0001494650false00014946502023-07-272023-07-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________________________________________

FORM 8-K

____________________________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 18, 2023

__________________________________________________________________________________________

OPTINOSE, INC.

(Exact Name of Registrant as Specified in its Charter)

____________________________________________________________________________________________ | | | | | | | | |

| Delaware | 001-38241 | 42-1771610 |

| (State or Other Jurisdiction of Incorporation or Organization) | (Commission File No.) | (I.R.S. Employer Identification No.) |

1020 Stony Hill Road, Suite 300

Yardley, Pennsylvania 19067

(Address of principal executive offices and zip code)

(267) 364-3500

(Registrant’s telephone number, including area code)

(Former name or former address, if changed from last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.001 per share | | OPTN | | Nasdaq Global Select Market |

____________________________________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | |

| |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-14(c)) |

| |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| |

| ☐ | Emerging growth company |

| |

| ☐ | If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

Item 1.01 Entry Into a Material Definitive Agreement

On December 18, 2023, OptiNose US, Inc. ("Optinose") entered into Amendment No. 1 (the "Amendment") to its Supply Agreement, dated July 1, 2017 (the "Supply Agreement") with Hovione Inter Ltd (“Hovione”). The Supply Agreement sets forth the terms and conditions pursuant to which Hovione manufactures and supplies fluticasone propionate, the active pharmaceutical ingredient included in XHANCE®, to Optinose. Pursuant to the Amendment, among other changes:

•the term of the Supply Agreement was extended to December 31, 2026;

•the annual volume tiers and associated pricing for fluticasone propionate quantities were modified, including the addition of an annual sourcing fee payable by Optinose; and

•Optinose may now also terminate the Supply Agreement without cause provided that it pays a specified termination fee.

The Supply Agreement, as amended, does not require Optinose to purchase any minimum quantity of fluticasone propionate.

The foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment, a copy of which is attached to this Current Report on Form 8-K as Exhibit 10.1 and is incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | |

|

| | |

| | | |

| | | OptiNose, Inc. |

| | By: /s/ Michael F. Marino |

| | | Michael F. Marino |

| | | Chief Legal Officer |

December 21, 2023

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 10.1* | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

* Portions of this exhibit (indicated by asterisks "[**]") have been omitted in compliance with Item 601 of Regulation S-K.

Portions of this exhibit indicated by asterisks [**] have been omitted because they are not material and are the type of information that the registrant treats as private or confidential

AMENDMENT NO. 1 TO SUPPLY AGREEMENT

This AMENDMENT NO. 1 TO SUPPLY AGREEMENT (this “Amendment”) is made effective January 1, 2023 (the “Amendment Effective Date”) and is entered into by and between HOVIONE INTER LTD, Bahnhofstrasse 21, CH-6000 Lucerne 7, Switzerland (“Hovione”) and OPTINOSE US, INC., a Delaware corporation, having its principal place of business at 1020 Stony Hill Road, Suite 300, Yardley, PA 19067 (“OptiNose”). Hovione and OptiNose are sometimes referred to herein individually as a “Party” and collectively as the “Parties.”

RECITALS

WHEREAS Hovione and OptiNose, OptiNose AS and OptiNose UK Ltd. entered into that certain Supply Agreement effective as of July 1, 2017 (the “Agreement”), which outlines the rights and obligations of Hovione and OptiNose with respect to the conduct of certain services to be performed by Hovione;

WHEREAS OptiNose AS and OptiNose UK Ltd. are currently in the process of being dissolved and the Parties wish to remove them as Parties to the Agreement;

WHEREAS the Parties wish to enter into this Amendment in accordance with the terms and conditions set forth herein;

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties hereto, intending to be legally bound, hereby agree as follows:

1. Defined Terms. All capitalized terms used herein shall have the meaning ascribed to each of them as defined herein and, if not defined herein, shall have the meaning ascribed to each of them in the Agreement.

2. Amendments to Agreement.

(a) Preamble. OptiNose AS and OptiNose UK Ltd. shall no longer be Parties to the Agreement, and all references to OptiNose AS and OptiNose UK Ltd. are hereby deleted.

(b) Section 1, Definitions.

Section 1.13 “Firm Forecast” is hereby deleted in its entirety and all references to such are hereby deleted.

Section 1.16 “Product Specifications” is hereby amended and restated in its entirety to read in full as follows:

“Product Specifications” shall have the meaning given to such term in Section 2.1.a hereof”.

