Raises 2024 Financial Guidance to Include

Acquisition;

Approves Cash Dividend of $0.2825 Per Share

($1.13 Annualized)

Kinder Morgan, Inc.’s (NYSE: KMI) board of directors today

approved a cash dividend of $0.2825 per share for the fourth

quarter ($1.13 annualized), payable on February 15, 2024, to

stockholders of record as of the close of business on January 31,

2024. This dividend is a 2% increase over the fourth quarter of

2022.

The company is reporting:

- Fourth quarter earnings per share (EPS) of $0.27 and

distributable cash flow (DCF) per share of $0.52, down 10% and 4%,

respectively, compared to the fourth quarter of 2022.

- Net income attributable to KMI of $594 million, compared to

$670 million in the fourth quarter of 2022.

- DCF of $1,171 million compared to $1,217 million in the fourth

quarter of 2022.

- Adjusted Earnings of $633 million for the quarter versus $708

million in the fourth quarter of 2022.

The decreases versus fourth quarter 2022 are largely related to

increased interest expense which was anticipated in the company’s

2023 budget guidance. The company finished the year slightly behind

its budget primarily due to lower commodity prices.

KMI ended the quarter with a Net Debt-to-Adjusted EBITDA ratio

of 4.2, even with its $1.8 billion STX Midstream acquisition

closing just before year end. Our leverage ratio would be lower

with a full-year contribution of Adjusted EBITDA from the acquired

assets.

“As we continue to implement a business model that relies on

stable, fee-based assets in the energy infrastructure space, we

generated substantial cash in 2023, with net income of $2.4 billion

and Adjusted EBITDA of $7.6 billion for the year,” said Executive

Chairman Richard D. Kinder.

“The company consistently exercises disciplined capital

allocation based on conservative assumptions with high return

thresholds while maintaining a strong balance sheet. At the same

time, we are making prudent investments in the energy transition,”

continued Kinder.

“Our commitment to returning value to shareholders is

unwavering, as we have internally funded capital projects and pay a

healthy and growing dividend with robust coverage of $540 million

in the fourth quarter. In 2023, we further returned additional

value to shareholders by repurchasing more than 31.5 million of our

shares for approximately $522 million,” Kinder concluded.

“This quarter we expeditiously closed a major acquisition of STX

Midstream for $1.8 billion. Those assets fit nicely into our

existing Texas Intrastate system serving Gulf Coast and Mexico

demand markets. We also continued to execute on expansion projects

in all of our business segments, most notably our Natural Gas

Pipelines business segment, where four major projects were placed

in service during the quarter and another four are underway,” said

Chief Executive Officer Kim Dang.

“Our Products Pipelines business segment completed two projects

that added 17,500 barrels per day (Bbl/d) of renewable diesel (RD)

throughput capacity in Northern California and an additional

178,000 barrels of RD storage capacity in Southern California. And

our Energy Transition Ventures group put the Prairie View landfill

renewable natural gas (RNG) facility into service, bringing our

total RNG generation capacity to 6.1 billion cubic feet (Bcf) per

year,” Dang said.

“Financial contributions from the Products Pipelines business

segment and our Terminals business segment were up relative to the

fourth quarter of 2022, while the Natural Gas Pipelines and our CO2

business segments were down by a similar amount. EPS and DCF per

share for the quarter were down compared to the fourth quarter of

2022 due to higher interest expense. Both EPS and DCF per share

benefited from share repurchases.

“KMI’s balance sheet is strong, as we ended the year with a Net

Debt-to-Adjusted EBITDA ratio of 4.2 times. This is especially

noteworthy given that we executed approximately $522 million in

unbudgeted, opportunistic share repurchases during the year and

closed on the STX Midstream assets in December,” continued

Dang.

“Our project backlog at the end of the fourth quarter was $3

billion, down from $3.8 billion in the third quarter due to the

completion of multiple large projects including Tennessee Gas

Pipeline’s (TGP) East 300 line upgrade, the Permian Highway

Pipeline (PHP) expansion project and our Texas Intrastates’ Freer

to Sinton project. In calculating backlog Project EBITDA multiples,

we exclude both the capital and EBITDA from the CO2 business

segment and our gathering and processing projects, where the

earnings are more uneven than with our other business segments. To

compensate for those uneven earnings profiles we require higher

return thresholds for those projects. We expect the remaining $1.9

billion of projects in the backlog to generate an average Project

EBITDA multiple of approximately 4.6 times.

“While continuing our strong emphasis on our core businesses, we

are also devoting nearly 80% of our project backlog to lower-carbon

energy investments, including natural gas as a substitute for

higher emitting fuels, RNG, RD, feedstocks associated with RD and

sustainable aviation fuel, and carbon capture and sequestration,”

Dang concluded.

For the full year of 2023, the company reported net income

attributable to KMI of $2,391 million, compared to $2,548 million

for the full year of 2022; and DCF of $4,715 million, down from

$4,970 million for the comparable period in 2022. More than all of

this year-over-year decrease can be explained by higher interest

expense compared to the full year of 2022. DCF was further impacted

by higher sustaining capital expenditures versus 2022.

2024 Outlook

For 2024, KMI’s preliminary budget published on December 4, 2023

forecasted, among other metrics, EPS of $1.21 and DCF per share of

$2.21. It did not include the acquisition of NextEra Energy

Partners’ STX Midstream assets that closed on December 28, 2023.

KMI is updating its budget to incorporate the acquisition of the

STX Midstream assets, which results in a final 2024 budgeted EPS of

$1.22, up 15% versus 2023, DCF per share of $2.26, and Adjusted

EBITDA of $8.16 billion, both up 8% versus 2023 and a year-end 2024

Net Debt-to-Adjusted EBITDA ratio of 3.9 times. KMI’s expectation

to declare dividends of $1.15 per share for 2024 is unchanged.

The preliminary and final budgets assume average annual prices

for West Texas Intermediate (WTI) crude oil and Henry Hub natural

gas of $82 per barrel and $3.50 per million British thermal unit

(MMBtu), respectively, consistent with the forward curve during the

company’s annual budget process.

“While current prices are lower, we did not update commodity

prices in our final guidance given their potential to change over

the next year. However, using our disclosed sensitivities even at

current prices, we would still expect strong growth over 2023,

given our relatively modest commodity exposure. For example, at a

WTI crude oil price of $72 per barrel and Henry Hub natural gas

price of $2.80 per MMBtu, 2024, EPS would grow at 12% versus 2023

and DCF per share would grow at 6%,” said Dang.

