UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

_____________________

System1, Inc.

(Name of Issuer)

Class A Common Stock, Par Value $0.0001 Per Share

(Title of Class of Securities)

87200P109

(CUSIP Number)

Nicholas Graeme Baker

16-18 Barnes Wallis Road

Segensworth, Fareham, Hampshire, England, PO15 5TT

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

December 4, 2023

(Date of Event Which Requires Filing of this Statement)

_____________________

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended (the “Act”) or otherwise subject to the liabilities of that section of the Act, but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP No. 87200P109

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| 1. | Names of Reporting Persons Nicholas Graeme Baker | | |

| 2. | Check the Appropriate Box if a Member of a Group (See Instructions) (a) (b) ☒ | | |

| 3. | SEC Use Only | | |

| 4. | Source of Funds (See Instructions) PF, WC | | |

| 5. | Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) | | |

| 6. | Citizenship or Place of Organization United Kingdom | | |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With | 7. | Sole Voting Power 7,699,449 shares(1) | |

| 8. | Shared Voting Power 0 shares | |

| 9. | Sole Dispositive Power 7,699,449 shares(1) | |

| 10. | Shared Dispositive Power 0 shares | |

| 11. | Aggregate Amount Beneficially Owned by Each Reporting Person 7,699,449 shares(1) | | |

| 12. | Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) | | |

| 13. | Percent of Class Represented by Amount in Row (11) 11.7%(2) | | |

| 14. | Type of Reporting Person (See Instructions) IN | | |

(1)Represents 7,699,449 Shares, including 7,208,087 Shares held directly by the Reporting Person and 491,362 Shares held by Honix Capital Limited Holding (“Honix”), of which the Reporting Person is the sole stockholder.

(2)Based upon 65,653,118 shares of Class A Common Stock outstanding as of December 4, 2023, based on information provided to the Reporting Persons by the Issuer on December 4, 2023.

Explanatory Note

This Amendment No. 1 (“Amendment No. 1”) amends the statement on Schedule 13D originally filed by Nicholas Graeme Baker (the “Reporting Person”) on January 4, 2024 (as amended from time to time, the “Schedule 13D”), and relates to the Class A common stock, par value $0.0001 per share (“Class A common stock”), of System1, Inc. (the “Issuer” or the “Company”). Except as specifically provided herein, this Amendment No. 1 does not modify any of the information previously reported in the Schedule 13D. Unless otherwise indicated, each defined term used but not defined in this Amendment No. 1 shall have the meaning assigned to such term in the Schedule 13D.

On December 4, 2023, the Company filed a Current Report on Form 8-K and reported that on November 30, 2023, the Company, its wholly owned subsidiary, Total Security Limited, formerly known as Protected.net Group Limited, a private limited company incorporated in England and Wales (“Total Security”), Avance Investment Management, LLC, a Delaware limited liability company (“Avance”), Just Develop It Limited, a private limited company incorporated in England and Wales (“JDIL” and, collectively, the “Parties”), completed the sale of Total Security’s business, including its antivirus and consumer privacy software solutions (the “Business”), pursuant to the terms of a share purchase agreement executed by the Parties on November 30, 2023 (the “Share Purchase Agreement”). Pursuant to the Share Purchase Agreement, JDIL acquired Total Security for consideration to the Company comprised of, among other things, the transfer to the Company by JDIL and related parties of 29,075,143 shares of Class A common stock. As a result of the transfer to the Company of such shares, which resulted in a decrease in the number of outstanding shares of Class A common stock, the Reporting Person’s ownership changed by more than one percent from its ownership reported on the Schedule 13D.

As a result of the transactions described herein, the Reporting Person ceased to be an indirect beneficial owner of Shares through JDIL.

Item 3. Source and Amount of Funds or Other Consideration

Item 3 of the Schedule 13D is hereby amended and supplemented as set forth below.

The description of the transactions set forth and defined in Item 4 of this Schedule 13D, are incorporated by reference in their entirety into this Item 3. It is anticipated that funding for the consideration payable will be obtained through JDIL’s existing resources, including cash on hand, as well as committed financing on market terms.

Item 4. Purpose of Transaction.

Item 4 of the Schedule 13D is hereby amended and supplemented as set forth below.

On November 30, 2023, the Company, Total Security, Avance, and JDIL, completed the sale of Total Security’s business. Pursuant to the Share Purchase Agreement, JDIL acquired Total Security for consideration to the Company comprised of: (i) $240 million of cash delivered to Issuer at closing, (ii) the repurchase or redemption of 29,075,143 shares of common stock of Issuer currently owned by certain affiliates of JDIL, and (iii) the assumption by JDIL, or cancellation by Issuer, of earnout payments owed to certain affiliates of JDIL.

Item 5. Interest in Securities of the Issuer

Subsection (a) of Item 5 of the Schedule 13D is hereby amended and supplemented as set forth below.

| | | | | |

| (a) | See rows (11) and (13) of the cover pages to this Schedule 13D/A for the aggregate number of Shares and percentage of Shares beneficially owned by the Reporting Person. Calculations of the percentage of Shares beneficially owned is based upon 65,653,118 shares of Class A Common Stock outstanding as of December 5, 2023, based on information provided to the Reporting Person by the Issuer on December 5, 2023. |

| | |

| (b) | See rows (7) through (10) of the cover pages to this Schedule 13D/A for the number of Shares as to which the Reporting Person has the sole or shared power to vote or direct the vote and sole or shared power to dispose or to direct the disposition. |

| | |

| (c) | The Reporting Person has not effected any transactions in Common Stock during the sixty day period prior to the filing of this Schedule 13D/A. |

| | |

| (d) | To the best knowledge of the Reporting Person, no other person has the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the Shares beneficially owned by the Reporting Person. |

| | |

Signature

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: January 5, 2024

NICHOLAS GRAEME BAKER

/s/ Nicholas Graeme Baker

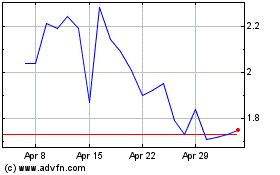

System1 (NYSE:SST)

Historical Stock Chart

From Apr 2024 to May 2024

System1 (NYSE:SST)

Historical Stock Chart

From May 2023 to May 2024