0001334036false00013340362024-01-082024-01-0800013340362023-01-012023-09-300001334036us-gaap:OperatingSegmentsMembercrox:CrocsBrandSegmentMember2022-01-012022-12-31iso4217:USD0001334036us-gaap:OperatingSegmentsMembercrox:CrocsBrandSegmentMember2021-01-012021-12-310001334036us-gaap:OperatingSegmentsMembercrox:CrocsBrandSegmentMember2020-01-012020-12-310001334036us-gaap:OperatingSegmentsMembercrox:HEYDUDEBrandSegmentMember2022-01-012022-12-310001334036us-gaap:OperatingSegmentsMembercrox:HEYDUDEBrandSegmentMember2021-01-012021-12-310001334036us-gaap:OperatingSegmentsMembercrox:HEYDUDEBrandSegmentMember2020-01-012020-12-3100013340362022-01-012022-12-3100013340362021-01-012021-12-3100013340362020-01-012020-12-310001334036us-gaap:CorporateNonSegmentMember2022-01-012022-12-310001334036us-gaap:CorporateNonSegmentMember2021-01-012021-12-310001334036us-gaap:CorporateNonSegmentMember2020-01-012020-12-310001334036us-gaap:OperatingSegmentsMembercrox:CrocsBrandSegmentMember2023-01-012023-03-310001334036us-gaap:OperatingSegmentsMembercrox:HEYDUDEBrandSegmentMember2023-01-012023-03-3100013340362023-01-012023-03-310001334036us-gaap:CorporateNonSegmentMember2023-01-012023-03-310001334036us-gaap:OperatingSegmentsMembercrox:CrocsBrandSegmentMember2023-04-012023-06-300001334036us-gaap:OperatingSegmentsMembercrox:CrocsBrandSegmentMember2023-01-012023-06-300001334036us-gaap:OperatingSegmentsMembercrox:HEYDUDEBrandSegmentMember2023-04-012023-06-300001334036us-gaap:OperatingSegmentsMembercrox:HEYDUDEBrandSegmentMember2023-01-012023-06-3000013340362023-04-012023-06-3000013340362023-01-012023-06-300001334036us-gaap:CorporateNonSegmentMember2023-04-012023-06-300001334036us-gaap:CorporateNonSegmentMember2023-01-012023-06-300001334036us-gaap:OperatingSegmentsMembercrox:CrocsBrandSegmentMember2023-07-012023-09-300001334036us-gaap:OperatingSegmentsMembercrox:CrocsBrandSegmentMember2023-01-012023-09-300001334036us-gaap:OperatingSegmentsMembercrox:HEYDUDEBrandSegmentMember2023-07-012023-09-300001334036us-gaap:OperatingSegmentsMembercrox:HEYDUDEBrandSegmentMember2023-01-012023-09-3000013340362023-07-012023-09-300001334036us-gaap:CorporateNonSegmentMember2023-07-012023-09-300001334036us-gaap:CorporateNonSegmentMember2023-01-012023-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (date of earliest event reported): January 8, 2024

CROCS, INC.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | | | | | | | |

Delaware |

| 0-51754 |

| 20-2164234 |

(State or other jurisdiction |

| (Commission File Number) |

| (I.R.S. Employer |

of incorporation) |

| |

| Identification No.) |

|

|

|

| 500 Eldorado Blvd., Building 5 |

| | | |

| Broomfield, | | Colorado | | 80021 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (303) 848-7000

13601 Via Varra

Broomfield, Colorado 80020

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class: | Trading symbol: | Name of each exchange on which registered: | |

| Common Stock, par value $0.001 per share | CROX | The Nasdaq Global Select Market | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.45) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On January 8, 2024, Crocs, Inc. (“we,” “our”) issued a press release updating its financial guidance and announcing its participation in the 2024 Annual ICR Conference. A copy of the press release is furnished as Exhibit 99.1 to this report.

Item 8.01. Other Events.

We are also filing this Current Report on Form 8-K to reflect changes to the presentation of our notes to the consolidated financial statements as set forth in (i) our Annual Report on Form 10-K for the year ended December 31, 2022, as filed with the Securities and Exchange Commission (the “SEC”) on February 16, 2023 (the “2022 10-K”), (ii) our Quarterly Report on Form 10-Q for the period ended March 31, 2023, as filed with the SEC on April 27, 2023 (the “Q1 2023 10-Q”), (iii) our Quarterly Report on Form 10-Q for the period ended June 30, 2023, as filed with the SEC on July 27, 2023 (the “Q2 2023 10-Q”), and (iv) our Quarterly Report on Form 10-Q for the period ended September 30, 2023, as filed with the SEC on November 2, 2023 (the “Q3 2023 10-Q”), in order to give effect to a change in segment reporting.

