false

2023

FY

0001362516

0001362516

2022-10-01

2023-09-30

0001362516

2023-09-30

0001362516

2023-12-20

0001362516

2022-09-30

0001362516

us-gaap:SeriesAPreferredStockMember

2023-09-30

0001362516

us-gaap:SeriesAPreferredStockMember

2022-09-30

0001362516

us-gaap:SeriesBPreferredStockMember

2023-09-30

0001362516

us-gaap:SeriesBPreferredStockMember

2022-09-30

0001362516

us-gaap:SeriesCPreferredStockMember

2023-09-30

0001362516

us-gaap:SeriesCPreferredStockMember

2022-09-30

0001362516

us-gaap:SeriesDPreferredStockMember

2023-09-30

0001362516

us-gaap:SeriesDPreferredStockMember

2022-09-30

0001362516

us-gaap:SeriesEPreferredStockMember

2023-09-30

0001362516

us-gaap:SeriesEPreferredStockMember

2022-09-30

0001362516

2021-10-01

2022-09-30

0001362516

2021-09-30

0001362516

clri:PreferredStockSeriesAMember

2021-09-30

0001362516

clri:PreferredStockSeriesBMember

2021-09-30

0001362516

clri:PreferredStockSeriesCMember

2021-09-30

0001362516

clri:PreferredStockSeriesDMember

2021-09-30

0001362516

clri:PreferredStockSeriesEMember

2021-09-30

0001362516

us-gaap:CommonStockMember

2021-09-30

0001362516

us-gaap:AdditionalPaidInCapitalMember

2021-09-30

0001362516

us-gaap:RetainedEarningsMember

2021-09-30

0001362516

clri:PreferredStockSeriesAMember

2022-09-30

0001362516

clri:PreferredStockSeriesBMember

2022-09-30

0001362516

clri:PreferredStockSeriesCMember

2022-09-30

0001362516

clri:PreferredStockSeriesDMember

2022-09-30

0001362516

clri:PreferredStockSeriesEMember

2022-09-30

0001362516

us-gaap:CommonStockMember

2022-09-30

0001362516

us-gaap:AdditionalPaidInCapitalMember

2022-09-30

0001362516

us-gaap:RetainedEarningsMember

2022-09-30

0001362516

clri:PreferredStockSeriesAMember

2021-10-01

2022-09-30

0001362516

clri:PreferredStockSeriesBMember

2021-10-01

2022-09-30

0001362516

clri:PreferredStockSeriesCMember

2021-10-01

2022-09-30

0001362516

clri:PreferredStockSeriesDMember

2021-10-01

2022-09-30

0001362516

clri:PreferredStockSeriesEMember

2021-10-01

2022-09-30

0001362516

us-gaap:CommonStockMember

2021-10-01

2022-09-30

0001362516

us-gaap:AdditionalPaidInCapitalMember

2021-10-01

2022-09-30

0001362516

us-gaap:RetainedEarningsMember

2021-10-01

2022-09-30

0001362516

clri:PreferredStockSeriesAMember

2022-10-01

2023-09-30

0001362516

clri:PreferredStockSeriesBMember

2022-10-01

2023-09-30

0001362516

clri:PreferredStockSeriesCMember

2022-10-01

2023-09-30

0001362516

clri:PreferredStockSeriesDMember

2022-10-01

2023-09-30

0001362516

clri:PreferredStockSeriesEMember

2022-10-01

2023-09-30

0001362516

us-gaap:CommonStockMember

2022-10-01

2023-09-30

0001362516

us-gaap:AdditionalPaidInCapitalMember

2022-10-01

2023-09-30

0001362516

us-gaap:RetainedEarningsMember

2022-10-01

2023-09-30

0001362516

clri:PreferredStockSeriesAMember

2023-09-30

0001362516

clri:PreferredStockSeriesBMember

2023-09-30

0001362516

clri:PreferredStockSeriesCMember

2023-09-30

0001362516

clri:PreferredStockSeriesDMember

2023-09-30

0001362516

clri:PreferredStockSeriesEMember

2023-09-30

0001362516

us-gaap:CommonStockMember

2023-09-30

0001362516

us-gaap:AdditionalPaidInCapitalMember

2023-09-30

0001362516

us-gaap:RetainedEarningsMember

2023-09-30

0001362516

clri:SeriesAConvertiblePreferredStockMember

2022-09-30

0001362516

2023-01-01

0001362516

clri:LicensingOfReadyOpSoftwareMember

2022-10-01

2023-09-30

0001362516

clri:LicensingOfReadyOpSoftwareMember

2021-10-01

2022-09-30

0001362516

clri:HardwareSalesAndConsultingMember

2022-10-01

2023-09-30

0001362516

clri:HardwareSalesAndConsultingMember

2021-10-01

2022-09-30

0001362516

clri:PreferredStockDividendsMember

2023-09-30

0001362516

us-gaap:SeriesAPreferredStockMember

2022-10-01

2023-09-30

0001362516

us-gaap:SeriesEPreferredStockMember

2022-10-01

2023-09-30

0001362516

srt:SubsidiariesMember

clri:VoiceInteropIncMember

2021-12-01

0001362516

2022-12-31

0001362516

srt:SubsidiariesMember

clri:VoiceInteropIncMember

2022-12-31

0001362516

srt:SubsidiariesMember

clri:VoiceInteropIncMember

2023-09-30

0001362516

us-gaap:RelatedPartyMember

2023-09-30

0001362516

2022-11-26

2022-12-02

0001362516

2021-11-26

2021-12-01

0001362516

clri:ObligationUnderOperatingLeaseMember

2022-10-01

2023-09-30

0001362516

clri:ObligationUnderOperatingLeaseMember

2021-10-01

2022-09-30

0001362516

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

clri:OneCustomerMember

2022-10-01

2023-09-30

0001362516

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

clri:OneCustomerMember

2021-10-01

2022-06-30

0001362516

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

clri:NoustomerMember

2022-10-01

2023-09-30

0001362516

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

clri:NoustomerMember

2021-10-01

2022-09-30

0001362516

srt:ChiefExecutiveOfficerMember

2016-11-01

2016-11-28

0001362516

srt:ChiefExecutiveOfficerMember

2022-04-01

2022-04-20

0001362516

srt:ChiefFinancialOfficerMember

2015-03-01

2015-03-13

0001362516

srt:ChiefFinancialOfficerMember

2021-09-26

2021-10-02

0001362516

clri:SouthernFloridaResearchFoundationMember

2022-10-01

2023-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

utr:sqft

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

10-K

| |

|

| (Mark One) |

| ☒ |

ANNUAL

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For

the fiscal year ended September 30, 2023 |

| |

|

| ☐ |

TRANSITION

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For

the transition period from ____________________ to _____________________ |

Commission

File No. 000-55329

| |

|

CLEARTRONIC, INC.

(Exact

name of registrant as specified in its charter)

|

| Florida |

65-0958798 |

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S.

