false

0001267565

0001267565

2024-01-01

2024-01-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): January 1, 2024

COLLEGIUM PHARMACEUTICAL, INC.

(Exact Name of Registrant as Specified in its Charter)

| Virginia |

|

001-37372 |

|

03-0416362 |

(State or Other

Jurisdiction

of Incorporation or Organization) |

|

(Commission File Number) |

|

(IRS Employer Identification

No.) |

| 100 Technology Center Drive |

| Suite 300 |

| Stoughton, MA 02072 |

| (Address of principal executive offices) (Zip Code) |

Registrant’s telephone number, including

area code: (781) 713-3699

Securities registered pursuant to Section 12(b) of the Act:

| Title of

each class |

Trading Symbol(s) |

Name of each

exchange on which

registered |

| Common stock, par value $0.001 per share |

COLL |

The NASDAQ Global Select Market |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01

Regulation FD Disclosure.

On January 3, 2024, Collegium Pharmaceutical, Inc. (the “Company”)

issued a press release announcing full-year revenue, adjusted operating expense and adjusted EBITDA guidance for 2024. The Company also

announced that the Board of Directors of the Company authorized a new share repurchase program from January 2024 through June 2025 to

repurchase up to $150 million of the Company’s shares of common stock, which program is described in more detail under Item 8.01

of this Current Report on Form 8-K. A copy of the press release is attached hereto as Exhibit 99.1 and is being furnished, not filed,

under Item 7.01 of this Current Report on Form 8-K.

In addition, on January 3, 2024, the Company posted a corporate presentation

to its website that representatives of the Company may use from time to time in presentations or discussions with investors, analysts

or other parties. A copy of the presentation is attached hereto as Exhibit 99.2 and is being furnished, not filed, under Item 7.01 of

this Current Report on Form 8-K.

To the extent that the information in this Current Report on Form 8-K,

including Exhibits 99.1 and 99.2 furnished herewith, are not descriptions of historical facts regarding the Company, they are forward-looking

statements reflecting the current beliefs and expectations of management made pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. The Company may, in some cases, use terms such as “predicts,” “forecasts,” “believes,”

“potential,” “proposed,” “continue,” “estimates,” “anticipates,” “expects,”

“plans,” “intends,” “may,” “could,” “might,” “should” or other

words that convey uncertainty of future events or outcomes to identify these forward-looking statements. Examples of forward-looking statements

contained in this Current Report on Form 8-K, including Exhibits 99.1 and 99.2 furnished herewith, include, among others, statements related

to the Company’s full-year 2024 financial guidance, including projected product revenue, adjusted operating expenses and adjusted

EBITDA, current and future market opportunities for its products and the Company’s assumptions related thereto, expectations (financial

or otherwise) and intentions, and other statements that are not historical facts. Such statements are subject to numerous important factors,

risks and uncertainties that may cause actual events or results, performance, or achievements to differ materially from the Company's

current expectations. Actual results may differ materially from management’s expectations and such forward-looking statements in

this Current Report on Form 8-K, including Exhibits 99.1 and 99.2 furnished herewith, could be affected as a result of various important

factors, including risks relating to, among others: risks related to future opportunities and plans for our products, including uncertainty

of the expected financial performance of such products; unknown liabilities; our ability to commercialize and grow sales of our products;

our ability to manage our relationships with licensors; the success of competing products that are or become available; our ability to

obtain and maintain regulatory approval of our products and any product candidates, and any related restrictions, limitations, and/or

warnings in the label of an approved product; the size of the markets for our products and product candidates, and our ability to service

those markets; our ability to obtain reimbursement and third-party payor contracts for our products; the rate and degree of market acceptance

of our products and product candidates; the costs of commercialization activities, including marketing, sales and distribution; changing

market conditions for our products; the outcome of any patent infringement or other litigation that may be brought by or against us; the

outcome of any governmental investigation related to our business; our ability to secure adequate supplies of active pharmaceutical ingredient

for each of our products and manufacture adequate supplies of commercially saleable inventory; our ability to obtain funding for our operations

and business development; regulatory developments in the U.S.; our expectations regarding our ability to obtain and maintain sufficient

intellectual property protection for our products; our ability to comply with stringent U.S. and foreign government regulation

in the manufacture of pharmaceutical products, including U.S. Drug Enforcement Agency, or DEA, compliance; our customer concentration;

and the accuracy of our estimates regarding expenses, revenue, capital requirements and need for additional financing. These and other

risks are described under the heading "Risk Factors" in the Company’s Annual Reports on Form 10-K and Quarterly Reports

on Form 10-Q and other filings with the Securities and Exchange Committee. Any forward-looking statements that the Company makes in this

Current Report on Form 8-K, including Exhibits 99.1 and 99.2 furnished herewith, speak only as of the date of this Current Report on Form

8-K. The Company assumes no obligation to update any forward-looking statements whether as a result of new information, future events

or otherwise, after the date of this Current Report on Form 8-K.

| Item 8.01 |

Other Information. |

On January 1, 2024, the Board of Directors of the Company authorized

a new share repurchase program to repurchase up to $150 million of the Company’s shares of common stock through June 30, 2025. The

timing and amount of any shares purchased on the open market will be determined based on the Company’s evaluation of the market

conditions, share price and other factors. The Company plans to utilize existing cash on hand to fund the share repurchase program.

| Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: January 3, 2024 |

Collegium Pharmaceutical, Inc. |

| |

|

|

| |

By: |

/s/ Colleen Tupper |

| |

|

Name: Colleen Tupper |

| |

|

Title: Executive Vice President and Chief Financial Officer |

Exhibit 99.1

Collegium Provides 2024 Financial Guidance

– Product Revenues, Net Expected in the

Range of $580.0 Million to $595.0 Million –

– Adjusted Operating Expenses* Expected

in the Range of $120.0 Million to $125.0 Million –

– Adjusted EBITDA* Expected in the Range

of $380.0 Million to $395.0 Million –

– $150.0 Million Share Repurchase Program

Authorized by the Board of Directors –

STOUGHTON, Mass., January 3, 2024 -- Collegium

Pharmaceutical, Inc. (Nasdaq: COLL), a leading, diversified specialty pharmaceutical company, today announced its 2024 full-year financial

guidance and provided a business update.

“2023 was a banner year for Collegium. We

are on track to grow revenue over 20% and adjusted EBITDA over 35% in 2023 compared to 2022, leading to strong cash flow generation that

enabled us to rapidly pay down debt and opportunistically repurchase shares. Our operational accomplishments position the Company to deliver

top- and bottom-line growth in 2024 and strengthen our outlook for 2025 and 2026,” said Joe Ciaffoni, President and Chief Executive

Officer of Collegium. “In 2024, we are focused on operational execution, which includes achieving our financial commitments and

deploying capital to create value for shareholders.”

“We expect record revenue, driven by Belbuca®

and Xtampza® ER growth, and disciplined operating spend, to result in record adjusted EBITDA in 2024,” said Colleen

Tupper, Chief Financial Officer of Collegium. “We plan to deploy capital to rapidly pay down debt and opportunistically utilize

our new $150 million share repurchase program to return value to our shareholders.”