This press release includes Adjusted Earnings and DCF, in each

case in the aggregate and per share, Adjusted Segment EBDA,

Adjusted EBITDA, Net Debt, FCF (free cash flow), and Project

EBITDA, all of which are non-GAAP financial measures. For

descriptions of these non-GAAP financial measures and

reconciliations to the most comparable measures prepared in

accordance with generally accepted accounting principles, please

see “Non-GAAP Financial Measures” and the tables accompanying our

preliminary financial statements.

Overview of Business

Segments

“The Natural Gas Pipelines business segment’s financial

performance was down slightly across most of the network in the

fourth quarter of 2023 relative to the fourth quarter of 2022,

primarily as a result of milder winter weather in 2023,” said KMI

President Tom Martin.

“Natural gas transport volumes were up 5% compared to the fourth

quarter of 2022, primarily due to higher volumes delivered to power

generation, liquefied natural gas (LNG) facilities and industrial

customers, as well as the return to service of El Paso Natural Gas

Line 2000. Natural gas gathering volumes were up 27% from the

fourth quarter of 2022, primarily from our Haynesville and Eagle

Ford gathering systems.

“Contributions from the Products Pipelines business

segment were up compared to the fourth quarter of 2022 due to

higher rates on existing assets and contributions from new capital

projects. Total refined products volumes were up slightly compared

to the fourth quarter of 2022. Crude and condensate volumes were

also up 7%,” Martin said. “Gasoline volumes were flat to the fourth

quarter of 2022 while diesel volumes were down 1%. Jet fuel volumes

were up 7% versus the fourth quarter of 2022.

“Terminals business segment earnings were up compared to

the fourth quarter of 2022. Earnings from our Jones Act tanker

business were higher compared to the prior year period on higher

average charter rates. The fleet remains fully contracted under

term charter agreements. Contributions from our liquids terminals

were up versus the prior year period, benefiting from expansion

projects placed in service, improving tank lease rates at our

Carteret, New Jersey facility, contractual rate escalations and

continued strong utilization across our network,” continued Martin.

“Contributions from our bulk terminals were essentially flat versus

the fourth quarter of 2022.

“CO2 business segment earnings were down compared to the

fourth quarter of 2022, primarily due to lower crude oil and CO2

volumes, as well as lower realized natural gas liquids (NGL) and

CO2 prices, partially offset by contributions from the RNG business

in our Energy Transition Ventures group. Our realized weighted

average NGL price for the quarter was down 21% from the fourth

quarter of 2022 at $27.87 per barrel and our realized weighted

average CO2 prices were down $0.08 or 6%,” said Martin. “NGL sales

volumes net to KMI were down 1% versus the fourth quarter of 2022.

CO2 sales volumes were down 13% on a net-to-KMI basis compared to

the fourth quarter of 2022. Crude volumes were down 7% versus the

fourth quarter of 2022. For the year, crude volumes were above

plan, even excluding the Diamond M acquisition, a remarkable

achievement given the impact of an extended outage at SACROC in the

first quarter.”

Other News

Corporate

- During the fourth quarter, KMI repurchased approximately 8.1

million shares for approximately $132 million at an average price

of $16.37 per share. Throughout 2023, KMI repurchased approximately

31.5 million shares for approximately $522 million at an average

price of $16.56 per share, leaving approximately $1.5 billion

remaining in the board approved share repurchase program.

Natural Gas Pipelines

- On December 28, 2023, KMI closed on its $1.815 billion

acquisition of NextEra Energy Partners’ South Texas assets (STX

Midstream), which includes a set of integrated, large diameter high

pressure natural gas pipeline systems that connect the Eagle Ford

basin to growing Mexico and Gulf Coast demand markets. These

pipeline systems include Eagle Ford Midstream, a 90% interest in

the NET Mexico pipeline and a 50% interest in Dos Caminos, LLC. The

portfolio of assets is highly contracted, with an average contract

length of over 8 years. Approximately 75% of the business is

supported by take-or-pay contracts.

- On November 1, 2023, Kinder Morgan Tejas Pipeline (Tejas)

placed in service its project to expand its Eagle Ford natural gas

transportation system to deliver nearly 2 Bcf/d of Eagle Ford

production to Gulf Coast markets. As part of the approximately $232

million project, Tejas constructed an approximately 67-mile,

42-inch pipeline from KMI’s existing Kinder Morgan Texas Pipeline

(KMTP) compressor station near Freer, Texas to the Tejas pipeline

system near Sinton, Texas.

- The PHP Expansion project was placed in service on December 1,

2023, and expanded PHP’s capacity by approximately 550 million

cubic feet per day (MMcf/d) to increase natural gas deliveries from

the Permian to U.S. Gulf Coast markets. PHP is jointly owned by

subsidiaries of KMI, Kinetik Holdings Inc. and Exxon Mobil

Corporation. KMI is the operator of PHP.

- Construction is nearly complete on KMI’s project to expand the

working gas storage capacity at its Markham Storage facility

(Markham) in Matagorda County along the Texas Gulf Coast. The

project involves adding an additional cavern at Markham to provide

more than 6 Bcf of incremental working gas storage capacity and 650

MMcf/d of incremental withdrawal capacity on KMI’s extensive Texas

intrastate system. Shippers have subscribed to most of the

available capacity under long-term agreements. Partial commercial

service began November 1, 2023, with full commercial service

expected in June 2024.

- Construction activities are underway for Tejas’ approximately

$97 million South Texas to Houston Market expansion project. The

project will add compression on Tejas’ mainline to increase natural

gas deliveries by approximately 0.35 Bcf/d to Houston markets. The

target in-service date is the third quarter of 2024.

- Construction has begun on an approximately $180 million

expansion of the KMTP system to provide transportation services,

including treating, for Kimmeridge Texas Gas and other third

parties. The expansion project, supported by a long-term contract,

is designed to deliver up to 500 MMcf/d of Eagle Ford natural gas

supply to markets along the Texas Gulf Coast and Mexico through a

new approximately 30-mile, 30-inch pipeline. The project is

currently expected to be placed in service in November 2024.

