As filed with the U.S. Securities and Exchange Commission on December 29, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

IGC PHARMA, INC.

(Exact name of registrant as specified in its charter)

|

Maryland

|

|

|

|

20-2760393

|

|

(State or other jurisdiction of

|

|

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

|

|

Identification No.)

|

10224 Falls Road

Potomac, Maryland 20854

Tel.: +1 (301) 983-0998

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Ram Mukunda

President and Chief Executive Officer IGC Pharma, Inc.

10224 Falls Road

Potomac, Maryland 20854

Tel.: +1 (301) 983-0998

(Name, address, including zip code, and telephone number, including area code, of agent for service) Copies of notices and communications to:

Spencer G. Feldman, Esq.

Kenneth A. Schlesinger, Esq.

Olshan Frome Wolosky LLP

1325 Avenue of the Americas, 15th Floor New York, New York 10019

Tel.: (212) 451-2300

Approximate Date of Commencement of Proposed Sale to the Public: From time to time after this Registration Statement becomes effective.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☑

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

☐ |

Accelerated Filer

|

☐

|

|

Non-accelerated filer

|

☑ |

Smaller reporting company

|

☑

|

| |

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS |

Subject to completion, dated December 29, 2023 |

IGC PHARMA, INC.

$100,000,000

Common Stock Warrants Units

Rights

This prospectus relates to common stock, warrants, units, and rights that we may sell from time to time in one or more offerings up to a total dollar amount of $100,000,000 on terms to be determined at the time of sale. We will provide specific terms of these securities in supplements to this prospectus. You should read this prospectus and any supplement carefully before you invest. This prospectus may not be used to offer and sell securities unless accompanied by a prospectus supplement for those securities.

These securities may be sold directly by us, through dealers or agents designated from time to time, to or through underwriters, or through a combination of these methods. See “Plan of Distribution” in this prospectus. We may also describe the plan of distribution for any particular offering of these securities in any applicable prospectus supplement. If any agents, underwriters or dealers are involved in the sale of any securities in respect of which this prospectus is being delivered, we will disclose their names and the nature of our arrangements with them in a prospectus supplement. The net proceeds we expect to receive from any such sale will also be included in a prospectus supplement.

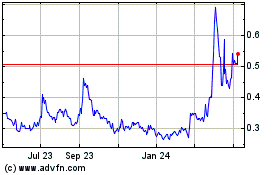

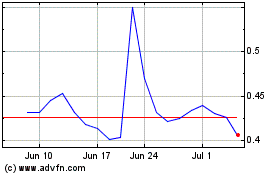

Our common stock is listed for trading on the NYSE American under the symbol IGC. The closing price of our common stock on December 28, 2023, as reported by the NYSE American, was $0.30 per share.

We are a smaller reporting company under Rule 405 of the Securities Act and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus, the documents incorporated by reference herein, and future filings.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 2.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023

TABLE OF CONTENTS

Important Notice about the Information Presented in this Prospectus

You should rely only on the information contained or incorporated by reference in this prospectus or any applicable prospectus supplement. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. For further information, see the section of this prospectus entitled “Where You Can Find More Information.” We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

You should not assume that the information appearing in this prospectus or any applicable prospectus supplement is accurate as of any date other than the date on the front cover of this prospectus or the applicable prospectus supplement, or that the information contained in any document incorporated by reference is accurate as of any date other than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any prospectus supplement or any sale of common stock. Our business, financial condition, results of operations and prospects may have changed since such dates.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission, or the SEC, using a “shelf” registration process. Under this shelf process, we may sell any combination of the securities described in this prospectus in one or more offerings up to a total dollar amount of $100,000,000. This prospectus provides you with a general description of the securities we may offer. Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the securities being offered and the terms of that offering. The prospectus supplement may also add to, update, or change information contained in this prospectus. You should read both this prospectus and any prospectus supplement together with the additional information described under the heading “Where You Can Find More Information” carefully before making an investment decision.

Unless the context requires otherwise, all references in this report to “IGC,” “the Company,” “we,” “our,” and/or “us” refer to IGC Pharma, Inc. (formerly known as India Globalization Capital, Inc.), together with our subsidiaries and beneficially owned subsidiary

ABOUT IGC PHARMA, INC.

Overview

IGC Pharma, Inc., is a clinical-stage pharmaceutical company with a diversified revenue model that develops prescription drugs and over-the-counter (OTC) products. We were formerly known as India Globalization Capital, Inc. and incorporated in Maryland on April 29, 2005. Our fiscal year is the 52- or 53-week period ending March 31.

Our focus is on developing innovative therapies for neurological disorders such as Alzheimer’s disease, epilepsy, Tourette syndrome, and sleep disorders. We also focus on formulations for eating disorders, chronic pain, premenstrual syndrome (PMS), and dysmenorrhea, in addition to health and wellness OTC formulations. The Company is developing its proprietary lead candidate, IGC-AD1, an investigational oral therapy for the treatment of agitation associated with Alzheimer’s disease. IGC-AD1 is currently in Phase 2 (Phase 2B) clinical trials after completing nearly a decade of research and realizing positive results from pre-clinical and a Phase 1 trial. This previous research into IGC-AD1 has demonstrated efficacy in reducing plaques and tangles, which are two important hallmarks of Alzheimer’s, as well as reducing neuropsychiatric symptoms associated with dementia in Alzheimer’s disease, such as agitation.

The progress we are making in clinical trials gives us confidence in the potential of IGC-AD1 to be a groundbreaking therapy, with the potential to treat Alzheimer’s and also to manage devastating symptoms that separate families, increase admissions to nursing homes, and drive the cost of Alzheimer’s care. We have filed forty-one (41) patent applications in different countries and secured ten patents, including control of four in the Alzheimer’s space. We have built a facility for a potential Phase 3 trial and have strategic relations for the procurement of Active Pharmaceutical Ingredients (APIs). In addition, we have acquired and initiated work on TGR-63, a pre-clinical molecule that exhibits an impressive affinity for reducing neurotoxicity in Alzheimer’s cell lines. The advancement of IGC-AD1 into Phase 2 trials represents a significant milestone for the Company and positions us for multiple pathways to future success. We anticipate that the positive outcomes from these and other trials will drive further growth, valuation, and market potential for IGC-AD1, although there can be no assurance thereof.

