As filed with the Securities and Exchange Commission on January 4, 2024

No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

____________________________

ADVANCED EMISSIONS SOLUTIONS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 2890 | 27-5472457 |

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

8051 E. Maplewood Ave., Suite 210

Greenwood Village, CO 80111

(720) 598-3500

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

____________________________

Robert Rasmus

Chief Executive Officer

8051 E. Maplewood Ave., Suite 210

Greenwood Village, CO 80111

(720) 598-3500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

____________________________

Copies to:

| | | | | | | | |

| Jonathan Whalen | |

| Gibson, Dunn & Crutcher LLP | |

| 2001 Ross Ave., Suite 2100 | |

| Dallas, TX 75201 | |

| (214) 698-3196 | |

____________________________

Approximate date of commencement of proposed sale of the securities to the public:

As soon as practicable after the effectiveness of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ | Smaller reporting company ☒ | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

____________________________

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion,

Preliminary Prospectus dated January 4, 2024

PROSPECTUS

10,709,755 Shares

Advanced Emissions Solutions, Inc.

Common Stock

____________________________

The selling stockholders identified in this prospectus may offer and sell, from time to time, in one or more offerings, up to 10,709,755 shares of our common stock, which number consists of (i) 10,384,298 shares of our common stock currently held by the selling stockholders identified in this prospectus and (ii) 325,457 shares of our common stock issuable upon exercise of a warrant to purchase our common stock (the "Warrant") held by a selling stockholder identified in this process. We are not selling any common stock under this prospectus and will not receive any proceeds from the sale of the shares by the selling stockholders. You should carefully read this prospectus and any accompanying prospectus supplement before you decide to invest in the shares that may be offered under this prospectus.

The distribution of the common stock by the selling stockholders may be effected from time to time by a variety of methods, including:

•in underwritten public offerings;

•in ordinary brokerage transactions on securities exchanges, including the Nasdaq Global Market;

•to or through brokers or dealers who may act as principal or agent; or

•in one or more negotiated transactions at prevailing market prices or negotiated prices.

The brokers or dealers through or to whom the shares of common stock may be sold may be deemed underwriters of the shares within the meaning of the Securities Act of 1933, as amended, in which event all brokerage commissions or discounts and other compensation received by those brokers or dealers may be deemed to be underwriting compensation. To the extent required, the names of any underwriters and applicable commissions or discounts and any other required information with respect to any particular sale will be set forth in an accompanying prospectus supplement. See "Plan of Distribution" for a further description of how the selling stockholders may dispose of the shares covered by this prospectus.

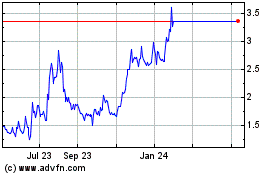

Our common stock is listed on the Nasdaq Global Market ("Nasdaq") under the symbol "ADES." On December 29, 2023, the last reported sales price of a share of our common stock on Nasdaq was $2.98. Investing in our common stock involves risks. See the section titled "Risk Factors," beginning on page 3 for a discussion of information that should be considered in connection with an investment in our common stock. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023.

TABLE OF CONTENTS

| | | | | |

| |

| | Page |

ABOUT THIS PROSPECTUS | |

WHERE YOU CAN FIND MORE INFORMATION | |

INCORPORATION BY REFERENCE | |

ABOUT THE COMPANY | |

RISK FACTORS | |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | |

USE OF PROCEEDS | |

| UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS | |

SELLING STOCKHOLDERS | |

DESCRIPTION OF CAPITAL STOCK | |

PLAN OF DISTRIBUTION | |

LEGAL MATTERS | |

EXPERTS | |

____________________________

ABOUT THIS PROSPECTUS

This prospectus is part of the registration statement that we filed with the U.S. Securities and Exchange Commission (the "SEC"), using a "shelf" registration process. Under this shelf registration process, the selling stockholders may, from time to time, offer and sell certain shares of our common stock in one or more offerings. When a selling stockholder sells shares of common stock under this shelf registration process, we may provide a prospectus supplement that will contain more specific information about the terms of such offering. The prospectus supplement may also add to, update or change any of the information contained in this prospectus. You should carefully read this prospectus, any accompanying prospectus supplement, any free writing prospectuses we have prepared or authorized as well as the information incorporated in this prospectus or any accompanying prospectus supplement by reference. See "Incorporation by Reference." Any information in any accompanying prospectus supplement, any free writing prospectus or any subsequent material incorporated herein or therein by reference will supersede the information in this prospectus or any earlier prospectus supplement.

This prospectus contains summaries of certain provisions in some of the documents described herein, but reference is hereby made to the actual documents for complete information. All of the summaries are qualified in their entirety by reference to the complete text of the actual documents. Copies of some of the documents referred to herein have been filed or will be filed or incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below in the section entitled "Where You Can Find More Information."

Neither we nor any of the selling stockholders have authorized anyone to provide any information or to make any representations other than those contained in this prospectus, in any accompanying prospectus supplement or in any free writing prospectuses we have prepared or authorized. You should rely only on the information provided in this prospectus or any prospectus supplement, including information incorporated by reference herein or therein, or any free writing prospectus that we have specifically referred you to. Neither we nor any of the selling stockholders take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby and only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus, any prospectus supplement or any documents we incorporate herein or therein, or in any free writing prospectus, is current only as of the respective dates thereof. Our business, financial condition, results of operations and prospects may have changed since those respective dates.

No action is being taken in any jurisdiction outside the United States to permit a public offering of common stock or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restriction as to this offering and the distribution of this prospectus applicable to those jurisdictions.

Unless otherwise indicated or the context otherwise requires, all references in this prospectus to "we," "our," "us," "ADES" and the "Company" refer to Advanced Emissions Solutions, Inc. together with its consolidated subsidiaries.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains an internet website at www.sec.gov that contains periodic and current reports, proxy and information statements, and other information regarding registrants, including us, that file electronically with the SEC.

We also make available, free of charge, on or through our Internet website, www.advancedemissionssolutions.com, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements on Schedule 14A and, if applicable, amendments to those reports filed or furnished pursuant to Section 13(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The information on or that can be accessed through our website is not a part of this prospectus and the inclusion of our website address in this prospectus is an inactive textual reference only. In addition, you may request copies of these filings at no cost at: Advanced Emissions Solutions, Inc., 8051 E. Maplewood Ave., Suite 210, Greenwood Village, Colorado 80111, telephone: (720) 598-3500.

We have filed with the SEC a registration statement on Form S-1 under the Securities Act of 1933, as amended (the "Securities Act"), including exhibits, of which this prospectus forms a part, with respect to the shares of common stock that may be offered hereunder. This prospectus does not contain all of the information set forth in the registration statement and exhibits thereto. For further information with respect to our company and the shares of common stock offered hereby, reference is made to the registration statement, including the exhibits thereto. Whenever we make reference in this prospectus to any of our contracts, agreements or other documents, the references are summaries and are not necessarily complete and you should refer to the exhibits attached to or incorporated by reference into the registration statement for copies of the actual contract, agreement or other document. Our SEC filings, including the registration statement of which this prospectus forms a part and the exhibits thereto, are available to you for free on the SEC’s website listed above.

INCORPORATION BY REFERENCE

The SEC allows us to "incorporate by reference" into this prospectus and any prospectus supplement the information we file with the SEC. This means that we can disclose important information to you by referring you to another document filed separately with the SEC. Any information referenced in this way is considered part of this prospectus. Any subsequent information filed with the SEC will automatically be deemed to update and supersede the information in this prospectus and in our other filings with the SEC.