Our business has continued to evolve in the period following the consummation of the HEYDUDE acquisition, as we have grown the brand and staffed and developed our leadership team at HEYDUDE. In the fourth quarter of 2023, to reflect changes in the way management evaluates performance, makes operating decisions, and allocates resources, we updated our reportable operating segments to be (i) Crocs Brand and (ii) HEYDUDE Brand. Each of the reportable operating segments derives its revenues from the sale of footwear, apparel, and accessories to external customers. Each segment’s performance is evaluated based on segment results without allocating Enterprise corporate expenses, which include global corporate costs associated with both brands such as legal, information technology, human resources, and finance. Segment profit and losses include adjustments to eliminate inter-segment sales. Reconciling items between segment income from operations and income from operations consist of unallocated Enterprise corporate and other expenses, as well as inter-segment eliminations.

To reflect the change in segment reporting, we have attached Exhibit 99.2 to this Current Report on Form 8-K to update the information in the Operating Segments and Geographic Information footnote in the 2022 10-K as well as previously reported amounts in the Operating Segments and Geographic footnotes for the quarters following December 31, 2022, as disclosed in our Q1 2023 10-Q, Q2 2023 10-Q, and Q3 2023 10-Q. Such information has been recast to conform with the realigned segments.

Except for the segment changes described above, this Current Report on Form 8-K does not modify, or update disclosures as presented in our 2022 10-K or our Q1 2023 10-Q, Q2 2023 10-Q, and Q3 2023 10-Q and does not reflect any changes, events, or activities occurring after the applicable filing date. We have not otherwise updated for activities or events occurring after the applicable dates these items were originally presented. The information in this Current Report on Form 8-K should be read in conjunction with the other information included in our 2022 10-K, Q1 2023 10-Q, Q2 2023 10-Q, and Q3 2023 10-Q.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

99.1 |

| |

| | |

| 99.2 | | |

| | |

| 101.INS | | XBRL Instance Document - the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document. |

| | |

| 101.SCH | | XBRL Taxonomy Extension Schema Document. |

| | |

| 101.CAL | | XBRL Taxonomy Extension Calculation Linkbase Document. |

| | |

| 101.DEF | | XBRL Taxonomy Extension Definition Linkbase Document. |

| | |

| 101.LAB | | XBRL Taxonomy Extension Label Linkbase Document. |

| | |

| 101.PRE | | XBRL Taxonomy Extension Presentation Linkbase Document. |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| CROCS, INC. |

| | |

| Date: January 8, 2024 | By: | /s/ Anne Mehlman |

| | Anne Mehlman |

| | Executive Vice President and Chief Financial Officer |

Exhibit 99.1

| | | | | | | | |

| Investor Contact: | Erinn Murphy, Crocs, Inc. |

| | (303) 848-7005 |

| | emurphy@crocs.com |

| | |

| PR Contact: | Melissa Layton, Crocs, Inc. |

| | (303) 848-7885 |

| | mlayton@crocs.com |

Crocs, Inc. Expects Record Annual Revenues of ~$3.95B, Up Over 11% Year-Over-Year

Expects To Exceed Full-Year Operating Margin Target

Anticipates 2024 Enterprise Revenue Growth Of 3-5%

___________________________________________________________________________

BROOMFIELD, COLORADO — January 8, 2024 — Crocs, Inc. (NASDAQ: CROX), a world leader in innovative casual footwear for all, today announced it expects record 2023 revenues of approximately $3.95 billion, which would represent over 11% growth compared to 2023.

“2023 was a strong year for Crocs, Inc. that culminated in a successful holiday season with market share gains for both brands. Fourth-quarter revenue is now expected to exceed our former guidance and we are raising our operating margin target for the year. Our strong free-cash flow generation enabled us to pay down $277 million in net debt in the quarter, bringing our full-year debt pay down to $665 million,” said Andrew Rees, Chief Executive Officer. “We are coming into 2024 from a position of strength and are making the decision to reinvest our best-in-class margins into focused strategic investments as we continue to set ourselves up for long-term, durable growth.”

Updated Fourth Quarter and 2023 Outlook

•We expect fourth quarter 2023 revenues to grow over 1% compared to 2022, above our guidance for a decline of (4%) to (1%), with the Crocs Brand growing almost 10% and HEYDUDE down (19%) and ahead of guidance.

•We expect full year 2023 revenues to grow over 11% compared to 2022, slightly above our guidance of 10% to 11% growth, with our Crocs Brand growing over 13% surpassing the $3 billion mark and HEYDUDE revenues of approximately $949 million.