Recent Business Highlights

| · | Collegium’s board of directors authorized a new share repurchase program

to repurchase up to $150.0 million in common stock over 18 months. |

| · | Returned $75.0 million in capital to shareholders in 2023 under the share

repurchase program authorized by Collegium’s board of directors in January 2023, including $25.0 million repurchased through an

accelerated share repurchase program since November 9, 2023. |

| · | Successfully completed Xtampza ER contract renegotiations with payors that

represent 30% of Xtampza ER total prescriptions in 2023. As a result, Xtampza ER gross-to-net is expected to be in the range of 56% to

58% in 2024. |

| · | Renegotiated a major Medicare Part D contract for Belbuca, maintaining its

access position and materially reducing the rebate, and won a new Medicare Part D plan for Belbuca representing approximately one million

covered lives. |

Financial Guidance for 2024

| · | Product revenues, net are expected in the range

of $580.0 million to $595.0 million. |

| · | Adjusted operating expenses (excluding stock-based

compensation) are expected in the range of $120.0 million to $125.0 million. |

| · | Adjusted EBITDA (excluding stock-based compensation)

is expected in the range of $380.0 million to $395.0 million. |

* Non-GAAP

financial measure. Please refer to the “Non-GAAP Financial Measures” section for details regarding these measures.

About Collegium Pharmaceutical, Inc.

Collegium is a diversified, specialty pharmaceutical

company committed to improving the lives of people living with serious medical conditions. Collegium’s headquarters are located

in Stoughton, Massachusetts. For more information, please visit the Company’s website at www.collegiumpharma.com.

Non-GAAP Financial Measures

We have included information about certain non-GAAP

financial measures in this press release. We use these non-GAAP financial measures to understand, manage and evaluate our business as

we believe they provide additional information on the performance of our business. We believe that the presentation of these non-GAAP

financial measures, taken in conjunction with our results under GAAP, provide analysts, investors, lenders and other third parties insight

into our view and assessment of our ongoing operating performance. In addition, we believe that the presentation of these non-GAAP financial

measures, when viewed with our results under GAAP and the accompanying reconciliations, where applicable, provide supplementary information

that may be useful to analysts, investors, lenders, and other third parties in assessing our performance and results from period to period.

We report these non-GAAP financial measures to portray the results of our operations prior to considering certain income statement elements.

These non-GAAP financial measures should be considered in addition to, and not as a substitute for, or superior to, net income or other

financial measures calculated in accordance with GAAP.

In this press release we discuss the following

financial measures that are not calculated in accordance with GAAP.

Adjusted EBITDA

Adjusted EBITDA is a non-GAAP financial measure

that represents GAAP net income (loss) adjusted to exclude interest expense, interest income, the benefit from or provision for income

taxes, depreciation, amortization, stock-based compensation, and other adjustments to reflect changes that occur in our business but do

not represent ongoing operations. Adjusted EBITDA, as used by us, may be calculated differently from, and therefore may not be comparable

to, similarly titled measures used by other companies.

There are several limitations related to the use

of adjusted EBITDA rather than net income (loss), which is the nearest GAAP equivalent, such as:

| · | adjusted

EBITDA excludes depreciation and amortization, and, although these are non-cash expenses, the assets being depreciated or amortized may

have to be replaced in the future, the cash requirements for which are not reflected in adjusted EBITDA; |

| · | we

exclude stock-based compensation expense from adjusted EBITDA although (a) it has been, and will continue to be for the foreseeable future,

a significant recurring expense for our business and an important part of our compensation strategy and (b) if we did not pay out a portion

of our compensation in the form of stock-based compensation, the cash salary expense included in operating expenses would be higher,

which would affect our cash position; |

| · | adjusted

EBITDA does not reflect changes in, or cash requirements for, working capital needs; |

| · | adjusted

EBITDA does not reflect the benefit from or provision for income taxes or the cash requirements to pay taxes; |

| · | adjusted

EBITDA does not reflect historical cash expenditures or future requirements for capital expenditures or contractual commitments; |

| · | we exclude impairment expenses from adjusted EBITDA and, although these are

non-cash expenses, the asset being impaired may have to be replaced in the future, the cash requirements for which are not reflected in

adjusted EBITDA; |

| · | we exclude restructuring expenses from adjusted EBITDA. Restructuring expenses

primarily include employee severance and contract termination costs that are not related to acquisitions. The amount and/or frequency

of these restructuring expenses are not part of our underlying business; |

| · | we exclude litigation settlements from adjusted EBITDA, as well as any applicable

income items or credit adjustments due to subsequent changes in estimates. This does not include our legal fees to defend claims, which

are expensed as incurred; |

| · | we exclude acquisition related expenses as the amount and/or frequency of

these expenses are not part of our underlying business. Acquisition related expenses include transaction costs, which primarily consist

of financial advisory, banking, legal, and regulatory fees, and other consulting fees, incurred to complete an acquisition, employee related

expenses (severance cost and benefits) for terminated employees after the acquisition, and miscellaneous other acquisition related expenses

incurred; |

| · | we exclude recognition of the step-up basis in inventory from acquisitions

(i.e., the adjustment to record inventory from historic cost to fair value at acquisition) as the adjustment does not reflect the ongoing

expense associated with sale of our products as part of our underlying business; and |

| · | we exclude losses on extinguishments of debt as these expenses are episodic

in nature and do not directly correlate to the cost of operating our business on an ongoing basis. |

Adjusted Operating Expenses

Adjusted operating expenses is a non-GAAP financial

measure that represents GAAP operating expenses adjusted to exclude stock-based compensation expense, and other adjustments to reflect

changes that occur in our business but do not represent ongoing operations.

We have not provided a reconciliation of our full-year

2024 guidance for adjusted EBITDA or adjusted operating expenses to the most directly comparable forward-looking GAAP measures, in reliance

on the unreasonable efforts exception provided under Item 10(e)(1)(i)(B) of Regulation S-K,

because we are unable to predict, without unreasonable efforts, the timing and amount of items that would be included in such a reconciliation,

including, but not limited to, stock-based compensation expense, acquisition related expense and litigation settlements. These items are

uncertain and depend on various factors that are outside of the Company’s control or cannot be reasonably predicted. While we are

unable to address the probable significance of these items, they could have a material impact on GAAP net income and operating expenses

for the guidance period. A reconciliation of adjusted EBITDA or adjusted operating expenses would imply a degree of precision and certainty

as to these future items that does not exist and could be confusing to investors.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of The Private Securities Litigation Reform Act of 1995. We may, in some cases, use terms such as

"predicts," "forecasts," "believes," "potential," "proposed,"

"continue," "estimates," "anticipates," "expects," "plans," "intends,"

"may," "could," "might," "should" or other words that convey uncertainty of future events or

outcomes to identify these forward-looking statements. Examples of forward-looking statements contained in this press release

include, among others, statements related to our full-year 2024 financial guidance, including projected product revenue, adjusted

operating expenses and adjusted EBITDA, current and future market opportunities for our products and our assumptions related

thereto, expectations (financial or otherwise) and intentions, and other statements that are not historical facts. Such statements

are subject to numerous important factors, risks and uncertainties that may cause actual events or results, performance, or

achievements to differ materially from the Company's current expectations, including risks relating to, among others: unknown

liabilities; risks related to future opportunities and plans for our products, including uncertainty of the expected financial

performance of such products; our ability to commercialize and grow sales of our products; our ability to manage our relationships

with licensors; the success of competing products that are or become available; our ability to obtain and maintain regulatory

approval of our products and any product candidates, and any related restrictions, limitations, and/or warnings in the label of an

approved product; the size of the markets for our products and product candidates, and our ability to service those markets; our

ability to obtain reimbursement and third-party payor contracts for our products; the rate and degree of market acceptance of our

products and product candidates; the costs of commercialization activities, including marketing, sales and distribution; changing

market conditions for our products; the outcome of any patent infringement or other litigation that may be brought by or against us;

the outcome of any governmental investigation related to our business; our ability to secure adequate supplies of active

pharmaceutical ingredient for each of our products and manufacture adequate supplies of commercially saleable inventory; our ability

to obtain funding for our operations and business development; regulatory developments in the U.S.; our expectations regarding

our ability to obtain and maintain sufficient intellectual property protection for our products; our ability to comply with

stringent U.S. and foreign government regulation in the manufacture of pharmaceutical products, including U.S. Drug