Employer Identification No.) |

| |

|

28050 S Highway 19 N, Ste 310

Clearwater,

Florida |

33761 |

| (Address

of principal executive offices) |

(Zip

Code) |

| |

|

| Registrant’s

telephone number, including area code: (813) 289-7620 |

| |

|

|

| Securities

registered pursuant to Section 12(b) of the Act: |

| None |

| Securities

registered pursuant to Section 12(g) of the Act: |

| Title

of each class |

Trading Symbol

(s) |

Name

of each exchange on which registered |

| Common

stock, par value $0.00001 per share |

CLRI |

None |

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No

☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No

☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirement for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding

12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained

herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated

by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting

company” in Rule 12b-2 of the Exchange Act:

| |

|

|

|

|

| |

Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| |

Non-accelerated filer |

☒ |

Smaller

reporting company |

☒ |

☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12(b)-2 of the Exchange Act). Yes ☐ No ☒

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

The

aggregate market value of the registrant’s common stock held by non-affiliates of the registrant on September 30, 2023 (based on the

closing sale price of $0.0281 per share of the registrant’s common stock, as reported on the OTCPINK operated by The OTC Markets Group,

Inc. on that date) was approximately $6,439,416. The stock price of $0.0281 at September 30, 2023, takes into account a one for 3,000

reverse stock split on December 28, 2012. Common stock held by each officer and director and by each person known to the registrant to

own five percent or more of the outstanding common stock has been excluded in that those persons may be deemed to be affiliates. This

determination of affiliate status is not necessarily a conclusive determination for other purposes. Indicate the number of shares outstanding

of each of the registrant’s classes of common stock, as of the latest practicable date. At December 20, 2023, the registrant had outstanding

229,160,695 shares of common stock, par value $0.00001 per share.

Table

of Contents

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

In

light of the risks and uncertainties inherent in all projected operational matters, the inclusion of forward-looking statements in this

Form 10-K, should not be regarded as a representation by us or any other person that any of our objectives or plans will be achieved

or that any of our operating expectations will be realized. Our revenues and results of operations are difficult to forecast and could

differ materially from those projected in the forward-looking statements contained in this Form 10-K, as a result of certain risks and

uncertainties including, but not limited to, our business reliance on third parties to provide us with technology, our ability to integrate

and manage acquired technology, assets, companies and personnel, changes in market condition, the volatile and intensely competitive

environment in the business sectors in which we operate, rapid technological change, and our dependence on key and scarce employees in

a competitive market for skilled personnel. These factors should not be considered exhaustive; we undertake no obligation to release

publicly the results of any future revisions we may make to forward-looking statements to reflect events or circumstances after the date

hereof or to reflect the occurrence of unanticipated events.

PART

I

Except

for historical information, this report contains forward-looking statements within the meaning of Section 21E of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”). Such forward-looking statements involve risks and uncertainties, including,

among other things, statements regarding our business strategy, future revenues and anticipated costs and expenses. Such forward-looking

statements include, among others, those statements including the words “expects,” “anticipates,” “intends,”

“believes” and similar language. Our actual results may differ significantly from those projected in the forward-looking

statements. Factors that might cause or contribute to such differences include, but are not limited to, those discussed in the

section “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.” You are

cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this report. We undertake

no obligation to publicly release any revisions to the forward-looking statements or reflect events or circumstances taking place after

the date of this document.

Item

1. Business.

The

Company

The

Company was initially incorporated on November 15, 1999, as Menu Sites, Inc., a Florida corporation. On March 9, 2001, the Company’s

name was changed to CNE Communications, Inc. On October 1, 2004, the name was changed to CNE Industries, Inc. and on March 29,

2005, the name was changed to GlobalTel IP, Inc. On May 9, 2008, the Company’s name was changed to Cleartronic, Inc.

All

current operations are conducted through the Company’s wholly owned subsidiary, ReadyOp Communications, Inc. (“ReadyOp”), a

Florida corporation incorporated on September 15, 2014. ReadyOp facilitates the marketing and sales of subscriptions to the ReadyOp™

and ReadyMed ™ platform and the AudioMate IP gateways discussed below.

In

March 2018, the Company approved the spin-off VoiceInterop into a separate company under a Form S-1 registration to be filed with the

United States Securities and Exchange Commission. On May 13, 2019, VoiceInterop filed an S-1 registration with the United States Securities

and Exchange Commission. All VoiceInterop transactions have been recorded as discontinued operations. On February 14, 2020, the distribution

of shares was approved by FINRA and VoiceInterop was deconsolidated from Cleartronic, Inc. (See Note 6).

In

October 2019, the Company acquired the ReadyMed software platform from Collabria LLC. ReadyMed is a web-based secure communications platform

initially designed for the healthcare industry. This includes hospitals, clinics, doctor’s offices, health insurance companies, workers

compensation insurance companies and many other segments of the healthcare industry. The Company offers both the ReadyOp and ReadyMed

capabilities to clients and usually refers to the platform as ReadyOp to avoid confusion in the marketplace of two platforms.

ReadyOp™

Software

ReadyOp

is a proprietary, innovative web-based planning and communications platform for efficiently and effectively planning, managing, communicating,

and directing operations and emergency response. ReadyOp is used by local, state and federal government agencies, corporations,

school districts, utilities, hospitals and others to manage and report daily operations as well as the ability to handle incidents and

emergency situations. ReadyOp is offered as a software as a service (SAAS) program on an annual contract basis although an increasing

number of clients have requested multi-year agreements.

ReadyOp

requires no new or on-site hardware or programming by clients and provides multiple options for communications including radio interoperability

using the Company’s AudioMate gateways. Plans and operations can be built and stored securely in ReadyOp on a by-location, region

and systemwide basis. Assets can be listed along with their location, person to contact and other information that may be needed.

Diagrams, charts, maps, pictures, report forms and other documentation can be securely stored yet immediately available securely

from any location. ReadyOp also provides efficient planning and response for responding to disasters and for continuity of operations

(COOP) and recovery. ReadyOp is the COOP platform for multiple organizations including many federal agencies.

ReadyMed™

Software

In

October 2019, the Company acquired the ReadyMed software platform from Collabria LLC. In exchange for this asset, the Company issued

12,000,000 shares of Common stock of the Company. ReadyMed is a web-based secure communications platform initially designed for the healthcare

industry. This includes hospitals, clinics, doctor’s offices, health insurance companies, workers compensation insurance companies and

many other segments of the healthcare industry. The platform provides caregivers with patient tracking capability and allows physicians

and other healthcare entities to track patient progress after medical treatment and/or release from hospital care. The software also

enables monitoring and reporting of patients in medium- and long-term care. Additionally, the platform provides secure communications

capabilities and recordkeeping to track the healing process of patients, record their recovery and monitor their medications. During

the COVID-19 pandemic this software proved beneficial to multiple federal and state agencies and clients in the healthcare industry.

The Company offers both the ReadyOp and ReadyMed capabilities to clients and usually refers to the platform as ReadyOp to avoid confusion

in the marketplace of two products.

AudioMate

IP Gateways

The

Company offers a proprietary line of Internet Protocol Gateways branded as AudioMate 360 IP Gateway. The AudioMate 360 IP Gateway

was designed to provide an Internet Protocol Gateway to users of unified group communications. The AudioMate units are currently

being sold directly to end-users by the Company’s sales teams and by Value Added Resellers (“VARs”). More than 1,000 end-users

in the United States and 18 foreign countries have purchased the Company’s AudioMate gateways. Although other devices are available that

perform the same or similar functions, we believe that our price for the AudioMate 360 IP Gateway is competitive with prices other

companies are charging for similar devices.