- Construction on TGP’s approximately $267 million East 300

Upgrade project was completed. It was placed in partial service on

November 1, with full service available on November 16. TGP has

entered into a long-term, binding agreement with Con Edison for the

115 MMcf/d of capacity.

- Construction is ongoing for TGP’s phase 1 of the Evangeline

Pass project. Construction is expected to begin on TGP’s and

Southern Natural Gas Company’s (SNG) portions of phase 2 in the

first quarter of 2024. The two-phase $672 million project involves

modifications and enhancements to portions of the TGP and SNG

systems in Mississippi and Louisiana, which will result in the

delivery of approximately 2 Bcf/d of natural gas to Venture

Global’s proposed Plaquemines LNG facility. The expected in-service

dates for each phase will be aligned with Venture Global’s

in-service dates.

- The first of two Wyoming Interstate Company egress projects to

access the growing supply from the Bakken formation began

commercial in-service on November 1, 2023. This project added

approximately 92 MMcf/d of Bakken export transportation capacity

from leases on Big Horn Gas Gathering and Fort Union Gas Gathering

(FUGG). The second project will add approximately 300 MMcf/d of

Bakken export transportation capacity from leases on FUGG, Northern

Border Pipeline Company and Bison Pipeline, and is scheduled to be

in service in the first quarter of 2026. All of this capacity is

backed by long-term commitments from creditworthy shippers.

Products Pipelines

- KMI’s Northern California RD hub Phase II capacity project was

placed in commercial operation on January 1, 2024. This project

expands the existing 21,000 Bbl/d of Bay area RD supply by an

additional 17,500 Bbl/d (38,500 Bbl/d total) to the Sacramento, San

Jose and Fresno markets. The project is anchored with customer

commitments and has potential capacity expandability remaining in

subsequent phases. To date, KMI has placed an aggregate of 56,500

Bbl/d of capacity at its Northern and Southern California RD

hubs.

- In late December 2023, KMI completed the second phase of its

Carson Terminal renewables conversion project, which connects

marine supplies of RD coming into its Los Angeles harbor hub to its

truck rack for delivery to local markets and to San Diego and the

Inland Empire markets via pipeline delivery. This project added

178,000 barrels to the terminal’s existing 400,000 barrels of RD

storage capacity at the facility and remains on track to add an

additional 178,000 barrels (third phase) of incremental RD storage

capacity by July 1, 2024. All phases of the Carson Terminal project

are fully subscribed with customer commitments.

Terminals

- Civil and tank foundation work has commenced on KMI’s latest

expansion of the company’s industry-leading RD and sustainable

aviation fuel feedstock storage and logistics offering in its lower

Mississippi River hub. The scope of work at its Geismar River

Terminal in Geismar, Louisiana includes construction of multiple

tanks totaling approximately 250,000 barrels of heated storage

capacity as well as various marine, rail and pipeline

infrastructure improvements. The approximately $54 million Geismar

River Terminal project, which is supported by a long-term

commercial commitment, is expected to be in service by the fourth

quarter of 2024.

- Commissioning is complete on the previously announced vapor

recovery unit (VRU) project at KMI’s refined products terminal hub

along the Houston Ship Channel. The approximately $64 million

investment addresses emissions related to product handling

activities at KMI’s Galena Park and Pasadena terminals and will

generate an attractive return on invested capital. The expected

Scope 1 & 2 CO2 equivalent emissions reduction across the

combined facilities represent a 38% reduction in total facility

greenhouse gas emissions versus 2019 (pre-pandemic) emissions.

Energy Transition Ventures

- The Prairie View landfill RNG facility began commercial

in-service on December 20, 2023. Together with the Twin Bridges and

Liberty landfill RNG facilities completed earlier in the year,

these three projects have added approximately 3.9 Bcf to KMI’s

total annual RNG capacity.

- Construction activities are underway on the previously

announced conversion of the Autumn Hills, Michigan, landfill gas

site to an RNG facility. The site is expected to be placed in

service in the second half of 2024 with a capacity of 0.8 Bcf of

RNG annually. Once complete and in service, this additional

facility will bring KMI’s total RNG generation capacity to 6.9 Bcf

per year.

CO2

- The first phase of KMI’s planned enhanced oil recovery

expansion at our recently acquired Diamond M field was approved in

October 2023. Together with the second phase in the project

backlog, the total expansion is expected to cost approximately $180

million and result in peak oil production of over 5,000 Bbl/d by

late 2026.

Kinder Morgan, Inc. (NYSE: KMI) is one of the largest energy

infrastructure companies in North America. Access to reliable,

affordable energy is a critical component for improving lives

around the world. We are committed to providing energy

transportation and storage services in a safe, efficient and

environmentally responsible manner for the benefit of the people,

communities and businesses we serve. We own an interest in or

operate approximately 82,000 miles of pipelines, 139 terminals, 702

billion cubic feet of working natural gas storage capacity and have

renewable natural gas generation capacity of approximately 6.1 Bcf

per year with an additional 0.8 Bcf in development. Our pipelines

transport natural gas, refined petroleum products, crude oil,

condensate, CO2, renewable fuels and other products, and our

terminals store and handle various commodities including gasoline,

diesel fuel, jet fuel, chemicals, metals, petroleum coke, and

ethanol and other renewable fuels and feedstocks. Learn more about

our work advancing energy solutions on the lower carbon initiatives

page at www.kindermorgan.com.

Please join Kinder Morgan, Inc. at 4:30 p.m. ET on Wednesday,

January 17, at www.kindermorgan.com for a LIVE webcast conference

call on the company’s fourth quarter earnings.

Non-GAAP Financial

Measures

Our non-GAAP financial measures described below should not be

considered alternatives to GAAP net income attributable to Kinder

Morgan, Inc. or other GAAP measures and have important limitations

as analytical tools. Our computations of these non-GAAP financial

measures may differ from similarly titled measures used by others.

You should not consider these non-GAAP financial measures in

isolation or as substitutes for an analysis of our results as

reported under GAAP. Management compensates for the limitations of

our consolidated non-GAAP financial measures by reviewing our

comparable GAAP measures identified in the descriptions of

consolidated non-GAAP measures below, understanding the differences

between the measures and taking this information into account in

its analysis and its decision-making processes.

Certain Items, as adjustments used

to calculate our non-GAAP financial measures, are items that are

required by GAAP to be reflected in net income attributable to

Kinder Morgan, Inc., but typically either (1) do not have a cash

impact (for example, unsettled commodity hedges and asset

impairments), or (2) by their nature are separately identifiable

from our normal business operations and in most cases are likely to

occur only sporadically (for example, certain legal settlements,

enactment of new tax legislation and casualty losses). (See the

accompanying Tables 2, 3, 4, and 6.) We also include adjustments

related to joint ventures (see “Amounts from

Joint Ventures” below).

