false

0000061398

0000061398

2023-12-28

2023-12-28

0000061398

us-gaap:CommonStockMember

2023-12-28

2023-12-28

0000061398

tell:SeniorNotes8.25PercentDue2028Member

2023-12-28

2023-12-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported): |

December 28, 2023 |

|

Tellurian

Inc.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-5507 |

|

06-0842255 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

| 1201

Louisiana Street, Suite

3100, Houston,

TX |

|

77002 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

| Registrant’s telephone number, including

area code: |

(832)

962-4000 |

|

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

symbol |

|

Name of each exchange on which registered |

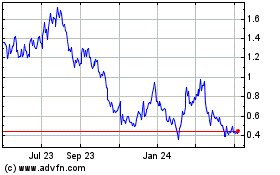

| Common

stock, par value $0.01 per share |

|

TELL |

|

NYSE

American LLC |

| |

|

|

|

|

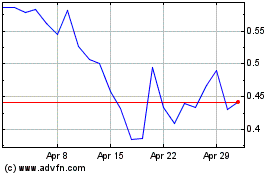

| 8.25%

Senior Notes due 2028 |

|

TELZ |

|

NYSE

American LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry Into a Material Definitive Agreement. |

Letter Agreement

On December 28, 2023,

Tellurian Inc. (the “Company”) entered into a letter agreement (the “Letter Agreement”) with an

institutional investor (the “Investor”) pursuant to which the Company agreed to issue to the Investor 47,865,061 shares

(the “Exchange Shares”) of common stock of the Company. Upon the issuance of the Exchange Shares, (i) $37,900,000

of the principal amount (the “Principal Exchange Amount”) of the $250,000,000 aggregate principal amount of 10.00%

senior secured notes due 2025 (the “Senior Notes”) previously issued to the Investor will be extinguished, (ii) certain

terms of the indentures governing the $83,334,000 aggregate principal amount of 6.00% senior secured convertible notes due 2025 (the “Convertible

Notes,” and together with the Senior Notes, the “Notes”) previously issued to the Investor and the Senior

Notes will be amended, and (iii) the Company will be deemed to have satisfied its obligations to make the cash interest payments

due in respect of the Notes on January 1, 2024. The transactions contemplated by the Letter Agreement are expected to close in the

near future (the “Closing Date”), subject to the satisfaction of customary closing conditions. The Letter Agreement

includes a provision pursuant to which the Company may be obligated to make a cash payment to the Investor after a specified period that

is not expected to exceed 90 days, depending on the volume-weighted average price of the common stock of the Company during that

period.

The Letter Agreement contains

customary representations, warranties, and agreements by the Company, obligations of the parties, termination provisions, and closing

conditions. Pursuant to the Letter Agreement, the Company has agreed to indemnify the Investor against certain liabilities. The representations,

warranties, and covenants contained in the Letter Agreement were made only for purposes of such agreement and as of specific dates, were

solely for the benefit of the parties to such agreement, and may be subject to limitations agreed upon by the contracting parties.

The foregoing description

of the terms and conditions of the Letter Agreement does not purport to be complete and is qualified in its entirety by the full text

of the Letter Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein

by reference.

Forms of Amendments to Supplemental Indentures

The terms of the Senior Notes

are governed by an indenture (the “Base Indenture”), dated as of June 3, 2023, between the Company and Wilmington

Trust, National Association, as trustee (the “Trustee”), and an eighth supplemental indenture (the “Eighth

Supplemental Indenture”), dated as of August 15, 2023, among the Company, the Trustee and the collateral agent named therein.

The terms of the Convertible Notes are governed by the Base Indenture between the Company and the Trustee, and a ninth supplemental indenture

(the “Ninth Supplemental Indenture,” and together with the Eighth Supplemental Indenture, the “Supplemental

Indentures”), dated as of August 15, 2023, among the Company, the Trustee and the collateral agent named therein.

Currently, the Eighth

Supplemental Indenture provides that on or after October 1, 2024, the holders of the Senior Notes may redeem up to the entire

principal amount of the Senior Notes for a cash purchase price equal to the principal amount of the Senior Notes being redeemed,

plus accrued and unpaid interest, if the Company’s liquidity falls below (a) $200,000,000, if the Convertible Notes are

not outstanding at such time, or (b) $250,000,000, if any of the Convertible Notes are outstanding at such time. On the Closing

Date, the Eighth Supplemental Indenture will be amended to provide that the liquidity threshold in clause (a) above will be reduced

to $170,000,000 and clause (b) above will be reduced to $212,100,000.

Currently, the Ninth Supplemental

Indenture provides that on or after October 1, 2024, the holders of the Convertible Notes may redeem up to the entire principal amount

of the Convertible Notes for a cash purchase price equal to the principal amount of the Convertible Notes being redeemed, plus accrued

and unpaid interest, if the Company’s liquidity falls below (a) $75,000,000, if the Senior Notes are not outstanding at such

time, or (b) $250,000,000, if any of the Senior Notes are outstanding at such time. On the Closing Date, the Ninth Supplemental Indenture

will be amended to provide that the liquidity threshold in clause (b) above will be reduced to $212,100,000.

In addition, on the Closing

Date, the minimum cash covenant of $50,000,000 in the Supplemental Indentures will be modified to equal to (i) $40,000,000 for the

period commencing on the Closing Date through and including the tenth (10th) trading day after the end of the Top-Up Measuring

Period (as defined in the Letter Agreement) and (ii) $50,000,000 thereafter.

The foregoing description

of the terms and conditions of the amendments to the Supplemental Indentures does not purport to be complete and is qualified in its entirety

by reference to the full text of the First Amendment to Eighth Supplemental Indenture and the First Amendment to Ninth Supplemental Indenture,

forms of which are filed as Exhibits A and B, respectively, to the Letter Agreement and are incorporated herein by reference.

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information set forth

in Item 1.01 is incorporated herein by reference to this Item 2.03.

| Item 3.02 | Unregistered Sales of Equity Securities. |

The information set forth

in Item 1.01 is incorporated herein by reference to this Item 3.02.

The Company and the Investor

entered into the Letter Agreement in reliance upon the exemption from securities registration afforded by Section 3(a)(9) of

the Securities Act of 1933, as amended, and the Exchange Shares will be issued under such exemption. The transactions contemplated by

the Letter Agreement were exclusively with the Investor, an existing security holder of the Company, and no commission or other remuneration

will be paid or be given directly or indirectly for soliciting such transactions.

| Item 3.03 | Material Modification to Rights of Security Holders. |

The information set forth

in Item 1.01 is incorporated herein by reference to this Item 3.03.

| Item 5.07 | Submission of Matters to a Vote of Security Holders. |

The information set forth

in Item 1.01 is incorporated herein by reference to this Item 5.07.

Pursuant to, and concurrent

with the execution of, the Letter Agreement on December 28, 2023, the Investor was deemed to have consented to each of the Supplemental

Indentures. The Investor is the holder of the Notes.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| ‡ | Certain schedules or similar attachments to this exhibit have been omitted in accordance with Item 601(a)(5) of

Regulation S-K. The registrant hereby agrees to furnish supplementally to the Securities and Exchange Commission upon request a copy

of any omitted schedule or attachment to this exhibit. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

TELLURIAN INC. |

| |

|

|

| Date: December 28, 2023 |

By: |

/s/ Simon G. Oxley |

| |

Name: |

Simon G. Oxley |

| |

Title: |

Executive Vice President and Chief Financial Officer |

Exhibit 10.1

HIGH TRAIL CAPITAL LP

80 River Street, Suite 4C

Hoboken, NJ 07030

December 28, 2023

| To: | Tellurian Inc.