Enforcement Agency, or DEA, compliance; our customer concentration; and the accuracy of our estimates regarding expenses, revenue,

capital requirements and need for additional financing. These and other risks are described under the heading "Risk

Factors" in our Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q and other filings with the SEC. Any

forward-looking statements that we make in this press release speak only as of the date of this press release. We assume no

obligation to update our forward-looking statements whether as a result of new information, future events or otherwise, after the

date of this press release.

Investor Contact:

Christopher James, M.D.

Vice President, Investor Relations

ir@collegiumpharma.com

Media Contact:

Marissa Samuels

Vice President, Corporate Communications

communications@collegiumpharma.com

Exhibit 99.2

Investor Presentation January 2024 | Nasdaq: COLL

Forward - Looking Statements This presentation contains forward - looking statements within the meaning of The Private Securities Litigation Reform Act of 1995 . We may, in some cases, use terms such as "predicts," "forecasts," "believes," "potential," "proposed," "continue," "estimates," "anticipates," "expects," "plans," "intends," "may," "could," "might," "should" or other words that convey uncertainty of future events or outcomes to identify these forward - looking statements . Examples of forward - looking statements contained in this presentation include, among others, statements related to our full - year 2024 financial guidance, including projected product revenue, adjusted operating expenses and adjusted EBITDA, current and future market opportunities for our products and our assumptions related thereto, expectations (financial or otherwise) and intentions, and other statements that are not historical facts . Such statements are subject to numerous important factors, risks and uncertainties that may cause actual events or results, performance, or achievements to differ materially from the Company's current expectations, including risks relating to, among others : unknown liabilities ; risks related to future opportunities and plans for our products, including uncertainty of the expected financial performance of such products ; our ability to commercialize and grow sales of our products ; our ability to manage our relationships with licensors ; the success of competing products that are or become available ; our ability to obtain and maintain regulatory approval of our products and any product candidates, and any related restrictions, limitations, and/or warnings in the label of an approved product ; the size of the markets for our products and product candidates, and our ability to service those markets ; our ability to obtain reimbursement and third - party payor contracts for our products ; the rate and degree of market acceptance of our products and product candidates ; the costs of commercialization activities, including marketing, sales and distribution ; changing market conditions for our products ; the outcome of any patent infringement or other litigation that may be brought by or against us ; the outcome of any governmental investigation related to our business ; our ability to secure adequate supplies of active pharmaceutical ingredient for each of our products and manufacture adequate supplies of commercially saleable inventory ; our ability to obtain funding for our operations and business development ; regulatory developments in the U . S .; our expectations regarding our ability to obtain and maintain sufficient intellectual property protection for our products ; our ability to comply with stringent U . S . and foreign government regulation in the manufacture of pharmaceutical products, including U . S . Drug Enforcement Agency, or DEA, compliance ; our customer concentration ; and the accuracy of our estimates regarding expenses, revenue, capital requirements and need for additional financing . These and other risks are described under the heading "Risk Factors" in our Annual Reports on Form 10 - K and Quarterly Reports on Form 10 - Q and other filings with the SEC . Any forward - looking statements that we make in this presentation speak only as of the date of this presentation . We assume no obligation to update our forward - looking statements whether as a result of new information, future events or otherwise, after the date of this presentation . Non - GAAP Financial Measures To supplement our financial results presented on a GAAP basis, we have included information about certain non - GAAP financial measures . We use these non - GAAP financial measures to understand, manage and evaluate our business as we believe they provide additional information on the performance of our business . We believe that the presentation of these non - GAAP financial measures, taken in conjunction with our results under GAAP, provide analysts, investors, lenders and other third parties insight into our view and assessment of our ongoing operating performance . In addition, we believe that the presentation of these non - GAAP financial measures, when viewed with our results under GAAP and the accompanying reconciliations, provide supplementary information that may be useful to analysts, investors, lenders, and other third parties in assessing our performance and results from period to period . We report these non - GAAP financial measures to portray the results of our operations prior to considering certain income statement elements . These non - GAAP financial measures should be considered in addition to, and not as a substitute for, or superior to, net income or other financial measures calculated in accordance with GAAP . In this presentation, we discuss the following financial measures that are not calculated in accordance with GAAP, to supplement our consolidated financial statements presented on a GAAP basis . Adjusted EBITDA Adjusted EBITDA is a non - GAAP financial measure that represents GAAP net income (loss) adjusted to exclude interest expense, interest income, the benefit from or provision for income taxes, depreciation, amortization, stock - based compensation, and other adjustments to reflect changes that occur in our business but do not represent ongoing operations . Adjusted EBITDA, as used by us, may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies . There are several limitations related to the use of adjusted EBITDA rather than net income (loss), which is the nearest GAAP equivalent, such as : • adjusted EBITDA excludes depreciation and amortization, and, although these are non - cash expenses, the assets being depreciated or amortized may have to be replaced in the future, the cash requirements for which are not reflected in adjusted EBITDA ; • we exclude stock - based compensation expense from adjusted EBITDA although (a) it has been, and will continue to be for the foreseeable future, a significant recurring expense for our business and an important part of our compensation strategy and (b) if we did not pay out a portion of our compensation in the form of stock - based compensation, the cash salary expense included in operating expenses would be higher, which would affect our cash position ; • adjusted EBITDA does not reflect changes in, or cash requirements for, working capital needs ; • adjusted EBITDA does not reflect the benefit from or provision for income taxes or the cash requirements to pay taxes ; • adjusted EBITDA does not reflect historical cash expenditures or future requirements for capital expenditures or contractual commitments ; • we exclude impairment expenses from adjusted EBITDA and, although these are non - cash expenses, the asset being impaired may have to be replaced in the future, the cash requirements for which are not reflected in adjusted EBITDA ; • we exclude restructuring expenses from adjusted EBITDA . Restructuring expenses primarily include employee severance and contract termination costs that are not related to acquisitions . The amount and/or frequency of these restructuring expenses are not part of our underlying business ; • we exclude litigation settlements from adjusted EBITDA, as well as any applicable income items or credit adjustments due to subsequent changes in estimates . This does not include our legal fees to defend claims, which are expensed as incurred ; • we exclude acquisition related expenses as the amount and/or frequency of these expenses are not part of our underlying business . Acquisition related expenses include transaction costs, which primarily consisted of financial advisory, banking, legal, and regulatory fees, and other consulting fees, incurred to complete the acquisition, employee - related expenses (severance cost and benefits) for terminated employees after the acquisition, and miscellaneous other acquisition related expenses incurred ; • we exclude recognition of the step - up basis in inventory from acquisitions (i . e . , the adjustment to record inventory from historic cost to fair value at acquisition) as the adjustment does not reflect the ongoing expense associated with sale of our products as part of our underlying business ; and • we exclude losses on extinguishments of debt as these expenses are episodic in nature and do not directly correlate to the cost of operating our business on an ongoing basis . Adjusted Operating Expenses Adjusted operating expenses is a non - GAAP financial measure that represents GAAP operating expenses adjusted to exclude stock - based compensation expense, and other adjustments to reflect changes that occur in our business but do not represent ongoing operations . Adjusted Net Income and Adjusted Earnings Per Share Adjusted net income is a non - GAAP financial measure that represents GAAP net income (loss) adjusted to exclude significant income and expense items that are non - cash or not indicative of ongoing operations, including consideration of the tax effect of the adjustments . Adjusted earnings per share is a non - GAAP financial measure that represents adjusted net income per share . Adjusted weighted - average shares - diluted is calculated in accordance with the treasury stock, if - converted, or contingently issuable accounting methods, depending on the nature of the security . Reconciliations of adjusted EBITDA, adjusted operating expenses, adjusted net income, and adjusted earnings per share to the most directly comparable GAAP financial measures are included in this presentation . The Company has not provided a reconciliation of its full - year 2023 or full - year 2024 guidance for adjusted EBITDA or adjusted operating expenses to the most directly comparable forward - looking GAAP measures, in reliance on the unreasonable efforts exception provided under Item 10 (e)( 1 )(i)(B) of Regulation S - K, because the Company is unable to predict, without unreasonable efforts, the timing and amount of items that would be included in such a reconciliation, including, but not limited to, stock - based compensation expense, acquisition related expense and litigation settlements . These items are uncertain and depend on various factors that are outside of the Company’s control or cannot be reasonably predicted . While the Company is unable to address the probable significance of these items, they could have a material impact on GAAP net income and operating expenses for the guidance period . A reconciliation of adjusted EBITDA or adjusted operating expenses would imply a degree of precision and certainty as to these future items that does not exist and could be confusing to investors . 2

