UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D/A

(Rule

13d-101)

INFORMATION

TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO

§ 240.13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

§

240.13d-2(a)

(Amendment

No. 12)

Stratasys

Ltd.

(Name

of Issuer)

Ordinary

Shares, par value NIS 0.01 per share

(Title

of Class of Securities)

M85548101

(CUSIP

Number)

nano

dimension LTD.

2

Ilan Ramon, Ness Ziona,

7403635,

Israel

Tomer

Pinchas

2

Ilan Ramon, Ness Ziona,

7403635,

Israel

972-73-7509142

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications)

December

23, 2023

(Date

of Event Which Requires Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☐.

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §

240.13d-7 for other parties to whom copies are to be sent.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

| 1 |

The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page. |

| CUSIP

No. M85548101 |

13D/A |

Page

2 of 7 |

| 1 |

NAME

OF REPORTING PERSON |

| |

|

| |

Nano

Dimension Ltd. |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a)

☐ |

| |

|

(b)

☐ |

| |

|

|

| 3 |

SEC

USE ONLY |

|

| |

|

|

| |

|

|

| 4 |

SOURCE

OF FUNDS |

| |

|

| |

WC |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

| |

|

|

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION |

| |

|

| |

Israel |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE

VOTING POWER |

| |

|

| |

9,695,015 |

| 8 |

SHARED

VOTING POWER |

| |

|

| |

100 |

| 9 |

SOLE

DISPOSITIVE POWER |

| |

|

| |

9,695,015 |

| 10 |

SHARED

DISPOSITIVE POWER |

| |

|

| |

100 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

| |

9,695,115 |

|

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

| |

|

|

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

| |

14.02%*

|

|

| 14 |

TYPE

OF REPORTING PERSON |

|

| |

|

|

| |

CO |

|

| * |

Based on 69,136,761 Ordinary Shares outstanding as of September 28, 2023 (as reported by the Issuer in its Report on Form 6-K filed with the Securities and Exchange Commission on September 28 ,2023). |

| CUSIP

No. M85548101 |

13D/A |

Page

3 of 7 |

| 1 |

NAME

OF REPORTING PERSON |

| |

|

| |

Nano

Dimension NY Ltd. |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a)

☐ |

| |

|

(b)

☐ |

| |

|

|

| 3 |

SEC

USE ONLY |

|

| |

|

|

| |

|

|

| 4 |

SOURCE

OF FUNDS |

| |

|

| |

N/A |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

| |

|

|

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION |

| |

|

| |

New

York |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE

VOTING POWER |

| |

|

| |

0 |

| 8 |

SHARED

VOTING POWER |

| |

|

| |

100 |

| 9 |

SOLE

DISPOSITIVE POWER |

| |

|

| |

0 |

| 10 |

SHARED

DISPOSITIVE POWER |

| |

|

| |

100 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

| |

100 |

|

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

| |

|

|

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

| |

0.000001%*

|

|

| 14 |

TYPE

OF REPORTING PERSON |

|

| |

|

|

| |

CO |

|

| * |

Based on 69,136,761 Ordinary Shares outstanding as of September 28, 2023 (as reported by the Issuer in its Report on Form 6-K filed with the Securities and Exchange Commission on September 28 ,2023). |

| CUSIP

No. M85548101 |

13D/A |

Page

4 of 7 |

This

Amendment No. 12 to Schedule 13D (this “Schedule 13D/A”) amends and supplements the Schedule 13D initially filed with the

Securities and Exchange Commission (the “SEC”) on March 6, 2023, as amended by Amendment No. 1 on March 10, 2023, Amendment

No. 2 on March 30, 2023, Amendment No. 3 on May 25, 2023, Amendment No. 4 on May 31, 2023, Amendment No. 5 on June 9, 2023, Amendment

No. 6 on June 14, 2023, Amendment No. 7 on June 27, 2023, Amendment No. 8 on July 10, 2023, Amendment No. 9 on July 20, 2023,Amendment

No. 10 on July 28, 2023 and Amendment No. 11 on August 1, 2023 (as amended, the “Schedule 13D”) by Nano Dimension Ltd., a

corporation incorporated under the laws of Israel (the “Company”), and Nano Dimension NY Ltd., a New York corporation and

a wholly-owned subsidiary of the Company (the “Subsidiary”), pursuant to Rule 13d-1(e) under the Securities Exchange Act

of 1934, as amended.

Item

1. Security and Issuer.

This

item is not being amended by this Schedule 13D/A.