•We expect full year 2023 non-GAAP operating margin to now be in excess of 27%.

•We paid down approximately $277 million of net debt and repurchased $25 million in stock in the fourth quarter.

Preliminary 2024 Outlook

With respect to 2024, we expect revenue growth of 3% to 5% compared to 2023 comprised of 4% to 6% growth for the Crocs brand and flat to slightly up for HEYDUDE Brand.

We expect gross margin improvement over 2023 and plan to reinvest these dollars into brand accretive and strategic SG&A investments. This will result in 2024 non-GAAP operating margins of approximately 25%.

Segment Reporting Change

In tandem with this press release, we announced on Form 8-K our plans to change our segment reporting from four reportable segments to two with the filing of our 2023 Form 10-K. This anticipated change aligns with how we manage our business. Our new segments will comprise of the Crocs Brand and the HEYDUDE Brand. Please refer to our 8-K for more detailed information.

ICR Conference

We will present at the 2024 ICR Conference today, January 8, 2024 at 9:00 am ET. A live broadcast of our presentation may be found on the Investor Relations section of the Crocs Inc. website, investors.crocs.com. A replay of the webcast will remain available on the website after the presentation.

About Crocs, Inc.:

Crocs, Inc. (Nasdaq: CROX), headquartered in Broomfield, Colorado, is a world leader in innovative casual footwear for all, combining comfort and style with a value that consumers know and love. The Company's brands include Crocs and HEYDUDE, and its products are sold in more than 85 countries through wholesale and direct-to-consumer channels. For more information on Crocs, Inc. visit investors.crocs.com. To learn more about our brands, visit www.crocs.com or www.heydude.com. Individuals can also visit https://investors.crocs.com/news-and-events/ and follow both Crocs and HEYDUDE on their social platforms.

Forward Looking Statements

This press release includes estimates, projections, and statements relating to our business plans, commitments, objectives, and expected operating results that are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

These statements include, but are not limited to, statements regarding potential impacts to our business related to our supply chain challenges, cost inflation, our financial condition, brand and liquidity outlook, and expectations regarding our future revenue, margins, non-GAAP adjustments, tax rate, earnings per share, debt ratios and capital expenditures, share repurchases, the acquisition of HEYDUDE and benefits thereof, Crocs' strategy, plans, objectives, expectations (financial or otherwise) and intentions, future financial results and growth potential, statements regarding fourth quarter, full year 2023, and full year 2024 financial outlook and future profitability, cash flows, and brand strength, anticipated product portfolio and our ability to deliver sustained, highly profitable growth and create significant shareholder value. These statements involve known and unknown risks, uncertainties, and other factors, which may cause our actual results, performance, or achievements to be materially different from any future results, performances, or achievements expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the following: our expectations regarding supply chain disruptions; cost inflation; current global financial conditions, the effect of competition in our industry; our ability to effectively manage our future growth or declines in revenues; changing consumer preferences; our ability to maintain and expand revenues and gross margin; our ability to accurately forecast consumer demand for our products; our ability to successfully implement our strategic plans; our ability to develop and sell new products; our ability to obtain and protect intellectual property rights; the effect of potential adverse currency exchange rate fluctuations and other international operating risks; and other factors described in our most recent Annual Report on Form 10-K under the heading "Risk Factors" and our subsequent filings with the Securities and Exchange Commission. Readers are encouraged to review that section and all other disclosures appearing in our filings with the Securities and Exchange Commission.

All information in this document speaks only as of January 8, 2024. We do not undertake any obligation to update publicly any forward-looking statements, whether as a result of the receipt of new information, future events, or otherwise, except as required by applicable law.

Category: Investors

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL GUIDANCE

| | | | | |

| Full Year 2023 (estimated): | |

| Approximately: |

| Non-GAAP operating margin reconciliation: | |

| GAAP operating margin | >25.5% |

| Non-GAAP adjustments associated with distribution center investments & Other | 1.5% |

| Non-GAAP operating margin | >27.0% |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Our guidance for “Non-GAAP Operating Margin” is a non-GAAP financial measure that excludes or otherwise has been adjusted for special items from our U.S. GAAP financial statements, such as inventory write-offs, duplicate rent costs, bad debt expense. We consider these items to be necessary adjustments for purposes of evaluating our ongoing business performance and are often considered non-recurring. Such adjustments are subjective and involve significant management judgment. We are unable to reconcile Crocs Inc. 2024 non-GAAP operating margin guidance measures to their nearest U.S. GAAP measures without unreasonable efforts because we are unable to predict with a reasonable degree of certainty the actual impact of the special and other non-core items. By their very nature, special and other non-core items are difficult to anticipate with precision because they are generally associated with unexpected and unplanned events that impact our company and its financial results. Therefore, we are unable to provide a reconciliation of these measures.

