0001668370falseCA--12-31

0001668370

2023-12-21

2023-12-21

SECURITIES AND EXCHANGE COMMISSION

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

TOUGHBUILT INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

(State or other jurisdiction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Address of principal executive offices) |

|

|

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Name of each exchange on which |

Common Stock, par value $0.0001 per share |

|

|

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

|

Material Modification to Rights of Security Holders. |

To the extent required by Item 3.03 of Form 8-K, the information contained in Item 5.03 of this Current Report on Form 8-K (this “Current Report”) is incorporated herein by reference.

|

|

Amendment to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

On December 21, 2023, ToughBuilt Industries, Inc., a Nevada corporation (the “

”) filed a Certificate of Amendment to the Company’s Amended and Restated Articles of Incorporation, as amended (the “

t”), with the Secretary of State of Nevada to effect a 1-for-65 reverse stock split of the shares of the Company’s common stock, par value $0.0001 per share (the “

”), issued and outstanding, effective as of 4:30 p.m. (New York time) on January 1, 2024, (the “

”). As previously reported by the Company, the Company held the Annual Stockholders’ Meeting on December 11, 2023 (the “

”), at which meeting, the Company’s stockholders approved the amendment to the Company’s Amended and Restated Articles of Incorporation, as amended (the “

Articles of Incorporation

”), to effect a reverse stock split of the Company’s Common Stock at a ratio in the range of 1-for-20 to 1-for-100, with such ratio to be determined by the Company’s board of directors (the “

”) and included in a public announcement. Following the Annual Meeting, the Board determined to effect the Reverse Stock Split at a ratio of 1-for-65 and approved the corresponding final form of the Certificate of Amendment.

As a result of the Reverse Stock Split, every sixty-five (65) shares of issued and outstanding Common Stock will be automatically combined into one (1) issued and outstanding share of Common Stock. No fractional shares will be issued as a result of the Reverse Stock Split. Any fractional shares that would otherwise have resulted from the Reverse Stock Split will be rounded up to the next whole number. The Reverse Stock Split will reduce the number of shares of Common Stock outstanding from 36,915,222 shares to approximately 567,927 shares, subject to adjustment for the rounding up of fractional shares. The number of authorized shares of Common Stock under the Articles of Incorporation will remain unchanged at 200 million (200,000,000) shares and the par value of the Common Stock will remain $0.0001 per share.

The Common Stock will begin trading on a reverse stock split-adjusted basis on The Nasdaq Capital Market on January 2, 2024. The trading symbol for the Common Stock will remain “TBLT.” The new CUSIP number for the Common Stock following the Reverse Stock Split is 89157G 86 8.

Proportionate adjustments will be made to the per share exercise price and the number of shares of Common Stock that may be purchased upon exercise of outstanding stock options granted by the Company, and the number of shares of Common Stock reserved for future issuance under the Company’s equity incentive plans.

The Company will also adjust the number of shares available for issuance upon the exercise of outstanding warrants to issue Common Stock as well as the exercise price to reflect the effects of the Reverse Stock Split.

The information set forth herein is qualified in its entirety by reference to the complete text of the Certificate of Amendment, a copy of which is filed as Exhibit 3.1 to this Current Report and is incorporated by reference herein.

|

|

Regulation FD Disclosure. |

On December 26, 2023, the Company issued a press release announcing the Reverse Stock Split. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information in this Item 7.01 of this Current Report, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, except as shall be expressly set forth by reference in such a filing. Furthermore, the furnishing of information under Item 7.01 of this Current Report is not intended to constitute a determination by the Company that the information contained herein, including the exhibits hereto, is material or that the dissemination of such information is required by Regulation FD.

|

|

Financial Statements and Exhibits. |

|

|

|

|

|

|

|

|

|

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

TOUGHBUILT INDUSTRIES, INC. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit 3.1

| STATE OF NEVADA | |

FRANCISCO V. AGUILAR |

| Commercial Recordings Division |

Secretary of State | 401 N. Carson Street Carson City, NV 89701 |

| Telephone (775) 684-5708 |

| Fax (775) 684-7138 |

DEPUTY BAKKEDAHL | North Las Vegas City Hall |

Deputy Secretary for | OFFICE OF THE | 2250 Las Vegas Blvd North, Suite 400 North Las Vegas, NV 89030 |

Commercial Recordings | SECRETARY OF STATE | Telephone (702) 486-2880 |

| | Fax (702) 486-2888 |

Business Entity - Filing Acknowledgement

| 12/22/2023 |

| |

Work Order Item Number: | W2023122200457-3354318 |

Filing Number: | 20233711588 |

Filing Type: | Amendment After Issuance of Stock |

Filing Date/Time: | 12/21/2023 3:44:00 PM |

Filing Page(s): | 3 |

Indexed Entity Information: | |

| |

Entity ID: E0199732012-3 | Entity Name: TOUGHBUILT

INDUSTRIES, INC. |

| |

Entity Status: Active | Expiration Date: None |

Commercial Registered Agent

EASTBIZ.COM, INC.