The following table summarizes our Certain Items for the three

and twelve months ended December 31, 2023 and 2022.

Three Months Ended

December 31,

Year Ended

December 31,

2023

2022

2023

2022

(In millions)

Certain Items

Fair value amortization

$

—

$

(4

)

$

—

$

(15

)

Legal, environmental and other

reserves

—

28

—

51

Change in fair value of derivative

contracts (1)

(33

)

8

(126

)

57

Loss on impairment

—

—

67

—

Income tax Certain Items (2)

27

(2

)

33

(37

)

Other (3)

45

8

45

32

Total Certain Items (4)(5)

$

39

$

38

$

19

$

88

Notes

(1)

Gains or losses are reflected when

realized.

(2)

Represents the income tax provision on

Certain Items plus discrete income tax items. Includes the impact

of KMI’s income tax provision on Certain Items affecting earnings

from equity investments and is separate from the related tax

provision recognized at the investees by the joint ventures which

are also taxable entities.

(3)

Three-month and twelve-month periods of

2023 represent pension cost adjustments related to settlements made

by our pension plans.

(4)

Amounts for the periods ending December

31, 2023 and 2022 include the following amounts reported within

“Earnings from equity investments” on the accompanying Preliminary

Consolidated Statements of Income: (i) $(3) million and $1 million

for the 2022 three-month and twelve-month periods, respectively,

included within “Change in fair value of derivative contracts” and

(ii) $67 million for the 2023 twelve-month period only included

within “Loss on impairment” for a non-cash impairment related to

our investment in Double Eagle Pipeline LLC in our Products

Pipelines business segment.

(5)

Amounts for the periods ending December

31, 2023 and 2022 include, in aggregate, $3 million and $35 million

for the three-month periods, respectively, and $(7) million and

$(11) million for the twelve-month periods, respectively, included

within “Interest, net” on the accompanying Preliminary Consolidated

Statements of Income which consist of (i) $(4) million for the 2022

three-month period and $(15) million for the 2022 twelve-month

period of “Fair value amortization” and (ii) $3 million and $39

million for the three-month periods, respectively, and $(7) million

and $4 million for the twelve-month periods, respectively, of

“Change in fair value of derivative contracts.”

Adjusted Earnings is calculated by

adjusting net income attributable to Kinder Morgan, Inc. for

Certain Items. Adjusted Earnings is used by us, investors and other

external users of our financial statements as a supplemental

measure that provides decision-useful information regarding our

period-over-period performance and ability to generate earnings

that are core to our ongoing operations. We believe the GAAP

measure most directly comparable to Adjusted Earnings is net income

attributable to Kinder Morgan, Inc. Adjusted Earnings per share

uses Adjusted Earnings and applies the same two-class method used

in arriving at basic earnings per share. (See the accompanying

Tables 1 and 2.)

DCF is calculated by adjusting net

income attributable to Kinder Morgan, Inc. for Certain Items, and

further for DD&A and amortization of excess cost of equity

investments, income tax expense, cash taxes, sustaining capital

expenditures and other items. We also adjust amounts from joint

ventures for income taxes, DD&A, cash taxes and sustaining

capital expenditures (see “Amounts from Joint

Ventures” below). DCF is a significant performance measure

used by us, investors and other external users of our financial

statements to evaluate our performance and to measure and estimate

the ability of our assets to generate economic earnings after

paying interest expense, paying cash taxes and expending sustaining

capital. DCF provides additional insight into the specific costs

associated with our assets in the current period and facilitates

period-to-period comparisons of our performance from ongoing

business activities. DCF is also used by us, investors, and other

external users to compare the performance of companies across our

industry. DCF per share serves as the primary financial performance

target for purposes of annual bonuses under our annual incentive

compensation program and for performance-based vesting of equity

compensation grants under our long-term incentive compensation

program. DCF should not be used as an alternative to net cash

provided by operating activities computed under GAAP. We believe

the GAAP measure most directly comparable to DCF is net income

attributable to Kinder Morgan, Inc. DCF per share is DCF divided by

average outstanding shares, including restricted stock awards that

participate in dividends. (See the accompanying Table 2.)

Adjusted Segment EBDA is calculated

by adjusting segment earnings before DD&A and amortization of

excess cost of equity investments, general and administrative

expenses and corporate charges, interest expense, and income taxes

(Segment EBDA) for Certain Items attributable to the segment.

Adjusted Segment EBDA is used by management in its analysis of

segment performance and management of our business. We believe

Adjusted Segment EBDA is a useful performance metric because it

provides management, investors and other external users of our

financial statements additional insight into performance trends

across our business segments, our segments’ relative contributions

to our consolidated performance and the ability of our segments to

generate earnings on an ongoing basis. Adjusted Segment EBDA is

also used as a factor in determining compensation under our annual

incentive compensation program for our business segment presidents

and other business segment employees. We believe it is useful to

investors because it is a measure that management uses to allocate

resources to our segments and assess each segment’s performance.

(See the accompanying Table 4.)

Adjusted EBITDA is calculated by

adjusting net income attributable to Kinder Morgan, Inc. before

interest expense, income taxes, DD&A, and amortization of

excess cost of equity investments (EBITDA) for Certain Items. We

also include amounts from joint ventures for income taxes and

DD&A (see “Amounts from Joint

Ventures” below). Adjusted EBITDA (on a rolling 12-months

basis) is used by management, investors and other external users,

in conjunction with our Net Debt (as described further below), to

evaluate our leverage. Management and external users also use

Adjusted EBITDA as an important metric to compare the valuations of

companies across our industry. Our ratio of Net Debt-to-Adjusted

EBITDA is used as a supplemental performance target for purposes of

our annual incentive compensation program. We believe the GAAP

measure most directly comparable to Adjusted EBITDA is net income

attributable to Kinder Morgan, Inc. (See the accompanying Tables 3

and 6.)

