false

0000806172

SONO TEK CORP

0000806172

2024-01-16

2024-01-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 16, 2024

Sono-Tek Corporation

(Exact name of registrant as specified in its charter)

Commission File Number: 000-16035

| New York |

|

14-1568099 |

| (State of Incorporation) |

|

(I.R.S. Employer ID No.) |

| |

|

|

| 2012 Route 9W, Milton, New York |

|

12547 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (845)

795-2020

Check appropriate box below if the Form 8-K filing is intended to simultaneously satisfy

the filing obligations of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading

Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.01 par value per share |

SOTK |

NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined

in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2

of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02: Results of Operations and Financial Condition.

Item 7.01: Regulation FD Disclosure

On January 16, 2024, Sono-Tek Corporation issued a press release regarding its financial

results for the three months ended November 30, 2023 in the form attached as exhibit 99.1.

The information furnished pursuant to this Item 7.01, including Exhibit 99.1, shall not

be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)

or otherwise subject to the liabilities under such section and shall not be deemed to be incorporated by reference into any filing of

the Company under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01: Financial Statements and Exhibits.

(d) Exhibits

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has

duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

SONO-TEK CORPORATION

By: /s/ Stephen J. Bagley

Stephen J. Bagley

Chief Financial Officer

January 16, 2024

Exhibit 99.1

Sono-Tek Reports 59% Increase in Q3 Fiscal 2024 Net Sales

to Record $5.7 Million and Provides Sales Guidance for Fiscal Year 2024

- Q3 Backlog Increased 96% YOY and

Remains Strong at Near Record $10.4 Million -

- Projects ~30% Revenue Growth for Fiscal Year 2024, ending

February 29, 2024-

MILTON, N.Y., January 16, 2024 – Sono-Tek

Corporation (Nasdaq: SOTK), the leading developer and manufacturer of ultrasonic coating systems, today reported financial results

for the third quarter and first nine months of fiscal year 2024, ended November 30, 2023.

Third Quarter Fiscal 2024 Highlights (compared with

the third quarter of fiscal 2023 unless otherwise noted). The three-month periods ended November 30, 2023 and 2022 are referred to as

the third quarter of fiscal 2024 and fiscal 2023, respectively.

- Net Sales increased to a

record $5,690,000, driven by strong shipments to the Alternative/Clean Energy and Medical markets. Net Sales

increased 59% compared to $3,586,000 for the third quarter of fiscal 2023.

- Gross Profit increased 60% to $2,926,000

and Gross Margin remained steady at 51%.

- Operating income increased

600% to $721,000 from $103,000, primarily due to the increase in gross profit partially offset by increases in operating expenses.

- Income before taxes increased

569% to $890,000 from $133,000, fueled by positive operating leverage from the strong increase in quarterly sales.

- As of November 30, 2023,

the Company had no outstanding debt and cash, cash equivalents and marketable securities totaling $12.6 million.

- Despite record sales, backlog

at quarter end remained strong at $10,439,000, a year-over-year increase of 96% and roughly even with the record high backlog of the

previous quarter.

- Revenue growth of approximately

30% is expected for the full fiscal year ending February 29, 2024, a record high and a result of increasing shipments from Sono-Tek’s

strong backlog and projected new and [repeat or reoccurring?] orders.

“Sono-Tek reported its strongest quarter ever for the third

quarter of FY2024 ended November 30th,” said Dr. Christopher L. Coccio, Executive Chairman. “Significant improvements in our

supply chain enabled us to ship both new orders and from backlog, resulting in record net sales of $5.7 million, an increase of 59% compared

to net sales of $3.6 million in the comparable period last year. Sales growth was again driven by strong shipments to the alternative/clean

energy and medical markets.

“Operating Income increased over 6-fold to $721,000 due to the

large increase in sales and gross profit, offset by increases in operating expenses, which reflects continued investment in revenue-related

activities, especially R&D and sales and marketing. Net Income increased nearly 6-fold as well.

“Backlog remained high despite the record sales and nearly doubled

from a year ago to $10.4 million. This is the second highest reported backlog in our history - the second quarter of this year was the

highest - and it reflects the increasing order activity from the clean energy sector in particular, as well as continuing strength in

our other business segments.

