false000006527000000652702023-12-182023-12-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): December 18, 2023 |

METHODE ELECTRONICS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-33731 |

36-2090085 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

8750 West Bryn Mawr Avenue |

|

Chicago, Illinois |

|

60631-3518 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (708) 867-6777 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.50 Par Value |

|

MEI |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

As previously announced on August 31, 2023, Donald W. Duda, the President and Chief Executive Officer of Methode Electronics, Inc. (the “Company”) notified the Company of his intention to retire upon the appointment of his successor.

On December 19, 2023, the Company announced the appointment of Avi Avula as the Company’s new President and Chief Executive Officer, starting January 29, 2024. As previously announced, Mr. Duda will remain an employee of the Company for the three month period following the commencement of Mr. Avula’s employment, in order to assist in the transition, after which he will retire but continue to serve as a strategic consultant for a period of nine months.

In connection with his appointment, Mr. Avula will also be appointed to the Board of Directors of the Company, effective as of the commencement of his employment, replacing Mr. Duda who will offer his resignation as of such date.

Prior to joining the Company, Mr. Avula, age 50, served as Vice President of Strategy for the Electronics and Industrial (E&I) business at DuPont de Nemours, Inc., a position he held since August 2023. In that role, Mr. Avula has been responsible for strategy, growth, new business development and global commercial excellence for E&I, which reported approximately $6 billion in 2022 revenue. Mr. Avula previously served as Global Vice President and General Manager for the Interconnect Solutions (ICS) line of business within E&I, where he was deeply involved in key strategic initiatives including the integration of DuPont Circuit and Packaging Materials (CPM) and Dow Interconnect Technologies during the merger between Dow and DuPont, from 2016 through July 2023.

In connection with the appointment of Mr. Avula, the Company and Mr. Avula entered into an Offer Letter, dated as of December 18, 2023 (the “Offer Letter”), outlining the terms of his employment and certain compensatory arrangements. Under the Offer Letter, which was approved by the Compensation Committee of the Company’s Board of Directors, Mr. Avula will be entitled to receive the following compensation:

•a base salary of $800,000 annually, which will be pro rated for the Company’s fiscal year ending April 27, 2024 (“fiscal 2024”);

•eligibility for an annual bonus with a target amount equal to 100% of his base salary, pro rated for fiscal 2024, with bonuses and target amounts for years after fiscal 2025 and future years to be set by the Compensation Committee;

•a restricted stock unit (RSU) grant valued at $3,125,000, using the market price of the Company’s common stock on the first day of employment, vesting 20% as of the first five anniversary dates of the grant date, subject to his continued employment (except in the case of permanent disability or death, or a change of control in which the award is not assumed or replaced), representing Mr. Avula’s participation in the Company’s long term incentive plan (LTIP) for the approximately 15-month period through the end of fiscal 2025, with participation in fiscal 2026 and future years determined by the Compensation Committee;

•a sign-on bonus intended to replace certain forfeited incentive awards from Mr. Avula’s prior employer, payable in the amounts of (a) $263,000 within 60 days of commencement of his employment; $385,000 following the end of calendar year 2024; $285,000 following the end of calendar year 2025; and $50,000 after June 1, 2026, and (b) up to $233,000 cash in the event that Mr. Avula’s prior employer fails to pay amounts relating to a performance-based stock award scheduled to vest as of December 31, 2023, in each case with any amounts previously paid to Mr. Avula being repayable to Methode in the event he terminates his employment or is terminated for cause prior to the two-year anniversary of his start date;

•certain relocation expenses; and

•participation in Company benefit plans as made available to similarly situated employees.

Upon commencement of his employment, Mr. Avula will also enter into a change of control agreement, on similar terms to those entered into with other executive officers, under which he would be eligible to receive three times his annual salary and target bonus in the event that he is terminated without cause pending or within 24 months after a change of control of Methode, or if he resigns for good reason (as defined in that agreement) during the same period.