1201 Louisiana Street, Suite 3100

Houston, Texas 77002

Telephone: (832) 962-4000

Attention: Legal

E-Mail: legal.notices@tellurianinc.com |

| | |

| Re: | Partial Debt Conversion |

To the addressee listed above:

Reference is made to (i) that

certain 10.00% Senior Secured Note due 2025 (the “10% Note”), previously issued to HB Fund LLC (“High Trail”)

pursuant to that certain Securities Purchase Agreement, dated as of August 8, 2023 (the “Purchase Agreement”)

between Tellurian Inc. (the “Company” and together with High Trail, the “Parties”) and High Trail

and that certain Eighth Supplemental Indenture, dated as of August 15, 2023 (the “Eighth Supplemental Indenture”)

entered into between the Company, Wilmington Trust, National Association (the “Trustee”) and High Trail as the Collateral

Agent and (ii) that certain 6.00% Senior Secured Convertible Note due 2025 (the “6% Note” and together with the

10% Note, the “Notes”), previously issued to High Trail pursuant to the Purchase Agreement and that certain Ninth Supplemental

Indenture, dated as of August 15, 2023 (the “Ninth Supplemental Indenture” and together with the Eighth Supplemental

Indenture, the “Supplemental Indentures”) entered into between the Company, the Trustee and High Trail as the Collateral

Agent. All capitalized terms used in this letter agreement, but not defined herein, shall have the meanings ascribed to such terms in

the Supplemental Indentures and the Purchase Agreement. The Parties hereby agree that in exchange for valuable consideration, the sufficiency

of which is hereby acknowledged, the Parties agree as follows:

| 1. | Securities Act Exemption. The Company and High Trail are executing and delivering this letter agreement in reliance upon the

exemption from securities registration afforded by Section 3(a)(9) of the Securities Act of 1933, as amended (the “1933

Act”), and the Exchange Shares (as defined below) issued hereunder shall be issued thereunder. |

| 2.

| Exchange of Debt for shares of Common Stock. Subject to Section 3, the Company shall on the Closing Date (as defined below)

issue to High Trail 47,865,061 shares of Common Stock (such number of shares being equal to (A) the Principal Exchange Amount (as

defined below) plus the January Interest Payment Amount (as defined below) divided by (B) the “market value” (as

defined in NYSE American Rule 713(a)) on the date of execution of this letter agreement (or, if the date of execution is not a Trading

Day, or if the time of execution is before 4:00 p.m. (New York City time) on a Trading Day, on the immediately preceding Trading

Day) (such date being the “Pricing Date”) (the “Exchange Shares”)); provided, that upon the

earlier of (A) the later to occur of (i) such date upon which the Exchange Shares shall have been Freely Tradable for ninety (90)

days and (ii) such date upon which the Exchange Shares shall have been Freely Tradable for sixty four (64) Trading Days (the

“Outside Top-Up Date Trigger”) and (B) such date on which High Trail shall have sold all of the Exchange Shares

and no Exchange Shares shall be held in abeyance pursuant to Section 3 hereof (the earlier of clause (A) and clause (B) being,

the “Top-Up Date”), if the quotient of (x) the Principal Exchange Amount plus the January Interest Payment

Amount divided by (y) the Top-Up Measuring Price (as defined below) (the resulting quotient, the “Top-Up Measuring Share

Amount”) is a number greater than the number of Exchange Shares issued on the Closing Date (inclusive of any Exchange Shares

held in abeyance on the Closing Date pursuant to Section 3 hereof), the Company shall pay High Trail in cash by wire transfer of

immediately available funds an amount equal to the product of (i) the Top-Up Measuring Share Amount less the number of Exchange Shares

issued on the Closing Date (inclusive of any Exchange Shares held in abeyance on the Closing Date pursuant to Section 3 hereof) and

(ii) the Top-Up Measuring Price (the “Top-Up Cash Amount”). Such payment shall be made within two (2) Business

Days of the earlier to occur of (i) the Outside Top-Up Date Trigger and (ii) the date upon which High Trail shall have delivered

written notice (of which email shall be sufficient) to the Company that it has sold all of the Exchange Shares. For purposes of this letter

agreement, “Top-Up Measuring Price” means the average of the Daily VWAPs of the Common Stock on the Trading Days on

which the Exchange Shares were Freely Tradable during the period beginning on, and including, the calendar day immediately following the

Pricing Date and ending on, and including, the Top-Up Date (such period, the “Top-Up Measuring Period”); provided,

that such result shall be appropriately adjusted for any stock splits, stock dividends, stock combinations, recapitalizations or other

similar transactions during such Top-Up Measuring Period. For the avoidance of doubt, in no event shall High Trail be obligated to make

any payment to the Company as a result of this Section 2. Upon the issuance of the Exchange Shares (regardless of whether any such

shares are held in abeyance pursuant to Section 3 below), the Closing shall be deemed to have occurred and $37,900,000 of the principal

amount of the 10% Note (the “Principal Exchange Amount”) shall be extinguished. For purposes of this letter agreement,

the Exchange Shares shall have been “Freely Tradable” on a date, whether or not such date is a Trading Day, if on such

date (A) such Exchange Shares were eligible to be offered, sold or otherwise transferred by High Trail pursuant to Rule 144,

without any requirements as to volume, manner of sale, availability of current public information (whether or not then satisfied) or notice

under the 1933 Act and without any requirement for registration under any state securities or “blue sky” laws; or (B) such

shares were eligible for immediate resale pursuant to an effective registration statement under the 1933 Act. The term “January Interest

Payment Amount” means seven million five hundred thousand ten dollars ($7,500,010.00), an amount equal to the cash interest

payment due in respect of the Notes on January 1, 2024. Upon the issuance of the Exchange Shares, the Company will be deemed to have

satisfied its obligation to make such interest payment. The closing of the issuance of the Exchange Shares pursuant to the first sentence

of this Section 2 (the “Closing”) shall occur by electronic transmission or other transmission as mutually acceptable

to the Parties. The date and time of the Closing (the “Closing Date”) shall be 10:00 a.m., New York time, on the

first (1st) Business Day on which the conditions to Closing set forth in Section 18 are satisfied or waived, or such

other date as is mutually agreed to by the Parties. The Parties agree that the Company’s obligation hereunder to pay the Top-Up

Cash Amount shall constitute a Secured Obligation within the meaning of such term in the Pledge Agreement. |

| 3. | Abeyance of Exchange Shares. Notwithstanding the foregoing, if the Exchange Shares required to

be issued on the date hereof pursuant to this letter agreement would result in High Trail, together with the other Attribution Parties

collectively, beneficially owning in excess of 4.99% (the “Maximum Percentage”) of the shares of Common Stock outstanding,

then High Trail shall notify the Company of a number of shares otherwise issuable pursuant hereto on the date hereof (the “Excess

Shares”) that shall instead be held in abeyance for the benefit of High Trail. The Company shall issue such Excess Shares, or

such portion thereof requested by High Trail, upon the written request of High Trail, provided that no Excess Shares shall be issued hereunder

to the extent such issuance would result in High Trail and the other Attribution Parties exceeding the Maximum Percentage. Subject to

the limitations set forth in this Section 3, the Company shall deliver any Excess Shares requested in writing by High Trail to High