We recognize the significance of operational excellence and cost management in clinical trials. We have established an internal capability to manage trials, including proprietary software, rather than working with an external Contract Research Organization (CRO). We believe this empowers us to substantially reduce the costs associated with clinical trials compared to relying on external CROs. Our proprietary software allows us to streamline the trial processes, enabling seamless coordination and data management. Additionally, we are integrating machine learning technologies into our software framework. We believe this overlay of Artificial Intelligence (AI) will help us simulate trial scenarios, generate new insights to facilitate improved decision-making, efficiently design our Phase 3 trial, provide advanced data analysis, and ultimately enhancing the effectiveness and efficiency of our clinical trials, although there can be no assurance thereof.

Corporate Information

We were incorporated in the State of Maryland on April 29, 2005 under our former name, India Globalization Capital, Inc. Our principal executive offices are located at 10224 Falls Road, Potomac, Maryland 20854 and our telephone number is (301) 983-0998. We maintain several websites, including www.igcinc.us and www.igcpharma.com. Our public filings with the SEC are accessible on the SEC’s website, www.sec.gov.

The information contained on our websites is not incorporated by reference into this prospectus and you should not consider any information contained on, or that can be accessed through, our websites as part of this prospectus or in deciding whether to purchase our securities.

RISK FACTORS

An investment in our securities involves a high degree of risk. In addition to the following risk factors, you should carefully consider the risks, uncertainties, and assumptions discussed in Item 1A., “Risk Factors” of our annual report on Form 10-K for the fiscal year ended March 31, 2023, and in other documents that we subsequently file with the SEC that update, supplement or supersede such information, which documents are incorporated by reference into this prospectus. See “Where You Can Find More Information.” Additional risks not presently known to us or which we consider immaterial based on information currently available to us may also materially adversely affect us. If any of the events anticipated by the risks described occur, our results of operations and financial condition could be adversely affected, which could result in a decline in the market price of our common stock, causing you to lose all or part of your investment.

We may not be successful in our artificial intelligence initiatives, which could adversely affect our business, reputation, or financial results.

We are making investments in AI initiatives, including generative AI, to, among other things, recommend relevant unconnected content across our products, enhance our advertising tools, develop new products, and develop new features for existing products. In particular, we expect our AI initiatives will require increased investment in infrastructure and headcount.

There are significant risks involved in developing and deploying AI and there can be no assurance that the usage of AI will enhance our products or services or be beneficial to our business, including our efficiency or profitability. For example, our AI-related efforts, particularly those related to generative AI, subject us to risks related to harmful content, accuracy, bias, discrimination, toxicity, intellectual property infringement or misappropriation, defamation, data privacy, cybersecurity, and sanctions and export controls, among others. It is also uncertain how various laws related to online services, intermediary liability, and other issues will apply to content generated by AI. In addition, we are subject to the risks of new or enhanced governmental or regulatory scrutiny, litigation, or other legal liability, ethical concerns, negative consumer perceptions as to automation and AI, or other complications that could adversely affect our business, reputation, or financial results.

As a result of the complexity and rapid development of AI, it is also the subject of evolving review by various U.S. governmental and regulatory agencies, and other foreign jurisdictions are applying, or are considering applying, their platform moderation, intellectual property, cybersecurity, and data protection laws to AI and/or are considering general legal frameworks on AI. We may not always be able to anticipate how to respond to these frameworks, given they are still rapidly evolving. We may also have to expend resources to adjust our offerings in certain jurisdictions if the legal frameworks on AI are not consistent across jurisdictions.

As such, it is not possible to predict all of the risks related to the use of AI, and changes in laws, rules, directives, and regulations governing the use of AI may adversely affect our ability to develop and use AI or subject us to legal liability.

Potential Risks Associated with Disposal of Non-Core Assets

Investing in our company may be subject to risks related to the disposal of our non-core assets. The Company owns land in Nagpur with a book value of approximately $4.1 million and other assets in Cochin, India and Vancouver, Washington totaling about $ 2 million that are not core to our pharmaceutical business focus. While our decision to dispose of these non-core assets is aimed at monetizing non-core assets, streamlining operations, and optimizing resource allocation, the process carries certain risks that may negatively impact our financial performance. The sale of these assets could result in a potential financial loss that is approximately the difference between the book value reflected on the balance sheet and the sale price.

Market conditions, negotiation challenges, and external factors beyond our control could result in realizing a sale price significantly lower than the book value reflected on the balance sheet. The carrying costs of maintaining these non-core assets until their sale, incurs holding costs, including property taxes, and maintenance expenses, and these costs could also negatively impact our financial performance. Additionally, the disposal process may involve temporary disruptions to certain infrastructure operations. However, we are actively managing the disposal process to mitigate these risks and maximize shareholder value.

Investors should be aware of the potential risks associated with this process and its potential impact on our financial performance before investing in our company.

SPECIAL NOTE ABOUT FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated in this prospectus by reference contain “forward-looking statements.” Additionally, we or our representatives may, from time to time, make written or verbal forward-looking statements. In this prospectus and the documents incorporated by reference, we discuss plans, expectations, and objectives regarding our business, financial condition, and results of operations. Without limiting the foregoing, statements that are in the future tense, and all statements accompanied by terms such as “believe,” “project,” “expect,” “trend,” “estimate,” “forecast,” “assume,” “intend,” “plan,” “target,” “anticipate,” “outlook,” “preliminary,” “will likely result,” “will continue,” and variations of them and similar terms are intended to be “forward-looking statements” as defined by federal securities laws. We caution you not to place undue reliance on forward-looking statements, which are based upon assumptions, expectations, plans, and projections. In addition, our goals and objectives are aspirational and are not guarantees or promises that such goals and objectives will be met. Forward-looking statements are subject to risks and uncertainties, including those identified in the “Risk Factors” included in this prospectus and in the documents incorporated by reference that may cause actual results to differ materially from those expressed or implied in the forward-looking statements. Forward-looking statements speak only as of the date when they are made. Except as required by federal securities law, we do not undertake any obligation to update forward-looking statements to reflect events, circumstances, changes in expectations, or the occurrence of unanticipated events after the date of those statements.