Patents

and Intellectual Property

Our

business will be dependent in part on our intellectual property. For projects that are in development, we intend to rely on intellectual

property rights afforded by trademark and trade secret laws, as well as confidentiality procedures, licensing arrangements and potential

patent filings. These measures are to establish and protect our rights to the technology and other intellectual property. We cannot foretell

if these procedures and arrangements will be adequate in protecting our intellectual property.

On

March 13, 2012, the United States Patent Office notified the Company that U.S. Patent Number 8,135,001 B1 had been granted for the 34

claims of our patent application for Multi Ad Hoc Interoperable Communicating Networks. We may file similar patent applications in additional

countries. The claims in the patent application relate to various aspects of the AudioMate 360 IP Gateway. It may be that one

or more of the claims are not meaningful. Furthermore, the validity of issued patents is frequently challenged by others. One or

more patent applications may have been filed by others previous to our filing, which encompass the same or similar claims. A patent application

does not in and of itself grant exclusive rights. A patent application must be reviewed by the Patent Office of each relevant country

prior to issuing as a patent and granting exclusive rights. The laws of many foreign countries do not protect intellectual property rights

to the same extent as do the laws of the United States, if at all.

Because

of limited resources, the Company may be unable to protect a patent, either owned or licensed, or to challenge others who may infringe

upon a patent. Because many holders of patents have substantially greater resources and patent litigation is very expensive, we may not

have the resources necessary to successfully challenge the validity of patents held by others or withstand claims of infringement or

challenges to any patent the Company may possess or obtain. Even if we prevail, the cost and management distraction of litigation could

have a material adverse effect on the Company.

Internet

Protocol Gateways and their related manufacturing processes are covered by a large number of patents and patent applications. Infringement

actions may be instituted against the Company if we use or are suspected of using technology, processes or other subject matter that

is claimed under patents of others. An adverse outcome in any future patent dispute could subject us to significant liabilities to third

parties, require disputed rights to be licensed or require us to cease using the infringed technology.

If

trade secrets and other means of protection upon which the Company relies may not adequately protect us, the Company’s intellectual

property could become available to others. Although we may rely on trade secrets, copyright law, employee and third-party nondisclosure

agreements and other protective measures to protect some of our intellectual property, these measures may not provide meaningful protection

to the Company.

Exclusive

Licensing Agreement

On

May 5, 2017, the Company entered into an Exclusive Licensing Agreement with Sublicensing Terms (the “Agreement”) with the University

of South Florida Research Foundation, Inc. (“USFRF”) relating to an exclusive license of certain patent rights in connection

with one of USFRF’s U.S. Patent Applications. Both parties recognize that the research and development work provided by the Company was

sufficient for USFRF to enter into the Agreement with the Company.

The

Agreement is effective April 25, 2017 and continues until the later of the date that no Licensed Patent remains a pending application

or an enforceable patent or the date on which the Licensee’s obligation to pay royalties expires.

The

Company paid USFRF a License Issue Fee of $6,000 and $2,373 as reimbursement of expenses associated with the filing of the Licensed Patent

for the year ended September 30, 2023. The company agreed to pay USFRF a royalty of 3% for sales of all Licensed Products and Licensed

Processes and agreed to pay USFRF minimum royalty payments as follows:

| |

|

|

| Payment |

Year |

| $1,000 |

2019 |

| $4,000 |

2020 |

| $8,000 |

2021 |

-and

every year thereafter on the same date, for the life of the agreement.

In

the event the Company proposes to sell any Equity Securities, then USFRF will have the right to purchase 5% of the securities issued

in such offering on the same terms and conditions as are offered to other purchasers in such financing.

Rapid

Technological Change Could Render the Company’s Products Obsolete

The

Company’s markets are characterized by rapid technological changes, frequent new product introductions and enhancements, uncertain product

life cycles, changes in customer requirements, and evolving industry standards. The introduction of new products embodying new technologies

and the emergence of new industry standards could render our existing products obsolete. The Company’s future success will depend upon

our ability to continue to develop and introduce new products and services to address the increasingly sophisticated needs of customers.

The Company may experience delays in releasing new products, product enhancements and services in the future which may cause customers

and prospective to forego purchase and use of our products and purchase those of competitors.

Sales

to government entities are subject to a number of challenges and risks.

The

ReadyOp platform is a Cloud Service Offering (CSO) that is being used by several agencies of the federal government. In order to expand

the usage by additional federal government agencies the Company is in the process of obtaining a FedRAMP Authorization. FedRAMP provides

a standardized security framework for all cloud products and services that is recognized by all executive branch federal agencies. As

a Cloud Service Provider or CSP the Company only needs to go through the FedRAMP Authorization process once for each CSO and perform

continuous monitoring, with all agencies reviewing the same continuous monitoring deliverables, creating efficiencies across the government.

The Company commenced the FedRamp certification process in 2023 and expects to have completed the certification by mid 2024.

Seasonality

of Our Business

We

do not anticipate that our business will be affected by seasonal factors.

Impact

of Inflation

We

are affected by inflation along with the rest of the economy. Specifically, our costs to complete our products could rise if specific

components needed incur an increase in cost.

Manufacturing

and Suppliers

We

have outsourced the manufacturing of our AudioMate 360 IP Gateway. This outsourcing has allowed us to:

| |

|

|

| |

● |

Avoid

costly capital expenditures for the establishment of manufacturing operations; |

| |

● |

Focus

on the design, development, sales and support of our products and services; and |

| |

● |

Leverage

the scale, expertise and purchasing power of specialized contract manufacturers. |

Currently,

Company has arrangements for the production of the AudioMate gateways with two contract manufacturers. The reliance on contract manufacturing

involves a number of potential risks, including the absence of adequate capacity, ownership of certain elements of electronic designs,

and reduced control over delivery schedules. The Company’s contract manufacturers can provide a range of operational and manufacturing

services, including component procurement and performing final testing and assembly of our products. The Company intends to continue

use of contract manufacturers to procure components and to maintain adequate manufacturing capacity.

Competition

We

are not aware of any direct competitors for ReadyOp and ReadyMed that offer the same combinations of capabilities and function. However,

there are similar programs being marketed that appear similar and are sometimes confused with ReadyOp such as WebEOC and Everbridge.

ReadyOp provides different capabilities and is priced lower than both of these and in fact, has several clients that use one or even

both of these programs in addition to ReadyOp. We may have increased competition in the future. We continue to develop and enhance the

ReadyOp/ReadyMed platform to improve the value and increase the potential market size and growth of our client clientele.

The

unified communications industry where the Company’s gateways are offered is competitive. The Company will continue to offer the AudioMate

gateways, but primarily in conjunction with the ReadyOp platform to provide radio interoperability. Competition for an integrated radio

and operations platform is limited and the Company will continue to market the ReadyOp platform, both with the gateways and without.

Sales

and Marketing

The

ReadyOp/ReadyMed platform is currently marketed through a combination of inside salespersons and outside sales groups. We intend to expand

the use of commissioned sales groups and individual sales representatives to market and sell our programs and gateways.

Key

Personnel of Cleartronic

Our

future financial success depends to a large degree upon the personal efforts of our key personnel, Michael M. Moore, our Chief Executive

Officer (CEO) and Director, and Larry M. Reid, our Chief Financial Officer (CFO), Secretary and Director. They and their designees play

the major role in securing persons capable of developing and executing the Company’s business strategy. While the Company intends to

employ additional executive, development and technical personnel in order to minimize dependency upon any one person, we may not be successful

in attracting and retaining the persons needed.

