Form 8-K - Current report

January 08 2024 - 4:45PM

Edgar (US Regulatory)

false

0000895665

0000895665

2024-01-08

2024-01-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event Reported): January 8, 2024 (January 2, 2024)

Clearday,

Inc.

(Exact

Name of Registrant as Specified in Charter)

| Delaware |

|

0-21074 |

|

77-0158076 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

8800

Village Drive, Suite 106, San Antonio, TX 78217

(Address

of Principal Executive Offices) (Zip Code)

(210)

451-0839

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 |

|

CLRD |

|

OTCQX |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.04 Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

Clearday,

Inc. (the “Company” or “we”) has not made payments required under the previously reported Guaranty (“Guaranty”)

dated March 31, 2023 that guarantees the obligations (“Guaranteed Obligations”) of (1) subsidiaries of the Company (“Tenants”)

party to the previously reported Lease Transition Agreement, as amended (the “Transition Agreement”) dated as of March 31,

2023, by and among certain affiliates (“Landlord”) of Invesque Inc. and Tenants; and (2) the Tenants under the previously

reported promissory note (the “Guaranteed Note”) payable to the Landlord in the initial principal amount of $2,995,547 dated

March 31, 2023. The payment of the Down Payment of $350,000, as defined under the Transition Agreement, was due January 2, 2024. The

Guaranteed Note provides a late charge (“Late Charge”) equal to 10% of the amount of any unpaid payment after the fifth day

following the due date therefor to defray part of the increased cost of collecting late payments and the opportunity costs incurred by

Landlord because of the unavailability of the funds. Additionally, the Landlord has customary rights upon the default under the

Transition Agreement, the Guaranteed Note and the Guaranty. The Company expects to negotiate an additional deferral or amendment of the

payment date of the Down Payment. There can be no assurance that any such additional deferral or amendment will be consummated on acceptable

terms or at all.

Forward

Looking Statements

This

communication contains forward-looking statements (including within the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended, and Section 27A of the Securities Act of 1933, as amended) concerning the Company. These statements may discuss goals, intentions

and expectations as to future plans, trends, events, results of operations or financial condition, or otherwise, based on current beliefs

of the management of the Company, as well as assumptions made by, and information currently available to, management. Forward-looking

statements generally include statements that are predictive in nature and depend upon or refer to future events or conditions, and include

words such as “may,” “will,” “should,” “would,” “expect,” “anticipate,”

“plan,” “likely,” “believe,” “estimate,” “project,” “intend,”

and other similar expressions. Statements that are not historical facts are forward-looking statements. Forward-looking statements are

based on current beliefs and assumptions that are subject to risks and uncertainties and are not guarantees of future performance. Actual

results could differ materially from those contained in any forward-looking statement as a result of various factors, including, without

limitation: the risks regarding the Company and its business, generally; risks related to the Company’s ability to correctly estimate

and manage its operating expenses and develop its innovate non-acute care businesses and the acceptance of its proposed products and

services, including with respect to future financial and operating results; the ability of the Company to protect its intellectual property

rights; competitive responses to the Company’s businesses including its innovative non-acute care business; unexpected costs, charges

or expenses; regulatory requirements or developments; changes in capital resource requirements; and legislative, regulatory, political

and economic developments. The foregoing review of important factors that could cause actual events to differ from expectations should

not be construed as exhaustive and should be read in conjunction with statements that are included herein and elsewhere, including the

risk factors included in the Company’s most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports

on Form 8-K filed with the SEC and the registration statement regarding the Company’s previously announced merger, that was filed

and declared effective. The Company can give no assurance that the actual results will not be materially different than those based on

the forward looking statements. Except as required by applicable law, the Company undertakes no obligation to revise or update any forward-looking

statement, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

| No. |

|

Description |

| |

|

|

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

CLEARDAY,

INC. |

| |

|

|

| |

By: |

/s/

James Walesa |

| |

Name:

|

James

Walesa |

| |

Title: |

Chief

Executive Officer |

| |

|

|

| Dated

January 8, 2024 |

|

|

v3.23.4

Cover

|

Jan. 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 08, 2024

|

| Entity File Number |

0-21074

|

| Entity Registrant Name |

Clearday,

Inc.

|

| Entity Central Index Key |

0000895665

|

| Entity Tax Identification Number |

77-0158076

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

8800

Village Drive

|

| Entity Address, Address Line Two |

Suite 106

|

| Entity Address, City or Town |

San Antonio

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78217

|

| City Area Code |

(210)

|

| Local Phone Number |

451-0839

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.001

|

| Trading Symbol |

CLRD

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

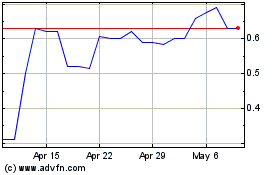

Clearday (QX) (USOTC:CLRD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Clearday (QX) (USOTC:CLRD)

Historical Stock Chart

From Apr 2023 to Apr 2024