Filed pursuant to General Instruction II.L. of Form F-10,

File No. 333-276023

Prospectus Supplement

to a Short Form Base Shelf Prospectus dated December 13, 2023

|

|

|

| New Issue |

|

December 14, 2023 |

PEMBINA PIPELINE CORPORATION

$1,114,100,000

26,000,000 Subscription Receipts

each representing the right to receive one Common Share

Price: $42.85 per Subscription Receipt

Pembina Pipeline Corporation

(“Pembina” or the “Corporation”) is hereby qualifying the distribution (the “Offering”) of 26,000,000 subscription receipts (“Subscription Receipts”) at a price of $42.85 per

Subscription Receipt (the “Offering Price”), each of which will entitle the holder thereof to receive (i) automatically upon the closing of the Acquisition (as defined herein), without any further action on the part of the

holder thereof and without payment of additional consideration, one (1) common share (“Common Share”) of the Corporation, and (ii) Dividend Equivalent Payments (as defined herein) during the period from the Offering

Closing Date (as defined herein) to, but excluding, the Acquisition Closing Date (as defined herein) or to, and including, the date of a Termination Event (as defined herein), as applicable. See “Details of the Offering” and

“Plan of Distribution”.

On December 13, 2023, the Corporation entered into a purchase and sale agreement (as amended,

supplemented or otherwise modified from time to time in accordance with the terms thereof, the “Purchase and Sale Agreement”) with Enbridge Inc. (“Enbridge”) to acquire all of Enbridge’s interests in Alliance,

Aux Sable and NRGreen (each as defined herein) and in the related operatorship contracts for an aggregate purchase price of approximately $3.1 billion (subject to certain adjustments) (the “Purchase Price”), including

approximately $327 million of assumed debt, representing Enbridge’s proportionate share of the indebtedness of Alliance (the “Acquisition”). A portion of the Purchase Price will be funded from the net proceeds of the

Offering, with the remaining portion of the Purchase Price expected to be funded by borrowings under the Corporation’s existing credit facilities and cash on hand. In lieu of drawing on its existing credit facilities, in whole or in

part, the Corporation may issue debt securities prior to the Acquisition Closing Date to fund a portion of the Purchase Price. See “The Acquisition”, “Use of Proceeds” and “Consolidated

Capitalization”.

The gross proceeds from the sale of the Subscription Receipts, less the

Non-Escrowed Underwriters’ Fee (as defined herein) (the “Proceeds”) will, from the Offering Closing Date until the earlier of the delivery of the Escrow Release Notice and Direction (as

defined herein) and the Termination Time (as defined herein), be held in escrow by Computershare Trust Company of Canada, as subscription receipt agent (the “Subscription Receipt Agent”), and deposited or invested, as applicable,

pursuant to the terms of the Subscription Receipt Agreement (as defined herein), provided that Dividend Equivalent Payments may be made from the Proceeds and the interest and other income received or credited thereon from time to time (the

“Earned Interest” and, together with the Proceeds and any interest and other income received or credited on the Earned Interest, the “Escrowed Funds”), as described herein. See “Details of the Offering

– Escrowed Funds”.

The Corporation is a foreign private issuer that is permitted, under the multijurisdictional disclosure system

adopted by the Canadian Securities Administrators and the United States Securities and Exchange Commission (“SEC”), to prepare this Prospectus Supplement and the Prospectus in accordance with disclosure requirements under Canadian

securities laws. You should be aware that such requirements are different from the disclosure requirements under United States (“U.S.”) securities laws. Pembina’s financial statements included or incorporated by reference into the

Prospectus have been prepared in accordance with International Financial Reporting Standards, as issued by the International Accounting Standards Board, and, accordingly, may not be comparable to financial statements of U.S. companies.

Owning the Subscription Receipts and the Common Shares issuable pursuant to the terms of the Subscription Receipts may have tax consequences for holders

both in Canada and the U.S. This Prospectus Supplement may not describe these tax consequences fully. You should read the tax discussion under “Certain Canadian Federal Income Tax Considerations”,

“Certain U.S. Federal Income Tax Considerations” and “Eligibility for Investment” in this Prospectus Supplement and consult with an independent tax advisor with respect to your particular

circumstances.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY STATE SECURITIES REGULATORY AUTHORITY, NOR HAS THE SEC OR

ANY STATE SECURITIES REGULATORY AUTHORITY PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS SUPPLEMENT OR THE PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

Your ability to enforce civil liabilities under U.S. federal securities laws may be adversely affected by the fact that the Corporation is organized under

the laws of the Province of Alberta, Canada, that some or all of its directors and officers are residents of Canada, that some or all of the experts named in this Prospectus Supplement and the Prospectus are residents of Canada and that all or a

substantial portion of the Corporation’s assets and the assets of such persons are located outside of the U.S. See “Enforceability of Civil Liabilities” in the Prospectus.

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Price to the

Public |

|

|

Underwriters’

Fee(1) |

|

|

Net Proceeds to the

Corporation(2) |

|

| Per Subscription Receipt |

|

$ |

42.85 |

|

|

$ |

1.714 |

|

|

$ |

41.136 |

|

| Total |

|

$ |

1,114,100,000 |

|

|

$ |

44,564,000 |

|

|

$ |

1,069,536,000 |

|

| (1) |

Pursuant to the Underwriting Agreement (as defined herein), the Corporation has agreed to pay to the

Underwriters (as defined herein) a fee equal to 4.0% of the gross proceeds of the Offering (the “Underwriters’ Fee”). One-half (50%) of the Underwriters’ Fee is payable on the

Offering Closing Date (the “Non-Escrowed Underwriters’ Fee”) and the other one-half (50%) of the Underwriters’ Fee is payable upon closing of

the Acquisition (the “Escrowed Underwriters’ Fee”). See “Plan of Distribution”. If a Termination Event occurs, the Underwriters’ Fee will consist solely of the

Non-Escrowed Underwriters’ Fee. |

i

| (2) |

Before deducting the estimated expenses of the Offering of approximately $1 million and excluding any Dividend

Equivalent Payments and interest and other income that may be earned on the Escrowed Funds. The expenses of the Offering will be paid from the general funds of the Corporation. |

| (3) |

The Corporation has granted to the Underwriters an over-allotment option (the “Over-Allotment

Option”), exercisable, in whole or in part, at any time and from time to time until the earlier of: (i) 5:00 p.m. (Calgary time) on the day that is thirty (30) days following the Offering Closing Date; and (ii) the Termination