Forward-looking statements are based upon, among other things, our assumptions with respect to:

|

●

|

the sufficiency of our existing cash and cash equivalents and marketable securities to fund our future operating and capital expenses;

|

|

●

|

our ability to successfully register trademarks and patents, create and market new products and services, including trading in Hong Kong and other parts of South Asia, contract for infrastructure projects and rental of equipment in India, and achieve customer acceptance in the industries we serve;

|

|

●

|

current and future economic and political conditions, including in Hong Kong, North America, Colombia, and India;

|

|

●

|

our ability to accurately predict the future demand for our products and services;

|

|

●

|

our ability to successfully market our hemp-based products in countries and states where hemp and hemp products are legal;

|

|

●

|

our ability to maintain a stock listing on a national securities exchange;

|

|

●

|

our ability to obtain and maintain regulatory approval of our existing product candidates and any other product candidates we may develop, and the labeling under any approval we may obtain;

|

|

●

|

our ability to timely complete regulatory filings;

|

|

●

|

our ability to obtain the U.S. Food and Drug Administration (FDA) approval for an Investigational New Drug Application (INDA) and to successfully run medical trials, including a Phase 2 trial for IGC-AD1;

|

|

●

|

our reliance on third parties to conduct clinical trials and for the manufacture of IGC-AD1 for non-clinical studies and clinical trials;

|

|

●

|

the impact of the COVID-19 pandemic on our results of operations, including the delay in our ability to launch certain projects;

|

|

●

|

our financial performance;

|

|

●

|

the outcome of medical trials that are conducted on our Investigational Drug Candidates and products;

|

|

●

|

our ability to fund the costs of clinical trials and other related expenses;

|

|

●

|

our ability to maintain our intellectual property position and our ability to maintain and protect our intellectual property rights;

|

|

●

|

competition and general acceptance of phytocannabinoids for alternative, pharmaceutical, and nutraceutical therapies;

|

|

●

|

our ability to effectively compete and our dependence on market acceptance of our brands and products within and outside the United States;

|

|

●

|

federal and state legislation and administrative policy regulating phytocannabinoids;

|

|

●

|

our ability (based in part on regulatory concerns) to license our products to processors that can produce pharmaceutical grade phytocannabinoids;

|

|

●

|

our ability to obtain and protect patents for the use of phytocannabinoids in our formulations;

|

|

●

|

our ability to obtain and install equipment for processing and manufacturing hemp and hemp products;

|

|

●

|

our ability to successfully navigate disruptions of information technology systems or data security breaches that could adversely affect our business.

|

You should consider the limitations on and risks associated with forward-looking statements and not unduly rely on the accuracy of predictions contained in such forward-looking statements. As noted above, these forward-looking statements speak only as of the date when they are made. Moreover, in the future, we may make forward-looking statements through our senior management that involve the risk factors and other matters described in this report, as well as other risk factors subsequently identified, including, among others, those identified in our filings with the SEC in our quarterly reports on Form 10-Q and our current reports on Form 8-K.

This document contains statements and claims that are not approved by the FDA, including statements on hemp and hemp extracts, including cannabidiol and other cannabinoids. These statements and claims are intended to be in compliance with state laws, specifically in states where medical cannabis has been legalized, and the diseases which we anticipate our products will target are approved conditions for treatment or usage with cannabis or cannabinoids.

USE OF PROCEEDS

We currently intend to use the estimated net proceeds from the sale of our securities in this offering to fund our working capital and capital expenditure requirements over the next 12 to 36 months. In particular, we plan to utilize the net proceeds to:

|

●

|

cover working capital needs, including paying continuing product development expenses, employees’ and officers’ salaries and ongoing public reporting costs;

|

|

●

|

fund pre-clinical and various phases of clinical trials on IGC-AD1 and other potential IDCs in the U.S. and other countries;

|

|

●

|

fund pre-clinical and various phases of clinical trials on TGR-63;

|

|

●

|

fund the development of AI for streamlining the clinical trials;

|

|

●

|

fund the development or acquisition of a lab for analyzing pharmaceutical products;

|

|

●

|

fund the acquisition or development of an FDA approved GMP facility for the manufacture of pharmaceutical grade products;

|

|

●

|

fund purchasing and selling of infrastructure materials, personal protection equipment, among others;

|

|

●

|

fund bidding on infrastructure projects, government contracts, including providing bonds;

|

|

●

|

finance marketing and brand awareness campaigns in the United States and other countries where our products and services can be sold in accordance with applicable law and regulation;

|

|

●

|

finance the costs of acquiring additional patents or patent filings;

|

|

●

|

fund the filing and potential litigation of patents;

|

|

●

|

develop and test products based on our patent pending formulations;

|

|

●

|

fund potential acquisitions of, investments in, and joint ventures with, complementary (including competitive) businesses, products and technologies, including in the cannabis industry, all conducted in accordance with applicable laws and regulations, however, we currently have no commitments or agreements with respect to any such acquisitions, investments or joint ventures.

|

In the event we raise substantially less than the maximum proceeds, we will expend the proceeds generally in the order set forth above, except that general working capital expenses are expected to be consistent over time.

There is no guarantee that we will sell the securities covered by this prospectus and, in the event that we do, there is no guarantee as to the total number of securities that we will sell, nor is there any guarantee as to the amount of net proceeds of this offering to be applied to any one particular proposed use as described above. Our management will have significant discretion and flexibility in applying the net proceeds from the sale of these securities. Pending any use, as described above, we intend to invest the net proceeds in high-quality, short-term, interest-bearing securities. Our plans to use the estimated net proceeds from the sale of these securities may change and, if they do, we will update this information in a prospectus supplement.

THE SECURITIES WE MAY OFFER

The descriptions of the securities contained in this prospectus, together with the applicable prospectus supplements, summarize the material terms and provisions of the securities that we may offer. We will describe in the applicable prospectus supplement relating to any securities the particular terms of the securities offered by that prospectus supplement. If we so indicate in the applicable prospectus supplement, the terms of the securities may differ from the terms we have summarized below. We will also include in the prospectus supplement information, where applicable, about material United States federal income tax considerations relating to the securities, and the securities exchange or market, if any, on which the securities will be listed.

