Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

December 26 2023 - 8:30AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

| Filed

by the Registrant |

☒ |

| Filed

by a Party other than the Registrant |

☐ |

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the SEC Only (As Permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive

Proxy Statement |

| ☒ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material Pursuant to § 240.14a-12 |

Staffing

360 Solutions, Inc.

(Name

of Registrant as Specified in Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No

fee required. |

| ☐ |

Fee

paid previously with preliminary materials. |

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

SUPPLEMENT

TO DEFINITIVE PROXY STATEMENT

FOR

THE 2023 Annual MEETING OF STOCKHOLDERS

TO

BE HELD ON December 27, 2023

EXPLANATORY

NOTE

On

December 11, 2023, Staffing 360 Solutions, Inc. (the “Company”) filed with the Securities and Exchange Commission

(the “SEC”) a definitive proxy statement on Schedule 14A (the “Proxy Statement”), relating to the

Company’s 2023 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on December 27, 2023 at 10:00

a.m., New York time. As previously disclosed, the board of directors of the Company has fixed the close of business on November 14,

2023 as the record date (the “Record Date”) for determining stockholders entitled to notice of, and to vote at, the

Annual Meeting and at any adjournment(s) or postponement(s) thereof. Capitalized terms used in this supplement to the Proxy Statement

(this “Supplement”) without definition have the same meanings as set forth in the Proxy Statement.

This

Supplement is being filed to clarify the voting power of the shares of common stock, par value $0.00001 per share (the

“Common Stock”), issued as of the Record Date. The Proxy Statement previously stated that there were 7,812,190

shares of Common Stock outstanding as of the Record Date and entitled to vote on all matters listed in the Proxy Statement.

The number of shares of Common Stock issued as of the Record Date is 5,601,020 shares, which amount is less than the number of

shares outstanding due to 2,211,170 shares of Common Stock being held in abeyance. Shares held in abeyance are not considered to be

beneficially owned by the applicable stockholder(s). As a result, they will not be considered entitled to vote at the Annual Meeting

for purposes of determining whether a quorum is present at the Annual Meeting.

This

Supplement amends and restates a portion of the section of the Proxy Statement titled “Questions and Answers About the Annual Meeting”

and the entirety of the section of the Proxy Statement titled “Security Ownership of Certain Beneficial Owners and Management.”

This

Supplement should be read in conjunction with the Proxy Statement. Except as specifically amended or supplemented by the information

contained herein, this Supplement does not otherwise modify, amend or supplement the Proxy Statement, and the information contained in

the Proxy Statement should be considered in voting your shares. If you have already returned your proxy card or provided voting instructions,

you do not need to take any action unless you wish to change your vote.

—

As

corrected, the disclosure on page 2 of the Proxy Statement under the heading “Questions and Answers About the Annual Meeting”

should read as follows:

Who

is entitled to vote at the Annual Meeting, and how many votes do they have?

Stockholders

of record of our Common Stock and Series H Preferred Stock at the close of business on November 14, 2023 (the “Record Date”)

may vote at the Annual Meeting. On the Record Date, there were 5,601,020 shares of Common Stock and 9,000,000 shares of Series

H Preferred Stock issued. A complete list of registered stockholders entitled to vote at the Annual Meeting will be available

for inspection at the principal executive offices of the Company during regular business hours for the 10 calendar days prior to the

Annual Meeting. The list will also be available online during the Annual Meeting.