Trail (or its designee) no later than the second (2nd) Trading Day (or, if less, the standard settlement period, expressed in a number

of Trading Days, for the Company’s Principal Market) after the delivery of such written request by High Trail. |

| 4. | Exchange Shares. The Exchange Shares will be validly issued, fully paid and nonassessable and free

from all preemptive or similar rights or Liens with respect to the issuance thereof, with High Trail being entitled to all rights accorded

to a holder of Common Stock with respect thereto. Subject to the limitations set forth in Section 3, the Company shall cause its

transfer agent (the “Transfer Agent”) to credit the Exchange Shares to High Trail’s account with The Depositary

Trust Company upon delivery pursuant to this letter agreement. The Company acknowledges that the holding period for purposes of Rule 144(d)(1) with

respect to the Notes and the Exchange Shares commenced on August 15, 2023. The Company further acknowledges and agrees that it will

neither assert nor maintain a contrary position with respect to the date of commencement of the holding period under Rule 144 with

respect to the Notes and the Exchange Shares. |

| 5. | Amendment to Supplemental Indentures. Concurrent with the execution of this letter agreement, the

Company shall deliver to High Trail fully executed copies of an amendment to the Eighth Supplemental Indenture, in the form attached hereto

as Exhibit A, and an amendment to the Ninth Supplemental Indenture, in the form attached hereto as Exhibit B (collectively,

the “Supplemental Indenture Amendments”), and High Trail shall be deemed to have consented to each of the Supplemental

Indenture Amendments. High Trail represents to the Company that High Trail has not transferred any beneficial ownership in the Notes. |

| 6. | Purchase Agreement. For purposes of this letter agreement, the Company and High Trail hereby agree

that, from and after the Closing Date, (i) the Exchange Shares shall constitute Securities (as defined in the Purchase Agreement),

and (ii) this letter agreement and the Supplemental Indenture Amendments shall each constitute a Transaction Document for all purposes

under the Purchase Agreement. The Company represents that the representations and warranties of the Company set forth in Sections 3(b),

3(c), 3(d), 3(e), 3(f), 3(g), 3(h), 3(i), 3(j), 3(ee), 3(hh), 3(jj) and 3(uu) of the Purchase Agreement are true and correct in all material

respects (except for such representations and warranties that are qualified by materiality or material adverse effect, which are true

and correct in all respects) as of the Closing Date (except for representations and warranties that speak as of a specific date, which

are true and correct in all material respects as of such specific date). High Trail represents that the representations and warranties

of the Holders set forth in the Purchase Agreement are true and correct in all material respects (except for such representations and

warranties that are qualified by materiality or material adverse effect, which are true and correct in all respects) as of the Closing

Date (except for representations and warranties that speak as of a specific date, which are true and correct in all material respects

as of such specific date). |

| 7. | Material Non-Public Information. By no later than 9:15 a.m., New York City time on the date

hereof (or, if this letter agreement is executed after such time, no later than 9:15 a.m. the following day), the Company shall

file a Current Report on Form 8-K disclosing all the material terms of the transactions contemplated by this letter agreement (the

“Form 8-K”). From and after the issuance of the Form 8-K, the Company shall have disclosed all material,

nonpublic information (if any) provided to High Trail by the Company or any of its subsidiaries or any of their respective officers, directors,

employees or agents and neither High Trail nor any of its officers, directors, employees or agents shall be in possession of any material,

non-public information regarding the Company or any of its Subsidiaries. |

| 8. | 3(a)(9) Exchange. The Company agrees that it does not believe that High Trail is acting as

an underwriter in connection with the transactions contemplated by this letter agreement. Neither the Company nor any Subsidiary or affiliate

thereof shall identify High Trail as being an underwriter or potentially being an “underwriter” in any disclosure to, or filing

with, the SEC, the Principal Market or any other Eligible Market. High Trail shall not be required by the Company or any subsidiary of

affiliate thereof to agree or admit that it is, or may be, acting as an “underwriter” in connection with the transactions

contemplated hereby or agree to be named as an underwriter or as potentially being an underwriter in any public disclosure or filing with

the SEC, the Principal Market or any other Eligible Market, nor shall High Trail be required to make any representations to, or undertake

any obligations to, the SEC in connection with any registration statement filed by the Company, unless such designation or potential designation

is required by the staff of the SEC, in connection with any registration statement filed by the Company with respect to the Exchange Shares.

High Trail being deemed an underwriter, or potentially to be an underwriter, by the SEC shall not relieve the Company of any obligations

it has under this letter agreement or any other Transaction Document. |

| 9. | Registration Rights. The Company shall: |

| i. | file a prospectus supplement in substantially the form attached hereto as Exhibit C (the “Prospectus

Supplement”) to the Company’s current registration statement on Form S-3 (File No. 333-269069) with the SEC

as soon as practicable but in no event later than one (1) Business Day after the Closing Date with respect to the Exchange Shares

(the “Filing Date”) to register all such Exchange Shares (the “Registrable Shares”) under the 1933

Act (providing for shelf registration of such Registrable Shares under SEC Rule 415) (such registration statement and any replacement

thereof, including any preliminary prospectus, preliminary prospectus supplement, final prospectus, final prospectus supplement, exhibit

or amendment included in or relating to such registration statement being the “Resale Registration Statement”); |

| ii. | promptly prepare and file with the SEC such amendments and supplements to each such Resale Registration

Statement and the prospectus used in connection therewith as may be necessary to keep such Resale Registration Statement continuously

effective and free from any material misstatement or omission to state a material fact therein until termination of such obligation as

provided in Section 12 below, subject to the Company’s right to suspend pursuant to Section 11 below; |

| iii. | not less than four (4) Business Days prior to the filing of any amendment or supplement to the

Resale Registration Statement (not including any documents incorporated by reference therein), furnish via email to High Trail copies

of all such documents proposed to be filed, which documents (other than any document that is incorporated or deemed to be incorporated

by reference therein) will be subject to the review of High Trail. The Company shall reflect in each such document when so filed with

the SEC such comments regarding High Trail and the plan of distribution as High Trail may reasonably and promptly propose no later than

two (2) Business Days after High Trail has been so furnished with copies of such documents as aforesaid; |

| iv. | furnish to High Trail such number of copies of prospectuses in conformity with the requirements of the

1933 Act and such other documents as High Trail may reasonably request, in order to facilitate the public sale or other disposition of

all or any of the Registrable Shares by High Trail; |

| v. | file such documents as may be required of the Company for normal securities law clearance for the resale

of the Registrable Shares in such states of the United States as may be reasonably requested by High Trail and use its commercially reasonable

efforts to maintain such blue sky qualifications during the period the Company is required to maintain effectiveness of each such Resale

Registration Statement; provided, however, that the Company shall not be required in connection with this Section 9(v) to qualify

as a foreign corporation or execute a general consent to service of process in any jurisdiction in which it is not now so qualified or

has not so consented; |

| vi. | upon notification by the SEC that a Resale Registration Statement will not be reviewed or is not subject

to further review by the SEC, the Company shall within three (3) Business Days following the date of such notification request

acceleration of such Resale Registration Statement (with the requested effectiveness date to be not more than two (2) Business

