UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 28, 2023

CLS HOLDINGS USA, INC.

(Exact name of registrant as specified in its charter)

| Nevada | | 000-55546 | | 45-1352286 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| 516 S. 4th Street | | |

| Las Vegas, Nevada | | 89101 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (888) 359-4666

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Securities Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Amendments to Convertible Debentures and Underlying Warrants

On December 28, 2023, CLS Holdings USA, Inc. (“CLS” or the “Company”) executed a Supplemental Indenture to amend that certain debenture indenture by and between the Company and Odyssey Trust Company, as Trustee, dated as of December 12, 2018, as supplemented March 31, 2021, as further supplemented September 15, 2022 (collectively, the “Debenture Indenture”), in order to amended the terms of its outstanding US$5,252,873 principal amount unsecured convertible debentures (the “December Debentures”) issued December 12, 2018 to, among other things, (i) decrease the conversion price of the remaining December Debentures to $0.07 per unit; (ii) change the maturity date of the December Debentures so that the December Debentures mature on January 31, 2028; (iii) providing for interest accruing between July 1, 2022 and December 31, 2023 to be added to the principal balance of the December Debentures; (iv) granting debentureholders a put right exercisable to December 29, 2023, granting each debentureholder the right to require the Company to redeem all or any part of such debentureholder’s outstanding December Debenture in cash at a redemption price equal to US$600 per US$1000 principal amount of December Debentures elected to be redeemed; any accrued but unpaid interest through to and including the date of the debentureholder’s election shall not be paid and shall be cancelled; (v) granting debentureholders a put right in the event the Company’s cash available for debt service for any fiscal quarter exceeds US$750,000, subject to pro ration, to require the Company to redeem all or any part of such debetureholder’s outstanding December Debentures in cash at a redemption price equal to the aggregate principal amount of the December Debentures being so redeemed, (vi) including a provision providing that the Company shall redeem on the last day of each calendar month beginning March 31, 2025 an aggregate amount of outstanding December Debentures equal to US$108,799.73 less the amount of interest paid on such date; and (vii) subject to the receipt of regulatory approvals, granting a security interest in certain of the Company’s assets (such as licenses, inventory (including work in process), equipment (excluding equipment subject to purchase money financing) and contract rights (excluding investments in entities other than wholly owned subsidiaries)) to the holders of the December Debentures and to other holders of the Company’s debt, now or in the future, as the Company may elect.

On December 28, 2023, the Company also executed a Notice of Amendment to Warrant Terms to extend the terms of the warrants to December 28, 2026.

Item 9.01 Financial Statements and Exhibits.

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

CLS HOLDINGS USA, INC.

|

| |

|

|

| |

|

|

|

Date: January 2, 2024

|

|

By: /s/ Andrew Glashow

|

| |

|

Andrew Glashow

Chairman and Chief Executive Officer

|

false

0001522222

true

NONE

0001522222

2023-12-28

2023-12-28

Exhibit 4.1

THIS SUPPLEMENTAL INDENTURE dated as of December 28, 2023

|

BY AND AMONG:

|

CLS HOLDINGS USA, INC., a corporation governed by the laws of the State of Nevada

(the “Corporation”)

|

|

AND:

|

ODYSSEY TRUST COMPANY, a trust company existing under the laws of the Province of Alberta

(the “Trustee”)

|

WHEREAS:

A. The Corporation and the Trustee executed a debenture indenture dated as of December 12, 2018 (as amended on March 31, 2021 and September 15, 2022, the “Indenture”) providing for the issue of convertible debentures (the “Debentures”).

B. Pursuant to a consent resolution signed by holders of at least 66 2/3% of the outstanding principal amount of Debentures, the holders of the Debentures approved an Extraordinary Resolution (as such term is defined in the Indenture) to effect amendments to the Indenture to, inter alias: (i) change the maturity date of the Debentures to January 31, 2028, (ii) amend the Conversion Price (as such term is defined in the Indenture) to US$0.07 per Unit (as such term is defined in the Indenture), (iii) capitalize all accrued interest and amend the payment terms with respect to interest payable on the Debentures, (iv) add security for the Debentures, (v) amend the principal payment terms and to provide for separate quarterly cash payment to Debenture holders based on excess cash available to the Corporation at the end of each such fiscal quarter, and (vi) provide holders of Debentures with the rights (the “Put Rights”) to cause the Corporation to redeem all, or a portion of, their outstanding Debentures as more particularly provided for herein.