Healthier people. Stronger communities. Mission Driven Building a leading, diversified specialty pharmaceutical company committed to improving the lives of people living with serious medical conditions. Doing Good As We Do Well Partnering with organizations driving equitable access to STEM education in underserved communities to support the next generation of scientists. Committed To Environmental, Social And Governance (ESG) Operating with integrity, accountability and responsibility and investing in the long - term sustainability of our business and the health of our broader communities. 3

2024 Focus : Operational Execution

5 2024 Priorities: Operational Execution Financial Commitments • ACHIEVE record revenue, adjusted EBITDA and net income • GENERATE record free cash flow Deploy Capital • RAPIDLY pay down debt, de - levering on a quarterly basis • OPPORTUNISTICALLY leverage $150M share repurchase program DELIVER ON 5 STRATEGICALLY

2024 Financial Guidance 1 $580 – 595 M Up 3.5% YoY 2 Product Revenues, Net $120 – 125 M Down (3.9)% YoY 2 Adjusted Operating Expenses 3 (Excluding Stock - Based Compensation) $380 – 395 M Up 6.9% YoY 2 1. This financial data was provided by Collegium in its press release filed with the SEC on January 3 , 2024. 2. This financial data is calculated based on data provided by Collegium in its press release filed with the SEC on January 3, 2024, and in its press release filed with the SEC on on November 7, 2023, and represents the percent change of the mid - point of 2024 financial guidance ranges compared to the mid - point of 2023 financial guidance ranges. 3. Represents a n on - GAAP financial measure. Refer to “Non - GAAP Financial Measures” on slide 2. 6 Adjusted EBITDA 3 (Excluding Stock - Based Compensation)

Disciplined Capital Deployment 7 1. Adjusted EBITDA is a non - GAAP financial measure. Refer to “Non - GAAP Financial Measures” on slide 2. 2023 net debt/adjusted EBITD A is calculated based on Collegium’s forecast of net debt at year - end 2023, compared to the mid - point of the 2023 guidance ranges provided by Collegium in its press release filed with the SEC on Novembe r 7, 2023 . 2024 net debt/adjusted EBITDA is calculated based on Collegium’s forecast of net debt at year - end 2024, compared to the mid - po int of the 2024 guidance ranges provided by Collegium in its press release filed with the SEC on January 3 , 2024 . This financial data assumes no additional debt is incurred. 2. Details regarding the Pharmakon term - loan debt amortization schedule were provided by Collegium on form SC TO - C filed with the S EC on February 14, 2022. 3. This financial data is calculated from data provided by Collegium in its Annual Report on Form 10 - K filed with the SEC on Februa ry 23, 2023, in its Quarterly Report on Form 10 - Q filed with the SEC on November 7, 2023, and in its press release filed with the SEC on January 3, 2024 . Rapidly Pay Down Debt • Expect n et debt/adjusted EBITDA of ~1.0 x by year - end 2023 ; de minimis by year - end 2024 1,2 • Repaid $162.5M of Pharmakon loan in 2023 ($650M issued 3/22/2022) and will repay $183.3M in 2024 2 • Pharmakon loan expected to be paid in full in Q1’26 2 Leverage Share Repurchase Program • From 2021 to 2023, returned $137M to shareholders ; repurchased 6.3M shares at average price of $21.65 3 • Board authorized new $150M share repurchase program

Collegium: The Leader in Responsible Pain Management

1. ATU (Awareness, Trial, & Usage) Market Research Study, fielded Q4 2022. 2. IQVIA NPA through November 2023 (Belbuca, Xtampza ER, and Nucynta® ER). 9 Path to Building a Leading Pain Portfolio 1990s – 2000s Rise of opioid epidemic in the U.S., marked by sharp increases in prescription opioid overdose deaths 2002 Collegium formed to address opioid epidemic through development of prescription pain treatments with abuse - deterrent properties 2015 Initial Public Offering 2016 FDA approved Collegium’s first product, Xtampza ® ER Formulated with DETERx ® , a proprietary abuse - deterrent technology, designed to deter common methods of abuse and misuse 2018 – 2022 Collegium in - licenses and acquires the Nucynta Franchise and acquires BioDelivery Sciences International (BDSI) adding Belbuca ® to the pain portfolio Present Collegium is the leader in responsible pain management with a differentiated pain portfolio of four products distinctly positioned to treat acute and chronic pain responsibly Rated #1 in responsible pain management by HCPs 1 ; portfolio holds over 50% market share of branded ER market 2

1. IQVIA NPA through November 2023. 2. IQVIA Xponent through September 2023; approximate quarterly prescriber counts. 10 Pain Portfolio Growth Drivers Expect prescription and revenue growth in 2024 Expect revenue growth in 2024 Strong Market Position 36.6% share of growing buprenorphine market 1 Large Prescriber Base GtN Impacts Market Access ~9.8K unique prescribers in Q3’23 2 Expect stable GtN Strong commercial coverage 37.1% share of OER market 1 ~17.7K unique prescribers in Q3’23 2 Expect GtN improvement to 56 - 58% Strong coverage across all payor types