Days later); |

| vii. | upon notification by the SEC that a Resale Registration Statement has been declared effective by the SEC,

the Company shall file the final prospectus under Rule 424 of the 1933 Act (“Rule 424”) within the applicable

time period prescribed by Rule 424; |

| viii. | advise High Trail promptly (and in any event within two (2) Business Days thereof): |

| 1. | of the effectiveness of a Resale Registration Statement or any post-effective amendments thereto; |

| 2. | of any request by the SEC for amendments to a Resale Registration Statement or amendments to the prospectus

or for additional information relating thereto; |

| 3. | of the issuance by the SEC of any stop order suspending the effectiveness of a Resale Registration Statement

under the 1933 Act or of the suspension by any state securities commission of the qualification of the Registrable Shares for offering

or sale in any jurisdiction, or the initiation of any proceeding for any of the preceding purposes; and |

| 4. | of the existence of any fact and the happening of any event that makes any statement of a material fact

made in a Resale Registration Statement, the prospectus and amendment or supplement thereto, or any document incorporated by reference

therein, untrue, or that requires the making of any additions to or changes in a Resale Registration Statement or the prospectus in order

to make the statements therein not misleading; |

| ix. | cause all Registrable Shares to be listed on each securities exchange, if any, on which equity securities

by the Company are then listed; and |

| x. | bear all expenses in connection with the procedures in paragraphs (i) through (ix) of this

Section 9 and the registration of the Registrable Shares on each such Resale Registration Statement and the satisfaction of the blue

sky laws of such states. |

| 10. | Registration Rights Indemnification. |

| i. | The Company agrees to indemnify and hold harmless High Trail and its respective affiliates, partners,

members, officers, directors, agents and representatives, and each person, if any, who controls High Trail within the meaning of Section 15

of the 1933 Act or Section 20 the U.S. Securities Exchange Act of 1934, as amended (the “1934 Act”) (each, an

“Exchange Party” and collectively the “Exchange Parties”), to the fullest extent permitted by applicable

law, from and against any losses, claims, damages or liabilities (collectively, “Losses”) to which they may become

subject (under the 1933 Act or otherwise) insofar as such Losses (or actions or proceedings in respect thereof) arise out of, or are based

upon, any untrue statement or alleged untrue statement of a material fact contained in a Resale Registration Statement or any omission

or alleged omission to state therein a material fact required to be stated therein or necessary to make the statements therein, in light

of the circumstances under which they were made, not misleading or arise out of any failure by the Company to fulfill any undertaking

included in a Resale Registration Statement and the Company will, as incurred, reimburse the Exchange Parties for any legal or other expenses

reasonably incurred in investigating, defending or preparing to defend any such action, proceeding or claim; provided, however, that the

Company shall not be liable in any such case to the extent that such Loss arises out of, or is based upon an untrue statement or omission

or alleged untrue statement or omission made in a Resale Registration Statement in reliance upon and in conformity with written information

furnished to the Company by or on behalf of High Trail specifically for use in preparation of a Resale Registration Statement; provided

further, however, that the Company shall not be liable to any Exchange Party (or any partner, member, officer, director or controlling

person of High Trail) to the extent that any such Loss is caused by an untrue statement or omission or alleged untrue statement or omission

made in any preliminary prospectus if either (i) (A) High Trail failed to send or deliver a copy of the final prospectus with

or prior to, or High Trail failed to confirm that a final prospectus was deemed to be delivered prior to (in accordance with Rule 172

of the 1933 Act), the delivery of written confirmation of the sale by High Trail to the person asserting the claim from which such Loss

resulted and (B) the final prospectus corrected such untrue statement or omission, or (ii) (X) such untrue statement or

omission is corrected in an amendment or supplement to the prospectus and (Y) having previously been furnished by or on behalf of

the Company with copies of the prospectus as so amended or supplemented or notified by the Company that such amended or supplemented prospectus

has been filed with the SEC, in accordance with Rule 172 of the 1933 Act, High Trail thereafter fails to deliver such prospectus

as so amended or supplemented, with or prior to or High Trail fails to confirm that the prospectus as so amended or supplemented was deemed

to be delivered prior to (in accordance with Rule 172 of the 1933 Act), the delivery of written confirmation of the sale by High

Trail to the person asserting the claim from which such Loss resulted. |

| ii. | High Trail agrees to indemnify and hold harmless the Company and its officers, directors, affiliates,

agents and representatives and each person, if any, who controls the Company within the meaning of Section 15 of the 1933 Act or

Section 20 of the 1934 Act (each a “Company Party” and collectively the “Company Parties”),

to the fullest extent permitted by applicable law, from and against any Losses to which the Company Parties may become subject (under

the 1933 Act or otherwise), insofar as such Losses (or actions or proceedings in respect thereof) arise out of, or are based upon, any

untrue statement or alleged untrue statement of a material fact contained in a Resale Registration Statement (or any omission or alleged

omission to state therein a material fact required to be stated therein or necessary to make the statements therein, in light of the circumstances

under which they were made, not misleading in each case, on the effective date thereof), if, and only to the extent, such untrue statement

or omission or alleged untrue statement or omission was made in reliance upon and in conformity with written information furnished by

or on behalf of High Trail specifically for use in preparation of a Resale Registration Statement, and High Trail will, as incurred, reimburse

each Company Party for any legal or other expenses reasonably incurred in investigating, defending or preparing to defend any such action,

proceeding or claim; provided, however, that in no event shall any indemnity under this Section 10 be greater in amount than the

dollar amount of the net proceeds received by High Trail upon its sale of the Registrable Shares included in the Resale Registration Statement

giving rise to such indemnification obligation. |

| iii. | Promptly after receipt by any indemnified person of a notice of a claim or the beginning of any action

in respect of which indemnity is to be sought against an indemnifying person pursuant to this Section 10, such indemnified person

shall notify the indemnifying person in writing of such claim or of the commencement of such action, and, subject to the provisions hereinafter

stated, in case any such action shall be brought against an indemnified person and such indemnifying person shall have been notified thereof,

such indemnifying person shall be entitled to participate therein, and, to the extent that it shall wish, to assume the defense thereof,

with counsel reasonably satisfactory to such indemnified person. After notice from the indemnifying person to such indemnified person

of its election to assume the defense thereof, such indemnifying person shall not be liable to such indemnified person for any legal expenses

subsequently incurred by such indemnified person in connection with the defense thereof; provided, however, that if there exists or shall

exist a conflict of interest that would make it inappropriate in the reasonable judgment of the indemnified person for the same counsel

to represent both the indemnified person and such indemnifying person or any affiliate or associate thereof, the indemnified person shall

be entitled to retain its own counsel at the expense of such indemnifying person; provided, further, that no indemnifying person shall

be responsible for the fees and expense of more than one separate counsel for all indemnified parties. The indemnifying party shall not

settle an action without the consent of the indemnified party, which consent shall not be unreasonably withheld. |

| iv. | If after proper notice of a claim or the commencement of any action against the indemnified party, the

indemnifying party does not choose to participate, then the indemnified party shall assume the defense thereof and upon written notice

by the indemnified party requesting advance payment of a stated amount for its reasonable defense costs and expenses, the indemnifying

party shall advance payment for such reasonable defense costs and expenses (the “Advance Indemnification Payment”)

to the indemnified party. In the event that the indemnified party’s actual defense costs and expenses exceed the amount of the Advance

