SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2023

Commission File Number 001-36258

Crescent Point Energy Corp.

(Name of Registrant)

Suite 2000, 585 - 8th Avenue S.W.

Calgary, Alberta, T2P 1G1

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form

40-F ☒

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Crescent Point Energy Corp. |

| |

(Registrant) |

| |

|

|

| |

By: |

/s/ Ken Lamont |

| |

Name: |

Ken Lamont |

| |

Title: |

Chief Financial Officer |

Date: December 22, 2023

EXHIBIT INDEX

2

Exhibit 99.1

Form 62-103F1

Required Disclosure under the Early

Warning Requirements

State if this report is filed to amend information

disclosed in an earlier report. Indicate the date of the report that is being amended.

Not applicable.

Item 1 –

Security and Reporting Issuer

| 1.1 | State the designation of securities to which this report relates and the name and address of the head

office of the issuer of the securities. |

This report relates to the Class A common

shares (each, a “Common Share”) in the capital of Hammerhead Energy Inc. (“Hammerhead”).

The head office of Hammerhead is located

at:

Suite 2700, 525 – 8th Avenue S.W.

Calgary, Alberta, T2P 1G1

| 1.2 | State the name of the market in which the transaction or other occurrence that triggered the requirement

to file this report took place. |

Not applicable.

Item 2 –

Identity of the Acquiror

| 2.1 | State the name and address of the acquiror. |

Crescent Point Energy Corp. (the “Purchaser”)

Suite 2000, 585 – 8th Avenue SW

Calgary, Alberta, T2P 1G1

The Purchaser exists under the Business

Corporations Act (Alberta) (the “ABCA”). The Purchaser is a conventional oil and gas producer with assets strategically

focused in properties comprised of high quality, long life, operated, light and medium crude oil, natural gas liquids and natural gas

reserves in Western Canada.

| 2.2 | State the date of the transaction or other occurrence that triggered the requirement to file this report

and briefly describe the transaction or other occurrence. |

On December 21, 2023, the Purchaser

acquired all of the issued and outstanding Common Shares, pursuant to a court-approved plan of arrangement under Section 193 of the ABCA

(the “Arrangement”).

The Arrangement was completed in accordance

with the arrangement agreement dated November 6, 2023 between the Purchaser and Hammerhead (the “Agreement”).

| 2.3 | State the names of any joint actors. |

Not

applicable.

Item 3 –

Interest in Securities of the Reporting Issuer

| 3.1 | State the designation and number or principal amount of securities acquired or disposed of that triggered

the requirement to file this report and the change in the acquiror’s securityholding percentage in the class of securities. |

Prior to the Arrangement, the Purchaser

did not hold any Common Shares.

Pursuant to the Arrangement, on December

21, 2023, the Purchaser acquired 99,629,831 Common Shares, representing 100% of the issued and outstanding Common Shares.

| 3.2 | State whether the acquiror acquired or disposed ownership of, or acquired or ceased to have control over,

the securities that triggered the requirement to file this report. |

See Item 3.1.

| 3.3 | If the transaction involved a securities lending arrangement, state that fact. |

Not applicable.

| 3.4 | State the designation and number or principal amount of securities and the acquiror’s securityholding

percentage in the class of securities, immediately before and after the transaction or other occurrence that triggered the requirement

to file this report. |

See Item 3.1.

| 3.5 | State the designation and number or principal amount of securities and the acquiror’s securityholding

percentage in the class of securities referred to in Item 3.4 over which |

| (a) | the acquiror, either alone or together with any joint actors, has ownership and control, |

See Item 3.1.

| (b) | the acquiror, either alone or together with any joint actors, has ownership but control is held by persons

or companies other than the acquiror or any joint actor, and |

Not applicable.

| (c) | the acquiror, either alone or together with any joint actors, has exclusive or shared control but does

not have ownership. |

Not applicable.

