false

0001499717

0001499717

2024-01-10

2024-01-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

January

10, 2024

Date

of Report (Date of earliest event reported)

STAFFING

360 SOLUTIONS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-37575 |

|

68-0680859 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

757

3rd Avenue

27th

Floor

New

York, NY 10017

(Address

of principal executive offices)

(646)

507-5710

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, par value $0.00001 per share |

|

STAF |

|

NASDAQ |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On

January 10, 2024, Staffing 360 Solutions, Inc. issued a press release announcing its third quarter 2023 financial results for the period

ended September 30, 2023. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

In

accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1, that

is furnished pursuant to this Item 7.01 shall not be deemed to be “filed” for the purposes of Section 18 of the Exchange

Act, or otherwise subject to the liabilities of that section, and shall not be incorporated by reference into any registration statement

or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by

specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits

*

This exhibit is furnished pursuant to Item 2.02 and shall not be deemed to be “filed.”

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Staffing

360 Solutions, Inc. |

| |

|

|

| |

By: |

/s/

Brendan Flood |

| |

Name:

|

Brendan

Flood |

| Date:

January 10, 2024 |

Title:

|

Chairman

and Chief Executive Officer |

Exhibit

99.1

Staffing

360 Solutions Reports Third Quarter

and Nine-Month 2023 Financial Results

NEW

YORK, January 10, 2024 - Staffing 360 Solutions, Inc. (Nasdaq: STAF) (“Staffing 360 Solutions” or the “Company”),

a company executing an international buy-integrate-build strategy through the acquisition of staffing organizations in the United States

and the United Kingdom, today reported financial results for the 2023 third quarter and nine-month period ended September 30, 2023.

Third

Quarter 2023 Overview

| |

● |

Revenue

declined by 4.0% (a decline of 5.5% in constant currency) to $63.5 million, compared with $66.1 million for the prior year period,

resulting primarily from market softening in the current economic environment. |

| |

● |

Gross

profit was $9.4 million, compared with $12.3 million for the prior-year period. |

| |

● |

Operating

loss was $2.3 million, compared with an operating profit of $496,000 for the prior-year period. |

| |

● |

Net

loss totaled $4.3 million, compared with a net profit of $1.0 million for the prior-year period. |

| |

● |

Diluted

loss per share loss was $0.98, compared with a diluted profit per share of $0.43 in the prior-year period. |

| |

● |

EBITDA

loss was $1.7 million, compared with an EBITDA profit of $3.0 million for the prior-year period. |

| |

● |

Adjusted

EBITDA, a non-GAAP measure, was $190,000, compared with $4.9 million in the prior-year period. |

Nine-Month

2023 Overview

| |

● |

Revenue

increased by 7.8% (an increase of 8.0% in constant currency) to $188.7 million, compared with $175.1 million for the prior-year period,

resulting primarily from the Company’s acquisition of Headway Workforce Solutions in 2022. |

| |

● |

Gross

profit was $27.7 million, compared with $31.4 million for the prior-year period. |

| |

● |

Operating

loss was $5.3 million, compared with an operating loss of $1.2 million for the prior-year period. |

| |

● |

Net

loss totaled $10.0 million, compared with a net loss of $3.6 million for the prior-year period. |

| |

● |

Diluted

loss per share loss was $2.63, compared with a diluted loss per share loss of $1.80 in the prior-year period. |

| |

● |

EBITDA

loss was $3.1 million, compared with an EBITDA profit of $1.7 million for the prior-year period. |

| |

● |

Adjusted

EBITDA, a non-GAAP measure, was $2.1 million, compared with $5.3 million in the prior-year period. |

Non-GAAP

financial measures are meant to supplement, and be viewed in conjunction with, GAAP financial results. The presentation of these non-GAAP

financial measures should not be considered in isolation or as a substitute for comparable GAAP financial measures and should be read

only in conjunction with the Company’s financial statements prepared in accordance with GAAP. Reconciliations of the Company’s

non-GAAP measures are included in the tables below.