Pursuant

to our Amended and Restated Bylaws (the “Bylaws”), each share of our Common Stock is entitled to one vote on all matters

listed in this Proxy Statement. Each holder of Series H Preferred Stock is entitled to the number of votes equal to the number of whole

shares of Common Stock into which the shares of Series H Preferred Stock held by such holder is convertible with respect to any and all

matters presented to the common stockholders for their action or consideration at the Annual Meeting. Certain holders of Series H Preferred

Stock have entered into a voting rights agreement related to the Series H Preferred Stock such that such holders have agreed, at every

meeting of our stockholders, and at every adjournment or postponement thereof, to appear or issue a proxy to a third party to be present

for purposes of establishing a quorum, and to vote all applicable shares in favor of each matter proposed and recommended for approval

by our Board either in person or by proxy, amongst other provisions. As of the Record Date, the stockholder parties to the voting rights

agreement own shares of the Series H Preferred Stock convertible into an aggregate of approximately 350,004 shares of Common Stock, representing

approximately 6.25% of our Common Stock issued at such time. The voting rights agreement will terminate on the third anniversary

of the date of its effectiveness.

—

As

corrected, the disclosure on pages 38 through 41 of the Proxy Statement under the heading “Security Ownership of Certain Beneficial

Owners and Management” should read as follows:

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth certain information with respect to the beneficial ownership of our Common Stock in accordance with the rules

of the SEC, as of the Record Date for:

| ● |

each

of our directors; |

| |

|

| ● |

each

of (i) our principal executive officers during the year ended December 31, 2022, (ii) the two most highly compensated executive officers

other than our principal executive officer during that year, and (iii) up to two additional executive officers for whom disclosure

would have been provided but for the fact that each such officer was not serving as an executive officer at the end of that year;

and |

| |

|

| ● |

all

persons, to our knowledge, that are the beneficial owners of more than five percent (5%) of the outstanding shares of Common Stock;

and |

Except

as indicated in footnotes to this table, we believe each person named in this table has sole voting and investment power with respect

to the shares of Common Stock and Series H Preferred Stock opposite such person’s name. Percentage ownership is based on 5,601,020 shares of Common Stock and 9,000,000 shares of Series H Preferred Stock issued as of the Record Date.

Name of Beneficial Owner | |

Address | |

Common Stock Beneficially Owned (1) | | |

Shares of Series H Preferred Stock | | |

Percent of Common Stock | | |

Percent of Series H Preferred Stock | | |

Percentage of Voting Power (2) | |

| Brendan Flood (3) | |

3 London Wall Buildings, London Wall, London, EC2M 5SY | |

| 287,770 | | |

| - | | |

| 5.09 | % | |

| - | | |

| 4.80 | % |

| Joe Yelenic (4) | |

757 Third Avenue, 27th Floor, New York, NY 10017 | |

| 1,208 | | |

| 31,050 | | |

| * | | |

| * | | |

| * | |

| Dimitri Villard (5) | |

8721 Santa Monica Blvd, Suite 100 Los Angeles, CA 90069 | |

| 41,595 | | |

| - | | |

| * | | |

| - | | |

| * | |

| Nicholas Florio (6) | |

Citrin Cooperman & Company LLP 529 Fifth Avenue New York, NY 10017 | |

| 31,641 | | |

| - | | |

| * | | |

| - | | |

| * | |

| Alicia Barker (7) | |

757 Third Avenue, 27th Floor, New York, NY 10017 | |

| 42,795 | | |

| - | | |

| * | | |

| - | | |

| * | |

| Vincent Cebula (8) | |

757 Third Avenue, 27th Floor, New York, NY 10017 | |

| 40,800 | | |

| - | | |

| * | | |

| - | | |

| * | |

| Directors and officers as a group (6 persons) | |

| |

| 445,809 | | |

| 31,050 | | |

| 7.90 | % | |

| * | | |

| 7.46 | % |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Greater than 5% Holders: | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Jackson Investment Group, LLC (9) | |