Exhibit 99.2

| | | | | | | | | | | | | | | | | |

| Year Ended December 31, |

| 2022 | | 2021 | | 2020 |

| (in thousands) |

| Revenues: | | | | | |

| Crocs Brand | $ | 2,659,125 | | | $ | 2,313,416 | | | $ | 1,385,951 | |

| HEYDUDE Brand | 895,860 | | | — | | | — | |

| Total consolidated revenues | $ | 3,554,985 | | | $ | 2,313,416 | | | $ | 1,385,951 | |

| Income from operations: | | | | | |

| Crocs Brand | $ | 852,025 | | | $ | 861,394 | | | $ | 329,423 | |

| HEYDUDE Brand | 211,361 | | | — | | | — | |

| Reconciliation of total segment income from operations to income before income taxes: | | | | | |

| Enterprise corporate | (212,630) | | | (178,330) | | | (115,299) | |

| Income from operations | $ | 850,756 | | | $ | 683,064 | | | $ | 214,124 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Depreciation and amortization: | | | | | |

| Crocs Brand | $ | 18,877 | | | $ | 16,931 | | | $ | 13,869 | |

| HEYDUDE Brand | 12,248 | | | — | | | — | |

| Enterprise corporate | 8,104 | | | 15,045 | | | 13,750 | |

| Total consolidated depreciation and amortization | $ | 39,229 | | | $ | 31,976 | | | $ | 27,619 | |

| | | | | |

| Three Months Ended March 31, 2023 |

| (in thousands) |

| Revenues: | |

| Crocs Brand | $ | 648,778 | |

| HEYDUDE Brand | 235,388 | |

| Total consolidated revenues | $ | 884,166 | |

| Income from operations: | |

| Crocs Brand | $ | 218,007 | |

| HEYDUDE Brand | 76,620 | |

| Reconciliation of total segment income from operations to income before income taxes: | |

| Enterprise corporate | (59,699) | |

| Income from operations | $ | 234,928 | |

| |

| |

| |

| |

| |

| |

| Depreciation and amortization: | |

| Crocs Brand | $ | 7,437 | |

| HEYDUDE Brand | 3,506 | |

| Enterprise corporate | 2,193 | |

| Total consolidated depreciation and amortization | $ | 13,136 | |

| | | | | | | | | | | |

| Three Months Ended June 30, 2023 | | Six Months Ended June 30, 2023 |

| (in thousands) |

| Revenues: | | | |

| Crocs Brand | $ | 832,950 | | | $ | 1,481,728 | |

| HEYDUDE Brand | 239,417 | | | 474,805 | |

| Total consolidated revenues | $ | 1,072,367 | | | $ | 1,956,533 | |

| Income from operations: | | | |

| Crocs Brand | $ | 317,684 | | | $ | 535,691 | |

| HEYDUDE Brand | 65,509 | | | 142,129 | |

| Reconciliation of total segment income from operations to income before income taxes: | | | |

| Enterprise corporate | (64,704) | | | (124,403) | |

| Income from operations | $ | 318,489 | | | $ | 553,417 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Depreciation and amortization: | | | |

| Crocs Brand | $ | 7,099 | | | $ | 14,536 | |

| HEYDUDE Brand | 3,562 | | | 7,068 | |

| Enterprise corporate | 1,983 | | | 4,176 | |

| Total consolidated depreciation and amortization | $ | 12,644 | | | $ | 25,780 | |

| | | | | | | | | | | |

| Three Months Ended September 30, 2023 | | Nine Months Ended September 30, 2023 |

| (in thousands) |

| Revenues: | | | |

| Crocs Brand | $ | 798,769 | | | $ | 2,280,497 | |

| HEYDUDE Brand | 246,948 | | | 721,753 | |

| Total consolidated revenues | $ | 1,045,717 | | | $ | 3,002,250 | |

| Income from operations: | | | |

| Crocs Brand | $ | 297,456 | | | $ | 833,145 | |

| HEYDUDE Brand | 31,776 | | | 173,905 | |

| Reconciliation of total segment income from operations to income before income taxes: | | | |

| Enterprise corporate | (55,380) | | | (179,781) | |

| Income from operations | $ | 273,852 | | | $ | 827,269 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Depreciation and amortization: | | | |

| Crocs Brand | $ | 8,692 | | | $ | 23,228 | |

| HEYDUDE Brand | 3,919 | | | 10,987 | |

| Enterprise corporate | 2,140 | | | 6,316 | |

| Total consolidated depreciation and amortization | $ | 14,751 | | | $ | 40,531 | |

v3.23.4

Document and Entity Information Document

|

Jan. 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 08, 2024

|

| Entity Registrant Name |

CROCS, INC.