We may sell from time to time, in one or more offerings:

|

●

|

shares of our common stock,

|

|

●

|

warrants to purchase common stock or units,

|

|

●

|

units comprised of common stock and warrants in any combination, and

|

|

●

|

rights.

|

In this prospectus, we refer to the common stock, warrants, units and rights collectively as “securities.” The total dollar amount of all securities that we may issue will not exceed $100,000,000. This prospectus may not be used to consummate a sale of our securities unless it is accompanied by a prospectus supplement.

DESCRIPTION OF COMMON STOCK

The following is a description of the material terms and provisions of our common stock. It may not contain all the information that is important to you. You can access complete information by referring to our articles of incorporation and by-laws, each as amended to date, which we refer to as our “articles of incorporation” and “by-laws.”

General

We are a Maryland corporation. Under our articles of incorporation, we have authority to issue 150,000,000 shares of common stock, par value $0.0001 per share, and 1,000,000 shares of preferred stock, par value $0.0001 per share.

As of December 28, 2023, there were issued and outstanding:

|

●

|

63,734,439 shares of common stock;

|

|

●

|

no shares of preferred stock;

|

|

●

|

91,472 units; and

|

|

●

|

150,000 options subject to the exercise.

|

Voting, Dividends and Other Rights

Holders of shares of our common stock are entitled to one vote for each share held of record on each matter submitted to a vote of stockholders. There is no cumulative voting for election of directors. Accordingly, the holders of a majority of our outstanding shares of common stock entitled to vote in any election of directors can elect all of the directors standing for election, if they should so choose. Holders of shares of our common stock are entitled to receive dividends ratably when, as, and if declared by the board of directors out of funds legally available therefor and, upon our liquidation, dissolution or winding up are entitled to share ratably in all assets remaining after payment of liabilities. Holders of shares of our common stock have no preemptive rights and have no rights to convert their common stock into any other securities. There are no redemption or sinking fund provisions applicable to our common stock. The outstanding shares of our common stock are, and the shares of common stock to be sold in this offering will be, when issued, validly authorized and issued, fully paid and non-assessable.

Transfer Agent

The transfer agent and registrar for our common stock is Continental Stock Transfer & Trust Co. and its address is 1 State Street, 30th Floor, New York, NY 10004-1561, telephone number +1 (212) 509-4000.

Listing

Our common stock is listed for trading on the NYSE American under the symbol IGC. It is also quoted on the Frankfurt, Berlin and Stuttgart (XETRA2) stock exchanges in Germany under the symbol IGSI.

DESCRIPTION OF WARRANTS

We may issue warrants for the purchase of common stock or units. Warrants may be issued independently or together with common stock or units, and the warrants may be attached to or separate from such securities. We may issue warrants directly or under a warrant agreement to be entered into between us and a warrant agent. We will name any warrant agent in the applicable prospectus supplement. Any warrant agent will act solely as our agent in connection with the warrants of a particular series and will not assume any obligation or relationship of agency or trust for or with any holders or beneficial owners of warrants.

The following is a description of the general terms and provisions of any warrants we may issue and may not contain all the information that is important to you. You can access complete information by referring to the applicable prospectus supplement. In the applicable prospectus supplement, we will describe the terms of the warrants and any applicable warrant agreement, including, where applicable, the following:

|

●

|

the offering price and aggregate number of warrants offered;

|

|

●

|

the designation and terms of the securities with which the warrants are issued and the number of warrants issued with each such security;

|

|

●

|

the date on and after which the warrants and the related securities will be separately transferable;

|

|

●

|

the number of shares of common stock or units, as the case may be, purchasable upon the exercise of one warrant and the price at which these securities may be purchased upon such exercise;

|

|

●

|

the effect of any merger, consolidation, sale or other disposition of our business on the warrant agreement and the warrants;

|

|

●

|

the terms of any rights to redeem or call the warrants;

|

|

●

|

any provisions for changes to or adjustments in the exercise price or number of securities issuable upon exercise of the warrants;

|

|

●

|

the dates on which the right to exercise the warrants will commence and expire;

|

|

●

|

the manner in which the warrant agreement and warrants may be modified;

|

|

●

|

a discussion of any material U.S. federal income tax considerations of holding or exercising the warrants;

|

|

●

|

the terms of the securities issuable upon exercise of the warrants; and

|

|

●

|

any other specific terms, preferences, rights or limitations of or restrictions on the warrants.

|

DESCRIPTION OF UNITS

The following description, together with the additional information we include in any applicable prospectus supplement, summarizes the material terms and provisions of the units that we may offer under this prospectus. Units may be offered independently or together with common stock and/or warrants offered by any prospectus supplement and may be attached to or separate from those securities.

While the terms we have summarized below will generally apply to any future units that we may offer under this prospectus, we will describe the particular terms of any series of units that we may offer in more detail in the applicable prospectus supplement. The terms of any units offered under a prospectus supplement may differ from the terms described below.

We will incorporate by reference into the registration statement of which this prospectus is a part the form of unit agreement, including a form of unit certificate, if any, which describes the terms of the series of units we are offering before the issuance of the related series of units. The following summaries of material provisions of the units and the unit agreements are subject to, and qualified in their entirety by reference to, all the provisions of the unit agreement applicable to a particular series of units. We urge you to read the applicable prospectus supplements related to the units that we sell under this prospectus, as well as the complete unit agreements that contain the terms of the units.

General

We may issue units consisting of common stock, warrants or any combination thereof. Each unit will be issued so that the holder of the unit is also the holder of each security included in the unit. Thus, the holder of a unit will have the rights and obligations of a holder of each included security. The unit agreement under which a unit is issued may provide that the securities included in the unit may not be held or transferred separately, at any time, or at any time before a specified date.

We will describe in the applicable prospectus supplement the terms of the series of units, including the following:

|

●

|

the designation and terms of the units and of the securities comprising the units, including whether and under what circumstances those securities may be held or transferred separately;

|

|

●

|

any provisions of the governing unit agreement that differ from those described below;

|

|

●

|

any provisions for the issuance, payment, settlement, transfer, or exchange of the units or of the securities comprising the units;

|

|

●

|

the designation and terms of the units and of the securities comprising the units, including whether and under what circumstances those securities may be held or transferred separately;

|

|

●

|

any provisions of the governing unit agreement that differ from those described below; and

|

|

●

|

any provisions for the issuance, payment, settlement, transfer, or exchange of the units or of the securities comprising the units.

|

The provisions described in this section, as well as those described under “Description of Common Stock,” “Description of Warrants” and “Description of Units” will apply to each unit and to any common stock or warrant included in each unit, respectively.