2655 Northwinds Parkway, Alpharetta, GA 30009 | |

| 373,905 | | |

| - | | |

| 6.63 | % | |

| - | | |

| 6.24 | % |

| RScube Investment, LLC (10) | |

Rscube Investment, LLC 24 Hayhurst Drive Newtown, PA 18940 | |

| 642,342 | | |

| - | | |

| 11.47 | % | |

| - | | |

| 10.79 | % |

| Chapel Hill Partners, L.P. (11) | |

Chapel Hill Partners, LP

Jean-Pierre Sakey, GP

33 Bella Casa Way

Clayton, NC 27527 | |

| 350,004 | | |

| 9,000,000 | | |

| 5.88 | % | |

| 100 | % | |

| 5.88 | % |

| KLS Investments LLC (12) | |

c/o Staffing 360 Solutions, Inc. 757 Third Avenue, 27th Floor, New York, NY 10016 | |

| 25,502 | | |

| 613,151 | | |

| * | | |

| 6.81 | % | |

| * | |

| Ausdauer HW Staffing, LLC (13) | |

c/o Staffing 360 Solutions, Inc. 757 Third Avenue, 27th Floor, New York, NY 10016 | |

| 67,297 | | |

| 1,730,483 | | |

| 1.19 | % | |

| 19.23 | % | |

| 1.13 | % |

| Jean Neustadt, Jr. Irrevocable Trust II (14) | |

c/o Staffing 360 Solutions, Inc. 757 Third Avenue, 27th Floor, New York, NY 10016 | |

| 25,208 | | |

| 648,194 | | |

| * | | |

| 7.20 | % | |

| * | |

| Tristar Partners of Texas LP (15) | |

c/o Staffing 360 Solutions, Inc. 757 Third Avenue, 27th Floor, New York, NY 10016 | |

| 35,570 | | |

| 914,641 | | |

| * | | |

| 10.16 | % | |

| * | |

*

Less than 1%.

| (1) |

Shares

of Common Stock beneficially owned and the respective percentages of beneficial ownership of Common Stock assume the exercise of

all options and other securities convertible into Common Stock beneficially owned by such person or entity currently exercisable

or exercisable within 60 days of the Record Date, except as otherwise noted. Shares issuable pursuant to the exercise of stock options

and other securities convertible into Common Stock exercisable within 60 days are deemed outstanding and held by the holder of such

options or other securities for computing the percentage of outstanding Common Stock beneficially owned by such person, but are not

deemed outstanding for computing the percentage of outstanding Common Stock beneficially owned by any other person. |

| |

|

| (2) |

All

shares of Series H Preferred Stock shall vote on an as-converted basis, subject to certain beneficial ownership limitations. |

| (3) |

Includes

237,450 shares of Common Stock owned and options to purchase up to 50,320 shares of Common Stock. |

| |

|

| (4) |

Mr.

Yelenic owns 31,050 shares of Series H Preferred Stock, convertible into an aggregate of approximately 1,208 shares of Common Stock. |

| |

|

| (5) |

Includes

40,511 shares of Common Stock held personally by Mr. Villard, 1,067 shares of Common Stock held through Byzantine Productions, Inc.,

for which Mr. Villard is deemed the beneficial owner with sole voting and dispositive power over the securities held by the entity,

and options held by Mr. Villard to purchase up to 17 shares of Common Stock. |

| |

|

| (6) |

Includes

70 shares of Common Stock held personally by Mr. Florio, and 31,554 shares of Common Stock and options to purchase up to 17 shares

of Common Stock held in the name of Citrin Cooperman, for which Mr. Florio is deemed the beneficial owner with sole voting and dispositive

power over the securities held by the firm. |

| |

|

| (7) |

Ms.

Barker owns 42,795 shares of Common Stock. |

| |

|

| (8) |

Mr.