C. Section 12.2 of the Indenture provides for the creation of indentures supplemental to the Indenture, including to give effect to the above-noted Extraordinary Resolution.

D. The foregoing recitals are made as representations of the Corporation and not by the Trustee.

E. The Trustee has agreed to enter into this Supplemental Indenture and to hold all rights, interests and benefits contained herein for and on behalf of those persons who are holders of Debentures issued pursuant to the Indenture as modified by this Supplemental Indenture from time to time.

NOW THEREFORE THIS SUPPLEMENTAL INDENTURE WITNESSES that for good and valuable consideration mutually given and received, the receipt and sufficiency of which are hereby acknowledged, it is hereby agreed and declared as follows:

| |

1.

|

This Supplemental Indenture is supplemental to the Indenture and the Indenture shall henceforth be read in conjunction with this Supplemental Indenture and all the provisions of the Indenture, except only insofar as the same may be inconsistent with the express provisions hereof, shall apply and have the same effect as if all the provisions of the Indenture and of this Supplemental Indenture were contained in one instrument and the terms and expressions used herein shall have the same meaning as is ascribed to the corresponding terms and expressions in the Indenture.

|

| |

2.

|

On and after the date hereof, each reference to the Indenture, as amended by this Supplemental Indenture, “this Indenture”, “this indenture”, “herein”, “hereby”, “hereunder”, “hereof” and similar references, and each reference to the Indenture in any other agreement, certificate, document or instrument relating thereto, shall mean and refer to the Indenture as amended hereby. Except as specifically amended by this Supplemental Indenture, all other terms and conditions of the Indenture shall remain in full force and unchanged.

|

| |

3.

|

Section 1.1 of the Indenture is amended to add the definition of “CAFDS” as follows:

|

““CAFDS” means, for any period ending on a Measurement Date and for which financial statements are available, the excess of the Corporation’s gross revenues for such period, as determined in accordance with GAAP, minus the sum of the Corporation’s expenses for such period, such expenses including, without limitation:

| |

(a)

|

additions to property and equipment, net of lease incentives received in such period;

|

| |

(b)

|

additions to intangible assets in such period;

|

| |

(c)

|

repayment of long-term debt made in such period, excluding the principal amount of Debentures redeemed pursuant to Section 3.9 hereof during such period;

|

| |

(d)

|

any payments made with respect to earn-out or similar arrangements existing as of December 31, 2023; and

|

| |

(e)

|

any payments otherwise due and payable to the Holders pursuant to the terms of this Indenture;

|

in each case, such expenses calculated in accordance with GAAP.”

| |

4.

|

Section 1.1 of the Indenture is amended to replace the definition of “Conversion Price” with the following:

|

““Conversion Price” means US$0.07 per Unit, subject to adjustment in accordance with the provisions of Section 4.6;”

| |

5.

|

Section 1.1 of the Indenture is amended to replace the definition of “Interest Payment Date” with the following:

|

““Interest Payment Date” means, subject to Section 2.3(4), the last day of each calendar month, and such other dates to which interest accrues and is payable pursuant to Section 2.3, it being acknowledged that (a) for a period (i) of 18 months from the Issue Date, and (ii) commencing on July 1, 2022 and continuing until February 28, 2025, any Interest Obligation payable hereunder shall automatically accrue to the principal amount of the Debentures, and shall thereafter be deemed to be part of the principal amount of the Debentures, and (b) for that period commencing on July 1, 2022, and continuing up to and including December 31, 2023, such Interest Payment Date shall be December 31, 2023;”

| |

6.

|

Section 1.1 of the Indenture is amended to replace the definition of “Maturity Date” with the following:

|

““Maturity Date” means January 31, 2028;”

| |

7.

|

Section 1.1 of the Indenture is amended to add a definition of “Measurement Date” after the definition of “Maturity Date” as follows:

|

““Measurement Date” means the last day of each fiscal quarter of the Corporation;”

| |

8.

|

Subsection 2.3(4) of the Indenture is deleted in its entirety and replaced with the following:

|

“For a period (i) of 18 months from the Issue Date, and (ii) commencing on July 1, 2022 and continuing until February 28, 2025, any Interest Obligation payable hereunder shall automatically accrue on each Interest Payment Date to the principal amount of the Debentures, and shall thereafter be deemed to be part of the principal amount of the Debentures, provided, however, that notwithstanding anything herein to the contrary, Interest Obligations accruing and unpaid for that period commencing on July 1, 2022, and continuing up to and including December 31, 2023, shall be payable as of December 31, 2023, in accordance with this Section 2.3(4).”