11 Well Positioned to Grow Belbuca Prescriptions and Revenue in 2024 #1 highest rated branded ER opioid in terms of product differentiation and favorability 3 74% of surveyed target HCPs plan to increase prescribing 3 In 2023, successfully renegotiated major Medicare Part D plan representing 12% of Belbuca prescriptions; maintained formulary position at significantly lower rebate Achieved new payor win for Belbuca in Medicare Part D plan representing ~1M covered lives 1. IQVIA NPA. Q4’23 QTD YoY growth represents October and November 2023 compared to the same period in 2022. 2. IQVIA NPA for 2023 YTD through November compared to the same period in 2022. 3. ATU (Awareness, Trial, & Usage) Market Research Study, fielded Q4 2022. Positive Momentum for Belbuca Coming Out of 2023 +6.5% YoY growth in total buprenorphine prescriptions November 2023 YTD 2 GROWING BELBUCA PRESCRIPTIONS 1 EXPANDING BUPRENORPHINE MARKET STRONG BRAND FUNDAMENTALS & PAYOR PROGRESS Q3'23 Q4'23 QTD +1.2% +4.3% YoY growth in Belbuca prescriptions

12 Xtampza ER Poised to Grow Revenue in 2024 Improved GtN Expected to Drive Revenue Growth in 2024 7 7% of renegotiation opportunity maintained position at equal or better rebate 23 % of renegotiation opportunity removed from formulary to parity position with Oxycontin ® with no rebate Plans representing 84% of Xtampza ER prescriptions renegotiated in 2022 and 2023 Xtampza ER GtN expected to improve to 56% – 58% in 2024

1. 2021 product revenues, net were impacted by a negative $38.3M returns adjustment, including a negative $24.5M returns adju stm ent related to Nucynta. 13 Nucynta Franchise: Stable Contributor with Mid - Term Outlook Bolstered by Regulatory Exclusivity Extension Stable Contributor to the Pain Portfolio $182.0M $173.2M $184.5M $143.9M 2020 2021 2022 Q3'23 YTD Product Revenues, Net Nucynta Franchise net revenue All other net product revenue Improved Outlook for 2025 and 2026 • Nucynta ® granted New Patient Population exclusivity; U.S. regulatory exclusivity extended from June 27, 2025, to July 3, 2026 • Potential for 6 - month pediatric exclusivity (Dec. 2025 for Nucynta ® ER, Jan. 2027 for Nucynta) • Royalty declines from 14% to 7% in 2025 1

Strong Track Record of Execution and Achieving Financial Commitments

15 Track Record of Strong Top - and Bottom - Line Growth 1. This financial data was provided by Collegium in its Annual Report on Form 10 - K filed with the SEC on February 23, 2023. 2. This financial data was provided by Collegium in its press release filed with the SEC on November 7, 2023, and represents the mid - point of 2023 financial guidance ranges. 3. This financial data was provided by Collegium in its press release filed with the SEC on January 3, 2024, and represents the mid - point of 2024 financial guidance ranges. 4. Represents a non - GAAP financial measure. Refer to “Non - GAAP Financial Measures” on slide 2. GROW LEVERAGE EXPAND $277M 1 $464M 1 $568M 2 $588M 3 2021 2022 2023E 2024E Product Revenues, Net $101M 1 $122M 1 $128M 2 $123M 3 2021 2022 2023E 2024E Adjusted Operating Expenses 4 $118M 1 $266M 1 $363M 2 $388M 3 2021 2022 2023E 2024E Adjusted EBITDA 4

16 Robust Operating Cash Flow Generation from Pain Portfolio Cash Flows from Operating A ctivities 1. This financial data was provided by Collegium in its Annual Report on Form 10 - K filed with the SEC on February 24, 2022. 2. This financial data was provided by Collegium in its Annual Report on Form 10 - K filed with the SEC on February 23, 2023. 3. This financial data was provided by Collegium in its Quarterly Report on Form 10 - Q filed with the SEC on November 7, 2023. 4. This financial data is calculated from data provided by Collegium in its Annual Reports on Form 10 - K filed with the SEC on Febru ary 23, 2023, in its Quarterly Report on Form 10 - Q filed with the SEC on November 7, 2023, and in its press release filed with the SEC on January 3, 2024. 5. Represents the sum of the purchase price consideration paid for the Nucynta Acquisition in 2020 and the BDSI Acquisition in 2 022 as disclosed on Annual Reports on Form 10 - K filed with the SEC on February 25, 2021 and February 23, 2023, respectively. +$66M +$10M +$20M +$77M $170M 1 $177M 2 $189M 2 $176M 2 $305M 3 • Maximizing differentiated pain portfolio to generate robust operating cashflows • Strong cash generation enables disciplined capital deployment strategy • Executed $137M in share repurchases 2019 – 2023 4 • Invested ~ $1B in business development 2019 – 2023 5 $28M 1 $94M 2 $104M 2 $124M 2 $201M 3 2019 2020 2021 2022 Q3'23 YTD Period End Cash and Marketable Securities

Disciplined Capital Deployment

$650M $575M $413M $229M $46M $0M Mar 2022 2022 YE 2023E YE 2024E YE 2025E YE 2026E YE Pharmakon Loan Principal Balance 1. Adjusted EBITDA is a non - GAAP financial measure. Refer to “Non - GAAP Financial Measures” on slide 2. 2023 net debt/adjusted EBITD A is calculated based on Collegium’s forecast of net debt at year - end 2023, compared to the mid - point of the 2023 guidance ranges provided by Collegium in its press release filed with the SEC on Novembe r 7, 2023 . 2024 net debt/adjusted EBITDA is calculated based on Collegium’s forecast of net debt at year - end 2024, compared to the mid - point of the 2024 guidance ranges provided by Collegium in its press release filed with the S EC on January 3 , 2024 . This financial data assumes no additional debt is incurred. 2. Details regarding the Pharmakon term - loan debt amortization schedule were provided by Collegium on form SC TO - C filed with the S EC on February 14, 2022. 18 Rapid Paydown of Debt • Expect n et debt/adjusted EBITDA of ~1.0 x by year - end 2023; de minimis by year - end 2024 1,2 • Repaid $162.5M of Pharmakon loan in 2023 ($650M issued 3/22/2022) and will repay $183.3M in 2024 2 • Pharmakon loan expected to be paid in full in Q1’26 2 Convertible Debt • $267.9M in convertible debt principal as of 9/30/2023 • In February 2023, completed a $241.5M convertible note financing: • Due in February 2029 • Interest rate of 2.875% • Conversion premium: ~30% (conversion price of $36.56 per share) • Used portion of proceeds to repurchase $117.4M of principal related to previously issued convertible notes due 2026 • Later maturity provides more financial flexibility in the management of debt • Net increase in principal balance of convertible debt was $124.1M from 12/31/2022

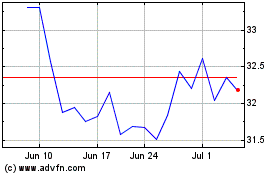

2021 2022 2023 ASR program Open market share repurchases 19 Opportunistic Share Repurchases 1 1. This financial data is calculated from data provided by Collegium in its Annual Report on Form 10 - K filed with the SEC on Februa ry 23, 2023 , in its Quarterly Report on Form 10 - Q filed with the SEC on November 7, 2023, and in its press release filed with the SEC on January 3, 2024. $43M $19M $75M $25M ASR $50M ASR $25M ASR Returned $137M of Capital to Shareholders from 2021 to 2023 Repurchased 6.3M shares at average price of $21.65 Board Authorized New $150M Share Repurchase Program