Indemnification Payment, then upon written request by the indemnified party, the indemnifying party shall reimburse the indemnified party

for such difference; in the event that the Advance Indemnification Payment exceeds the indemnified party’s actual costs and expenses,

the indemnified party shall promptly remit payment of such difference to the indemnifying party. |

| v. | If the indemnification provided for in this Section 10 is held by a court of competent jurisdiction

to be unavailable to an indemnified party with respect to any losses, claims, damages or liabilities referred to herein, the indemnifying

party, in lieu of indemnifying such indemnified party thereunder, shall to the extent permitted by applicable law contribute to the amount

paid or payable by such indemnified party as a result of such loss, claim, damage or liability in such proportion as is appropriate to

reflect the relative fault of the indemnifying party on the one hand and of the indemnified party on the other, as well as any other relevant

equitable considerations; provided, that in no event shall any contribution by an indemnifying party hereunder be greater in amount than

the dollar amount of the proceeds received by such indemnifying party upon the sale of such Registrable Shares. |

| 11. | Suspensions. High Trail acknowledges that there may be times when the Company must suspend the

use of the prospectus forming a part of a Resale Registration Statement until such time as an amendment to such Resale Registration Statement

has been filed by the Company and declared effective by the SEC, or until such time as the Company has filed an appropriate report with

the SEC pursuant to the 1934 Act. High Trail hereby covenants that it will not sell any Registrable Shares pursuant to said prospectus

during the period commencing at the time at which the Company gives High Trail notice of the suspension of the use of said prospectus

and ending at the time the Company gives High Trail notice that High Trail may thereafter effect sales pursuant to said prospectus; provided,

that such suspension periods shall in no event exceed forty-five (45) days in any 12-month period or thirty (30) days in any

three-month period and that, in the good faith judgment of the Board of Directors of the Company, the Company would, in the absence of

such delay or suspension hereunder, be required under state or federal securities laws to disclose any corporate development, a potentially

significant transaction or event involving the Company, or any negotiations, discussions, or proposals directly relating thereto, in either

case the disclosure of which would reasonably be expected to have an adverse effect upon the Company or its stockholders. |

| 12. | Termination of Registration Rights. The obligations of the Company pursuant to Section 9 hereof

shall cease and terminate, with respect to any Registrable Shares, upon such time as such Registrable Shares have been resold or, if earlier,

the third anniversary of the date hereof. |

| 13. | Resale of Exchange Shares. High Trail hereby represents to the Company that if High Trail sells

Exchange Shares pursuant to an effective registration statement, such Exchange Shares shall be sold in compliance with applicable prospectus

delivery requirements and the plan of distribution set forth therein and acknowledges that the removal of the restrictive legend from

the certificates or book-entry notations representing the Exchange Shares as set forth in Section 15 is predicated upon the Company’s

reliance upon such representation. Notwithstanding the foregoing, the Company acknowledges that the timely filing by the Company of the

Prospectus Supplement with the SEC shall satisfy High Trail’s prospectus delivery requirements. High Trail further represents that,

assuming the accuracy of the Company’s representations and compliance with its covenants herein, any sale by it of Exchange Shares

will comply with the registration or qualification requirements of all applicable securities laws. |

| 14. | Legends. High Trail understands that the Exchange Shares will be issued pursuant to an exemption

from registration or qualification under the 1933 Act and applicable state securities laws, and except as set forth herein, the Exchange

Shares shall bear any legend as required by the “blue sky” laws of any state and a restrictive legend in substantially the

following form (and a stop-transfer order may be placed against transfer of such stock certificates): |

THE SECURITIES REPRESENTED BY THIS CERTIFICATE

HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES LAWS. THE SECURITIES MAY NOT

BE OFFERED FOR SALE, SOLD, TRANSFERRED OR ASSIGNED (I) IN THE ABSENCE OF (A) AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES

UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR (B) AN OPINION OF COUNSEL TO THE HOLDER (IF REQUESTED BY THE COMPANY), IN A

FORM REASONABLY ACCEPTABLE TO THE COMPANY THAT REGISTRATION IS NOT REQUIRED UNDER SAID ACT OR (II) UNLESS SOLD OR ELIGIBLE TO

BE SOLD PURSUANT TO RULE 144 OR RULE 144A UNDER SAID ACT WITH REASONABLE ASSURANCE THAT SUCH SECURITIES CAN BE SOLD, TRANSFERRED OR ASSIGNED

PURSUANT TO RULE 144 OR RULE 144A. NOTWITHSTANDING THE FOREGOING, THE SECURITIES MAY BE PLEDGED IN CONNECTION WITH A BONA FIDE MARGIN

ACCOUNT OR OTHER LOAN OR FINANCING ARRANGEMENT SECURED BY THE SECURITIES.

| 15. | Removal of Legends. Certificates evidencing Exchange Shares shall not be required to contain the

legend set forth in Section 14 or any other legend (i) while a registration statement covering the resale of such Exchange Shares

is effective under the 1933 Act or (ii) following any sale of such Exchange Shares pursuant to Rule 144 (assuming the transferor

is not an affiliate of the Company), provided that High Trail furnishes the Company with reasonable assurances that such Exchange Shares

are eligible for sale, assignment or transfer under Rule 144 without any requirement other than with respect to holding period (which

holding period is then satisfied), which shall not include an opinion of High Trail’s counsel, (iii) if such Exchange Shares

are eligible to be sold, assigned or transferred under Rule 144 without restriction, and (iv) in connection with a sale, assignment

or other transfer (other than under Rule 144), provided that High Trail provides the Company with an opinion of counsel to High Trail,

in a generally acceptable form, to the effect that such sale, assignment or transfer of the Exchange Shares may be made without registration

under the applicable provisions of the 1933 Act and that such legends would no longer be required following such sale, assignment or transfer.

If a legend is not required pursuant to the foregoing, the Company shall no later than two (2) Business Days (or such earlier

date as required pursuant to the 1934 Act or other applicable law, rule or regulation for the settlement of a trade initiated on

the date High Trail delivers such legended certificate representing such Exchange Shares to the Company) following the delivery by High

Trail to the Company or the Transfer Agent (with notice to the Company) of a legended certificate representing such Exchange Shares (endorsed

or with stock powers attached, signatures guaranteed, and otherwise in form necessary to affect the reissuance and/or transfer, if applicable),

together with any other deliveries from High Trail as may be reasonably required above in this Section 15 (such date, the “Legend

Removal Date”), as directed by High Trail, either: (A) provided that the Transfer Agent is participating in the Fast Automated

Securities Transfer (“FAST”) system, credit the applicable number of shares of Common Stock to which High Trail shall

be entitled to High Trail’s or its designee’s balance account with The Depository Trust Company (“DTC”)

through its deposit/withdrawal at custodian system or (B) if the Transfer Agent is not participating in FAST, issue and deliver (via

reputable overnight courier) to High Trail, a certificate representing such Exchange Shares that is free from all restrictive and other

legends, registered in the name of High Trial or its designee. The Company shall be responsible for any transfer agent fees, DTC fees

or costs of obtaining legal opinions with respect to any issuance of Exchange Shares or the removal of any legends with respect to any

Exchange Shares in accordance herewith. |

| 16. | Failure to Deliver Unlegended Shares. If the Company or the Transfer Agent fails to deliver shares

to High Trail or an applicable assignee or transferee (as the case may be) without any restrictive legend in accordance with Section 15,

then in addition to High Trail’s other available remedies hereunder, the Company shall pay to High Trail, in cash, (1) as partial

liquidated damages and not as a penalty, for each $1,000 of Exchange Shares (based on the daily volume-weighted average price on the date

that High Trail delivered notice of its entitlement to such shares of the Common Stock or the date High Trail delivers notice or a legended

certificate, as applicable, to the Company or the Transfer Agent) for which the Company or the Transfer Agent fails to deliver shares

without any restrictive legend an amount equal to $10 per Business Day (increasing to $20 per Business Day five (5) Business

Days after such damages have begun to accrue) for each Business Day after the Legend Removal Date until such undelivered shares are delivered

without a legend; and (2) if the Company is obligated to remove the restrictive legends pursuant to Section 15 but fails to