Item 2. Identity and Background.

“Item 2. Identity and Background” of the Schedule 13D is

hereby amended and restated as follows:

This Schedule 13D is being filed by the following (each, a “Reporting

Person” and together the “Reporting Persons”):

(i) the Company; and

(ii) Nano Dimension NY Ltd.,

a New York corporation and a wholly-owned direct subsidiary of the Company (the “Subsidiary”).

The principal business address of the Reporting Persons is: 2 Ilan

Ramon, Ness Ziona 7403635 Israel.

The directors of the Company

are Yoav Nissan-Cohen (chairman of the Board of Directors of the Company), Simon Anthony-Fried, Yoav Stern, Oded Gera, Roni Kleinfeld,

Christopher J. Moran and Michael X. Garrett. The executive officers of the Company are Yoav Stern (Chief Executive Officer), Tomer Pinchas

(Chief Operating Officer), Hanan Gino (Chief Product Officer and Head of Strategic M&A), Zvi Peled (President of Nano Dimension EMEA)

and Zivi Nedivi (President), Nick Geddes (Chief Technology Officer) and Yael Sandler (Chief Financial Officer).

The Subsidiary is a corporation that was formed on June 23, 2023 as

a wholly owned direct subsidiary of the Company to engage in any lawful act or activity for which corporations may be organized under

the New York Business Corporation Law.

The directors of the Subsidiary are Yoav Stern and Zivi Nedivi. The

officers of the Subsidiary are Yoav Stern (President), Zivi Nedivi (Secretary) and Yael Sandler (Chief Financial Officer).

Neither the Reporting Persons

nor, to the knowledge of the Reporting Persons, any individual specified above, during the last five years, has been convicted in a criminal

proceeding (excluding traffic violations or similar misdemeanors) or been party to any civil proceeding of a judicial or administrative

body of competent jurisdiction which resulted in a judgment, decree or final order enjoining future violations of, or prohibiting or mandating

activities subject to, federal or state securities laws or finding any violation with respect to such laws.

To the knowledge

of the Reporting Persons, each of the individuals listed above is a citizen of Israel or the United States.

Item 3. Source and Amount of Funds or Other Consideration.

This item is not being amended by this Schedule

13D/A.

| CUSIP

No. M85548101 |

13D/A |

Page

5 of 7 |

Item

4. Purpose of Transaction.

“Item

4. Purpose of Transaction” of the Schedule 13D is hereby amended to add the following:

On

December 23, 2023, the Company submitted to the Stratasys Ltd. (“Stratasys”) board of directors a letter regarding a preliminary

indicative non-binding proposal to acquire all the outstanding ordinary shares of Stratasys that it does not currently own for $16.50

per share in cash, with an ability to increase its price subject to due diligence, a copy of which is filed hereto as Exhibit 99.1 and

incorporated herein by reference. The proposal is subject to the completion of a satisfactory confirmatory due diligence process and

the negotiation and execution of a mutually satisfactory definitive acquisition agreement. There is no guarantee that an acquisition

will be completed.

On

the same day, the Company issued a press release regarding the same, a copy of which is filed as Exhibit 99.2 and incorporated herein

by reference.

| CUSIP

No. M85548101 |

13D/A |

Page

6 of 7 |

Item

5. Interest in Securities of the Issuer.

“Item 5. Interest in Securities of the Issuer” of the Schedule

13D is hereby amended and restated as follows:

The aggregate percentage of Issuer ordinary shares reported owned by

the Reporting Persons is based upon 69,136,761 Issuer ordinary shares outstanding as of September 28, 2023, as reported by the Issuer

in its Report on Form 6-K filed with the Securities and Exchange Commission on September 28, 2023.

To the Reporting Persons’ knowledge, the individuals named in

Item 2 above do not beneficially own any Issuer ordinary shares.

| |

a. |

As of December 22, 2023, the Company beneficially owned 9,695,115 Issuer

ordinary shares, including 100 shares owned directly by the Subsidiary, representing approximately 14.02% of the ordinary shares of the

Issuer outstanding as of September 28, 2023.