Time, to purchase up to an additional 3,900,000 Subscription Receipts on the same terms and conditions as the Offering, to cover over-allotments, if any, and for market stabilization purposes. If the Over-Allotment Option is exercised in full, the

total price to the public, the Underwriters’ Fee and the net proceeds to the Corporation, before expenses of the Offering and excluding any Dividend Equivalent Payments and interest and other income that may be earned on the Escrowed Funds,

will be $1,281,215,000, $51,248,600 and $1,229,966,400, respectively. The distribution of the Subscription Receipts that may be issued upon the exercise of the Over-Allotment Option is also qualified under this Prospectus Supplement. A purchaser who

acquires Subscription Receipts forming part of the Underwriters’ over-allocation position acquires those Subscription Receipts under this Prospectus Supplement, regardless of whether the over-allocation position is ultimately filled through the

exercise of the Over-Allotment Option or secondary market purchases. See “Plan of Distribution”. |

|

|

|

|

|

|

|

| Underwriters’ Position |

|

Maximum Number of

Subscription Receipts

Available |

|

Exercise Period |

|

Exercise Price |

| Over-Allotment Option |

|

3,900,000 |

|

Exercisable until the earlier

of (i) 5:00 p.m. (Calgary time) on the day that is thirty (30) days following the Offering Closing Date, and

(ii) the Termination Time |

|

$42.85 per Subscription Receipt |

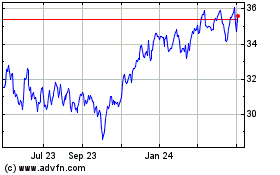

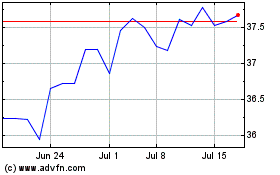

The issued and outstanding Common Shares of the Corporation are listed and posted for trading on the Toronto Stock Exchange

(the “TSX”) under the symbol “PPL” and on the New York Stock Exchange (the “NYSE”) under the symbol “PBA”. On December 13, 2023, the last trading day on the TSX and NYSE

before the date of this Prospectus Supplement, the closing price of the Common Shares on the TSX and on the NYSE was $46.16 and US$34.19, respectively. There is currently no market through which the Subscription Receipts

issuable pursuant to the Prospectus Supplement may be sold and purchasers may not be able to resell Subscription Receipts purchased under this Prospectus Supplement. This may affect the pricing of the Subscription Receipts in the secondary market,

the transparency and availability of trading prices, the liquidity of the Subscription Receipts and the extent of issuer regulation. See “Risk Factors”.

The TSX has conditionally approved the listing of the Subscription Receipts offered pursuant to this Prospectus Supplement and the Common Shares issuable

pursuant to the terms of the Subscription Receipts (including the Subscription Receipts issuable pursuant to the Over-Allotment Option and the Common Shares issuable pursuant to the terms of such Subscription Receipts) on the TSX. Listing will be

subject to the Corporation fulfilling all of the listing requirements of the TSX on or before March 12, 2024. In addition, the Corporation has applied to the NYSE to list the Common Shares issuable pursuant to the terms of the Subscription Receipts

(including the Common Shares issuable pursuant to the terms of the Subscription Receipts issuable pursuant to the Over-Allotment Option) on the NYSE. The Subscription Receipts will not be listed on the NYSE. There can be no assurance that the

Subscription Receipts will be listed on the TSX or that the Common Shares issuable pursuant to the terms of the Subscription Receipts will be listed on the TSX or the NYSE.

It is currently anticipated that the closing date of the Offering (the “Offering Closing Date”) will be on or about December 19, 2023, or

such later date as the Corporation and the Underwriters may agree, but in any event, not later than December 21, 2023. See “Details of the Offering”.

Each Subscription Receipt will entitle the holder thereof to receive automatically, without additional consideration or further action on the part of the

holder thereof, one (1) Common Share of the Corporation upon closing of the Acquisition. The Acquisition is expected to close in the first half of 2024 (the date of such closing,

ii

the “Acquisition Closing Date” and the time of such closing, the “Acquisition Closing Time”), subject to the satisfaction or waiver of customary closing

conditions, including the receipt of all required regulatory approvals, including under the Competition Act (Canada), the Canada Transportation Act and the United States Hart-Scott-Rodino Antitrust Improvements Act of 1976 and

approval from the United States Federal Communications Commission. See “The Acquisition – Purchase and Sale Agreement”.

Holders of

Subscription Receipts (including Subscription Receipts that may be issued upon the exercise of the Over-Allotment Option) will be entitled to receive payments per Subscription Receipt equal to the cash dividends per Common Share, if any, paid or

payable to holders of Common Shares in respect of all record dates for such dividends occurring from the Offering Closing Date to, but excluding, the Acquisition Closing Date or to, and including, the Termination Date (as defined herein), as

applicable, to be paid to Subscription Receipt holders of record on the record date for the corresponding dividend on the Common Shares on the date on which such dividend is paid to holders of Common Shares, paid first out of any interest and other

income received or credited on the investment of the Escrowed Funds and then out of the Escrowed Funds, net of any applicable withholding taxes (each, a “Dividend Equivalent Payment”). For greater certainty, the first Dividend

Equivalent Payment that holders of Subscription Receipts are expected to be eligible to receive will be, if so declared by the Board of Directors of Pembina, in respect of the dividend payable to holders of Common Shares on or about March 29,

2024, to shareholders of record as of March 15, 2024.

In the event that the Termination Date occurs after a dividend has been declared on the Common

Shares but before the record date for such dividend, holders of Subscription Receipts will receive, as part of the Termination Payment (as defined herein), a pro rata Dividend Equivalent Payment in respect of such dividend declared on the Common

Shares equal to the amount of such dividend multiplied by a fraction equal to: (i) the number of days from, and including, the date of the prior Dividend Equivalent Payment (or, if none, the date of the Offering Closing Date) to, but excluding,

the date of the Termination Event; divided by (ii) the number of days from, and including, the date of the prior Dividend Equivalent Payment (or, if none, the prior payment date for dividends on the Common Shares) to, but excluding, the date on

which such dividend is paid to holders of Common Shares. If the Termination Date occurs on a record date or following a record date for a dividend on the Common Shares but on or prior to the payment date for such dividend, Subscription Receipt

holders of record on the record date will be entitled to receive the full Dividend Equivalent Payment. See “Details of the Offering”.

After the Acquisition Closing Date, the former holders of Subscription Receipts will be entitled, as holders of Common Shares, to receive dividends if, as and

when declared by the Board of Directors of the Corporation from time to time, to receive notice of and to vote at all meetings of holders of Common Shares and to all other rights available to holders of Common Shares. See “Description of the

Common Shares and the Preferred Shares” in the Prospectus.