The foregoing description of the Offer Letter is a summary of the terms contained therein and is qualified in its entirety by reference to the terms of the Offer Letter, which is attached as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

There are no other understandings or arrangements between Mr. Avula and any other person pursuant to which Mr. Avula was appointed to serve as the Company’s Chief Executive Officer. There are no existing relationships between Mr. Avula and any person that would require disclosure pursuant to Item 404(a) of Regulation S-K or any familial relationships that would require disclosure under Item 401(d) of Regulation S-K.

Item 7.01 Regulation FD Disclosure

On December 19, 2023, the Company issued a press release announcing Mr. Avula’s appointment as President and Chief Executive Officer as successor to Mr. Duda. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

In accordance with General Instruction B.2 of Form 8-K, the information in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information in Item 7.01 of this Current Report on Form 8-K shall not be incorporated by reference into any filing or other document pursuant to the Securities .Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing or document

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Methode Electronics, Inc. |

|

|

|

|

Date: |

December 19, 2023 |

By: |

/s/ Ronald L.G. Tsoumas |

|

|

|

Ronald L.G. Tsoumas

Chief Financial Officer |

Exhibit 10.1

Methode Electronics, Inc.

8750 West Bryn Mawr Avenue, Suite 1000

Chicago, Illinois 60131

December 18, 2023

Dear Mr. Avinash Avula:

By this letter (this “Offer Letter”), we are pleased to offer you the position of President and Chief Executive Officer (collectively, “CEO”) of Methode Electronics, Inc. (the “Company”). In the position of CEO, you will report directly to the Company’s Board of Directors (the “Board”).

In such position, you will perform senior executive duties and responsibilities on behalf of the Company consistent with such position and as set forth in the Company’s bylaws, and such other duties and responsibilities as the Board may prescribe from time to time. You will use your best efforts to promote the business of the Company and devote your full business attention, skill, and working time to performance of such duties and responsibilities, and shall not engage in any other business activities or employment while employed by the Company without the written consent of the Board. You shall not serve on any other public or private boards (other than charitable boards) during your employment, except that after two (2) years of service you may request, and the Board at its discretion may approve, your service on no more than one (1) additional board. You acknowledge that you will be legally obligated to observe, and will discharge, a duty of loyalty to act in the Company’s best interests during your employment by the Company.

You will be headquartered at the Company’s principal office in Chicago, Illinois, unless otherwise determined by the Board. You agree to relocate to the Chicago area by no later than nine (9) months after your start date.

The start date of your employment will be January 29, 2024.

Your compensation, which is subject to applicable withholding taxes and other lawful deductions, and which may be adjusted by the Compensation Committee of the Board from time to time in its discretion, will be as follows:

Salary: $800,000 annually, payable in accordance with the Company’s standard payroll practices.

Bonus: You will be eligible for an annual bonus with a target amount equal to 100% of your base salary. Your annual bonus will be paid at the target level, on a prorated basis, for FY2024. Bonuses and target amounts for future fiscal years (after FY2024) will be determined in the Compensation Committee’s sole discretion.

Your eligibility for a bonus is conditioned on your remaining employed by the Company through the date that such bonus is scheduled to be paid.

Long Term Incentive Plan: You will be eligible to participate in the Company’s LTI program. The initial grant will be a one-time grant of RSUs covering the approximately 15-month period ending April of 2025 (end of FY2025), such grant to be in the amount of $3,125,000 (based upon the Company’s closing stock price on the first day of your employment), vesting 20% as of each of the first five anniversary dates of the grant date, subject to your continued employment as of each such anniversary date, except in the case of total and permanent disability or death, or in the case of a change of control in which the surviving or successor entity does not assume or replace the award. Commencing with FY2026, you will be eligible to participate in the Company’s new LTI plan, all subject to approval by the Compensation Committee in its sole discretion. All equity grants under this section or others will require your execution of separate award agreements to be provided by the Compensation Committee that will contain other terms applicable to the award.

Expenses: The Company will, in accordance with Company policies as they may exist and be amended from time to time, reimburse reasonable business expenses incurred by you in the performance of your duties, and for your convenience for charging appropriate expenses, will issue you a Company corporate credit card.