“We recently increased our projections for the full fiscal year

ending February 29, 2024, and now expect net sales to grow approximately 30% over last fiscal year. This will be a record high for the

Company and is the result of increasing shipments from our strong backlog and orders from new and repeat customers. We look forward to

closing out a record year and entering the new fiscal year with a strong foundation and continued momentum,” concluded Dr. Coccio.

| Third Quarter Fiscal 2024 Results |

| ($ in thousands) |

|

| | |

Three Months Ended November 30, | | |

Change | |

| | |

2023 | | |

2022 | | |

$ | | |

% | |

| Net Sales | |

$ | 5,690 | | |

$ | 3,586 | | |

| 2,104 | | |

| 59% | |

| Gross Profit | |

$ | 2,926 | | |

$ | 1,824 | | |

| 1,002 | | |

| 57% | |

| Gross Margin | |

| 51% | | |

| 51% | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Income | |

$ | 721 | | |

$ | 103 | | |

$ | 618 | | |

| 600% | |

| Operating Margin | |

| 13% | | |

| 3% | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Income | |

$ | 690 | | |

$ | 105 | | |

$ | 585 | | |

| 557% | |

| Net Margin | |

| 12% | | |

| 3% | | |

| | | |

| | |

| Nine Month Fiscal 2024 Results |

| ($ in thousands) |

|

| | |

Nine Months Ended November 30, | | |

Change | |

| | |

2023 | | |

2022 | | |

$ | | |

% | |

| Net Sales | |

$ | 14,932 | | |

$ | 11,401 | | |

| 3,531 | | |

| 31% | |

| Gross Profit | |

$ | 7,504 | | |

$ | 5,827 | | |

| 1,677 | | |

| 29% | |

| Gross Margin | |

| 50% | | |

| 51% | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Income | |

$ | 1,195 | | |

$ | 662 | | |

| 533 | | |

| 81% | |

| Operating Margin | |

| 8% | | |

| 6% | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Income | |

$ | 1,285 | | |

$ | 573 | | |

| 712 | | |

| 124% | |

| Net Margin | |

| 9% | | |

| 5% | | |

| | | |

| | |

Third Quarter Fiscal 2024 Sales Overview

Net sales increased 59% to $5,690,000 compared to $3,586,000 in the

third quarter of fiscal 2023. The increase was primarily driven by increased demand for Multi-Axis Coating systems which grew 98% in the

third quarter, and are commonly used in the clean energy and medical device markets. Integrated Coating System sales accelerated by 635%

due to continued success from Sono-Tek’s newly developed float glass coating platform as well as a newly completed custom built

system for an important strategic customer in the solar market. PCB Fluxing sales dipped by 75% for the third quarter compared to especially

strong sales in the third quarter of fiscal 2023. Management believes that the PCB spray fluxer market has slowed and returned to historical

revenue norms, although quoting activity remains strong.

Sales to the Alternative/Clean Energy market grew 189% to $2,083,000,

positively impacted by a growing number of Sono-Tek’s customers transitioning from our R&D systems to production scale systems

that carry much higher average selling prices. Sono-Tek platforms are used in the manufacturing of critical membranes for carbon capture,

green hydrogen generation and fuel cell applications. Medical sales recorded 53% growth in large part due to the shipment of two custom

implantable device coating machines to a repeat customer, with further orders projected from the same customer in fiscal 2025.

Approximately 60% of sales were to the U.S. and Canada compared to

44% in the comparable period of fiscal 2023. Sales to the U.S. and Canada increased by 116% impacted by the continuing trend to onshoring

in addition to several U.S. government initiatives that are investing in the clean energy sector and advanced research markets. Asia Pacific

(APAC) sales decreased by 18% primarily due to decreased sales to China. Sales to Europe, Middle East, Asia (EMEA) increased by 102% primarily

due to a strong quarter for shipments in Germany to the clean energy sector.