Provided that the Escrow Release Notice and Direction is delivered to the

Subscription Receipt Agent on or prior to the Termination Time, the Escrowed Funds, less the Escrowed Underwriters’ Fee and any amounts required to satisfy any unpaid Dividend Equivalent Payments, will be released by the Subscription Receipt

Agent to or as directed by the Corporation and will be used to fund a portion of the Purchase Price. See “Use of Proceeds”.

If

(i) by 5:00 p.m. (Calgary time) on October 1, 2024, (a) the Escrow Release Notice and Direction is not delivered to the Subscription Receipt Agent prior to such time, or (b) an Escrow Release Notice and Direction has been

delivered to the Subscription Receipt Agent prior to such time, but the Escrowed Funds are subsequently returned to the Subscription Receipt Agent and no further Escrow Release Notice and Direction is delivered to the Subscription Receipt Agent

prior to such time; (ii) the Purchase and Sale Agreement is terminated; (iii) the Corporation gives notice to TD Securities Inc., RBC Dominion Securities Inc. and Scotia Capital Inc. (collectively, the “Lead

Underwriters”), on behalf of the Underwriters, that it does not intend to proceed with the Acquisition; or (iv) the Corporation announces to the public that it does not intend to proceed with the Acquisition (each, a

“Termination Event” and the time of the earliest of such Termination Event to occur, the “Termination Time” and the date on which such Termination Time occurs, the “Termination

iii

Date”), the Subscription Receipt Agent will pay to each holder of Subscription Receipts, no earlier than the third business day following the Termination Date, an amount per

Subscription Receipt (the “Termination Payment”) equal to the Offering Price in respect of such Subscription Receipt, plus (x) if a Dividend Equivalent Payment has been paid or is payable in respect of the Subscription Receipts

at any time following the issuance of the Subscription Receipts, any unpaid Dividend Equivalent Payment owing to such holder, or (y) if no Dividend Equivalent Payment has been paid or is payable in respect of the Subscription Receipts at any

time following the issuance of the Subscription Receipts, such holder’s proportionate share of any interest and other income received or credited on the investment of the Escrowed Funds between the Offering Closing Date and the Termination

Date, in each case net of any applicable withholding taxes. The Termination Payment will be made from the balance of the Escrowed Funds at the Termination Time, provided that if the balance of the Escrowed Funds at the Termination Time is

insufficient to cover the aggregate amount of the Termination Payments payable to the holders of Subscription Receipts, pursuant to the Subscription Receipt Agreement, the Corporation will be required to pay to the Subscription Receipt Agent, as

agent on behalf of the holders of Subscription Receipts, the deficiency between the amount of Escrowed Funds at the Termination Time and the aggregate of the Termination Payments due to the holders of Subscription Receipts. See “Details of

the Offering”. Any remaining Escrowed Funds after the payment of the Termination Payments shall be paid by the Subscription Receipt Agent to the Corporation.

TD Securities Inc., RBC Dominion Securities Inc., Scotia Capital Inc., BMO Nesbitt Burns Inc., CIBC World Markets Inc., National Bank Financial Inc., ATB

Capital Markets Inc., Mizuho Securities Canada Inc., Merrill Lynch Canada Inc., J.P. Morgan Securities Canada Inc., Peters & Co. Limited, Stifel Nicolaus Canada Inc. and Tudor, Pickering, Holt & Co. Securities – Canada, ULC

(collectively, the “Underwriters”), as principals, conditionally offer the Subscription Receipts, subject to prior sale, if, as and when issued by the Corporation and accepted by the Underwriters in accordance with the conditions

contained in the Underwriting Agreement, and subject to the approval of certain legal matters relating to the Offering with respect to matters of Canadian law on behalf of the Corporation by Blake, Cassels & Graydon LLP and on behalf of the

Underwriters by Stikeman Elliott LLP and with respect to matters of U.S. law on behalf of the Corporation by Paul, Weiss, Rifkind, Wharton & Garrison LLP and on behalf of the Underwriters by Skadden, Arps, Slate, Meagher & Flom

LLP.

Subscriptions will be received subject to rejection or allotment in whole or in part and the Underwriters reserve the right to close the

subscription books at any time without notice. See “Plan of Distribution”.

The Subscription Receipts will be registered and

electronically deposited through the non-certificated inventory system of CDS Clearing and Depository Services Inc. (“CDS”) and no certificates evidencing Subscription Receipts will be issued

to purchasers thereof. Purchasers of Subscription Receipts will receive only a customer confirmation or statement from the Underwriter or other registered dealer which is a CDS Participant (as defined herein) from or through which a Subscription

Receipt is purchased. See “Details of the Offering”.

The Underwriters propose to offer the Subscription Receipts initially at the

Offering Price specified above. After a reasonable effort has been made to sell all of the Subscription Receipts at the Offering Price specified above, the Underwriters may reduce the selling price to investors from time to time in order to sell any

of the Subscription Receipts remaining unsold. Any such reduction will not affect the proceeds received by the Corporation. See “Plan of Distribution”.

Subject to applicable laws, the Underwriters may, in connection with the Offering, over-allot or effect transactions which stabilize or maintain the market

price of the Subscription Receipts at levels other than those which might otherwise prevail on the open market. Such transactions, if commenced, may be discontinued at any time. See “Plan of Distribution”.

An investment in the Subscription Receipts and the Common Shares issuable pursuant to the terms of the Subscription Receipts involves certain risks. See

“Risk Factors”.

iv

Each of TD Securities Inc., RBC Dominion Securities Inc., Scotia Capital Inc., BMO Nesbitt Burns Inc.,

CIBC World Markets Inc., National Bank Financial Inc., ATB Capital Markets Inc., Mizuho Securities Canada Inc., Merrill Lynch Canada Inc. and J.P. Morgan Securities Canada Inc. is, directly or indirectly, a subsidiary or an affiliate of a Canadian

chartered bank that is a lender to the Corporation or its affiliates or equity accounted investees and to which the Corporation or its affiliates or equity accounted investees is currently or will be indebted. In addition, TD Securities Inc. is

acting as the financial advisor to the Corporation in connection with the Acquisition. Accordingly, pursuant to applicable Canadian securities laws, the Corporation may be considered a “connected issuer” of such Underwriters. See

“Relationship Between the Corporation and Certain of the Underwriters”.