Benefits: You will be eligible to participate in the Company’s benefit plans as they are made available to similarly-situated employees, subject to the terms and conditions of the applicable plan documents and subject to the Company’s right to change its benefit plans at any time.

Vacation: Under the Company’s vacation policy, employees accrue vacation over time (i.e., on an earn-as-you-go basis). From the start of your employment, you will accrue vacation at a rate of 20 days per year, subject to all of the terms of the Company’s vacation policy. Note that accrued vacation may not be used within the first 90 days of employment.

Sign On Bonus (Compensation for Certain Forfeited Incentives from Prior Employer): You will receive a cash sign-on bonus, subject to applicable withholding taxes and other lawful deductions, as follows: (i) $263,000 within sixty (60) days of your start of employment, (ii) $385,000 on the next regularly scheduled payroll date after December 31, 2024, (iii) $285,000 on the next regularly scheduled payroll date after December 31, 2025, and (iv) $50,000 on the next regularly scheduled payroll date after June 1, 2026, so long as you are employed by the Company as of such respective dates. In addition, if your current employer fails to pay your performance-based stock award vesting as of December 31, 2023 in the amount of approximately 3,289 shares of such employer’s stock, you will receive an additional cash sign-on bonus, subject to applicable withholding taxes and other lawful deductions, of up to $233,000 as of the next regularly scheduled payroll date

2

following such employer’s determination to not pay such award. If you terminate your employment or are terminated for Cause prior to the two-year anniversary of your start date, you will be required to repay all portions of the sign-on bonuses set forth in the preceding two sentences within 30 days of the date your employment terminates and agree to do so by your signature on this letter.

Relocation: You will be eligible for assistance with reasonable relocation expenses including moving of household goods/personal effects, fees associated with the acquisition of your primary residence and a $10,000 allowance to cover miscellaneous expenses. Temporary housing will be covered for a period of up to nine (9) months. In the event that you are required to re-pay your relocation allowance from your current employer, the Company will reimburse you up to a gross amount of $200,000. If you terminate your employment or are terminated for Cause prior to the two-year anniversary of your start date, you will be required to repay all relocation-related benefits set forth in the preceding two sentences within 30 days of the date your employment terminates and agree to do so by your signature on this letter.

Coaching: You will be offered coaching through the Spencer Stuart onboarding program.

All compensation is subject to the Company’s Incentive Compensation Recovery Policy (as posted on the Company’s website) and any amendment thereof, and any other recoupment, clawback, or similar policy in effect from time to time, as well as any similar provisions of applicable law.

“Cause” as used in this letter means: (i) your conviction of a felony other than a traffic violation; (ii) your commission of any act or acts of personal dishonesty intended to result in personal enrichment to you to the material detriment of the Company; (iii) a failure to perform assigned duties, provided that such failure has continued for more than ten (10) days after the Board has given written notice of such failure and of its intention to terminate your employment because of such failure; (iv) any willful misconduct by you which materially affects the business reputation of the Company; (v) breach in any material respect by you of any provision of any employment, consulting, advisory, nondisclosure, non-competition, proprietary information, or other similar agreement between you and the Company; or (vi) your material violation of the Company’s code of conduct.

As of the start of your employment, you will be afforded a change-in-control agreement in the form attached to this letter as Exhibit A, at a three-times (3x) level.

Subject to the start of your employment in accordance with this Offer Letter, you will be appointed to the Board as an employee director, without additional compensation, to fill a remaining term through the date of the Company’s next Annual Meeting of Stockholders scheduled for September 12, 2024, or such earlier date upon which such term may expire. Any subsequent nominations to the Board will be at the sole discretion of the Board. If so requested, you also agree to serve, again without additional compensation, as an officer and/or director (or similar positions) of any of the affiliates or subsidiaries of the Company.

3

Your employment with the Company will be on an “at-will” basis, meaning that either you or the Company will be entitled to terminate your employment at any time, with or without prior notice and with or without cause. The “at-will” nature of your employment may only be changed with the express approval of the Board and an express written agreement signed by the Chair of the Board. This letter should not be construed as offering you employment for any definite period. Upon the termination of your employment for any reason, you agree to immediately resign, and shall be deemed to have resigned, as a director, officer, manager, trustee, and agent of, and any other position that you hold with, the Company or any of its subsidiaries or affiliates.

