0001671933false00016719332024-01-172024-01-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 17, 2024

THE TRADE DESK, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 001-37879 | 27-1887399 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

42 N. Chestnut Street

Ventura, California 93001

(Address of principal executive offices) (Zip Code)

(805) 585-3434

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

Class A Common Stock, par value $0.000001 per share | | TTD | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(d)

Effective January 17, 2024, the Board of Directors (the “Board”) of The Trade Desk, Inc. (the “Company”) appointed Samantha Jacobson, the Company’s Chief Strategy Officer, to the Board as a Class II director to serve for a term expiring at the 2024 Annual Meeting of Stockholders and until her successor is duly elected and qualified. Ms. Jacobson was appointed to fill the previously announced vacancy on the Board created by the resignation of David R. Pickles. Ms. Jacobson has not been appointed to serve on any committee of the Board. The Company will enter into an indemnification agreement with Ms. Jacobson in substantially the same form entered into with the other officers and directors of the Company.

There are no arrangements or understandings between Ms. Jacobson, on the one hand, and any other persons, on the other hand, pursuant to which Ms. Jacobson was selected as a director of the Company. Ms. Jacobson has no family relationship with any director or executive officer of the Company, and is not a party to any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

A copy of the press release announcing this appointment is filed as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 8.01 Other Events.

Officer Appointments

On January 17, 2024, the Company announced the promotion of Tim Sims from his position as Chief Revenue Officer to the newly formed role of Chief Commercial Officer and the promotion of Jed Dederick to Chief Revenue Officer. A copy of the press release announcing these appointments is filed as Exhibit 99.2 to this Current Report on Form 8-K and incorporated herein by reference.

Investor Presentation

On January 17, 2024, the Company posted to its website a new investor presentation (the “Presentation”) for use in meetings with investors and others. A copy of the Presentation is filed as Exhibit 99.3 to this Current Report on Form 8-K and incorporated herein by reference.

Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements relating to the Company’s financial targets, such as revenue and Adjusted EBITDA, the industry in which the Company participates, market trends and the Company’s corporate governance goals. Any forward-looking statements contained in this Current Report on Form 8-K are based upon the Company’s historical performance and its current plans, estimates and expectations, and are not a representation that such plans, estimates or expectations will be achieved. These forward-looking statements represent the Company’s expectations as of the date of this Current Report on Form 8-K, and involve risks, uncertainties and assumptions. The actual results may differ materially from those anticipated in the forward-looking statements as a result of numerous factors, many of which are beyond the control of the Company, including the risks and uncertainties disclosed in the Company’s reports filed from time to time with the Securities and Exchange Commission, including its most recent Form 10‑K and any subsequent filings on Forms 10-Q or 8-K, available at www.sec.gov. The Company does not intend to update any forward-looking statement contained in this Current Report on Form 8-K to reflect events or circumstances arising after the date hereof.

Item 9.01 Financial Statements and Exhibits.

(d) The following exhibits are being filed herewith:

| | | | | | | | |

Exhibit No. | | Description |

| 99.1 | | |

99.2 | | |

99.3 | | |

104 | | Cover Page Interactive Data File (formatted as Inline XBRL). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| THE TRADE DESK, INC.

|

| | |

Date: January 17, 2024 | By: | /s/ Jay R. Grant |

| | Jay R. Grant |

| | Chief Legal Officer |

| | |

The Trade Desk’s Chief Strategy Officer, Samantha Jacobson, Joins the Company’s Board of Directors

Ventura, CA – January 17, 2024 – Global advertising technology leader The Trade Desk (Nasdaq: TTD) today announced that Samantha Jacobson has joined its board of directors. As Chief Strategy Officer and Executive Vice President, Jacobson manages the company’s strategic investments, partnerships and cross-functional initiatives to reinforce The Trade Desk’s position as an industry leader.

“I’m thrilled to have Samantha join our board of directors,” said Jeff Green, CEO and Co-Founder, The Trade Desk. “Samantha has played an important role in advancing key strategic initiatives for The Trade Desk over the last three years, including Unified ID 2.0. Her leadership is helping create the new identity fabric of the internet in a way that increases value for advertisers, publishers and consumers.”

“I’m excited to join The Trade Desk board of directors at a time when our company and the industry are undergoing such a transformational shift in how we apply data to make advertising as powerful and valuable as possible,” said Jacobson. “The Trade Desk has emerged as an industry leader since its founding 14 years ago, and we have a tremendous opportunity to help the advertising industry grow in a way that maximizes competition, objectivity and value. I look forward to providing my expertise to Jeff and the board in this new role.”