In the opinion of

counsel, the Subscription Receipts and the Common Shares issuable to the holders of the Subscription Receipts pursuant to the terms thereof, if issued on the date hereof, generally would be qualified investments under the Income Tax Act

(Canada) and the regulations thereunder (collectively, the “Tax Act”) for certain tax-exempt trusts. See “Eligibility for Investment”.

The principal and registered offices of the Corporation are located at #4000, 585 – 8th Avenue S.W., Calgary, Alberta, T2P 1G1.

v

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

TABLE OF CONTENTS (continued)

PROSPECTUS

IMPORTANT NOTICE ABOUT INFORMATION IN THIS PROSPECTUS

SUPPLEMENT AND THE PROSPECTUS

This document consists of two parts. The first part of this document is this Prospectus Supplement, which describes the

specific terms of the Subscription Receipts and Common Shares issuable pursuant to the terms thereof that Pembina is qualifying for distribution and also adds to, and updates certain information contained in, the Prospectus and the documents

incorporated by reference therein. The second part of this document is the Prospectus, which gives more general information, some of which may not apply to the Subscription Receipts and Common Shares issuable pursuant to the terms thereof that

Pembina is qualifying for distribution. Defined terms or abbreviations used in this Prospectus Supplement that are not defined herein have the meanings ascribed thereto in the Prospectus.

If the description of the Subscription Receipts and Common Shares issuable pursuant to the terms thereof or any other information varies between this

Prospectus Supplement, the Prospectus and the documents incorporated by reference therein, you should rely on the information in this Prospectus Supplement.

Pembina and the Underwriters have not authorized anyone to provide you with information other than that contained in this Prospectus Supplement or

contained in, or incorporated by reference into, the Prospectus or to make any representations other than those contained in this Prospectus Supplement or contained in, or incorporated by reference into, the Prospectus. Pembina and the Underwriters

take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you or any representation that others may make to you. Pembina is not, and the Underwriters are not, making an offer to

sell the Subscription Receipts in any jurisdiction where such offer or sale is not permitted. You should assume that the information in this Prospectus Supplement and the Prospectus, as well as the information in any document incorporated by

reference into the Prospectus that Pembina previously filed with any securities commission or similar regulatory authority in Canada, is accurate only as of the respective dates of the applicable documents. Pembina’s business, financial

condition, results of operations and prospects may have changed since those dates. A prospective purchaser should carefully read this Prospectus Supplement and the Prospectus and the documents incorporated by reference therein and consult its own

professional advisors to assess the risks associated with, and the income tax, legal and other aspects of, an investment in the Subscription Receipts and Common Shares issuable pursuant to the terms thereof.

This Prospectus Supplement is deemed to be incorporated by reference into the Prospectus solely for the purposes of qualifying the distribution of the

Subscription Receipts and Common Shares issuable pursuant to the terms thereof. Other documents are also incorporated, or deemed to be incorporated, by reference into the Prospectus. See “Documents Incorporated by Reference”.

S-1

EXCHANGE RATES

In this Prospectus Supplement, all dollar amounts are expressed in Canadian dollars. Accordingly, all references to “$” or “dollars” are

to the lawful currency of Canada and all references to “US$” are to the lawful currency of the United States. In this Prospectus Supplement, where applicable, and unless otherwise specified, dollar amounts are converted from U.S. dollars

to Canadian dollars by applying the daily average rate of exchange for conversion of one U.S. dollar to Canadian dollars, as reported by the Bank of Canada on December 13, 2023.

The following table sets forth, for each of the periods indicated, the period end daily average exchange rate, the average daily exchange rate and the high

and low daily average exchange rates of one U.S. dollar in exchange for Canadian dollars, as reported by the Bank of Canada.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Nine Months Ended

September 30, |

|

|

Year Ended

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

|

2020 |

|

| End of Period |

|

$ |

1.3520 |

|

|

$ |

1.3707 |

|

|

$ |

1.3544 |

|

|

$ |

1.2678 |

|

|

$ |

1.2732 |

|

| Average |

|

$ |

1.3457 |

|

|

$ |

1.2828 |

|

|

$ |

1.3011 |

|

|

$ |

1.2535 |

|

|

$ |

1.3415 |

|

| High |

|

$ |

1.3807 |

|

|

$ |

1.3726 |

|

|

$ |

1.3856 |

|

|

$ |

1.2942 |

|

|

$ |

1.4496 |

|

| Low |

|

$ |

1.3128 |

|

|

$ |

1.2451 |

|

|

$ |

1.2451 |

|

|

$ |

1.2040 |

|

|

$ |

1.2718 |

|

On December 13, 2023, the daily average rate of exchange for the conversion of one U.S. dollar into Canadian dollars, as

reported by the Bank of Canada, was US$1.00 equals 1.3561.

S-2

FORWARD-LOOKING STATEMENTS

Certain statements contained in this Prospectus Supplement, the Prospectus and in certain documents incorporated by reference into the Prospectus constitute

“forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities laws (collectively,

“forward-looking statements”).

In addition to the following cautionary statement and the cautionary statement contained under

“Forward-Looking Statements” in the Prospectus, with respect to forward-looking statements contained in the documents incorporated by reference into the Prospectus, prospective purchasers should refer to “Forward-Looking

Statements and Information” in the AIF and “Forward-Looking Statements & Information” in the Annual MD&A and the Interim MD&A, as well as the advisories section of any documents

incorporated by reference into the Prospectus that are filed after the date of this Prospectus Supplement and prior to the termination of the Offering.

All forward-looking statements are based on Pembina’s current expectations, estimates, projections, beliefs and assumptions based on information

available at the time the forward-looking statement was made and in light of Pembina’s experience and its perception of historical trends. Forward-looking statements are typically identified by words such as “anticipate”,

“continue”, “estimate”, “expect”, “may”, “will”, “project”, “should”, “could”, “would”, “believe”, “plan”, “intend”,

“design”, “target”, “undertake”, “view”, “indicate”, “maintain”, “explore”, “entail”, “forecast”, “schedule”, “objective”,

“strategy”, “likely”, “potential”, “aim”, “outlook”, “propose”, “goal” and similar expressions suggesting future events or future performance. In particular, this

Prospectus Supplement contains forward-looking statements pertaining to: the Acquisition, including the expected timing of closing and the expected benefits thereof, including Pembina’s ability to unlock incremental value from the Acquired