At all times, you will be subject to and agree to comply with all applicable Company policies and requirements in effect from time to time, including but not limited to those relating to insider trading, corrupt practices, health and safety, harassment, discrimination, political contributions, conflicts of interest, gifts and entertainment, technology, confidentiality, and travel and expense reimbursements. Without limiting the foregoing, you acknowledge that you have reviewed, and agree to abide by, the Company’s Code of Business Conduct and the associated Anti-Corruption Policy.

As a condition of your employment, you must comply with the terms of any agreements that you may have with your prior employers, including without limitation all such agreements affecting the protection of confidential or proprietary information and/or trade secrets, the solicitation of employees, and/or the solicitation of those entities’ customers. You represent and warrant to the Company that you have fully disclosed in writing to the Company all such agreements. The Company does not wish to receive from you any confidential or proprietary information of any third party to which you owe an obligation of confidence, and the Company strictly prohibits the use of any such information in your work for the Company.

By signing and accepting this offer, you represent, warrant and covenant that: (a) your employment with the Company will not violate or be restricted or limited in any way by any of your agreements with or obligations to any of your prior employers or any other third parties, including without limitation, any non-competition obligations; (b) you will not possess any document of a secret, confidential, or proprietary nature regarding the business of any of your prior employers (whether in hard copy or electronic form), and you will not breach any agreement or duty to keep in confidence or return any such information, knowledge, or data; (c) you will not disclose to anyone at the Company or any of its subsidiaries, affiliates, customers or suppliers, or use in any way to perform your job duties with the Company, any confidential or proprietary information and/or trade secrets of another person or entity; and (d) you have not solicited and will not solicit in the future, any employees, consultants, contractors, customers or suppliers of any prior employers in violation of any your contractual obligations owed to such prior employers.

The Company and its affiliates and subsidiaries may take such actions as they deem appropriate to ensure that all applicable federal, state, city, foreign and other payroll, withholding, income or other taxes arising from any compensation, benefits or any other payments made in connection with your employment are withheld or collected from you.

4

No provision of this Offer Letter may be modified, waived, or discharged unless such waiver, modification, or discharge is agreed to in a writing signed by you and a duly authorized signatory of the Board. This Offer Letter is not assignable by you, and it will governed by, and construed in accordance with, the laws of the State of Illinois, without reference to principles of conflict of laws. The Company’s obligation to pay or provide any amounts or benefits to you is subject to set-off, counterclaim, or recoupment of any other amounts you owe to the Company or any of its affiliates or subsidiaries (except to the extent any such action would violate, or result in the imposition of tax under, Section 409A of the Internal Revenue Code of 1986, as amended). This Offer Letter (together with such documents and agreements to the extent referenced herein) constitutes the entire agreement between the parties as of the date hereof and supersedes all previous agreements and understandings between the parties with respect to the subject matter hereof.

Any dispute or claim relating to your employment with the Company shall, except as otherwise prohibited by applicable law, be adjudicated by arbitration administered by the American Arbitration Association (“AAA”) under its Employment Arbitration Rules, and judgment on the award rendered by the arbitrator may be entered in any court having jurisdiction thereof. Notwithstanding the preceding sentence, the Company may, at its option, file a lawsuit in court to seek temporary, preliminary, or permanent injunctive relief against you for any claimed breach of the provisions of the Proprietary Interests Protection Agreement or any duty under statute or common law to preserve the confidentiality of the trade secrets of the Company or its subsidiaries or affiliates. Arbitration shall be by a single arbitrator. Unless otherwise required by law, each party shall bear its own attorneys’ fees associated with the arbitration, and the parties will share equally in the costs of the arbitration (e.g., the arbitrator’s fee). The arbitration will take place in Chicago, Illinois.