Amounts from Joint Ventures -

Certain Items, DCF and Adjusted EBITDA reflect amounts from

unconsolidated joint ventures (JVs) and consolidated JVs utilizing

the same recognition and measurement methods used to record

“Earnings from equity investments” and “Noncontrolling interests

(NCI),” respectively. The calculations of DCF and Adjusted EBITDA

related to our unconsolidated and consolidated JVs include the same

items (DD&A and income tax expense, and for DCF only, also cash

taxes and sustaining capital expenditures) with respect to the JVs

as those included in the calculations of DCF and Adjusted EBITDA

for our wholly-owned consolidated subsidiaries; further, we remove

the portion of these adjustments attributable to non-controlling

interests. (See Tables 2, 3, and 6.) Although these amounts related

to our unconsolidated JVs are included in the calculations of DCF

and Adjusted EBITDA, such inclusion should not be understood to

imply that we have control over the operations and resulting

revenues, expenses or cash flows of such unconsolidated JVs.

Net Debt is calculated by

subtracting from debt (1) cash and cash equivalents, (2) debt fair

value adjustments, and (3) the foreign exchange impact on

Euro-denominated bonds for which we have entered into currency

swaps. Net Debt, on its own and in conjunction with our Adjusted

EBITDA (on a rolling 12-months basis) as part of a ratio of Net

Debt-to-Adjusted EBITDA, is a non-GAAP financial measure that is

used by management, investors and other external users of our

financial information to evaluate our leverage. Our ratio of Net

Debt-to-Adjusted EBITDA is also used as a supplemental performance

target for purposes of our annual incentive compensation program.

We believe the most comparable measure to Net Debt is total debt as

reconciled in the notes to the accompanying Preliminary

Consolidated Balance Sheets in Table 6.

Project EBITDA is calculated for an

individual capital project as earnings before interest expense,

taxes, DD&A and general and administrative expenses

attributable to such project, or for JV projects, consistent with

the methods described above under “Amounts from Joint Ventures,”

and in conjunction with capital expenditures for the project, is

the basis for our Project EBITDA multiple. Management, investors

and others use Project EBITDA to evaluate our return on investment

for capital projects before expenses that are generally not

controllable by operating managers in our business segments. We

believe the GAAP measure most directly comparable to Project EBITDA

is the portion of net income attributable to a capital project. We

do not provide the portion of budgeted net income attributable to

individual capital projects (the GAAP financial measure most

directly comparable to Project EBITDA) due to the impracticality of

predicting, on a project-by-project basis through the second full

year of operations, certain amounts required by GAAP, such as

projected commodity prices, unrealized gains and losses on

derivatives marked to market, and potential estimates for certain

contingent liabilities associated with the project completion.

FCF is calculated by reducing cash

flow from operations for capital expenditures (sustaining and

expansion), and FCF after dividends is calculated by further

reducing FCF for dividends paid during the period. FCF is used by

management, investors and other external users as an additional

leverage metric, and FCF after dividends provides additional

insight into cash flow generation. Therefore, we believe FCF is

useful to our investors. We believe the GAAP measure most directly

comparable to FCF is cash flow from operations. (See the

accompanying Table 7.)

Important Information Relating to

Forward-Looking Statements

This news release includes forward-looking statements within the

meaning of the U.S. Private Securities Litigation Reform Act of

1995 and Section 21E of the Securities Exchange Act of 1934.

Generally the words “expects,” “believes,” “anticipates,” “plans,”

“will,” “shall,” “estimates,” “projects,” and similar expressions

identify forward-looking statements, which are generally not

historical in nature. Forward-looking statements in this news

release include, among others, express or implied statements

pertaining to: the long-term demand for KMI’s assets and services;

energy evolution-related opportunities; KMI’s 2023 expectations;

anticipated dividends; and KMI’s capital projects, including

expected costs, completion timing and benefits of those projects.

Forward-looking statements are subject to risks and uncertainties

and are based on the beliefs and assumptions of management, based

on information currently available to them. Although KMI believes

that these forward-looking statements are based on reasonable

assumptions, it can give no assurance as to when or if any such

forward-looking statements will materialize nor their ultimate

impact on our operations or financial condition. Important factors

that could cause actual results to differ materially from those

expressed in or implied by these forward-looking statements

include: the timing and extent of changes in the supply of and

demand for the products we transport and handle; commodity prices;

counterparty financial risk; and the other risks and uncertainties

described in KMI’s reports filed with the Securities and Exchange

Commission (SEC), including its Annual Report on Form 10-K for the

year-ended December 31, 2022 (under the headings “Risk Factors” and

“Information Regarding Forward-Looking Statements” and elsewhere),

and its subsequent reports, which are available through the SEC’s

EDGAR system at www.sec.gov and on our website at

ir.kindermorgan.com. Forward-looking statements speak only as of

the date they were made, and except to the extent required by law,

KMI undertakes no obligation to update any forward-looking

statement because of new information, future events or other

factors. Because of these risks and uncertainties, readers should

not place undue reliance on these forward-looking statements.

Table 1

Kinder Morgan, Inc. and

Subsidiaries

Preliminary Consolidated

Statements of Income

(In millions, except per share

amounts, unaudited)

Three Months Ended

December 31,

% change

Year Ended

December 31,

% change

2023

2022

2023

2022

Revenues

$

4,038

$

4,579

$

15,334

$

19,200

Operating costs, expenses and other

Costs of sales (exclusive of items shown

separately below)

1,347

1,961

4,938

9,255

Operations and maintenance

745

695

2,807

2,655

Depreciation, depletion and

amortization

567

554

2,250

2,186

General and administrative

171

167

668

637

Taxes, other than income taxes

102

101

421

441

Loss (gain) on divestitures and

impairments, net

1

(2

)

(15

)

(32

)

Other expense (income), net

4

(1

)

2

(7

)

Total operating costs, expenses and

other

2,937

3,475

11,071

15,135

Operating income

1,101

1,104

4,263

4,065

Other income (expense)

Earnings from equity investments

231

239

838

803

Amortization of excess cost of equity

investments

(12

)

(18

)

(66

)

(75

)

Interest, net

(452

)

(426

)

(1,797

)

(1,513

)

Other, net

(44

)

(8

)

(37

)

55

Income before income taxes

824

891

3,201

3,335

Income tax expense

(206

)

(198

)

(715

)

(710

)

Net income

618

693

2,486

2,625

Net income attributable to NCI

(24

)

(23

)

(95

)

(77

)

Net income attributable to Kinder

Morgan, Inc.