Backlog on November 30, 2023 was $10,439,000, a 96% year-over-year

increase and an increase of 22% compared with backlog of $8.5 million on February 28, 2023 (the end of fiscal year 2023). Quarter-end

backlog also nearly matched the record high of $10,707,000 for the second quarter of fiscal year 2024, ended August 31, 2023. The increase

in backlog is primarily due to growing orders from the Alternative/Clean Energy and Medical markets.

Third Quarter FY 2024 Financial Overview

Gross profit was $2,926,000, an increase of 60%, compared with $1,824,000

for the third quarter of fiscal 2023. The gross profit margin was 51% for both periods.

Operating expenses were $2,205,000, a 28% increase from $1,721,000

in the prior year period. The increase was largely due to an approximate 14% increase in headcount, which is primarily composed of technical

professionals hired to support our increasing growth and expansion for large platform custom engineered systems.

Research and product development costs increased 49% to $776,000 primarily

due to increased headcount, salaries and the higher costs of research and development materials and supplies, which are directed to the

Company’s ongoing focused growth initiatives.

Marketing and selling expenses increased 20% to $955,000 primarily

due to increases in headcount, salaries, travel and trade show expenses, partially offset by a decrease in commission and insurance expenses.

General and Administrative expenses increased 16% to $474,000 primarily

due to increased salaries and corporate expenses, partially offset by a decrease in stock-based compensation expense.

Operating income increased 600% to $721,000 compared to $103,000 in

the prior year period. The current period’s increase in operating income is a result of an increase in revenue and gross profit

offset by an increase in operating expenses. Operating margin for the quarter increased to 13% compared with 3% in the prior year period.

Interest income, dividend income and unrealized gain on marketable

securities increased to $170,000 compared to $30,000, primarily due to the current high interest rate environment.

Net income increased 557% to $690,000, or $0.04 per share, compared

with $105,000, or $0.01 per share, for the third quarter of fiscal 2023, primarily due to an increase in gross profit and interest and

dividend income partially offset by an increase in operating expenses and income tax expense. Diluted weighted average shares outstanding

were 15,776,972 compared to 15,773,370 for the prior year period.

First Nine Months FY 2024 Overview

Net sales increased by 31% to $14,932,000

compared to $11,401,000 for the first nine months of fiscal 2023. Gross profit increased 29% to $7,504,000 for the first nine months of

fiscal 2024 compared with $5,827,000 in the first nine months of fiscal 2023. The gross profit margin was 50% compared with 51% for the

prior year period.

Operating income increased 81% to $1,195,000 compared with $662,000

for the first nine months of fiscal 2023. Operating margin for the first nine months of fiscal 2024 increased to 8% compared with 6% in

the first nine months of fiscal 2023. Net income increased 124% to $1,285,000, or $0.08 per share, for the first nine months of fiscal

2024 compared with $573,000, or $0.04 per share, for the first nine months of fiscal 2023. Diluted weighted average shares outstanding

were 15,775,675 compared to 15,764,351 for the prior year period.

Balance Sheet and Cash Flow Overview

At November 30, 2023, cash, cash equivalents and marketable securities

totaled $12.6 million, Sono-Tek had no debt on its balance sheet and stockholders’ equity was $16.1 million.

At November 30, 2023, the Company had received approximately $3.1

million in cash deposits or down-payments for orders from its customers.

Capital expenditures in the third quarter of fiscal 2024 were

$327,000, which were invested in ongoing upgrades to the Company’s manufacturing facilities. Sono-Tek anticipates capital expenditures

will total approximately $750,000 for fiscal year 2024.

About Sono-Tek

Sono-Tek Corporation is the leading developer and manufacturer of

ultrasonic coating systems for applying precise, thin film coatings to protect, strengthen or smooth surfaces on parts and components

for the microelectronics/electronics, alternative energy, medical and industrial markets, including specialized glass applications in

construction and automotive.

The Company’s solutions are environmentally-friendly, efficient

and highly reliable, and enable dramatic reductions in overspray, savings in raw material, water and energy usage and provide improved

process repeatability, transfer efficiency, high uniformity and reduced emissions.

