Free Writing Prospectus

Filed Pursuant to Rule 433

Registration No. 333-267520

December 22, 2023

Transcript of Fighting and Finance Podcast (Episode #35)

Moderator:

If you’ve ever traded the gold market, I'm sure you've probably heard of the ETF GLD. Well my next guest is actually the person who created that ETF. George Milling-Stanley is a legend of the gold market, he's been trading for over 50 years, is head of gold strategy at State Street Global Advisors, has traded gold at Leman Brothers, and was Head of Gold Strategy at the World Gold Council. It was truly an honor to have him on the Fighting and Finance podcast and I hope you enjoy.

I'd like to just start with, I guess, the most recent activities in gold. We had a false breakout if you will based on I assume low volume in the overnight session a little under a week ago, if you don't mind just starting and give me your thoughts on obviously we've set all-time highs since then pulled back, but if you don't mind just giving me your input on what you think transpired to see that breakout as well as the massive pullback although in the past day or so based on the Fed's meeting we're starting to pull back up.

George Milling-Stanley:

Yeah I'm happy to do that, there's a number of different things that we need to touch on there. I think that it was a very interesting little phenomenon. I take issue with you calling it a false breakout because I'm not sure that it is. Let's put it into perspective for something like four or five years, the gold price has been flirting with the $2,000 an ounce level, it's been above there several times but only briefly including earlier this year, the early part of this year gold was above $2,000 for a few days, so for the speculative community and by this I really mean the hedge funds, day traders, a whole bunch of diverse different kinds of people, but the speculative community as opposed to long-term allocators, the strategic holders so the speculative community has basically found it a really good idea to take profits on gold whenever the price had a two at the front. And I think that's what they did when they saw the price shoot up over $2,100 rather than following the momentum and buying more, which is what the speculative community often does, they still were in this Paradigm that they've been in for the last five years, if it's over $2,000 this is where we should take profits. So you know the way that the pendulum always swings it goes way too far to the upside in any market and then when there's profit taking it goes way too far to the downside so we drop back below that $2,000 an ounce level. What I'm looking for, and I'm not certain of this, but what I'm looking for is to see gold actually consolidate its position above $2,000 an ounce. We got as high as what $2,130 or something on the intraday spot market and probably go on to set new highs after that. You know financial markets as well as I do what tends to happen is what had been an area of overhead resistance, once you've breached it positively and you've breached it in a sustained manner, then that tends to become downside support and that's what I'm looking to the $2,000 an ounce area to do I think over the next few months. Now as to what precipitated this - first of all the price started to move up, there were some suggestions in the market it kind of felt like there was maybe one or two very big buyers. People who are sometimes very big buyers of gold might be a central bank for example. We've seen sustained interest on the part of central banks especially in the emerging markets for 14 years now, so it could have been one of them moving in a big way. We've also seen more recently renewed interest on the part of sovereign wealth funds and it's interesting because central banks will tend to buy gold in the over-the-counter market. The Sovereign wealth funds will more often trade in a vehicle like GLD, they like ETFs, they like the liquidity, they like being able to move in size and they like being able to move quickly in a vehicle that has a very good track record of trading on the New York Stock Exchange. So that that's the possibility.

Again it's going to take us some time to isolate exactly what these reasons were but that's one possibility that maybe there was one big buyer. In any event, what it did over that weekend was essentially generate some very significant interest in gold and to generate momentum and I think that there was definitely some idea of momentum chasing that pushed us up beyond the $2,100 mark. A good deal higher than we've ever been before.