(a) issue and deliver (or cause to be delivered) shares to High Trial by the Legend Removal Date that are free from all restrictive

and other legends and (b) if after the Legend Removal Date High Trial purchases (in an open market transaction or otherwise) shares

of Common Stock to deliver in settlement of a sale by High Trail of all or any portion of the number of shares of Common Stock, or a sale

of a number of shares of Common Stock equal to all or any portion of the number of shares of Common Stock, that High Trail anticipated

receiving from the Company without any restrictive legend, then an amount equal to the excess of High Trail’s total purchase price

(including brokerage commissions and other out-of-pocket expenses, if any) for the shares of Common Stock so purchased (including brokerage

commissions and other out-of-pocket expenses, if any) over the product of (A) such number of shares of Common Stock that the Company

was required to deliver to High Trail by the Legend Removal Date multiplied by (B) the price at which the sell order giving rise

to such purchase obligation was executed. For avoidance of doubt, this Section 16 shall not be duplicative with any provisions in

the Notes addressing any failure to deliver shares without restrictive legends. |

| 17. | Fees and Expenses. The Company shall promptly pay all reasonable and documented out-of-pocket expenses

and costs of High Trail (including, without limitation, the reasonable and documented attorney fees and expenses of counsel for High Trail)

in connection with the preparation, negotiation, execution and approval of this letter agreement and the transactions contemplated hereby. |

| i. | Each Party shall use its reasonable best efforts to satisfy each of the conditions to be satisfied by

it as provided below. |

| ii. | The obligations of each Party to effect the Closing is subject to the satisfaction at the closing of the

following conditions: (A) the Exchange Shares (1) shall be designated for quotation or listed (as applicable) on the Principal

Market and (2) shall not have been suspended, as of the Closing Date, by the SEC or the Principal Market from trading on the Principal

Market nor shall suspension by the SEC or the Principal Market have been threatened, as of the Closing Date, either in writing by the

SEC or the Principal Market or by falling below the minimum maintenance requirements of the Principal Market, (B) the Company shall

have obtained all governmental, regulatory or third party consents and approvals, if any, necessary for the issuance of the Exchange Shares,

including without limitation, those required by the Principal Market, if any, (C) no statute, rule, regulation, executive order,

decree, ruling or injunction shall have been enacted, entered, promulgated or endorsed by any court or Governmental Entity of competent

jurisdiction that prohibits the consummation of any of the transactions contemplated by the Transaction Documents and (D) the representations

and warranties of the other Party shall be true and correct in all material respects (except for such representations and warranties that

are qualified by materiality or material adverse effect, which shall be true and correct in all respects) as of the date when made and

as of the Closing Date as though originally made at that time (except for representations and warranties that speak as of a specific date,

which shall be true and correct as of such specific date) and the other Party shall have performed, satisfied and complied in all material

respects with the covenants, agreements and conditions (except for covenants, agreements or conditions that are qualified by materiality

or material adverse effect, which shall be performed, satisfied and complied with in all respects) required to be performed, satisfied

or complied with by such Party at or prior to the Closing Date. |

| iii. | The obligations of High Trail to effect the Closing is subject to the satisfaction at the closing of the

following conditions: (A) since the date of execution of this Agreement, no event or series of events shall have occurred that reasonably

would have or result in a Material Adverse Effect and (B) the Company and its Subsidiaries shall have delivered to High Trail such

other documents, instruments or certificates relating to the transactions contemplated by the Transaction Documents as High Trail or its

counsel may reasonably request. |

| iv. | In the event that the Closing shall not have occurred within ten (10) days of the date hereof,

either Party shall have the right to terminate this Agreement, provided that the right to terminate this Agreement shall not be available

to the terminating party if the failure of the transactions contemplated by this Agreement to have been consummated by such date is the

result of such party’s breach of this Agreement (it being understood that if the Closing shall not have occurred on or before January 1,

2024, then interest on the Principal Exchange Amount that has not yet been extinguished will accrue and be payable in cash under the Eighth

Supplemental Indenture at a rate of $13,888.89 per day beginning on, and including, January 1, 2024, but no Default or Event of Default

shall occur as a result of such interest being paid after January 1, 2024 so long as the Closing occurs in accordance herewith or,

if this letter agreement is terminated, such interest is paid within one (1) Business Day of such termination). |

The terms and provisions of

the Transaction Documents (as amended hereby with respect to the Supplemental Indentures), the Notes are ratified and confirmed and remain

in full force and effect. Any breach of the terms and conditions of this letter agreement by the Company will constitute an event of default

under the Notes and a breach of the Purchase Agreement, as applicable. If the foregoing correctly sets forth the understanding between

the Company and High Trail, please so indicate in the space provided below for that purpose, whereupon this letter shall constitute a

binding agreement between the Company and High Trail.

[Remainder of Page Left Blank; Signature

Page Follows]

This letter agreement may

be executed in any number of counterparts and by different parties hereto in separate counterparts, each of which when so executed and

delivered shall be deemed an original, but all of which counterparts together shall constitute but one and the same instrument.

| |

Sincerely, |

| |

|

| |

HB Fund LLC |

| |

|

| |

By: |

/s/ Richard Allison |

| |

Name: |

Richard Allison |

| |

Title: |

Authorized Signatory* |

| |

|

| |

* Authorized Signatory |

| |

Hudson Bay Capital Management LP |

| |

Not individually, but solely as investment adviser to HB Fund LLC |

| |

|

| ACKNOWLEDGED AND AGREED: |

|

|

|

| TELLURIAN INC. |

|

|

|

| By: |

/s/ Daniel Belhumeur |

|

| Name: |

Daniel Belhumeur |

|

| Title: |

President |

|

[Signature Page to Letter Agreement]

Exhibit A

Final Form

FIRST AMENDMENT TO EIGHTH

SUPPLEMENTAL INDENTURE

FIRST AMENDMENT TO EIGHTH

SUPPLEMENTAL INDENTURE (this “Supplemental Indenture”), dated as of December [●], 2023, by and among TELLURIAN

INC., a Delaware corporation (the “Company”), WILMINGTON TRUST, NATIONAL ASSOCIATION, as trustee (the “Trustee”)

and HB FUND LLC, as collateral agent (the “Collateral Agent”).

W I T N E S S E T H

WHEREAS, the Company

has heretofore executed and delivered to the Trustee an indenture, dated as of June 3, 2022 (the “Base Indenture”),

as amended and supplemented by the eighth supplemental indenture, dated as of August 15, 2023, between the Issuer, the Trustee and

the Collateral Agent (the “Eighth Supplemental Indenture” and the Base Indenture, as amended and supplemented by the

Eighth Supplemental Indenture, the “Indenture”), providing for the issuance of $250,000,000 aggregate principal amount

of the Company’s 10.00% Senior Secured Notes due 2025 (the “Notes”);

WHEREAS, Section 9.2(a) of

the Eighth Supplemental Indenture provides that the Company, the Trustee and the Collateral Agent, as applicable, may, with the consent

of the 100% of Holders (the “Required Holders”), amend or supplement the Indenture, the Notes or the Collateral Documents;

WHEREAS, the Company

and Required Holders have agreed to a repurchase of $37,900,000 of Notes (the “Repurchased Notes”) pursuant to Section 2.18

of the Eighth Supplemental Indenture and a separately negotiated letter agreement, dated December 28, 2023 between the Company and

the Required Holders and the consideration for such repurchase includes all interest due and payable in connection with the January 1,

2024 Interest Payment Date (the “January Payment Date”) on the Notes; and

WHEREAS, the Company

desires, pursuant to Section 9.2(a) of the Eighth Supplemental Indenture, to amend the Indenture with the consent of the Required

Holders.

NOW THEREFORE, for

and in consideration of the provisions set forth herein, it is mutually agreed, for the equal and proportional benefit of the Holders,

from time to time, as follows:

1. Capitalized

Terms. Capitalized terms used herein without definition shall have the meanings assigned to them in the Indenture.

2. Amendments

to the Indenture and Interest Payment Waiver.

a. The

definition of “Liquidity Threshold” contained in Section 1.01 of the Eighth Supplemental Indenture is amended and restated

in its entirety to read as follows:

““Liquidity

Threshold” means the Company’s Liquidity required to be equal to or greater than (a) one hundred seventy million dollars ($170,000,000) (if the Convertible Notes are not outstanding at such time); and (b) two hundred twelve million one hundred thousand

dollars ($212,100,000) (if any of the Convertible Notes are outstanding at such time); provided that in the case of both (a) and

(b), such Cash and Cash Equivalents shall be held in accounts (x) in which the Company and/or the applicable Subsidiaries have

granted the Collateral Trustee a security interest in form and substance acceptable to the Collateral Trustee and (y) with a

Deposit Account Control Agreement in effect with each of such accounts; provided further, that such Deposit Account Control

Agreement(s) shall (I) be “fully blocked”/“access restricted” or similar Deposit Account Control

Agreement(s) that do not allow the Company and its Subsidiaries access to the accounts nor permit the Company and its

Subsidiaries to access the amounts and assets on deposit or credited to such deposit accounts without the consent of the Collateral

Trustee (“Blocked DACA”) and (II) perfect the Collateral Trustee’s security interest in such

accounts.”

b. Section 4.14

of the Eighth Supplemental Indenture is amended and restated in its entirety to read as follows:

“The Company shall have at all

times liquidity calculated as unrestricted, unencumbered Cash or Cash Equivalents of the Company and its Subsidiaries, excluding the

Driftwood Companies, as taken as a whole, in one or more deposit, securities or money market or similar accounts located in the United

States (“Liquidity”) in an aggregate minimum amount equal to (i) forty million dollars ($40,000,000) for

the period commencing on December [●], 2023 through and including the tenth (10th) Trading Day after the end of

the Top-Up Measuring Period (as defined in that certain letter agreement, dated as of December 28, 2023, entered into between HB

Fund LLC and the Company), and (ii) fifty million dollars ($50,000,000) thereafter.”

c. For

all purposes under the Indenture, (i) interest due and payable on the Notes on the January Payment Date has been paid by the

Company directly to the Required Holders in the form of the consideration paid in connection with the Repurchased Notes and (ii) the

Trustee shall have no obligations with respect to the payment of any interest on the Notes on the January Payment Date or the payment

in respect of the Repurchased Notes and shall be entitled to conclusively presume such amounts were paid directly to the Holders.

3. Governing

Law. This Supplemental Indenture shall be governed by and construed in accordance with the laws of the State of New

York.

4. Counterparts. This

Supplemental Indenture may be executed in two or more identical counterparts, all of which shall be considered one and the same agreement

and shall become effective when counterparts have been signed by each party and delivered to the other party. Any signature to this Supplemental

Indenture may be delivered by facsimile, electronic mail (including pdf) or any electronic signature complying with the U.S. federal

ESIGN Act of 2000 or the New York Electronic Signature and Records Act or other transmission method and any counterpart so delivered

shall be deemed to have been duly and validly delivered and be valid and effective for all purposes to the fullest extent permitted by

applicable law. Each party hereto accepts the foregoing and any document received in accordance with this Section 4 shall be deemed

to have been duly and validly delivered and be valid and effective for all purposes to the fullest extent permitted by applicable law.

5. Effect

of Headings. The Section headings herein are for convenience only and shall not affect the construction hereof.

6. The

Trustee. The Trustee makes no representation or warranty as to the validity or

sufficiency of this Supplemental Indenture or with respect to the recitals contained herein, all of which recitals are made solely by

the other parties hereto.

7. Ratification

of Indenture; Supplemental Indenture part of Indenture. Except as expressly amended hereby, the Indenture is in all

respects ratified and confirmed and all the terms, conditions and provisions thereof shall remain in full force and effect. This Supplemental

Indenture shall form a part of the Indenture for all purposes, and every Holder heretofore or hereafter authenticated and delivered shall

be bound hereby.

[Remainder of page intentionally left

blank]

IN WITNESS WHEREOF, the parties

to this Supplemental Indenture have caused this Supplemental Indenture to be duly executed as of the date first written above.

| |

Tellurian Inc. |

| |

|

| |

By: |

|

| |

|

Name: |

| |

|

Title: |

| |

|

| |

Wilmington Trust, National

Association, as trustee |

| |

|

| |

By: |

|

| |

|

Name: |

| |

|

Title: |

| |

|

| |

HB Fund LLC, as the Collateral

Agent |

| |

|

| |

By: Hudson Bay Capital

Management LP |

| |

Not individually, but solely

as Investment Advisor to HB Fund LLC |

| |

|

| |

By: |

|

| |

|

Name: |

| |

|

Title: |

[Signature Page to First Amendment to

Eighth Supplemental Indenture]

In connection with the execution of this First

Amendment to Eighth Supplemental Indenture, dated as of December [●],

2023, by and among the Company, the Trustee and the Collateral Agent, the undersigned holders of the Notes, representing 100% of the

aggregate principal amount of the outstanding Notes immediately prior to execution of this First Amendment to Eighth Supplemental Indenture,

hereby (i) consent to the amendments to the Eighth Supplemental Indenture set forth in Section 2 of this First Amendment to

Eighth Supplemental Indenture; (ii) direct the Trustee to execute the this First Amendment to Eighth Supplemental Indenture; (iii) represent

and warrant that they are the Holders of the aggregate principal amount of the outstanding Notes set forth under their signature line

on the date hereof and have not transferred its position in such Notes; (iv) certify that it has the full power and authority to

deliver this consent and that such power has not been granted or assigned to any other person:

| HOLDER: |

|

| |

|

| HB Fund

LLC |

|

| |

|

| By: |

|

|

| |

Name: |

Richard Allison |

|

| |

Title: |

Authorized Signatory* |

|

Aggregate Principal Amount of Notes Held: $250,000,000

* Authorized Signatory

Hudson Bay Capital Management LP

Not individually, but solely as investment adviser to HB Fund LLC

[Signature Page to First Amendment to

Eighth Supplemental Indenture]

Exhibit B

Final Form

FIRST AMENDMENT TO NINTH SUPPLEMENTAL INDENTURE

FIRST AMENDMENT TO NINTH

SUPPLEMENTAL INDENTURE (this “Supplemental Indenture”), dated as of December [●], 2023, by and among TELLURIAN

INC., a Delaware corporation (the “Company”), WILMINGTON TRUST, NATIONAL ASSOCIATION, as trustee (the “Trustee”)

and HB FUND LLC, as collateral agent (the “Collateral Agent”).