You acknowledge and agree that you have had an opportunity to seek such legal, financial, and other advice as you have deemed necessary or desirable in connection with this Offer Letter, and that you have not relied on any representations, warranties, documents or statements not contained in this Offer Letter.

If an arbitrator or court of competent jurisdiction determines that certain provisions of this Offer Letter are illegal, excessively broad, or otherwise unenforceable, then this Offer Letter will be construed so that the remaining provisions shall not be affected, but shall remain in full force and effect, and any such illegal, overbroad or otherwise unenforceable provisions will be deemed, without further action on the part of any person, to be modified, amended, and/or limited to the limited extent necessary to render the same valid and enforceable in such jurisdiction.

Attached to this letter as Exhibit B is a Proprietary Interests Protection Agreement (the “PIPA”), and this offer is conditioned on your execution of the PIPA. Consistent with the PIPA, you will have no less than 14 days to consider this letter and the PIPA before signing, and you are advised to consult with an attorney before signing this letter and the PIPA. This offer is also conditioned on a reference and background check and drug screening that is satisfactory to the Company as well as satisfactory documentation establishing your eligibility to work in the United States (as required by federal law). This offer is open for acceptance until the date which is 14 days after the date of this letter.

5

We very much look forward to you joining us as the new President and Chief Executive Officer of Methode Electronics, Inc.

Please sign, date and return a copy of this letter and the enclosed Proprietary Interests Protection Agreement to Ms. Andrea Barry at the Company, and retain a copy of each for your records.

Sincerely,

METHODE ELECTRONICS, INC.

By: /s/ Walter J. Aspatore

Walter J. Aspatore

Chairman of The Board

ACKNOWLEDGMENT AND AGREEMENT

I have read and agree to the above terms and conditions of my at-will employment with Methode Electronics, Inc.

/s/ Avinash Avula December 18, 2023

Avinash Avula Date

Exhibit 99.1

Methode Electronics Appoints Avi Avula as New CEO

Seasoned Electronics Industry Leader Brings More than 20 Years of Experience

Driving Transformational Growth and Value Creation Initiatives to Methode

Chicago, IL – December 19, 2023 – Methode Electronics, Inc. (NYSE: MEI), a leading global supplier of custom-engineered solutions for user interface, LED lighting system and power distribution applications, announced today that Avi Avula has been appointed as Methode’s new President and Chief Executive Officer (CEO), starting on January 29, 2024. Mr. Avula’s appointment follows the previously announced retirement of Donald W. Duda, President and CEO.

Mr. Duda will work with Mr. Avula through a three-month transition period, after which Mr. Duda will serve as a strategic consultant for a nine-month period.

Mr. Avula will also be appointed as a director of Methode as of his start date, replacing Mr. Duda who intends to resign as of such date.

Mr. Avula brings 17 years of electronics industry leadership experience to Methode, and currently serves as the Vice President of Strategy for DuPont’s Electronics & Industrial (E&I) business. In this role, Mr. Avula leads strategy, growth, new business development and global commercial excellence for E&I, which reported approximately $6 billion in 2022 revenue. Mr. Avula previously led the Interconnect Solutions line of business within E&I, where he was deeply involved in key strategic initiatives including the integration of DuPont Circuit and Packaging Materials and Dow Interconnect Technologies during the merger between Dow and DuPont.

Chairman Walter J. Aspatore said, "On behalf of Methode’s Board of Directors, we are thrilled to welcome Avi to the Methode team. Avi’s appointment follows a comprehensive search process to identify the right CEO to lead Methode forward. He is a proven executive having led large engineered-product businesses on a global basis that have grown both organically and through acquisition. His strategic, technical, and transformative manufacturing experiences will help drive Methode’s innovation and growth initiatives and create value for shareholders."

Mr. Aspatore continued, "We thank Don for his outstanding contributions to Methode since his arrival in 2000 and wish him the very best in his retirement. Because of Don and his leadership, Methode is well-positioned to drive value creation for our shareholders, customers, and employees."