Business, its expectations for the accretive effect of the Acquisition and the expected additions to incremental low risk, predominantly fee-based cash flow from operating activities; Pembina’s plans regarding financing the Purchase Price of

the Acquisition; the anticipated use of proceeds of the Offering; the expected Offering Closing Date; Pembina’s 2024 capital investment program, including the amount and allocation thereof; expectations regarding Pembina’s new projects and

developments, including the Cedar LNG Project (as defined herein); expectations regarding the relationship between Pembina and current and future contractual counterparties and other stakeholders, including future actions to be taken in connection

therewith; expectations regarding the EPC Contract (as defined herein), including, the timing of entering into the EPC Contract, the steps taken in connection therewith, the terms thereof and Pembina’s financial commitments in relation thereto;

the outlook for Alliance and Aux Sable; expectations for capacity utilization, and the timing of, Canadian liquefied natural gas export capacity; expectations for U.S. market demand for liquefied natural gas; expectations for demand growth in the

WCSB (as defined herein); the alignment between Alliance’s strategic value and Canadian natural gas market dynamics; expectations for U.S. Gulf Coast liquefied natural gas export capacity; Pembina’s acceleration to a lighter commodity mix

and Pembina’s expansion of its U.S. presence, reputation and brand. In addition, the Prospectus incorporates by reference forward-looking statements pertaining to Pembina’s future plans, growth projects, business strategies and expected

results from future operations.

Various factors or assumptions are typically applied by Pembina in drawing conclusions or making the forecasts,

projections, predictions or estimates set out in forward-looking statements based on information currently available to Pembina at the time such forward-looking statements are made, including those factors and assumptions described under

“Forward-Looking Statements and Information” in the AIF and “Forward-Looking Statements & Information” in the Annual MD&A and the Interim MD&A. Pembina believes that the

expectations reflected in the forward-looking statements included in this Prospectus Supplement and those included in, or incorporated by reference into, the Prospectus are reasonable, in each case, as at the time that such statements were made, but

no assurance can be given that these expectations will prove to be correct and the forward-looking statements included in this Prospectus Supplement or included in, or incorporated by reference into, the Prospectus should not be unduly relied upon.

S-3

By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors

that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. These known and unknown risks, uncertainties and other factors include, but are not limited to, the risk factors described under

“Risk Factors” in this Prospectus Supplement, “Risk Factors” in the Prospectus and “Risk Factors” in the AIF and the Annual MD&A, as well as the other risk factors described in any documents

incorporated by reference into the Prospectus that are filed after the date hereof and prior to the termination of the Offering. These factors should not, however, be construed as exhaustive.

The forward-looking statements contained herein or contained in, or incorporated by reference into, the Prospectus are, in each case, made as of the date of

this Prospectus Supplement or as of the date of the document in which they are contained, as applicable. Unless required by law, Pembina does not undertake any obligation to publicly update or revise such forward-looking statements, whether as a

result of new information, future events or otherwise. Any forward-looking statements contained herein or contained in, or incorporated by reference into, the Prospectus are expressly qualified by this cautionary statement.

S-4

WHERE TO FIND MORE INFORMATION

The Corporation has filed with the SEC, under the United States Securities Act of 1933, as amended, a registration statement on Form F-10 relating to the Subscription Receipts and the Common Shares issuable pursuant to the terms thereof. This Prospectus Supplement, which constitutes a part of the registration statement, does not contain all of

the information contained in the registration statement, certain items of which are contained in the exhibits to the registration statement as permitted or required by the rules and regulations of the SEC. See “Documents Filed as Part of the

Registration Statement”. Statements included in this Prospectus Supplement or incorporated by reference into the Prospectus about the contents of any contract, agreement or other document referred to are not necessarily complete and, in

each case, prospective investors should refer to the exhibits to the registration statement for a complete description of the contract, agreement or other document involved. Each such statement is qualified in its entirety by such reference.

The Corporation is subject to the information reporting requirements of the United States Securities Exchange Act of 1934, as amended (the

“U.S. Exchange Act”), and applicable Canadian securities laws and, in accordance therewith, files and furnishes annual and quarterly financial information and material change reports, business acquisition reports and other material

with the securities commission or similar authority in each of the provinces of Canada and with the SEC. Under the multijurisdictional disclosure system adopted by the Canadian Securities Administrators and the SEC, documents and other information

filed by the Corporation with the SEC are generally permitted to be prepared in accordance with disclosure requirements under Canadian securities laws, which are different from the disclosure requirements under the U.S. securities laws. Prospective

investors may read and download any public document that the Corporation has filed with the securities commission or similar authority in each of the provinces of Canada on Pembina’s profile on the System for Electronic Data Analysis and

Retrieval + (“SEDAR+”) at www.sedarplus.ca. Reports and other information filed by the Corporation with and furnished to the SEC can be read and downloaded on Pembina’s profile on the SEC’s Electronic Data Gathering and

Retrieval (“EDGAR”) website at www.sec.gov.

S-5

DOCUMENTS INCORPORATED BY REFERENCE

Information has been incorporated by reference into the Prospectus from documents filed with securities commissions or similar authorities in

each of the provinces of Canada. Copies of the documents incorporated by reference herein may be obtained on request without charge from the Corporate Secretary of Pembina at #4000, 585—8th Avenue S.W., Calgary, Alberta,

T2P 1G1, Telephone (403) 231-7500. These documents are also available through the internet on SEDAR+, which can be accessed at www.sedarplus.ca, and on EDGAR, which can be accessed at www.sec.gov.

This Prospectus Supplement is deemed to be incorporated by reference into the Prospectus solely for the purposes of qualifying the distribution of the

Subscription Receipts and the Common Shares issuable pursuant to the terms thereof.

The following documents filed by Pembina, with the securities

commissions or similar authorities in each of the provinces of Canada, are specifically incorporated by reference in, and form an integral part of, the Prospectus, provided that such documents are not incorporated by reference to the extent that

their contents are modified or superseded by a statement contained in this Prospectus Supplement, the Prospectus or in any other subsequently filed document that is also incorporated by reference into the Prospectus:

Any

documents of the type required by National Instrument 44-101 – Short Form Prospectus Distributions to be incorporated by reference into a short form prospectus, including any material change

reports (excluding material change reports filed on a confidential basis), interim financial reports, annual financial statements and the auditors’ reports thereon, management’s discussion and analysis of financial condition and results of

operations, information circulars, annual information forms and business acquisition reports, as well as all prospectus supplements disclosing additional or updated information relating to the Offering of the Subscription Receipts and Common Shares

issuable pursuant to the terms thereof, filed by the Corporation with the securities commissions or similar authorities in each of the provinces of Canada subsequent to the date of this Prospectus Supplement and prior to the termination of the

Offering are deemed to be incorporated by reference into this Prospectus. In addition, to the extent that any document or information incorporated by reference into the

S-6

Prospectus is included in any report on Form 6-K, Form 40-F, Form 20-F,

Form 10-K, Form 10-Q or Form 8-K (or any respective successor form) that is filed with or furnished to the SEC after the date of

this Prospectus Supplement and prior to the termination of the Offering, such document or information shall be deemed to be incorporated by reference as an exhibit to the registration statement of which the Prospectus forms a part (in the case of

Form 6-K and Form 8-K, if and only to the extent expressly set out therein). Pembina may also incorporate by reference into the Prospectus other information filed with

or furnished to the SEC under the U.S. Exchange Act, provided that information included in any report on Form 6-K or Form 8-K shall be deemed to be incorporated by

reference into the Prospectus only if and to the extent expressly set out therein.