As of December 22, 2023, the Subsidiary beneficially owned 100 ordinary

shares of the Issuer, representing less than 0.0000001% of the ordinary shares of the Issuer outstanding as of September 28, 2023. |

| |

1. |

The Company’s sole power to vote or direct vote: 9,695,015 |

| |

2. |

The Company’s shared power to vote or direct vote: 100 |

| |

3. |

The Company’s sole power to dispose or direct the disposition: 9,695,015 |

| |

|

|

| |

4. |

The Company’s shared power to dispose or direct the disposition: 100 |

| |

|

|

| |

5. |

The Subsidiary’s sole power to vote or director vote: 0 |

| |

|

|

| |

6. |

The Subsidiary’s shared power to vote or direct vote: 100 |

| |

|

|

| |

7. |

The Subsidiary’s sole power to dispose or direct the disposition:

0 |

| |

|

|

| |

8. |

The Subsidiary’s shared power to dispose or direct the disposition:

100 |

| |

c. |

The have been no transactions in the Issuer’s ordinary shares by the Reporting Persons, or any of the persons named in Item 2 above, during the past sixty days. |

| d. | No

other person is known to have the right to receive or the power to direct the receipt of

dividends from, or the proceeds from the sale of, the securities covered by this Schedule

13D. |

Item

6. Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer.

This

item is not being amended by this Schedule 13D/A.

Item

7. Material to be Filed as Exhibits.

“Item

7. Material to be Filed as Exhibits” of the Schedule 13D is hereby amended to add the following:

| CUSIP

No. M85548101 |

13D/A |

Page

7 of 7 |

SIGNATURES

After

reasonable inquiry and to the best of her knowledge and belief, the undersigned certifies that the information set forth in this statement

is true, complete and correct.

Dated:

December 26, 2023

| Nano

Dimension Ltd. |

|

| |

|

| By: |

/s/

Tomer Pinchas |

|

| |

Name:

|

Tomer

Pinchas |

|

| |

Title: |

Chief

Operating Officer |

|

| Nano

Dimension NY Ltd. |

|

| |

|

| By: |

/s/

Tomer Pinchas |

|

| |

Name: |

Tomer

Pinchas |

|

| |

Title: |

Chief

Operating Officer |

|

Exhibit 99.1

December 23rd, 2023

To: The Board of Directors of Stratasys,

Ltd.

Attn: Dov Ofer, Chairman,

and Yoav Zeif, Chief Executive Officer

Dear Dov and Yoav,

As you know, Nano Dimension Ltd.

(collectively with its affiliates, “NANO” or “we”) has been a significant long-term shareholder of Stratasys

Ltd. (“Stratasys” or the “Company”) and gained high regard and appreciation for the Company’s

achievements under your leadership. We have been particularly impressed by the Company’s trajectory as a polymers’ Additive

Manufacturing (“AM”) pioneer, creating the preeminent platform for premium polymers’ 3D printing systems, material and

consumables as well as design and other supporting software.

We have closely followed the Company’s

operational and financial performance in recent quarters, and we paid special attention to your previously announced September 28th

public statement that you are pursuing a Strategic Alternatives process, including a sale of the Company. Given the ongoing challenges

in Israel, we have spent the better part of the past three months ensuring that our people, our business and our stakeholders were safe

and on solid foundation; we are now prepared to move forward with our publicly stated strategy of acquiring best-in-class AM assets to

create an AM leader for tomorrow’s generation.

As such, Dr. Yoav Nissan-Cohen (Chairman

of Nano Dimension) and I (Chief Executive officer of same) are pleased to present you with this non-binding indicative offer (the “Indicative

Offer”), to acquire all of the Stratasys shares that we do not currently own for $16.50 in cash per share (the “Proposed

Transaction”).1

This Proposed Transaction not only

represents a significant premium of 40% to the VWAP since September 28th, the day that Stratasys announced its strategic review,

but also a 26% premium to the closing price on December 22nd. This Proposed Transaction would give all shareholders a direct

path to realizing a compelling premium for their shares with far greater certainty than if Stratasys were to remain a publicly traded

company. Upon completion of an expedited confirmatory due diligence process, we believe that we should be able to increase our offer.

The Proposed Transaction has received the full support of Nano Dimension’s Board of Directors, and all necessary internal approvals

have been received by Nano Dimension to proceed.

While we anticipate financing the

proposal with available cash on hand, Nano Dimension has entered discussions with financing sources to support any transaction, should

such support be needed, and there will be no financing contingency related to the Proposed Transaction.

| 1 | Nano Dimension is currently the largest shareholder of Stratasys, owning 9.695 million shares. |

Further, it should be said that

Nano Dimension views certain management team members and employees of any organization as a vital component of the organization’s

ability to continue to compete and succeed in the marketplace. Nano Dimension will commit to motivating and endeavoring to retain the

key personnel of Stratasys, including the issuance of retention packages and equity participation to help participate in any future value

created.