Jacobson joined The Trade Desk after six years at Oracle where she managed the global business development and strategy team. Prior to Oracle, Samantha served as Director of Strategic Partnerships at Datalogix where she crafted alliances with industry giants including Twitter, Pinterest, Microsoft, Google, and Apple.

Jacobson holds a Bachelor of Science in Economics degree from The Wharton School at the University of Pennsylvania with concentrations in Finance and Management, and received her Masters in Business Administration from Harvard Business School.

About The Trade Desk

The Trade Desk™ is a technology company that empowers buyers of advertising. Through its self-service, cloud-based platform, ad buyers can create, manage, and optimize digital advertising campaigns across ad formats and devices. Integrations with major data, inventory, and publisher partners ensure maximum reach and decisioning capabilities, and enterprise APIs enable custom development on top of the platform. Headquartered in Ventura, CA, The Trade Desk has offices across North America, Europe, and Asia Pacific. To learn more, visit thetradedesk.com or follow us on Facebook, Twitter, LinkedIn and YouTube.

Media Contact

Melinda Zurich

The Trade Desk

melinda.zurich@thetradedesk.com

The Trade Desk Announces Changes on Senior Leadership Team

Tim Sims named Chief Commercial Officer

Jed Dederick becomes Chief Revenue Officer

Ventura, CA – January 17, 2024 – Global advertising technology leader The Trade Desk (Nasdaq: TTD) today announced changes to its senior leadership team to further advance the company’s growth strategy globally. Tim Sims is appointed to a new role as Chief Commercial Officer, and Jed Dederick is promoted to the role of Chief Revenue Officer. Both Sims and Dederick will report to Jeff Green, The Trade Desk’s Co-Founder and CEO.

“The Trade Desk has grown more rapidly and gained more market share in the last four years than at any point in our history, and these leadership appointments ensure that we are well positioned to continue on that high-growth trajectory,” said Jeff Green, CEO and Co-Founder, The Trade Desk. “I have worked with Tim and Jed for many years, and I could not be more excited to see them help The Trade Desk achieve its ambitious growth goals, all while providing the highest possible level of client support.”

In the newly formed role as Chief Commercial Officer, Sims is responsible for The Trade Desk’s global client services organization as well as the company’s global inventory teams. This new role brings together key commercial teams critical to the success of The Trade Desk’s growth strategy. A 10-year veteran of The Trade Desk, Sims has risen through the organization, most recently serving as the company’s Chief Revenue Officer, and prior to that as Senior Vice President, Inventory Partnerships.

“The advertising industry is evolving rapidly, and the scope of our supply side partnerships is expanding. At the same time, our clients are looking to make the most of these partnerships in the context of breakthrough technology innovations, including Kokai,” said Sims. “I look forward to bringing these key teams together as part of a new commercial organization aimed at furthering the company’s market leadership.”

With more than 12 years at The Trade Desk, Dederick is promoted to the role of Chief Revenue Officer, responsible for driving revenue generation across the organization globally. Prior to this role, Dederick was the Chief Client Officer, overseeing the company’s top brand and client relationships.

“As more brands and agencies embrace the power of data-driven advertising, we have an incredible opportunity to partner in new ways around the world, bringing powerful innovation to their fingertips,” said Dederick. “One of our strengths has always been our industry-leading client support, and I look forward to building on that legacy in this new role.”

About The Trade Desk

The Trade Desk™ is a technology company that empowers buyers of advertising. Through its self-service, cloud-based platform, ad buyers can create, manage, and optimize digital advertising campaigns across ad formats and devices. Integrations with major data, inventory,

and publisher partners ensure maximum reach and decisioning capabilities, and enterprise APIs enable custom development on top of the platform. Headquartered in Ventura, CA, The Trade Desk has offices across North America, Europe, and Asia Pacific. To learn more, visit thetradedesk.com or follow us on Facebook, Twitter, LinkedIn and YouTube.

Media Contact

Melinda Zurich

The Trade Desk

melinda.zurich@thetradedesk.com

STOCKHOLDER STEWARDSHIP MEETINGS January 2024 Exhibit 99.3

The Trade Desk Our platform empowers ad buyers to make data-driven decisions when selecting the impressions they buy, the content they support and the channels they use to most effectively reach their target audiences; importantly, without compromising consumer privacy. Most ad buyers are ad agencies, brands or other technology companies.

