Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

December 28 2023 - 5:25PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

December 28, 2023

Commission File Number 001-37974

VIVOPOWER INTERNATIONAL PLC

(Translation of registrant’s name into English)

The Scalpel, 18th Floor, 52 Lime Street

London EC3M 7AF

United Kingdom

+44-203-667-5158

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F:

Form 20- F ☒ Form 40-F ☐

Indicate by checkmark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by checkmark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Results of Annual General Meeting

On December 28, 2023, VivoPower International PLC (the "Company”) held its annual general meeting of shareholders (the "Meeting”). At the Meeting, the Company’s shareholders voted on the following nine resolutions, each of which was approved by no less than 95% of votes cast:

| |

1.

|

To approve the receipt of the accounts and the reports of the directors and the auditors for the financial year ended 30 June 2023 (the "June 2023 Annual Report").

|

| |

2.

|

To approve the directors’ remuneration report for the financial year ended 30 June 2023 as set out in the June 2023 Annual Report (the "Directors' Remuneration Report").

|

| |

3.

|

To re-appoint PKF Littlejohn LLP as auditors of the Company, to hold office until the conclusion of the next annual general meeting of the Company.

|

| |

4.

|

To authorise the Company's audit committee to determine the remuneration of the auditors.

|

| |

5.

|

To approve the extension of the term of appointment as directors of the Company of Peter Jeavons and Michael Hui, Class A directors of the Company, by 3 years, such that the term of such appointment expires in 2026.

|

| |

6.

|

To consider and, if thought fit, pass the following as an ordinary resolution: THAT the directors be and are hereby generally and unconditionally authorised in accordance with section 551 of the Companies Act 2006 to exercise all the powers of the Company to allot shares in the Company and to grant rights to subscribe for, or to convert any security into, shares in the Company up to an aggregate nominal amount of US$3,600,000 provided that this authority shall, unless renewed varied or revoked expire on 27 December 2028 save that the Company shall be entitled to make offers or agreements before the expiry of such authority which would or might require shares to be allotted or such rights to be granted after such expiry and the directors shall be entitled to allot shares and grant rights pursuant to any such offer or agreement as if this authority had not expired.

|

| |

7.

|

To consider and, if thought fit, pass the following as a special resolution: THAT if Resolution 6 above is passed, the directors be and are hereby authorised pursuant to section 570 of the Companies Act 2006 to allot equity securities (within the meaning of section 560 of the Companies Act 2006) for cash pursuant to the authority conferred by Resolution 6 above as if section 561(1) of the Companies Act 2006 did not apply to any such allotment provided that this power shall be limited to the allotment of equity securities up to an aggregate nominal amount of US$3,600,000, and shall expire on the expiry of the general authority conferred by Resolution 6 above, save that the Company shall be entitled to make offers or agreements before the expiry of such power which would or might require equity securities to be allotted after such expiry and the directors shall be entitled to allot equity securities pursuant to any such offer or agreement as if the power conferred hereby had not expired.

|

| |

8.

|

To consider and, if thought fit, pass the following as an ordinary resolution: THAT the directors be and are hereby generally and unconditionally authorised to merge or divest the subsidiary businesses of the Company, be they Tembo e-LV B.V. (“Tembo”), Aevitas O Holdings Pty Ltd (“Aevitas”), VivoPower USA LLC (“Caret”), or the current or future subsidiaries of Tembo, Aevitas and Caret, subject to acceptable proposals that deliver value.

|

| |

9.

|

To consider and, if thought fit, pass the following as an ordinary resolution: THAT the directors be and are hereby authorised to make a distribution in kind in the form of shares in an entity consolidating the majority of its Caret business unit’s portfolio, provided that the spin-off transaction is completed and that any such distribution fulfills all legal and regulatory conditions.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: December 28, 2023

|

VivoPower International PLC

|

| |

|

| |

/s/ Kevin Chin

|

| |

Kevin Chin

Executive Chairman

|

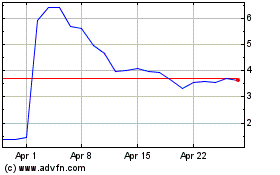

VivoPower (NASDAQ:VVPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

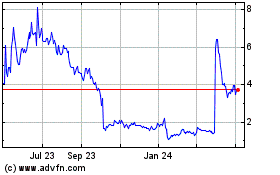

VivoPower (NASDAQ:VVPR)

Historical Stock Chart

From Apr 2023 to Apr 2024