“Our

third quarter results reflect the continued uncertainty that has been characteristic of the employment sector, with clients remaining

cautious about their hiring needs and the economy,” said Brendan Flood, Chairman, CEO and President. “As a result, we are

facing many of the same challenges as other staffing firms, especially in the area of light industrial. At the same time, workers compensation

costs and a weaker permanent placement/direct hire market have contributed to softer margins.”

Outlook

Although

industry conditions remain uncertain and are subject to change, the Company currently estimates revenues in excess of $250 million for

the 2023 fiscal year.

About

Staffing 360 Solutions, Inc.

Staffing

360 Solutions, Inc. is engaged in the execution of an international buy-integrate-build strategy through the acquisition of domestic

and international staffing organizations in the United States and United Kingdom. The Company believes that the staffing industry offers

opportunities for accretive acquisitions and as part of its targeted consolidation model, is pursuing acquisition targets in the finance

and accounting, administrative, engineering, IT, and light industrial staffing space.

For

more information, visit http://www.staffing360solutions.com. Follow Staffing 360 Solutions on Facebook, LinkedIn and Twitter.

Forward-Looking

Statements

This

press release contains forward-looking statements, which may be identified by words such as “expect,” “look forward

to,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate,”

“will,” “project,” or words of similar meaning. Forward-looking statements are not guarantees of future performance,

are based on certain assumptions and are subject to various known and unknown risks and uncertainties, many of which are beyond the Company’s

control, and cannot be predicted or quantified; consequently, actual results may differ materially from those expressed or implied by

such forward-looking statements. Such risks and uncertainties include, without limitation, our ability to retain our listing on the Nasdaq

Capital Market and to regain and maintain compliance with the rules of the Nasdaq Capital Market; market and other conditions; the geographic,

social and economic impact of COVID-19 endemic and its ongoing effects on the Company’s ability to conduct its business and raise

capital in the future when needed; weakness in general economic conditions and levels of capital spending by customers in the industries

the Company serves; weakness or volatility in the financial and capital markets, which may result in the postponement or cancellation

of customer capital projects or the inability of the Company’s customers to pay the Company’s fees; the termination of a

major customer contract or project; delays or reductions in U.S. government spending; credit risks associated with the Company’s

customers; competitive market pressures; the availability and cost of qualified labor; the Company’s level of success in attracting,

training and retaining qualified management personnel and other staff employees; changes in tax laws and other government regulations,

including the impact of health care reform laws and regulations; the possibility of incurring liability for the Company’s business

activities, including, but not limited to, the activities of the Company’s temporary employees; the Company’s performance

on customer contracts; negative outcome of pending and future claims and litigation; government policies, legislation or judicial decisions

adverse to the Company’s businesses; the Company’s ability to access the capital markets by pursuing additional debt and

equity financing to fund its business plan and expenses on terms acceptable to the Company or at all; and the Company’s ability

to comply with its contractual covenants, including in respect of its debt agreements, as well as various additional risks, many of which

are now unknown and generally out of the Company’s control, and which are detailed from time to time in reports filed by the Company

with the Securities and Exchange Commission, including its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports

on Form 8-K. Staffing 360 Solutions does not undertake any duty to update any statements contained herein (including any forward-looking

statements), except as required by law.

Investor

Relations Contact:

Roger

Pondel or Laurie Berman

PondelWilkinson

Inc.

310-279-5980

pwinvestor@pondel.com

(financial

tables follow)

STAFFING

360 SOLUTIONS, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEETS

(All

amounts in thousands, except share, per share and par values)

| | |

As of | | |

As of | |

| | |

September 30, 2023 | | |

December 31, 2022 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Cash | |

$ | 681 | | |

$ | 1,992 | |

| Accounts receivable, net | |

| 25,222 | | |

| 23,628 | |

| Prepaid expenses and other current assets | |

| 1,774 | | |

| 1,762 | |

| Total Current Assets | |

| 27,677 | | |

| 27,382 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 1,296 | | |

| 1,230 | |

| Goodwill | |

| 19,891 | | |

| 19,891 | |

| Intangible assets, net | |

| 15,404 | | |

| 17,385 | |

| Other assets | |

| 8,018 | | |

| 6,701 | |

| Right of use asset | |

| 8,269 | | |

| 9,070 | |

| Total Assets | |

$ | 80,555 | | |

$ | 81,659 | |

| LIABILITIES AND STOCKHOLDERS’ (DEFICIT) EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 19,146 | | |