At

present, Cleartronic has two executive officers, Michael M. Moore and Larry M. Reid. A copy of the employment agreement with Mr. Moore

has been previously filed on January 13, 2016 as an exhibit to a Form 10-K. Mr. Moore is paid a base salary of $16,667 per month. Effective

April 20, 2022, the annual compensation increased to $220,000. See Item 13. “Certain Relationships and Related Transactions and

Director Independence.”

In

March 2015, the Company entered into a new employment agreement with the Company’s CFO, Larry M. Reid (the “Agreement”). Under

the Agreement, Mr. Reid agreed to remit 2.0 billion shares of common stock back to the Company in exchange for 200,000 shares of Series

C Convertible Preferred stock with a fair value of $252,000. Mr. Reid is paid a base salary of $8,000 per month. A copy of the employment

agreement with Mr. Reid has been previously filed on March 18, 2015 with the SEC as an exhibit to a Form 8-K. Effective October 1, 2021,

the annual compensation increased to $104,000.

Unless

the Company shall have given Mr. Moore or Mr. Reid written notice at least 30 days prior to the Termination Date, the employment agreements

automatically renew and continue in effect for additional one-year periods. The Company has the election at any time after the expiration

of the initial term of the Mr. Reid’s Agreement to give Mr. Reid notice of Termination.

The

Financial Results for Cleartronic May Be Affected by Factors Outside of Our Control

Our

future operating results may vary from quarter to quarter due to a variety of factors, many of which are outside our control. Our anticipated

expense levels are based, in part, on our estimates of future revenues and may vary from projections. We may be unable to adjust spending

rapidly enough to compensate for any unexpected revenue shortfall. Accordingly, any significant shortfall in revenue in relation to our

planned expenditures could materially and adversely affect our business, operating results, and financial condition. Further, we believe

that period-to-period comparisons of our operating results are not necessarily a meaningful indication of future performance.

Transfer

Agent

Our

transfer agent is ClearTrust, LLC, whose address is 16540 Pointe Village Drive, Suite 206, Lutz, Florida 33558, and telephone number

is (813) 235-4490.

Company

Contact Information

Our

principal executive offices are located at 28050 US Highway 19 N., Ste 310, Clearwater, FL 33761, telephone (813) 240-0307. Our

email address is info@cleartronic.com. The Cleartronic Internet website is www.cleartronic.com and the ReadyOp website is www.readyop.com.

The information contained in our website does not constitute part of this report.

Item

1A. Risk Factors.

Not

applicable.

Item

1B. Unresolved Staff Comments.

None.

Item

2. Property.

During

the years prior to December 1, 2022, the Company sub-leased approximately 1,700 square feet for our principal offices in Boca Raton,

Florida, from VoiceInterop, Inc. The monthly rent is $1,400 and provided for annual increases of base rent of 4% until the expiration

date. The lease expired on November 30, 2021. On December 1, 2021, the Company signed a one year lease for approximately 2,000 square

feet for our principal offices in Boca Raton, Florida. The monthly rent is $2,200. The lease expires on November 30, 2022.

On

December 2, 2022, and effective on January 1, 2023, the Company signed a two-year lease of 1,145 square feet for our principal offices

in Clearwater, Florida. The monthly rent is $2,134 in year one and increases to $2,198 in year two. The lease expires on December 31,

2024 (See Note 6).

Item

3. Legal Proceedings.

Cleartronic

is not engaged in any litigation at the present time and management is unaware of any claims or complaints that could result in future

litigation. Management will seek to minimize disputes with the Company’s customers but recognizes the inevitability of legal action

in today’s business environment as an unfortunate price of conducting business.

Item

4. Safety Disclosures.

Not

applicable.

PART

II

Item

5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

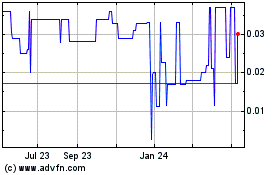

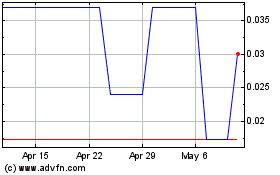

The

Company’s common stock has been traded on the OTCPINK under the symbol “CLRI.” The last price of our common stock as reported

on the pink tier of OTC Markets on September 30, 2023 was $0.0281 per share.

As

of September 30, 2023 we were authorized to issue 5,000,000,000 shares of our common stock, of which 229,160,695 shares were outstanding.

Our shares of common stock are held by approximately 218 stockholders of record. The number of record holders was determined from the

records of our transfer agent and does not include beneficial owners of our common stock whose shares are held in the names of various

securities brokers, dealers, and registered clearing agencies. In addition to our authorized common stock, Cleartronic has designated

200,000,000 shares of preferred stock, par value $0.00001 per share, of which 7,317,403 shares are issued or outstanding. There is no

trading market for the shares of our preferred stock.

Dividends

We

do not anticipate paying any cash dividends or other distributions on the Company’s common stock in the foreseeable future. Any future

dividends will be declared at the discretion of the Company’s board of directors and will depend, among other things, on the earnings

and financial requirements for future operations and growth, and other facts as the board of directors may then deem appropriate. See

“Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters,” for a description

of the preferred stock and dividend rights pertaining to the preferred stock.

The

Company is obligated to pay dividends on its Series A Convertible Preferred Stock. Each Series A Preferred Holder is entitled to receive

cumulative dividends at the rate of 8% of $1.00 per annum for each outstanding share of Series A Preferred then held by such Series A

Preferred Holder, on a pro rata basis. As of September 30, 2023 and 2022, the cumulative arrearage of undeclared dividends totalled $206,181

and $165,144, respectively.

Recent

Sales of Unregistered Securities

Except

for those unregistered securities previously disclosed in reports filed with the Securities Exchange Commission during the period covered

by this report, we have not sold any securities under the Securities Act of 1933.

Issuer

Purchases of Equity Securities

None

Item

6. Selected Financial Data.

Not

applicable.

Item

7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

THE

FOLLOWING DISCUSSION SHOULD BE READ TOGETHER WITH THE INFORMATION CONTAINED IN THE CONSOLIDATED FINANCIAL STATEMENTS AND RELATED NOTES

INCLUDED ELSEWHERE IN THIS ANNUAL REPORT ON FORM 10-K.

MANAGEMENT

DISCUSSION

The

following discussion reflects the Company’s plan of operation. This discussion should be read in conjunction with the financial statements

which are attached to this report. This discussion contains forward-looking statements, including statements regarding our expected financial

position, business and financing plans. These statements involve risks and uncertainties. The actual results could differ materially

from the results described in or implied by these forward-looking statements as a result of various factors, including those discussed

below and elsewhere in this report, particularly under the headings “Special Note Regarding Forward-Looking Statements.”

Unless

the context otherwise suggests, “we,” “our,” “us,” and similar terms, as well as references to “Cleartronic”,

all refer to Cleartronic, Inc. and our subsidiaries as of the date of this report.

Results

of Operations

YEAR

ENDED SEPTEMBER 30, 2023 COMPARED TO THE YEAR ENDED SEPTEMBER 30, 2022

Revenue

Revenues

increased 5.67% to $2,131,955 for the year ended September 30, 2023 as compared to $2,017,563 for the year ended September 30, 2022.