(c) Section 2.1 Supply. Effective as of the Amendment Effective Date, Section 2.1, Supply, is hereby amended and restated in its entirety to read in full as follows:

“Supply. During the term of this Agreement and subject to the terms and conditions set forth herein, Hovione shall manufacture and supply API to OptiNose (or a third party designated by OptiNose) in such quantities as from time to time may be ordered by OptiNose in accordance with Exhibit B hereto. During the term of this Agreement, Hovione shall ensure that it has the

Portions of this exhibit indicated by asterisks [**] have been omitted because they are not material and are the type of information that the registrant treats as private or confidential

capacity to meet all of OptiNose’s requirements for API in a timely manner in accordance with Exhibit B.

(a) Product Specifications. The specifications of the API as set out in Hovione’s US DMF are set forth in Exhibit A to this Agreement (the “Product Specifications”); as such Exhibit may be amended in accordance with the terms of the Quality Agreement and Section 4.1 hereof.”

(d) Section 3.2, Forecasting. Effective as of the Amendment Effective date, Section 3.2, Forecasting is hereby amended and restated in its entirety to read in full as follows:

“Forecasting. For each calendar year during the term of this Agreement, OptiNose shall submit a [**] ([**]) month forecast updated on a quarterly basis, broken down on a quarterly basis covering OptiNose’s anticipated requirements of API, each such forecast to be provided to Hovione at least [**] ([**]) days prior to the start of the relevant calendar year, except in the case of the first forecast after the Effective Date which the Parties acknowledge has already been provided by OptiNose.. The forecast will be for information purposes only and non-binding. OptiNose shall place all purchase orders with Hovione at least [**] ([**]) days in advance of required delivery to OptiNose. Within [**] ([**]) days of receipt of a purchase order, Hovione shall notify OptiNose in writing of its acceptance or rejection of the purchase order and indicate the delivery date, which delivery date shall be no less than [**] ([**]) days and no more than [**] ([**]) days after the date of the purchase order unless agreed upon by the parties.”

(e) Section 3.3, Delivery Terms. Effective as of the Amendment Effective date, Section 3.3, Delivery Terms is hereby amended and restated in its entirety to read in full as follows:

“Delivery Terms. Each purchase order shall specify: (i) an identification of the API ordered; (ii) quantity requested; (iii) the requested delivery date; and (iv) shipping instructions and address. Hovione agrees to deliver API conforming to the Specifications and the requirements of this Agreement DDP (Incoterms 2020) to such U.S. or Canadian location as may be designated by OptiNose on the purchase order.”

(f) Section 3.4, Late Delivery. Effective as of the Amendment Effective date, Section 3.4, Late Delivery is hereby amended and restated in its entirety to read in full as follows:

“Late Delivery. Failure to deliver by the [**] ([**]) [**] from the agreed delivery shall constitute a breach of this Agreement and, for purposes of clarity, any liability of Hovione under this Agreement resulting from such breach shall be, to the extent applicable, subject to the limitations set forth in Section 8.4.”

(g) Section 3.6, Payment Terms. Effective as of the Amendment Effective date, the first and second sentences of Section 3.6, Payment Terms, are hereby amended and restated in their entirety to read in full as follows:

“Hovione can invoice OptiNose for the annual sourcing fee listed in Exhibit B at any time of the relevant calendar year or after its end if the invoice has not been issued during the relevant calendar year. OptiNose shall pay all undisputed amounts to Hovione for conforming API within [**] ([**]) calendar days of the date of receipt of invoice of such API.”

(h) Section 4.2, Right of Audit. Effective as of the Amendment Effective date, the first sentence of Section 4.2, Right of Audit, is hereby amended and restated in its entirety to read in full as follows:

Portions of this exhibit indicated by asterisks [**] have been omitted because they are not material and are the type of information that the registrant treats as private or confidential

“OptiNose and its representatives shall have the right to audit Hovione for compliance with applicable regulatory requirements, including but not limited to cGMPs, at reasonable intervals and upon [**] days written notice (or [**] days written notice where the audit is for cause).”

(i) Section 4.6, Inspection of API. Effective as of the Amendment Effective date, the first and second sentences of Section 4.6, Inspection of API, are hereby amended and restated in their entirety to read in full as follows:

“Within [**] ([**]) calendar days of the arrival of each lot of API at the facility designated by OptiNose, OptiNose shall inspect and test each lot of API at its own cost and expense. If, upon inspecting and testing the API, OptiNose determines that a lot of API does not conform to the Product Specifications, then OptiNose shall, within such [**] ([**]) day period, give Hovione written notice of such non-conformity (setting forth the details of such non-conformity) in the form of a written complaint, and unless Hovione, within [**] ([**]) working days from the notice by OptiNose, objects to the non-conformity or provides a status report indicating the investigation is still ongoing, OptiNose shall return the non-conforming API to Hovione at Hovione’s sole cost and expense.”