Issuance in Series

We may issue units in such amounts and in such numerous distinct series as we determine.

Enforceability of Rights by Holders of Units

Each unit agent will act solely as our agent under the applicable unit agreement and will not assume any obligation or relationship of agency or trust with any holder of any unit. A single bank or trust company may act as unit agent for more than one series of units. A unit agent will have no duty or responsibility in case of any default by us under the applicable unit agreement or unit, including any duty or responsibility to initiate any proceedings at law or otherwise, or to make any demand upon us. Any holder of a unit, without the consent of the related unit agent or the holder of any other unit, may enforce by appropriate legal action its rights as holder under any security included in the unit.

Title

We, the unit agent, and any of their agents may treat the registered holder of any unit certificate as an absolute owner of the units evidenced by that certificate for any purposes and as the person entitled to exercise the rights attaching to the units so requested, despite any notice to the contrary.

DESCRIPTION OF RIGHTS

This section describes the general terms of the rights that we may offer and sell by this prospectus. This prospectus and any accompanying prospectus supplement will contain the material terms and conditions for each right. The accompanying prospectus supplement may add, update or change the terms and conditions of the rights as described in this prospectus.

The particular terms of each issue of rights, the rights agreement relating to the rights and the rights certificates representing rights will be described in the applicable prospectus supplement, including, as applicable:

|

●

|

the title of the rights;

|

|

●

|

the date of determining the stockholders entitled to the rights distribution;

|

|

●

|

the title, aggregate number of shares of common stock or preferred stock purchasable upon exercise of the

|

|

●

|

rights;

|

|

●

|

the exercise price;

|

|

●

|

the aggregate number of rights issued;

|

|

●

|

the date, if any, on and after which the rights will be separately transferable;

|

|

●

|

the date on which the right to exercise the rights will commence and the date on which the right will expire; and

|

|

●

|

any other terms of the rights, including terms, procedures and limitations relating to the distribution, exchange and exercise of the rights.

|

ANTI-TAKEOVER LAW, LIMITATIONS OF LIABILITY AND INDEMNIFICATION

Business Combinations

Under the Maryland General Corporation Law, some business combinations, including a merger, consolidation, share exchange or, in some circumstances, an asset transfer or issuance or reclassification of equity securities, are prohibited for a period of time and require an extraordinary vote. These transactions include those between a Maryland corporation and the following persons (a “Specified Person”):

An interested stockholder, which is defined as any person (other than a subsidiary) who beneficially owns 10% or more of the corporation’s voting stock, or who is an affiliate or an associate of the corporation who, at any time within a two-year period prior to the transaction, was the beneficial owner of 10% or more of the voting power of the corporation’s voting stock; or an affiliate of an interested stockholder.

A person is not an interested stockholder if the board of directors approved in advance the transaction by which the person otherwise would have become an interested stockholder. The board of directors of a Maryland corporation also may exempt a person from these business combination restrictions prior to the time the person becomes a Specified Person and may provide that its exemption be subject to compliance with any terms and conditions determined by the board of directors. Transactions between a corporation and a Specified Person are prohibited for five years after the most recent date on which such stockholder becomes a Specified Person. After five years, any business combination must be recommended by the board of directors of the corporation and approved by at least 80% of the votes entitled to be cast by holders of voting stock of the corporation and two-thirds of the votes entitled to be cast by holders of shares other than voting stock held by the Specified Person with whom the business combination is to be effected, unless the corporation’s stockholders receive a minimum price as defined by Maryland law and other conditions under Maryland law are satisfied.

A Maryland corporation may elect not to be governed by these provisions by having its board of directors exempt various Specified Persons, by including a provision in its charter expressly electing not to be governed by the applicable provision of Maryland law or by amending its existing charter with the approval of at least 80% of the votes entitled to be cast by holders of outstanding shares of voting stock of the corporation and two-thirds of the votes entitled to be cast by holders of shares other than those held by any Specified Person. Our articles of incorporation do not include any provision opting out of these business combination provisions.

Control Share Acquisitions

The Maryland General Corporation Law also prevents, subject to exceptions, an acquirer who acquires sufficient shares to exercise specified percentages of voting power of a corporation from having any voting rights except to the extent approved by two-thirds of the votes entitled to be cast on the matter not including shares of stock owned by the acquiring person, any directors who are employees of the corporation and any officers of the corporation.

These provisions are referred to as the control share acquisition statute.

The control share acquisition statute does not apply to shares acquired in a merger, consolidation or share exchange if the corporation is a party to the transaction, or to acquisitions approved or exempted prior to the acquisition by a provision contained in the corporation’s charter or bylaws. Our bylaws include a provision exempting us from the restrictions of the control share acquisition statute, but this provision could be amended or rescinded either before or after a person acquired control shares. As a result, the control share acquisition statute could discourage offers to acquire our common stock and could increase the difficulty of completing an offer.

Board of Directors

The Maryland General Corporation Law provides that a Maryland corporation which is subject to the Exchange Act and has at least three outside directors (who are not affiliated with an acquirer of the company) under certain circumstances may elect by resolution of the board of directors or by amendment of its charter or bylaws to be subject to statutory corporate governance provisions that may be inconsistent with the corporation’s charter and bylaws. Under these provisions, a board of directors may divide itself into three separate classes without the vote of stockholders such that only one-third of the directors are elected each year. A board of directors classified in this manner cannot be altered by amendment to the charter of the corporation. Further, the board of directors may, by electing to be covered by the applicable statutory provisions and notwithstanding the corporation’s articles of incorporation or bylaws:

|

●

|

provide that a special meeting of stockholders will be called only at the request of stockholders entitled to cast at least a majority of the votes entitled to be cast at the meeting,

|

|

●

|

reserve for itself the right to fix the number of directors,

|

|

●

|

provide that a director may be removed only by the vote of at least two-thirds of the votes entitled to be cast generally in the election of directors, and

|

|

●

|

retain for itself sole authority to fill vacancies created by an increase in the size of the board or the death, removal, or resignation of a director.