Sono-Tek’s growth strategy is focused on leveraging its innovative

technologies, proprietary know-how, unique talent and experience, and global reach to further develop thin film coating technologies that

enable better outcomes for its customers’ products and processes. For further information, visit www.sono-tek.com.

Safe Harbor Statement

This news release contains forward looking statements regarding future

events and the future performance of Sono-Tek Corporation that involve risks and uncertainties that could cause actual results to differ

materially. These “forward-looking statements’ are based on currently available competitive, financial and economic data and

our operating plans. They are inherently uncertain, and investors must recognize that events could turn out to be significantly different

from our expectations and could cause actual results to differ materially.

These factors include, among other considerations, general economic

and business conditions; political, regulatory, tax, competitive and technological developments affecting our operations or the demand

for our products; inflationary and supply chain pressures; residual effects from COVID-19 pandemic; maintenance of increased order backlog

and timely completion and shipment of related product; the imposition of tariffs; timely development and market acceptance of new products

and continued customer validation of our coating technologies; adequacy of financing; capacity additions, the ability to enforce patents;

maintenance of operating leverage; maintenance of increased order backlog; consummation of order proposals; completion of large orders

on schedule and on budget; continued sales growth in the medical and alternative energy markets; successful transition from primarily

selling ultrasonic nozzles and components to a more complex business providing complete machine solutions and higher value subsystems;

and realization of quarterly and annual revenues within the forecasted range of sales guidance. We undertake no obligation to update any

forward-looking statement.

For more information, contact:

Stephen J. Bagley

Chief Financial Officer

Sono-Tek Corporation

info@sono-tek.com

Investor Relations:

Stephanie Prince

PCG Advisory

(646) 863-6341

sprince@pcgadvisory.com

-FINANCIAL TABLES FOLLOW –

SONO-TEK CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

| | |

November 30, | | |

| |

| | |

2023 | | |

February 28, | |

| | |

(Unaudited) | | |

2023 | |

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 2,981,931 | | |

$ | 3,354,601 | |

| Marketable securities | |

| 9,609,444 | | |

| 8,090,000 | |

| Accounts receivable (less allowance of $12,225) | |

| 1,762,309 | | |

| 1,633,866 | |

| Inventories | |

| 4,252,550 | | |

| 3,242,909 | |

| Prepaid expenses and other current assets | |

| 81,785 | | |

| 254,046 | |

| Total current assets | |

| 18,688,019 | | |

| 16,575,422 | |

| | |

| | | |

| | |

| Land | |

| 250,000 | | |

| 250,000 | |

| Buildings, equipment, furnishings and leasehold improvements, net | |

| 2,850,100 | | |

| 2,624,996 | |

| Intangible assets, net | |

| 51,674 | | |

| 57,202 | |

| Deferred tax asset | |

| 842,010 | | |

| 667,098 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

$ | 22,681,803 | | |

$ | 20,174,718 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 1,504,382 | | |

$ | 810,863 | |

| Accrued expenses | |

| 1,720,020 | | |

| 1,427,446 | |

| Customer deposits | |

| 3,143,009 | | |

| 2,838,165 | |

| Income taxes payable | |

| 248,152 | | |

| 381,421 | |

| Total current liabilities | |

| 6,615,563 | | |

| 5,457,895 | |

| | |

| | | |

| | |

| Deferred tax liability | |

| — | | |

| 82,865 | |

| Total liabilities | |

| 6,615,563 | | |

| 5,540,760 | |

| | |

| | | |

| | |

| Stockholders’ Equity | |

| | | |

| | |

| Common stock, $.01 par value; 25,000,000 shares authorized, 15,745,206 and 15,742,073 shares issued and outstanding, respectively | |

| 157,452 | | |

| 157,421 | |

| Additional paid-in capital | |

| 9,714,301 | | |

| 9,566,898 | |

| Accumulated earnings | |

| 6,194,487 | | |

| 4,909,639 | |

| Total stockholders’ equity | |

| 16,066,240 | | |

| 14,633,958 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | |

$ | 22,681,803 | | |

$ | 20,174,718 | |

See notes to unaudited condensed consolidated financial statements.