$

594

$

670

$

2,391

$

2,548

Class P Shares

Basic and diluted earnings per share

$

0.27

$

0.30

(10

)%

$

1.06

$

1.12

(5

)%

Basic and diluted weighted average shares

outstanding

2,221

2,248

(1

)%

2,234

2,258

(1

)%

Declared dividends per share

$

0.2825

$

0.2775

2

%

$

1.13

$

1.11

2

%

Adjusted Earnings (1)

$

633

$

708

(11

)%

$

2,410

$

2,636

(9

)%

Adjusted Earnings per share (1)

$

0.28

$

0.31

(10

)%

$

1.07

$

1.16

(8

)%

Notes

(1)

Adjusted Earnings is Net income

attributable to Kinder Morgan, Inc. adjusted for Certain Items; see

Table 2 for a reconciliation. Adjusted Earnings per share uses

Adjusted Earnings and applies the same two-class method used in

arriving at basic earnings per share.

Table 2

Kinder Morgan, Inc. and

Subsidiaries

Preliminary Net Income

Attributable to Kinder Morgan, Inc. to Adjusted Earnings and DCF

Reconciliations

(In millions, except per share

amounts, unaudited)

Three Months Ended

December 31,

% change

Year Ended

December 31,

% change

Preliminary Net Income Attributable to

Kinder Morgan, Inc. to Adjusted Earnings

2023

2022

2023

2022

Net income attributable to Kinder

Morgan, Inc.

$

594

$

670

(11

)%

$

2,391

$

2,548

(6

)%

Certain Items (1)

Fair value amortization

—

(4

)

—

(15

)

Legal, environmental and other

reserves

—

28

—

51

Change in fair value of derivative

contracts

(33

)

8

(126

)

57

Loss on impairment

—

—

67

—

Income tax Certain Items

27

(2

)

33

(37

)

Other

45

8

45

32

Total Certain Items

39

38

3

%

19

88

(78

)%

Adjusted Earnings

$

633

$

708

(11

)%

$

2,410

$

2,636

(9

)%

Preliminary Net Income Attributable to

Kinder Morgan, Inc. to DCF

Net income attributable to Kinder

Morgan, Inc.

$

594

$

670

(11

)%

$

2,391

$

2,548

(6

)%

Total Certain Items (2)

39

38

3

%

19

88

(78

)%

DD&A

567

554

2,250

2,186

Amortization of excess cost of equity

investments

12

18

66

75

Income tax expense (3)

179

200

682

747

Cash taxes

(1

)

(1

)

(11

)

(13

)

Sustaining capital expenditures

(275

)

(263

)

(868

)

(761

)

Amounts from joint ventures

Unconsolidated JV DD&A

82

81

323

323

Remove consolidated JV partners'

DD&A

(16

)

(16

)

(63

)

(50

)

Unconsolidated JV income tax expense

(4)(5)

19

21

89

75

Unconsolidated JV cash taxes (4)

(3

)

(19

)

(76

)

(70

)

Unconsolidated JV sustaining capital

expenditures

(45

)

(59

)

(163

)

(148

)

Remove consolidated JV partners'

sustaining capital expenditures

3

2

9

8

Other items (6)

16

(9

)

67

(38

)

DCF

$

1,171

$

1,217

(4

)%

$

4,715

$

4,970

(5

)%

Weighted average shares outstanding for

dividends (7)

2,234

2,261

2,247

2,271

DCF per share

$

0.52

$

0.54

(4

)%

$

2.10

$

2.19

(4

)%

Declared dividends per share

$

0.2825

$

0.2775

$

1.13

$

1.11

Notes

(1)

See table included in “Non-GAAP Financial

Measures—Certain Items.”

(2)

See “Preliminary Net Income Attributable

to Kinder Morgan, Inc. to Adjusted Earnings” above for a detailed

listing.

(3)

To avoid duplication, adjustments for

income tax expense for the periods ended December 31, 2023 and 2022

exclude $27 million and $(2) million for the three-month periods,

respectively, and $33 million and $(37) million for the

twelve-month periods, respectively, which amounts are already

included within “Certain Items.” See table included in “Non-GAAP

Financial Measures—Certain Items.”

(4)

Associated with our Citrus, NGPL and

Products (SE) Pipe Line equity investments.

(5)

Includes the tax provision on Certain

Items recognized by the investees that are taxable entities. The

impact of KMI’s income tax provision on Certain Items affecting

earnings from equity investments is included within “Certain Items”

above. See table included in “Non-GAAP Financial Measures—Certain

Items.”

(6)

Includes non-cash pension expense,

non-cash compensation associated with our restricted stock program

and pension contributions.

(7)

Includes restricted stock awards that

participate in dividends.

Table 3

Kinder Morgan, Inc. and

Subsidiaries

Preliminary Net Income

Attributable to Kinder Morgan, Inc. to Adjusted EBITDA

Reconciliation

(In millions,

unaudited)

Three Months Ended

December 31,

% change

Year Ended

December 31,

% change

2023

2022

2023

2022

Net income attributable to Kinder

Morgan, Inc.

$

594

$

670

(11

)%

$

2,391

$

2,548

(6

)%

Certain Items (1)

Fair value amortization

—

(4

)

—

(15

)

Legal, environmental and other

reserves

—

28

—

51

Change in fair value of derivative

contracts

(33

)

8

(126

)

57

Loss on impairment

—

—

67

—

Income tax Certain Items

27

(2

)

33

(37

)

Other

45

8

45

32

Total Certain Items

39

38

19

88

DD&A

567

554

2,250

2,186

Amortization of excess cost of equity

investments

12

18

66

75

Income tax expense (2)

179

200

682

747

Interest, net (3)

449

391

1,804

1,524

Amounts from joint ventures

Unconsolidated JV DD&A

82

81

323

323

Remove consolidated JV partners'

DD&A

(16

)

(16

)

(63

)

(50

)

Unconsolidated JV income tax expense

(4)

19

21

89

75

Adjusted EBITDA

$

1,925

$

1,957

(2

)%

$

7,561

$

7,516

1

%

Notes

(1)

See table included in “Non-GAAP Financial

Measures—Certain Items.”

(2)

To avoid duplication, adjustments for

income tax expense for the periods ended December 31, 2023 and 2022

exclude $27 million and $(2) million for the three-month periods,

respectively, and $33 million and $(37) million for the

twelve-month periods, respectively, which amounts are already

included within “Certain Items.” See table included in “Non-GAAP

Financial Measures—Certain Items.”

(3)

To avoid duplication, adjustments for

interest, net for the periods ended December 31, 2023 and 2022

exclude $3 million and $35 million for the three-month periods,

respectively, and $(7) million and $(11) million for the

twelve-month periods, respectively, which amounts are already

included within “Certain Items.” See table included in “Non-GAAP

Financial Measures—Certain Items.”