We are targeting a massive TAM Source: Magna Global, Estimated 2023 Global Ad Spending and Company Reports. “We believe advertising will be transacted digitally. The future of all media is digital and programmatic… Eventually all media will be digital, and it will be transacted by machines. – CEO OF A GLOBAL MEDIA INVESTMENT MANAGEMENT GROUP ~$830B ~$250B ~$135B TOTAL GLOBAL AD SPENDING LINEAR TELEVISION DIGITAL MEDIA (EX-SEARCH AND SOCIAL)

$65 $95 $159 $214 $284 $503 $668 $758 2016A 2017A 2018A 2019A 2020A 2021A 2022A 2023E $203 $308 $477 $661 $836 $1,196 $1,578 $1,920 2016A 2017A 2018A 2019A 2020A 2021A 2022A 2023E The Trade Desk by the Numbers 2009 Founded 2,770+ Employees ~$830bn Total Global Ad Spend (TAM)(2) 2016 IPO REVENUE(1) 32%43%26%39%55%52%% Growth 32% 42%42%34%32%33%31%% Margin (1) (1) ($ in millions) ADJ. EBITDA(1) ($ in millions) (1) Company reports, SEC Filings (2) Magna Global, estimated 2023 global ad spending.

+ 61% (10)% + 520% + 3,898% + 54% + 31% + 166% + 247% + 65% (64)% + 199% + 476% (7)% (53)% + 15% + 39% 1 Year 3 Years 5 Years Since IPO Source: FactSet as of December 31, 2023. (1) Proxy peers reflects current public companies, including CRWD, DDOG, DOCU, HUBS, OKTA, PINS, RNG, ROKU, SHOP, SNAP, TWLO, ZM, and ZS (2) 2016 Tech IPO peers include Technology companies with a current market capitalization greater than $100mm as of December 31, 2023. (3) TTD first started trading on Nasdaq on September 21, 2016. 2016 Tech IPOs occurring after TTD are priced based on each respective IPO date. Benchmarked Total Shareholder Returns NASDAQ 100 Proxy Peers(1) 2016 Tech IPOs(2) (3)

Meeting agenda

The Road Ahead > Board Decision Framework Company Vision • Committed to making digital advertising better. The future of the open internet depends on it • TTD strives to be the top independent alternative to tech giants • Advertisers need options beyond walled gardens • Vision and Agility → Proven Competitive Advantage Board’s Decision Framework • Balance short- and long-term considerations for the benefit of our stockholders • Board commitment to increasing interactions with stockholders • Align pay with performance to retain and motivate executive officers Throughout its history, The Trade Desk has demonstrated its commitment to long- term stockholder value creation by investing ahead of key technology transitions. Board Decision Framework

The Road Ahead > Board Decision Framework > Executive Compensation 2021 CEO Performance Option Current StatusGoal • Proactively align executive incentives with long-term value creation Mechanism • 100% Performance-based • Ultra long-term (10 years) • “Stretch” vesting hurdles – designed to be a win for stockholders Stock Price Achievement Premium to Stock Price Vesting Condition at Grant Date Vested? In the Money? $90 + 32% � $115 + 68% $145 + 112% $185 + 171% $225 + 229% $260 + 281% $300 + 339% $340 + 398% Stock Price (Grant Date): $68.29

The Road Ahead > Board Decision Framework > Sustainability Goal • Communicate the company’s strategy as it relates to sustainability Approach • Create a baseline for energy emissions • Increase transparency in regard to social and diversity initiatives • Highlight strategy and achievements in areas of governance Current Status • Deepen engagement with stakeholders to help broaden perspectives and hear diverse opinions Sustainability

The Road Ahead > Board Decision Framework > Corporate Governance Goal • Transparently maintain strict adherence to corporate governance standards • Focus on shareholder returns by enabling operational agility and flexibility in a very competitive and constantly evolving marketplace Structure • Created lead independent director role • Strong board composition; added expertise / increased diversity • One director (or two depending on board size) is elected by the Class A stockholders • Extended dual class structure (2020) through MFW process Current Status • Feedback always welcome and encouraged Corporate Governance — Board Composition and Dual Class Structure

Thank you

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

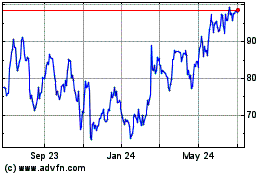

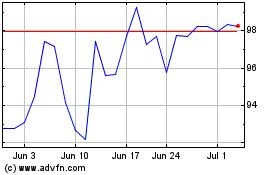

The Trade Desk (NASDAQ:TTD)

Historical Stock Chart

From Mar 2024 to Apr 2024

The Trade Desk (NASDAQ:TTD)

Historical Stock Chart

From Apr 2023 to Apr 2024