5348 VEGAS DRIVE, Las Vegas, NV 89108, USA

The attached document(s) were filed with the Nevada Secretary of State, Commercial Recording Division. The filing date and time have been affixed to each document, indicating the date and time of filing. A filing number is also affixed and can be used to reference this document in the future.

| Respectfully, |

|

|

| FRANCISCO V. AGUILAR |

| Secretary of State |

Commercial Recording Division

401 N. Carson Street

ANNEX A

CERTIFICATE OF AMENDMENT

OF

AMENDED AND RESTATED ARTICLES OF INCORPORATION OF

TOUGHBUILT INDUSTRIES, INC.

ToughBuilt Industries, Inc., a corporation organized and existing under and by virtue of the provisions of the Nevada Revised Statutes (the “Corporation”), hereby certifies as follows:

1. The name of the Corporation is ToughBuilt Industries, Inc. (the “Corporation”).

2. Article 3 of the Corporation’s Amended and Restated Articles of Incorporation, as amended, is hereby amended to adding the following paragraph:

“Reverse Stock Split. Upon the effectiveness of the filing of this Certificate of Amendment (the “Effective Time”) each share of the Corporation’s common stock, $0.0001 par value per share (the “Old Common Stock”), either issued or outstanding or held by the Corporation as treasury stock, immediately prior to the Effective Time, will be automatically reclassified and combined (without any further act) into a smaller number of shares such that each sixty-five (65) shares of Old Common Stock issued and outstanding or held by the Company as treasury stock immediately prior to the Effective Time is reclassified into one share of Common Stock, $0.0001 par value per share, of the Corporation (the “New Common Stock”) (the “Reverse Stock Split”). The Board of Directors shall make provision for the issuance of that number of fractions of New Common Stock such that any fractional share of a holder otherwise resulting from the Reverse Stock Split shall be rounded up to the next whole number of shares of New Common Stock. Any stock certificate that, immediately prior to the Effective Time, represented shares of the Old Common Stock will, from and after the Effective Time, automatically and without the necessity of presenting the same for exchange, represent the number of shares of the New Common Stock into which such shares of Old Common Stock shall have been reclassified plus the fraction, if any, of a share of New Common Stock issued as aforesaid. The Reverse Stock Split shall have effect on the authorized number or par value of the capital stock of the Corporation.”

3. Except as set forth in this Certificate of Amendment of Articles of Incorporation, the Articles of Incorporation, as amended, remains in full force and effect.

IN WITNESS WHEREOF, ToughBuilt Industries, Inc. has caused this Certificate of Amendment of Articles of Incorporation to be signed by Michael Panosian, a duly authorized officer of the Corporation, on December 19, 2023.

| By: | /s/ Michael Panosian |

| Name: Michael Panosian |

| Title: Chief Executive Officer |

Exhibit 99.1

ToughBuilt Industries, Inc. Announces Reverse Stock Split

Common Stock Will Begin Trading on a Split-Adjusted Basis of 1-for-65

Irvine, CA, December 26, 2023 – ToughBuilt Industries, Inc. (NASDAQ: TBLT) (“ToughBuilt” or the “Company”), today announced that it intends to effect a reverse stock split of its common stock at a ratio of 1 post-split share for every 65 pre-split shares. The reverse stock split will become effective at 4:30 p.m., New York time, on January 1, 2024. ToughBuilt’s common stock will continue to be traded on the Nasdaq Capital Market under the symbol “TBLT” and will begin trading on a split-adjusted basis when the market opens on January 2, 2024. The new CUSIP number for the common stock following the reverse stock split will be 89157G 86 8.

At the Company’s annual stockholders’ meeting held on December 11, 2023, ToughBuilt’s stockholders granted the Company’s Board of Directors the discretion to effect a reverse stock split of ToughBuilt’s common stock through an amendment to its Amended and Restated Certificate of Incorporation, as amended, at a ratio of not less than 1-for-20 and not more than 1-for-100, such ratio to be determined by the Company’s Board of Directors.

At the effective time of the reverse stock split, every 65 shares of ToughBuilt’s issued and outstanding common stock will be converted automatically into 1 issued and outstanding share of common stock without any change in the $0.0001 par value per share. Stockholders holding shares through a brokerage account will have their shares of common stock automatically adjusted to reflect the 1-for-65 reverse stock split. It is not necessary for stockholders holding shares of the Company’s common stock in certificated form to exchange their existing stock certificates for new stock certificates of the Company in connection with the reverse stock split, although stockholders may do so if they wish.