(4)

Includes the tax provision on Certain

Items recognized by the investees that are taxable entities

associated with our Citrus, NGPL and Products (SE) Pipe Line equity

investments. The impact of KMI’s income tax provision on Certain

Items affecting earnings from equity investments is included within

“Certain Items” above.

Table 4

Kinder Morgan, Inc. and

Subsidiaries

Preliminary Reconciliation of

Segment EBDA to Adjusted Segment EBDA

(In millions,

unaudited)

Three Months Ended

December 31,

Year Ended

December 31,

2023

2022

2023

2022

Segment EBDA (1)

Natural Gas Pipelines Segment EBDA

$

1,353

$

1,348

$

5,282

$

4,801

Certain Items (2)

Legal, environmental and other

reserves

—

28

—

51

Change in fair value of derivative

contracts

(23

)

(25

)

(122

)

64

Other

—

2

—

26

Natural Gas Pipelines Adjusted Segment

EBDA

$

1,330

$

1,353

$

5,160

$

4,942

Products Pipelines Segment EBDA

$

282

$

252

$

1,062

$

1,107

Certain Items (2)

Change in fair value of derivative

contracts

(4

)

—

(1

)

—

Loss on impairment

—

—

67

—

Products Pipelines Adjusted Segment

EBDA

$

278

$

252

$

1,128

$

1,107

Terminals Segment EBDA

$

266

$

244

$

1,040

$

975

CO2 Segment EBDA

$

179

$

200

$

689

$

819

Certain Items (2)

Change in fair value of derivative

contracts

(9

)

(6

)

4

(11

)

CO2 Adjusted Segment EBDA

$

170

$

194

$

693

$

808

Notes

(1)

Includes revenues, earnings from equity

investments, operating expenses, loss (gain) on divestitures and

impairments, net, other income, net, and other, net. Operating

expenses include costs of sales, operations and maintenance

expenses, and taxes, other than income taxes. The composition of

Segment EBDA is not addressed nor prescribed by generally accepted

accounting principles.

(2)

See “Non-GAAP Financial Measures—Certain

Items.”

Table 5

Segment Volume and CO2 Segment

Hedges Highlights

(Historical data is pro forma

for acquired and divested assets, JV volumes at KMI share)

Three Months Ended

December 31,

Year Ended

December 31,

2023

2022

2023

2022

Natural Gas Pipelines (1)

Transport volumes (BBtu/d)

41,461

39,572

40,282

38,657

Sales volumes (BBtu/d)

2,466

2,366

2,346

2,482

Gathering volumes (BBtu/d)

3,973

3,132

3,562

2,994

NGLs (MBbl/d)

35

33

34

30

Products Pipelines (MBbl/d)

Gasoline (2)

967

965

980

978

Diesel fuel

358

360

351

367

Jet fuel

288

268

285

264

Total refined product volumes

1,613

1,593

1,616

1,609

Crude and condensate

489

455

483

471

Total delivery volumes (MBbl/d)

2,102

2,048

2,099

2,080

Terminals (1)

Liquids leasable capacity (MMBbl)

78.7

78.2

78.7

78.2

Liquids leased capacity %

93.3

%

92.2

%

93.6

%

91.3

%

Bulk transload tonnage (MMtons)

13.5

13.2

53.3

53.2

CO2 (1)

SACROC oil production (3)

19.42

21.13

20.22

20.29

Yates oil production

6.58

6.52

6.63

6.52

Other

2.16

2.55

2.32

2.75

Total oil production - net (MBbl/d)

(4)

28.16

30.20

29.17

29.56

NGL sales volumes - net (MBbl/d) (4)

9.11

9.20

8.97

9.40

CO2 sales volumes - net (Bcf/d)

0.328

0.377

0.336

0.358

RNG sales volumes (BBtu/d)

7

4

6

3

Realized weighted average oil price ($ per

Bbl)

$

67.22

$

65.06

$

67.42

$

66.78

Realized weighted average NGL price ($ per

Bbl)

$

27.87

$

35.26

$

30.84

$

39.59

CO2 Segment Hedges

2024

2025

2026

2027

2028

Crude Oil (5)

Price ($ per Bbl)

$

65.27

$

63.91

$

65.16

$

64.38

$

61.40

Volume (MBbl/d)

21.00

12.85

8.60

3.60

0.10

NGLs

Price ($ per Bbl)

$

51.58

Volume (MBbl/d)

3.20

Notes

(1)

Volumes for acquired assets are included

for all periods, however, EBDA contributions from acquisitions are

included only for periods subsequent to their acquisition. Volumes

for assets divested, idled and/or held for sale are excluded for

all periods presented.

(2)

Gasoline volumes include ethanol pipeline

volumes.

(3)

Includes volumetric data for Diamond

M.

(4)

Net of royalties and outside working

interests.

(5)

Includes West Texas Intermediate

hedges.

Table 6

Kinder Morgan, Inc. and

Subsidiaries

Preliminary Consolidated

Balance Sheets (1)

(In millions,

unaudited)

December 31,

December 31,

2023

2022

Assets

Cash and cash equivalents

$

83

$

745

Other current assets

2,459

3,058

Property, plant and equipment, net

37,216

35,599

Investments

8,073

7,653

Goodwill

19,971

19,965

Deferred charges and other assets

3,219

3,058

Total assets

$

71,021

$

70,078

Liabilities and Stockholders'

Equity

Short-term debt

$

4,049

$

3,385

Other current liabilities

3,172

3,545

Long-term debt

27,880

28,288

Debt fair value adjustments

187

115

Other

4,003

2,631

Total liabilities

39,291

37,964

Other stockholders' equity

30,523

31,144

Accumulated other comprehensive loss

(217

)

(402

)

Total KMI stockholders' equity

30,306

30,742

Noncontrolling interests

1,424

1,372

Total stockholders' equity

31,730

32,114

Total liabilities and stockholders'

equity

$

71,021

$

70,078

Net Debt (2)

$

31,837

$

30,936

Adjusted EBITDA Twelve Months

Ended (3)

Reconciliation of Net Income

Attributable to Kinder Morgan, Inc. to Last Twelve Months Adjusted

EBITDA

December 31,

December 31,

2023

2022

Net income attributable to Kinder

Morgan, Inc.