| |

9.

|

Subsection 2.3(5) of the Indenture is deleted in its entirety.

|

| |

10.

|

New Section 3.8 of the Indenture is added as follows:

|

“(a)

| |

(i)

|

At any time during the period beginning on December 28, 2023 and ending on December 29, 2023 (the “Put Right Period”) each Holder shall have the right (the “Put Right”), to require the Corporation to redeem, on the date which is not later than four (4) Business Days following the end of the Put Right Period, and

|

| |

|

provided such Holder delivers to the Trustee written notice of exercise of the Put Right (the “Put Right Exercise Notice”), in the form of notice attached as Schedule “A” hereto, duly executed by the holder or their executors or administrators or other legal representatives or their attorney duly appointed by an instrument in writing in form and executed in a manner satisfactory to the Trustee (the redemption date, the “Put Date”), all or any part of such Holder’s Outstanding Debentures in cash at a redemption price (the “Put Price”) equal to US$600 per US$1,000 principal amount of Debentures specified in the Put Right Exercise Notice in denominations of US$1,000 or an integral multiple thereof, and shall be in excess of US$1,000. Any accrued but unpaid interest through to and including the Put Date shall be not be paid and shall be cancelled. |

| |

(ii)

|

During the period commencing on May 31, 2024 and ending on the Maturity Date (the “CAFDS Put Right Period”), the Corporation shall promptly deliver, or cause to be delivered, to the Holders, as of the date of the public filing of the Corporation’s quarterly Form 10-Q or annual Form 10-K in the United States in accordance with Applicable Securities Laws, a notice in writing (a “CAFDS Calculation Notice”) setting forth in reasonable detail, (i) whether or not the Corporation’s CAFDS for such fiscal period exceeds US$750,000.00, and if so, the amount (the “Available Excess Amount”) by which the Corporation’s CAFDS for such fiscal period exceeds US$750,000.00, and (ii) the Corporation’s calculations with respect to such determination. In the event that a CAFDS Calculation Notice delivered to Holders during the CAFDS Put Right Period specifies that the Corporation’s CAFDS in respect of an applicable fiscal period exceeds US$750,000.00, then each Holder shall have the right (the “CAFDS Put Right”), subject to pro ration as provided for in this subsection 3.8(a)(ii), to require the Corporation to redeem, on the date which is not later than 10 Business Days following the date of the applicable CAFDS Calculation Notice (the applicable redemption date, the “CAFDS Put Date”), all or any part of such Holder’s Outstanding Debentures in cash at a redemption price (the “CAFDS Put Price”) equal to the aggregate principal amount of the Debentures being so redeemed (which aggregate amount shall be in denominations of US$1,000 or an integral multiple thereof), plus any accrued and unpaid interest thereon, if any, up to, but excluding, the applicable CAFDS Put Date. The CAFDS Put Right may be exercised by a Holder by delivering to the Trustee written notice of exercise of the CAFDS Put Right not later than 10 Business Days following the date of the applicable CAFDS Calculation Notice (the “CAFDS Put Right Exercise Notice”), in the form of notice attached as Schedule “B” hereto, duly executed by the Holder or their executors or administrators or other legal representatives or their attorney duly appointed by an instrument in writing in form and executed in a manner

|

| |

|

satisfactory to the Trustee. Notwithstanding anything to the contrary herein, (A) the maximum aggregate amount of Debentures (for certainty, such amount being the aggregate principal amount, together with accrued and unpaid interest thereon) the Corporation is required to redeem in respect of any fiscal quarter pursuant to this Section 3.8(a)(ii) upon the exercise of CAFDS Put Rights (in respect of such fiscal quarter) shall not under any circumstances exceed the Available Excess Amount in respect of such fiscal quarter, and (B) any redemption by the Corporation of Debentures pursuant to this Section 3.8(a)(ii) shall be on a pro rata basis in respect of the Holders who have delivered the CAFDS Put Right Exercise Notice in accordance herewith, to the extent necessary, taking into account the balance of the funds available to the Corporation (from the Available Excess Amount in respect of such fiscal quarter allocated for such purpose) at the applicable time, and any determination in respect of the foregoing shall be made by the Trustee in consultation with the Corporation, whose decision shall be final and binding upon all parties. |

| |

(b)

|

Any exercise of the Put Right or the CAFDS Put Right by a Holder shall be conditional upon, and shall be valid only upon, such Holder delivering to the Trustee, the Put Right Exercise Notice or the CAFDS Put Right Exercise Notice, respectively and as applicable, together with the Debentures with respect to which the applicable right is being exercised, in accordance with Section 3.8.