(j) Section 8.2, Indemnification by Hovione. Effective as of the Amendment Effective date, Section 8.2 is hereby amended and restated in its entirety to read in full as follows:

“8.2 Hovione shall indemnify, defend and hold OptiNose and its officers, directors, affiliates, agents and employees harmless from and against any and all claims, demands, costs, expenses, losses, liabilities and/or damages (including, but not limited to, reasonable attorneys' fees and court costs) of every kind and nature caused by, arising out of or resulting from (i) Hovione’s gross negligence relating to, or material breach of, this Agreement and (ii) any claim for personal or bodily injury arising from (a) the manufacture and/or distribution of API by Hovione or (b) the use or administration of the API, provided, however, that in no event shall this Section apply to any claim covered by Section 8.1 above. This indemnification obligation does not apply to any claim for personal or bodily injury arising from the use or administration of the API except to the extent such injury is attributable to a Defect in the API arising out of Hovione’s gross negligence, willful misconduct, or material breach of this Agreement.”

(k) Section 8.4, Limitation of Liability. Effective as of the Amendment Effective date, Section 8.4 is hereby amended and restated in its entirety to read in full as follows:

“8.4 NOTWITHSTANDING ANYTHING IN THIS AGREEMENT TO THE CONTRARY, IN NO EVENT WILL EITHER PARTY BE LIABLE FOR ANY SPECIAL, INCIDENTAL, CONSEQUENTIAL OR INDIRECT DAMAGES ARISING OUT OF THIS AGREEMENT, HOWEVER CAUSED AND ON ANY THEORY OF LIABILITY. THIS LIMITATION WILL APPLY EVEN IF THE OTHER PARTY HAS BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGE; PROVIDED, HOWEVER, THAT THIS LIMITATION WILL NOT APPLY TO DAMAGES RESULTING FROM A PARTY’S WILLFUL MISCONDUCT OR GROSS NEGLIGENCE OR BREACHES BY A PARTY OF ITS DUTY OF CONFIDENTIALITY AND NON-USE IMPOSED UNDER THIS AGREEMENT OR THE CONFIDENTIALITY AGREEMENT (COLLECTIVELY, THE “EQUITABLE EXCEPTIONS’’) OR SUCH PARTY’S INDEMNIFICATION OBLIGATIONS STATED ABOVE. FURTHERMORE, EXCEPT PURSUANT TO THE EQUITABLE EXCEPTIONS, THE TOTAL AGGREGATE LIABILITY OF HOVIONE TO OPTINOSE UNDER THIS AGREEMENT SHALL BE LIMITED TO [**].”

Portions of this exhibit indicated by asterisks [**] have been omitted because they are not material and are the type of information that the registrant treats as private or confidential

(l) Section 10.1, Term. Effective as of the Amendment Effective date, Section 10.1, Term, is hereby amended and restated in its entirety to read in full as follows:

“10.1 Term. Unless terminated in accordance with the provisions of Section 10.2 below, the term of this Agreement shall commence on the Effective Date and shall continue in effect thereafter until December 31, 2026. The term of this Agreement may be extended, upon mutual agreement of the parties, at the expiration of the term unless and until this Agreement is terminated by any party in accordance with the terms hereof. For the avoidance of doubt, this Agreement does not automatically renew.”

(m) Section 10.2, Grounds for Termination. The following sentence is hereby added to the end of Section 10.2(b):

“OptiNose shall also have the right to terminate this Agreement without cause upon [**] ([**]) days prior written notice to Hovione, provided that in this event OptiNose shall pay in a lump sum of $[**] for each calendar year remaining in the Term as of the date of termination.”

(n) Exhibit A, Product Specifications. Effective as of the Amendment Effective Date, Exhibit A to the Agreement is hereby deleted in its entirety and replaced with the new Exhibit A, Product Specifications, attached hereto as Exhibit A to Amendment No. 1 and incorporated herein by reference.

(o) Exhibit B, Pricing. Effective as of the Amendment Effective Date, Exhibit B to the Agreement is hereby deleted in its entirety and replaced with the new Exhibit B, Annual Sourcing Fee, and Supply, attached hereto as Exhibit B to Amendment No. 1 and incorporated herein by reference.

3. No Release from Obligations. Section 2(a) of this Amendment does not intend to release either Party from its obligations under the Agreement accrued prior to this Amendment becoming effective. The Parties agree that if this Agreement or any interest herein is assigned by OptiNose to its affiliate, division, or subsidiary, OptiNose shall remain liable under this Agreement (in addition to the transferee), as set forth in Section 13.1 of the Agreement.

4. Entire Agreement. Each Party acknowledges that this Amendment, together with the Agreement, constitutes the entire agreement of the Parties with respect to the subject matter hereof.

5. Full Force and Effect. Except as expressly amended hereby, all of the other terms and conditions of the Agreement shall remain unchanged and in full force and effect in accordance with their original terms.

6. Authority. Each Party hereby represents and warrants that is has full power and authority to enter into this Amendment.