|

In addition, a director elected to fill a vacancy under these provisions serves for the balance of the unexpired term instead of until the next annual meeting of stockholders. A board of directors may implement all or any of these provisions without amending the charter or bylaws and without stockholder approval. Although a corporation may be prohibited by its charter or by resolution of its board of directors from electing any of the provisions of the statute, we have not adopted such a prohibition. We have adopted a staggered board of directors with three separate classes in our articles of incorporation and given the Board the right to fix the number of directors, but we have not prohibited the amendment of these provisions. The adoption of the staggered board may discourage offers to acquire our common stock and may increase the difficulty of completing an offer to acquire our stock. If our Board chose to implement the statutory provisions, it could further discourage offers to acquire our common stock and could further increase the difficulty of completing an offer to acquire our common stock.

Effect of Certain Provisions of our Articles of Incorporation and Bylaws

In addition to the articles of incorporation and bylaws provisions discussed above, certain other provisions of our bylaws may have the effect of impeding the acquisition of control of our Company by means of a tender offer, proxy fight, open market purchases or otherwise in a transaction not approved by our Board of Directors. These provisions of bylaws are intended to reduce our vulnerability to an unsolicited proposal for the restructuring or sale of all or substantially all of our assets or an unsolicited takeover attempt, which our Board believes is otherwise unfair to our stockholders. These provisions, however, also could have the effect of delaying, deterring or preventing a change in control of our company.

Our bylaws provide that with respect to annual meetings of stockholders, (i) nominations of individuals for election to our Board of Directors and (ii) the proposal of business to be considered by stockholders may be made only pursuant to our notice of the meeting, by or at the direction of our Board of Directors, or by a stockholder who is entitled to vote at the meeting and has complied with the advance notice procedures set forth in our bylaws.

Special meetings of stockholders may be called only by the chief executive officer, the board of directors or the secretary of our company (upon the written request of the holders of a majority of the shares entitled to vote). At a special meeting of stockholders, the only business that may be conducted is the business specified in our notice of meeting. With respect to nominations of persons for election to our Board of Directors, nominations may be made at a special meeting of stockholders only pursuant to our notice of meeting, by or at the direction of our Board of Directors, or if our Board of Directors has determined that directors will be elected at the special meeting, by a stockholder who is entitled to vote at the meeting and has complied with the advance notice procedures set forth in our bylaws.

These procedures may limit the ability of stockholders to bring business before a stockholders meeting, including the nomination of directors and the consideration of any transaction that could result in a change in control and that may result in a premium to our stockholders.

Disclosure of the SEC’s Position on Indemnification for Securities Act Liabilities

Insofar as indemnification for liabilities under the Securities Act may be permitted to directors, officers or persons controlling us pursuant to the above provisions, we have been informed that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment of expenses incurred or paid by a director, officer or controlling person in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the shares of common stock being registered, we will, unless in the opinion of our counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by us is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

PLAN OF DISTRIBUTION

We may sell the securities being offered hereby in one or more of the following ways from time to time:

|

●

|

through agents to the public or to investors;

|

|

●

|

to one or more underwriters or dealers for resale to the public or to investors;

|

|

●

|

on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale;

|

|

●

|

in the over-the-counter market;

|

|

●

|

in transactions other than on these exchanges or systems or in the over-the-counter market;

|

|

●

|

in “at the market offerings,” within the meaning of Rule 415(a)(4) of the Securities Act, to or through a market maker or into an existing trading market, or an exchange or otherwise;

|

|

●

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

●

|

block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

●

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

●

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

●

|

directly to investors in privately negotiated transactions;

|

|

●

|

through a combination of these methods of sale; or

|

|

●

|

any other method permitted pursuant to applicable law.

|

The securities that we distribute by any of these methods may be sold, in one or more transactions, at:

|

●

|

a fixed price or prices, which may be changed;

|

|

●

|

market prices prevailing at the time of sale;

|

|

●

|

prices related to prevailing market prices; or

|

|

●

|

negotiated prices.

|

We will set forth in a prospectus supplement the terms of the offering of our securities, including:

|

●

|

the name or names of any agents or underwriters;

|

|

●

|

the purchase price of our securities being offered and the proceeds we will receive from the sale;

|

|

●

|

any over-allotment options under which underwriters may purchase additional securities from us;

|

|

●

|

any agency fees or underwriting discounts and commissions and other items constituting agents’ or underwriters’ compensation;

|

|

●

|

the public offering price;

|

|

●

|

any discounts or concessions allowed or re-allowed or paid to dealers; and

|

|

●

|

any securities exchanges on which such common stock may be listed.

|

Underwriters

Underwriters, dealers and agents that participate in the distribution of the securities may be underwriters as defined in the Securities Act and any discounts or commissions they receive from us and any profit on their resale of the securities may be treated as underwriting discounts and commissions under the Securities Act. We will identify in the applicable prospectus supplement any underwriters, dealers or agents and will describe their compensation. We may have agreements with the underwriters, dealers and agents to indemnify them against specified civil liabilities, including liabilities under the Securities Act. Underwriters, dealers and agents may engage in transactions with or perform services for us or our subsidiaries in the ordinary course of their business.

If we use underwriters for a sale of securities, the underwriters will acquire the securities for their own account. The underwriters may resell the securities in one or more transactions, including negotiated transactions, at a fixed public offering price or at varying prices determined at the time of sale. The obligations of the underwriters to purchase the securities will be subject to the conditions set forth in the applicable underwriting agreement. The underwriters will be obligated to purchase all the securities offered if they purchase any of the securities offered. We may change from time to time any initial public offering price and any discounts or concessions the underwriters allow or re-allow or pay to dealers. We may use underwriters with whom we have a material relationship. We will describe in the prospectus supplement naming the underwriters the nature of any such relationship.