$ | 16,526 | |

| Accrued expenses - related party | |

| 227 | | |

| 218 | |

| Current portion of debt | |

| - | | |

| 249 | |

| Accounts receivable financing | |

| 15,937 | | |

| 18,268 | |

| Leases - current liabilities | |

| 1,297 | | |

| 1,188 | |

| Earnout liabilites | |

| 7,489 | | |

| 7,489 | |

| Other current liabilities | |

| 2,610 | | |

| 2,639 | |

| Total Current Liabilities | |

| 46,706 | | |

| 46,577 | |

| | |

| | | |

| | |

| Long-term debt | |

| 9,740 | | |

| 8,661 | |

| Redeemable Series H preferred stock, net | |

| 7,520 | | |

| 8,393 | |

| Leases - non current | |

| 7,807 | | |

| 8,640 | |

| Other long-term liabilities | |

| 248 | | |

| 180 | |

| Total Liabilities | |

| 72,021 | | |

| 72,451 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| — | | |

| — | |

| | |

| | | |

| | |

| Stockholders’ Equity: | |

| | | |

| | |

| Preferred stock, $0.00001 par value, 20,000,000 shares authorized; | |

| | | |

| | |

| Series J Preferred Stock, 40,000 designated, $0.00001 par value, 0 and 0 shares issued and outstanding as of July 1, 2023 and January 1, 2022, respectively | |

| | | |

| | |

| Common stock, $0.00001 par value, 200,000,000 shares authorized; 4,811,020 and 2,629,199 shares issued and outstanding, as of July 1, 2023 and December 31, 2022, respectively | |

| 1 | | |

| 1 | |

| Additional paid in capital | |

| 120,896 | | |

| 111,586 | |

| Accumulated other comprehensive loss | |

| (1,359 | ) | |

| (2,219 | ) |

| Accumulated deficit | |

| (111,004 | ) | |

| (101,015 | ) |

| Total Stockholders’ Equity | |

| 8,534 | | |

| 8,353 | |

| Total Liabilities and Stockholders’ Equity | |

$ | 80,555 | | |

$ | 80,804 | |

STAFFING

360 SOLUTIONS, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(All

amounts in thousands, except share, per share and per share values)

(UNAUDITED)

| | |

THREE MONTHS ENDED | | |

NINE MONTHS ENDED | |

| | |

September 30, 2023 | | |

October 1, 2022 | | |

September 30, 2023 | | |

October 1, 2022 | |

| Revenue | |

$ | 63,467 | | |

$ | 66,120 | | |

$ | 188,650 | | |

$ | 175,066 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of Revenue, excluding depreciation and amortization stated below | |

| 54,095 | | |

| 53,795 | | |

| 160,929 | | |

| 143,709 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross Profit | |

| 9,372 | | |

| 12,325 | | |

| 27,721 | | |

| 31,357 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Expenses: | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative expenses | |

| 10,837 | | |

| 11,043 | | |

| 30,720 | | |

| 30,416 | |

| Depreciation and amortization | |

| 882 | | |

| 787 | | |

| 2,308 | | |

| 2,140 | |

| Total Operating Expenses | |

| 11,719 | | |

| 11,829 | | |

| 33,028 | | |

| 32,556 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss From Operations | |

| (2,347 | ) | |

| 496 | | |

| (5,307 | ) | |

| (1,199 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other Expenses: | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (1,530 | ) | |

| (891 | ) | |

| (4,229 | ) | |

| (2,512 | ) |

| Amortization of debt discount and deferred financing costs | |

| (120 | ) | |

| (236 | ) | |

| (322 | ) | |

| (518 | ) |

| Other loss, net | |

| (237 | ) | |

| 717 | | |

| (63 | ) | |

| 738 | |

| Total Other Expenses, net | |

| (1,887 | ) | |

| 599 | | |

| (4,615 | ) | |

| (2,292 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss Before Benefit from Income Tax | |

| (4,234 | ) | |

| 1,094 | | |

| (9,922 | ) | |

| (3,491 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Provision from Income taxes | |

| (22 | ) | |

| (62 | ) | |

| (67 | ) | |

| (65 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss | |

| (4,256 | ) | |

| 1,032 | | |

| (9,989 | ) | |

| (3,556 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss - Basic and Diluted | |