Any statement contained in this Prospectus Supplement, the

Prospectus or in any other document (or part thereof) incorporated or deemed to be incorporated by reference into the Prospectus shall be deemed to be modified or superseded, for the purposes of this Prospectus Supplement, to the extent that a

statement contained herein or in any subsequently filed document (or part thereof) which also is or is deemed to be incorporated by reference into the Prospectus modifies or supersedes such statement. The modifying or superseding statement need not

state that it has modified or superseded a prior statement or include any other information set forth in the document which it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any

purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not

misleading in light of the circumstances in which it was made. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Prospectus Supplement or the Prospectus.

S-7

MARKETING MATERIALS

The Offering Marketing Materials are incorporated by reference into the Prospectus, but do not form part of this Prospectus Supplement or the Prospectus to

the extent that the contents thereof have been modified or superseded by a statement contained in this Prospectus Supplement.

Any template version of any

marketing materials (as such term is defined in National Instrument 41-101 – General Prospectus Requirements) filed with the securities commission or similar authority in each of the

provinces of Canada in connection with the Offering after the date of this Prospectus Supplement but prior to the completion or termination of the distribution of the securities under this Prospectus Supplement is deemed to be incorporated by

reference into the Prospectus.

S-8

PEMBINA PIPELINE CORPORATION

Pembina is a leading energy transportation and midstream service provider that has served North America’s energy industry for more than 65 years. Pembina

owns an integrated network of hydrocarbon liquids and natural gas pipelines, gas gathering and processing facilities, oil and natural gas liquids infrastructure and logistics services, and an export terminals business. Through Pembina’s

integrated value chain, it seeks to provide safe and reliable energy solutions that connect producers and consumers across the world, support a more sustainable future and benefit its customers, investors, employees and communities. For a

description of the business and operations of Pembina and its operating divisions, see “Description of Pembina’s Business and Operations” in the AIF and “Segment Results – Business Overview” in the Annual

MD&A and the Interim MD&A.

S-9

RECENT DEVELOPMENTS

On December 11, 2023, Pembina provided its financial guidance for 2024 and an

end-of-year business update. In its financial guidance, Pembina announced its expected 2024 capital investment program of $880 million, allocated as follows:

$380 million to its Pipelines Division; $323 million to its Facilities Division; $7 million to its Marketing and New Ventures Division; $40 million to its Corporate segment; and $130 million to contributions to equity accounted

investees of Pembina. Pipelines Division capital expenditures primarily relate to the construction of the Phase VIII Peace Pipeline Expansion and the northeast British Columbia (“NEBC”) Pipeline system expansion, pre-final

investment decision development spending on potential future projects, including new pipelines and terminal upgrades within the NEBC Pipeline system and downstream systems between Taylor, British Columbia and Gordondale, Alberta, and investments in

smaller growth projects, including various laterals and terminals. Capital expenditures in the Facilities Division primarily relate to construction of the 55,000 barrels per day propane-plus fractionator at Pembina’s fractionation and

storage facilities at Redwater, Alberta, smaller growth projects and sustaining capital spending. The Corporation’s 2024 capital program includes $90 million of non-recoverable sustaining capital to

support safe and reliable operations and $50 million related to digitization, technology and systems investments, which aim to enhance operational efficiency. In addition, Pembina Gas Infrastructure Inc., as equity accounted investee of

Pembina, is proceeding with the development of a new cogeneration facility at the Kaybob South 3 Processing Plant. In addition to the 2024 capital investment program detailed above, Pembina is in development of additional growth projects that could

increase the program by up to $280 million. This includes approximately $210 million related to pre-FID contributions for Cedar LNG (as defined below) and approximately $70 million related to growth projects to accommodate growing Western Canadian

Sedimentary Basin (“WCSB”) volumes and incremental demand for transportation and gas processing services.

Pembina also announced that the

Corporation’s partnership (“Cedar LNG”) with the Haisla First Nation, which is developing the proposed floating LNG facility in Kitimat, British Columbia (the “Cedar LNG Project”), had entered into a heads of

agreement (the “HOA”) with Samsung Heavy Industries Co., Ltd. (“SHI”) and Black & Veatch Corporation (“B&V”). The HOA provides Cedar LNG, on an exclusive basis with SHI and B&V,

secure access to shipyard capacity to meet the target commercial operations date for the Cedar LNG Project. Cedar LNG, SHI and B&V are expected to finalize a lump sum engineering, procurement, and construction agreement (the “EPC

Contract”) in December 2023, which will provide Cedar LNG with the necessary services to construct the Cedar LNG Project, subject to a positive final investment decision in respect thereof. In connection with, and following the

execution of the EPC Contract, Pembina expects to take additional steps and will be required to provide letters of credit to progress upstream infrastructure projects prior to a final investment decision. Such letters of credit, net to Pembina, are

currently expected to be up to $200 million, which may become payable in the case of a negative final investment decision. In conjunction with a positive final investment decision, these letters of credit would be transferred to Cedar LNG.

S-10

THE ACQUISITION

The Acquisition

On December 13, 2023, the

Corporation entered into the Purchase and Sale Agreement with Enbridge to acquire all of Enbridge’s interests in the Alliance (“Alliance”), Aux Sable (“Aux Sable”) and NRGreen Power (“NRGreen”)

joint ventures and the related operatorship contracts (collectively, the ”Acquired Business”) for an aggregate purchase price of approximately $3.1 billion (subject to certain adjustments), including approximately

$327 million of assumed debt, representing Enbridge’s proportionate share of the indebtedness of Alliance. The Acquisition has an effective date of January 1, 2024 (the “Effective Date”), and any capital contributions made

by Enbridge after that date will increase the Purchase Price by an equivalent amount and any cash distributions or dividends paid to Enbridge by the Acquired Business in respect of operations after the Effective Date will reduce the Purchase Price

by an equivalent amount. Interest will accrue on the cash portion of the Purchase Price, as adjusted, between the Effective Date and the Acquisition Closing Date. Completion of the Acquisition is subject to customary conditions for transactions of

this nature, as described further below.