We incorporate by reference in this prospectus the documents listed below that have been previously filed with the SEC, as well as any filings made by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act from the initial filing of the registration statement of which this prospectus forms a part until the termination or completion of the offering of the securities described in this prospectus; provided, however, we are not incorporating by reference any documents or portions of documents deemed to have been furnished rather than filed in accordance with SEC rules:

• our Annual Report on Form 10-K for the year ended December 31, 2022, as filed with the SEC on March 8, 2023;

• the information specifically incorporated by reference into our Annual Report on Form 10-K from our definitive proxy statement on Schedule 14A, filed with the SEC on April 27, 2023;

• our Quarterly Reports on Form 10-Q for the quarter ended March 31, 2023, as filed with the SEC on May 9, 2023; for the quarter ended June 30, 2023, as filed with the SEC on August 9, 2023; and for the quarter ended September 30, 2023, as filed with the SEC on November 8, 2023;

• our Current Reports on Form 8-K filed with the SEC on February 1, 2023, March 2, 2023, March 29, 2023 (Item 8.01 only), April 14, 2023, June 6, 2023, June 15, 2023, July 17, 2023, August 3, 2023 and September 18, 2023 and November 8, 2023 (filing containing Item 5.02 only);

• the description of our common stock contained or incorporated by reference in our Registration Statement on Form 8-A filed with the SEC on July 6, 2016, as updated by any amendments or reports filed for the purpose of updating such description; and

•the description of our Series B Junior Participating Preferred Stock (currently traded with our common stock (contained or incorporated by reference in our Registration Statement on Form 8-A filed on May 8, 2027, as amended by the Forms

8-A/As filed on April 11, 2018, April 11, 2019, April 9, 2020, April 13, 2021, March 16, 2022 and April 14, 2023, as updated by any amendments or reports filed for the purpose of updating such description.

Notwithstanding the foregoing, information furnished under Items 2.02 and 7.01 of any Current Report on Form 8-K, including the related exhibits under Item 9.01, is not incorporated by reference in this prospectus or any prospectus supplement.

To obtain copies of these filings, see "Where You Can Find More Information" above.

ABOUT THE COMPANY

ADA-ES, Inc. ("ADA"), a Colorado corporation, was incorporated in 1997. Pursuant to an Agreement and Plan of Merger, effective July 1, 2013, Advanced Emissions Solutions, Inc. ("ADES"), a Delaware company incorporated in 2011, succeeded ADA as the publicly-held corporation and ADA became a wholly-owned subsidiary of ADES. In 2018, we acquired ADA Carbon Solutions, LLC as a means to enter into the broader Activated Carbon ("AC") market and to expand our product offerings in the mercury control industry and other applicable AC markets. In February 2023, we acquired the direct subsidiaries of Arq Ltd (hereafter the Arq Limited subsidiaries referred to as "Arq") to secure access to a unique feedstock, a manufacturing facility and certain patented processes as a means to further expand our product offerings to new markets. Our Annual Report on Form 10-K is referred to as the "Form 10-K" or the "Report." As used in this prospectus, the terms the "Company," "we," "us" and "our" means ADES and its consolidated subsidiaries.

We are an environmental technology company and sell consumable products that utilize AC and chemical-based technologies to a broad range of customers, including coal-fired utilities, industrials, water treatment plants and other diverse markets served by one our major customers. Our primary products are comprised of AC, which is produced from a variety of carbonaceous raw materials. Our AC products include both powdered activated carbon, Colloidal Activated Carbon Product and granular activated carbon.Our proprietary technologies and associated product offerings provide purification solutions to enable our customers to reduce certain contaminants and pollutants to meet the challenges of existing and potential future regulations. Additionally, we own an associated lignite mine that supplies the primary raw material for the manufacturing of our current products.

As of December 31, 2022 and 2021, we held equity interests of 42.5% and 50.0% in Tinuum Group, LLC ("Tinuum Group") and Tinuum Services, LLC ("Tinuum Services"), respectively, which are both unconsolidated entities, and through December 31, 2021, both contributed significantly to our financial position and results of operations. We account for Tinuum Group and Tinuum Services under the equity method of accounting. As a result of the expiration of Internal Revenue Code ("IRC") Section 45 - Production Tax Credit ("Section 45") refined coal tax credit program effective December 31, 2021, both Tinuum Group and Tinuum Services ceased operations in 2023 and continue to wind down their operations.

Our Corporate Information

We were incorporated as a Delaware corporation in 2011. Our current corporate headquarters address is 8051 E. Maplewood Ave., Suite 210, Greenwood Village, Colorado 80111. For further information please view our official company website at www.advancedemissionssolutions.com. Information included or referred to on, or otherwise accessible through, our website is not deemed to form a part of, or be incorporated by reference into, this prospectus or the registration statement of which this prospectus forms a part, and you should not rely on that information when making a decision to invest in our common stock.

Implications of Being a Smaller Reporting Company

We are currently a "smaller reporting company" as defined in Rule 12b-2 under the Exchange Act. We may take advantage of certain of the scaled disclosures available to smaller reporting companies and will be able to take advantage of these scaled disclosures until the fiscal year following the determination that the aggregate market price of our voting and non-voting common stock held by non-affiliates is more than $250 million measured on the last business day of our second fiscal quarter, or our annual revenue is more than $100 million during the most recently completed fiscal year and the aggregate market price of our voting and non-voting common stock held by non-affiliates is more than $700 million measured on the last business day of our second fiscal quarter. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should consider the risks, uncertainties and other factors described in "Risk Factors" and elsewhere in our most recent Annual Report on Form 10-K, as supplemented and updated by subsequent Quarterly Reports on Form 10-Q, that we have filed or will file with the SEC, and in other documents which are incorporated by reference in this prospectus, as well as the risk factors and other information contained in or incorporated by reference in any accompanying prospectus supplement, together with all of the other information included in this prospectus. If any of these or any unanticipated risks actually occur, our business, financial condition and results of operations could be materially and adversely affected and the trading price of our common stock could decline, causing you to lose some or all of your investment in our common stock.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains "forward-looking statements" within the meaning of Section 27A of the Securities Act, and Section 21E of the Exchange Act. Forward-looking statements generally relate to future events or our future financial or operating performance. Words or phrases such as "anticipates," "believes," "expects," "estimates," "predicts," the negative expressions of such words, or similar expressions are used in this prospectus to identify forward-looking statements, and such forward-looking statements include, but are not limited to, statements or expectations regarding:

•the anticipated effects from an increase in pricing of our activated carbon ("AC") products;

•the anticipated effects from an increase in costs of our AC products and related cost increases in supply and logistics;

•expected supply and demand for our AC products and services;

•increasing competition in the AC market;

•the effects of the transaction (the "Arq Acquisition") with Arq Limited ("Arq Ltd"), pursuant to which we acquired all of the direct and indirect equity interests of Arq’s subsidiaries ("Arq");

•the ability to successfully integrate Arq’s business;

•the ability to develop and utilize Arq’s products and technology;

•the ability to make Arq’s products commercially viable;

•the expected future demand of Arq’s products;

•future level of research and development activities;

•future plant capacity expansions and site development projects;

•the effectiveness of our technologies and the benefits they provide;

•probability of any loss occurring with respect to certain guarantees made by Tinuum Group;

•the timing of awards of, and work and related testing under, our contracts and agreements and their value;

•the timing and amounts of, or changes in, future revenues, backlog, funding for our business and projects, margins, expenses, earnings, tax rates, cash flows, royalty payment obligations, working capital, liquidity and other financial and accounting measures;

•the amount and timing of future capital expenditures needed for our business and needed by Arq to fund our business plan;

•awards of patents designed to protect our proprietary technologies both in the U.S. and other countries;

•the adoption and scope of regulations to control certain chemicals in drinking water and other environmental concerns;

•the impact of adverse global macroeconomic conditions, including rising interest rates, recession fears and inflationary pressures, and geopolitical events or conflicts;

•opportunities to effectively provide solutions to U.S. coal-related businesses to comply with regulations, improve efficiency, lower costs and maintain reliability.

•the impact of prices of competing power generation sources such as natural gas and renewable energy on demand for our products; and

•bank failures or other events affecting financial institutions.