| 3.6 | If the acquiror or any of its joint actors has an interest in, or right or obligation associated with,

a related financial instrument involving a security of the class of securities in respect of which disclosure is required under this item,

describe the material terms of the related financial instrument and its impact on the acquiror’s securityholdings. |

Not applicable.

| 3.7 | If the acquiror or any of its joint actors is a party to a securities lending arrangement involving a

security of the class of securities in respect of which disclosure is required under this item, describe the material terms of the arrangement

including the duration of the arrangement, the number or principal amount of securities involved and any right to recall the securities

or identical securities that have been transferred or lent under the arrangement. |

State if the

securities lending arrangement is subject to the exception provided in section 5.7 of NI 62-104.

Not applicable.

| 3.8 | If the acquiror or any of its joint actors is a party to an agreement, arrangement or understanding that

has the effect of altering, directly or indirectly, the acquiror’s economic exposure to the security of the class of securities

to which this report relates, describe the material terms of the agreement, arrangement or understanding. |

Not applicable.

Item 4 –

Consideration Paid

| 4.1 | State the value, in Canadian dollars, of any consideration paid or received per security and in total. |

Pursuant to the Arrangement, holders

of Common Shares received $15.50 cash and 0.5340 of a common share of the Purchaser (a “Crescent Point Share”) per

fully diluted Common Share.

Under the Arrangement, the Purchaser

issued an aggregate of 53,202,339 Crescent Point Shares and paid an aggregate of $ $1,544,262,366.83. The closing price of a Crescent

Point Share on the Toronto Stock Exchange on the last trading day prior to the completion of the Arrangement was $9.13 per Crescent Point

Share.

| 4.2 | In the case of a transaction or other occurrence that did not take place on a stock exchange or other

market that represents a published market for the securities, including an issuance from treasury, disclose the nature and value, in Canadian

dollars, of the consideration paid or received by the acquiror. |

See Item 4.1 above.

| 4.3 | If the securities were acquired or disposed of other than by purchase or sale, describe the method of

acquisition or disposition. |

Not applicable.

Item 5 –

Purpose of the Transaction

| 5.1 | State the purpose or purposes of the acquiror and any joint actors for the acquisition or disposition

of securities of the reporting issuer. Describe any plans or future intentions which the acquiror and any joint actors may have which

relate to or would result in any of the following: |

| a) | the acquisition of additional securities of the reporting issuer, or the disposition of securities

of the reporting issuer; |

| b) | a corporate transaction, such as a merger, reorganization or liquidation, involving the reporting issuer

or any of its subsidiaries; |

| c) | a sale or transfer of a material amount of the assets of the reporting issuer or any of its subsidiaries; |

| d) | a change in the board of directors or management of the reporting issuer, including any plans or intentions

to change the number or term of directors or to fill any existing vacancy on the board; |

| e) | a material change in the present capitalization or dividend policy of the reporting issuer; |

| f) | a material change in the reporting issuer’s business or corporate structure; |

| g) | a change in the reporting issuer’s charter, bylaws or similar instruments or another action which

might impede the acquisition of control of the reporting issuer by any person or company; |

| h) | a class of securities of the reporting issuer being delisted from, or ceasing to be authorized to be

quoted on, a marketplace; |

| i) | the issuer ceasing to be a reporting issuer in any jurisdiction of Canada; |

| j) | a solicitation of proxies from securityholders; |

| k) | an action similar to any of those enumerated above. |

The

purpose of the Arrangement was for the Purchaser to acquire all of the issued and outstanding Common Shares, such that Hammerhead would

become a wholly-owned subsidiary of the Purchaser.