$ | (0.98 | ) | |

$ | 0.43 | | |

$ | (2.63 | ) | |

$ | (1.80 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted Average Shares Outstanding – Basic and Diluted | |

| 4,349,587 | | |

| 2,401,961 | | |

| 3,800,371 | | |

| 1,980,398 | |

STAFFING

360 SOLUTIONS, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(All

amounts in thousands)

(UNAUDITED)

| | |

September 30, 2023 | | |

October 1, 2022 | |

| | |

| | |

| |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| Net (Loss) Income | |

$ | (9,989 | ) | |

$ | (3,556 | ) |

| Adjustments to reconcile net loss income to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 2,308 | | |

| 2,140 | |

| Amortization of debt discount and deferred financing costs | |

| 322 | | |

| 518 | |

| Bad debt expense | |

| 21 | | |

| (302 | ) |

| Right of use assets depreciation | |

| 973 | | |

| 1,066 | |

| Stock based compensation | |

| 1,167 | | |

| 325 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (6,611 | ) | |

| (6,114 | ) |

| Prepaid expenses and other current assets | |

| (12 | ) | |

| (1,854 | ) |

| Other assets | |

| (2,167 | ) | |

| (944 | ) |

| Accounts payable and accrued expenses | |

| 2,462 | | |

| (1,083 | ) |

| Accounts payable, related party | |

| - | | |

| 125 | |

| Other current liabilities | |

| 79 | | |

| 357 | |

| Other long-term liabilities and other | |

| 721 | | |

| 1,041 | |

| NET CASH USED IN OPERATING ACTIVITIES | |

| (10,726 | ) | |

| (8,281 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Purchase of property and equipment | |

| (328 | ) | |

| (719 | ) |

| Acquisition of business, net of cash acquired | |

| — | | |

| 1,395 | |

| Collection of UK factoring facility deferred purchase price | |

| 5,046 | | |

| 5,282 | |

| NET CASH PROVIDED BY INVESTING ACTIVITIES | |

| 4,718 | | |

| 5,958 | |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Third party financing costs | |

| (653 | ) | |

| (554 | ) |

| Proceeds from term loan - Related party | |

| 2,000 | | |

| 67 | |

| Repayment of term loan | |

| (1,156 | ) | |

| (379 | ) |

| Repayments on accounts receivable financing, net | |

| (2,239 | ) | |

| (3,345 | ) |

| Warrant Inducement, net | |

| 2,292 | | |

| (160 | ) |

| Proceeds from sale of common stock | |

| 4,433 | | |

| 4,013 | |

| NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES | |

| 4,677 | | |

| (358 | ) |

| | |

| | | |

| | |

| NET DECREASE IN CASH | |

| (1,331 | ) | |

| (2,681 | ) |

| | |

| | | |

| | |

| Effect of exchange rates on cash | |

| 19 | | |

| (123 | ) |

| | |

| | | |

| | |

| Cash - Beginning of period | |

| 1,992 | | |

| 4,558 | |

| | |

| | | |

| | |

| Cash - End of period | |

$ | 681 | | |

$ | 1,754 | |

Use

of Non-GAAP Financial Measures

Staffing

360 Solutions provides Adjusted EBITDA, a non-generally accepted accounting principal (“GAAP”) financial measure, because

it believes it offers to investors additional information for monitoring its profit and cash flow generation. Adjusted EBITDA is a non-GAAP

financial measure and is defined as net income (loss) attributable to common stock before interest expense, benefit from income taxes,

depreciation and amortization, acquisition, capital raising and other non-recurring expenses, other non-cash charges, impairment of goodwill,

re-measurement gain on intercompany note, restructuring charges, other income, and charges the Company considers to be non-recurring

in nature such as legal expenses associated with litigation, professional fees associated potential and completed acquisition. Adjusted