|

| Entity Central Index Key |

0001334036

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

0-51754

|

| Entity Tax Identification Number |

20-2164234

|

| Entity Address, Address Line One |

500 Eldorado Blvd., Building 5

|

| Entity Address, City or Town |

Broomfield,

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80021

|

| City Area Code |

303

|

| Local Phone Number |

848-7000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

CROX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.23.4

OPERATING SEGMENTS AND GEOGRAPHIC INFORMATION

|

9 Months Ended |

Sep. 30, 2023 |

|---|

| Segment Reporting [Abstract] |

|

| OPERATING SEGMENTS AND GEOGRAPHIC INFORMATION |

| | | | | | | | | | | | | | | | | | | Year Ended December 31, | | 2022 | | 2021 | | 2020 | | (in thousands) | | Revenues: | | | | | | | Crocs Brand | $ | 2,659,125 | | | $ | 2,313,416 | | | $ | 1,385,951 | | | HEYDUDE Brand | 895,860 | | | — | | | — | | | Total consolidated revenues | $ | 3,554,985 | | | $ | 2,313,416 | | | $ | 1,385,951 | | | Income from operations: | | | | | | | Crocs Brand | $ | 852,025 | | | $ | 861,394 | | | $ | 329,423 | | | HEYDUDE Brand | 211,361 | | | — | | | — | | | Reconciliation of total segment income from operations to income before income taxes: | | | | | | | Enterprise corporate | (212,630) | | | (178,330) | | | (115,299) | | | Income from operations | $ | 850,756 | | | $ | 683,064 | | | $ | 214,124 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Depreciation and amortization: | | | | | | | Crocs Brand | $ | 18,877 | | | $ | 16,931 | | | $ | 13,869 | | | HEYDUDE Brand | 12,248 | | | — | | | — | | | Enterprise corporate | 8,104 | | | 15,045 | | | 13,750 | | | Total consolidated depreciation and amortization | $ | 39,229 | | | $ | 31,976 | | | $ | 27,619 | |

| | | | | | | Three Months Ended March 31, 2023 | | (in thousands) | | Revenues: | | | Crocs Brand | $ | 648,778 | | | HEYDUDE Brand | 235,388 | | | Total consolidated revenues | $ | 884,166 | | | Income from operations: | | | Crocs Brand | $ | 218,007 | | | HEYDUDE Brand | 76,620 | | | Reconciliation of total segment income from operations to income before income taxes: | | | Enterprise corporate | (59,699) | | | Income from operations | $ | 234,928 | | | | | | | | | | | | | | | Depreciation and amortization: | | | Crocs Brand | $ | 7,437 | | | HEYDUDE Brand | 3,506 | | | Enterprise corporate | 2,193 | | | Total consolidated depreciation and amortization | $ | 13,136 | |

| | | | | | | | | | | | | Three Months Ended June 30, 2023 | | Six Months Ended June 30, 2023 | | (in thousands) | | Revenues: | | | | | Crocs Brand | $ | 832,950 | | | $ | 1,481,728 | | | HEYDUDE Brand | 239,417 | | | 474,805 | | | Total consolidated revenues | $ | 1,072,367 | | | $ | 1,956,533 | | | Income from operations: | | | | | Crocs Brand | $ | 317,684 | | | $ | 535,691 | | | HEYDUDE Brand | 65,509 | | | 142,129 | | | Reconciliation of total segment income from operations to income before income taxes: | | | | | Enterprise corporate | (64,704) | | | (124,403) | | | Income from operations | $ | 318,489 | | | $ | 553,417 | | | | | | | | | | | | | | | | | | | | | | | | | | | Depreciation and amortization: | | | | | Crocs Brand | $ | 7,099 | | | $ | 14,536 | | | HEYDUDE Brand | 3,562 | | | 7,068 | | | Enterprise corporate | 1,983 | | | 4,176 | | | Total consolidated depreciation and amortization | $ | 12,644 | | | $ | 25,780 | |