The forward-looking statements included in this prospectus involve risks and uncertainties. Actual events or results could differ materially from those discussed in the forward-looking statements as a result of various factors including, but not limited to, timing of new and pending regulations and any legal challenges to or extensions of compliance dates of them; the U.S. government’s failure to promulgate regulations that benefit our business; changes in laws and regulations, accounting rules, prices, economic conditions and market demand; impact of competition; availability, cost of and demand for alternative energy sources and other technologies; technical, start up and operational difficulties; our inability to commercialize our advanced purification technologies ("APT") on favorable terms; our inability to ramp up our operations to effectively address recent and expected growth in our business; loss of key personnel; availability of materials and equipment for our business; intellectual property infringement claims from third parties; pending litigation; as well as other factors relating to our business strategy, goals and expectations concerning the Arq Acquisition (including future operations, future performance or results); our ability to maintain relationships with customers, suppliers and other with whom we do business, or our results of operations and business generally; risks related to diverting management's

attention from our ongoing business operations; the ability to meet Nasdaq's listing standards; costs related to the Arq Acquisition; opportunities for additional sales of our lignite AC products and end-market diversification; our ability to meet customer supply requirements; the rate of coal-fired power generation in the U.S., the timing and cost of capital expenditures and the resultant impact to our liquidity and cash flows as described in our filings with the SEC, with particular emphasis on the risk factor disclosures contained in those filings. You are cautioned not to place undue reliance on the forward-looking statements made in this prospectus and to consult filings we have made and will make with the SEC for additional discussion concerning risks and uncertainties that may apply to our business and the ownership of our securities. The forward-looking statements contained in this prospectus are presented as of the date hereof, and we disclaim any duty to update such statements unless required by law to do so.

USE OF PROCEEDS

All shares of our common stock sold pursuant to this prospectus will be offered and sold by the selling stockholders.The selling stockholders will receive all proceeds from the sale of the shares of common stock offered by this prospectus and any accompanying prospectus supplement. We will not receive any of the proceeds from the sale of our common stock by the selling stockholders.

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS

Acquisition

On February 1, 2023 (the "Acquisition Date"), Advanced Emissions Solutions, Inc. ("ADES" or the "Company") entered into a Securities Purchase Agreement (the "Purchase Agreement") with Arq Limited, a company incorporated under the laws of Jersey ("Arq Ltd."), pursuant to which ADES acquired all of the direct and indirect equity interests of Arq Ltd's subsidiaries (the "Acquisition," and hereafter the Arq Ltd. subsidiaries referred to as "Arq") in exchange for consideration (the "Purchase Consideration") totaling $31.2 million and consisting of (i) 3,814,864 shares of common stock, par value $0.001 per share, of ADES (the "Common Stock") and (ii) 5,294,462 shares of Series A Convertible Preferred Stock, par value $0.001 per share, of ADES (the "Preferred Shares"). In connection with the issuance of the Preferred Shares pursuant to the Purchase Agreement, ADES filed the Certificate of Designations of Preferred Stock for the Series A Preferred Stock (the "Certificate of Designations") with the Secretary of State of the State of Delaware.

Series A Preferred Stock

Each outstanding share of Series A Preferred Stock was automatically converted into the number of shares of Common Stock described below upon approval by the stockholders of the Company. On June 13, 2023, ADES' stockholders approved the issuance of shares of Common Stock in exchange for the conversion of all of the outstanding shares of Series A Preferred Stock.

Each Preferred Share was deemed to have an original issue price of $4.00 per share (the "Original Issue Amount"). The number of shares of Common Stock issued upon conversion of each Preferred Share was equal to the product of (i) the sum of (A) the Original Issue Amount plus (B) an amount equal to the cumulative amount of the accrued and unpaid dividends (the "Series A Dividend") on such share at such time (regardless of whether or not declared or funds for their payment are lawfully available) divided by (ii) the Original Issue Amount, subject to adjustment as provided in the Certificate of Designations.

On March 31, 2023, the Company declared a dividend of 68,464 Series A Shares (the "Series A Quarterly Dividend Shares") with respect to the accrued dividends on the Series A Preferred Stock for the first quarter of 2023. The Series A Quarterly Dividend was determined by dividing (i) the Series A Quarterly Dividend payable with respect to all Preferred Shares held by a holder thereof by (ii) the aggregate Original Issue Amount of all Preferred Shares held by a holder thereof. Each fractional Series A Quarterly Dividend Share was rounded to the nearest whole Series A Quarterly Dividend Share (with 0.5 of a share being rounded down to 0.0). The Series A Quarterly Dividend Shares were recorded at the estimated fair value of $0.2 million as of March 31, 2023 and were issued on April 21, 2023.

Subscription Agreements

On February 1, 2023, and pursuant to the Arq Acquisition, the Company entered into Subscription Agreements (the "Subscription Agreements") with certain persons (the "Subscribers"), which included existing shareholders of Arq Ltd., pursuant to which the Subscribers subscribed for and purchased shares of Common Stock for an aggregate purchase price of $15.4 million and at a price per share of $4.00 (the "PIPE Price Per Share" and such transaction, the "PIPE Investment").

Loan Agreement

As required under the Purchase Agreement, and on February 1, 2023, ADES, as borrower, certain of its subsidiaries, as guarantors, and CF Global ("CFG"), as administrative agent and lender (the "Lender"), entered into a term loan in the amount of $10.0 million, less original issue discount of $0.2 million, (the "Term Loan") upon execution of a Term Loan and Security Agreement (the "Loan Agreement"). The Term Loan has a term of 48 months and bears interest at a rate equal to either (a) Adjusted Term SOFR (subject to a 1.00% floor and a cap of 2.00%) plus a margin of 9.00% paid in cash and 5.00% paid in kind or (b) Base Rate plus a margin of 8.00% paid in cash and 5.00% paid in kind, which interest on the Term Loan in each case shall be payable (or capitalized, in the case of in kind interest) quarterly in arrears. The Term Loan is secured by substantially all of the assets of ADES and its subsidiaries (including those acquired in the Acquisition, but excluding those pledged as collateral under a term loan assumed by the Company in the Arq Acquisition), subject to customary exceptions. The Company incurred issuance costs of $1.3 million associated with the Loan Agreement.

The Loan Agreement also provided for the issuance of a warrant (the "Warrant") to CFG to purchase 325,457 shares of Common Stock, which represented 1% of the post-transaction fully diluted share capital (as defined in the Loan Agreement), at an exercise price of $0.01 per share. The Warrant has a term of 10 years and contains a cash-less exercise provision.

Unaudited Pro Forma Condensed Combined Financial Information

The following unaudited pro forma condensed combined financial information (the "unaudited pro forma financial statements") is based on the historical annual audited consolidated financial statements for the year ended December 31, 2022 of ADES, the historical audited consolidated financial statements for the year ended December 31, 2022 of Arq Ltd., the historical interim unaudited condensed financial statements of ADES for nine months ended September 30, 2023, and the historical unaudited condensed consolidated financial statements of Arq Ltd. and for the period from January 1 to February 1, 2023, as adjusted to give effect to the

Purchase Agreement, the PIPE Investment and the Term Loan and related Warrant issuance (collectively, the "Transactions") for the aforementioned periods. It should be noted that the Arq Ltd. historical financial statements have been prepared under International Financial Reporting Standards ("IFRS") issued by the International Accounting Standards Board. The effects of the Transactions are reflected in the unaudited condensed balance sheet as of September 30, 2023. Accordingly, an unaudited pro forma condensed combined balance sheet is not presented.

The unaudited pro forma condensed combined statements of operations (the "unaudited pro forma statements of operations") for the year ended December 31, 2022 and the nine months ended September 30, 2023 give effect to the Transactions as if they had occurred on January 1, 2022. In addition, certain operating expenses and finance costs pertaining to Arq Ltd. have been excluded in deriving the unaudited pro forma statements of operations.

