | | | |

| Trade accounts payable | $ | 1,113,849 | | | $ | 1,115,269 | | | $ | 1,420 | |

| Accrued expenses and other current liabilities | 779,625 | | | 835,015 | | | 55,390 | |

| Total current liabilities | 1,893,474 | | | 1,950,284 | | | 56,810 | |

| Operating lease liabilities | 500,578 | | | 500,624 | | | 46 | |

| Other long-term liabilities | 61,927 | | | 61,931 | | | 4 | |

| Total liabilities | 2,455,979 | | | 2,512,839 | | | 56,860 | |

| Stockholders’ equity: | | | | | |

Preferred stock, $0.01 par value per share, 5,000,000 shares authorized, no shares issued and outstanding as of April 30, 2023 | — | | | — | | | — | |

Class A common stock, $0.01 par value per share, 1,500,000,000 shares authorized, 115,919,876 shares issued and outstanding as of April 30, 2023 | 1,159 | | | 1,159 | | | — | |

Class B common stock, $0.01 par value per share, 395,000,000 shares authorized, 311,188,356 shares issued and outstanding as of April 30, 2023 | 3,112 | | | 3,112 | | | — | |

| Additional paid-in capital | 2,217,456 | | | 2,217,456 | | | — | |

| Accumulated deficit | (1,939,362) | | | (1,992,373) | | | (53,011) | |

| | | | | |

| Total stockholders’ equity | 282,365 | | | 229,354 | | | (53,011) | |

| Total liabilities and stockholders’ equity | $ | 2,738,344 | | | $ | 2,742,193 | | | $ | 3,849 | |

| | | | | |

CHEWY, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEET

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | |

| As of | | |

| January 29,

2023 | | January 29,

2023 | | $ Change |

| Assets | (As Filed) | | (Restated) | | |

| Current assets: | | | | | |

| Cash and cash equivalents | $ | 330,441 | | | $ | 331,641 | | | $ | 1,200 | |

| Marketable securities | 346,944 | | | 346,944 | | | — | |

| Accounts receivable | 126,349 | | | 126,969 | | | 620 | |

| Inventories | 675,520 | | | 678,005 | | | 2,485 | |

| Prepaid expenses and other current assets | 41,067 | | | 41,221 | | | 154 | |

| Total current assets | 1,520,321 | | | 1,524,780 | | | 4,459 | |

| Property and equipment, net | 478,738 | | | 478,885 | | | 147 | |

| Operating lease right-of-use assets | 423,423 | | | 423,518 | | | 95 | |

| Goodwill | 39,442 | | | 39,442 | | | — | |

| Other non-current assets | 53,152 | | | 53,193 | | | 41 | |

| Total assets | $ | 2,515,076 | | | $ | 2,519,818 | | | $ | 4,742 | |

| Liabilities and stockholders’ equity | | | | | |

| Current liabilities: | | | | | |

| Trade accounts payable | $ | 1,030,882 | | | $ | 1,033,184 | | | $ | 2,302 | |

| Accrued expenses and other current liabilities | 738,467 | | | 794,534 | | | 56,067 | |

| Total current liabilities | 1,769,349 | | | 1,827,718 | | | 58,369 | |

| Operating lease liabilities | 471,765 | | | 471,821 | | | 56 | |

| Other long-term liabilities | 60,005 | | | 60,011 | | | 6 | |

| Total liabilities | 2,301,119 | | | 2,359,550 | | | 58,431 | |

| Stockholders’ equity: | | | | | |

Preferred stock, $0.01 par value per share, 5,000,000 shares authorized, no shares issued and outstanding as of January 29, 2023 | — | | | — | | | — | |

Class A common stock, $0.01 par value per share, 1,500,000,000 shares authorized, 114,160,531 shares issued and outstanding as of January 29, 2023 | 1,141 | | | 1,141 | | | — | |

Class B common stock, $0.01 par value per share, 395,000,000 shares authorized, 311,188,356 shares issued and outstanding as of January 29, 2023 | 3,112 | | | 3,112 | | | — | |

| Additional paid-in capital | 2,171,247 | | | 2,171,247 | | | — | |

| Accumulated deficit | (1,961,543) | | | (2,015,232) | | | (53,689) | |

| | | | | |

| Total stockholders’ equity | 213,957 | | | 160,268 | | | (53,689) | |

| Total liabilities and stockholders’ equity | $ | 2,515,076 | | | $ | 2,519,818 | | | $ | 4,742 | |

| | | | | |

CHEWY, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEET

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | |

| As of | | |

| January 30,

2022 | | January 30,

2022 | | $ Change |

| Assets | (As Filed) | | (Restated) | | |

| Current assets: | | | | | |

| Cash and cash equivalents | $ | 603,079 | | | $ | 604,102 | | | $ | 1,023 | |

| Accounts receivable | 123,510 | | | 124,291 | | | 781 | |

| Inventories | 560,430 | | | 562,744 | | | 2,314 | |

| Prepaid expenses and other current assets | 36,513 | | | 34,028 | | | (2,485) | |

| Total current assets | 1,323,532 | | | 1,325,165 | | | 1,633 | |

| Property and equipment, net | 367,166 | | | 367,421 | | | 255 | |

| Operating lease right-of-use assets | 372,693 | | | 372,707 | | | 14 | |

| | | | | |

| Other non-current assets | 22,890 | | | 22,930 | | | 40 | |

| Total assets | $ | 2,086,281 | | | $ | 2,088,223 | | | $ | 1,942 | |

| Liabilities and stockholders’ equity | | | | | |

| Current liabilities: | | | | | |

| Trade accounts payable | $ | 883,316 | | | $ | 885,719 | | | $ | 2,403 | |

| Accrued expenses and other current liabilities | 761,563 | | | 815,444 | | | 53,881 | |

| Total current liabilities | 1,644,879 | | | 1,701,163 | | | 56,284 | |

| Operating lease liabilities | 410,168 | | | 410,168 | | | — | |

| Other long-term liabilities | 16,498 | | | 16,512 | | | 14 | |

| Total liabilities | 2,071,545 | | | 2,127,843 | | | 56,298 | |

| Stockholders’ equity: | | | | | |

Preferred stock, $0.01 par value per share, 5,000,000 shares authorized, no shares issued and outstanding as of January 30, 2022 | — | | | — | | | — | |

Class A common stock, $0.01 par value per share, 1,500,000,000 shares authorized, 108,918,032 shares issued and outstanding as of January 30, 2022 | 1,089 | | | 1,089 | | | — | |