SONO-TEK CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

| | |

Nine Months Ended

November 30, | | |

Three Months Ended

November 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Net Sales | |

$ | 14,932,157 | | |

$ | 11,401,029 | | |

$ | 5,690,022 | | |

$ | 3,586,165 | |

| Cost of Goods Sold | |

| 7,428,348 | | |

| 5,574,035 | | |

| 2,764,013 | | |

| 1,761,797 | |

| Gross Profit | |

| 7,503,809 | | |

| 5,826,994 | | |

| 2,926,009 | | |

| 1,824,368 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Expenses | |

| | | |

| | | |

| | | |

| | |

| Research and product development costs | |

| 2,221,712 | | |

| 1,543,310 | | |

| 776,013 | | |

| 520,187 | |

| Marketing and selling expenses | |

| 2,700,327 | | |

| 2,359,430 | | |

| 955,017 | | |

| 792,710 | |

| General and administrative costs | |

| 1,387,006 | | |

| 1,262,670 | | |

| 474,457 | | |

| 407,990 | |

| Total Operating Expenses | |

| 6,309,045 | | |

| 5,165,410 | | |

| 2,205,487 | | |

| 1,720,887 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Income | |

| 1,194,764 | | |

| 661,584 | | |

| 720,522 | | |

| 103,481 | |

| | |

| | | |

| | | |

| | | |

| | |

| Interest and Dividend Income | |

| 379,949 | | |

| 64,725 | | |

| 149,666 | | |

| 38,803 | |

| Net unrealized gain/(loss) on marketable securities | |

| 31,031 | | |

| (40,256 | ) | |

| 20,176 | | |

| (9,231 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income Before Income Taxes | |

| 1,605,744 | | |

| 686,053 | | |

| 890,364 | | |

| 133,053 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income Tax Expense | |

| 320,896 | | |

| 113,396 | | |

| 200,195 | | |

| 28,155 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Income | |

$ | 1,284,848 | | |

$ | 572,657 | | |

$ | 690,169 | | |

$ | 104,898 | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic Earnings Per Share | |

$ | 0.08 | | |

$ | 0.04 | | |

$ | 0.04 | | |

$ | 0.01 | |

| | |

| | | |

| | | |

| | | |

| | |

| Diluted Earnings Per Share | |

$ | 0.08 | | |

$ | 0.04 | | |

$ | 0.04 | | |

$ | 0.01 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted Average Shares - Basic | |

| 15,743,224 | | |

| 15,733,284 | | |

| 15,744,543 | | |

| 15,738,180 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted Average Shares - Diluted | |

| 15,775,675 | | |

| 15,764,351 | | |

| 15,776,972 | | |

| 15,773,370 | |

See notes to unaudited condensed consolidated financial statements.