The unaudited pro forma financial statements are based on and should be read in conjunction with:

•the accompanying notes to the unaudited pro forma financial statements;

•the historical audited consolidated financial statements of ADES as of and for the year ended December 31, 2022 and 2021, which are included in ADES’ Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and the historical unaudited condensed consolidated financial statements of ADES as of and for the nine months ended September 30, 2023, which are included in ADES’ Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2023.

•the historical audited consolidated financial statements of Arq Ltd. for the year ended December 31, 2022.

The unaudited pro forma financial statements are presented using the acquisition method of accounting, with ADES identified as the acquirer of Arq. Under the acquisition method of accounting, the purchase price is allocated to the underlying Arq tangible and intangible assets acquired and liabilities assumed based on their respective fair market values with any excess purchase price allocated to goodwill.

The unaudited pro forma combined financial statements are presented for informational purposes only and have been prepared in accordance with Article 11 of Regulation S-X of the SEC, and do not necessarily reflect what the combined company’s financial position or results of operations would have been had the Transactions occurred as of the dates indicated herein, nor do they purport to project the future financial position and operating results of the combined companies. The pro forma financial statements also do not reflect the costs of any integration activities or cost savings or synergies expected to be achieved as a result of the Transactions, and, accordingly, do not attempt to predict or suggest future results.

The unaudited pro forma financial statements include "Transaction Accounting Adjustments" that are necessary to account for the Transactions as of the dates specified above. In addition, the unaudited pro forma financial statements include adjustments for the accounting differences between IFRS and accounting principles generally accepted in the United States ("U.S. GAAP") as well as reclassifications of certain financial statement components in Arq Ltd’s historical financial statements to conform to ADES’ financial statement presentation.

The assumptions underlying all of the adjustments made in the unaudited pro forma financial statements are described in the accompanying notes. Adjustments are based on information available to us during the preparation of the unaudited pro forma financial statements and assumptions that we believe are reasonable and factually supportable. The adjustments, which are described in the accompanying notes, are based on the actual adjustments recorded upon completion of the Transactions.

The unaudited pro forma condensed combined financial statements have been adjusted for the following Transactions:

•The Acquisition, in which ADES acquired 100% of the equity interests of Arq in exchange for 3,814,864 newly issued shares of ADES Common stock and 5,294,462 Preferred Shares, which totaled $31.2 million based on the estimated fair values of the shares of Common Stock and the Preferred Shares as of the Acquisition Date.

•The issuance of 3,842,315 shares of ADES Common Stock pursuant to the PIPE Investment in exchange for $15.4 million of cash at the PIPE Price Per Share of $4.00.

•The Loan Agreement in the principal amount of $10.0 million for net cash proceeds of approximately $8.5 million, net of original issue discount and debt issuance costs, and the related issuance of the Warrant to purchase 325,457 shares of Common Stock.

ADVANCED EMISSIONS SOLUTIONS, INC.

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF OPERATIONS

FOR THE YEAR ENDED DECEMBER 31, 2022

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| (in thousands) | | ADES Historical | | Arq Ltd. Historical Reclassified (Note 2) | | IFRS to US GAAP Adjustments (Note 3) | | Ref | | Arq Ltd. Historical Reclassified US GAAP | | Transaction Accounting Adjustments (Note 4) | | Ref | | ADES Pro Forma Combined |

| | | | | | | | | | | | | | | | |

| Revenues: | | | | | | | | | | | | | | | | |

| Consumables | | $ | 102,987 | | | $ | — | | | $ | — | | | | | $ | — | | | $ | — | | | | | $ | 102,987 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Total revenues | | 102,987 | | | — | | | — | | | | | — | | | — | | | | | 102,987 | |

| Operating expenses: | | | | | | | | | | | | | | | | |

| Consumables cost of revenues, exclusive of depreciation and amortization | | 80,465 | | | — | | | — | | | | | — | | | — | | | | | 80,465 | |

| | | | | | | | | | | | | | | | |

| Selling, general and administrative | | 28,140 | | | 18,744 | | | 5,039 | | | (b),(e) | | 23,783 | | | (6,421) | | | (g),(k) | | 45,502 | |

| Depreciation, amortization, depletion and accretion | | 6,416 | | | 3,911 | | | (850) | | | (b),(c) | | 3,061 | | | 631 | | | (h),(i),(j) | | 10,108 | |

| Other operating expenses | | 34 | | | — | | | — | | | | | — | | | — | | | | | 34 | |

| Impairment of long-lived assets | | — | | | 44,560 | | | (45) | | | (d) | | 44,515 | | | — | | | | | 44,515 | |

| Total operating expenses | | 115,055 | | | 67,215 | | | 4,144 | | | | | 71,359 | | | (5,790) | | | | | 180,624 | |

| Operating (loss) income | | (12,068) | | | (67,215) | | | (4,144) | | | | | (71,359) | | | 5,790 | | | | | (77,637) | |

| Other income (expense): | | | | | | | | | | | | | | | | |

| Earnings from equity method investments | | 3,541 | | | — | | | — | | | | | — | | | — | | | | | 3,541 | |

| | | | | | | | | | | | | | | | |

| Interest expense | | (336) | | | (20,136) | | | 18,178 | | | (a),(b),(c) | | (1,958) | | | (499) | | | (g),(l) | | (2,793) | |

| Other | | 155 | | | 11,478 | | | (5,329) | | | (a),(b),(f) | | 6,149 | | | (699) | | | (g) | | 5,605 | |

| Total other income (loss) | | 3,360 | | | (8,658) | | | 12,849 | | | | | 4,191 | | | (1,198) | | | | | 6,353 | |

| (Loss) income before income tax expense (benefit) | | (8,708) | | | (75,873) | | | 8,705 | | | | | (67,168) | | | 4,592 | | | | | (71,284) | |

| Income tax expense (benefit) | | 209 | | | (442) | | | 442 | | | (f) | | — | | | — | | | (m) | | 209 | |

| Net (loss) income | | $ | (8,917) | | | $ | (75,431) | | | $ | 8,263 | | | | | $ | (67,168) | | | $ | 4,592 | | | | | $ | (71,493) | |

ADVANCED EMISSIONS SOLUTIONS, INC.

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF OPERATIONS

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | | ADES Historical for the nine months ended September 30, 2023 | | Arq Ltd. Historical Reclassified for the period from January 1 to February 1, 2023 (Note 2) | | IFRS to US GAAP Adjustments (Note 3) | | Ref | | Arq Ltd. Historical Reclassified US GAAP for the period from January 1 to February 1, 2023 | | Transaction Accounting Adjustments (Note 4) | | Ref | | ADES Pro Forma Combined |

| Revenues: | | | | | | | | | | | | | | | | |

| Consumables | | $ | 71,079 | | | $ | — | | | $ | — | | | | | $ | — | | | $ | — | | | | | $ | 71,079 | |

| | | | | | | | | | | | | | | | |

| Total revenues | | 71,079 | | | — | | | — | | | | | — | | | — | | | | | 71,079 | |

| Operating expenses: | | | | | | | | | | | | | | | | |

| Consumables cost of revenue, exclusive of depreciation and amortization | | 53,218 | | | — | | | — | | | | | — | | | — | | | | | 53,218 | |

| | | | | | | | | | | | | | | | |

| Selling, general and administrative | | 29,719 | | | 4,624 | | | 417 | | | (b),(e) | | 5,041 | | | (551) | | | (g),(k) | | 34,209 | |

| Depreciation, amortization, depletion and accretion | | 7,276 | | | 77 | | | (73) | | | (b),(c) | | 4 | | | 236 | | | (h),(i),(j) | | 7,516 | |

| Other operating expense | | (2,695) | | | — | | | — | | | | | — | | | — | | | | | (2,695) | |

| | | | | | | | | | | | | | | | |

| Total operating expenses | | 87,518 | | | 4,701 | | | 344 | | | | | 5,045 | | | (315) | | | | | 92,248 | |