Class B common stock, $0.01 par value per share, 395,000,000 shares authorized, 311,188,356 shares issued and outstanding as of January 30, 2022 | 3,112 | | | 3,112 | | | — | |

| Additional paid-in capital | 2,021,310 | | | 2,021,310 | | | — | |

| Accumulated deficit | (2,010,775) | | | (2,065,131) | | | (54,356) | |

| | | | | |

| Total stockholders’ equity | 14,736 | | | (39,620) | | | (54,356) | |

| Total liabilities and stockholders’ equity | $ | 2,086,281 | | | $ | 2,088,223 | | | $ | 1,942 | |

| | | | | |

CHEWY, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | |

| 13 Weeks Ended | | |

| October 29,

2023 | | October 29,

2023 | | $ Change |

| (As Filed) | | (Restated) | | |

| Net sales | $ | 2,738,611 | | | $ | 2,745,875 | | | $ | 7,264 | |

| Cost of goods sold | 1,957,850 | | | 1,964,019 | | | 6,169 | |

| Gross profit | 780,761 | | | 781,856 | | | 1,095 | |

| Operating expenses: | | | | | |

| Selling, general and administrative | 611,718 | | | 612,375 | | | 657 | |

| Advertising and marketing | 179,200 | | | 179,200 | | | — | |

| Total operating expenses | 790,918 | | | 791,575 | | | 657 | |

| Loss from operations | (10,157) | | | (9,719) | | | 438 | |

| Interest income, net | 10,173 | | | 10,173 | | | — | |

| Other expense, net | (34,122) | | | (34,122) | | | — | |

| Loss before income tax provision | (34,106) | | | (33,668) | | | 438 | |

| Income tax provision | 1,704 | | | 1,704 | | | — | |

| Net loss | $ | (35,810) | | | $ | (35,372) | | | $ | 438 | |

| | | | | |

| Loss per share attributable to common Class A and Class B stockholders: | | | | | |

| Basic | $ | (0.08) | | | $ | (0.08) | | | $ | — | |

| Diluted | $ | (0.08) | | | $ | (0.08) | | | $ | — | |

| Weighted-average common shares used in computing loss per share: | | | | | |

| Basic | 430,758 | | | 430,758 | | | — | |

| Diluted | 430,758 | | | 430,758 | | | — | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

CHEWY, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | |

| 13 Weeks Ended | | |

| July 30,

2023 | | July 30,

2023 | | $ Change |

| (As Filed) | | (Restated) | | |

| Net sales | $ | 2,777,769 | | | $ | 2,785,302 | | | $ | 7,533 | |

| Cost of goods sold | 1,990,996 | | | 1,996,581 | | | 5,585 | |

| Gross profit | 786,773 | | | 788,721 | | | 1,948 | |

| Operating expenses: | | | | | |

| Selling, general and administrative | 619,202 | | | 619,889 | | | 687 | |

| Advertising and marketing | 185,491 | | | 185,491 | | | — | |

| Total operating expenses | 804,693 | | | 805,380 | | | 687 | |

| Loss from operations | (17,920) | | | (16,659) | | | 1,261 | |

| Interest income, net | 8,928 | | | 8,928 | | | — | |

| Other income, net | 29,242 | | | 29,242 | | | — | |

| Income before income tax provision | 20,250 | | | 21,511 | | | 1,261 | |

| Income tax provision | 1,304 | | | 1,304 | | | — | |

| Net income | $ | 18,946 | | | $ | 20,207 | | | $ | 1,261 | |

| | | | | |

| Earnings per share attributable to common Class A and Class B stockholders: | | | | | |

| Basic | $ | 0.04 | | | $ | 0.05 | | | $ | 0.01 | |

| Diluted | $ | 0.04 | | | $ | 0.05 | | | $ | 0.01 | |

| Weighted-average common shares used in computing earnings per share: | | | | | |

| Basic | 428,618 | | | 428,618 | | | — | |

| Diluted | 431,576 | | | 431,576 | | | — | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

CHEWY, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | |

| 13 Weeks Ended | | |

| April 30,

2023 | | April 30,

2023 | | $ Change |

| (As Filed) | | (Restated) | | |

| Net sales | $ | 2,784,675 | | | $ | 2,790,639 | | | $ | 5,964 | |

| Cost of goods sold | 1,993,220 | | | 1,997,783 | | | 4,563 | |

| Gross profit | 791,455 | | | 792,856 | | | 1,401 | |

| Operating expenses: | | | | | |

| Selling, general and administrative | 583,666 | | | 584,389 | | | 723 | |

| Advertising and marketing | 183,733 | | | 183,733 | | | — | |

| Total operating expenses | 767,399 | | | 768,122 | | | 723 | |

| Income from operations | 24,056 | | | 24,734 | | | 678 | |

| Interest income, net | 8,016 | | | 8,016 | | | — | |

| Other expense, net | (8,888) | | | (8,888) | | | — | |

| Income before income tax provision | 23,184 | | | 23,862 | | | 678 | |

| Income tax provision | 1,003 | | | 1,003 | | | — | |

| Net income | $ | 22,181 | | | $ | 22,859 | | | $ | 678 | |

| | | | | |

| Earnings per share attributable to common Class A and Class B stockholders: | | | | | |

| Basic | $ | 0.05 | | | $ | 0.05 | | | $ | — | |

| Diluted | $ | 0.05 | | | $ | 0.05 | | | $ | — | |

| Weighted-average common shares used in computing earnings per share: | | | | | |

| Basic | 426,852 | | | 426,852 | | | — | |

| Diluted | 430,471 | | | 430,471 | | | — | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

CHEWY, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | |

| 52 Weeks Ended | | |

| January 29,

2023 | | January 29,

2023 | | $ Change |

| (As Filed) | | (Restated) | | |

| Net sales | $ | 10,098,939 | | | $ | 10,119,000 | | | $ | 20,061 | |

| Cost of goods sold | 7,268,034 | | | 7,284,505 | | | 16,471 | |

| Gross profit | 2,830,905 | | | 2,834,495 | | | 3,590 | |

| Operating expenses: | | | | | |

| Selling, general and administrative | 2,125,766 | | | 2,128,688 | | | 2,922 | |

| Advertising and marketing | 649,386 | | | 649,386 | | | — | |

| Total operating expenses | 2,775,152 | | | 2,778,074 | | | 2,922 | |

| Income from operations | 55,753 | | | 56,421 | | | 668 | |

| Interest income, net | 9,291 | | | 9,290 | | | (1) | |

| Other expense, net | (13,166) | | | (13,166) | | | — | |

| Income before income tax provision | 51,878 | | | 52,545 | | | 667 | |

| Income tax provision | 2,646 | | | 2,646 | | | — | |

| Net income | $ | 49,232 | | | $ | 49,899 | | | $ | 667 | |

| | | | | |

| Earnings per share attributable to common Class A and Class B stockholders: | | | | | |

| Basic | $ | 0.12 | | | $ | 0.12 | | | $ | — | |

| Diluted | $ | 0.12 | | | $ | 0.12 | | | $ | — | |

| Weighted-average common shares used in computing earnings per share: | | | | | |

| Basic | 422,331 | | | 422,331 | | | — | |

| Diluted | 427,770 | | | 427,770 | | | — | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