|

| |

(c)

|

In the event that a Holder exercises the Put Right or the CAFDS Put Right, as applicable, in respect of only a part of such Holder’s Debentures, such Holder shall, upon the exercise of the Put Right or the CAFDS Put Right, as the case may be, surrender such Debenture to the Trustee in accordance with Section 3.4, and the Trustee shall cancel the same and shall without charge forthwith Authenticate and deliver to the holder, in accordance with the terms of this Indenture, a new Debenture or Debentures in an aggregate principal amount equal to the unredeemed part of the principal amount of the Debenture so surrendered.

|

| |

(d)

|

The Corporation will establish and maintain with the Trustee a payment account for the Debentures redeemed pursuant to this Section 3.8 (the “Put Account”). On or before 12:00 p.m. (Toronto time) not more than four (4) Business Days following the Put Date or CAFDS Put Date, as applicable (such date being the “Put Payment Date”), the Corporation will deliver to the Trustee a certified cheque or wire transfer for deposit in the Put Account in an amount sufficient to pay the cash amount payable in respect of the Debentures to be redeemed pursuant to the Put Right or CAFDS Put Right (which amount, with respect to the CAFDS Put Right only, shall not exceed the Available Excess Amount, and will be less any tax required by law to be deducted). The Trustee, on behalf of the Corporation, will pay to each holder entitled to receive

|

| |

|

payment the principal amount of and accrued and unpaid interest on the Debenture in accordance with Section 3.8, upon surrender of the Debenture at any branch of the Trustee designated for such purpose from time to time by the Corporation and the Trustee. The delivery of such funds to the Trustee for deposit to the Put Account will satisfy and discharge the liability of the Corporation for the Debentures to which the delivery of funds relates to the extent of the amount delivered (plus the amount of any tax deducted as aforesaid) and such Debentures so redeemed will thereafter to that extent not be considered as outstanding under this Indenture and such Holder will have no other right in regard thereto other than to receive out of the money so delivered or made available the amount to which it is entitled. Interest shall cease to accrue on the Debentures so redeemed upon the Put Date or CAFDS Put Date, as applicable, provided the Trustee has received, by the Put Payment Date from the Corporation all the funds due and payable on such Debentures being so redeemed. |

| |

(e)

|

Subject to the provisions above in this Section 3.8 in respect of Debentures purchased in part only, all Debentures paid and redeemed under this Section 3.8 shall forthwith be delivered to the Trustee and cancelled and no Debentures shall be issued in substitution therefor.

|

| |

(f)

|

The Corporation will comply with all Applicable Securities Laws if the Corporation is required to redeem Debentures pursuant to this Section 3.8.

|

| |

(g)

|

If any excess amount in respect of the Available Excess Amount remains after compliance with Subsection 3.8(a)(ii) following the CAFDS Put Date, and after the Corporation has funded the Put Account in respect of the CAFDS Put Right Period pursuant to Section 3.8(d) hereof, the Corporation may use an amount equal to or less than the remaining portion of the Available Excess Amount, if any, for any purpose not prohibited by the terms of this Indenture.

|

| |

11.

|

New Subsection 3.9 of the Indenture is added as follows:

|

| |

(a)

|

Commencing on March 31, 2025, and continuing to the Maturity Date, in addition to the interest payments payable to each Holder pursuant to Section 2.3 hereof, the Corporation shall redeem (the “Scheduled Redemption”), on each Interest Payment Date (for the purposes of this Section 3.9, the ”Scheduled Redemption Date”), Outstanding Debentures in an aggregate amount equal to US$108,799.73 less (i) the amount of interest paid on such Interest Payment Date, and (ii) an amount equal to amount delivered by the Corporation to the Trustee in respect of Holders exercising CAFDS Put Right, in accordance with Section 3.8(d) hereof, since the immediately preceding Scheduled Redemption Date (as adjusted, the “Scheduled Redemption Amount”), which aggregate amount shall be payable in cash on a pro rata basis to the Holders (which aggregate amount shall be in denominations of US$1,000 or an integral multiple thereof). Any