$

2,391

$

2,548

Total Certain Items (4)

19

88

DD&A

2,250

2,186

Amortization of excess cost of equity

investments

66

75

Income tax expense (5)

682

747

Interest, net (5)

1,804

1,524

Amounts from joint ventures

Unconsolidated JV DD&A

323

323

Less: Consolidated JV partners'

DD&A

(63

)

(50

)

Unconsolidated JV income tax expense

89

75

Adjusted EBITDA

$

7,561

$

7,516

Net Debt-to-Adjusted EBITDA (6)

4.2

4.1

Notes

(1)

The December 31, 2023 Preliminary

Consolidated Balance Sheet reflects a preliminary assessment of

fair values for the assets and liabilities from the STX Midstream

acquisition that closed on December 28, 2023, and as such, the

allocation of the purchase price within our consolidated balance

sheet could be adjusted for the 2023 10-K filing.

(2)

Amounts calculated as total debt, less (i)

cash and cash equivalents; (ii) debt fair value adjustments; and

(ii) the foreign exchange impact on our Euro denominated debt of $9

million and $(8) million as of December 31, 2023 and December 31,

2022, respectively, as we have entered into swaps to convert that

debt to U.S.$.

(3)

Reflects the rolling 12-month amounts for

each period above.

(4)

See table included in “Non-GAAP Financial

Measures—Certain Items.”

(5)

Amounts are adjusted for Certain Items.

See “Non-GAAP Financial Measures—Certain Items” for more

information.

(6)

Year-end 2023 net debt reflects borrowings

to fund the STX Midstream acquisition that closed on December 28,

2023. Including a full year of Adjusted EBITDA from the acquired

assets on a Pro Forma basis, the leverage ratio would have been

4.1x.

Table 7

Kinder Morgan, Inc. and

Subsidiaries

Preliminary Supplemental

Information

(In millions,

unaudited)

Three Months Ended

December 31,

Year Ended

December 31,

2023

2022

2023

2022

KMI FCF

Net income attributable to Kinder Morgan,

Inc.

$

594

$

670

$

2,391

$

2,548

Net income attributable to noncontrolling

interests

24

23

95

77

DD&A

567

554

2,250

2,186

Amortization of excess cost of equity

investments

12

18

66

75

Deferred income taxes

215

193

710

692

Earnings from equity investments

(231

)

(239

)

(838

)

(803

)

Distribution of equity investment earnings

(1)

183

177

755

725

Working capital and other items (2)(3)

958

8

1,062

(533

)

Cash flow from operations

2,322

1,404

6,491

4,967

Capital expenditures (GAAP)

(628

)

(477

)

(2,317

)

(1,621

)

FCF

1,694

927

4,174

3,346

Dividends paid

(631

)

(628

)

(2,529

)

(2,504

)

FCF after dividends

$

1,063

$

299

$

1,645

$

842

Notes

(1)

Periods ended December 31, 2023 and 2022

exclude distributions from equity investments in excess of

cumulative earnings of $62 million and $30 million for the

three-month periods, respectively, and $228 million and $156

million for the twelve-month periods, respectively. These are

included in cash flows from investing activities on our

consolidated statement of cash flows.

(2)

Three-month and twelve-month periods of

2023 include $843 million for cash received related to an agreement

with a customer to prepay certain fixed reservation charges under

long-term transportation and terminaling contracts. The prepayment,

which relates to contracts expiring from 2035 to 2040, was

discounted to present value at a rate that is attractive relative

to our cost of issuing long-term debt.

(3)

Includes non-cash impairments recognized.

See table included in “Non-GAAP Financial Measures—Certain Items”

for more information.

Table 8

Kinder Morgan, Inc. and

Subsidiaries

Reconciliation of Projected

Net Income Attributable to Kinder Morgan, Inc. to Projected

DCF

(In billions,

unaudited)

2024 Revised Budget

Net income attributable to Kinder

Morgan, Inc. (GAAP)

$

2.7

Total Certain Items

—

DD&A and amortization of excess cost

of equity investments

2.4

Income tax expense

0.8

Cash taxes

(0.1

)

Sustaining capital expenditures

(1.0

)

Amounts from joint ventures

Unconsolidated JV DD&A

0.3

Remove consolidated JV partners'

DD&A

—

Unconsolidated JV income tax expense

0.1

Unconsolidated JV cash taxes

(0.1

)

Unconsolidated JV sustaining capital

expenditures

(0.2

)

Remove consolidated JV partners'

sustaining capital expenditures

—

Other items (1)

0.1

DCF

$

5.0

Current commodity price impact to DCF

(2)(3)

(0.1

)

DCF with current commodity price

impact

$

4.9

Table 9

Kinder Morgan, Inc. and

Subsidiaries

Reconciliation of Projected

Net Income Attributable to Kinder Morgan, Inc. to Projected

Adjusted EBITDA

(In billions,

unaudited)

2024 Revised Budget

Net income attributable to Kinder

Morgan, Inc. (GAAP)

$

2.7

Total Certain Items

—

DD&A and amortization of excess cost

of equity investments

2.4

Income tax expense

0.8

Interest, net

1.9

Amounts from joint ventures

Unconsolidated JV DD&A

0.3

Remove consolidated JV partners'

DD&A

—

Unconsolidated JV income tax expense

0.1

Adjusted EBITDA

$

8.2

Notes

(1)

Includes non-cash pension expense,

non-cash compensation associated with our restricted stock program

and pension contributions.

(2)

Includes commodity price impact to Net

income attributable to KMI based on a WTI Crude oil price of $72

per barrel and Henry Hub natural gas price of $2.80 per MMBtu.

(3)

Includes $(0.1) billion adjustment to Net

income attributable to Kinder Morgan, Inc. and less than $(0.1)

billion associated reduction in income tax expense.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240117208156/en/

Dave Conover Media Relations Newsroom@kindermorgan.com

Investor Relations (800) 348-7320 km_ir@kindermorgan.com

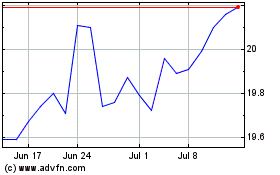

Kinder Morgan (NYSE:KMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

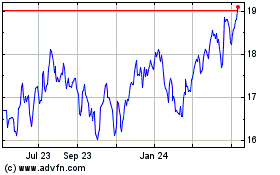

Kinder Morgan (NYSE:KMI)

Historical Stock Chart

From Apr 2023 to Apr 2024