EBITDA is not intended to replace EBITDA other measures of financial performance reported in accordance with GAAP.

| | |

Three Months Ended | | |

Nine Months Ended | | |

Trailing Twelve Months | |

| | |

September 30,

2023 | | |

October 1,

2022 | | |

September 30,

2023 | | |

October 1,

2022 | | |

September 30,

2023 | | |

October 1,

2022 | |

| Net (loss) income | |

$ | (4,256 | ) | |

$ | 1,032 | | |

$ | (9,989 | ) | |

$ | (3,556 | ) | |

$ | (23,427 | ) | |

$ | (10,200 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| 1,530 | | |

| 891 | | |

| 4,229 | | |

| 2,512 | | |

| 5,598 | | |

| 3,301 | |

| Expense (benefit) from income taxes | |

| 22 | | |

| 62 | | |

| 67 | | |

| 65 | | |

| (220 | ) | |

| (392 | ) |

| Depreciation and amortization | |

| 1,002 | | |

| 1,023 | | |

| 2,630 | | |

| 2,658 | | |

| 3,566 | | |

| 3,289 | |

| EBITDA | |

$ | (1,702 | ) | |

$ | 3,008 | | |

$ | (3,062 | ) | |

$ | 1,679 | | |

$ | (14,482 | ) | |

$ | (4,073 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Acquisition, capital raising and other non-recurring expenses (1) | |

| 1,730 | | |

| 1,399 | | |

| 5,053 | | |

| 2,587 | | |

| 7,724 | | |

| 4,847 | |

| Other non-cash charges (2) | |

| 59 | | |

| (16 | ) | |

| 133 | | |

| - | | |

| 949 | | |

| 253 | |

| Impairment of Goodwill | |

| - | | |

| - | | |

| - | | |

| - | | |

| 10,000 | | |

| 3,104 | |

| Re-measurement gain on intercompany note | |

| - | | |

| 566 | | |

| - | | |

| 1,009 | | |

| - | | |

| - | |

| Other loss (income) | |

| 103 | | |

| (79 | ) | |

| (63 | ) | |

| (21 | ) | |

| (51 | ) | |

| (412 | ) |

| Adjusted EBITDA | |

$ | 190 | | |

$ | 4,878 | | |

$ | 2,061 | | |

$ | 5,254 | | |

$ | 4,140 | | |

$ | 3,719 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted Gross Profit | |

| | | |

| | | |

| | | |

| | | |

$ | 39,133 | | |

$ | 35,866 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted EBITDA as percentage of Adjusted Gross Profit | |

| | | |

| | | |

| | | |

| | | |

| 10.6 | % | |

| 10.4 | % |

| |

(1) |

Acquisition,

capital raising, and other non-recurring expenses primarily relate to capital raising expenses, acquisition and integration expenses,

and legal expenses incurred in relation to matters outside the ordinary course of business. |

| |

|

|

| |

(2) |

Other

non-cash charges primarily relate to staff option and share compensation expense, expense for shares issued to directors for board

services, and consideration paid for consulting services. |

v3.23.4

Cover

|

Jan. 10, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 10, 2024

|

| Entity File Number |

001-37575

|

| Entity Registrant Name |

STAFFING

360 SOLUTIONS, INC.

|

| Entity Central Index Key |

0001499717

|

| Entity Tax Identification Number |

68-0680859

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

757

3rd Avenue

|

| Entity Address, Address Line Two |

27th

Floor

|

| Entity Address, City or Town |

New

York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10017

|

| City Area Code |

(646)

|

| Local Phone Number |

507-5710

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

stock, par value $0.00001 per share

|

| Trading Symbol |

STAF

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

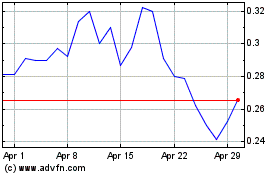

Staffing 360 Solutions (NASDAQ:STAF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Staffing 360 Solutions (NASDAQ:STAF)

Historical Stock Chart

From Apr 2023 to Apr 2024