$104M $139M $173M $325M 2021 2022 2023E 1. This financial data was provided by Collegium on Form 10 - K filed with the SEC on February 23, 2023. 2. This financial data was provided by Collegium in its press release filed with the SEC on November 7, 2023 and represents t he mid - point of 2023 financial guidance ranges. 3. Represents Xtampza ER product revenues. 4. Represents Nucynta IR, Nucynta ER, Belbuca, Symproic, and Other product revenues. 5. Represents a non - GAAP financial measure. Refer to “Non - GAAP Financial Measures” on slide 2. 20 Track Record of Successful Business Development Strategically Compelling Acquisitions Nucynta Franchise (February 2020) Successful business development established Collegium as the leader in responsible pain management and added diversified revenue streams and growth opportunities to the business Impact of Accretive Acquisitions $277M 1 $464M 1 $568M 2 $118M 1 $266M 1 $363M 2 2021 2022 2023E Revenue – organic 3 Revenue – acquisition 4 BDSI (March 2022) Adjusted EBITDA 5 Product Revenues, Net

Strong IP Management

Reflects (i) for Xtampza ER, the September 2033 entry date set forth in Collegium’s settlement agreement with Teva; (ii) for Bel buca, the January 2027 entry date set forth in BDSI’s settlement agreement with Teva; (iii) for the Nucynta Franchise, the New Patient Population exclusivity granted to Nucynta, and based on the judgment upholding its Ora nge - Book listed patents, the July 2025 and 2028 expiries of such patents for Nucynta ER; and (iv) for Symproic, which does not have any ANDA filers yet, the November 2031 expiry of its Orange Book - listed patents. 22 Patent Protected Commercial Portfolio September 2033 Growth Drivers Contributors …2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 …2037 January 2027 July 2026 July 2025 May 2033 Projected exclusivity Latest patent expiry Teva currently is the only generic manufacturer that has resolved legal challenges to its Xtampza ER and Belbuca ANDAs. Teva does not have tentative or final approval for either ANDA and has waived its first filer exclusivity with respect to Belbuca . 2036 2032 2028

Summary

24 Creating Long - Term Value Through Operational Execution 24 DELIVER ON Financial commitments of top - and bottom - line growth: • Achieve record revenue, adjusted EBITDA and net income • Generate record free cash flow STRATEGICALLY Deploy capital in a disciplined manner: • Rapidly pay down $183.3M in debt in 2024 • Return capital to shareholders by leveraging $150M share repurchase program Creating value for shareholders by: x Growing revenue x Increasing profitability x Generating strong cash flows x Strategically deploying capital

Important Safety Information

See full prescribing information, including Boxed Warning on Addiction, Abuse and Misuse, and other serious risks at XtampzaER.com/PI . 26 Important Safety Information about XTAMPZA ER (oxycodone) extended - release capsules WARNING: SERIOUS AND LIFE - THREATENING RISKS FROM USE OF XTAMPZA ER Addiction, Abuse, and Misuse Because the use of XTAMPZA ER exposes patients and other users to the risks of opioid addiction, abuse, and misuse, which can le ad to overdose and death, assess each patient’s risk prior to prescribing and reassess all patients regularly for the development of these behaviors and condi tio ns. Life - Threatening Respiratory Depression Serious, life - threatening, or fatal respiratory depression may occur with use of XTAMPZA ER, especially during initiation or fol lowing a dosage increase. To reduce the risk of respiratory depression, proper dosing and titration of XTAMPZA ER are essential. Accidental Ingestion Accidental ingestion of even one dose of XTAMPZA ER, especially by children, can result in a fatal overdose of oxycodone. Risks From Concomitant Use With Benzodiazepines Or Other CNS Depressants Concomitant use of opioids with benzodiazepines or other central nervous system (CNS) depressants, including alcohol, may res ult in profound sedation, respiratory depression, coma, and death. Reserve concomitant prescribing of XTAMPZA ER and benzodiazepines or other CNS depressants for u se in patients for whom alternative treatment options are inadequate. Neonatal Opioid Withdrawal Syndrome (NOWS) If opioid use is required for an extended period of time in a pregnant woman, advise the patient of the risk of NOWS, which m ay be life - threatening if not recognized and treated. Ensure that management by neonatology experts will be available at delivery. XTAMPZA ER (Oxycodone) extended - release capsules

See full prescribing information, including Boxed Warning on Addiction, Abuse and Misuse, and other serious risks at XtampzaER.com/PI . 27 Important Safety Information about XTAMPZA ER (oxycodone) extended - release capsules Opioid Analgesic Risk Evaluation and Mitigation Strategy (REMS) Healthcare providers are strongly encouraged to complete a REMS - compliant education program and to counsel patients and caregive rs on serious risks, safe use, and the importance of reading the Medication Guide with each prescription. Cytochrome P450 3A4 Interaction The concomitant use of XTAMPZA ER with all cytochrome P450 3A4 inhibitors may result in an increase in oxycodone plasma conce ntr ations, which could increase or prolong adverse drug effects and may cause potentially fatal respiratory depression. In addition, discontinuation of a concom ita ntly used cytochrome P450 3A4 inducer may result in an increase in oxycodone plasma concentration. Regularly evaluate patients receiving XTAMPZA ER and any CY P3A4 inhibitor or inducer. XTAMPZA ER (Oxycodone) extended - release capsules

See full prescribing information, including Boxed Warning on Addiction, Abuse and Misuse, and Other Serious Risks at Belbuca.com/#isi - block . 28 Important Safety Information about BELBUCA (buprenorphine buccal film) WARNING: SERIOUS AND LIFE - THREATENING RISKS FROM USE OF BELBUCA Addiction, Abuse, and Misuse BELBUCA exposes patients and other users to the risks of opioid addiction, abuse, and misuse, which can lead to overdose and dea th, assess each patient’s risk prior to prescribing and reassess all patients regularly for the development of these behaviors and conditions. Life - Threatening Respiratory Depression Serious, life - threatening, or fatal respiratory depression may occur with use of BELBUCA, especially during initiation or follow ing a dosage increase. To reduce the risk of respiratory depression, proper dosing and titration of BELBUCA are essential. Misuse or abuse of BELBUCA by chewing, swall owi ng, snorting, or injecting buprenorphine extracted from the buccal film will result in the uncontrolled delivery of buprenorphine and poses a significan t r isk of overdose and death. Accidental Exposure Accidental exposure of even one dose of BELBUCA, especially in children, can result in a fatal overdose of buprenorphine. Risks from Concomitant Use with Benzodiazepines Or Other CNS Depressants Concomitant use of opioids with benzodiazepines or other central nervous system (CNS) depressants, including alcohol, may res ult in profound sedation, respiratory depression, coma, and death. Reserve concomitant prescribing of BELBUCA and benzodiazepines or other CNS depressants for use in patients for whom alternative treatment options are inadequate. Neonatal Opioid Withdrawal Syndrome (NOWS) If opioid use is required for an extended period of time in a pregnant woman, advise the patient of the risk of NOWS, which m ay be life - threatening if not recognized and treated. Ensure that management by neonatology experts will be available at delivery. Opioid Analgesic Risk Evaluation and Mitigation Strategy (REMS) Healthcare providers are strongly encouraged to complete a REMS - compliant education program and to counsel patients and caregive rs on serious risks, safe use, and the importance of reading the Medication Guide with each prescription. BELBUCA (buprenorphine buccal film)