| Operating loss | | (16,439) | | | (4,701) | | | (344) | | | | | (5,045) | | | 315 | | | | | (21,169) | |

| Other income (expense): | | | | | | | | | | | | | | | | |

| Earnings from equity method investments | | 1,512 | | | — | | | — | | | | | — | | | — | | | | | 1,512 | |

| | | | | | | | | | | | | | | | |

| Interest expense | | (2,155) | | | (2,085) | | | 2,019 | | | (a),(b),(c) | | (66) | | | (149) | | | (g),(l) | | (2,370) | |

| Other | | 1,510 | | | (12) | | | 27 | | | (f) | | 15 | | | — | | | | | 1,525 | |

| Total other income (loss) | | 867 | | | (2,097) | | | 2,046 | | | | | (51) | | | (149) | | | | | 667 | |

| (Loss) income before income tax benefit | | (15,572) | | | (6,798) | | | 1,702 | | | | | (5,096) | | | 166 | | | | | (20,502) | |

| Income tax benefit | | (33) | | | (27) | | | 27 | | | (f) | | — | | | — | | | (m) | | (33) | |

| Net (loss) income | | $ | (15,539) | | | $ | (6,771) | | | $ | 1,675 | | | | | $ | (5,096) | | | $ | 166 | | | | | $ | (20,469) | |

NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

1. Basis of Presentation

The accompanying unaudited pro forma financial statements are prepared from the historical consolidated financial statements of ADES and Arq Ltd. after giving effect to the Transactions and assumptions, reclassifications and adjustments as described in the accompanying notes. The unaudited combined pro forma statements of operations give effect to the Transactions as if they had occurred on January 1, 2022.

The historical annual audited consolidated financial statements and interim unaudited condensed consolidated financial statements of ADES are prepared in accordance with U.S. GAAP and the historical annual audited consolidated financial statements and interim unaudited condensed consolidated financial statements of Arq Ltd. are prepared in accordance with IFRS.

The unaudited pro forma financial statements do not necessarily reflect what the combined company's financial condition or results of operations would have been had the Transactions occurred on the dates indicated and also may not be useful in predicting the future financial condition and results of operations of the combined company. The actual financial position and results of operations may differ significantly from the pro forma amounts reflected herein due to a variety of factors.

ADES has accounted for the Transactions under the acquisition method, which requires recognizing and measuring the identifiable assets acquired and the liabilities assumed at fair value. Accordingly, ADES has used its best estimates and assumptions to assign fair value to the tangible assets acquired, identifiable intangible asset(s) and liabilities assumed as of the Acquisition Date. The value of the Purchase Consideration is based on the estimated fair value of Preferred Shares, as determined by a third party valuation firm, and the closing price per share of Common Stock. All values were determined as of the Acquisition Date.

The fair values assigned to Arq's tangible and identifiable intangible assets acquired and liabilities assumed, as described in Note 4, are based on management's estimates and assumptions. ADES has estimated the fair value of Arq's assets acquired and liabilities assumed based on discussions with Arq's management, preliminary valuation studies, due diligence and information presented in Arq Ltd.'s historical audited and unaudited financial statements. The estimated fair values of these assets acquired and liabilities assumed are considered preliminary and represent management's best estimates of fair value and may be revised as additional information is received. Thus, the provisional measurements of fair value are subject to change.

The Transaction Accounting adjustments have been made solely for the purpose of providing the unaudited pro forma financial information presented herein.

Included in the historical statements of operations of ADES and Arq Ltd. for the nine months ended September 30, 2023 and for the year ended December 31, 2022 are Acquisition-related transaction costs of $5.9 million and $6.6 million, respectively, which are not expected to recur in ADES' statement of operations beyond 12 months after the Acquisition Date.

2. Arq Ltd. Historical Financial Statements

Arq Ltd.'s historical balances were derived from Arq Ltd.'s historical consolidated financial statements for the year ended December 31, 2022 and for the period from January 1 to February 1, 2023, as described above, and are presented under IFRS. The unaudited pro forma financial statements reflect certain reclassifications of Arq Ltd.'s historical financial statement captions to conform to ADES' presentation in its historical financial statements.

The reclassifications are summarized below (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Arq Ltd. Financial Statement Line | | Arq Ltd. for the year ended December 31, 2022 | | Reclassifications | | Arq Ltd. Historical Reclassified Amount | | ADES Financial Statement Line |

| | | | | | | | |

| Plant operating expenses | | $ | 51,316 | | | $ | (51,316) | | (1) | $ | — | | | |

| | — | | | 44,560 | | | 44,560 | | | Impairment of long-lived assets |

| | — | | | 3,911 | | | 3,911 | | | Depreciation, amortization, depletion and accretion |

| Research and development expense | | 1,815 | | | (1,815) | | (2) | — | | | |

| Administration expenses | | 14,084 | | | (14,084) | | (3) | — | | | |

| | — | | | 18,744 | | | 18,744 | | | Selling, general and administrative |

| Operating loss | | (67,215) | | | — | | | (67,215) | | | |

| Finance expense | | (20,136) | | | — | | | (20,136) | | | Interest expense |

| Gain on changes to liabilities and debt | | 11,267 | | | (11,267) | | | — | | | |

| Other income | | 299 | | | (299) | | | — | | | |

| Other expense | | (88) | | | 11,566 | | | 11,478 | | | Other |

| Loss before tax | | (75,873) | | | — | | | (75,873) | | | |

| Income tax income | | 442 | | | — | | | 442 | | | Income tax expense (benefit) |

| Net loss for the financial year | | (75,431) | | | — | | | (75,431) | | | Net income (loss) |

| Other comprehensive income | | — | | | — | | | — | | | |

| Total comprehensive loss for the financial year | | (75,431) | | | — | | | (75,431) | | | |

| Attributable to Equity shareholders of the company | | $ | (75,431) | | | $ | — | | | $ | (75,431) | | | |

(1) Represents amounts which were reclassified to conform with ADES' presentation as follows: approximately $44.6 million to Impairment of long-lived assets, $3.1 million to Selling, general and administrative and $3.6 million to Depreciation, amortization, depletion and accretion.

(2) $1.8 million was reclassified to Selling, general and administrative to conform with ADES' presentation.

(3) Represents amounts which were reclassified to conform with ADES' presentation as follows: $13.8 million to Selling, general and administrative and $0.3 million to Depreciation, amortization, depletion and accretion.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Arq Ltd. Financial Statement Line | | Arq Ltd. for the period from January 1 to February 1, 2023 | | Reclassifications | | Arq Ltd. Historical Reclassified Amount | | ADES Financial Statement Line |

| | | | | | | | |

| Plant operating expenses | | $ | 291 | | | $ | (291) | | (1) | $ | — | | | |

| | | | | | | | |

| | | | 77 | | | 77 | | | Depreciation, amortization, depreciation, and accretion |

| Research and development expenses | | 83 | | | (83) | | (2) | — | | | |

| Administration expenses | | 4,327 | | | (4,327) | | (3) | — | | | |

| | | | 4,624 | | | 4,624 | | | Selling, general and administrative |

| Operating loss | | (4,701) | | | — | | | (4,701) | | | |

| Finance expense | | (2,085) | | | — | | | (2,085) | | | Interest expense |

| | | | | | | | |

| Other income | | 80 | | | (92) | | | (12) | | | Other |

| Other expenses | | (92) | | | 92 | | | — | | | |

| Loss before tax | | (6,798) | | | — | | | (6,798) | | | |

| Income tax income | | 27 | | | — | | | 27 | | | Income tax expense (benefit) |

| Net loss and total comprehensive loss attributable to the shareholders of the company | | (6,771) | | | — | | | (6,771) | | | Net loss |

| Attributable to Equity shareholders of the company | | $ | (6,771) | | | $ | — | | | $ | (6,771) | | | |

(1) Represents amounts which were reclassified to conform with ADES’ presentation as follows: approximately $0.2 million to Selling, general and administrative and $0.1 million to Depreciation, amortization, depletion and accretion.