As far as the outlook's concerned, if we're able to establish ourselves firmly above $2,000 that I think will be will be very helpful. But one of the causes and just still isolating other causes, but one of the causes no question was you know cast your mind back to the beginning of this year, the betting was that there probably wouldn't be a pivot on the part of the Fed to cutting rates in 2023 and probably not even in 2024. Jerome Powell was saying he couldn't see really a good case for cutting rates. The market perception has changed dramatically and 10 days or so ago, the market consensus was rate cuts are going to come as soon as March of next year and maybe even February. I think, you know, Jerome Powell may have laid that one to rest in the meeting yesterday but you know I'm not sure. The Fed or FOMC meeting for December, he said that there may be rate cuts next year and the dot plots suggest there might be as many as three 25 basis point rate cuts, but he gave no indications on timing. He's a savvy guy I think it's fine to let the markets have one piece of good news for that but don't tell them when it's going to happen because he's now kept his options open. He can even raise rates if he chooses to. He reserved the right to do that if the data prompts him to raise rates at the beginning of next year and still be cutting rates by the end of the year, so he gave no indications on timing. But I think that was another of the causes if you like of our sudden run up in Gold and I'm just pleased to see that gold's back above $2,000 today and as I say, seems to be building a base up there which is which is good news.

Moderator:

Yeah I tend to agree with you. Gold showed quite a bit of resiliency with the raising of the interest rates and although it had some minor pullbacks, didn't have a drastic sell-off. What do you equate that to and if you can, provide us some price levels that you expect it to go to let's say by the end of 2024.

George Milling-Stanley:

Okay that's a lot to unpack. Let me let me start with interest rates. I think that that's a useful place to start. The important relationship in my view is not between gold and interest rates. Gold can go up when interest rates are going up, it frequently has, or it can go down or it can go nowhere. But the important relationship is between gold and what's happening to the dollar. So if we get a period when rising Fed funds rate is driving the dollar higher, that can be damaging for gold and that was what we had last fall when Jerome Powell basically felt that the markets were not getting his message of higher for longer and he decided to smack the markets upside the head by giving them three 75 basis point increases over three successive FOMC meetings. That was you know a real heads up I think to the markets. And that had a significant impact on the dollar, the dollar on the DXY the measure that I look at, the trade weighted dollar Index went rushing up to a 20-year high against practically any other currency you look at. That was one of the headwinds for gold last year which prevented gold from going anywhere. It didn't push gold down because there was this resilience that you mentioned in the gold price.

And basically in 2022, gold finished the year at almost exactly the same level as it had started it. But I think that the strength of the dollar especially in Q3 and onward was a major headwind for gold that prevented it from going any higher than it might otherwise have done. This year, we've seen several 25 basis point increases, we've seen several pauses, and the dollar really has done absolutely nothing. If anything, I believe we may have seen the beginnings, the incipient signs, of a reversion to the mean in the currency markets meaning that other currencies are going to appreciate against the dollar and we've already seen some signs of that, not very strong yet, I think we'll see more next year and in these cases gold often behaves like a component of the currency market. So I'm expecting other currencies, the Euro, the Renminbi, whatever and gold to appreciate against the dollar meaning higher gold prices.

Moderator:

And if you could, what targets do you see by the end of 2024?

George Milling-Stanley:

I think that having set a fresh all-time high at this point towards the very end of 2023, I think there's a real possibility we could go as high as a little above where we were with that all-time high. The group that I'm part of at State Street, the gold strategy team, published its forecasts for the gold market yesterday and our base case scenario, in other words if nothing changes, we don't get as serious recession, the economy continues to grow but growth is maybe a little slower, we don't get massive rate cuts or increases in rates but we might get a few rate Cuts toward the end of the year. So if everything stays the same, then our base case suggestion was that gold could probably trade between $1,950 and $2,200 an ounce and we like that scenario. We had a 50% degree of confidence in that one so that's really where we think that's where gold is likely to be.

Obviously we did a bullish scenario and a bearish scenario. We think that the bullish scenario is a possibility that in other words gold could trade perhaps between $2200 and $2400 for some of the time which would again set a fresh all-time high if we get above that $2,200 level. We gave that a 30% probability.

So that our bear case only has a 20% probability but you have to have one for the sake of symmetry and our bear case suggests that gold could trade between $1800 and $1950. I was very pleased to see the support above the $1950 area over the last week or 10 days of pullback, so you know that's suggests to me that we may well not get into our bear territory at all. But you need to have a bear case just in case everything goes wrong.