Cebula owns 40,800 shares of Common Stock. |

| |

|

| (9) |

Includes

(i) 334,478 shares of Common Stock directly owned by Jackson, (ii) up to 15,093 shares of Common Stock issuable upon the exercise

of the Amended and Restated Warrant Agreement, as amended, originally dated as of April 25, 2018, by and between us and Jackson,

and (iii) up to 24,332 shares of Common Stock issuable upon the exercise of the Warrant Agreement, dated as of October 27, 2022,

by and between us and Jackson. The number of shares of Common Stock beneficially owned by Jackson is accurate to the best of the

Company’s knowledge based on the Schedule 13D/A filed jointly by Jackson and Richard L. Jackson with the SEC on September 5,

2023. Additionally, Mr. Jackson individually and beneficially owns 2 shares of Common Stock. With the exception of the 2 shares of

Common Stock personally owned, Mr. Jackson disclaims beneficial ownership of all of the shares reported to be beneficially owned

by Mr. Jackson except to the extent of his pecuniary interest therein. |

| |

|

| (10) |

Consists

of 642,342 shares of Common Stock directly owned by RScube Investment, LLC (“Rscube”), as reported on the Schedule 13D/A

filed jointly by RScube, Satvinder Singh and Anil Sharma with the SEC on September 22, 2023. Mr. Singh beneficially owns 50% of the

outstanding shares of Rscube. Mr. Sharma beneficially owns the remaining 50% of the outstanding shares of Rscube. Accordingly, each

of Rscube, Mr. Singh and Mr. Sharma may be deemed to beneficially own the shares owned directly by Rscube. |

| |

|

| (11) |

Consists

of 9,000,000 shares of Series H Preferred Stock, convertible into an aggregate of approximately 350,004 shares of Common Stock. Pursuant

to a voting rights agreement (the “Voting Rights Agreement”), dated as of May 18, 2022, by and among the Company,

Headway Workforce Solutions, Inc., a Delaware corporation (“Headway”), Chapel Hill Partners, L.P., as the representative

of all the stockholders of Headway (“Chapel Hill”) and the certain stockholders of the Series H Preferred Stock

party to the Voting Rights Agreement, from the date of the Voting Rights Agreement until the third anniversary of such date, Chapel

Hill (in its capacity as a stockholder) shall, among others, appear at every meeting of the stockholders, including any adjournments

or postponements thereof, or otherwise cause all of the Company’s voting stock owned by Chapel Hill or issue a proxy to a third

party to vote such voting stock, in favor of each matter proposed and recommended for approval by the Board. Pursuant to the Voting

Rights Agreement, Chapel Hill may be deemed to hold voting power of the 9,000,000 shares of Series H Preferred Stock. |

| |

|

| (12) |

Consists

of 613,151 shares of Series H Preferred Stock beneficially owned by KLS Investments LLC (“KLS”), which are convertible

into an aggregate of approximately 25,502 shares of Common Stock. The shares of Series H Preferred Stock held by KLS is accurate

to the best of the Company’s knowledge. |

| |

|

| (13) |

Consists

of 1,730,483 shares of Series H Preferred Stock beneficially owned by Ausdauer HW Staffing, LLC (“Ausdauer”),

which are convertible into an aggregate of approximately 67,297 shares of Common Stock. The shares of Series H Preferred Stock held

by KLS is accurate to the best of the Company’s knowledge. |

| |

|

| (14) |

Consists

of 648,194 shares of Series H Preferred Stock beneficially owned by Jean Neustadt, Jr. Irrevocable Trust II (the “Jean Neustadt,

Jr. Trust”), which are convertible into an aggregate of approximately 25,208 shares of Common Stock. The shares of Series

H Preferred Stock held by the Jean Neustadt, Jr. Trust is accurate to the best of the Company’s knowledge. |

| |

|

| (15) |

Consists

of 914,641 shares of Series H Preferred Stock beneficially owned by Tristar Partners of Texas LP (“Tristar”),

which are convertible into an aggregate of approximately 35,570 shares of Common Stock. The shares of Series H Preferred Stock held

by Tristar is accurate to the best of the Company’s knowledge. |

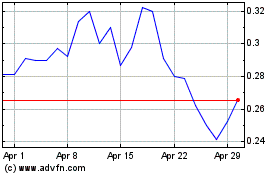

Staffing 360 Solutions (NASDAQ:STAF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Staffing 360 Solutions (NASDAQ:STAF)

Historical Stock Chart

From Apr 2023 to Apr 2024