|

| |

|

redemption by the Corporation of Debentures pursuant to this Section 3.9(a) shall be on a pro rata basis, to the extent necessary, taking into account the Scheduled Redemption Amount and any determination in respect of the foregoing shall be made by the Trustee in consultation with the Corporation, whose decision shall be final and binding upon all parties. |

| |

(b)

|

In the event that the exercise of the Scheduled Redemption redeems only a part of a Holder’s Debentures, such Holder shall, upon the exercise of the Scheduled Redemption, surrender such Debenture to the Trustee in accordance with Section 3.4, and the Trustee shall cancel the same and shall without charge forthwith Authenticate and deliver to the Holder, in accordance with the terms of this Indenture, a new Debenture or Debentures in an aggregate principal amount equal to the unredeemed part of the principal amount of the Debenture so surrendered.

|

| |

(c)

|

The Corporation will establish and maintain with the Trustee a payment account for the Debentures redeemed pursuant to this Section 3.9 (the “Scheduled Redemption Account”). On or before 12:00 p.m. (Toronto time) not more than on Business Day immediately preceding the relevant Scheduled Redemption Date, the Corporation will deliver to the Trustee a certified cheque or wire transfer for deposit in the Scheduled Redemption Account in an amount sufficient to pay the cash amount payable in respect of the Debentures to be redeemed pursuant to the Scheduled Redemption (which amount shall not exceed the Scheduled Redemption Amount, and will be less any tax required by law to be deducted). The Trustee, on behalf of the Corporation, will pay to each Holder entitled to receive payment the principal amount of the Debenture in accordance with Section 3.9, upon surrender of the Debenture at any branch of the Trustee designated for such purpose from time to time by the Corporation and the Trustee. The delivery of such funds to the Trustee for deposit to the Scheduled Redemption Account will satisfy and discharge the liability of the Corporation for the Debentures to which the delivery of funds relates to the extent of the amount delivered (plus the amount of any tax deducted as aforesaid) and such Debentures so redeemed will thereafter to that extent not be considered as outstanding under this Indenture and such Holder will have no other right in regard thereto other than to receive out of the money so delivered or made available the amount to which it is entitled. Interest shall cease to accrue on the Debentures so redeemed upon the Scheduled Redemption Date, provided the Trustee has received, by the Scheduled Redemption Date from the Corporation the Scheduled Redemption Amount.

|

| |

(d)

|

Subject to the provisions above in this Section 3.9 in respect of Debentures purchased in part only, all Debentures paid and redeemed under this Section 3.9 shall forthwith be delivered to the Trustee and cancelled and no Debentures shall be issued in substitution therefor.

|

| |

(e)

|

The Corporation will comply with all Applicable Securities Laws if the Corporation is required to repurchase Debentures pursuant to this Section 3.9.

|

| |

(f)

|

If any Available Excess Amount remains after compliance with Section 3.8(a)(ii) following the CAFDS Put Date and after the Corporation has funded the Put Account in respect of such CAFDS Put Right Period pursuant to Section 3.8(d) hereof, the Corporation may use an amount equal to or less than the remaining portion of the Available Excess amount, if any, for any purpose not prohibited by the terms of this Indenture.

|

| |

12.

|

The first paragraph of Schedule 2.2 – Form of Debenture of the Indenture is deleted in its entirety and replaced with the following:

|

“CLS HOLDINGS USA, INC. (the “Corporation”), for value received, hereby acknowledges itself indebted and promises to pay to the order of the registered holder the principal sum of

[insert amount], as follows,

on January 31, 2028 (the “Maturity Date”), or on such earlier date as the principal amount hereof may become due in accordance with the provisions of the Indenture (as defined below) hereinafter mentioned, the principal amount of this Debenture, in lawful money of the United States, on presentation and surrender of this Debenture (as defined below) at the principal office of the Trustee (defined below) in the manner specified in the Indenture, in the City of Calgary, Province of Alberta, and to pay interest on the principal amount then Outstanding (as defined in the Indenture) at the rate of 8.0% per annum from the most recent Interest Payment Date (as defined below) to which interest has been paid or made available for payment on the Debentures then outstanding.”