Moderator:

Sure if we can go back to the 1970s when we were dealing with stagflation and a very similar in many ways to what we're dealing with now, with sticky inflation around the 3%, gold obviously had a major breakout and went on a run that hadn't been seen in decades prior to that. Do you have any scenario in which something like that can present itself assuming inflation continues to rear its ugly head, potentially ticking up where gold would maybe test the $3,000 level?

George Milling-Stanley:

I think it's important to think of the similarities which you're doing and the differences. In the 1970s, US inflation was in the mid-teens, not CPI topping out at 9.2 as it did last year, but was around the 16 to17% area. We had significant inflation for probably 20 years by the time we got to the end of the 70s. So we had inflation during the 60s and in the 70s.

We had a very strong stock market for most of that period. Now obviously we've set record since then, but for the period the 1970s the stock market was very strong. The bond market was strong, the oil market was strong. Crude was trading at an unprecedented high of $40 a barrel which seems very unrealistic now but there's that. I think that President Carter was widely seen around the world as if anything a weak President, not the strong man that the country wanted and got in Ronald Reagan a few years later.

Iran and Iraq were rattling their sabers at one another, the Soviet Union was a much bigger potential adversary than Russia, but the Soviet Union as an Empire if you like had just invaded Afghanistan. So the fact that gold during the 1970s went up 20-fold wasn't a surprise to me. I was there, I was trading at the time. I was writing about gold too. It wasn't a surprise but I'm not seeing too many of the same kind of similarities.

We do have some things that are rather similar but A) we don't have inflation at the kind of levels we saw then and I think there was a general consensus in the markets that the government and that includes the Fed, really didn't know what to do about inflation. The whole notion of President Ford coming up with the lapel button reading w-i-n for whip inflation now didn't make much of a contribution to whipping inflation then or now. It just seemed like that the authorities had kind of lost control of inflation. I don't get that sense with Jerome Powell. I think that for the most part, the markets take Powell very seriously as a sound economic manager and somebody who if it is possible to engineer a soft landing or a “softish landing” to use his own phrase, out of the current situation, Powell will do so. I think there's always the possibility that he might.

But you know, we do have an armed conflict going on in Europe in Ukraine with the possibility to turn nuclear at the push of a button. We have the conflict in Israel which bad enough as it is in and of itself but signs that that Iran may be pushing Hezbollah to attack Israel on a second front in the north. Very worrying indeed. I think that you know that if that dispute that battle really escalates we could be in real problems.

And you know Xi Jinping made nice when he was in San Francisco with President Biden but the minute he got home to Beijing, he was sounding just as belligerent as ever in regard to Taiwan. So there's a lot of potentials on the geopolitical front that could possibly mirror what happened in the 70s, but we're not starting out with 20 years of very high inflation.

The other thing to think about: American investors have not been allowed to invest in gold bullion products, whether bars or coins from 1933 until January 1 of 1975, so there was a huge amount of pent-up demand from American investors and I think that was yet another thing that helped to fuel that 20-fold rise in the price. I think it's unlikely we'll ever see that concatenation of circumstances ever actually come together with the same degree of strength.

But you know I could be wrong. There's an awful lot of things that could still go very wrong: macroeconomic, geopolitically.

Moderator:

Got it. I read an article recently that stated advisors much like myself, about 76% of them have zero allocation to gold and I think that's a foolish allocation to have in your clients’ portfolios. Obviously I don't have that same approach but I’m just curious from your perspective, what can you attribute that to especially because gold has historically been a great insurance policy to many of the economic headwinds and geopolitical turmoil that we're seeing on the forefront. What would you in your opinion attribute the zero % allocation to Gold recently?

George Milling-Stanley:

Yeah, look if you take the quantum of investable assets around the world then allocations to investments with any relation to gold at all - whether gold mining stocks or gold ETFs or bars and coins or Futures - whatever it may be, is running at about 1% of the total quantum of investable assets. I think that's a mistake. It's a mistake I've been doing my best to address and to redress in my conversations with advisors since I joined State Street 10 years ago.