The reverse stock split will affect all stockholders uniformly and will not alter any stockholder’s percentage interest in the Company’s equity, except to the extent that the reverse stock split would result in a stockholder owning a fractional share. Any fractional share of a stockholder resulting from the reverse stock split will be rounded up to the nearest whole number of shares. The reverse stock split will reduce the number of shares of ToughBuilt’s common stock outstanding from 36,915,222 shares to approximately 567,927 shares. Proportional adjustments will be made to the number of shares of ToughBuilt’s common stock issuable upon exercise or conversion of ToughBuilt’s equity awards and warrants, as well as the applicable exercise price. Stockholders whose shares are held in brokerage accounts should direct any questions concerning the reverse stock split to their broker. All stockholders of record may direct questions to the Company’s transfer agent, Vstock Transfer, LLC at (212) 828-8436 or (855) 9VSTOCK (toll free).

ABOUT TOUGHBUILT INDUSTRIES, INC.

ToughBuilt is an advanced product design, manufacturer, and distributor with emphasis on innovative products. Currently focused on tools and other accessories for the professional and do-it-yourself construction industries. We market and distribute various home improvement and construction product lines for both the do-it-yourself and professional markets under the TOUGHBUILT brand name, within the global multibillion dollar per year tool market industry. All our products are designed by our in-house design team. Since launching product sales in 2013, we have experienced significant annual sales growth. Our current product line includes three major categories, with several additional categories in various stages of development, consisting of Soft Goods & Kneepads and Sawhorses & Work Products. Our mission is to provide products to the building and home improvement communities that are innovative, of superior quality derived in part from enlightened creativity for our end users while enhancing performance, improving well-being and building high brand loyalty. Additional information about the Company is available at: https://www.toughbuilt.com/.

FORWARD-LOOKING STATEMENTS

This press release contains “forward-looking statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential” or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions and are subject to various known and unknown risks and uncertainties, many of which are beyond the Company’s control, and cannot be predicted or quantified and consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, without limitation, risks and uncertainties associated with (i) the impact of the worldwide COVID-19 pandemic and government actions, on our business, (ii) supply chain disruptions, (iii) inflationary and interest rate concerns and the impact on consumers, (iv) cybersecurity breaches and threats, (v) market acceptance of our existing and new products, (vi) delays in bringing products to key markets; (vii) an inability to secure regulatory approvals for the ability to sell our products in certain markets, (viii) intense competition in our industry from much larger, multinational companies, (ix) product liability claims, (x) product malfunctions, (xi) our limited manufacturing capabilities and reliance on subcontractors for assistance, (xii) our efforts to successfully obtain and maintain intellectual property protection covering our products or defend ourselves from third parties’ infringement claims, (xiii) our reliance on a single supplier for certain product components, (xiv) the fact that we will need to raise additional capital to meet our business requirements in the future and that such capital raising may be costly, dilutive or difficult to obtain and (xv) the fact that we conduct business in multiple foreign jurisdictions, exposing us to tariffs, foreign currency exchange rate fluctuations, logistical and communications challenges, burdens and costs of compliance with foreign laws and political and economic instability in each jurisdiction and (xvi) changes in e-commerce marketplaces. More detailed information about the Company and the risk factors that may affect the realization of forward-looking statements is set forth in the Company’s filings with the Securities and Exchange Commission (SEC), including our Annual Report on Form 10-K and our subsequent Quarterly Reports on Form 10-Q. Investors and security holders are urged to read these documents free of charge on the SEC’s web site at http://www.sec.gov. The Company encourages you to consider all of these risks, uncertainties and other factors carefully in evaluating the forward-looking statements contained in this press release. As a result of these matters, changes in fact, assumptions not being realized or other circumstances, the Company's actual results may differ materially from the expected results discussed in the forward-looking statements contained in this press release. The forward-looking statements made in this press release are made only as of the date of this press release, and the Company undertakes no obligation to update them to reflect subsequent events or circumstances.

Investor Relations Contact:

KCSA Strategic Communications

David Hanover

toughbuilt@kcsa.com

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

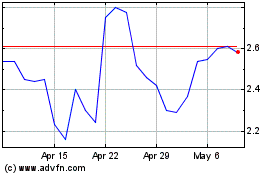

ToughBuilt Industries (NASDAQ:TBLT)

Historical Stock Chart

From Mar 2024 to Apr 2024

ToughBuilt Industries (NASDAQ:TBLT)

Historical Stock Chart

From Apr 2023 to Apr 2024