Pembina currently owns 50% of the equity interests in Alliance, Aux Sable’s Canadian operations and NRGreen

and approximately 42.7% of the equity interests in Aux Sable’s U.S. operations, and is the operator of certain assets of the Acquired Business pursuant to various operation services agreements (“COSAs”), with Enbridge being the

operator of the remaining assets of the Acquired Business under other COSAs. Following completion of the Acquisition, Pembina will hold 100% of the equity interests in Alliance, Aux Sable’s Canadian operations and NRGreen and approximately

85.4% of Aux Sable’s U.S. operations, and Pembina will become the operator of all of the Alliance, Aux Sable and NRGreen businesses. Pembina’s acquisition of Enbridge’s interests, including the additional interests in Aux Sable’s

U.S. operations, is not subject to any rights of first refusal.

Acquisition Rationale

The Acquisition is an opportunistic consolidation of critical and highly differentiated North American energy infrastructure. Further, it complements

Pembina’s strategy of providing access to premium end markets for world-class, long-life resources in the WCSB. Alliance has a strong track record of high reliability and utilization and is unique within North America in its ability to

transport liquids rich natural gas, while providing a cross-border conduit to high demand U.S. markets. Pembina is uniquely positioned to execute the Acquisition with minimal integration risk given Pembina’s existing ownership interests in the

Acquired Business, current commercial management of Alliance and operatorship of Aux Sable and established customer relationships. Using its deep knowledge of the assets of the Acquired Business, Pembina has identified both near-term and long-term

synergies that it expects to unlock incremental value. The Acquisition is expected to be funded in accordance with Pembina’s financial guardrails and is expected to deliver immediate accretion to adjusted cash flow from operating activities per

share. Further, Alliance and Aux Sable are currently treated by Pembina as equity accounted investees for accounting purposes and the Acquisition will allow Pembina to simplify its corporate reporting.

Pembina believes that the North American natural gas industry is in a period of dynamic transition in which the supply and demand factors support a favourable

outlook for both Alliance and Aux Sable. Growing WCSB natural gas production, most notably from the Montney play, is expected to largely fill the approximately 2.8 billion cubic feet per day of new Canadian West Coast liquefied natural gas

export capacity expected to come on-line over the next five (5) years, while existing production volume will continue to be drawn south to U.S. markets. Limited WCSB intra-basin demand growth, alongside

growing production from the Bakken play in North Dakota, highlight the growing need for U.S.-destined natural gas transportation. As well, the liquids-rich nature of Montney and Bakken natural gas aligns well with Alliance’s strategic value

within the North American natural gas market and its unique ability to transport liquids rich natural gas at a premium to U.S. Midwest markets. A significant expansion of U.S. Gulf Coast liquefied natural gas export capacity is expected over the

next five (5) years and Alliance acts as a valuable and cost-effective conduit for Canadian natural gas to access

S-11

this growing export market. Alliance also provides additional low risk, fee-based cash flows underpinned by long-term, predominantly take-or-pay contracts with high-quality counterparties. The Acquired Business is approximately 80-90% fee-based.

As the Acquired Business provides service for natural gas and natural gas liquids, the Acquisition is also expected to increase Pembina’s exposure to

lighter hydrocarbons. Further, the Acquisition enhances Pembina’s service offering for existing customers, with whom Pembina has established strong relationships, and is anticipated to strengthen its competitive advantage.

Increasing its ownership interest in Alliance and Aux Sable will also expand Pembina’s U.S. presence and Pembina expects such increase to also provide

opportunities to further establish the Corporation’s reputation and brand name in the robust U.S. natural gas liquids market. Post-2030, Pembina expects there will be an opportunity to grow its marketing portfolio by approximately 100,000

barrels per day and has identified incremental commercial integration opportunities that could further bolster Pembina’s service offering. Pembina also expects the Acquisition to deliver $225 million to $250 million of incremental low risk,

predominantly fee-based cash flow from operating activities with modest sustaining capital, which will support Pembina’s continued strategic growth investments and maintain Pembina’s strong financial

position.

Purchase and Sale Agreement

The

Acquisition is being effected by Enbridge causing certain of its affiliates that currently directly or indirectly hold Enbridge’s interests in the Acquired Business (the “Selling Entities”) to transfer those interests (the

“Conveyed Interests”) to Pembina or a designated affiliate of Pembina. The Purchase and Sale Agreement contains covenants, representations and warranties of and from each of Pembina and Enbridge and various conditions precedent.

Unless all such conditions are satisfied or waived by the party for whose benefit such condition exists, to the extent they may be capable of waiver, the Acquisition will not proceed as proposed, or at all. There can be no assurance that the

conditions will be satisfied or waived on a timely basis, or at all. See “ Risk Factors – Risks Relating to the Acquisition”.

The following is a description of the material provisions of the Purchase and Sale Agreement. This summary has been included to provide readers with

information regarding the key terms of the Purchase and Sale Agreement and is not intended to provide any other factual information about Pembina or Enbridge or any of their respective subsidiaries or affiliates.

Representations and Warranties of the Parties

The

Purchase and Sale Agreement contains certain customary representations and warranties of Enbridge related to, among other things: (i) the organization and authorization to complete the Acquisition of each of Enbridge, the Selling Entities and

the Enbridge entities that currently serve as operators under the COSAs; (ii) no violations, conflicts, breaches or defaults; (iii) except for the Regulatory Approvals (as defined below) and certain other approvals and post-closing

consents, no consents required in respect of the Acquisition; (iii) the ownership by Enbridge or the Selling Entities of the Conveyed Interests; and (iv) other customary tax, employment, litigation and commercial representations and

warranties with respect to the Conveyed Interests, having regard to Pembina’s existing equity interests in the Acquired Business. The Purchase and Sale Agreement also contains certain customary representations and warranties of Pembina related

to, among other things: (i) the organization and authorization of Pembina to complete the Acquisition; (ii) no violations, conflicts, breaches or defaults; (iii) except for the Regulatory Approvals and certain other approvals and

post-closing consents, no consents required in respect of the Acquisition; and (iii) Pembina having sufficient available funds to complete the Acquisition.