(2) $0.1 million was reclassified to Selling, general and administrative to conform with ADES’ presentation.

(3) Represents amounts which were reclassified to conform with ADES’ presentation as follows: approximately $4.3 million to Selling, general and administrative and $8.0 thousand to Depreciation, amortization, depletion and accretion.

3. IFRS to U.S. GAAP adjustments

IFRS differs in certain material respects from U.S. GAAP. The following material adjustments have been made to reflect Arq Ltd.'s historical statements of operations on a U.S. GAAP basis for purposes of presenting unaudited pro forma financial information. In addition, the adjustments have been made to align Arq Ltd.'s historical significant accounting policies under IFRS to ADES' significant accounting policies under U.S. GAAP.

(a) Preferred Units

Under IFRS, Arq Ltd. classified and accounted for certain preferred shares (the "Preferred Units") as liabilities and classified and recorded dividends earned on the Preferred Units as finance costs.

Under U.S. GAAP, the Preferred Units are not classified as liabilities, as they are not mandatorily redeemable as defined in U.S. GAAP. Further, under U.S. GAAP, dividends earned on the Preferred Units represent a "preferred return" and are recorded within equity. In addition, SEC accounting guidance "requires equity instruments with redemption features that are not solely within the control of the issuer to be classified outside of permanent equity (often referred to as classification in "temporary equity"). Accordingly, under U.S. GAAP and SEC accounting guidance, the Preferred Units, including cumulative dividends, are classified as temporary equity. Since the cumulative dividends earned on the Preferred Units do not represent finance costs under U.S. GAAP, they are not expensed in the statement of operations under U.S. GAAP.

For the year ended December 31, 2022 and for the period from January 1 to February 1, 2023, Arq Ltd. reported finance costs of $17.4 million and $2.0 million related to the Preferred Units, which are eliminated and recorded to temporary equity under U.S. GAAP. In addition, for the year ended December 31, 2022, Arq Ltd. recognized a gain of $5.8 million and corresponding reduction to the carrying amount of the Preferred Units related to a modification of conversion terms related to the Preferred Units (the "Preferred Gain"). Under U.S. GAAP, the impact of this modification is not recorded to the statement of operations but recorded within equity.

The following table reflects the decrease in interest expense and the reversal of the Preferred Gain due to the recording of cumulative dividends on the Preferred Units within equity under U.S. GAAP: | | | | | | | | | | | | | | |

| (in thousands) | | For the year ended December 31, 2022 | | For the period from January 1 to February 1, 2023 |

| Condensed Statement of Operations | | | | |

| Decrease to Interest expense | | $ | (17,440) | | | $ | (1,970) | |

| Decrease to Other income | | $ | (5,775) | | | $ | — | |

(b) Leases

Under IFRS, all leases are classified and accounted for as finance leases. Under U.S. GAAP, leases are classified as either finance or operating leases based on satisfying certain criteria, and under U.S. GAAP, certain Arq Ltd. leases meet the definition of operating leases. Arq Ltd. reports right of use ("ROU") assets for all of its leases in Property, plant and equipment. Under U.S. GAAP, ROU assets under operating leases are reported as Other long-term assets. The net carrying amount of ROU assets under operating leases under U.S. GAAP is different from their net carrying amounts as Property, plant and equipment under IFRS, primarily due to differences between depreciation of Property, plant and equipment recognized under IFRS and amortization recognized on ROU assets under operating leases under U.S. GAAP.

In addition, under U.S. GAAP, interest on an operating lease liability and amortization of an operating lease ROU asset are reported a single expense in operating expenses, in contrast to lease cost for finance leases, which are reported separately as interest expense and amortization of ROU assets. In converting the leases that meet the definition of operating leases, amounts for both interest expense and amortization of ROU assets reported under IFRS are reversed, and the aggregate amount of operating lease expense is reported under U.S. GAAP.

The following table reflects the adjustments to report lease costs of certain of Arq Ltd.'s leases as operating leases under U.S. GAAP: | | | | | | | | | | | | | | |

| (in thousands) | | For the year ended December 31, 2022 | | For the period from January 1 to February 1, 2023 |

| Condensed Statement of Operations | | | | |

| Increase to Selling, general and administrative | | $ | 1,430 | | | $ | 105 | |

| Decrease to Depreciation, amortization, depletion and accretion | | $ | (1,074) | | | $ | (73) | |

| Decrease to Interest expense | | $ | (600) | | | $ | (49) | |

| Increase to Other income | | $ | 4 | | | $ | — | |

(c) Asset retirement obligations

Under IFRS, the calculation of an asset retirement obligation ("ARO") is based on a risk-free rate, and under U.S. GAAP, it is determined using a credit adjusted rate. Arq Ltd. calculated its ARO using a discount rate that was significantly lower than a credit adjusted rate required under U.S. GAAP. The higher discount rate under U.S. GAAP resulted in significantly lower ARO and ARO asset amounts at inception reported under U.S. GAAP compared to IFRS. In addition, under IFRS, the accretion of an ARO is reported as interest expense and under U.S. GAAP is reported as accretion expense. The reduction of ARO and ARO asset amounts also impacted the reported amounts of accretion expense and depreciation, respectively, for the periods presented below. | | | | | | | | | | | | | | |

| (in thousands) | | For the year ended December 31, 2022 | | For the period from January 1 to February 1, 2023 |

| Condensed Statement of Operations | | | | |

| Increase to Depreciation, amortization, depletion and accretion | | $ | 224 | | | $ | — | |

| Decrease to Interest expense | | $ | (138) | | | $ | — | |

(d) Impairment

The following table reflects the adjustments to recognize changes in impairment under U.S. GAAP related to the IFRS to U.S. GAAP differences in reported asset and liability amounts for ROU assets under operating leases and AROs and ARO assets, as discussed in Notes 3(b) Leases and 3(c) Asset retirement obligations above: | | | | | | | | | | | | | | |

| (in thousands) | | For the year ended December 31, 2022 | | For the period from January 1 to February 1, 2023 |

| Condensed Statement of Operations | | | | |

| Decrease to impairment of long-lived assets | | $ | (45) | | | $ | — | |

(e) Stock-based compensation

Under IFRS, stock-based compensation for graded vesting stock awards containing only service conditions is recognized and measured only as, in substance, multiple awards. Under U.S. GAAP, an accounting election is made to treat graded vesting awards as either a single award (straight-line cost recognition), or, in substance, multiple awards for both recognition and measurement. ADES' policy is to account for all service-based stock awards as a single award and to recognize stock-based compensation expense on a straight-line method over the vesting period. Arq Ltd.'s historical stock awards are graded vesting awards that vest based on service conditions. ADES is adjusting Arq Ltd's historical stock-based compensation expense, which is based on an accelerated graded vesting method, to ADES' straight-line method. The calculation of the fair value of Arq Ltd.'s historical stock awards is the same under both IFRS and U.S. GAAP.

The following table reflects the adjustment of stock-based compensation expense from Arq Ltd.'s accelerated graded vesting method to ADES' straight-line method: | | | | | | | | | | | | | | |

| (in thousands) | | For the year ended December 31, 2022 | | For the period from January 1 to February 1, 2023 |

| Condensed Statement of Operations | | | | |

| Increase to Selling, general and administrative | | $ | 3,609 | | | $ | 312 | |

(f) Income taxes

Arq Ltd. has earned refundable tax credits in the United Kingdom based on qualified research and development expenses incurred. Under IFRS, the tax credits generated are a component of Income tax expense (benefit). Under U.S. GAAP, these tax credits are not presented as a a component of income tax expense (benefit) but as a component of Other income. The following table reflects the adjustment to present refundable tax credits as refundable research and development tax credits earned by Arq as a component of Other income rather than as a component of Income tax expense benefit. | | | | | | | | | | | | | | |

| (in thousands) | | For the year ended December 31, 2022 | | For the period from January 1 to February 1, 2023 |

| Condensed Statement of Operations | | | | |

| Increase to Other | | $ | 442 | | | $ | 27 | |

| Decrease to Income tax expense (benefit) | | $ | 442 | | | $ | 27 | |

4. Transaction Accounting Adjustments to the Unaudited Pro Forma Combined Financial Statements

The following transaction accounting adjustments have been made to reflect the Transactions. Further review may identify additional adjustments that could have a material impact on the unaudited pro forma financial statements of the combined company. At this time, ADES is not aware of any additional transaction accounting adjustments that would have a material impact on the unaudited pro forma financial statements that are not reflected or disclosed in the pro forma adjustments.