And in fact, the whole of my 50-year career in gold has basically been spent saying, “you know that really doesn't make sense I think that that's crazy.” The reasons for it, not everybody has studied gold in the way that I have and that you obviously have. So I think that you and I are probably much better aware of the benefits that gold can have and an awful lot of people simply don't buy that. An awful lot of people have the attitude that oh this is an asset that my grandparents might have bought but there's absolutely no need for me to do so.

You know there's very much a feeling there. I think finally, the margins in the gold business tend to be wafer thin, and that means that advisors such as yourself don't really make an awful lot of money out of putting your clients into gold. You may make them money in the long run or you may preserve their wealth in the long run, but you're not making an awful lot of money out of those allocations. Some advisors find that a major disincentive. Clearly you don't, and I'm delighted to hear that, but that's really I think the major reasons.

Moderator:

Got it. To piggyback off that last statement where you said many people think of it as something their grandparents may have stocked up on and present day it may not have as much value, do you think that the digital world and the digital assets, Bitcoin predominantly, may have kind of taken some of that luster away from gold?

George Milling-Stanley:

I think that you know the rise of cryptocurrencies over the last 13 14 years of their existence, may well have diverted some funds that might otherwise have gone into gold. I've not had any direct experience of talking to an advisor or to an end investor who has actually sold gold and bought cryptos. So let's lay that one down for a start.

I think it's possible that the margin but the way that I think about gold as an investment and this sort of goes back to your previous question as well if we could if you don't mind doing that. I think that historically the promise of gold for investors has always had a dual nature and that's one of the reasons I like gold so much. The first part of the promise is that over time, not every year but over time, gold can help to enhance the returns of a properly balanced portfolio and all the time gold is always going to be able to help to reduce the volatility of a properly balanced portfolio. So sometimes it will help returns, it will always help to reduce risk and I think that's a pretty good formula for success in the form of any asset. But there's an awful lot of advisors who simply don't share my view and I guess probably your view as well that gold has kind of an offer to make to investors. I like things that improve my Sharpe Ratio.

Moderator:

As do I, as do I. Well George thanks so much. Where can people find you if they wanted to reach out and follow some of your work?

George Milling-Stanley:

Yeah if they go to ssga.com, the SPDR website, they can always find stuff that has been produced by the team that I work for. They can also find out ways of getting in touch with their local representatives from State Street, their sales reps in local cities and those sales reps will then ask me if I can spare the time to go visit Chicago or Los Angeles or wherever it might be. I'm always happy to try to do that and if I can't actually be there in person because of the issues involving travel especially in the winter time when you live in Upstate New York, then we'll certainly get on a zoom call or a WebEx or whatever with those advisors. Always happy to be in touch with people directly.

Moderator:

Well I appreciate the time and I will take you up on that offer if you don't mind. I live in Denver, I've got an office in Los Angeles so don't expect you to come out here but would love to potentially bring you on some calls with some clients of mine.

George Milling-Stanley:

Always happy to do that. Thank you very much for the opportunity today. I really appreciate it.

Moderator:

Thank you, George, appreciate it.

SPDR® GOLD TRUST has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the Trust and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Trust or any Authorized Participant will arrange to send you the prospectus if you request it by calling toll free at 1-866-320-4053 or contacting State Street Global Advisors Funds Distributors, LLC, One Iron Street, Attn: SPDR® Gold Shares, 6th Floor, Boston, MA 02110.

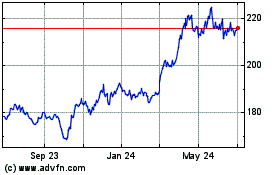

SPDR Gold (AMEX:GLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

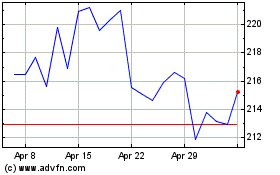

SPDR Gold (AMEX:GLD)

Historical Stock Chart

From Apr 2023 to Apr 2024