| |

13.

|

The following provision in Schedule 2.2 – Form of Debenture of the Indenture is deleted in its entirety:

|

“This Debenture is one of the 8.0% Unsecured Convertible Debentures due December 31, 2023 and December 31, 2024 (the “Debentures”) created and issued under an Indenture dated as of December 12, 2018, as amended pursuant to supplemental indentures dated as of March 31, 2021 and September 15, 2022 (as the same has otherwise been amended or may be amended, modified, restated, supplemented or replaced from time to time, collectively, the “Indenture”), made between, inter alia, the Corporation and Odyssey Trust Company, as trustee (the “Trustee”).”

and replaced with the following:

“This Debenture is one of the 8.0% Unsecured Convertible Debentures due January 31, 2028 (the “Debentures”) created and issued under an Indenture dated as of December 12, 2018, as amended pursuant to supplemental indentures dated as of March 31, 2021, September 15, 2022, and December 28, 2023 (as the same

has otherwise been amended or may be amended, modified, restated, supplemented or replaced from time to time, collectively, the “Indenture”), made between, inter alia, the Corporation and Odyssey Trust Company, as trustee (the “Trustee”).”

| |

14.

|

The following provision in Schedule 2.2 – Form of Debenture of the Indenture is deleted in its entirety:

|

“At any time following the date that is 4 months and one day following the Issue Date, the Corporation may force the conversion of the principal amount of the then Outstanding Debentures at the Conversion Price on not less than 30 days’ notice should the VWAP of the Common Shares be greater than US$0.20 for any 10 consecutive trading days.”

and replaced with the following:

“At any time following the date that is 4 months and one day following the Issue Date, the Corporation may force the conversion of the principal amount of the then Outstanding Debentures at the Conversion Price on not less than 30 days’ notice should the VWAP of the Common Shares be greater than US$0.14 for any 10 consecutive trading days.”

| |

15.

|

The reference to “December 31, 2023 and December 31, 2024” in the Trustee’s Certificate appended to Schedule 2.2 of the Indenture is replaced with “January 31, 2028.”

|

| |

16.

|

References to “December 31, 2023 and December 31, 2024” in Schedule Section 2.26 of the Indenture - Form of Regulation S Rule 904 Transfer Certificate are replaced with “January 31, 2028”.

|

| |

17.

|

The Indenture shall be and continue to be in full force and effect, unamended, except as provided herein, and the Corporation hereby confirms the Indenture in all other respects.

|

| |

18.

|

This Supplemental Indenture shall be governed by and be construed in accordance with the laws of the Province of Alberta and shall be binding upon the parties hereto and their respective successors and assigns.

|

| |

19.

|

This Supplemental Indenture may be simultaneously executed in several counterparts (including by electronic means), each of which when so executed shall be deemed to be an original and such counterparts together shall constitute one and the same instrument and notwithstanding their date of execution shall be deemed to bear the date set out at the top of the first page of this Supplement Indenture.

|

[Remainder of page left intentionally blank]

IN WITNESS WHEREOF the parties hereto have executed this Supplemental Indenture under the hands of their proper officers in that behalf.

|

|

CLS HOLDINGS USA, INC. |

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Andrew Glashow

|

|

|

|

|

Name: Andrew Glashow

|

|

|

|

|

Title: President, Chief Executive Officer and Director

|

|

|

|

ODYSSEY TRUST COMPANY, as Trustee

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Amy Douglas

|

|

|

|

|

Name: Amy Douglas

|

|

|

|

|

Title: Authorized Signatory

|

|

|

|

|

|

|

|

|

By:

|

/s/ Rachel Wales

|

|

|

|

|

Name: Rachel Wales

|

|

|

|

|

Title: Authorized Signatory

|

|

SCHEDULE “A”

PUT RIGHT EXERCISE NOTICE

To: CLS Holdings USA, Inc. (the “Corporation”)

Note: All capitalized terms used herein have the meaning ascribed thereto in the indenture dated December 12, 2018, between the Corporation and Odyssey Trust Company (the “Trustee”), as trustee (as amended on March 31, 2021, September 15, 2022, and December 28, 2023, the “Indenture”).