The primary reason for the increase was an increase in revenue from the ReadyOp platform from $1,818,035 in 2022 to $2,022,550 in 2023.

There was also an increase in sales of ReadyOp hardware products from $33,800 in 2022 to 48,325 in 2023. Consulting fees and related

income decreased from $86,000 in 2022 to $32,850 in 2023 due primarily to a decrease in sales of thermal scanners as these were primarily

purchased by clients for operations during the COVID 19 pandemic.

Cost

of Revenue

Cost

of revenues decreased to $316,163 for the year ended September 30, 2023 as compared to $334,138 for the year ended September 30, 2022.

Gross profits were $1,815,792 and $1,683,425 for the years ended September 30, 2023 and September 30, 2022, respectively. Gross profit

margins increased to 85.17% for the year ended September 30, 2023 from 83.44% for the year ended September 30, 2022.

Operating

Expenses

Operating

expenses increased 32.49% to $1,761,843 for the year ended September 30, 2023 compared to $1,329,791 for the year ended September 30,

2022. The increase was primarily due to administrative expenses and selling expenses. General and administrative expenses increased by

$270,184 or 26.14% as a result of the increase in general business expenses, an increase in headcount and personnel related costs associated

with the addition of new employees. In addition, the Company’s paid fees to outside consulting services that are assisting us in

obtaining FedRAMP certification. For the year ended September 30, 2023, $59,324 was paid in connection with FedRamp certification.

There were also charitable contributions and employee holiday bonuses paid during the year. For the year ended September 30, 2023,

selling expenses were $425,498 compared to $272,521 for the year ended September 30, 2022. This increase was primarily due expenses

associated with a trade show hosted by the Company and bad debt expense. There was also an increase in advertising and travel expenses

as the Company increased its sales and marketing efforts following the COVID 19 pandemic. Research and development expenses were $27,314

for the year ended September 30, 2023, as compared to $19,742 for the year ended September 30, 2022. This increase was primarily due

to research and development expenses.

Other

Income/(Expenses)

The

Company’s other income decreased by $44,654 from other income of $2,607 during the year ended September 30, 2023 as compared to

$47,261 in other expenses for the year ended September 30, 2022. The primary reason for this decrease was an increase in interest income

on note receivable due from a related party and offset by a settlement of certain accounts payable for the year ended September 30, 2022.

Income

before Income Taxes

The

Company’s income before income taxes was $56,556, during the year ended September 30, 2023, as compared to $400,895 for the year

ended September 30, 2022. The decrease was primarily due to expensing audit expenses, a move of the corporate headquarters, the addition

of new employees, employee related costs and costs associated with FedRAMP certification. The increased costs were partially offset by

an increase in subscriptions of ReadyOp licenses.

Net

Income Attributable to Common Stockholders

Net

income attributable to common stockholders was $15,518 for the year ended September 30, 2023 as compared to a net income of $359,858

for the year ended September 30, 2022. The decrease was primarily due to an increase in administrative and offset by an increase in sales

of ReadyOp licenses. The increased costs were partially due expenses related to a move of the corporate headquarters and the addition

of new employees. The preferred stock dividends remained consistent.

Liquidity

and Capital Resources

For

the year ended September 30, 2023, net cash provided in operations of $99,595 was the result of a net income of $56,556, depreciation

and amortization expense of $5,051, amortization of operating lease of $17,949, provision of bad debt of $97,994, an increase in accounts

payable of $10,640, and a decrease in inventory of $816. These were offset by an increase in accounts receivable of $105,537, increase

in prepaid expenses of $17,635 and an increase in deferred revenue of $52,169.

For

the year ended September 30, 2022, net cash used in operations of $74,649 was the result of a net income of $400,895, depreciation expense

of $3,732, provision of bad debt of $14,000, gain on settlement and reversal of accounts payable of $47,792, an increase in accounts

receivable of $231,785, and a decrease of accounts payable of $36,943. These were offset by an increase in inventory of $6,444, an increase

in prepaid expenses of $6,228, and an increase in deferred revenue of $6,285.

Net

cash used in investing activities was $50,807 for the year ended September 30, 2023 which was for the purchase of fixed assets of $6,434,

and intangible assets of $44,374.

Net

cash used in investing activities was $ $7,483 for the year ended 2022, which was for the purchase of fixed assets of $7,483.

Critical

Accounting Estimates

We

prepare our consolidated financial statements in accordance with accounting principles generally accepted in the United States of America,

and make estimates and assumptions that affect our reported amounts of assets, liabilities, revenue and expenses, and the related disclosures

of contingent liabilities. We base our estimates on historical experience and other assumptions that we believe are reasonable in the

circumstances. Actual results may differ from these estimates.

The

following critical accounting policies affect our more significant estimates and assumptions used in preparing our consolidated financial

statements.

Accounts

Receivable and Allowance for Credit Losses

The

Company maintains current receivable amounts with most of its customers. The Company regularly monitors and assesses its risk of not

collecting amounts owed by customers. This evaluation is based upon an analysis of current and past due amounts, along with relevant

history and facts particular to the customer. The Company records its allowance for credit losses based on the results of this analysis.

The analysis requires the Company to make significant estimates and as such, changes in facts and circumstances could result in material

changes in the allowance for credit losses. The Company considers as past due any receivable balance not collected within its contractual

terms.

The

Company provided $63,665 and $18,000 allowances for doubtful accounts as of September 30, 2023, and September 30, 2022, respectively.

Inventory

Inventory

consists of components held for assembly and finished goods held for resale or to be utilized for installation in projects. Inventory

is valued at lower of cost or net realizable value on a first-in, first-out basis. The Company’s policy is to record a reserve for

technological obsolescence or slow-moving inventory items. The Company only carries finished goods to be shipped along with completed

circuit boards and parts necessary for final assembly of finished product. All existing inventory is considered current and usable.

Recent

Accounting Pronouncements

The

recent accounting standards that have been issued or proposed by Financial Accounting Standard Board (FASB) or other standard setting

bodies that do not require adoption until a future date are not expected to have a material impact on the financial statement upon adoption.

The

recent accounting pronouncements are described in Note 2 to the consolidated financial statement appearing elsewhere in this report.

Off-Balance

Sheet Arrangements

We

do not have any off-balance sheet arrangements.

Item

7A. Quantitative and Qualitative Disclosures About Market Risk.

Not

applicable.

Item

8. Financial Statements and Supplementary Data.

The

financial statements and related notes are included as part of this report as indexed in the appendix on page F-1, et seq.

Item

9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

None

Item

9A. Controls and Procedures.

Evaluation

of Disclosure and Controls and Procedures. We carried out an evaluation, under the supervision and with the participation of

our management, including our principal executive officer and principal financial officer, of the effectiveness of our disclosure controls

and procedures (as defined) in Exchange Act Rules 13a - 15(c) and 15d - 15(e)). Based upon that evaluation, our chief executive officer

and chief financial officer concluded that, as of September 30, 2023, our disclosure controls and procedures were effective (1) to ensure

that information required to be disclosed by us in reports that we file or submit under the Exchange Act is recorded, processed, summarized

and reported, within the time periods specified in the SEC’s rules and forms and (2) to ensure that information required to be disclosed

by us in the reports that we file or submit under the Exchange Act is accumulated and communicated to us, including our Chief Executive

and Chief Financial Officer, as appropriate to allow timely decisions regarding required disclosure.

The

term disclosure controls and procedures means controls and other procedures of an issuer that are designed to ensure that information

required to be disclosed by the issuer in the reports that it files or submits under the Exchange Act (15 U.S.C. 78a ,et seq.)

is recorded, processed, summarized and reported, within the time periods specified in the Commission’s rules and forms. Disclosure

controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed

by an issuer in the reports that it files or submits under the Exchange Act is accumulated and communicated to the issuer’s management,

including its principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow

timely decisions regarding required disclosure.

Our

management, including our Chief Executive Officer and Chief Financial Officer, does not expect that our disclosure controls and procedures

or our internal controls over financial reporting will prevent all error and all fraud. A control system, no matter how well conceived

and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design

of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative

to their costs. Because of inherent limitations in all control systems, internal control over financial reporting may not prevent or

detect misstatements, and no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if

any, within the registrant have been detected. Also, projections of any evaluation of effectiveness to future periods are subject to

the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or

procedures may deteriorate.

Management’s

Annual Report on Internal Control over Financial Reporting. Our management is responsible for establishing and maintaining adequate

internal control over financial reporting as defined in Rule 13a-15(f) under the Exchange Act. Our internal control over financial reporting

is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial

statements for external purposes in accordance with accounting principles generally accepted in the United States.

The

term internal control over financial reporting is defined as a process designed by, or under the supervision of, the issuer’s principal

executive and principal financial officers, or persons performing similar functions, and effected by the issuer’s board of directors,

management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation

of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies

and procedures that:

| |

|

| ● |

Pertain

to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of our

assets; |

| |

|

| ● |

Provide

reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with

generally accepted accounting principles, and that receipts and expenditures of the issuer are being made only in accordance with

authorizations of management and directors of the issuer; and |

| |

|

| ● |

Provide

reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the issuer’s

assets that could have a material effect on the financial statements. |

Our

management assessed the effectiveness of our internal control over financial reporting as of September 30, 2023. In making this assessment,

our management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO-2013) in Internal

Control-Integrated Framework. Management concluded that our internal control over financial reporting was effective as of September 30,

2023.

Changes

in Internal Control Over Financial Reporting. There have been no changes in the registrant’s internal control over financial

reporting through the date of this report or during the quarter ended September 30, 2023, that materially affected, or is reasonably

likely to materially affect, the registrant’s internal control over financial reporting.

Independent

Registered Accountant’s Internal Control Attestation. This report does not include an attestation report of the registrant’s

registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation

by the registrant’s registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that

permit the registrant to provide only management’s report in this report.

Item

9B. Other Information.

None.

PART

III

Item

10. Directors, Executive Officers and Corporate Governance.

The

following table sets forth information concerning the directors and executive officers of Cleartronic as of the date of this report:

| |

|

|

|

| Name |

Age |

Position |

Director

Since |

| Richard

J. Martin |

63 |

Chairman

and Director |

2016 |

| Michael

M. Moore |

68 |

Chief

Executive Officer and Director |

2015 |

| Larry

M. Reid |

78 |

President,

Chief Financial Officer, Secretary and Director |

1999 |

The

members of our board of directors are subject to change from time to time by the vote of the stockholders at special or annual meetings

to elect directors. Our current board of directors consists of three directors who have expertise in the business of Cleartronic. Based

on our continuing profitability, we intend to seek directors and officers who would be able to assist in the execution of our business

plan.

The

foregoing notwithstanding, except as otherwise provided in any resolution or resolutions of the board, directors who are elected at an

annual meeting of stockholders, and directors elected in the interim to fill vacancies and newly created directorships, will hold office

for the term for which elected and until their successors are elected and qualified or until their earlier death, resignation or removal.

Whenever

the holders of any class or classes of stock or any series thereof are entitled to elect one or more directors pursuant to any resolution

or resolutions of the board, vacancies and newly created directorships of such class or classes or series thereof may generally be filled

by a majority of the directors elected by such class or classes or series then in office, by a sole remaining director so elected or

by the unanimous written consent or the affirmative vote of a majority of the outstanding shares of such class or classes or series entitled

to elect such director or directors. Officers are elected annually by the directors. There are no family relationships among our directors

and officers.

We

may employ additional management personnel, as our board of directors deems necessary. Cleartronic has not identified or reached an agreement

or understanding with any other individuals to serve in management positions, but does not anticipate any problem in employing qualified

staff.

A

description of the business experience for the directors and executive officers of Cleartronic is set forth below.

Richard

J. Martin currently serves as Chairman and Director of Cleartronic, Inc. Prior to joining the Cleartronic team, Martin served as CEO

of SMARTLogix, Inc., a petroleum logistics technology company which he founded in 2000. Graduating with an Engineering degree from The

University of Buffalo’s School of Engineering, Martin joined the Exxon Management Development Program. Following his tenure at Exxon,

he purchased an Exxon distributorship in the Carolinas. Culp Petroleum was transformed into a large regional distribution company. While

at Culp, Martin developed and implemented several technologies that have since become industry standards. Martin sold the petroleum business

in 2005 and focused his efforts on his technology ventures including the SMARTank division of SMARTLogix. SMARTank grew substantially

and the technology was later sold to a public company in 2011.

Michael

M. Moore is currently Chief Executive Officer and a Director of Cleartronic, Inc. He was founder and CEO of Collabria, LLC, a private

software development company. Prior to founding Collabria in 2008, Moore for 13 years was CEO of DTNet Group and for seven years served

as CEO of Payroll Transfers, Inc. He also was an assistant vice president with both Kidder Peabody and Merrill Lynch. Mr. Moore is an

honors graduate of the United States Air Force Academy and served as an Air Force fighter pilot for eight years, flying F-4 and F-16

fighter aircraft. He is also one of six entrepreneurs profiled in the book Daring Visionaries, How Entrepreneurs Build Companies,

Inspire Allegiance, and Create Wealth.

Larry

Reid is the founder of Cleartronic and a co-founder of VoiceInterop. With over thirty years of executive management experience including

sales and marketing, operations management, and financial management, from 2001 to 2005 Mr. Reid served as CFO and director of Connectivity,

Inc., a manufacturer and distributor of emergency call boxes. He was instrumental in Connectivity’s acquisition by CNE Group, Inc.,

(an American Stock Exchange listed company) and served as Executive Vice President and Director of CNE from 2003 to 2005. Mr. Reid has

broad experience in venture start-ups, raising capital, building organizational synergies, creating and developing joint ventures and

strategic partnerships, opening new markets, and driving key business initiatives. Early in his professional career in corporate financial

management, Mr. Reid was responsible for raising more than $5 million in start-up capital for Ocurest Laboratories, Inc., a company he

co-founded to package and distribute over-the-counter eye drops in a new (patented) eye drop dispenser. He forged Ocurest’s successful

IPO in 1996 and helped lead the company’s achieving an estimated 80% market penetration of optical supply retail outlets in the

United States.

Committees

of the Board

We

do not currently have an Audit, Executive, Finance, Compensation, or Nominating Committee, or any other committee of the Board of Directors.

Section

16(a) Beneficial Ownership Reporting Compliance

Under

Section 16(a) of the Exchange Act, our directors and certain of our officers, and persons holding more than 10 percent of our common

stock are required to file forms reporting their beneficial ownership of our common stock and subsequent changes in that ownership with

the United States Securities and Exchange Commission. Such persons are also required to furnish Cleartronic with copies of all

forms so filed.

Based

solely upon a review of copies of such forms filed on Forms 3, 4, and 5, and amendments thereto furnished to us, we believe that as of

the date of this report, our executive officers, directors and greater than 10 percent beneficial owners have not complied on a timely

basis with all Section 16(a) filing requirements.

Communication

with Directors

Stockholders

and other interested parties may contact any of our directors by writing to them at Cleartronic, Inc., at 8000 North Federal Highway,

Suite 100, Boca Raton, Florida 33487, Attention: Corporate Secretary.

The

Company’s Board has approved a process for handling letters received by us and addressed to any of our directors. Under that

process, the Secretary reviews all such correspondence and regularly forwards to the directors a summary of all such correspondence,

together with copies of all such correspondence that, in the opinion of the Secretary, deal with functions of the board or committees

thereof or that he otherwise determines requires their attention. Directors may at any time review a log of all correspondence

received by us that are addressed to members of the board and request copies of such correspondence.

Conflicts

of Interest

With

respect to transactions involving real or apparent conflicts of interest, we have not adopted any written policies and procedures.

Code

of Ethics for Senior Executive Officers and Senior Financial Officers

We

have not adopted a Code of Ethics for Senior Executive Officers and Senior Financial Officers.

Item

11. Executive Compensation.

Summary

of Cash and Certain Other Compensation

At

present, Cleartronic has two executive officers, Michael M. Moore and Larry M. Reid. Michael M. Moore is the Chief Executive Officer

of the Company. The Company executed an Employment Agreement with Mr. Moore on November 28, 2016. Under the Agreement, Mr. Moore agreed

that he shall carry out the strategic plans and policies as established by our business plan. Mr. Moore will advise us from time to time

on organization, hiring, mergers, and execution of our business plan. Mr. Moore is paid a base salary of $16,667 per month.

Unless

Cleartronic shall have given Mr. Moore written notice at least 30 days prior to the Termination Date, the Agreement shall automatically

renew and continue in effect for additional one-year periods (and all provisions of this anniversary from such original Termination Date

shall thereafter be designated as the “Termination Date” for all purposes under the Agreement, provided, however, that we may,

at our election at any time after the expiration of the initial term of the Agreement, give Mr. Moore notice of Termination, in which

event he shall continue to receive, as severance pay, six months of his base salary, if any, or the amount due through the next “Termination

Date”, whichever is less. Mr. Moore may terminate the Agreement without severance pay upon 10 days written notice to the Company.

The

Company executed an Employment Agreement with Mr. Reid on March 13, 2015. The Employment Agreement replaces the previously executed Employment

Agreement with Mr. Reid. Pursuant to the Employment Agreement (the “Agreement”), Cleartronic and Mr. Reid agreed that for a

one year period beginning on March 13, 2015, we employed Mr. Reid to perform services for us both on and offsite. The last day of the

one year period shall be the “Termination Date” for purposes of the Agreement. Termination of the agreement can be made by

either party without penalty upon 10 days written notice. Pursuant to the Agreement, Cleartronic and Mr. Reid agreed that for a one year

period beginning on November 28, 2016, Mr. Reid to perform services for us both on and offsite. The last day of the one year period shall

be the “Termination Date” for purposes of the Agreement.

Unless

Cleartronic shall have given Mr. Reid written notice at least 30 days prior to the Termination Date, the Agreement shall automatically

renew and continue in effect for additional one-year periods (and all provisions of this anniversary from such original Termination Date

shall thereafter be designated as the “Termination Date” for all purposes under the Agreement, provided, however, that we may,

at our election at any time after the expiration of the initial term of the Agreement, give Mr. Reid notice of Termination, in which

event he shall continue to receive, as severance pay, six months of his base salary, if any, or the amount due through the next “Termination

Date”, whichever is less. Mr. Reid may terminate the Agreement without severance pay upon 10 days written notice to the Company.

Under the Agreement, Mr. Reid agreed that he shall carry out the strategic plans and policies as established by our business plan. Mr.

Reid will advise us from time to time on organization, hiring, mergers, and execution of our business plan.

Summary

Compensation Table

The

following table sets forth, for our named executive officers for the two completed fiscal years ended September 30, 2023, and 2022:

| |

|

|

|

|

|

|

|

|

|

Name

and

Principal Position |

Year |

Salary

($) |

Bonus

($) |

Stock

Awards ($) |

Option

Awards ($) |

Non-Equity

Incentive Plan Compensation ($) |

Nonqualified

deferred

compensation

earnings

($) |

All

Other Compensation ($) |

Total

($) |

| Larry

M. Reid (1) |

2022 |

104,000 |

5,500 |

-0- |

-0- |

-0- |

-0- |

-0- |

109,500 |

| |

2023 |

104,000 |

400 |

-0- |

-0- |

-0- |

-0- |

-0- |

104,400 |

| Michael Moore

(2) |

2022 |

208,462 |

20,812 |

-0- |

-0- |

-0- |

-0- |

-0- |

229,274 |

| |

2023 |

220,000 |

3,100 |

-0- |

-0- |

-0- |

-0- |

-0- |

223,100 |

(1)

Mr. Reid is our Chief Financial Officer, Secretary, and a director.

(2)

Mr. Moore is our CEO and a director.

Outstanding

Equity Awards at Fiscal Year-End

Our

Executive Officers have not received any equity awards for the years ended September 30, 2023 and 2022.

Director

Compensation

Our

Directors have not received compensation for the years September 30, 2023 and 2022.

Item

12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

The

following table presents information regarding the beneficial ownership of all shares of our common stock and preferred stock as of the

date of this report by:

| |

|

| ● |

Each

person who owns beneficially outstanding shares of our preferred stock; |

| ● |

Each

director; |

| ● |

Each

named executive officer; and |

| ● |

All

directors and officers as a group. |

| | |

Shares of Common Stock Beneficially Owned (2) | | |

Shares of Preferred Stock Beneficially Owned (2) | |

| Name of Beneficial Owner (1) | |

Number | | |

Percent | | |

Number | | |

Percent | |

| Larry M. Reid (3) | |

| 5,016,325 | | |

| 2.19 | % | |

| 511,225 | | |

| 5.93 | % |

| Michael Moore (4) | |

| 5,702,988 | | |

| 2.50 | % | |

| 3,000,000 | | |

| 34.18 | % |

| Richard J. Martin | |

| 1,868,202 | | |

| 0.82 | % | |

| 1,582,966 | | |

| 18.37 | % |

| All directors and officers as a group (one person) | |

| 12,587,515 | | |

| 5.51 | % | |

| 5,094,199 | | |

| 59.12 | % |

(1)

Unless otherwise indicated, the address for each of these stockholders is c/o Cleartronic, Inc., at 8000 North Federal Highway, Suite

100, Boca Raton, Florida 33487. Also, unless otherwise indicated, each person named in the table above has the sole voting and investment

power with respect to our shares of common stock or preferred stock which he beneficially owns.