Product Sales

| | |

Three Months Ended

November 30, | | |

Change | | |

Nine Months Ended

November 30, | | |

Change | |

| | |

2023 | | |

2022 | | |

$ | | |

% | | |

2023 | | |

2022 | | |

$ | | |

% | |

| Fluxing Systems | |

$ | 62,000 | | |

$ | 252,000 | | |

| (190,000 | ) | |

| (75% | ) | |

$ | 503,000 | | |

$ | 960,000 | | |

| (457,000 | ) | |

| (48% | ) |

| Integrated Coating Systems | |

| 1,418,000 | | |

| 193,000 | | |

| 1,225,000 | | |

| 635% | | |

| 2,579,000 | | |

| 787,000 | | |

| 1,792,000 | | |

| 228% | |

| Multi-Axis Coating Systems | |

| 2,962,000 | | |

| 1,493,000 | | |

| 1,469,000 | | |

| 98% | | |

| 7,648,000 | | |

| 4,962,000 | | |

| 2,686,000 | | |

| 54% | |

| OEM Systems | |

| 268,000 | | |

| 503,000 | | |

| (235,000 | ) | |

| (47% | ) | |

| 1,078,000 | | |

| 1,819,000 | | |

| (741,000 | ) | |

| (41% | ) |

| Other | |

| 980,000 | | |

| 1,145,000 | | |

| (165,000 | ) | |

| (14% | ) | |

| 3,124,000 | | |

| 2,873,000 | | |

| 251,000 | | |

| 9% | |

| TOTAL | |

$ | 5,690,000 | | |

$ | 3,586,000 | | |

| 2,104,000 | | |

| 59% | | |

$ | 14,932,000 | | |

$ | 11,401,000 | | |

| 3,531,000 | | |

| 31% | |

Market Sales

| | |

Three Months Ended

November 30, | | |

Change | | |

Nine Months Ended

November 30, | | |

Change | |

| | |

2023 | | |

2022 | | |

$ | | |

% | | |

2023 | | |

2022 | | |

$ | | |

% | |

| Electronics/Microelectronics | |

$ | 1,374,000 | | |

$ | 1,307,000 | | |

| 67,000 | | |

| 5% | | |

$ | 3,724,000 | | |

$ | 4,316,000 | | |

| (592,000 | ) | |

| (14% | ) |

| Medical | |

| 1,340,000 | | |

| 877,000 | | |

| 463,000 | | |

| 53% | | |

| 3,452,000 | | |

| 3,350,000 | | |

| 102,000 | | |

| 3% | |

| Alternative Energy | |

| 2,083,000 | | |

| 720,000 | | |

| 1,363,000 | | |

| 189% | | |

| 4,735,000 | | |

| 2,027,000 | | |

| 2,708,000 | | |

| 134% | |

| Emerging R&D and Other | |

| 152,000 | | |

| 102,000 | | |

| 50,000 | | |

| 49% | | |

| 315,000 | | |

| 322,000 | | |

| (7,000 | ) | |

| (2% | ) |

| Industrial | |

| 741,000 | | |

| 580,000 | | |

| 161,000 | | |

| 28% | | |

| 2,706,000 | | |

| 1,386,000 | | |

| 1,320,000 | | |

| 95% | |

| TOTAL | |

$ | 5,690,000 | | |

$ | 3,586,000 | | |

| 2,104,000 | | |

| 59% | | |

$ | 14,932,000 | | |

$ | 11,401,000 | | |

| 3,531,000 | | |

| 31% | |

Geographic Sales

| | |

Three Months Ended

November 30, | | |

Change | | |

Nine Months Ended

November 30, | | |

Change | |

| | |

2023 | | |

2022 | | |

$ | | |

% | | |

2023 | | |

2022 | | |

$ | | |

% | |

| U.S. & Canada | |

$ | 3,421,000 | | |

$ | 1,585,000 | | |

| 1,836,000 | | |

| 116% | | |

$ | 8,988,000 | | |

$ | 5,176,000 | | |

| 3,812,000 | | |

| 74% | |

| Asia Pacific (APAC) | |

| 681,000 | | |

| 834,000 | | |

| (153,000 | ) | |

| (18% | ) | |

| 1,790,000 | | |

| 2,367,000 | | |

| (577,000 | ) | |

| (24% | ) |

| Europe, Middle East, Asia (EMEA) | |

| 1,476,000 | | |

| 731,000 | | |

| 745,000 | | |

| 102% | | |

| 3,057,000 | | |

| 2,557,000 | | |

| 500,000 | | |

| 20% | |

| Latin America | |

| 112,000 | | |

| 436,000 | | |

| (324,000 | ) | |

| (74% | ) | |

| 1,097,000 | | |

| 1,301,000 | | |

| (204,000 | ) | |

| (16% | ) |

| TOTAL | |

$ | 5,690,000 | | |

$ | 3,586,000 | | |

| 2,104,000 | | |

| 59% | | |

$ | 14,932,000 | | |

$ | 11,401,000 | | |

| 3,531,000 | | |

| 31% | |

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

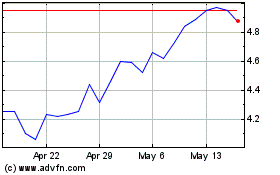

Sono Tek (NASDAQ:SOTK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sono Tek (NASDAQ:SOTK)

Historical Stock Chart

From Apr 2023 to Apr 2024