See full prescribing information, including Boxed Warning on Addiction, Abuse and Misuse, and other serious risks at Nucynta.com/erPI . 29 Important Safety Information about NUCYNTA ER (tapentadol) extended - release tablets WARNING: SERIOUS AND LIFE - THREATENING RISKS FROM USE OF NUCYNTA ER Addiction, Abuse, and Misuse Because the use of NUCYNTA ER exposes patients and other users to the risks of opioid addiction, abuse, and misuse, which can le ad to overdose and death, assess each patient’s risk prior to prescribing and reassess all patients regularly for the development of these behaviors and condi tio ns. Life - Threatening Respiratory Depression Serious, life - threatening, or fatal respiratory depression may occur with use of NUCYNTA ER, especially during initiation or fol lowing a dosage increase. To reduce the risk of respiratory depression, proper dosing and titration of NUCYNTA ER are essential. Instruct patients to swallow NUCYNTA ER tablets whole; crushing, chewing, or dissolving NUCYNTA ER tablets can cause rapid release and absorption of a potentially fatal dose of tapentadol . Accidental Ingestion Accidental ingestion of even one dose of NUCYNTA ER, especially by children, can result in a fatal overdose of tapentadol . Interaction with Alcohol Instruct patients not to consume alcoholic beverages or use prescription or nonprescription products that contain alcohol whi le taking NUCYNTA ER. The co - ingestion of alcohol with NUCYNTA ER may result in increased plasma tapentadol levels and a potentially fatal overdose of tapentadol . Risks From Concomitant Use With Benzodiazepines Or Other CNS Depressants Concomitant use of opioids with benzodiazepines or other central nervous system (CNS) depressants, including alcohol, may res ult in profound sedation, respiratory depression, coma, and death. Reserve concomitant prescribing of NUCYNTA ER and benzodiazepines or other CNS depressants for u se in patients for whom alternative treatment options are inadequate. NUCYNTA ER (tapentadol) extended - release tablets

See full prescribing information, including Boxed Warning on Addiction, Abuse and Misuse, and other serious risks at Nucynta.com/erPI . 30 Important Safety Information about NUCYNTA ER (tapentadol) extended - release tablets Neonatal Opioid Withdrawal Syndrome If opioid use is required for an extended period of time in a pregnant woman, advise the patient of the risk of NOWS, which m ay be life - threatening if not recognized and treated. Ensure that management by neonatology experts will be available at delivery. Opioid Analgesic Risk Evaluation and Mitigation Strategy (REMS) Healthcare providers are strongly encouraged to complete a REMS - compliant education program and to counsel patients and caregive rs on serious risks, safe use, and the importance of reading the Medication Guide with each prescription. NUCYNTA ER (tapentadol) extended - release tablets

See full prescribing information, including Boxed Warning on Addiction, Abuse and Misuse and other serious risks at Nucynta.com/irPI . 31 Important Safety Information about NUCYNTA (Tapentadol) tablets WARNING: SERIOUS AND LIFE - THREATENING RISKS FROM USE OF NUCYNTA TABLETS Addiction, Abuse, and Misuse Because the use of NUCYNTA tablets exposes patients and other users to the risks of opioid addiction, abuse, and misuse, whic h c an lead to overdose and death, assess each patient’s risk prior to prescribing and reassess all patients regularly for the development of these behaviors an d c onditions. Life - Threatening Respiratory Depression Serious, life - threatening, or fatal respiratory depression may occur with use of NUCYNTA tablets, especially during initiation o r following a dosage increase. To reduce the risk of respiratory depression, proper dosing and titration of NUCYNTA tablets are essential. Accidental Ingestion Accidental ingestion of even one dose of NUCYNTA tablets, especially by children, can result in a fatal overdose of tapentadol . Risks From Concomitant Use With Benzodiazepines Or Other CNS Depressants Concomitant use of opioids with benzodiazepines or other central nervous system (CNS) depressants, including alcohol, may res ult in profound sedation, respiratory depression, coma, and death. Reserve concomitant prescribing of NUCYNTA tablets and benzodiazepines or other CNS depressants for use in patients for whom alternative treatment options are inadequate. Neonatal Opioid Withdrawal Syndrome (NOWS) If opioid use is required for an extended period of time in a pregnant woman, advise the patient of the risk of NOWS, which m ay be life - threatening if not recognized and treated. Ensure that management by neonatology experts will be available at delivery. Opioid Analgesic Risk Evaluation and Mitigation Strategy (REMS) Healthcare providers are strongly encouraged to complete a REMS - compliant education program and to counsel patients and caregive rs on serious risks, safe use, and the importance of reading the Medication Guide with each prescription. NUCYNTA (tapentadol) tablets

See full prescribing Information and other s erious risks at Symproic.com/#isi . 32 Important Safety Information about SYMPROIC (naldemedine) tablets SYMPROIC may cause serious side effects, including: • Tear in your stomach or intestinal wall (perforation). Stomach pain that is severe can be a sign of a serious medical conditi on. If you get stomach pain that does not go away, stop taking SYMPROIC and get emergency medical help right away • Opioid withdrawal. You may have symptoms of opioid withdrawal during treatment with SYMPROIC including sweating, chills, tear ing , warm or hot feeling to your face (flush), sneezing, fever, feeling cold, abdominal pain, diarrhea, nausea, and vomiting. Tell your healthcare provider if yo u have any of these symptoms Do not take SYMPROIC if you: • Have a bowel blockage (intestinal obstruction) or have a history of bowel blockage • Are allergic to SYMPROIC or any of the ingredients in SYMPROIC. See the Medication Guide for a complete list of ingredients i n S YMPROIC. Tell your healthcare provider or pharmacist before you start or stop any medicines during treatment with SYMPROIC Before you take SYMPROIC, tell your healthcare provider about all of your medical conditions, including if you: • Have any stomach or bowel (intestines) problems, including stomach ulcer, Crohn’s disease, diverticulitis, cancer of the stom ach or bowel, or Ogilvie’s syndrome • Have liver problems • Are pregnant or plan to become pregnant. Taking SYMPROIC during pregnancy may cause opioid withdrawal symptoms in your unborn ba by. Tell your healthcare provider right away if you become pregnant during treatment with SYMPROIC • Are breastfeeding or plan to breastfeed. It is not known if SYMPROIC passes into your breast milk. You should not breastfeed dur ing treatment with SYMPROIC and for 3 days after your last dose. Taking SYMPROIC while you are breastfeeding may cause opioid withdrawal symptoms in your ba by. You and your healthcare provider should decide if you will take SYMPROIC or breastfeed. You should not do both • The most common side effects of SYMPROIC include stomach (abdomen) pain, diarrhea, nausea and vomiting (gastroenteritis) • Tell your healthcare provider if you have any side effect that bothers you or that does not go away. These are not all the po ssi ble side effects of SYMPROIC. Call your doctor for medical advice about side effects. You may report side effects to FDA at 1 - 800 - FDA - 1088 SYMPROIC (naldemedine) tablets