| | | | | | | | | | | | | Three Months Ended September 30, 2023 | | Nine Months Ended September 30, 2023 | | (in thousands) | | Revenues: | | | | | Crocs Brand | $ | 798,769 | | | $ | 2,280,497 | | | HEYDUDE Brand | 246,948 | | | 721,753 | | | Total consolidated revenues | $ | 1,045,717 | | | $ | 3,002,250 | | | Income from operations: | | | | | Crocs Brand | $ | 297,456 | | | $ | 833,145 | | | HEYDUDE Brand | 31,776 | | | 173,905 | | | Reconciliation of total segment income from operations to income before income taxes: | | | | | Enterprise corporate | (55,380) | | | (179,781) | | | Income from operations | $ | 273,852 | | | $ | 827,269 | | | | | | | | | | | | | | | | | | | | | | | | | | | Depreciation and amortization: | | | | | Crocs Brand | $ | 8,692 | | | $ | 23,228 | | | HEYDUDE Brand | 3,919 | | | 10,987 | | | Enterprise corporate | 2,140 | | | 6,316 | | | Total consolidated depreciation and amortization | $ | 14,751 | | | $ | 40,531 | |

|

| X |

- References

+ Details

| Name: |

us-gaap_SegmentReportingAbstract |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe entire disclosure for reporting segments including data and tables. Reportable segments include those that meet any of the following quantitative thresholds a) it's reported revenue, including sales to external customers and intersegment sales or transfers is 10 percent or more of the combined revenue, internal and external, of all operating segments b) the absolute amount of its reported profit or loss is 10 percent or more of the greater, in absolute amount of 1) the combined reported profit of all operating segments that did not report a loss or 2) the combined reported loss of all operating segments that did report a loss c) its assets are 10 percent or more of the combined assets of all operating segments. Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 22

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-22

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 15

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-15

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 31

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-31

Reference 4: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 32

-Subparagraph (d)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-32

Reference 5: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 42

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-42

Reference 6: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 32

-Subparagraph (f)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-32

Reference 7: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 40

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-40

Reference 8: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-Name Accounting Standards Codification

-Publisher FASB

-URI https://asc.fasb.org//280/tableOfContent

Reference 9: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 26

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-26

Reference 10: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 34

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-34

Reference 11: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 41

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-41

Reference 12: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 21

-Subparagraph (a)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-21

Reference 13: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 21

-Subparagraph (b)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-21

Reference 14: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 32

-Subparagraph (e)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-32

| Name: |

us-gaap_SegmentReportingDisclosureTextBlock |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.23.4

OPERATING SEGMENTS AND GEOGRAPHIC INFORMATION (Tables)

|

9 Months Ended |

Sep. 30, 2023 |

|---|

| Segment Reporting [Abstract] |

|

| Information Related to Reportable Operating Segments |

| | | | | | | | | | | | | | | | | | | Year Ended December 31, | | 2022 | | 2021 | | 2020 | | (in thousands) | | Revenues: | | | | | | | Crocs Brand | $ | 2,659,125 | | | $ | 2,313,416 | | | $ | 1,385,951 | | | HEYDUDE Brand | 895,860 | | | — | | | — | | | Total consolidated revenues | $ | 3,554,985 | | | $ | 2,313,416 | | | $ | 1,385,951 | | | Income from operations: | | | | | | | Crocs Brand | $ | 852,025 | | | $ | 861,394 | | | $ | 329,423 | | | HEYDUDE Brand | 211,361 | | | — | | | — | | | Reconciliation of total segment income from operations to income before income taxes: | | | | | | | Enterprise corporate | (212,630) | | | (178,330) | | | (115,299) | | | Income from operations | $ | 850,756 | | | $ | 683,064 | | | $ | 214,124 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Depreciation and amortization: | | | | | | | Crocs Brand | $ | 18,877 | | | $ | 16,931 | | | $ | 13,869 | | | HEYDUDE Brand | 12,248 | | | — | | | — | | | Enterprise corporate | 8,104 | | | 15,045 | | | 13,750 | | | Total consolidated depreciation and amortization | $ | 39,229 | | | $ | 31,976 | | | $ | 27,619 | |

| | | | | | | Three Months Ended March 31, 2023 | | (in thousands) | | Revenues: | | | Crocs Brand | $ | 648,778 | | | HEYDUDE Brand | 235,388 | | | Total consolidated revenues | $ | 884,166 | | | Income from operations: | | | Crocs Brand | $ | 218,007 | | | HEYDUDE Brand | 76,620 | | | Reconciliation of total segment income from operations to income before income taxes: | | | Enterprise corporate | (59,699) | | | Income from operations | $ | 234,928 | | | | | | | | | | | | | | | Depreciation and amortization: | | | Crocs Brand | $ | 7,437 | | | HEYDUDE Brand | 3,506 | | | Enterprise corporate | 2,193 | | | Total consolidated depreciation and amortization | $ | 13,136 | |

| | | | | | | | | | | | | Three Months Ended June 30, 2023 | | Six Months Ended June 30, 2023 | | (in thousands) | | Revenues: | | | | | Crocs Brand | $ | 832,950 | | | $ | 1,481,728 | | | HEYDUDE Brand | 239,417 | | | 474,805 | | | Total consolidated revenues | $ | 1,072,367 | | | $ | 1,956,533 | | | Income from operations: | | | | | Crocs Brand | $ | 317,684 | | | $ | 535,691 | | | HEYDUDE Brand | 65,509 | | | 142,129 | | | Reconciliation of total segment income from operations to income before income taxes: | | | | | Enterprise corporate | (64,704) | | | (124,403) | | | Income from operations | $ | 318,489 | | | $ | 553,417 | | | | | | | | | | | | | | | | | | | | | | | | | | | Depreciation and amortization: | | | | | Crocs Brand | $ | 7,099 | | | $ | 14,536 | | | HEYDUDE Brand | 3,562 | | | 7,068 | | | Enterprise corporate | 1,983 | | | 4,176 | | | Total consolidated depreciation and amortization | $ | 12,644 | | | $ | 25,780 | |

| | | | | | | | | | | | | Three Months Ended September 30, 2023 | | Nine Months Ended September 30, 2023 | | (in thousands) | | Revenues: | | | | | Crocs Brand | $ | 798,769 | | | $ | 2,280,497 | | | HEYDUDE Brand | 246,948 | | | 721,753 | | | Total consolidated revenues | $ | 1,045,717 | | | $ | 3,002,250 | | | Income from operations: | | | | | Crocs Brand | $ | 297,456 | | | $ | 833,145 | | | HEYDUDE Brand | 31,776 | | | 173,905 | | | Reconciliation of total segment income from operations to income before income taxes: | | | | | Enterprise corporate | (55,380) | | | (179,781) | | | Income from operations | $ | 273,852 | | | $ | 827,269 | | | | | | | | | | | | | | | | | | | | | | | | | | | Depreciation and amortization: | | | | | Crocs Brand | $ | 8,692 | | | $ | 23,228 | | | HEYDUDE Brand | 3,919 | | | 10,987 | | | Enterprise corporate | 2,140 | | | 6,316 | | | Total consolidated depreciation and amortization | $ | 14,751 | | | $ | 40,531 | |

|

| X |

- DefinitionTabular disclosure of the profit or loss and total assets for each reportable segment. An entity discloses certain information on each reportable segment if the amounts (a) are included in the measure of segment profit or loss reviewed by the chief operating decision maker or (b) are otherwise regularly provided to the chief operating decision maker, even if not included in that measure of segment profit or loss. Reference 1: http://fasb.org/us-gaap/role/ref/legacyRef

-Name Accounting Standards Codification

-Topic 350

-SubTopic 20

-Section 50

-Paragraph 1

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482573/350-20-50-1

Reference 2: http://fasb.org/us-gaap/role/ref/legacyRef

-Name Accounting Standards Codification

-Topic 280

-SubTopic 10

-Section 50

-Paragraph 25

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-25

Reference 3: http://fasb.org/us-gaap/role/ref/legacyRef

-Name Accounting Standards Codification

-Topic 280

-SubTopic 10

-Section 50

-Paragraph 22

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-22

Reference 4: http://fasb.org/us-gaap/role/ref/legacyRef

-Name Accounting Standards Codification

-Topic 280

-SubTopic 10

-Section 50

-Paragraph 30

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-30

| Name: |

us-gaap_ScheduleOfSegmentReportingInformationBySegmentTextBlock |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

us-gaap_SegmentReportingAbstract |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.23.4

OPERATING SEGMENTS AND GEOGRAPHIC INFORMATION (Information Related To Reportable Operating Business Segments) (Details) - USD ($)

$ in Thousands |

3 Months Ended |

6 Months Ended |

9 Months Ended |

12 Months Ended |

Sep. 30, 2023 |

Jun. 30, 2023 |

Mar. 31, 2023 |

Jun. 30, 2023 |

Sep. 30, 2023 |

Dec. 31, 2022 |

Dec. 31, 2021 |

Dec. 31, 2020 |

| Segment Reporting Information [Line Items] |

|

|

|

|

|

|

|

|

| Total consolidated revenues |

$ 1,045,717

|

$ 1,072,367

|

$ 884,166

|

$ 1,956,533

|

$ 3,002,250

|

$ 3,554,985

|

$ 2,313,416

|

$ 1,385,951

|

| Income from operations |

273,852

|

318,489

|

234,928

|

553,417

|

827,269

|

850,756

|

683,064

|

214,124

|

| Total consolidated depreciation and amortization |

14,751

|

12,644

|

13,136

|

25,780

|

40,531

|

39,229

|

31,976

|

27,619

|

| Reportable Operating Segments | Crocs Brand |

|

|

|

|

|

|

|

|

| Segment Reporting Information [Line Items] |

|

|

|

|

|

|

|

|

| Total consolidated revenues |

798,769

|

832,950

|

648,778

|

1,481,728

|

2,280,497

|

2,659,125

|

2,313,416

|

1,385,951

|

| Income from operations |

297,456

|

317,684

|

218,007

|

535,691

|

833,145

|

852,025

|

861,394

|

329,423

|

| Total consolidated depreciation and amortization |

8,692

|

7,099

|

7,437

|

14,536

|

23,228

|

18,877

|

16,931

|

13,869

|

| Reportable Operating Segments | HEYDUDE Brand |

|

|

|

|

|

|

|

|

| Segment Reporting Information [Line Items] |

|

|

|

|

|

|

|

|

| Total consolidated revenues |

246,948

|

239,417

|

235,388

|

474,805

|

721,753

|

895,860

|

0

|

0

|

| Income from operations |

31,776

|

65,509

|

76,620

|

142,129

|

173,905

|

211,361

|

0

|

0

|

| Total consolidated depreciation and amortization |

3,919

|

3,562

|

3,506

|

7,068

|

10,987

|

12,248

|

0

|

0

|

| Enterprise corporate |

|

|

|

|

|

|

|

|

| Segment Reporting Information [Line Items] |

|

|

|

|

|

|

|

|

| Income from operations |

(55,380)

|

(64,704)

|

(59,699)

|

(124,403)

|

(179,781)

|

(212,630)

|

(178,330)

|

(115,299)

|

| Total consolidated depreciation and amortization |

$ 2,140

|

$ 1,983

|

$ 2,193

|

$ 4,176

|

$ 6,316

|

$ 8,104

|

$ 15,045

|

$ 13,750

|

| X |

- DefinitionThe aggregate expense recognized in the current period that allocates the cost of tangible assets, intangible assets, or depleting assets to periods that benefit from use of the assets. Reference 1: http://fasb.org/us-gaap/role/ref/legacyRef

-Name Accounting Standards Codification

-Section 45

-Paragraph 28

-Subparagraph (b)

-SubTopic 10

-Topic 230

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482740/230-10-45-28

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 22

-Subparagraph (e)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-22

| Name: |

us-gaap_DepreciationDepletionAndAmortization |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

duration |

|

| X |

- DefinitionThe net result for the period of deducting operating expenses from operating revenues. Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 22

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-22

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 30

-Subparagraph (b)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-30

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 32

-Subparagraph (f)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-32

Reference 4: http://www.xbrl.org/2003/role/exampleRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 31

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-31

Reference 5: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 32

-Subparagraph (c)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-32

| Name: |

us-gaap_OperatingIncomeLoss |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

duration |

|

| X |

- DefinitionAmount, excluding tax collected from customer, of revenue from satisfaction of performance obligation by transferring promised good or service to customer. Tax collected from customer is tax assessed by governmental authority that is both imposed on and concurrent with specific revenue-producing transaction, including, but not limited to, sales, use, value added and excise. Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Topic 924

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SAB Topic 11.L)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147479941/924-10-S99-1

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Topic 606

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 5

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147479806/606-10-50-5

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 30

-Subparagraph (a)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-30

Reference 4: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 42

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-42

Reference 5: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 22

-Subparagraph (b)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-22

Reference 6: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 32

-Subparagraph (b)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-32

Reference 7: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 40

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-40

Reference 8: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 22

-Subparagraph (a)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-22

Reference 9: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 32

-Subparagraph (a)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-32

Reference 10: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 41

-Subparagraph (a)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-41

Reference 11: http://www.xbrl.org/2003/role/disclosureRef

-Topic 606

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 4

-Subparagraph (a)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147479806/606-10-50-4

| Name: |

us-gaap_RevenueFromContractWithCustomerExcludingAssessedTax |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

srt_ConsolidationItemsAxis=us-gaap_OperatingSegmentsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementBusinessSegmentsAxis=crox_CrocsBrandSegmentMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementBusinessSegmentsAxis=crox_HEYDUDEBrandSegmentMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

srt_ConsolidationItemsAxis=us-gaap_CorporateNonSegmentMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

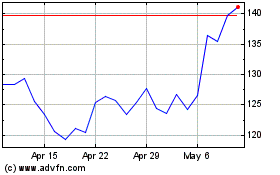

Crocs (NASDAQ:CROX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Crocs (NASDAQ:CROX)

Historical Stock Chart

From Apr 2023 to Apr 2024