Added Mr. Avula, "It is an honor to be selected as Methode’s CEO. I am joining a company that has excelled for over 75 years and is well-positioned given its strong foundation. The Company’s position in the growing markets for lighting, power distribution, and sensor solutions is an exciting opportunity to

1

take Methode forward into the next chapter of its proud history. I look forward to working with the Board and management team to drive enhanced growth and performance."

About Avi Avula

Avi Avula, age 50, joins Methode from DuPont, where he is currently the Vice President of Strategy for DuPont’s Electronics & Industrial (E&I) business with additional responsibility for sustainability and business excellence. Before his current role, he was the Global Vice President & General Manager for Interconnect Solutions (ICS), a line of business within DuPont E&I focused on delivering total solutions and systems design to address signal integrity and power transmission challenges. During his tenure in ICS, Mr. Avula led the integration of DuPont Circuit and Packaging Materials and Dow Interconnect Technologies during the merger between Dow and DuPont. He also led the $2.3 billion Laird Performance Materials acquisition, successfully integrated Laird, and tripled ICS’ revenue to $1.8 billion. Mr. Avula also made an impact around the world, including setting up E&I’s regional headquarters in Singapore and acting as Singapore country leader. Previously in DuPont, he served as the Global Business Director for Displays, where he led the OLED and flexible display business.

Prior to DuPont, Mr. Avula held numerous roles with Applied Materials, most recently in Singapore where he led their business and technology development for advanced packaging. His earlier roles at Applied Materials’ headquarters included serving as Assistant to the Chairman and CEO on strategic, operational and governance matters. Mr. Avula’s additional experience includes serving as a management consultant at Booz & Co. where he worked on business, operations and product strategies across the automotive, pharmaceuticals and consumer products sectors in the U.S. and Europe. He has also worked extensively in the semiconductor fabrication, electronics packaging and assembly industries in the U.S. and Asia.

Mr. Avula has an MBA from the University of Chicago, and an MS in Industrial Engineering from Texas A&M University. He earned his bachelor’s degree in mechanical engineering, specializing in composite materials, in India.

About Methode Electronics, Inc.

Methode Electronics, Inc. (NYSE: MEI) is a leading global supplier of custom-engineered solutions with sales, engineering and manufacturing locations in North America, Europe, Middle East and Asia. We design, engineer, and produce mechatronic products for OEMs utilizing our broad range of technologies for user interface, LED lighting system, power distribution and sensor applications.

Our solutions are found in the end markets of transportation (including automotive, commercial vehicle, e-bike, aerospace, bus, and rail), cloud computing infrastructure, construction equipment, and consumer appliance. Our business is managed on a segment basis, with those segments being Automotive, Industrial, Interface and Medical.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that reflect, when made, our current views with respect to current events and financial performance. Such forward-looking statements are subject to many risks, uncertainties and factors relating to our operations and business environment, which may cause our actual results to be materially different from any future results, expressed or implied, by such forward-looking statements. All statements that address future operating, financial or business performance or our strategies or expectations are forward-looking statements. In some cases, you can identify these

2

statements by forward-looking words such as “may,” “might,” “will,” “should,” “expects,” “plans,” “intends,” “anticipates,” “believes,” “estimates,” “predicts,” “projects,” “potential,” “outlook” or “continue,” and other comparable terminology.

Any forward-looking statements made by us speak only as of the date on which they are made. We are under no obligation to, and expressly disclaim any obligation to, update or alter our forward-looking statements, whether as a result of new information, subsequent events or otherwise.

For Methode Electronics, Inc.

Robert K. Cherry

Vice President Investor Relations

rcherry@methode.com

708-457-4030

3

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

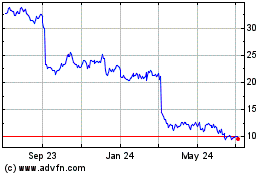

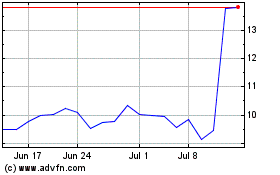

Methode Electronics (NYSE:MEI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Methode Electronics (NYSE:MEI)

Historical Stock Chart

From Apr 2023 to Apr 2024