(2)

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission. As of the date of this

report, we have 5,000,000,000 authorized shares of common stock, par value $0.00001 per share, of which 228,578,995 shares were issued

and outstanding. As of the date of this report, we have 71,250,010 authorized and designated shares of preferred stock, par value

$0.00001 per share, of which 7,525,403 shares were issued and outstanding. Mr. Reid owns 511,525 shares of Series C Preferred stock.

See below for a description of our preferred stock and voting rights. Mr. Martin owns 512,996 shares of our Series A Preferred

stock and 1,070,000 shares of our Series C Preferred stock.

(3)

Mr. Reid is our president, chief financial officer, principal accounting officer, secretary, and director.

(4)

Mr. Moore is our Chief Executive Officer and a director. Mr. Moore owns 5,702,988 shares of our common stock and 3,000,000 shares of

our Series E Preferred stock.

Other

than as stated herein, there are no arrangements or understandings, known to us, including any pledge by any person of our securities:

| |

|

| ● |

The

operation of which may at a subsequent date result in a change in control of Cleartronic; or |

| ● |

With

respect to the election of directors or other matters. |

Preferred

Stock

As

of the date of this report, we have 200,000,000 authorized shares of preferred stock, par value $0.00001 per share, of which 7,317,403

shares were issued and outstanding. There are currently 5 series of preferred stock designated as follows:

| |

|

| ● |

1,250,000

shares have been designated as Series A Preferred Stock, 512,996 of which are issued and outstanding; |

| |

|

| ● |

10

shares have been designated as Series B Preferred Stock, none of which is issued and outstanding; |

| |

|

| ● |

50,000,000

shares have been designated as Series C Preferred Stock, 3,133,503 of which are issued and outstanding; and |

| |

|

| ● |

10,000,000

shares have been designated Series D Preferred stock, of which 670,904 are issued and outstanding; and |

| |

|

| ● |

10,000,000

shares have been designated Series E Preferred stock, of which 3,000,000 are issued and outstanding. |

Pursuant

to our Articles of Incorporation establishing our preferred stock:

| |

|

| ● |

A

holder of shares of the Series A Preferred Stock is entitled to the number of votes equal

to the number of shares of the Series A Preferred Stock held by such holder multiplied by

one on all matters submitted to a vote of our stockholders. Each one share of our Series

A Preferred Stock shall be convertible into 100 shares of our common stock. Each holder

of Series A Preferred Stock is entitled to receive cumulative dividends at the rate of 8%

of $1.00 per annum on each outstanding share of Series A Preferred Stock then held by such

holder, on a pro rata basis.

|

| ● |

A

holder of shares of the Series B Preferred Stock is entitled one vote per share on all matters

submitted to a vote of our stockholders. If at least one share of Series B Preferred

Stock is issued and outstanding, then the total aggregate issued shares of Series B Preferred

Stock at any given time, regardless of their number, shall have voting rights equal to two

times the sum of the total number of shares of our common stock which are issued and outstanding

at the time of voting, plus the total number of shares of any shares of our preferred stock

which are issued and outstanding at the time of voting. A holder of shares of the Series

B Preferred Stock shall have no conversion rights or rights to dividends.

|

| ● |

A

holder of shares of the Series C Preferred Stock is entitled, to the number of votes equal

to the number of shares of the Series C Preferred Stock held by such holder multiplied by

5 on all matters submitted to a vote of our stockholders. In addition, the holders

of our Series C Preferred Stock shall be entitled to receive dividends when, as and if declared

by the Board of Directors, in its sole discretion. No dividends have been declared.

Finally, each one share of our Series C Preferred Stock shall be convertible into five shares

of our common stock.

|

| ● |

A

holder of shares of the Series D Preferred Stock is entitled, to the number of votes equal

to the number of shares of the Series D Preferred Stock held by such holder multiplied by

5 on all matters submitted to a vote of our stockholders. In addition, the holders

of our Series D Preferred Stock shall be entitled to receive dividends when, as and if declared

by the Board of Directors, in its sole discretion. No dividends have been declared.

Finally, each one share of our Series D Preferred Stock shall be convertible into five shares

of our common stock.

|

| ● |

A

holder of shares of the Series E Preferred Stock is entitled, to the number of votes equal to the number of shares of the Series

E Preferred Stock held by such holder multiplied by 100 on all matters submitted to a vote of our stockholders. In addition,

the holders of our Series E Preferred Stock shall be entitled to receive dividends when, as and if declared by the Board of Directors,

in its sole discretion. No dividends have been declared. Finally, each one share of our Series E Preferred Stock shall be convertible

into 100 shares of our common stock. |

Item

13. Certain Relationships and Related Transactions and Director Independence.

None

Item

14. Principal Accounting Fees and Services.

Change

in Audit Firms

On

October 6, 2022, Liggett & Webb P.A. (“L&W”) resigned as the independent auditors of Cleartronic, Inc., a company incorporated

under the laws of the State of Florida (the “Company”). The Company’s Board of Directors accepted L&W’s resignation

on October 6, 2022.

The

reports of L&W on the financial statements of the Company as of and for the fiscal year ended September 30, 2021 did not contain

any adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles.

During

the Company’s most recent fiscal years and the subsequent interim period through October 6, 2022, there were no disagreements with

L&W on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreement(s),

if not resolved to the satisfaction of L&W, would have caused it to make reference to the subject matter of the disagreement(s) in

connection with its report. During the Company’s most recent fiscal years and the subsequent period through October 6, 2022, there

were no reportable events of the type described in Item 304(a)(1)(v) of Regulation S-K.

The

Company provided L&W with a copy of the foregoing disclosure and requested L&W to furnish the Company with a letter addressed

to the Securities and Exchange Commission stating whether it agrees with the statements made therein. A copy of such letter furnished

by L&W is filed as Exhibit 16.1 to the form 8-K filed by the Company.

On

December 7, 2022, the Board of Directors of the Company approved the engagement of Assurance Dimensions (“Assurance”) as the

Company’s independent registered public accounting firm for the audit of the Company’s annual report on Form 10-K for the year

ended September 30, 2022.

Audit

Fees

The

aggregate fees billed by Liggett & Webb, P.A. for professional services rendered for the audit and reviews of our financial statements

for the fiscal years ended September 30, 2022, was $48,000.

The

aggregate fees billed by Assurance Dimensions for professional services rendered for the audit and review of our financial statements

for the fiscal year ended September 30, 2022, was $30,000.

The

aggregate fees billed by Assurance Dimensions for professional services rendered for the audit and review of our financial statements

for the fiscal year ended September 30, 2023, was $50,000.

Audit

Related Fees

The

aggregate audit-related fees billed by Liggett & Webb, P.A. for professional services rendered for the audit of our annual financial

statements for the fiscal year ended September 30, 2022 was $4,000.

Tax

Fees

The

aggregate tax fees billed by Liggett & Webb, P.A. professional services rendered for tax services for the fiscal year ended September

30, 2023 and 2022 was $1,500 and $1,500, respectively.

All

Other Fees

There

were no other fees billed by Assurance Dimensions (“Assurance”) for professional services rendered during the fiscal year ended

September 30, 2023, other than as stated under the captions Audit Fees, Audit-Related Fees, and Tax Fees.

There

were no other fees billed by Ligget & Webb, P.A. for professional services rendered during the fiscal years ended September 30, 2023

and 2022, other than as stated under the captions Audit Fees, Audit-Related Fees, and Tax Fees.

Audit

Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors

Given