ADES performed a valuation analysis of the fair value of Arq's assets and liabilities based on the purchase consideration of $31.2 million. The table below summarizes the allocation of the purchase price to the assets acquired and liabilities assumed for purposes of the unaudited pro forma financial information as of the Acquisition Date:

| | | | | | | | | | | | |

| (in thousands) | | | | | | Preliminary Purchase Price Allocation |

| | | | | | |

| Fair value of assets acquired: | | | | | | |

| Cash | | | | | | $ | 1,411 | |

| Prepaid expenses and other current assets | | | | | | 2,229 | |

| Restricted cash, long-term | | | | | | 814 | |

| Property, plant and equipment, net | | | | | | 39,159 | |

| Other long-term assets, net | | | | | | 11,717 | |

| | | | | | |

| Amount attributable to assets acquired | | | | | | $ | 55,330 | |

| | | | | | |

| Fair Value of liabilities assumed: | | | | | | |

| Accounts payable and accrued expenses | | | | | | $ | 9,806 | |

| Current portion of long-term debt | | | | | | 494 | |

| Other current liabilities | | | | | | 103 | |

| Long-term debt, net of current portion | | | | | | 9,199 | |

| Other long-term liabilities | | | | | | 4,523 | |

| Amount attributable to liabilities assumed | | | | | | $ | 24,125 | |

| | | | | | |

| Net assets acquired | | | | | | $ | 31,205 | |

The purchase price allocation, which the Company used in recording the Arq Acquisition in its financial statements on February 1, 2023, has been used to prepare transaction accounting adjustments in the pro forma statements of operations.

As part of its preliminary valuation of Arq, the Company identified an intangible asset, developed technology. The estimated fair value of the developed technology was determined using significant estimates and assumptions. As such, actual amounts may differ from these estimates. The estimated fair value and useful live of the developed technology are as follows:

| | | | | | | | | | | | | | |

| (in thousands) | | Estimated Fair Value | | Estimated Useful Life in Years |

| | | | |

| Developed technology | | $ | 7,700 | | | 20 |

| | | | |

| | | | |

Transaction Accounting Adjustments to Unaudited Pro Forma Condensed Combined Statement of Operations

The following transaction accounting adjustments have been made to reflect the Transactions in the unaudited pro forma combined statements of operations for the year ended December 31, 2022 and nine months ended September 30, 2023 assuming the Transactions had occurred as of January 1, 2022:

(g) Represents elimination of certain expenses solely attributable to Arq Ltd. (in thousands):

| | | | | | | | | | | | | | |

| | Year ended December 31, 2022 | | Nine months ended September 30, 2023 |

| Decrease in Stock-based compensation | | $ | (5,906) | | | $ | (480) | |

| Elimination of Interest expense on convertible notes payable | | 1,492 | | | — | |

| Elimination of gain on conversion of convertible notes payable | | (699) | | | — | |

(h) Represents an adjustment to historical depreciation of the property, plant and equipment acquired by the company based on its estimated fair value as of the Acquisition Date. The estimated average useful life of the acquired property, plant and equipment was 20 years. The following table summarizes the change in the estimated depreciation (in thousands):

| | | | | | | | | | | | | | |

| | Year ended December 31, 2022 | | Nine months ended September 30, 2023 |

| Estimated depreciation | | $ | 2,976 | | | $ | 198 | |

| Historical depreciation | | (2,787) | | | (5) | |

| Transaction accounting adjustment to depreciation | | $ | 189 | | | $ | 193 | |

(i) Represents the amortization of Arq's developed technology acquired by the Company based on its estimated fair value as of the Acquisition Date. The following table summarizes the change in the estimated amortization (in thousands):

| | | | | | | | | | | | | | |

| | Year ended December 31, 2022 | | Nine months ended September 30, 2023 |

| Estimated amortization | | $ | 385 | | | $ | 32 | |

| Historical amortization | | — | | | — | |

| Transaction accounting adjustment to amortization | | $ | 385 | | | $ | 32 | |

(j) Represents the increase in accretion on asset retirement obligations assumed by the Company based on their estimated fair values as of the Acquisition Date. The following table summarizes the change in the estimated accretion (in thousands):

| | | | | | | | | | | | | | |

| | Year ended December 31, 2022 | | Nine months ended September 30, 2023 |

| Estimated accretion | | $ | 235 | | | $ | 23 | |

| Historical accretion | | (178) | | | (12) | |

| Transaction accounting adjustment to accretion | | $ | 57 | | | $ | 11 | |

(k) Represents the decrease in operating lease expense on operating leases assumed by the Company based on their estimated fair values as of the Acquisition Date. The following table summarizes the change in operating lease expense (in thousands)

| | | | | | | | | | | | | | |

| | Year ended December 31, 2022 | | Nine months ended September 30, 2023 |

| Estimated operating lease expense | | $ | 616 | | | $ | 51 | |

| Historical operating lease expense | | (1,131) | | | (122) | |

| Transaction accounting adjustment to operating lease expense | | $ | (515) | | | $ | (71) | |

(l) Represents the increase to interest expense resulting from the stated interest on the Term Loan and the amortization of related debt discount and debt issuance costs as follows (in thousands):

| | | | | | | | | | | | | | |

| | Year ended December 31, 2022 | | Nine months ended September 30, 2023 |

| Interest expense on Term Loan (1) | | $ | (1,458) | | | $ | (99) | |

| Amortization of Term Loan discount and debt issuance costs (2) | | (533) | | | (50) | |

| | | | |

| Transaction accounting adjustment to interest expense | | $ | (1,991) | | | $ | (149) | |

(1)The Term Loan bears interest at a per annum rate equal to: (i) Term SOFR plus a margin of 9.0% paid in cash quarterly and (ii) 5.0% paid-in-kind ("PIK"), with PIK interest added to the principal balance of the Term Loan on a quarterly basis. Term SOFR is capped at a rate of 2.0% per annum and floored at a rate of 1.0% per annum. The stated interest rate assumed for purposes of preparing this unaudited pro forma consolidated financial information is 16.0% per annum (Term SOFR of 2.0% plus margin of 9.0% plus PIK interest of 5.0%). A 100 basis point decrease in the Term SOFR would result in a decrease in interest expense of approximately $0.1 million for the year ended December 31, 2022 and approximately $4.0 thousand for the nine months ended September 30, 2023.

(2)The Term Loan was recorded at the principal amount of $10.0 million, less original issue discount and debt issuance costs of $0.2 million and $1.3 million, respectively, and debt discount associated with the allocation of cash proceeds to the Warrant of $0.9 million. The Company estimated the standalone fair values of the Term Loan and the Warrant and allocated the proceeds to each instrument based on its relative fair value. The amount allocated to the Warrant is recorded as a debt discount and is amortized to interest expense over the term of the Term Loan. The standalone fair value of the Term Loan was based on a comparison of borrowings, credit ratings, etc. As the Warrant is exercisable for $0.01 per share, the fair value was deemed to be equal to the fair value of the underlying shares, and accordingly, the fair value of the Warrant was determined as the number of shares issuable from the exercise of the Warrant (based on 1.0% of post-transaction fully diluted share capital) multiplied by the closing price of ADES' common stock on the Acquisition Date;

(m) For the year ended December 31, 2022, both ADES and Arq incurred pretax losses, and pro forma combined income tax expense is comprised of out of period tax items incurred by ADES. As of December 31, 2022, both ADES and Arq do not forecast the ability to utilize the pretax losses, and accordingly, the transaction accounting adjustments have been tax-effected at a zero percent tax rate.