Lastly, we are prepared to focus

our efforts on the Proposed Transaction and are confident we can complete our due diligence and negotiate all definitive documentation

within 30 days. Notwithstanding the foregoing, we would expect to jointly agree on the appropriate timeline to best position the Proposed

Transaction for future success. We are willing to dedicate meaningful financial and personnel resources to this project and would expect

a similar level of commitment from the Company.

Advisors

We have retained Greenhill &

Co., LLC (“Greenhill”) and Sullivan & Worcester, LLC (“Sullivan”) to advise us on this Proposed Transaction.

Any notification under this agreement and any email exchanged by parties shall be conducted with NANO’s advisors at the addresses

stipulated below:

Greenhill & Co., LLC

Douglas Jackson

Co-Head of U.S. M&A

155 North Wacker Drive

Chicago,

IL 60606, USA

DJackson@greenhill.com

|

Sullivan & Worcester LLP

Oded Har-Even

Partner

1633 Broadway

New York, NY, 10019, USA

OHareven@sullivanlaw.com

|

Guy Rozentsveig

Principal

155 North Wacker Drive

Chicago, IL 60606, USA

Guy.Rozentsveig@greenhill.com

Greenberg Traurig, LLC

Bruce March

Chair of Global Corporate

Practice

401 East Las Olas Boulevard,

Suite 2000

Fort Lauderdale, FL 33301

marchb@gtlaw.com

This Indicative Offer is not intended

to be a binding contract between us or an offer by us capable of acceptance, but rather it is a proposal to confirm NANO’s interest

in Stratasys and to facilitate further discussions. NANO and Stratasys will be bound only in accordance with the terms and conditions

to be negotiated and contained in mutually executed definitive documentation.This letter shall be governed by and construed in accordance

with the laws of New York, USA, without regard to principles of conflicts of law.

Gentlemen, I would like to reiterate

our sincere interest and enthusiasm in pursuing this opportunity with Stratasys. Like you, we have been affected meaningfully by the Israel-Hamas

war, and we stand with you in partnership to move forward and provide value to both our shareholders.

We remain available both personally

as well as through our advisers to elaborate on our Indicative Offer. We look forward to hearing from you expeditiously.

Sincerely,

Nano Dimension Ltd.

| By: |

/s/ Yoav Stern |

|

| |

Yoav Stern |

|

| |

Chief Executive Officer |

|

3

Exhibit 99.2

Nano Dimension Announces Preliminary All Cash Proposal to Acquire

Stratasys for $16.50 per share

Waltham, Mass., Dec. 23, 2023 (GLOBE NEWSWIRE)

-- Nano Dimension Ltd. (Nasdaq: NNDM) (“Nano Dimension”, or “Nano” or the “Company”), a leading supplier

of Additively Manufactured Electronics (“AME”) and multi-dimensional polymer, metal & ceramic Additive Manufacturing (“AM”)

3D printers, today announced that it has submitted a preliminary all cash proposal to the Board of Directors of Stratasys Ltd. (Nasdaq:

SSYS) (“Stratasys”) to purchase all the outstanding shares of Stratasys that it does not currently own for $16.50 per share

in cash, with an ability to increase its price subject to due diligence. This proposal represents a 40% premium from the volume-weighted

average Stratasys share price since September 28, 2023, the day that Stratasys announced that its Board of Directors initiated a process

to explore strategic alternatives for the Company, including a potential sale.1

Notwithstanding the public announcement from

Stratasys that it intended to launch a comprehensive strategic review, Nano Dimension’s standing as the largest single shareholder

of Stratasys, Nano Dimension’s current liquidity profile including over $800 million of net cash, and Nano Dimension’s publicly

announced prior attempts to acquire Stratasys, Nano Dimension has not been approached by Stratasys or its representatives during Stratasys’

strategic alternatives assessment. To this end, a public press release announcing Nano Dimension’s intent is believed to be required.

Following the proactive submission of its

proposal to acquire Stratasys, Nano Dimension is willing to immediately enter customary transaction-related documentation required to

complete confirmatory due diligence and seeks to do so in the immediate future. Given Nano Dimension’s deep understanding of Stratasys

and the AM industry, only a short due diligence period is expected to be required by the Board of Nano Dimension.