See full prescribing Information and other s erious risks at Symproic.com/#isi . 33 Important Safety Information about SYMPROIC ( naldemedine ) tablets INDICATIONS AND USAGE SYMPROIC is indicated for the treatment of opioid - induced constipation (OIC) in adult patients with chronic non - cancer pain, inc luding patients with chronic pain related to prior cancer or its treatment who do not require frequent (e.g., weekly) opioid dosage escalation. CONTRAINDICATIONS SYMPROIC is contraindicated in: • Patients with known or suspected gastrointestinal obstruction and patients at increased risk of recurrent obstruction, due to th e potential for gastrointestinal perforation • Patients with a history of a hypersensitivity reaction to Naldemedine . Reactions have included bronchospasm and rash WARNINGS AND PRECAUTIONS Gastrointestinal Perforation: Cases of gastrointestinal perforation have been reported with use of another peripherally acting opioid antagonist in patient s w ith conditions that may be associated with localized or diffuse reduction of structural integrity in the wall of the gastrointestinal tract (e.g., peptic ulcer dis eas e, Ogilvie’s syndrome, diverticular disease, infiltrative gastrointestinal tract malignancies, or peritoneal metastases). Take into account the overall risk - benefit profile when using SYMPROIC in patients with these conditions or other conditions which might result in impaired integrity of the gastrointestinal tract wall (e.g., Crohn’s disease). Monitor for the development of severe, persistent, or w ors ening abdominal pain; discontinue SYMPROIC in patients who develop this symptom. Opioid Withdrawal: Clusters of symptoms consistent with opioid withdrawal, including hyperhidrosis, chills, increased lacrimation, hot flush/flu shi ng, pyrexia, sneezing, feeling cold, abdominal pain, diarrhea, nausea, and vomiting have occurred in patients treated with SYMPROIC. Patients having disruptions to the blood - brain b arrier may be at increased risk for opioid withdrawal or reduced analgesia. Take into account the overall risk - benefit profile and monitor for symptoms of opioid withdrawal when using SYMPROIC in such patients. ADVERSE REACTIONS • The most common adverse reactions with SYMPROIC compared to placebo in two pooled 12 - week studies were: abdominal pain (8% vs 2% ), diarrhea (7% vs 2%), nausea (4% vs 2%), and gastroenteritis (2% vs 1%). • The incidence of adverse reactions of opioid withdrawal in two pooled 12 - week studies was 1% (8/542) for SYMPROIC and 1% (3/546) for placebo. In a 52 - week study, the incidence was 3% (20/621) for SYMPROIC and 1% (9/619) for placebo. OVERDOSAGE Single doses of Naldemedine up to 100 mg (500 times the recommended dose) and multiple doses of up to 30 mg (150 times the recommended dose) for 10 days ha ve been administered to healthy subjects in clinical studies. Dose - dependent increases in gastrointestinal - related adverse reactions, including abdominal pain, diarrhea, and nausea, were observed. Single doses of Naldemedine up to 3 mg (15 times the recommended dose) and multiple doses of 0.4 mg (twice the recommended dose) for 28 days have been administ ere d to patients with OIC in clinical studies. Dose dependent increases in gastrointestinal - related adverse reactions, including abdominal pain, diarrhea, nausea, and vomiting, were observed . Also, chills, hyperhidrosis, and dizziness were reported more frequently at 1 and 3 mg doses and hyperhidrosis at the 0.4 mg dose. No antidote for Naldemedine is known. Hemodialysis is not an effective means to remove Naldemedine from the blood. SYMPROIC ( naldemedine ) tablets

See full prescribing Information and other s erious risks at Symproic.com/#isi . 34 Important Safety Information about SYMPROIC ( naldemedine ) tablets USE IN SPECIFIC POPULATIONS Pregnancy : There are no available data with Naldemedine in pregnant women to inform a drug - associated risk of major birth defects and miscarriage . There is a potential for opioid withdrawal in a fetus when SYMPROIC is used in pregnant women . SYMPROIC should be used during pregnancy only if the potential benefit justifies the potential risk . Fetal/Neonatal Adverse Reactions Naldemedine crosses the placenta and may precipitate opioid withdrawal in a fetus due to the immature fetal blood - brain barrier. Lactation There is no information regarding the presence of Naldemedine in human milk, the effects on the breastfed infant, or the effects on milk production . Because of the potential for serious adverse reactions, including opioid withdrawal in breastfed infants, a decision should be made to discontinue breastfeeding or discontinue the drug, taking into account the importance of the drug to the mother . If drug is discontinued in order to minimize drug exposure to a breastfed infant, advise women that breastfeeding may be resumed 3 days after the final dose of SYMPROIC . Pediatric Use The safety and effectiveness of SYMPROIC have not been established in pediatric patients . Geriatric Use Of the 1163 patients exposed to SYMPROIC in clinical studies, 183 ( 16 % ) were 65 years of age and over, while 37 ( 3 % ) were 75 years and over . No overall differences in safety or effectiveness between these and younger patients were observed, but greater sensitivity of some older individuals cannot be ruled out . In a population pharmacokinetic analysis, no age - related alterations in the pharmacokinetics of Naldemedine were observed . Hepatic Impairment The effect of severe hepatic impairment (Child - Pugh Class C) on the pharmacokinetics of Naldemedine has not been evaluated . Avoid use of SYMPROIC in patients with severe hepatic impairment . No dose adjustment of SYMPROIC is required in patients with mild or moderate hepatic impairment . SYMPROIC ( naldemedine ) tablets

Non - GAAP Reconciliations

Collegium Pharmaceutical, Inc. Reconciliation of GAAP Net Income (Loss) to Adjusted EBITDA (in thousands) (unaudited) 36 GAAP net (loss) income $ (25,002) $ 71,517 Adjustments: Interest expense 63,213 21,014 Interest income (1,047) (12) Benefit from income taxes (3,845) (74,891) Depreciation 2,684 1,736 Amortization 131,469 67,181 Impairment expense 4,786 — Stock-based compensation expense 22,874 24,255 Restructuring — 4,578 Litigation settlements — 2,935 Acquisition related expenses 31,297 — Recognition of step-up basis in inventory 39,584 — Total adjustments $ 291,015 $ 46,796 Adjusted EBITDA $ 266,013 $ 118,313 Years Ended December 31, 2022 2021

Collegium Pharmaceutical, Inc. Reconciliation of GAAP Operating Expenses to Adjusted Operating Expenses (in thousands) (unaudited) 37 GAAP operating expenses $ 176,169 $ 132,989 Adjustments: Stock-based compensation 22,874 24,255 Restructuring — 4,578 Litigation settlements — 2,935 Acquisition related expenses 31,297 — Total adjustments $ 54,171 $ 31,768 Adjusted operating expenses $ 121,998 $ 101,221 Years Ended December 31, 2022 2021

v3.23.4

Cover

|

Jan. 01, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 01, 2024

|

| Entity File Number |

001-37372

|

| Entity Registrant Name |

COLLEGIUM PHARMACEUTICAL, INC.

|

| Entity Central Index Key |

0001267565

|

| Entity Tax Identification Number |

03-0416362

|

| Entity Incorporation, State or Country Code |

VA

|

| Entity Address, Address Line One |

100 Technology Center Drive

|

| Entity Address, Address Line Two |

Suite 300

|

| Entity Address, City or Town |

Stoughton

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02072

|

| City Area Code |

781

|

| Local Phone Number |

713-3699

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.001 per share

|

| Trading Symbol |

COLL

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |