Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-256627

Prospectus Supplement

(to Prospectus dated June 11, 2021)

3,602,253 Shares of Common Stock

Pre-Funded Warrants to Purchase 3,442,583 Shares of Common Stock

We are offering 3,602,253 shares of our common stock (the "Shares") at a price of $0.64 per share, to investors pursuant to this prospectus supplement and the accompanying prospectus, and a securities purchase agreement with such investors. In a concurrent private placement, we are selling to such investors warrants to purchase up to 14,089,672 shares of our common stock (the “Warrants”). The Warrants will become exercisable on the effective date of such stockholder approval as may be required by the applicable rules and regulations of the Nasdaq Stock Market with respect to issuance of all of the Warrants and the common stock upon the exercise thereof. The Warrants will expire on the five-year anniversary from the receipt of the foregoing stockholder approval. The Warrants and the shares of our common stock issuable upon the exercise of the Warrants are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act of 1933, as amended (“Securities Act”), and/or Regulation D promulgated thereunder, and they are not being offered pursuant to this prospectus supplement and the accompanying prospectus.

We are also offering 3,442,583 pre-funded warrants in lieu of Shares to certain investors whose purchase of shares of common stock in this offering would otherwise result in the investor, together with its affiliates, beneficially owning more than 4.99% (or, at the election of the investor, 9.99%) of our common stock. Each pre-funded warrant will be exercisable for one share of our common stock. The purchase price of each pre-funded warrant will be equal to the price at which the Share and Warrant is sold to the public in this offering, minus $0.001, and the exercise price of each pre-funded warrant will be $0.001 per share. The pre-funded warrants will be immediately exercisable and may be exercised at any time until all of the pre-funded warrants are exercised in full. This offering also relates to the shares of common stock issuable upon exercise of any pre-funded warrants sold in this offering.

Walter V. Klemp, our Chief Executive Officer, Jonathan P. Foster, our Chief Financial Officer, certain other employees and advisors, and a member of our board of directors, have agreed to purchase an aggregate of 326,086 shares in this offering and Warrants to purchase an aggregate of up to 652,172 shares of common stock in the concurrent private placement on the same terms as the other investors participating in the offering, provided that such individuals have agreed that the purchase price per share of common stock shall be $0.69 per share.

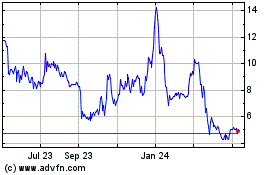

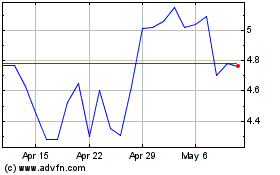

Our common stock is listed on The Nasdaq Capital Market, or Nasdaq, under the symbol “MBRX.” On December 20, 2023, the last reported sale price of our common stock on Nasdaq was $0.69 per share. The Warrants being issued in the concurrent private placement and the pre-funded warrants are not listed on any securities exchange, and we do not expect to list the Warrants or pre-funded warrants.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page S-7 of this prospectus supplement and the risk factors incorporated by reference into this prospectus supplement and the accompanying prospectus.

As of December 20, 2023, the aggregate market value of the voting and non-voting common equity held by non-affiliates, computed by reference to the price at which the common equity was last sold on December 19, 2023, was $20.42 million, based on 29,810,443 shares of outstanding common stock as of such date, of which 29,176,224 were held by non-affiliates. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities in a public primary offering with a value exceeding more than one-third of our public float in any 12-month period so long as our public float remains below $75.0 million. During the 12 calendar months prior to and including the date of this prospectus, we have sold $210,750 of securities pursuant to General Instruction I.B.6 of Form S-3.

We are selling the securities directly to the investors. We have retained Maxim Group LLC to act as placement agent in connection with the securities offered by this prospectus supplement and the accompanying prospectus. The placement agent is not purchasing the securities offered by us and are not required to sell any specific number or dollar amount of securities but have agreed to use their best efforts to solicit offers to purchase the securities offered by this prospectus supplement and the accompanying prospectus. There are no arrangements to place the funds raised in this offering in an escrow, trust or similar account. We have agreed to pay the placement agent a fee of 7% of the aggregate gross proceeds in this offering. See “Plan of Distribution” beginning on page S-14 of this prospectus supplement for more information regarding these arrangements.

| |

|

Per Share

|

|

|

Per Pre-

Funded

Warrant

|

|

|

Total(1)

|

|

|

Public offering price

|

|

$ |

0.64 |

|

|

$ |

0.639 |

|

|

$ |

4,524,999.34 |

|

|

Placement agent fees(2)

|

|

$ |

0.0448 |

|

|

$ |

0.0447 |

|

|

$ |

316,749.95 |

|

|

Proceeds, before expenses, to us

|

|

$ |

0.5952 |

|

|

$ |

0.5943 |

|

|

$ |

4,208,249.39 |

|

| |

(1)

|

Certain of our affiliates have agreed to purchase 326,086 shares in this offering at a purchase price per share of $0.69. The amounts set forth in “Total” reflect the increased purchase price for these shares. The amounts set forth in "Total" also assumes the full exercise of the pre-funded warrants.

|

| |

(2)

|

The placement agent will receive compensation in addition to the cash commission set forth above. See “Plan of Distribution” beginning on page S-14 of this prospectus supplement for more information regarding the compensation payable to the placement agent.

|

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

Delivery of the securities offered hereby is expected to be made on or about December 26, 2023, subject to the satisfaction of certain conditions.

Maxim Group LLC

The date of this prospectus supplement is December 20, 2023

TABLE OF CONTENTS

About This Prospectus Supplement

This prospectus supplement and the accompanying prospectus are part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”) utilizing a “shelf” registration process. Each time we conduct an offering to sell securities under the accompanying prospectus we will provide a prospectus supplement that will contain specific information about the terms of that offering, including the price, the amount of securities being offered and the plan of distribution. The shelf registration statement was initially filed with the SEC on May 28, 2021, and was declared effective by the SEC on June 11, 2021. This prospectus supplement describes the specific details regarding this offering and may add, update or change information contained in the accompanying prospectus. The accompanying prospectus provides general information about us and our securities, some of which, such as the section entitled “Plan of Distribution,” may not apply to this offering. This prospectus supplement and the accompanying prospectus are an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. We are not making offers to sell or solicitations to buy our common stock in any jurisdiction in which an offer or solicitation is not authorized or in which the person making that offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation.

If information in this prospectus supplement is inconsistent with the accompanying prospectus or the information incorporated by reference with an earlier date, you should rely on this prospectus supplement. This prospectus supplement, together with the base prospectus, the documents incorporated by reference into this prospectus supplement and the accompanying prospectus and any free writing prospectus we have authorized for use in connection with this offering include all material information relating to this offering. We have not, and the placement agent has not, authorized anyone to provide you with different or additional information and you must not rely on any unauthorized information or representations. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus, the documents incorporated by reference in this prospectus supplement and the accompanying prospectus and any free writing prospectus we have authorized for use in connection with this offering is accurate only as of the respective dates of those documents. Our business, financial condition, results of operations and prospects may have changed since those dates. You should carefully read this prospectus supplement, the accompanying prospectus and the information and documents incorporated herein by reference herein and therein, as well as any free writing prospectus we have authorized for use in connection with this offering, before making an investment decision. See “Incorporation by Reference” and “Where You Can Find More Information” in this prospectus supplement and in the accompanying prospectus.

No action is being taken in any jurisdiction outside the United States to permit a public offering of these securities or possession or distribution of this prospectus supplement or the accompanying prospectus in that jurisdiction. Persons who come into possession of this prospectus supplement and the accompanying prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus supplement and the accompanying prospectus applicable to that jurisdiction.

This prospectus supplement and the accompanying prospectus contain summaries of certain provisions contained in some of the documents described herein which are summaries only and are not intended to be complete. Reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the full text of the actual documents, some of which have been filed or will be filed and incorporated by reference herein. See “Where You Can Find More Information” in this prospectus supplement. We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference into this prospectus supplement or the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

This prospectus supplement and the accompanying prospectus contain and incorporate by reference certain market data and industry statistics and forecasts that are based on Company-sponsored studies, independent industry publications and other publicly available information. Although we believe these sources are reliable, estimates as they relate to projections involve numerous assumptions, are subject to risks and uncertainties, and are subject to change based on various factors, including those discussed under “Risk Factors” in this prospectus supplement and the accompanying prospectus and under similar headings in the documents incorporated by reference herein and therein. Accordingly, investors should not place undue reliance on this information.

Unless otherwise stated or the context requires otherwise, all references in this prospectus supplement to the “Company,” “we,” “us,” “our”, “MBI” and “Moleculin” refer to Moleculin Biotech, Inc., a Delaware corporation, and its wholly-owned subsidiaries..

Prospectus Supplement Summary

This summary highlights information contained elsewhere in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein. This summary does not contain all of the information that you should consider before deciding to invest in our securities. You should read this entire prospectus supplement and the accompanying prospectus carefully, including the section entitled “Risk Factors” beginning on page S-7 and our consolidated financial statements and the related notes and the other information incorporated by reference into this prospectus supplement and the accompanying prospectus, before making an investment decision.

Our Company

We are a clinical stage pharmaceutical company with a growing pipeline, including Phase 2 clinical programs for hard-to-treat cancers and viruses. We have three core technologies, each of which have had one or more drugs successfully complete a Phase 1 clinical trial (subject to publishing final Clinical Study Report), based substantially on discoveries made at and licensed from MD Anderson Cancer Center (MD Anderson) in Houston, Texas. Three of our six drug candidates have shown human activity in clinical trials and are currently in Phase 1b/2 or Phase 2 clinical trials. Since our inception, our drugs have completed, are currently in, or have received approval to proceed in eleven clinical trials.

Our core technologies consist of the following: a) Annamycin or L-Annamycin is a “next generation” anthracycline designed to be different than currently approved anthracyclines, which are limited in utility because of cardiotoxicity risks and their susceptibility to multidrug resistance mechanisms. Annamycin was designed to avoid multidrug resistance and to be non-cardiotoxic and has shown no cardiotoxicity in subjects treated in clinical trials to date. Furthermore, we have demonstrated safe dosing beyond the dose limitations imposed by regulatory authorities upon currently prescribed anthracyclines due to their inherent cardiotoxicity; b) our WP1066 Portfolio, which includes WP1066 and WP1220, two of several Immune/Transcription Modulators in the portfolio designed to inhibit p-STAT3 (phosphorylated signal transducer and activator of transcription 3) among other transcription factors associated with tumor activity, while also stimulating a natural immune response to tumors by inhibiting the errant activity of Regulatory T-Cells (TRegs); and c) our WP1122 Portfolio, which contains compounds (including WP1122, WP1096, and WP1097) designed to exploit the potential uses of inhibitors of glycolysis such as 2-deoxy-D-glucose (2-DG), which we believe may provide an opportunity to cut off the fuel supply of tumors by taking advantage of their high level of dependence on glucose in comparison to healthy cells, as well as viruses that depend upon glycolysis and glycosylation to infect and replicate.

Recent Developments

On December 20, 2023, our Board of Directors adopted the Fourth Amended and Restated Bylaws of Moleculin Biotech, Inc. (as amended and restated, the “Bylaws”), effective on such date. The changes to the Bylaws include a clarification that all matters presented to the stockholders of the Company at a duly called or convened meeting at which a quorum is present (other than the election of directors, which shall be a plurality of the votes cast) shall be decided by the affirmative vote of the holders of a majority in voting power of the votes cast (excluding abstentions and broker nonvotes) on such matter.

On December 11, 2023, we announced the presentation of preliminary efficacy findings from our ongoing European Phase 1B/2 clinical trial evaluating Annamycin for the treatment of acute myeloid leukemia or AML (MB-106) to key opinion leaders and current investigators at a meeting held in conjunction with the 65th American Society of Hematology Meeting and Exposition on December 10, 2023.

The presentation included an update to the positive preliminary efficacy findings previously reported on MB-106. To date, among patients who had an evaluable post treatment bone marrow biopsy, or who dropped out due to an adverse event (AE), there have been 4 complete responses (CRs) or 36% of the intent to treat (ITT) subjects (n=11) and 44% of the subjects treated (dosed with Annamycin) (n=9). Two subjects experienced adverse events and were not dosed with one being an allergic reaction to Annamycin, the first we have seen in over 70 subjects dosed in our multiple Annamycin clinical trials; the second dropout was due to an allergic reaction to cytarabine. There continues to be no evidence of cardiotoxicity as measured by ejection fraction, strain analyses, ECGs, and cardiac biomarkers including Troponin-I and T in MB-106.

Currently, the median age of subjects in MB-106 is 69 years with a median number of prior therapies for AML of one. While two of the complete responders are too recent to measure durability, we has seen durability as high as 8 months and increasing, and we have yet to see any relapses of CRs experienced to date in the trial. We have recruited 16 subjects to date with 2 subjects withdrawing from the trial due to adverse events and 3 other subjects having received treatment and not having the bone marrow aspirate fully evaluated.

Additionally, one of the subjects treated but not evaluated experienced a grade 4 serious adverse event (SAE) with septic shock caused by Escherichia coli (E. coli) and was reported on a Suspect Adverse Reaction Report to the appropriate regulatory bodies and ethics committees. The subject was treated for the infection, the SAE is still reported as “ongoing,” and the subject is recovering. This subject will be evaluated until resolution of the SAE and will be assessed for efficacy per protocol.

The Offering

|

Common Stock Offered by Us

|

3,602,253 shares of common stock (the “Shares”).

|

| |

|

|

Pre-funded Warrants Offered by Us

|

We are also offering 3,442,583 pre-funded warrants in lieu of Shares to certain investors whose purchase of shares of common stock in this offering would otherwise result in the investor, together with its affiliates, beneficially owning more than 4.99% (or, at the election of the investor, 9.99%) of our common stock. Each pre-funded warrant will be exercisable for one share of our common stock. The purchase price of each pre-funded warrant will equal the price at which a share of common stock is being sold to the public in this offering, minus $0.001, and the exercise price of each pre-funded warrant will be $0.001 per share. The pre-funded warrants will be exercisable immediately and may be exercised at any time until all of the pre-funded warrants are exercised in full. This offering also relates to the shares of common stock issuable upon exercise of any pre-funded warrants sold in this offering.

|

| |

|

|

Common Stock to be Outstanding After This Offering

|

33,412,696, assuming no exercise of the pre-funded warrants; 36,855,279, assuming full exercise of the pre-funded warrants (in each case assuming no exercise of the Warrants issued in the concurrent private placement).

|

| |

|

|

Concurrent Offering

|

In a concurrent private placement, we are selling to the investors of shares of our common stock in this offering Warrants to purchase up to 14,089,672 shares of common stock, which represent 200% of the number of shares of our common stock (or pre-funded warrants in lieu thereof) being purchased in this offering. We will receive gross proceeds from the concurrent private placement transaction solely to the extent such warrants are exercised for cash. The Warrants will become exercisable on or after the effective date of such stockholder approval as may be required by the applicable rules and regulations of the Nasdaq Stock Market with respect to issuance of all of the Warrants and the common stock upon the exercise thereof. The Warrants will expire on the five-year anniversary of the receipt of the foregoing stockholder approval.

The Warrants and the shares of our common stock issuable upon the exercise of the Warrants are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and/or Regulation D promulgated thereunder, and they are not being offered pursuant to this prospectus supplement and the accompanying prospectus. See “Private Placement of Warrants” on page S-11 of this prospectus supplement for a more complete description of the concurrent offering.

|

|

Use of Proceeds

|

We expect to receive net proceeds of approximately $4.0 million from this offering, excluding the proceeds, if any, for the exercise of the Warrants issued in the concurrent private placement, after deducting the placement agent’s fees and estimated offering expenses payable by us. We intend to use the net proceeds from this offering for working capital and for general corporate purposes. See “Use of Proceeds” on page S-10 of the prospectus supplement for a more complete description of the intended use of proceeds from this offering.

|

| |

|

| Insider Participation |

Walter V. Klemp, our Chief Executive Officer, Jonathan P. Foster, our Chief Financial Officer, certain other employees and advisors, and a member of our board of directors, have agreed to purchase an aggregate of 326,086 shares in this offering and Warrants to purchase an aggregate of up to 652,172 shares of common stock in the concurrent private placement on the same terms as the other investors participating in the offering, provided that such individuals have agreed that the purchase price per share of common stock shall be $0.69 per share. |

| |

|

|

Risk Factors

|

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page S-7 of this prospectus supplement and the risk factors incorporated by reference into this prospectus supplement and the accompanying prospectus.

|

| |

|

|

Nasdaq Capital Market Symbol

|

MBRX.

|

| The number of shares of common stock expected to be outstanding after this offering is based on 29,810,443 shares of common stock outstanding as of December 20, 2023 and excludes, as of that date, the following: |

| |

•

|

3,741,371 shares of common stock issuable upon the exercise of outstanding vested and unvested stock options at a weighted average exercise price of $3.76 per share;

|

| |

• |

3,050,010 shares of common stock issuable upon the exercise of outstanding warrants with a weighted average exercise price of $6.24 per share; |

| |

• |

1,408,343 shares of common stock issuable upon the vesting of restricted stock units; |

| |

• |

up to an aggregate of 56,064 shares of common stock reserved for future issuance under our equity plan, as amended; and |

| |

• |

14,089,672 shares of our common stock issuable upon the exercise of the Warrants offered in the concurrent private placement. |

|

Unless otherwise indicated, all information in this prospectus supplement:

|

| |

●

|

assumes no exercise or conversion of the outstanding securities described above; and

|

| |

● |

assumes no exercise of the Warrants offered in the concurrent private placement or the pre-funded warrants. |

Risk Factors

An investment in our securities involves risks. We urge you to consider carefully the risks described below, and in the documents incorporated by reference in this prospectus supplement and the accompanying prospectus, before making an investment decision, including those risks identified under “Item IA. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022, which is incorporated by reference in this prospectus supplement and which may be amended, supplemented or superseded from time to time by other reports that we subsequently file with the SEC. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be seriously harmed. This could cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment. Please also read carefully the section below entitled “Cautionary Note Regarding Forward-Looking Statements”.

Risks Related to this Offering

Our management will have broad discretion over the use of the net proceeds from this offering, you may not agree with how we use the proceeds, and the proceeds may not be invested successfully.

Our management will have broad discretion in the application of the net proceeds from this offering, and our stockholders will not have the opportunity as part of their investment decision to assess whether the net proceeds are being used appropriately. Because of the number and variability of factors that will determine our use of the net proceeds from this offering, their ultimate use may vary substantially from their currently intended use. The failure by our management to apply these funds effectively could harm our business. See “Use of Proceeds” on page S-10 of this prospectus supplement for a description of our proposed use of proceeds from this offering.

We will require additional capital funding, the receipt of which may impair the value of our common stock.

Our future capital requirements depend on many factors, including our research, development, sales and marketing activities. We will need to raise additional capital through public or private equity or debt offerings or through arrangements with strategic partners or other sources in order to continue to develop our drug candidates. There can be no assurance that additional capital will be available when needed or on terms satisfactory to us, if at all. To the extent we raise additional capital by issuing equity securities, our stockholders may experience substantial dilution and the new equity securities may have greater rights, preferences or privileges than our existing common stock.

We do not intend to pay dividends in the foreseeable future.

We have never paid cash dividends on our common stock and currently do not plan to pay any cash dividends in the foreseeable future.

There is no public market for the pre-funded warrants being offered by us in this offering.

There is no established public trading market for the pre-funded warrants being offered in this offering, and we do not expect a market to develop. In addition, we do not intend to apply to list the pre-funded warrants on any national securities exchange or other nationally recognized trading system, including Nasdaq. Without an active market, the liquidity of the pre-funded warrants will be limited.

Holders of pre-funded warrants purchased in this offering will have no rights as common stockholders until such holders exercise their pre-funded warrants and acquire our common stock.

Until holders of pre-funded warrants acquire shares of our common stock upon exercise thereof, such holders will have no rights with respect to the shares of our common stock underlying the pre-funded warrants. Upon exercise of the pre-funded warrants, the holders will be entitled to exercise the rights of a common stockholder only as to matters for which the record date occurs after the exercise date.

Cautionary Note Regarding Forward-Looking Statements

This prospectus supplement, the accompanying prospectus and the documents we have filed with the SEC that are incorporated by reference herein and therein contain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements concern our current plans, intentions, beliefs, expectations and statements of future economic performance. Statements containing terms such as “will,” “may,” “believe,” “do not believe,” “plan,” “expect,” “intend,” “estimate,” “anticipate” and other phrases of similar meaning are considered to be forward-looking statements.

Forward-looking statements include, but are not limited to, statements about:

| |

●

|

Our ability to continue our relationship with MD Anderson, including, but not limited to, our ability to maintain current licenses and license future intellectual property resulting from our sponsored research agreements with MD Anderson;

|

| |

●

|

The success or the lack thereof, including the ability to recruit subjects on a timely basis, for a variety of reasons, of our clinical trials through all phases of clinical development;

|

| |

●

|

Our ability to satisfy any requirements imposed by the US Food & Drug Administration (FDA) (or its foreign equivalents) as a condition of our clinical trials proceeding or beginning as planned;

|

| |

●

|

World-wide events including the war in Ukraine, conflicts in the Middle East, the COVID-19 pandemic, and the general supply chain shortages effects on our clinical trials, clinical drug candidate supplies, preclinical activities and our ability to raise future financing;

|

| |

●

|

Our ability to obtain additional funding to commence or continue our clinical trials, fund operations and develop our product candidates;

|

| |

●

|

The need to obtain and retain regulatory approval of our drug candidates, both in the United States and in Europe, and in countries deemed necessary for future trials;

|

| |

●

|

Our ability to complete our clinical trials in a timely fashion and within our expected budget and resources;

|

| |

●

|

Compliance with obligations under intellectual property licenses with third parties;

|

| |

●

|

Any delays in regulatory review and approval of drug candidates in clinical development;

|

| |

●

|

Potential efficacy of our drug candidates;

|

| |

●

|

Our ability to commercialize our drug candidates;

|

| |

●

|

Market acceptance of our drug candidates;

|

| |

●

|

Competition from existing therapies or new therapies that may emerge;

|

| |

●

|

Potential product liability claims;

|

| |

●

|

Our dependency on third-party manufacturers to successfully, and timely, supply or manufacture our drug candidates for our preclinical work and our clinical trials;

|

| |

●

|

Our ability to establish or maintain collaborations, licensing or other arrangements;

|

| |

●

|

The ability of our sublicense partners to successfully develop our product candidates in accordance with our sublicense agreements;

|

| |

●

|

Our ability and third parties’ abilities to protect intellectual property rights;

|

| |

●

|

Our ability to adequately support future growth; and

|

| |

●

|

Our ability to attract and retain key personnel to manage our business effectively.

|

Forward-looking statements are based on our assumptions and are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those reflected in or implied by these forward-looking statements. Factors that might cause actual results to differ include, among others, those set forth under “Risk Factors” in this prospectus supplement and those discussed in “Management’s Discussion and Analysis of Financial Condition and Results of Operation” in our most recent Annual Report on Form 10-K and in our future reports filed with the SEC, all of which are incorporated by reference herein. Readers are cautioned not to place undue reliance on any forward-looking statements contained in this prospectus supplement, the accompanying prospectus or the documents we have filed with the SEC that are incorporated by reference herein and therein, which reflect management’s views and opinions only as of their respective dates. We assume no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting such forward-looking statements, except to the extent required by applicable securities laws.

You should carefully read this prospectus supplement, the accompanying prospectus and the information incorporated herein by reference as described under the heading “Incorporation by Reference,” and the documents that we reference in this prospectus supplement and the accompanying prospectus and have filed as exhibits to the registration statement of which this prospectus supplement and the accompanying prospectus are a part with the understanding that our actual future results, levels of activity, performance and achievements may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

Use of Proceeds

We estimate that the net proceeds from this offering will be approximately $4.0 million, after deducting the estimated placement agent fees and estimated offering expenses payable by us, assuming all of the Shares (or pre-funded warrants) offered hereby are sold. This estimate excludes the proceeds, if any, from exercise of the Warrants issued in the concurrent private placement.

We intend to use the net proceeds from this offering for working capital and for general corporate purposes. This represents our best estimate of the manner in which we will use the net proceeds we receive from this offering based upon the current status of our business, but we have not reserved or allocated amounts for specific purposes and we cannot specify with certainty how or when we will use any of the net proceeds. Amounts and timing of our actual expenditures will depend on numerous factors. Our management will have broad discretion in applying the net proceeds from this offering.

Pending application of the net proceeds as described above, we intend to invest the proceeds to us in investment-grade, interest-bearing securities such as money market funds, certificates of deposit, or direct or guaranteed obligations of the U.S. government, or hold as cash. We cannot predict whether the proceeds invested will yield a favorable, or any, return.

Dividend Policy

We have never declared or paid any cash dividends on our capital stock, and we do not currently intend to pay any cash dividends on our common stock for the foreseeable future. We expect to retain future earnings, if any, to fund the development and growth of our business. Any future determination to pay dividends on our common stock will be at the discretion of our board of directors and will depend upon, among other factors, our results of operations, financial condition, capital requirements and any contractual restrictions.

Private Placement of Warrants

Concurrently with the closing of the sale of Shares of common stock in this offering, we also expect to issue and sell to the investors, Warrants to purchase an aggregate of up to 14,089,672 shares of our common stock. The Warrants will become exercisable on or after the effective date of such stockholder approval as may be required by the applicable rules and regulations of the Nasdaq Stock Market with respect to issuance of all of the Warrants and the common stock upon the exercise thereof. The Warrants will expire on the five-year anniversary from the receipt of the foregoing stockholder approval.

Subject to limited exceptions, a holder of Warrants will not have the right to exercise any portion of its Warrants if the holder, together with its affiliates, would beneficially own in excess of 4.99% (or, at the election of the purchaser prior to issuance of the Warrants, 9.99%) of the number of shares of our common stock outstanding immediately after giving effect to such exercise. A holder may increase or decrease the beneficial ownership limitation up to 9.99%, provided, however, that any increase in the beneficial ownership limitation shall not be effective until 61 days following notice of such change to the Company.

In the event of a Fundamental Transaction (as defined in the Warrant), we or any successor entity shall, at the holder’s option, purchase the holder’s Warrants for an amount of cash equal to the value of the Warrants as determined in accordance with the Black Scholes Value (as defined in the Warrant), provided that if the Fundamental Transaction involves a change of control (as described in the Warrant) and it is not within our control, including not approved by our Board of Directors, a holder shall only be entitled to receive the same type or form of consideration at the Black Scholes Value of the unexercised portion of the Warrant, that is being offered and paid to the holders of our common stock in connection with the Change of Control.

Such securities will be issued and sold without registration under the Securities Act, or state securities laws, in reliance on the exemptions provided by Section 4(a)(2) of the Act and/or Regulation D promulgated thereunder and in reliance on similar exemptions under applicable state laws. Accordingly, the investor may exercise those Warrants and sell the underlying shares only pursuant to an effective registration statement under the Securities Act covering the resale of those shares, an exemption under Rule 144 under the Securities Act, or another applicable exemption under the Securities Act. We have agreed to file a registration statement with the SEC registering the resale of the shares of common stock underlying the Warrants as soon as practicable (and in any event within 45 calendar days of the date of the Purchase Agreement).

Description of the Securities We are Offering

We are offering Shares (or pre-funded warrants) in this offering (and the shares of our common stock issuable from time to time upon exercise of the pre-funded Warrants).

Common Stock

The material terms and provisions of our common stock are described under the caption “Description of Common Stock” starting on page 4 of the accompanying prospectus.

Pre-Funded Warrants

The following summary of certain terms and provisions of the pre-funded warrants that are being offered hereby is not complete and is subject to, and qualified in its entirety by, the provisions of the pre-funded warrants, the form of which will be filed as an exhibit to a Current Report on Form 8-K in connection with this offering and incorporated by reference into the registration statement of which this prospectus supplement forms a part. Prospective investors should carefully review the terms and provisions of the form of pre-funded warrant for a complete description of the terms and conditions of the pre-funded warrants.

Exercise Price and Duration

Each pre-funded warrant has an exercise price of $0.001 per share. The pre-funded warrants will be immediately exercisable and may be exercised at any time until the pre-funded warrants are exercised in full. The exercise price and number of shares of common stock issuable upon exercise is subject to appropriate adjustment in the event of stock dividends, stock splits, reorganizations or similar events affecting our common stock and the exercise price, and also upon any distribution of assets, including cash, stock, or other property to our stockholders.

Exercisability

The pre-funded warrants will be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice accompanied by payment in full for the number of shares of our common stock purchased upon such exercise (except in the case of a cashless exercise as discussed below). A holder (together with its affiliates) may not exercise any portion of such holder’s pre-funded warrant to the extent that the holder would own more than 4.99% of the outstanding shares of common stock immediately after exercise, provided that upon at least 61 days’ prior notice from the holder to us, the holder may increase this beneficial ownership limit to up to 9.99% of the number of shares of common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the pre-funded warrants. No fractional shares of common stock will be issued in connection with the exercise of a pre-funded warrant. In lieu of fractional shares, we will either pay the holder an amount in cash equal to the fractional amount multiplied by the exercise price or round up to the next whole share.

Cashless Exercise

In lieu of making the cash payment otherwise contemplated to be made to us upon such exercise in payment of the aggregate exercise price, the holder may elect instead to receive upon such exercise (either in whole or in part) the net number of shares of common stock determined according to a cashless exercise formula set forth in the pre-funded warrant.

Fundamental Transaction

In the event of any fundamental transaction, as described in the pre-funded warrants and generally including any merger with or into another entity, sale of all or substantially all of our assets, tender offer or exchange offer, or reclassification of our shares of common stock, then upon any subsequent exercise of a pre-funded warrant, the holder will have the right to receive as alternative consideration, for each share of common stock that would have been issuable upon such exercise immediately prior to the occurrence of such fundamental transaction, the number of shares of common stock of the successor or acquiring corporation of our company, if it is the surviving corporation, and any additional consideration receivable upon or as a result of such transaction by a holder of the number of shares of common stock for which the pre-funded warrant is exercisable immediately prior to such event.

Transferability

Subject to applicable laws, a pre-funded warrant may be transferred at the option of the holder upon surrender of the pre-funded warrant to us together with the appropriate instruments of transfer and payment of funds sufficient to pay any transfer taxes (if applicable).

Exchange Listing

There is no trading market for the pre-funded warrants on any securities exchange or nationally recognized trading system, and we do not expect a market to develop. We do not intend to list the pre-funded warrants on any securities exchange or nationally recognized trading system.

Right as a Stockholder

Except as otherwise provided in the pre-funded warrants or by virtue of such holder’s ownership of shares of our common stock, the holders of the pre-funded warrants do not have the rights or privileges of holders of our common stock, including any voting rights, until they exercise their pre-funded warrants.

Plan of Distribution

We have engaged Maxim Group LLC to act as our placement agent pursuant to a placement agent agreement in connection with this offering, dated as of December 20, 2023. The placement agent is not purchasing or selling any of the securities we are offering by this prospectus supplement but have agreed to use their best efforts to arrange for the sale of the Shares (or pre-funded warrants) offered by this prospectus supplement. The placement agent may retain sub-agents and selected dealers in connection with this offering.

We have entered into securities purchase agreements, each dated December 20, 2023, directly with several investors who have agreed to purchase the securities in this offering. The securities purchase agreements and the placement agent agreement provide that the obligations of the placement agent and the investors are subject to certain conditions precedent, including, among other things, the absence of any material adverse change in our business and the receipt of customary opinions and closing certificates.

We currently anticipate that the closing of this offering will take place on or about December 26, 2023, subject to customary closing conditions. On the closing date, the following will occur:

| |

●

|

we will receive funds in the amount of the aggregate purchase price;

|

| |

|

|

| |

●

|

the placement agent will receive the placement agent fees in accordance with the terms of the placement agent agreement; and

|

| |

|

|

| |

●

|

we will deliver the shares of our common stock (or pre-funded warrants) to the investors.

|

Fees and Expenses

We have agreed to pay the placement agent a placement agent fee in cash equal to 7% of the gross proceeds from the sale of the securities in this offering.

The following table shows the per share and total cash placement agent’s fees we will pay to the placement agent in connection with the sale of the securities offered pursuant to this prospectus supplement and the accompanying prospectus, assuming the purchase of all of the securities offered hereby.

| |

|

Per Share

|

|

Per Pre-Funded Warrant

|

Total (1)

|

|

|

Public offering price

|

|

$

|

0.64

|

$

|

0.639

|

$

|

4,524,999.34

|

|

|

Placement agent fees

|

|

$

|

0.0448

|

$

|

0.0447

|

$

|

316,749.95

|

|

|

Proceeds, before expenses, to us

|

|

$

|

0.5952

|

$

|

0.5943

|

$

|

4,208,249.39

|

|

(1) Certain of our affiliates have agreed to purchase 326,086 shares in this offering at a purchase price per share of $0.69. The amounts set forth in "Total" reflect the increased purchase price for these shares. The amounts set forth in "Total" also assumes the full exercise of the pre-funded warrants.

In addition, we have agreed to reimburse the placement agent at the closing for its legal fees and expenses in connection with this offering in the amount of $85,000.

We estimate the total expenses of this offering (including the expenses reimbursable to the placement agent) payable by us, excluding the placement agent fee, will be approximately $200,000.

We have agreed to indemnify the placement agent and certain other persons against certain liabilities relating to or arising out of the placement agents’ activities under the placement agency agreement. We have also agreed to contribute to payments the placement agent may be required to make in respect of such liabilities.

The placement agent may be deemed to be underwriters within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by them and any profit realized on the resale of the shares sold by them while acting as principal might be deemed to be underwriting discounts or commissions under the Securities Act. As an underwriter, the placement agent would be required to comply with the requirements of the Securities Act and the Exchange Act, including, without limitation, Rule 415(a)(4) under the Securities Act and Rule 10b-5 and Regulation M under the Exchange Act. These rules and regulations may limit the timing of purchases and sales of shares of common stock by the placement agent acting as principal. Under these rules and regulations, the placement agent:

| |

●

|

must not engage in any stabilization activity in connection with our securities; and

|

| |

|

|

| |

●

|

must not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than as permitted under the Exchange Act, until it has completed its participation in the distribution.

|

A copy of the form of the securities purchase agreements we entered into with the investors and the placement agency agreement we entered with Maxim Group LLC will be included as an exhibit to our Current Report on Form 8-K that will be filed with the Securities and Exchange Commission in connection with the consummation of this offering.

Lock-Up Agreements

We and our executive officers and directors have agreed to a “lock-up” with respect to shares of our common stock and other securities beneficially owned, including securities that are convertible into, or exchangeable or exercisable for, shares of our common stock for a period ending 60 days after the closing of this offering. Subject to certain exceptions, during such lock-up period following the closing of this offering, we and our executive officers and directors may not offer, sell, pledge or otherwise dispose of these securities without the prior written consent of the placement agent.

Tail Fee

We have agreed to pay the placement agent a tail fee qual to the cash compensation in this offering, if any investor, who was contacted or introduced to us by the placement agent during the term of its engagement, provides us with capital in any financing of equity, equity-linked, convertible or debt or other capital raising activity during the 30 day period beginning from the closing of this offering.

Discretionary Accounts

The placement agent does not intend to confirm sales of the securities offered hereby to any accounts over which it has discretionary authority.

Listing

Our common stock is listed on The Nasdaq Capital Market under the symbol “MBRX.”

Other Relationships

The placement agent and certain of its affiliates are full service financial institutions engaged in various activities, which may include securities trading, commercial and investment banking, financial advisory, investment management, investment research, principal investment, hedging, financing and brokerage activities. The placement agent and certain of its affiliates have, from time to time, performed, and may in the future perform, various commercial and investment banking and financial advisory services for us and our affiliates, for which they received or will receive customary fees and expenses.

In the ordinary course of their various business activities, the placement agent and certain of its affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the accounts of their customers, and such investment and securities activities may involve securities and/or instruments issued by us and our affiliates. If the placement agent or its affiliates have a lending relationship with us, they routinely hedge their credit exposure to us consistent with their customary risk management policies. The placement agent and its affiliates may hedge such exposure by entering into transactions that consist of either the purchase of credit default swaps or the creation of short positions in our securities or the securities of our affiliates, including potentially the securities offered hereby. Any such short positions could adversely affect future trading prices of the securities offered hereby. The placement agent and certain of its affiliates may also communicate independent investment recommendations, market color or trading ideas and/or publish or express independent research views in respect of such securities or instruments and may at any time hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

Legal Matters

The validity of the securities offered hereby will be passed upon for us by ArentFox Schiff LLP, Washington, DC. Ellenoff Grossman & Schole LLP, New York, New York, is acting as counsel for the placement agent in connection with this offering.

Experts

The audited financial statements incorporated by reference in this prospectus and elsewhere in the registration statement have been incorporated by reference in reliance upon the report of Grant Thornton LLP, independent registered public accountants, upon the authority of said firm as experts in accounting and auditing.

Incorporation by Reference

The SEC allows us to “incorporate by reference” into this prospectus supplement the information in other documents that we file with it. This means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be a part of this prospectus supplement, and information in documents that we file later with the SEC will automatically update and supersede information contained in documents filed earlier with the SEC or contained in this prospectus supplement. We incorporate by reference in this prospectus supplement the documents listed below and any future filings that we may make with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act prior to the termination of the offering under this prospectus supplement; provided, however, that we are not incorporating, in each case, any documents or information deemed to have been furnished and not filed in accordance with SEC rules:

| |

●

|

Our Annual Report on Form 10-K for the year ended December 31, 2022 (filed on March 22, 2023);

|

| |

●

|

Our Quarterly Reports on Form 10-Q for the quarter ended March 31, 2023 (filed on May 10, 2023); for the quarter ended June 30, 2023 (filed on August 10, 2023); and for the quarter ended September 30, 2023 (filed on November 13, 2023);

|

| |

●

|

the description of our common stock, par value $0.001 per share contained in our Registration Statement on Form 8-A, dated and filed with the SEC on April 28, 2016, and any amendment or report filed with the SEC for the purpose of updating the description.

|

All reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of this offering will also be incorporated by reference in this prospectus supplement and deemed to be part of this prospectus supplement from the date of the filing of such reports and documents. We are not, however, incorporating by reference any documents or portions thereof, whether specifically listed above or filed in the future, that are not deemed “filed” with the SEC, including any information furnished pursuant to Items 2.02 or 7.01 of Form 8-K or related exhibits furnished pursuant to Item 9.01 of Form 8-K.

You may obtain a copy of any or all of the documents referred to above, which may have been or may be incorporated by reference into this prospectus supplement, including exhibits, at no cost to you by writing or telephoning us at the following address: Attention: Corporate Secretary, 5300 Memorial Drive, Suite 950, Houston, Texas 77007, telephone (713) 300-5160.

Where You Can Find More Information

This prospectus supplement and the accompanying prospectus are part of a registration statement on Form S-3 we filed with the SEC under the Securities Act and do not contain all the information set forth or incorporated by reference in the registration statement. Whenever a reference is made in this prospectus supplement or the accompanying prospectus to any of our contracts, agreements or other documents, the reference may not be complete and you should refer to the exhibits that are a part of the registration statement or the exhibits to the reports or other documents incorporated by reference into this prospectus supplement or the accompanying prospectus for a copy of such contract, agreement or other document. Because we are subject to the information and reporting requirements of the Exchange Act, we file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy information filed by us with the SEC at the SEC’s public reference section, 100 F Street, N.E., Washington, D.C. 20549. Information regarding the operation of the public reference section can be obtained by calling 1-800-SEC-0330. The SEC also maintains an Internet site at http://www.sec.gov that contains reports, statements and other information about issuers, such as us, who file electronically with the SEC.

We also maintain a website at www.moleculin.com through which you can access our SEC filings free of charge. The information set forth on our website is not part of this prospectus.

PROSPECTUS

$200,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

Units

We may from time to time issue up to $200,000,000 aggregate dollar amount of common stock, preferred stock, debt securities, warrants or units of securities. We will specify in the accompanying prospectus supplement the terms of the securities to be offered and sold. We may sell these securities directly to you, through underwriters, dealers or agents we select, or through a combination of these methods. We will describe the plan of distribution for any particular offering of these securities in the applicable prospectus supplement. This prospectus may not be used to sell our securities unless it is accompanied by a prospectus supplement.

Our common stock is listed on The NASDAQ Capital Market and traded under the symbol "MBRX". On May 27, 2021, the closing price of the common stock, as reported on NASDAQ was $3.65 per share.

Investing in our securities is highly speculative and involves a high degree of risk. You should purchase these securities only if you can afford a complete loss of your investment. You should carefully consider the risks and uncertainties described under the heading "Risk Factors" beginning on page 3 of this prospectus before making a decision to purchase our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is June 11, 2021.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, utilizing a "shelf" registration process. Under this shelf registration process, we may sell the securities described in this prospectus in one or more offerings up to a total dollar amount of $200,000,000.

We have provided to you in this prospectus a general description of the securities we may offer. Each time we sell securities under this shelf registration process, we will provide a prospectus supplement that will contain specific information about the terms of that offering. That prospectus supplement may include additional risk factors or other special considerations applicable to the securities being offered. We may also add, update or change in the prospectus supplement any of the information contained in this prospectus. To the extent there is a conflict between the information contained in this prospectus and the prospectus supplement, you should rely on the information in the prospectus supplement, provided that if a statement in any document is inconsistent with a statement in another document having a later date - for example, a document incorporated by reference in this prospectus or any prospectus supplement - the statement in the document having the later date modifies or supersedes the earlier statement. You should read both this prospectus and the prospectus supplement together with the additional information described under "Where You Can Find More Information."

The registration statement containing this prospectus, including the exhibits to the registration statement, provides additional information about us and the securities offered under this prospectus. The registration statement, including the exhibits, can be read at the SEC website or at the SEC offices mentioned under the heading "Where You Can Find More Information."

You should rely only on the information incorporated by reference or provided in this prospectus and the accompanying prospectus supplement. We have not authorized anyone to provide you with different information. We are not making an offer to sell or soliciting an offer to buy these securities in any jurisdiction in which the offer or solicitation is not authorized or in which the person making the offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make the offer or solicitation. You should not assume that the information in this prospectus or the accompanying prospectus supplement is accurate as of any date other than the date on the front of the document.

Unless the context requires otherwise, references to the "Company, " "we," "our," and "us," refer to Moleculin Biotech, Inc. and its subsidiaries, except that such terms refer to only Moleculin Biotech, Inc. and not its subsidiaries in the sections entitled "Description of Common Stock," "Description of Preferred Stock," "Description of Warrants," "Description of the Debt Securities," and "Description of the Stock Purchase Contracts and Stock Purchase Units."

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-3 under the Securities Act with respect to the securities offered in this offering. We file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission. You may read and copy the registration statement and any other documents we have filed at the Securities and Exchange Commission’s Public Reference Room 100 F Street, N.E., Washington, D.C. 20549. Please call the Securities and Exchange Commission at 1-800-SEC-0330 for further information on the Public Reference Room. Our Securities and Exchange Commission filings are also available to the public at the Securities and Exchange Commission’s Internet site at www.sec.gov.

This prospectus is part of the registration statement and does not contain all of the information included in the registration statement. Whenever a reference is made in this prospectus to any of our contracts or other documents, the reference may not be complete and, for a copy of the contract or document, you should refer to the exhibits that are a part of the registration statement.

INCORPORATION BY REFERENCE

The SEC allows us to "incorporate by reference" into this prospectus the information we file with it, which means that we can disclose important information to you by referring you to those documents. Later information filed with the SEC will update and supersede this information.

We incorporate by reference the documents listed below, all filings filed by us pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of the initial registration statement of which this prospectus forms a part prior to effectiveness of such registration statement, and any future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the time that all securities covered by this prospectus have been sold or the offering is otherwise terminated; provided, however, that we are not incorporating any information furnished under either Item 2.02 or Item 7.01 of any current report on Form 8-K:

An updated description of our capital stock is included in this prospectus under "Description of Common Stock" and "Description of Preferred Stock".

We will provide to each person, including any beneficial owner, to whom this prospectus is delivered, upon written or oral request, at no cost to the requester, a copy of any and all of the information that is incorporated by reference in this prospectus. You may request a copy of these filings, at no cost, by contacting us at:

Moleculin Biotech, Inc.

Attn: Corporate Secretary

5300 Memorial Drive, Suite 950

Houston, TX 77007

Phone: 713-300-5160

ABOUT MOLECULIN BIOTECH, INC.

Our Company

We are a clinical stage pharmaceutical company focused on the treatment of highly resistant cancers and viruses. We have three core technologies, based substantially on discoveries made at M.D. Anderson Cancer Center (MD Anderson). These three core technologies are Annamycin, the WP1066 Portfolio, and the WP1122 Portfolio and include a total of six drug candidates, three of which have now shown human activity in clinical trials.

We consider Annamycin to be a "next generation" anthracycline, unlike any currently approved anthracyclines, as it is designed to avoid multidrug resistance mechanisms with little to no cardiotoxicity (the efficacy of all currently approved anthracyclines is limited by both multidrug resistance and cardiotoxicity). WP1066 is one of several Immune/Transcription Modulators, designed to stimulate the immune response to tumors by inhibiting the errant activity of Regulatory T-Cells (TRegs) while also inhibiting key oncogenic transcription factors, including p-STAT3 (phosphorylated signal transducer and activator of transcription 3), c-Myc (a cellular signal transducer named after a homologous avian virus called Myelocytomatosis) and HIF-1α (hypoxia inducible factor 1α). These transcription factors are widely sought targets that are believed to contribute to an increase in cell survival and proliferation, and the angiogenesis (coopting vasculature for blood supply), invasion, metastasis and inflammation associated with tumors. They may also play a role in the inability of immune checkpoint inhibitors to affect more resistant tumors. WP1220 is a close analog to WP1066 that we have developed as a potential topical therapy for skin-related diseases.

Our third core technology is centered on new compounds designed to target the roles of glycolysis and glycosylation in both cancer and viral diseases. As an example, 2-deoxy-D-glucose (2-DG) is a glucose decoy that is capable of inhibiting glycolysis, thereby cutting off the primary fuel supply for both cancer cells and viral host cells by taking advantage of their high level of dependence on glucose in comparison to healthy cells. In addition, 2-DG is capable of altering glycosylation, a process by which, when coopted by tumors, cancer cells are believed to evade the body’s immune response. In the case of viruses like SARS-CoV-2 (the virus responsible for COVID-19), glycosylation forms the glycoprotein spikes surrounding the coronavirus that give it its name and enable both evasion of the immune response and the ability to infect new host cells. One of the limitations of 2-DG, however, is how rapidly it is metabolized, resulting in a short circulation time and limited tissue/organ distribution characteristics. Our lead Metabolism/Glycosylation Inhibitor, WP1122, is a prodrug of 2-DG that appears to improve the drug-like properties of 2-DG by increasing its circulation time and improving tissue/organ distribution. Recent published research has identified that 2-DG has antiviral potential against SARS-CoV-2 in vitro and, based on publicly available information, a recently completed Phase 2 clinical trial by an unrelated company in India has reported efficacy in COVID-19 patients, resulting in the Emergency Use Authorization of 2-DG by the Drugs Controller General of India. New research also points to the potential for 2-DG to be capable of enhancing the usefulness of checkpoint inhibitors. Considering that WP1122 generally outperforms 2-DG alone in both in vitro and in vivo tumor models and in viral in vitro models, we believe WP1122 has the opportunity to become an important drug to potentiate existing therapies, including checkpoint inhibitors. We are also engaged in preclinical development of additional antimetabolites (WP1096 and WP1097) targeting glycolysis and glycosylation.

Corporate Information

Our principal executive office is located at 5300 Memorial Drive, Suite 950, Houston, Texas 77007. Our website address is www.moleculin.com. Information contained in, or accessible through, our website does not constitute part of this prospectus and inclusions of our website address in this prospectus are inactive textual references only.

RISK FACTORS

Before making an investment decision, you should consider the "Risk Factors" included under Item 1A. of our most recent Annual Report on Form 10-K and in our updates to those Risk Factors in our Quarterly Reports on Form 10-Q, all of which are incorporated by reference in this prospectus, as updated by our future filings with the SEC. The market or trading price of our common stock could decline due to any of these risks. In addition, please read "Forward-Looking Statements" in this prospectus, where we describe additional uncertainties associated with our business and the forward-looking statements included or incorporated by reference in this prospectus. Please note that additional risks not currently known to us or that we currently deem immaterial may also impair our business and operations. The accompanying prospectus supplement may contain a discussion of additional risks applicable to an investment in us and the particular type of securities we are offering under that prospectus supplement.

FORWARD-LOOKING STATEMENTS

Some of the information in this prospectus, and the documents we incorporate by reference, contain forward-looking statements within the meaning of the federal securities laws. You should not rely on forward-looking statements in this prospectus, and the documents we incorporate by reference. Forward-looking statements typically are identified by use of terms such as "anticipate," "believe," "plan," "expect," "future," "intend," "may," "will," "should," "estimate," "predict," "potential," "continue," and similar words, although some forward-looking statements are expressed differently. This prospectus, and the documents we incorporate by reference, may also contain forward-looking statements attributed to third parties relating to their estimates regarding the markets we may enter in the future. All forward-looking statements address matters that involve risk and uncertainties, and there are many important risks, uncertainties and other factors that could cause our actual results to differ materially from the forward-looking statements contained in this prospectus, and the documents we incorporate by reference.

You should also consider carefully the statements under "Risk Factors" and other sections of this prospectus, and the documents we incorporate by reference, which address additional facts that could cause our actual results to differ from those set forth in the forward-looking statements. We caution investors not to place significant reliance on the forward-looking statements contained in this prospectus, and the documents we incorporate by reference. We undertake no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise.

USE OF PROCEEDS

We expect to use the net proceeds from the sale of securities offered by this prospectus and the prospectus supplement for our clinical trials, if any, and preclinical programs, for other research and development activities and for general corporate purposes. These may include additions to working capital, repayment of existing indebtedness and acquisitions. If we decide to use the net proceeds of any offering of securities other than for our clinical trials, if any, and preclinical programs, for other research and development activities and for general corporate purposes, we will describe the use of the net proceeds in the prospectus supplement for that offering.

DESCRIPTION OF COMMON STOCK

General

We are currently authorized to issue 100,000,000 shares of common stock, par value $0.001.

Subject to preferences that may be applicable to any preferred stock outstanding at the time, the holders of our common stock are entitled to receive dividends out of legally available assets at such times and in such amounts as our Board of Directors may from time to time determine. Each stockholder is entitled to one vote for each share of common stock held on all matters submitted to a vote of stockholders. Cumulative voting is not allowed.

Our common stock is not subject to conversion or redemption and holders of our common stock are not entitled to preemptive rights. Upon the liquidation, dissolution or winding up of our company, the remaining assets legally available for distribution to stockholders, after payment of claims or creditors and payment of liquidation preferences, if any, on outstanding preferred stock, are distributable ratably among the holders of our common stock and any participating preferred stock outstanding at that time. Each outstanding share of common stock is fully paid and nonassessable.

Anti-Takeover Effects of Provisions of Delaware Law and our Charter Documents

Provisions of Delaware law and our Amended and Restated Certificate of Incorporation ("Certificate of Incorporation") and our Amended and Restated Bylaws ("Bylaws") could make the acquisition of our company through a tender offer, a proxy contest or other means more difficult and could make the removal of incumbent officers and directors more difficult. We expect these provisions to discourage coercive takeover practices and inadequate takeover bids and to encourage persons seeking to acquire control of our company to first negotiate with our Board of Directors. We believe that the benefits provided by our ability to negotiate with the proponent of an unfriendly or unsolicited proposal outweigh the disadvantages of discouraging these proposals. We believe the negotiation of an unfriendly or unsolicited proposal could result in an improvement of its terms.

Our Bylaws do not permit stockholders to call a special meeting of stockholders. Our Bylaws provide that special meetings of the stockholders may be called by the Chairman of the Board of Directors, our Chief Executive Officer, our President, the Board of Directors, or in their absence or disability, by any vice president. Our Bylaws require that all stockholder actions be taken by a vote of the stockholders at an annual or special meeting, and do not permit our stockholders to act by written consent without a meeting. Our Bylaws provide for an advance notice procedure for stockholder proposals to be brought before an annual meeting of our stockholders, including proposed nominations of persons for election to the Board of Directors. At an annual meeting, stockholders may only consider proposals or nominations specified in the notice of meeting or brought before the meeting by or at the direction of the Board of Directors. The Bylaws do not give our Board of Directors the power to approve or disapprove stockholder nominations of candidates or proposals regarding other business to be conducted at a special or annual meeting of the stockholders. However, our Bylaws may have the effect of precluding the conduct of business at a meeting if the proper procedures are not followed. These provisions may also discourage or deter a potential acquirer from conducting a solicitation of proxies to elect the acquirer’s own slate of directors or otherwise attempting to obtain control of our company.

Exclusive Forum Provision.

Our certificate of incorporation provides that the Court of Chancery of the State of Delaware shall be the sole and exclusive forum for (i) any derivative action or proceeding brought our behalf, (ii) any action asserting a claim of breach of a fiduciary duty owed by any of our directors or officers to us or our stockholders, (iii) any action asserting a claim against us arising pursuant to any provision of the Delaware General Corporation Law, or our certificate of incorporation or the bylaws, and (iv) any action asserting a claim against us governed by the internal affairs doctrine. This provision would not apply to suits brought to enforce a duty or liability created by the Exchange Act or Securities Act.

This choice of forum provision may limit a stockholder’s ability to bring a claim in a judicial forum that it finds favorable for disputes with us or our directors, officers or other employees, which may discourage such lawsuits against us and our directors, officers and employees. In addition, these provisions could increase the costs to stockholders in bringing such claims. Alternatively, a court could find these provisions of our certificate of incorporation to be inapplicable or unenforceable in respect of one or more of the specified types of actions or proceedings, which may require us to incur additional costs associated with resolving such matters in other jurisdictions, which could adversely affect our business and financial condition.

Quotation

Our common stock is listed on The NASDAQ Capital Market and traded under the symbol "MBRX".

Transfer Agent

The transfer agent for our common stock is VStock Transfer, LLC located at 18 Lafayette Place, Woodmere, New York 11598.

DESCRIPTION OF PREFERRED STOCK

General

We are currently authorized to issue 5,000,000 shares of preferred stock, par value $0.001. As of the date of this prospectus, we have no shares of preferred stock outstanding.