[Signature page follows]

Portions of this exhibit indicated by asterisks [**] have been omitted because they are not material and are the type of information that the registrant treats as private or confidential

IN WITNESS WHEREOF, the Parties have each caused a duly authorized representative to execute this Amendment as of the Amendment Effective Date. | | | | | |

OPTINOSE: | HOVIONE: |

OptiNose US, Inc. | Hovione Inter Ltd. |

By:/s/ Ramy Mahmoud Name: Ramy Mahmoud Title: Chief Executive Officer Date: December 18, 2023 | By: /s/ Curtis Gingles Name: Curtis Gingles Title: Director, North America Products Date: December 14, 2023 |

| By: Joseph D’Antuono Name: Joseph D’Antuono Title: Vice President, Sales Date: December 14, 2023 |

Portions of this exhibit indicated by asterisks [**] have been omitted because they are not material and are the type of information that the registrant treats as private or confidential

EXHIBIT A to AMENDMENT NO. 1

Exhibit A to Supply Agreement

Product Specifications

[**]

Portions of this exhibit indicated by asterisks [**] have been omitted because they are not material and are the type of information that the registrant treats as private or confidential

EXHIBIT B to AMENDMENT NO. 1

Exhibit B to Supply Agreement

Annual Sourcing Fee and Supply

Hovione shall guarantee the capacity and willingness to manufacture and supply API in such quantities, and at such prices, as are set forth in the below sourcing model (“Sourcing Model”). Optinose shall not be obligated to purchase any minimum quantity of API.

Sourcing Model:

•OptiNose shall pay Hovione a fee of [**] dollars ($[**]) for the calendar year (beginning January 1 of the relevant year)

•Hovione shall guarantee capacity for, and commitment to supply, up to [**]kg of API for the calendar year, in monthly quantities at determined and ordered by OptiNose

•In the event OptiNose purchase orders exceed [**]kg of API in the calendar year, Hovione shall not be contractually obliged to supply the excess, meaning that Hovione shall use commercially reasonable efforts to fill such order(s) but shall not be in breach of this Agreement if Hovione does not supply the excess

•In the event of OptiNose purchase orders do not exceed [**]kg of API in the calendar year, API ordered by OptiNose shall be sold at a price of $[**] per gram, which shall be fixed until December 31, 2026, unless the Agreement is terminated earlier

•In the event OptiNose purchase orders exceed [**]kg of API in the calendar year, Hovione shall have the right at its sole discretion to issue a quote for price for any amounts beyond [**]kg of API, in which case the price may differ from the above-stated price of $[**] per gram.

•· Price per gram (“Purchase Price”) shall be adjusted as follows:

i. Purchase Price can be adjusted annually in an amount equal to the applicable producer price index as issued by the U.S. Bureau of Labor Statistics for Pharmaceutical Preparation Manufacture (commodity code 0638) (“PPI”) during the preceding [**] months.

ii. In the event of change of circumstances that were not foreseeable at Effective Date, for reasons beyond Hovione’s reasonable control, resulting in the agreed selling price becoming unsustainable and/or economically unviable, including without limitation an increase of Hovione’s cost of Manufacturing and/or the aggregate cost of Hovione-supplied materials by more than [**] percent ([**]%) since the beginning of the Effective Date if a PPI adjustment according to (i) has not been requested or since the latest PPI adjustment requested by Hovione according to (i), then Hovione can propose by written notice promptly following the change of circumstances to renegotiate the pricing terms of the Agreement. During the negotiation period, that shall not exceed [**] ([**]) months from the date of issuance of the written notice, Hovione shall continue to abide by the

Portions of this exhibit indicated by asterisks [**] have been omitted because they are not material and are the type of information that the registrant treats as private or confidential

terms of the Agreement. In the event the Parties, after good faith negotiations, cannot agree on an amendment to the existing Agreement during the negotiation period, then either Party may terminate this Agreement, subject to a [**] months ([**]) prior written notice only if Optinose is paying at the higher price during this notification period, after which termination OptiNose shall not continue to incur further fees including the $[**] annual fee. Should such termination occur, both Parties shall continue to comply with the terms of the Agreement during the notice period.

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

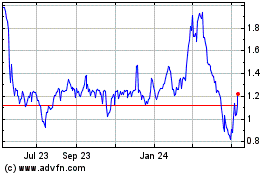

OptiNose (NASDAQ:OPTN)

Historical Stock Chart

From Mar 2024 to Apr 2024

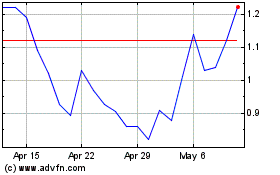

OptiNose (NASDAQ:OPTN)

Historical Stock Chart

From Apr 2023 to Apr 2024