The undersigned registered holder of Debentures irrevocably elects to put:

|

ISIN

|

ISIN

|

| |

|

|

CA12565JAB67

|

CA12565JAC41

|

| |

|

|

☐ the full principal amount of such Debenture

|

☐ the full principal amount of such Debenture

|

| |

|

|

OR

|

OR

|

| |

|

| ☐ $ in principal amount of such |

☐ $ in principal amount of such |

|

Debenture [See note below]

|

Debenture [See note below] |

to the Corporation to be purchased by the Corporation on (the “Put Date”) in accordance with the terms of the Indenture, as amended by the Supplemental Indenture dated December 28, 2023, at a price of $600 for each $1,000 principal amount of Debentures (the “Total Put Price”) and tenders herewith such Debentures. The undersigned registered holder further agrees and acknowledges (i) that it has read and fully understands the substance of the Amendments, and (ii) that any accrued but unpaid interest through to, and including, the Put Date payable on the Debentures tendered herewith shall not be paid and shall instead be cancelled.

*If less than the full principal amount of such Debenture, indicate in the space provided the principal amount (which must be $1,000 or integral multiples thereof).

| |

|

| |

Name of Registered Holder |

| |

|

| Dated: |

|

| |

(Signature of Registered Holder) |

The Total Put Price will be payable upon presentation and surrender of such Debenture with this form on or after the Put Date at the following corporate trust office:

Odyssey Trust Company

1230 – 300 5th Avenue SW

Calgary, Alberta, T2P 3C4

Email: corptrust@odysseytrust.com

SCHEDULE “B”

CAFDS PUT RIGHT EXERCISE NOTICE

To: CLS Holdings USA, Inc. (the “Corporation”)

Note: All capitalized terms used herein have the meaning ascribed thereto in the indenture dated December 12, 2018, between the Corporation and Odyssey Trust Company (the “Trustee”), as trustee (as amended on March 31, 2021, September 15, 2022, and December 28, 2023 the “Indenture”).

The undersigned registered holder of Debentures irrevocably elects to put:

|

ISIN

|

ISIN

|

| |

|

| CA12565JAB67 |

CA12565JAC41 |

| |

|

|

☐ the full principal amount of such Debenture

|

☐ the full principal amount of such Debenture

|

| |

|

|

OR

|

OR

|

| |

|

| ☐ $ in principal amount of such |

☐ $ in principal amount of such |

|

Debenture [See note below]

|

Debenture [See note below] |

to the Corporation to be purchased by the Corporation on (the “CAFDS Put Date”) in accordance with the terms of the Indenture, as amended by the Supplemental Indenture dated December 28, 2023, at a price equal to the aggregate principal amount of the Debentures being tendered herewith, plus any accrued and unpaid interest thereon, if any, up to, but excluding, the applicable CAFDS Put Date (collectively, the “Total Put Price”) and tenders herewith such Debentures.

| |

|

| |

Name of Registered Holder |

| |

|

| Dated: |

|

| |

(Signature of Registered Holder) |

*If less than the full principal amount of such Debenture, indicate in the space provided the principal amount (which must be $1,000 or integral multiples thereof).

The Total Put Price will be payable upon presentation and surrender of such Debenture with this form on or after the CAFDS Put Date at the following corporate trust office:

Odyssey Trust Company

1230 – 300 5th Avenue SW

Calgary, Alberta, T2P 3C4

Email: corptrust@odysseytrust.com

The interest upon the principal amount of such Debenture put to the Corporation hereunder will cease to be payable from and after the Put Date unless payment of the Total Put Price is not made on presentation for surrender of such Debenture at the above-mentioned corporate trust office on or after the CAFDS Put Date or prior to the setting aside of the Total Put Price pursuant to the Indenture.

[Remainder of page intentionally left blank.]

Exhibit 4.2

FORM 13

NOTICE OF AMENDMENT OF WARRANT TERMS

Name of Listed Issuer: CLS Holdings USA, Inc. (the “Issuer”). Trading Symbol: CLSH

Date: December 29, 2023

Date of Press Release announcing amendment: December 29, 2023

Closing price of underlying shares on the day prior to the announcement: C$0.065

Closing price of underlying shares at the time of issuance: N/A. The Issuer commenced trading on the Exchange on January 07, 2019.

| |

1.

|

Current terms of warrants to be amended:

|

|

Date Issued

|

Issue Price

|

Exercise Price

|

Market Price of underlying

shares

|

Number of Warrants

|

Expiry Date

|

Percentage of Warrant class held by Insiders

|

|

12/12/2018(1)

|

N/A

|

US$0.10

|

NA

|

11,768,673

|

September 15, 2025

|

0%

|

Notes: (1) The Warrants were originally issued in connection with a private placement of convertible debentures completed by the Issuer on December 12, 2018, for aggregate gross proceeds of approx. C$12 million. The Issuer was not listed on the Exchange on the date of issuance. The terms of the Warrants described in this table reflect the current terms of the Warrants, as last amended on September 15, 2022.