For the nine months ended September 30, 2023, both ADES and Arq incurred pretax losses, and pro forma combined income tax benefit is comprised of of out period tax items incurred by ADES. As of September 30, 2023, both ADES and Arq do not forecast the ability to utilize the losses, and accordingly, the transaction accounting adjustments for this period have been tax-effected at a zero percent tax rate.

Pro forma earnings (loss) per share

Pro forma income (loss) per share amounts for the Unaudited Pro Forma Combined Statements of Operations have been recalculated after giving effect to the Transactions, on a basic and diluted outstanding share basis, assuming that the Preferred Shares and shares of Common Stock issued in connection with the Transactions were outstanding at the beginning of the periods presented. The effect of anti-dilutive potential ordinary shares is ignored in calculating pro forma diluted income (loss) per share.

| | | | | | | | | | | | | | |

| | For the year ended December 31, 2022 |

| (in thousands, except for per share data) | | Historical ADES | | ADES Pro Forma Combined |

| Net loss | | $ | (8,917) | | | $ | (71,493) | |

| Preferred Shares dividends (1) | | — | | | (1,510) | |

| | | | |

| Loss attributable to common shareholders - basic | | $ | (8,917) | | | $ | (73,003) | |

| Weighted average number of common shares outstanding - basic (2) | | 18,453 | | | 26,436 | |

| Loss per share - basic | | $ | (0.48) | | | $ | (2.76) | |

| | | | |

| Net loss | | $ | (8,917) | | | $ | (71,493) | |

| Preferred Shares dividends (1) | | — | | | (1,510) | |

| | | | |

| Loss attributable to common shareholders - diluted | | $ | (8,917) | | | $ | (73,003) | |

| Weighted average number of common shares outstanding - diluted | | 18,453 | | | 26,436 | |

| Loss per share - diluted | | $ | (0.48) | | | $ | (2.76) | |

| | | | | | | | | | | | | | |

| | For the nine months ended September 30, 2023 |

| (in thousands, except for per share data) | | Historical ADES | | ADES Pro Forma Combined |

| Net loss | | $ | (15,539) | | | $ | (20,469) | |

| Preferred Shares dividends (1) | | (157) | | | (157) | |

| Loss attributable to common shareholders - basic | | $ | (15,696) | | | $ | (20,626) | |

| Weighted average number of common shares outstanding - basic (2) | | 27,894 | | | 28,781 | |

| Loss per share - basic | | $ | (0.56) | | | $ | (0.72) | |

| | | | |

| Loss attributable to common shareholders - diluted | | $ | (15,696) | | | $ | (20,626) | |

| Weighted average number of common shares outstanding - diluted | | 27,894 | | | 28,781 | |

| Loss per share - diluted | | $ | (0.56) | | | $ | (0.72) | |

(1)Preferred Shares dividends are calculated based on an 8% annual rate, compounded quarterly, of the Original Issue Amount and assume payment in kind (payable in Preferred Shares).

(2)The weighted-average number of common shares outstanding for basic and diluted net income (loss) per share for the year ended December 31, 2022 and nine months ended September 30, 2023 includes 325,457 shares issuable upon the exercise of the Warrant at $0.01 per share.

SELLING STOCKHOLDERS

This prospectus covers an aggregate of up to 10,709,755 shares of our common stock that may be sold or otherwise disposed of by the selling stockholders, which number consists of (i) 10,345,027 shares of our common stock currently held by the selling stockholders and (ii) 325,457 shares of our common stock issuable upon exercise of the Warrant held by a selling stockholder. The shares offered by this prospectus may be offered from time to time by the selling stockholders. The selling stockholders may sell some, all or none of their shares. We do not know how long the selling stockholders will hold the shares offered hereunder before selling them. The selling stockholders may have sold or transferred, in transactions exempt from the registration requirements of the Securities Act, some or all of their respective shares since the date on which the information in the table below is presented. Information about the selling stockholders may change over time. As used in this prospectus, the term "selling stockholders" includes the selling stockholders listed below, and any donee, pledgee, transferee or other successor in interest selling shares received after the date of this prospectus from a selling stockholder as a gift, pledge, or other non-sale related transfer.

The following table sets forth the name of each selling stockholder, the number of shares of our common stock and the percentage of our common stock beneficially owned by each selling stockholder prior to this offering, the number of shares that may be offered under this prospectus by each selling stockholder, and the number of shares of our common stock and the percentage of our common stock to be beneficially owned by each selling stockholder after completion of this offering, assuming that all shares offered hereunder are sold as contemplated herein. The number of shares in the column "Maximum Number of Shares That May Be Offered" represents all of the shares that the selling stockholder may offer under this prospectus.

There were 33,180,907 shares of common stock outstanding as of December 29, 2023.

Beneficial ownership is determined under the rules of the SEC and generally includes voting or investment power over securities. Except in cases where community property laws apply or as indicated in the footnotes to this table, we believe that each stockholder identified in the table possesses sole voting and investment power over all shares of common stock shown as beneficially owned by the stockholder. Shares of common stock subject to options and warrants that are exercisable or exercisable within 60 days of the date of this prospectus are considered outstanding and beneficially owned by the person holding the options for the purpose of computing the percentage ownership of that person but are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Shares of common stock beneficially owned prior to this offering | | | | Shares of common stock beneficially owned after this offering (assuming the sale of all shares that may be sold hereunder) |

| Name of Selling Stockholder | | Shares of common stock | | Percentage of Total Outstanding common

stock (%) (1) | | Shares of common stock

offered pursuant to this prospectus | | Shares of common stock | | Percentage of total outstanding common stock (%) |

| Julian McIntyre(2) | | 2,696,204 | | 8.13 | % | | 2,696,204 | | | — | | | * |

| Jeremy Blank(3) | | 2,224,115 | | 6.70 | % | | 2,224,115 | | | — | | | * |

| Arq Limited(4) | | 1,026,361 | | 3.09 | % | | 1,026,361 | | | — | | | * |

| FDAF Dislocated Asset Fund IV LP | | 925,276 | | 2.79 | % | | 925,276 | | | — | | | * |

| FDAF Dislocated Asset Fund II LP | | 632,528 | | 1.91 | % | | 632,528 | | | — | | | * |

| Vitol Energy (Bermuda) Limited | | 511,392 | | 1.54 | % | | 511,392 | | | — | | | * |

| Exuma Capital LP | | 415,635 | | 1.25 | % | | 415,635 | | | — | | | * |

| BNZ Investment SAL | | 391,030 | | 1.18 | % | | 391,030 | | | — | | | * |

| Lacerta Fund | | 381,639 | | 1.15 | % | | 381,639 | | | — | | | * |

| Integrity Coal Sales Inc | | 374,443 | | 1.13 | % | | 374,443 | | | — | | | * |

| Clean Carbon Holdings | | 267,748 | | * | | 267,748 | | | — | | | * |

| Richard Campbell-Breeden(5) | | 149,940 | | * | | 149,940 | | | — | | | * |

| Infinity Project Management | | 125,554 | | * | | 125,554 | | | — | | | * |

| Marsey Holdings LLC | | 117,697 | | * | | 117,697 | | | — | | | * |

| Dinan Management LP | | 110,663 | | * | | 110,663 | | | — | | | * |

| Gavin Colquhoun | | 48,150 | | * | | 48,150 | | | — | | | * |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Other Stockholders(6) | | 311,380 | | * | | 311,380 | | | — | | | * |

____________________________

* Designated ownership of less than 1% of our common stock.

(1)Applicable percentage of ownership is based upon 33,180,907 shares of common stock outstanding as of December 29, 2023.