In addition to financing the proposal with

available cash on hand, Nano Dimension has entered discussions with financing sources to support any transaction, should such support

be needed, and there is no financing contingency to the proposal. The proposal is subject to the completion of a satisfactory confirmatory

due diligence process and the negotiation and execution of a mutually satisfactory definitive acquisition agreement. There is no guarantee

that an acquisition will be completed.

Since the Israel-Hamas war began on October

7th, senior leadership at Nano Dimension have been consumed with ensuring that its business and its employees are safe, protected,

and supported. Conscious that Stratasys itself also has a significant presence in Israel, Nano Dimension has sought to minimize unnecessary

disruption. As time has passed and with the foundation of many Israel-based companies firmly stabilized, Nano Dimension can now continue

with its publicly stated strategy of acquiring leading AM companies to create the best-in-class market leader for the next generation

of development.

| 1 | Since the September 28, 2023, announcement date by the Stratasys

Board of Directors to pursue strategic alternatives, SSYS share price has had a volume-weighted average share price of $11.75. Per Bloomberg. |

About Nano Dimension

Nano Dimension’s (Nasdaq: NNDM) vision

is to transform existing electronics and mechanical manufacturing into Industry 4.0 environmentally friendly & economically efficient

precision additive electronics and manufacturing – by delivering solutions that convert digital designs to electronic or mechanical

devices - on demand, anytime, anywhere.

Nano Dimension’s strategy is driven

by the application of deep learning based AI to drive improvements in manufacturing capabilities by using self-learning & self-improving

systems, along with the management of a distributed manufacturing network via the cloud.

Nano Dimension serves over 2,000 customers

across vertical target markets such as aerospace & defense, advanced automotive, high-tech industrial, specialty medical technology,

R&D and academia. The company designs and makes Additive Electronics and Additive Manufacturing 3D printing machines and

consumable materials. Additive Electronics are manufacturing machines that enable the design and development of High-Performance-Electronic-Devices

(Hi-PED®s). Additive Manufacturing includes manufacturing solutions for production of metal, ceramic, and specialty polymers-based

applications - from millimeters to several centimeters in size with micron precision.

Through the integration of its portfolio

of products, Nano Dimension is offering the advantages of rapid prototyping, high-mix-low-volume production, IP security, minimal environmental

footprint, and design-for-manufacturing capabilities, which is all unleashed with the limitless possibilities of additive manufacturing.

For more information, please visit www.nano-di.com.

Forward Looking Statements

This press release contains forward-looking

statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 and

other Federal securities laws. Words such as “expects,” “anticipates,” “intends,” “plans,”

“believes,” “seeks,” “estimates,” and similar expressions or variations of such words are intended

to identify forward-looking statements. For example, Nano Dimension is using forward-looking statements in this press release when it

discusses the acquisition proposal and consideration and other terms and financing of such proposed acquisition, potential benefits and

advantages of the proposed acquisition, the negotiation of a definitive agreement and growth and value creation opportunities. Because

such statements deal with future events and are based on Nano Dimension’s current expectations, they are subject to various risks

and uncertainties. The execution of a definitive acquisition agreement between Nano Dimension and Stratasys would be subject to approval

by each company’s Board of Directors and completion of the transaction would be subject to customary closing conditions, including

the receipt of required regulatory approvals and approval of Stratasys shareholders. Actual results, performance, or achievements of Nano

Dimension could differ materially from those described in or implied by the statements in this press release. The forward-looking statements

contained or implied in this press release are subject to other risks and uncertainties, including those discussed under the heading “Risk

Factors” in Nano Dimension’s annual report on Form 20-F filed with the Securities and Exchange Commission (“SEC”)

on March 30, 2023, and in any subsequent filings with the SEC. Except as otherwise required by law, Nano Dimension undertakes no obligation

to publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect

the occurrence of unanticipated events. References and links to websites have been provided as a convenience, and the information contained

on such websites is not incorporated by reference into this press release. Nano Dimension is not responsible for the contents of third-party

websites.

NANO DIMENSION INVESTOR RELATIONS CONTACT

Investor Relations | ir@nano-di.com

NANO DIMENSION MEDIA CONTACTS

Kal Goldberg / Bryan Locke / Kelsey Markovich

| NanoDimension@fgsglobal.com

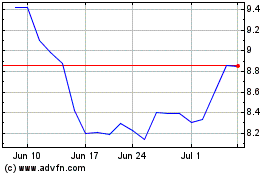

Stratasys (NASDAQ:SSYS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Stratasys (NASDAQ:SSYS)

Historical Stock Chart

From Apr 2023 to Apr 2024