As

a result of the Arrangement, each of Bryan Begley, J. Paul Charron, A. Stewart Hanlon, Robert M. Tichio, Scott Sobie, Michael Kohut, Jesal

Shah, and James AC McDermott resigned as directors of Hammerhead. The Purchaser appointed each of Craig Bryksa, Ken Lamont and Ryan Gritzfeldt,

to serve on the board of directors of Hammerhead. The Common Shares will be delisted from the Toronto Stock Exchange and the NASDAQ. Hammerhead

intends to submit an application to cease to be a reporting issuer in Alberta and Ontario under National Policy 11-206 Process for

Cease to be a Reporting Issuer Applications promptly upon the delisting of the Common Shares.

Item 6 –

Agreements, Arrangements, Commitments or Understandings With Respect to Securities of the Reporting Issuer

Describe the material terms of any agreements,

arrangements, commitments or understandings between the acquiror and a joint actor and among those persons and any person with respect

to securities of the class of securities to which this report relates, including but not limited to the transfer or the voting of any

of the securities, finder’s fees, joint ventures, loan or option arrangements, guarantees of profits, division of profits or loss,

or the giving or withholding of proxies. Include such information for any of the securities that are pledged or otherwise subject to a

contingency, the occurrence of which would give another person voting power or investment power over such securities, except that disclosure

of standard default and similar provisions contained in loan agreements need not be included.

See Item 2.2 above for information regarding the

Agreement.

Certain affiliates of Riverstone Holdings, LLC

(collectively “Riverstone”), being Hammerhead’s largest and controlling shareholder, and all of Hammerhead’s

directors and officers, holding an aggregate of approximately 82 percent of the Common Shares outstanding, have entered into voting support

agreements (the “Voting Support Agreements”) with Crescent Point to vote in favour of the Arrangement and against any

alternative or competing transaction.

Riverstone owns approximately seven percent of

the issued and outstanding Crescent Point Shares post-Arrangement. Riverstone has agreed, pursuant to a lock-up agreement (the “Lock-Up

Agreement”) entered into at the closing of the Arrangement, to hold 50 percent of the Crescent Point Shares it received pursuant

to the Arrangement for a period of at least three months following December 21, 2023 and has further agreed to hold the remaining 50 percent

of the Crescent Point Shares that it received pursuant to the Arrangement for a period of at least six months following December 21, 2023,

subject to the provisions of such Lock-Up Agreement.

The description of the terms of the Agreement,

the Voting Support Agreements and the Lock-up Agreement contained herein is a summary only and is qualified in its entirety by the terms

of the Agreement, the Voting Support Agreements and the form of Lock-up Agreement (which is appended to Riverstone’s Voting Support

Agreement), all of which are available on Hammerhead’s SEDAR+ profile at www.sedarplus.ca.

Item 7 –

Change in Material Fact

If applicable, describe any change in a material

fact set out in a previous report filed by the acquiror under the early warning requirements or Part 4 in respect of the reporting issuer’s

securities.

Not applicable.

Item 8 –

Exemption

Not applicable.

Item 9 –

Certification

I, as the acquiror,

certify, or I, as the agent filing this report on behalf of the acquiror, certify to the best of my knowledge, information and belief,

that the statements made in this report are true and complete in every respect.

Dated the 22nd day of December, 2023.

| |

crescent point energy corp. |

| |

|

|

| |

Per: |

/s/ Mark Eade |

| |

|

Name: Mark Eade |

| |

|

Title: Senior Vice President, General Counsel and Corporate Secretary |

[Signature Page – Early Warning Report]

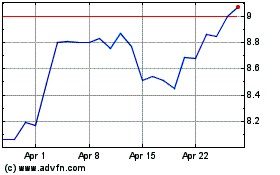

Crescent Point Energy (NYSE:CPG)

Historical Stock Chart

From Mar 2024 to Apr 2024

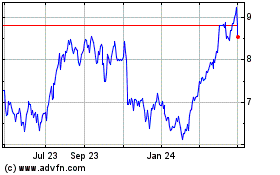

Crescent Point Energy (NYSE:CPG)

Historical Stock Chart

From Apr 2023 to Apr 2024