W I T N E S S E T H

WHEREAS, the Company

has heretofore executed and delivered to the Trustee an indenture, dated as of June 3, 2022 (the “Base Indenture”),

as amended and supplemented by the ninth supplemental indenture, dated as of August 15, 2023, between the Issuer, the Trustee and

the Collateral Agent (the “Ninth Supplemental Indenture” and the Base Indenture, as amended and supplemented by the

Ninth Supplemental Indenture, the “Indenture”), providing for the issuance of $83,334,000 aggregate principal amount

of the Company’s 6.00% Senior Secured Convertible Notes due 2025 (the “Notes”);

WHEREAS, Section 9.2(a) of

the Ninth Supplemental Indenture provides that the Company, the Trustee and the Collateral Agent, as applicable, may, with the consent

of the 100% of Holders (the “Required Holders”), amend or supplement the Indenture, the Notes or the Collateral Documents;

WHEREAS, the Company

and Required Holders have agreed to a separately negotiated letter agreement, dated December 28, 2023 (the “Letter Agreement”),

between the Company and the Required Holders and the consideration for such Letter Agreement, all interest due and payable in connection

with the January 1, 2024 Interest Payment Date (the “January Payment Date”) on the Notes shall be paid in

shares of Common Stock pursuant to the Letter Agreement; and

WHEREAS, the Company

desires, pursuant to Section 9.2(a) of the Ninth Supplemental Indenture, to amend the Indenture with the consent of the Required

Holders.

NOW THEREFORE, for

and in consideration of the provisions set forth herein, it is mutually agreed, for the equal and proportional benefit of the Holders,

from time to time, as follows:

1. Capitalized

Terms. Capitalized terms used herein without definition shall have the meanings assigned to them in the Indenture.

2. Amendments

to the Indenture and Interest Payment Waiver.

a. The

definition of “Liquidity Threshold” contained in Section 1.01 of the Ninth Supplemental Indenture is amended and restated

in its entirety to read as follows:

““Liquidity Threshold”

means the Company’s Liquidity required to be equal to or greater than (a) seventy five million dollars ($75,000,000) (if the

Secured Notes are not outstanding at such time); and (b) two hundred twelve million one hundred thousand dollars ($212,100,000)

(if any of the Secured Notes are outstanding at such time); provided that in the case of both (a) and (b), such Cash and Cash Equivalents

shall be held in accounts (x) in which the Company and/or the applicable Subsidiaries have granted the Collateral Trustee a security

interest in form and substance acceptable to the Collateral Trustee and (y) with a Deposit Account Control Agreement in effect with

each of such accounts; provided further, that such Deposit Account Control Agreement(s) shall (I) be “fully blocked”/“access

restricted” or similar Deposit Account Control Agreement(s) that do not allow the Company and its Subsidiaries access to the

accounts nor permit the Company and its Subsidiaries to access the amounts and assets on deposit or credited to such deposit accounts

without the consent of the Collateral Trustee (“Blocked DACA”) and (II) perfect the Collateral Trustee’s

security interest in such accounts.”

b. Section 4.14

of the Ninth Supplemental Indenture is amended and restated in its entirety to read as follows:

“The Company shall have at all

times liquidity calculated as unrestricted, unencumbered Cash or Cash Equivalents of the Company and its Subsidiaries, excluding the

Driftwood Companies, as taken as a whole, in one or more deposit, securities or money market or similar accounts located in the United

States (“Liquidity”) in an aggregate minimum amount equal to (i) forty million dollars ($40,000,000) for

the period commencing on December [●], 2023 through and including the tenth (10th) Trading Day after the end of

the Top-Up Measuring Period (as defined in that certain letter agreement, dated as of December 28, 2023, entered into between HB

Fund LLC and the Company), and (ii) fifty million dollars ($50,000,000) thereafter.”

c. For

all purposes under the Indenture, (i) interest due and payable on the Notes on the January Payment Date has been paid by the

Company directly to the Required Holders in the form of the consideration paid in connection with the Letter Agreement and (ii) the

Trustee shall have no obligations with respect to the payment of any interest on the Notes on the January Payment Date or the payment

in respect of the Letter Agreement and shall be entitled to conclusively presume such amounts were paid directly to the Holders.

3. Governing

Law. This Supplemental Indenture shall be governed by and construed in accordance with the laws of the State of New

York.

4. Counterparts. This

Supplemental Indenture may be executed in two or more identical counterparts, all of which shall be considered one and the same agreement

and shall become effective when counterparts have been signed by each party and delivered to the other party. Any signature to this Supplemental

Indenture may be delivered by facsimile, electronic mail (including pdf) or any electronic signature complying with the U.S. federal

ESIGN Act of 2000 or the New York Electronic Signature and Records Act or other transmission method and any counterpart so delivered

shall be deemed to have been duly and validly delivered and be valid and effective for all purposes to the fullest extent permitted by

applicable law. Each party hereto accepts the foregoing and any document received in accordance with this Section 4 shall be deemed

to have been duly and validly delivered and be valid and effective for all purposes to the fullest extent permitted by applicable law.

5. Effect

of Headings. The Section headings herein are for convenience only and shall not affect the construction hereof.

6. The

Trustee. The Trustee makes no representation or warranty as to the validity or

sufficiency of this Supplemental Indenture or with respect to the recitals contained herein, all of which recitals are made solely by

the other parties hereto.

7. Ratification

of Indenture; Supplemental Indenture part of Indenture. Except as expressly amended hereby, the Indenture is in all

respects ratified and confirmed and all the terms, conditions and provisions thereof shall remain in full force and effect. This Supplemental

Indenture shall form a part of the Indenture for all purposes, and every Holder heretofore or hereafter authenticated and delivered shall

be bound hereby.

[Remainder of page intentionally left

blank]

IN WITNESS WHEREOF, the parties

to this Supplemental Indenture have caused this Supplemental Indenture to be duly executed as of the date first written above.

| |

Tellurian Inc. |

| |

|

| |

By: |

|

| |

|

Name: |

| |

|

Title: |

| |

|

| |

Wilmington Trust, National

Association, as trustee |

| |

|

| |

By: |

|

| |

|

Name: |

| |

|

Title: |

| |

|

| |

HB Fund LLC, as the Collateral

Agent |

| |

|

| |

By: Hudson Bay Capital

Management LP |

| |

Not individually, but solely

as Investment Advisor to HB Fund LLC |

| |

|

| |

By: |

|

| |

|

Name: |

| |

|

Title: |

[Signature Page to First Amendment to

Ninth Supplemental Indenture]

In connection with the execution

of this First Amendment to Ninth Supplemental Indenture, dated as of December [●],

2023, by and among the Company, the Trustee and the Collateral Agent, the undersigned holders of the Notes, representing 100% of the

aggregate principal amount of the outstanding Notes immediately prior to execution of this First Amendment to Ninth Supplemental Indenture,

hereby (i) consent to the amendments to the Ninth Supplemental Indenture set forth in Section 2 of this First Amendment to

Ninth Supplemental Indenture; (ii) direct the Trustee to execute the this First Amendment to Ninth Supplemental Indenture; (iii) represent

and warrant that they are the Holders of the aggregate principal amount of the outstanding Notes set forth under their signature line

on the date hereof and have not transferred its position in such Notes; (iv) certify that it has the full power and authority to

deliver this consent and that such power has not been granted or assigned to any other person:

| HOLDER: |

|

| |

|

| HB Fund

LLC |

|

| |

|

| By: |

|

|

| |

Name: |

Richard Allison |

|

| |

Title: |

Authorized Signatory* |

|

Aggregate Principal Amount of Notes Held: $83,334,000

* Authorized Signatory

Hudson Bay Capital Management LP

Not individually, but solely as investment adviser to HB Fund LLC

[Signature Page to First Amendment to

Ninth Supplemental Indenture]

Exhibit C

Form of Prospectus Supplement

[Attached]

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12