If indicated in the applicable prospectus supplement, we will authorize underwriters or other persons acting as our agents to solicit offers by particular institutions to purchase securities from us at the public offering price set forth in such prospectus supplement pursuant to delayed delivery contracts providing for payment and delivery on the date or dates stated in such prospectus supplement. Each delayed delivery contract will be for an amount no less than, and the aggregate principal amounts of securities sold under delayed delivery contracts shall be not less nor more than, the respective amounts stated in the applicable prospectus supplement. Institutions with which such contracts, when authorized, may be made include commercial and savings banks, insurance companies, pension funds, investment companies, educational and charitable institutions and others, but will in all cases be subject to our approval. The obligations of any purchaser under any such contract will be subject to the conditions that (a) the purchase of the securities shall not at the time of delivery be prohibited under the laws of any jurisdiction in the United States to which the purchaser is subject, and (b) if the securities are being sold to underwriters, we shall have sold to the underwriters the total principal amount of the securities less the principal amount thereof covered by the contracts. The underwriters and such other agents will not have any responsibility in respect of the validity or performance of such contracts.

Agents

We may designate agents who agree to use their reasonable efforts to solicit purchases for the period of their appointment or to sell securities on a continuing basis.

Direct Sales

We may also sell securities directly to one or more purchasers without using underwriters or agents.

Trading Markets and Listing of Securities

Unless otherwise specified in the applicable prospectus supplement, each class or series of securities will be a new issue with no established trading market, other than our common stock, which is traded on the NYSE American. We may elect to list any other class or series of securities on any exchange, but we are not obligated to do so. It is possible that one or more underwriters may make a market in a class or series of securities, but the underwriters will not be obligated to do so and may discontinue any market making at any time without notice. We cannot give any assurance as to the liquidity of the trading market for any of the securities.

Stabilization Activities

In connection with an offering, an underwriter may purchase and sell securities in the open market. These transactions may include short sales, stabilizing transactions and purchases to cover positions created by short sales. Shorts sales involve the sale by the underwriters of a greater number of securities than they are required to purchase in the offering. “Covered” short sales are sales made in an amount not greater than the underwriters’ option to purchase additional securities from us, if any, in the offering. If the underwriters have an over-allotment option to purchase additional securities from us, the underwriters may close out any covered short position by either exercising their over-allotment option or purchasing securities in the open market. In determining the source of securities to close out the covered short position, the underwriters may consider, among other things, the price of securities available for purchase in the open market as compared to the price at which they may purchase securities through the over-allotment option. “Naked” short sales are any sales in excess of such option or where the underwriters do not have an over-allotment option. The underwriters must close out any naked short position by purchasing securities in the open market. A naked short position is more likely to be created if the underwriters are concerned that there may be downward pressure on the price of the securities in the open market after pricing that could adversely affect investors who purchase in the offering.

Accordingly, to cover these short sales positions or to otherwise stabilize or maintain the price of the securities, the underwriters may bid for or purchase securities in the open market and may impose penalty bids. If penalty bids are imposed, selling concessions allowed to syndicate members or other broker-dealers participating in the offering are reclaimed if securities previously distributed in the offering are repurchased, whether in connection with stabilization transactions or otherwise. The effect of these transactions may be to stabilize or maintain the market price of the securities at a level above that which might otherwise prevail in the open market. The impositions of a penalty bid may also affect the price of the securities to the extent that it discourages resale of the securities. The magnitude or effect of any stabilization or other transactions is uncertain. These transactions may be effected on the NYSE American or otherwise and, if commenced, may be discontinued at any time.

EXPERTS

The consolidated financial statements of IGC Pharma, Inc. included in our annual report on Form 10-K for the fiscal year ended March 31, 2023 and March 31, 2022, have been audited by Manohar Chowdhry & Associates, independent registered public accountants, as set forth in their reports thereon, included therein, and incorporated herein by reference in this prospectus and elsewhere in the registration statement. Such consolidated financial statements are incorporated herein by reference in reliance upon such reports given on the authority of said firm as experts in accounting and auditing.

LEGAL MATTERS

Olshan Frome Wolosky LLP, New York, New York, as our counsel, will pass upon certain legal matters, including the legality of the securities offered by this prospectus and any prospectus supplement. If the securities are distributed in an underwritten offering, certain legal matters will be passed upon for the underwriters by counsel identified in the applicable prospectus supplement.

WHERE YOU CAN FIND MORE INFORMATION

We are a public company and file annual, quarterly, and special reports, proxy statements, and other information with the SEC. Our SEC filings are available, at no charge, to the public at the SEC’s website at http://www.sec.gov.

This prospectus is part of a registration statement on Form S-3 that we filed with the SEC. The registration statement contains more information than this prospectus regarding us and our common stock, including certain exhibits and schedules. You can obtain a copy of the registration statement from the SEC at the address listed above or from the SEC’s Internet site.

You may also access our SEC filings at our website https://igcpharma.com/. The information on our Internet website is not incorporated by reference in this prospectus.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

We are “incorporating by reference” information into this prospectus. This means that we are disclosing important information to you by referring you to another document that has been filed separately with the SEC. The information incorporated by reference is considered to be part of this prospectus, and information that we file later with the SEC will automatically update and supersede the information contained in documents filed earlier with the SEC or contained in this prospectus. We incorporate by reference in this prospectus the documents listed below and any future filings made by us with the SEC under Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act after the initial filing of this prospectus and prior to the time that we sell all of the securities offered by this prospectus and the accompanying prospectus (except in each case the information contained in such documents to the extent “furnished” and not “filed”):

|

●

|

Annual Report on Form 10-K for the fiscal year ended March 31, 2023, filed with the SEC on July 7, 2023;

|

|

●

|

Our Quarterly Reports on Form 10-Q for the quarters ended June 30, 2023 filed with the SEC on August 10, 2023 and September 30, 2023 filed with the SEC on November 9, 2023;

|

|

●

|

Our Current Reports on Form 8-K (excluding any reports or portions thereof that are deemed to be furnished and not filed), filed with the SEC on May 8, 2023, July 7, 2023, July 7, 2023, August 21, 2023 and October 27, 2023; and

|

|

●

|

The description of our common stock contained in our Registration Statement on Form 8-A filed pursuant to Section 12 of the Exchange Act on March 7, 2006, and any amendments or reports filed for the purpose of updating the description.

|

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We will provide to each person, including any beneficial owner, to whom this prospectus is delivered, a copy of any or all of the information that has been incorporated by reference in this prospectus, but not delivered with this prospectus. Copies of the above documents (other than exhibits to such documents unless those exhibits have been specifically incorporated by reference in this prospectus) may be obtained upon written or oral request, without charge to you, by contacting:

IGC Pharma, Inc.

Attn: Corporate Secretary 10224 Falls Road

Potomac, Maryland 20854

Telephone: +1 (301) 983-0998.

You should rely only on the information contained in this prospectus, including information incorporated by reference as described above, or any prospectus supplement that we have specifically referred you to. We have not authorized anyone else to provide you with different information. You should not assume that the information in this prospectus or any prospectus supplement is accurate as of any date other than the date on the front of those documents or that any document incorporated by reference is accurate as of any date other than its filing date. You should not consider this prospectus to be an offer or solicitation relating to the securities in any jurisdiction in which such an offer or solicitation relating to the securities is not authorized. Furthermore, you should not consider this prospectus to be an offer or solicitation relating to the securities if the person making the offer or solicitation is not qualified to do so, or if it is unlawful for you to receive such an offer or solicitation.

PART II

INFORMATION NOT REQUIRED IN THE PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The expenses in connection with issuance and distribution of the securities being registered are set forth in the following table:

|

SEC registration fee

|

|

$ |

14,760.00 |

|

|

Legal fees and expenses

|

|

|

12,000.00 |

|

|

Accounting fees and expenses*

|

|

|

- |

|

|

Transfer agent fees and expenses*

|

|

|

- |

|

|

Printing fees and expenses*

|

|

|

- |

|

|

Miscellaneous expenses*

|

|

|

2,000.00 |

|

|

Total expenses

|

|

$ |

28,760.00 |

|

* These fees and expenses are calculated based on the securities offered and the number of issuances and, accordingly, cannot be estimated at this time. An estimate of the aggregate amount of these expenses will be reflected in the applicable prospectus supplement.

Item 15. Indemnification of Directors and Officers

Paragraph B of Article Ten of our amended and restated articles of incorporation provides as follows:

“The Corporation, to the full extent permitted by Section 2-418 of the MGCL, as amended from time to time, shall indemnify all persons whom it may indemnify pursuant thereto. Expenses (including attorneys’ fees) incurred by an officer or director in defending any civil, criminal, administrative, or investigative action, suit, or proceeding or which such officer or director may be entitled to indemnification hereunder shall be paid by the Corporation in advance of the final disposition of such action, suit or proceeding upon receipt of an undertaking by or on behalf of such director or officer to repay such amount if it shall ultimately be determined that he or she is not entitled to be indemnified by the Corporation as authorized hereby.”

Article IX of our bylaws also provides for indemnification of our directors, officers, employees, or agents for certain matters in accordance with Section 2-418 of the Maryland General Corporation Law.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers, and controlling persons pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment of expenses incurred or paid by a director, officer, or controlling person in a successful defense of any action, suit, or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, we will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to the court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

Item 16. Exhibits and Financial Statement Schedules

The exhibits listed in the following Exhibit Index are filed as part of this Registration Statement on Form S-3.

| Exhibit No. |

Description |

|

1.1**

|

Form of Underwriting Agreement, Placement Agency Agreement, Dealer-Manager Agreement, Distribution Agreement or similar agreement.

|

|

1.2

|

Sales Agreement dated October 27, 2023, by and between IGC Pharma, Inc. and A.G.P./Alliance Global Partners (incorporated by reference to Exhibit 10.1 to the registrant’s current report on Form 8-K filed on October 27, 2023).

|

|

3.1

|

Amended and Restated Articles of Incorporation (incorporated by reference to Exhibit 3.1 to the registrant’s current report on Form 8-K filed on August 6, 2012).

|

|

3.2

|

Amendment to the Amended and Restated Articles of Incorporation of the Registrant as amended on August 2, 2014. (incorporated by reference to Exhibit 3.3 to the Company’s Post-Effective Amendment No.1 to Form S-3 filed on January 22, 2021).

|

|

3.3

|

Articles of Amendment to the Company’s Amended and Restated Articles of Incorporation filed with the State Department of Assessments and Taxation of Maryland on March 7, 2023 (incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed on March 21, 2023).

|

|

3.4

|

By-laws of the Registrant (incorporated by reference to Exhibit 3.2 to the Company’s Post-Effective Amendment No.1 to Form S-3 filed on January 22, 2021).

|

|

3.5

|

Amendment to the Bylaws of the Company dated March 2, 2023 (incorporated by reference to Exhibit 3.2 to the Company’s Current Report on Form 8-K filed on March 21, 2023).

|

|

5.1*

|

Opinion of Olshan Frome Wolosky LLP, counsel to the registrant, as to the legality of the securities.

|

|

23.1*

|

Consent of Manohar Chowdhry & Associates, independent registered public accounting firm.

|

|

23.3*

|

Consent of Olshan Frome Wolosky LLP (included in the opinion filed as Exhibit 5.1).

|

|

24.1

|

Power of Attorney (set forth on signature page of the registration statement).

|

|

107

|

Filing Fee Table.

|

Unless otherwise indicated, exhibits were previously filed.

* Filed herewith.

** To be subsequently filed by amendment or as an exhibit to a document to be incorporated or deemed to be incorporated by reference to this registration statement, including a current report on Form 8-K.

Item 17. Undertakings

|

a.

|

The undersigned registrant hereby undertakes,

|

|

1.

|

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

|

| |

i.

|

To include any prospectus required by section 10(a)(3) of the Securities Act;

|

| |

|

|

| |

ii.

|

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post- effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Filing Fee Tables” or “Calculation of Registration Fee” table, as applicable, in the effective registration statement; and

|

| |

|

|

| |

iii.

|

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement,

|

provided, however, that the undertakings set forth in paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the information required to be included in a post- effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”) that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

|

2.

|

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

3.

|

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

|

|

4.

|

That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

|

| |

i.

|

Each prospectus filed by a registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

|

| |

|

|

| |

ii.

|

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at the date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which the prospectus relates, and the offering of such securities at the time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

|

|

5.

|

That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities:

|

The undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

| |

i.

|

Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

|

| |

|

|

| |

ii.

|

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

|