Pursuant to Policy 6, Section 7.4, Amendments are permitted provided that:

| |

a)

|

The warrants are not listed for trading;

|

| |

b)

|

The exercise price is higher than the current market price;

|

| |

c)

|

No warrants have been exercised in the last 6 months;

|

| |

d)

|

At least 10 trading days remain before expiry.

|

| |

a)

|

Extension – amended expiry date: December 28, 2026

|

The term of a warrant may not extend past the date that would have been allowed on the date of issuance.

FORM 13 – NOTICE OF AMENDMENT

OF WARRANT TERMS

January 2015

Page 1

| |

b)

|

Repricing – amended exercise price: N/A

|

If the amended price is below the market price of the underlying security at the time the warrants were issued, and following the amendment the exercise price is below the closing price of the underlying security for any 10 consecutive trading days by more than the permitted private placement discount, the term of the warrants must be amended to 30 days. The amended term must be announced by press release and Form 13 and the 30 day term will commence 7 days from the end of the 10 day period. See Policy 6 section 7.4 for details.

| |

3.

|

Amended terms of warrants:

|

|

Date Issued

|

Issue Price

|

Exercise Price

|

Market Price of underlying

shares

|

Number of

Amended Warrants

|

Expiry Date

|

Percentage of Warrant class held by Insiders

|

|

12/12/2018

|

N/A

|

US$0.10

|

N/A

|

11,768,673

|

December 28, 2026

|

0%

|

Listed Issuers must obtain appropriate corporate approvals prior to any change, modification or amendment of outstanding warrants or other convertible securities (including non-listed securities). The amendment of the terms of a warrant (or other security) may be considered to be the distribution of a new security under securities laws and require exemptions from legislative requirements. Furthermore, the amendment of the terms of a security held by an insider or a related party may be considered to be a related party transaction under Multilateral Instrument 61-101 and require exemptions from provisions of that rule. Issuers should consult legal counsel before amending the terms of a security.

FORM 13 – NOTICE OF AMENDMENT

OF WARRANT TERMS

January 2015

Page 2

| |

4.

|

Certificate of Compliance

|

The undersigned hereby certifies that:

| |

1.

|

The undersigned is a director and/or senior officer of the Issuer and has been duly authorized by a resolution of the board of directors of the Issuer to sign this Certificate of Compliance.

|

| |

2.

|

As of the date hereof there is no material information concerning the Issuer which has not been publicly disclosed.

|

| |

3.

|

The undersigned hereby certifies to the Exchange that the Issuer is in compliance with the requirements of applicable securities legislation (as such term is defined in National Instrument 14-101) and all Exchange Requirements (as defined in Policy 1).

|

| |

4.

|

All of the information in this Form 13 Notice of Amendment of Warrant Terms is true.

|

|

Dated December 29, 2023.

|

|

|

|

|

|

|

|

|

|

|

Andrew Glashow |

|

|

|

|

Name of Director or Senior Officer

|

|

| |

|

|

|

| |

|

(signed) "Andrew Glashow" |

|

| |

|

Signature |

|

| |

|

|

|

| |

|

CEO and Chairman of the Board |

|

| |

|

Official Capacity |

|

FORM 13 – NOTICE OF AMENDMENT

OF WARRANT TERMS

January 2015

Page 3

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

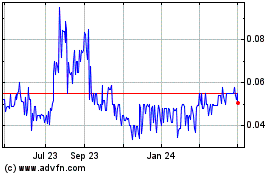

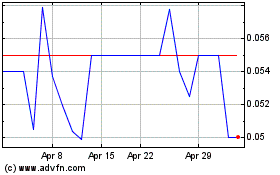

CLS Holdings USA (QB) (USOTC:CLSH)

Historical Stock Chart

From Mar 2024 to Apr 2024

CLS Holdings USA (QB) (USOTC:CLSH)

Historical Stock Chart

From Apr 2023 to Apr 2024