CHEWY, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | |

| 52 Weeks Ended | | |

| January 30,

2022 | | January 30,

2022 | | $ Change |

| (As Filed) | | (Restated) | | |

| Net sales | $ | 8,890,773 | | | $ | 8,967,407 | | | $ | 76,634 | |

| Cost of goods sold | 6,517,191 | | | 6,581,936 | | | 64,745 | |

| Gross profit | 2,373,582 | | | 2,385,471 | | | 11,889 | |

| Operating expenses: | | | | | |

| Selling, general and administrative | 1,826,858 | | | 1,840,135 | | | 13,277 | |

| Advertising and marketing | 618,902 | | | 618,902 | | | — | |

| Total operating expenses | 2,445,760 | | | 2,459,037 | | | 13,277 | |

| Loss from operations | (72,178) | | | (73,566) | | | (1,388) | |

| Interest expense, net | (1,639) | | | (1,641) | | | (2) | |

| | | | | |

| Loss before income tax provision | (73,817) | | | (75,207) | | | (1,390) | |

| Income tax provision | — | | | — | | | — | |

| Net loss | $ | (73,817) | | | $ | (75,207) | | | $ | (1,390) | |

| | | | | |

| Loss per share attributable to common Class A and Class B stockholders: | | | | | |

| Basic | $ | (0.18) | | | $ | (0.18) | | | $ | — | |

| Diluted | $ | (0.18) | | | $ | (0.18) | | | $ | — | |

| Weighted-average common shares used in computing loss per share: | | | | | |

| Basic | 417,218 | | | 417,218 | | | — | |

| Diluted | 417,218 | | | 417,218 | | | — | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

CHEWY, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(in thousands)

| | | | | | | | | | | | | | | | | |

| 39 Weeks Ended | | |

| October 29,

2023 | | October 29,

2023 | | $ Change |

| (As Filed) | | (Restated) | | |

| Cash flows from operating activities | | | | | |

| Net income | $ | 5,317 | | | $ | 7,694 | | | $ | 2,377 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | |

| Depreciation and amortization | 82,195 | | | 82,252 | | | 57 | |

| Share-based compensation expense | 178,897 | | | 178,897 | | | — | |

| Non-cash lease expense | 29,371 | | | 29,399 | | | 28 | |

| Change in fair value of equity warrants and investments | 13,589 | | | 13,589 | | | — | |

| Other | 3,810 | | | 3,810 | | | — | |

| Net change in operating assets and liabilities: | | | | | |

| Accounts receivable | (34,631) | | | (34,436) | | | 195 | |

| Inventories | (36,533) | | | (36,846) | | | (313) | |

| Prepaid expenses and other current assets | (27,363) | | | (27,346) | | | 17 | |

| Other non-current assets | (1,337) | | | (1,337) | | | — | |

| Trade accounts payable | 47,547 | | | 48,755 | | | 1,208 | |

| Accrued expenses and other current liabilities | 144,599 | | | 140,374 | | | (4,225) | |

| Operating lease liabilities | (19,774) | | | (19,805) | | | (31) | |

| Other long-term liabilities | 1,669 | | | 1,664 | | | (5) | |

| Net cash provided by operating activities | 387,356 | | | 386,664 | | | (692) | |

| Cash flows from investing activities | | | | | |

| Capital expenditures | (110,898) | | | (110,902) | | | (4) | |

| | | | | |

| Cash paid for acquisition of business, net of cash acquired | (367) | | | (367) | | | — | |

| Purchases of marketable securities | (876,189) | | | (876,189) | | | — | |

| Proceeds from maturities of marketable securities | 750,000 | | | 750,000 | | | — | |

| | | | | |

| Net cash used in investing activities | (237,454) | | | (237,458) | | | (4) | |

| Cash flows from financing activities | | | | | |

| | | | | |

| | | | | |

| Payments for tax sharing agreement with related parties | (10,279) | | | (10,279) | | | — | |

| Principal repayments of finance lease obligations | (475) | | | (479) | | | (4) | |

| Payment of debt modification costs | (175) | | | (175) | | | — | |

| | | | | |

| Payments for tax withholdings related to vesting of share-based compensation awards | (5) | | | (5) | | | — | |

| Net cash used in financing activities | (10,934) | | | (10,938) | | | (4) | |

| | | | | |

| Net increase in cash and cash equivalents | 138,968 | | | 138,268 | | | (700) | |

| Cash and cash equivalents, as of beginning of period | 330,441 | | | 331,641 | | | 1,200 | |

| Cash and cash equivalents, as of end of period | $ | 469,409 | | | $ | 469,909 | | | $ | 500 | |

CHEWY, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(in thousands)

| | | | | | | | | | | | | | | | | |

| 26 Weeks Ended | | |

| July 30,

2023 | | July 30,

2023 | | $ Change |

| (As Filed) | | (Restated) | | |

| Cash flows from operating activities | | | | | |

| Net income | $ | 41,127 | | | $ | 43,066 | | | $ | 1,939 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | |

| Depreciation and amortization | 56,672 | | | 56,712 | | | 40 | |

| Share-based compensation expense | 114,549 | | | 114,549 | | | — | |

| Non-cash lease expense | 22,053 | | | 22,072 | | | 19 | |

| Change in fair value of equity warrants and investments | (20,244) | | | (20,244) | | | — | |

| Other | 793 | | | 793 | | | — | |

| Net change in operating assets and liabilities: | | | | | |

| Accounts receivable | (36,332) | | | (37,487) | | | (1,155) | |

| Inventories | (62,684) | | | (64,969) | | | (2,285) | |

| Prepaid expenses and other current assets | (16,860) | | | (16,843) | | | 17 | |

| Other non-current assets | (1,975) | | | (1,975) | | | — | |

| Trade accounts payable | 88,434 | | | 90,445 | | | 2,011 | |

| Accrued expenses and other current liabilities | 131,796 | | | 131,374 | | | (422) | |

| Operating lease liabilities | (11,045) | | | (11,066) | | | (21) | |

| Other long-term liabilities | 864 | | | 860 | | | (4) | |

| Net cash provided by operating activities | 307,148 | | | 307,287 | | | 139 | |

| Cash flows from investing activities | | | | | |

| Capital expenditures | (79,213) | | | (79,217) | | | (4) | |

| | | | | |

| Cash paid for acquisition of business, net of cash acquired | (367) | | | (367) | | | — | |

| Purchases of marketable securities | (442,769) | | | (442,769) | | | — | |

| Proceeds from maturities of marketable securities | 350,000 | | | 350,000 | | | — | |

| | | | | |

| Net cash used in investing activities | (172,349) | | | (172,353) | | | (4) | |

| Cash flows from financing activities | | | | | |

| | | | | |

| | | | | |

| Payments for tax sharing agreement with related parties | (7,606) | | | (7,606) | | | — | |

| Principal repayments of finance lease obligations | (351) | | | (354) | | | (3) | |

| Payment of debt modification costs | (175) | | | (175) | | | — | |

| | | | | |

| Payments for tax withholdings related to vesting of share-based compensation awards | (5) | | | (5) | | | — | |

| Net cash used in financing activities | (8,137) | | | (8,140) | | | (3) | |

| | | | | |

| Net increase in cash and cash equivalents | 126,662 | | | 126,794 | | | 132 | |

| Cash and cash equivalents, as of beginning of period | 330,441 | | | 331,641 | | | 1,200 | |

| Cash and cash equivalents, as of end of period | $ | 457,103 | | | $ | 458,435 | | | $ | 1,332 | |

CHEWY, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(in thousands)

| | | | | | | | | | | | | | | | | |

| 13 Weeks Ended | | |

| April 30,

2023 | | April 30,

2023 | | $ Change |

| (As Filed) | | (Restated) | | |

| Cash flows from operating activities | | | | | |

| Net income | $ | 22,181 | | | $ | 22,859 | | | $ | 678 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | |

| Depreciation and amortization | 28,877 | | | 28,898 | | | 21 | |

| Share-based compensation expense | 48,553 | | | 48,553 | | | — | |

| Non-cash lease expense | 11,924 | | | 11,933 | | | 9 | |

| Change in fair value of equity warrants and investments | 8,948 | | | 8,948 | | | — | |

| Other | 489 | | | 489 | | | — | |

| Net change in operating assets and liabilities: | | | | | |

| Accounts receivable | (25,370) | | | (25,807) | | | (437) | |

| Inventories | (55,856) | | | (54,260) | | | 1,596 | |

| Prepaid expenses and other current assets | (10,721) | | | (10,699) | | | 22 | |

| Other non-current assets | 298 | | | 298 | | | — | |

| Trade accounts payable | 82,967 | | | 82,085 | | | (882) | |

| Accrued expenses and other current liabilities | 39,399 | | | 38,724 | | | (675) | |

| Operating lease liabilities | (5,219) | | | (5,229) | | | (10) | |

| Other long-term liabilities | 1,922 | | | 1,920 | | | (2) | |

| Net cash provided by operating activities | 148,392 | | | 148,712 | | | 320 | |

| Cash flows from investing activities | | | | | |

| Capital expenditures | (21,573) | | | (21,573) | | | — | |

| | | | | |

| Cash paid for acquisition of business, net of cash acquired | (367) | | | (367) | | | — | |

| Purchases of marketable securities | (394,098) | | | (394,098) | | | — | |

| Proceeds from maturities of marketable securities | 350,000 | | | 350,000 | | | — | |

| | | | | |

| Net cash used in investing activities | (66,038) | | | (66,038) | | | — | |

| Cash flows from financing activities | | | | | |

| | | | | |

| | | | | |

| Payments for tax sharing agreement with related parties | (3,761) | | | (3,761) | | | — | |

| Payment of debt modification costs | (175) | | | (175) | | | — | |

| Principal repayments of finance lease obligations | (174) | | | (175) | | | (1) | |

| | | | | |

| | | | | |

| Net cash used in financing activities | (4,110) | | | (4,111) | | | (1) | |

| Net increase in cash and cash equivalents | 78,244 | | | 78,563 | | | 319 | |

| Cash and cash equivalents, as of beginning of period | 330,441 | | | 331,641 | | | 1,200 | |

| Cash and cash equivalents, as of end of period | $ | 408,685 | | | $ | 410,204 | | | $ | 1,519 | |

CHEWY, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(in thousands)

| | | | | | | | | | | | | | | | | |

| 52 Weeks Ended | | |

| January 29,

2023 | | January 29,

2023 | | $ Change |

| (As Filed) | | (Restated) | | |

| Cash flows from operating activities | | | | | |

| Net income | $ | 49,232 | | | $ | 49,899 | | | $ | 667 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | |

| Depreciation and amortization | 83,307 | | | 83,440 | | | 133 | |

| Share-based compensation expense | 158,122 | | | 158,122 | | | — | |

| Non-cash lease expense | 39,470 | | | 39,389 | | | (81) | |

| Change in fair value of equity warrants | 13,340 | | | 13,340 | | | — | |

| | | | | |

| Other | 1,069 | | | 1,072 | | | 3 | |

| Net change in operating assets and liabilities: | | | | | |

| Accounts receivable | (2,735) | | | (2,573) | | | 162 | |

| Inventories | (115,090) | | | (115,261) | | | (171) | |

| Prepaid expenses and other current assets | (10,822) | | | (10,964) | | | (142) | |

| Other non-current assets | 1,114 | | | 1,114 | | | — | |

| Trade accounts payable | 147,566 | | | 147,465 | | | (101) | |

| Accrued expenses and other current liabilities | 8,245 | | | 7,932 | | | (313) | |

| Operating lease liabilities | (21,688) | | | (21,632) | | | 56 | |

| Other long-term liabilities | (1,558) | | | (1,566) | | | (8) | |

| Net cash provided by operating activities | 349,572 | | | 349,777 | | | 205 | |

| Cash flows from investing activities | | | | | |

| Capital expenditures | (230,290) | | | (230,310) | | | (20) | |

| Cash paid for acquisition of business, net of cash acquired | (40,033) | | | (40,033) | | | — | |

| Purchases of marketable securities | (543,761) | | | (543,761) | | | — | |

| Proceeds from maturities of marketable securities | 200,000 | | | 200,000 | | | — | |

| Other | (1,400) | | | (1,400) | | | — | |

| | | | | |

| | | | | |

| Net cash used in investing activities | (615,484) | | | (615,504) | | | (20) | |

| Cash flows from financing activities | | | | | |

| Payments for tax sharing agreement with related parties | (2,828) | | | (2,828) | | | — | |

| Payments for tax withholdings related to vesting of share-based compensation awards | (2,475) | | | (2,475) | | | — | |

| Payment of debt modification costs | (750) | | | (750) | | | — | |

| Principal repayments of finance lease obligations | (673) | | | (681) | | | (8) | |

| | | | | |

| | | | | |

| | | | | |

| Net cash used in financing activities | (6,726) | | | (6,734) | | | (8) | |

| Net decrease in cash and cash equivalents | (272,638) | | | (272,461) | | | 177 | |

| Cash and cash equivalents, as of beginning of period | 603,079 | | | 604,102 | | | 1,023 | |

| Cash and cash equivalents, as of end of period | $ | 330,441 | | | $ | 331,641 | | | $ | 1,200 | |

| Supplemental disclosure of cash flow information | | | | | |

| Cash paid for interest | $ | 2,057 | | | $ | 2,058 | | | $ | 1 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

CHEWY, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(in thousands)

| | | | | | | | | | | | | | | | | |

| 52 Weeks Ended | | |

| January 30,

2022 | | January 30,

2022 | | $ Change |

| (As Filed) | | (Restated) | | |

| Cash flows from operating activities | | | | | |

| Net loss | $ | (73,817) | | | $ | (75,207) | | | $ | (1,390) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | | | |

| Depreciation and amortization | 55,009 | | | 55,319 | | | 310 | |

| Share-based compensation expense | 77,772 | | | 77,772 | | | — | |

| Non-cash lease expense | 32,958 | | | 32,996 | | | 38 | |

| | | | | |

| Other | 595 | | | 595 | | | — | |

| Net change in operating assets and liabilities: | | | | | |

| Accounts receivable | (22,811) | | | (20,858) | | | 1,953 | |

| Inventories | (47,126) | | | (41,745) | | | 5,381 | |

| Prepaid expenses and other current assets | (18,931) | | | (7,357) | | | 11,574 | |

| Other non-current assets | (4,960) | | | (4,960) | | | — | |

| Trade accounts payable | 104,951 | | | 84,058 | | | (20,893) | |

| Accrued expenses and other current liabilities | 125,655 | | | 128,706 | | | 3,051 | |

| Operating lease liabilities | (19,850) | | | (19,864) | | | (14) | |

| Other long-term liabilities | (17,706) | | | (17,712) | | | (6) | |

| Net cash provided by operating activities | 191,739 | | | 191,743 | | | 4 | |

| Cash flows from investing activities | | | | | |

| Capital expenditures | (183,186) | | | (183,186) | | | — | |

| Acquisition of assets | (10,086) | | | (10,086) | | | — | |

| | | | | |

| | | | | |

| Net cash used in investing activities | (193,272) | | | (193,272) | | | — | |

| Cash flows from financing activities | | | | | |

| Proceeds from tax sharing agreement with related parties | 43,714 | | | 43,714 | | | — | |

| | | | | |

| | | | | |

| | | | | |

| Payment of debt modification and issuance costs | (1,584) | | | (1,584) | | | — | |

| Principal repayments of finance lease obligations | (863) | | | (869) | | | (6) | |

| | | | | |

| Net cash provided by financing activities | 41,267 | | | 41,261 | | | (6) | |

| Net increase in cash and cash equivalents | 39,734 | | | 39,732 | | | (2) | |

| Cash and cash equivalents, as of beginning of period | 563,345 | | | 564,370 | | | 1,025 | |

| Cash and cash equivalents, as of end of period | $ | 603,079 | | | $ | 604,102 | | | $ | 1,023 | |

| Supplemental disclosure of cash flow information | | | | | |

| Cash paid for interest | $ | 2,051 | | | $ | 2,053 | | | $ | 2 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Non-GAAP Financial Measures

We have included in this Exhibit 99.1 certain measures of financial performance that are not prepared in accordance with GAAP (“non-GAAP”).

For each of these non-GAAP financial measures, we provide a reconciliation between the non-GAAP measure and the most directly comparable GAAP measure, an explanation of why management believes the non-GAAP measure provides useful information to financial statement users, and any additional purposes for which management uses the non-GAAP measure. This non-GAAP financial information is provided as additional information for the financial statement users and is not in accordance with, or an alternative to, GAAP. These non-GAAP financial measures may be different from non-GAAP financial measures used by other companies and may exclude items that are significant in understanding and assessing our financial results. Therefore, these financial measures should not be considered in isolation and relied upon as substitutes for analysis of our results as reported under GAAP.

Adjusted EBITDA and Adjusted EBITDA Margin

To provide investors with additional information regarding our financial results, we have disclosed in this Exhibit 99.1 adjusted EBITDA, a non-GAAP financial measure that we calculate as net income (loss) excluding depreciation and amortization; share-based compensation expense and related taxes; income tax provision; interest income (expense), net; transaction related costs; changes in the fair value of equity warrants; exit costs; and litigation matters and other items that we do not consider representative of our underlying operations. We have provided a reconciliation below of adjusted EBITDA to net income (loss), the most directly comparable GAAP financial measure.

We have included adjusted EBITDA and adjusted EBITDA margin in this Exhibit 99.1 because each is a key measure used by our management and board of directors to evaluate our operating performance, generate future operating plans and make strategic decisions regarding the allocation of capital. In particular, the exclusion of certain expenses in calculating adjusted EBITDA and adjusted EBITDA margin facilitates operating performance comparability across reporting periods by removing the effect of non-cash expenses and certain variable charges. Accordingly, we believe that adjusted EBITDA and adjusted EBITDA margin provide useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors.

We believe it is useful to exclude non-cash charges, such as depreciation and amortization and share-based compensation expense from our adjusted EBITDA because the amount of such expenses in any specific period may not directly correlate to the underlying performance of our business operations. We believe it is useful to exclude income tax provision; interest income (expense), net; transaction related costs; changes in the fair value of equity warrants; exit costs; and litigation matters and other items which are not components of our core business operations. Adjusted EBITDA has limitations as a financial measure and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

•although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future and adjusted EBITDA does not reflect capital expenditure requirements for such replacements or for new capital expenditures;

•adjusted EBITDA does not reflect share-based compensation and related taxes. Share-based compensation has been, and will continue to be for the foreseeable future, a recurring expense in our business and an important part of our compensation strategy;

•adjusted EBITDA does not reflect interest income (expense), net; or changes in, or cash requirements for, our working capital;

•adjusted EBITDA does not reflect transaction related costs and other items which are either not representative of our underlying operations or are incremental costs that result from an actual or planned transaction and include changes in the fair value of equity warrants, exit costs, litigation matters, integration consulting fees, internal salaries and wages (to the extent the individuals are assigned full-time to integration and transformation activities) and certain costs related to integrating and converging IT systems; and

•other companies, including companies in our industry, may calculate adjusted EBITDA differently, which reduces its usefulness as a comparative measure.

Because of these limitations, you should consider adjusted EBITDA and adjusted EBITDA margin alongside other financial performance measures, including various cash flow metrics, net income (loss), net margin, and our other GAAP results.

Adjusted Net Income (Loss) and Adjusted Basic and Diluted Earnings (Loss) per Share

To provide investors with additional information regarding our financial results, we have disclosed in this Exhibit 99.1 adjusted net income (loss) and adjusted basic and diluted earnings (loss) per share, which represent non-GAAP financial measures. We calculate adjusted net income (loss) as net income (loss) excluding share-based compensation expense and related taxes, changes in the fair value of equity warrants, and exit costs. We calculate adjusted basic and diluted earnings (loss) per share by dividing adjusted net income (loss) attributable to common stockholders by the weighted-average shares outstanding during the period. We have provided a reconciliation below of adjusted net income (loss) to net income (loss), the most directly comparable GAAP financial measure.

We have included adjusted net income (loss) and adjusted basic and diluted earnings (loss) per share in this Exhibit 99.1 because each is a key measure used by our management and board of directors to evaluate our operating performance, generate future operating plans and make strategic decisions regarding the allocation of capital. In particular, the exclusion of certain expenses in calculating adjusted net income and adjusted basic and diluted earnings (loss) per share facilitates operating performance comparability across reporting periods by removing the effect of non-cash expenses and certain variable gains and losses that do not represent a component of our core business operations. We believe it is useful to exclude non-cash share-based compensation expense and related taxes because the amount of such expenses in any specific period may not directly correlate to the underlying performance of our business operations. We believe it is useful to exclude exit costs and the changes in the fair value of equity warrants, because exit costs and the variability of equity warrant gains and losses are not representative of our underlying operations. Accordingly, we believe that these measures provide useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors.

Adjusted net income (loss) and adjusted basic and diluted earnings (loss) per share have limitations as financial measures and you should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP. Other companies may calculate adjusted net income (loss) and adjusted basic and diluted earnings (loss) per share differently, which reduces their usefulness as comparative measures. Because of these limitations, you should consider adjusted net income (loss) and adjusted basic and diluted earnings (loss) alongside other financial performance measures, including various cash flow metrics, net income (loss), basic and diluted earnings (loss) per share, and our other GAAP results.

Free Cash Flow

To provide investors with additional information regarding our financial results, we have also disclosed in this Exhibit 99.1 free cash flow, a non-GAAP financial measure that we calculate as net cash provided by (used in) operating activities less capital expenditures (which consist of purchases of property and equipment, capitalization of labor related to our website, mobile applications, and software development, and leasehold improvements). We have provided a reconciliation below of free cash flow to net cash provided by (used in) operating activities, the most directly comparable GAAP financial measure.

We have included free cash flow in this Exhibit 99.1 because it is used by our management and board of directors as an important indicator of our liquidity as it measures the amount of cash we generate. Accordingly, we believe that free cash flow provides useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors.

Free cash flow has limitations as a financial measure and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. There are limitations to using non-GAAP financial measures, including that other companies, including companies in our industry, may calculate free cash flow differently. Because of these limitations, you should consider free cash flow alongside other financial performance measures, including net cash provided by (used in) operating activities, capital expenditures and our other GAAP results.

| | | | | | | | | | | | | | | | | |

| (in thousands, except percentages) | 13 Weeks Ended | | |

| Reconciliation of Net Loss to Adjusted EBITDA | October 29,

2023 | | October 29,

2023 | | Change |

| (As Filed) | | (Restated) | | |

| Net loss | $ | (35,810) | | | $ | (35,372) | | | $ | 438 | |

| Add (deduct): | | | | | |

| Depreciation and amortization | 25,523 | | | 25,540 | | | 17 | |

| Share-based compensation expense and related taxes | 65,799 | | | 65,799 | | | — | |

| Interest income, net | (10,173) | | | (10,173) | | | — | |

| | | | | |

| Change in fair value of equity warrants | 33,800 | | | 33,800 | | | — | |

| Income tax provision | 1,704 | | | 1,704 | | | — | |

| Exit costs | (778) | | | (778) | | | — | |

| Transaction related costs | 1,041 | | | 1,041 | | | — | |

| Other | 1,020 | | | 1,020 | | | — | |

| Adjusted EBITDA | $ | 82,126 | | | $ | 82,581 | | | $ | 455 | |

| Net sales | $ | 2,738,611 | | | $ | 2,745,875 | | | $ | 7,264 | |

| Net margin | (1.3) | % | | (1.3) | % | | — | % |

| Adjusted EBITDA margin | 3.0 | % | | 3.0 | % | | — | % |

| | | | | | | | | | | | | | | | | |

| (in thousands, except per share data) | 13 Weeks Ended | | |

| Reconciliation of Net Loss to Adjusted Net Income | October 29,

2023 | | October 29,

2023 | | Change |

| (As Filed) | | (Restated) | | |

| Net loss | $ | (35,810) | | | $ | (35,372) | | | $ | 438 | |

| Add (deduct): | | | | | |

| Share-based compensation expense and related taxes | 65,799 | | | 65,799 | | | — | |

| Change in fair value of equity warrants | 33,800 | | | 33,800 | | | — | |

| Exit costs | (778) | | | (778) | | | — | |

| Adjusted net income | $ | 63,011 | | | $ | 63,449 | | | $ | 438 | |

| Weighted-average common shares used in computing (loss) earnings per share and adjusted earnings per share: | | | | | |

| Basic | 430,758 | | | 430,758 | | | — | |

Effect of dilutive share-based awards (1) | 1,414 | | | 1,414 | | — |

Diluted (1) | 432,172 | | | 432,172 | | — |

| (Loss) earnings per share attributable to common Class A and Class B stockholders | | | | | |

| Basic | $ | (0.08) | | | $ | (0.08) | | | $ | — | |

Diluted (1) | $ | (0.08) | | | $ | (0.08) | | | $ | — | |

| Adjusted basic | $ | 0.15 | | | $ | 0.15 | | | $ | — | |

Adjusted diluted (1) | $ | 0.15 | | | $ | 0.15 | | | $ | — | |

(1) For the thirteen weeks ended October 29, 2023, our calculation of adjusted diluted earnings per share attributable to common Class A and Class B stockholders requires an adjustment to the weighted-average common shares used in the calculation to include the weighted-average dilutive effect of share-based awards. |

| | | | | | | | | | | | | | | | | |

| (in thousands) | 13 Weeks Ended | | |

| Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow | October 29,

2023 | | October 29,

2023 | | Change |

| (As Filed) | | (Restated) | | |

| Net cash provided by operating activities | $ | 80,208 | | | $ | 79,377 | | | $ | (831) | |

| Deduct: | | | | | |

| Capital expenditures | (31,685) | | | (31,685) | | | — | |

| Free Cash Flow | $ | 48,523 | | | $ | 47,692 | | | $ | (831) | |

| | | | | | | | | | | | | | | | | |

| (in thousands, except percentages) | 13 Weeks Ended | | |

| Reconciliation of Net Income to Adjusted EBITDA | July 30,

2023 | | July 30,

2023 | | Change |

| (As Filed) | | (Restated) | | |

| Net income | $ | 18,946 | | | $ | 20,207 | | | $ | 1,261 | |

| Add (deduct): | | | | | |

| Depreciation and amortization | 27,795 | | | 27,814 | | | 19 | |

| Share-based compensation expense and related taxes | 68,302 | | | 68,302 | | | — | |

| Interest income, net | (8,928) | | | (8,928) | | | — | |

| | | | | |

| Change in fair value of equity warrants | (29,192) | | | (29,192) | | | — | |

| Income tax provision | 1,304 | | | 1,304 | | | — | |

| Exit costs | 5,260 | | | 5,260 | | | — | |

| Transaction related costs | 2,126 | | | 2,126 | | | — | |

| Other | 1,254 | | | 1,254 | | | — | |

| Adjusted EBITDA | $ | 86,867 | | | $ | 88,147 | | | $ | 1,280 | |

| Net sales | $ | 2,777,769 | | | $ | 2,785,302 | | | $ | 7,533 | |

| Net margin | 0.7 | % | | 0.7 | % | | — | % |

| Adjusted EBITDA margin | 3.1 | % | | 3.2 | % | | 0.1 | % |

| | | | | | | | | | | | | | | | | |

| (in thousands, except per share data) | 13 Weeks Ended | | |

| Reconciliation of Net Income to Adjusted Net Income | July 30,

2023 | | July 30,

2023 | | Change |

| (As Filed) | | (Restated) | | |

| Net income | $ | 18,946 | | | $ | 20,207 | | | $ | 1,261 | |

| Add (deduct): | | | | | |

| Share-based compensation expense and related taxes | 68,302 | | | 68,302 | | | — | |

| Change in fair value of equity warrants | (29,192) | | | (29,192) | | | — | |

| Exit costs | 5,260 | | | 5,260 | | | — | |

| Adjusted net income | $ | 63,316 | | | $ | 64,577 | | | $ | 1,261 | |

| Weighted-average common shares used in computing adjusted earnings per share: | | | | | |

| Basic | 428,618 | | | 428,618 | | | — | |

| Effect of dilutive share-based awards | 2,958 | | | 2,958 | | — |

| Diluted | 431,576 | | | 431,576 | | — |

| Earnings per share attributable to common Class A and Class B stockholders | | | | | |

| Basic | $ | 0.04 | | | $ | 0.05 | | | $ | 0.01 | |

| Diluted | $ | 0.04 | | | $ | 0.05 | | | $ | 0.01 | |

| Adjusted basic | $ | 0.15 | | | $ | 0.15 | | | $ | — | |

| Adjusted diluted | $ | 0.15 | | | $ | 0.15 | | | $ | — | |

| | | | | | | | | | | | | | | | | |

| (in thousands) | 13 Weeks Ended | | |

| Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow | July 30,

2023 | | July 30,

2023 | | Change |

| (As Filed) | | (Restated) | | |

| Net cash provided by operating activities | $ | 158,756 | | | $ | 158,575 | | | $ | (181) | |

| Deduct: | | | | | |

| Capital expenditures | (57,640) | | | (57,644) | | | (4) | |

| Free Cash Flow | $ | 101,116 | | | $ | 100,931 | | | $ | (185) | |

| | | | | | | | | | | | | | | | | | | | | |

| (in thousands, except percentages) | 13 Weeks Ended | | | | |

| Reconciliation of Net Income to Adjusted EBITDA | April 30,

2023 | | April 30,

2023 | | Change | | | | |

| (As Filed) | | (Restated) | | | | | | |

| Net income | $ | 22,181 | | | $ | 22,859 | | | $ | 678 | | | | | |

| Add (deduct): | | | | | | | | | |

| Depreciation and amortization | 28,877 | | | 28,898 | | | 21 | | | | | |

| Share-based compensation expense and related taxes | 53,777 | | | 53,777 | | | — | | | | | |

| Interest income, net | (8,016) | | | (8,016) | | | — | | | | | |

| | | | | | | | | |

| Change in fair value of equity warrants | 8,934 | | | 8,934 | | | — | | | | | |

| Income tax provision | 1,003 | | | 1,003 | | | — | | | | | |

| Exit costs | 2,357 | | | 2,357 | | | — | | | | | |

| | | | | | | | | |

| Other | 1,061 | | | 1,061 | | | — | | | | | |

| Adjusted EBITDA | $ | 110,174 | | | $ | 110,873 | | | $ | 699 | | | | | |

| Net sales | $ | 2,784,675 | | | $ | 2,790,639 | | | $ | 5,964 | | | | | |

| Net margin | 0.8 | % | | 0.8 | % | | — | % | | | | |

| Adjusted EBITDA margin | 4.0 | % | | 4.0 | % | | — | % | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| (in thousands, except per share data) | 13 Weeks Ended | | | | |

| Reconciliation of Net Income to Adjusted Net Income | April 30,

2023 | | April 30,

2023 | | Change | | | | |

| (As Filed) | | (Restated) | | | | | | |

| Net income | $ | 22,181 | | | $ | 22,859 | | | $ | 678 | | | | | |

| Add: | | | | | | | | | |

| Share-based compensation expense and related taxes | 53,777 | | | 53,777 | | | — | | | | | |

| Change in fair value of equity warrants | 8,934 | | | 8,934 | | | — | | | | | |

| Exit costs | 2,357 | | | 2,357 | | | — | | | | | |

| Adjusted net income | $ | 87,249 | | | $ | 87,927 | | | $ | 678 | | | | | |

| Weighted-average common shares used in computing adjusted earnings per share: | | | | | | | | | |

| Basic | 426,852 | | | 426,852 | | | — | | | | | |

| Effect of dilutive share-based awards | 3,619 | | | 3,619 | | — | | | | |

| Diluted | 430,471 | | | 430,471 | | — | | | | |

| Earnings per share attributable to common Class A and Class B stockholders | | | | | | | | | |

| Basic | $ | 0.05 | | | $ | 0.05 | | | $ | — | | | | | |

| Diluted | $ | 0.05 | | | $ | 0.05 | | | $ | — | | | | | |

| Adjusted basic | $ | 0.20 | | | $ | 0.21 | | | $ | 0.01 | | | | | |

| Adjusted diluted | $ | 0.20 | | | $ | 0.20 | | | $ | — | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | 13 Weeks Ended | | | | |

| Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow | April 30,

2023 | | April 30,

2023 | | Change | | | | |

| (As Filed) | | (Restated) | | | | | | |

| Net cash provided by operating activities | $ | 148,392 | | | $ | 148,712 | | | $ | 320 | | | | | |

| Deduct: | | | | | | | | | |

| Capital expenditures | (21,573) | | | (21,573) | | | — | | | | | |

| Free Cash Flow | $ | 126,819 | | | $ | 127,139 | | | $ | 320 | | | | | |

| | | | | | | | | | | | | | | | | |

| (in thousands, except percentages) | 52 Weeks Ended | | |

| Reconciliation of Net Income to Adjusted EBITDA | January 29,

2023 | | January 29,

2023 | | Change |

| (As Filed) | | (Restated) | | |

| Net income | $ | 49,232 | | | $ | 49,899 | | | $ | 667 | |

| Add (deduct): | | | | | |

| Depreciation and amortization | 83,307 | | | 83,440 | | | 133 | |

| Share-based compensation expense and related taxes | 163,211 | | | 163,211 | | | — | |

| Interest income, net | (9,291) | | | (9,290) | | | 1 | |

| Change in fair value of equity warrants | 13,340 | | | 13,340 | | | — | |

| Income tax provision | 2,646 | | | 2,646 | | | — | |

| Transaction related costs | 3,953 | | | 3,953 | | | — | |

| Other | (460) | | | (460) | | | — | |

| | | | | |

| Adjusted EBITDA | $ | 305,938 | | | $ | 306,739 | | | $ | 801 | |

| Net sales | $ | 10,098,939 | | | $ | 10,119,000 | | | $ | 20,061 | |

| Net margin | 0.5 | % | | 0.5 | % | | — | % |

| Adjusted EBITDA margin | 3.0 | % | | 3.0 | % | | — | % |

|

|

| | | | | | | | | | | | | | | | | |

(in thousands, except per share data) | 52 Weeks Ended | | |

| Reconciliation of Net Income to Adjusted Net Income | January 29,

2023 | | January 29,

2023 | | Change |

| (As Filed) | | (Restated) | | |

| Net income | $ | 49,232 | | $ | 49,899 | | $ | 667 |

| Add: | | | | | |

| Share-based compensation expense and related taxes | 163,211 | | 163,211 | | — |

| Change in fair value of equity warrants | 13,340 | | 13,340 | | — |

| Adjusted net income | $ | 225,783 | | $ | 226,450 | | $ | 667 |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Weighted-average common shares used in computing adjusted earnings per share: | | | | | |

| Basic | 422,331 | | 422,331 | | — |

| Effect of dilutive share-based awards | 5,439 | | 5,439 | | — |

| Diluted | 427,770 | | 427,770 | | — |

| Earnings per share attributable to common Class A and Class B stockholders | | | | | |

| Basic | $ | 0.12 | | $ | 0.12 | | $ | — |

| Diluted | $ | 0.12 | | $ | 0.12 | | $ | — |

| Adjusted basic | $ | 0.53 | | $ | 0.54 | | $ | 0.01 |

| Adjusted diluted | $ | 0.53 | | $ | 0.53 | | $ | — |

|

| | | | | | | | | | | | | | | | | |

| (in thousands) | 52 Weeks Ended | | |

| Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow | January 29,

2023 | | January 29,

2023 | | Change |

| (As Filed) | | (Restated) | | |

| Net cash provided by operating activities | $ | 349,572 | | | $ | 349,777 | | | $ | 205 | |

| Deduct: | | | | | |

| Capital expenditures | (230,290) | | | (230,310) | | | (20) | |

| Free Cash Flow | $ | 119,282 | | | $ | 119,467 | | | $ | 185 | |

| | | | | | | | | | | | | | | | | |

| ($ in thousands, except percentages) | 52 Weeks Ended | | |

| Reconciliation of Net Loss to Adjusted EBITDA | January 30,

2022 | | January 30,

2022 | | Change |

| (As Filed) | | (Restated) | | |

| Net loss | $ | (73,817) | | | $ | (75,207) | | | $ | (1,390) | |

| Add: | | | | | |

| Depreciation and amortization | 55,009 | | | 55,319 | | | 310 | |

| Share-based compensation expense and related taxes | 85,308 | | | 85,308 | | | — | |

| | | | | |

| Interest expense, net | 1,639 | | | 1,641 | | | 2 | |

| | | | | |

| Transaction related costs | 2,423 | | | 2,423 | | | — | |

| Other | 7,990 | | | 7,990 | | | — | |

| Adjusted EBITDA | $ | 78,552 | | | $ | 77,474 | | | $ | (1,078) | |

| Net sales | $ | 8,890,773 | | | $ | 8,967,407 | | | $ | 76,634 | |

| Net Margin | (0.8) | % | | (0.8) | % | | — | % |

| Adjusted EBITDA margin | 0.9 | % | | 0.9 | % | | — | % |

|

|

| | | | | | | | | | | | | | | | | |

(in thousands, except per share data) | 52 Weeks Ended | | |

| Reconciliation of Net Loss to Adjusted Net Income | January 30,

2022 | | January 30,

2022 | | Change |

| (As Filed) | | (Restated) | | |

| Net loss | $ | (73,817) | | $ | (75,207) | | $ | (1,390) |

| Add: | | | | | |

| Share-based compensation expense and related taxes | 85,308 | | 85,308 | | — |

| | | | | |

| Adjusted net income | $ | 11,491 | | $ | 10,101 | | $ | (1,390) |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Weighted-average common shares used in computing adjusted earnings (loss) per share: | | | | | |

| Basic | 417,218 | | 417,218 | | — |

Effect of dilutive share-based awards (1) | 10,068 | | 10,068 | | — |

Diluted (1) | 427,286 | | 427,286 | | — |

| (Loss) earnings per share attributable to common Class A and Class B stockholders | | | | | |

| Basic | $ | (0.18) | | $ | (0.18) | | $ | — |

Diluted (1) | $ | (0.18) | | $ | (0.18) | | $ | — |

| Adjusted basic | $ | 0.03 | | $ | 0.02 | | $ | (0.01) |

Adjusted diluted (1) | $ | 0.03 | | $ | 0.02 | | $ | (0.01) |

(1) For the 52 weeks ended January 30, 2022, our calculation of adjusted diluted earnings per share attributable to common Class A and Class B stockholders requires an adjustment to the weighted-average common shares used in the calculation to include the weighted-average dilutive effect of share-based awards. |

| | | | | | | | | | | | | | | | | |

| ($ in thousands) | 52 Weeks Ended | | |

| Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow | January 30,

2022 | | January 30,

2022 | | Change |

| (As Filed) | | (Restated) | | |

| Net cash provided by operating activities | $ | 191,739 | | | $ | 191,743 | | | $ | 4 | |

| Deduct: | | | | | |

| Capital expenditures | (183,186) | | | (183,186) | | | — | |

| Free Cash Flow | $ | 8,553 | | | $ | 8,557 | | | $ | 4 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

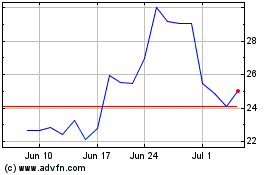

Chewy (NYSE:CHWY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Chewy (NYSE:CHWY)

Historical Stock Chart

From Apr 2023 to Apr 2024