S-12

Covenants of the Parties

In the Purchase and Sale Agreement, each party has agreed to certain covenants. Subject to the terms of the COSAs and other governance agreements in place with

respect to the Acquired Business and to the extent within its control given its current operatorship and ownership positions, Enbridge has agreed to conduct the Acquired Business in the ordinary course of business during the period from the date of

the Purchase and Sale Agreement until the Acquisition Closing Date and has agreed not to take certain actions prior to the Acquisition Closing Date without Pembina’s prior written consent, including, among other things, issuing additional debt

or equity securities relating to the Conveyed Interests, amending or proposing to amend any organizational documents relating to the Conveyed Interests, entering into or amending certain material contracts, paying or declaring any dividends or

distributions relating to the Conveyed Interests, incurring certain indebtedness, making certain commitments for capital expenditures, selling assets or businesses, settling any litigation or waiving certain rights and claims.

The parties have agreed to use commercially reasonable efforts to satisfy all conditions to closing (to the extent within their respective control) and to

take, or cause to be taken, all commercially reasonable actions and do, or cause to be done, all other commercially reasonable things necessary to consummate the Acquisition. In particular, the parties have agreed to use commercially reasonable

efforts to obtain all required approvals, including under the Competition Act (Canada), the Canada Transportation Act and the United States Hart-Scott-Rodino Antitrust Improvements Act of 1976 and approval from the United States

Federal Communications Commission (collectively, the “Regulatory Approvals”).

Closing Conditions

The Purchase and Sale Agreement provides that the respective obligations of the parties to complete the Acquisition are subject to the satisfaction of a number

of conditions for the benefit of each party, including: (i) that all Regulatory Approvals have been obtained or waived in writing by the applicable governmental authority; (ii) no law, injunction or other order or ruling has been issued by

a court or other governmental authority which restrains, enjoins, prohibits or otherwise makes illegal the consummation of all or any part of the Acquisition; and (iii) the accuracy of the other party’s representations and warranties and

compliance by the other party with its covenants at the Acquisition Closing Date, subject to certain materiality thresholds. In addition, it is a condition to the obligation of Pembina to complete the Acquisition that no “material adverse

effect” (as defined in the Purchase and Sale Agreement) has occurred from the date of the Purchase and Sale Agreement until the Acquisition Closing Date with respect to the Conveyed Interests, taken as a whole.

Termination

The Purchase and Sale Agreement may

be terminated at any time prior to the Acquisition Closing Date: (i) by mutual written consent of Pembina and Enbridge; (ii) in certain circumstances if the Acquisition Closing Date has not occurred on or before the Acquisition Outside

Date (as defined below); (iii) in certain circumstances if a court or other governmental authority has issued an order or ruling or taken other action that permanently restrains, enjoins or prohibits the Acquisition and such order is final and non-appealable; or (iv) in certain circumstances, if a fact, event or circumstance arises, including a breach by the other party of its representations and warranties or covenants contained in the Purchase and

Sale Agreement, that would result in the failure of a condition and which cannot be cured or is not cured within a thirty (30) day cure period.

“Acquisition Outside Date” means the later of (i) June 3, 2024, except that either Pembina or Enbridge may extend the Acquisition

Outside Date by up to an additional three (3) months in total, in one (1) month increments (and in each case to the first business day of the subsequent calendar month), if the Regulatory Approvals have not been obtained by such date, and

(ii) the thirtieth day after the date that a notice is provided by Pembina or Enbridge to the other party that a non-satisfaction of a condition to closing of the Acquisition or a breach of a

representation or warranty or covenant by the other party may give rise to a right of Pembina or Enbridge, as

S-13

applicable, to terminate the Purchase and Sale Agreement (provided such non-satisfaction of a condition or breach is capable of being cured); provided that

in no event shall the Acquisition Outside Date extend beyond 5:00 p.m. (Calgary time) on October 1, 2024.

Other Matters

Under the Purchase and Sale Agreement, each party has agreed to indemnify the other party for a period of 18 months (and indefinitely, in the case of certain

fundamental representations made by each party) from the Acquisition Closing Date in respect of certain losses and liabilities arising out of breaches of its representations and warranties, subject to certain exceptions, including a defined time

period relating to certain of Enbridge’s tax representations and warranties. Enbridge has also agreed to indemnify Pembina for (i) breaches by Enbridge of its covenants made in the Purchase and Sale Agreement; (ii) certain claims made in

respect of the COSAs or the governing documents relating to the Conveyed Interests that arise prior to the Acquisition Closing Date; and (iii) Enbridge’s current pro rata share of certain taxes and, subject to certain deductibles and

limitations, potential liabilities relating to existing litigation involving the Acquired Business. Certain of the indemnities for breach of Enbridge’s representations and warranties and covenants are subject to minimum thresholds and an

aggregate maximum amount, in a manner which is customary for agreements of this type. Pembina has agreed to indemnify Enbridge for any environmental liabilities and abandonment and reclamation obligations whenever arising (unless related to a breach

of Enbridge’s representations or warranties or covenants for which Pembina may be indemnified) and certain claims made in respect of the COSAs or the governing documents relating to the Conveyed Interests that arise after the Acquisition

Closing Date.

In connection with the Acquisition, all claims between Aux Sable and a third party related to a natural gas liquids supply agreement have

been settled and discontinued. In connection therewith, Pembina contributed approximately $145 million to Aux Sable, representing Pembina’s proportionate share of such claim, which is consistent with the provisions previously recognized and

disclosed by Pembina. Additionally, a new third party marketing arrangement was executed and will take effect January 1, 2024.

Transition Services

Agreement

Pursuant to the Purchase and Sale Agreement, on closing of the Acquisition, Pembina and Enbridge will enter into a transition services

agreement (the “Transition Services Agreement”) pursuant to which Enbridge will provide (or cause its applicable affiliate to provide) certain services to Pembina (or its applicable affiliate) to assist Pembina in the operation of

the Alliance, Aux Sable and NRGreen businesses where Enbridge previously operated such business under a COSA. The time period that Enbridge will provide such services will generally vary from six (6) to twelve (12) months, subject to

certain extension rights of Pembina, and the provision of certain services by Enbridge may be terminated by Pembina at any time upon ten (10) days’ prior written notice to Enbridge. In return for such services, Pembina will pay Enbridge

agreed-upon fees on a fixed monthly or hourly basis, depending on the particular service.

Financing of the Acquisition

Pembina expects that the Purchase Price and the expenses related to the Acquisition will be funded through a combination of: (i) the net proceeds of the

Offering; and (ii) borrowings under the Corporation’s existing credit facilities and cash on hand. In lieu of drawing on its existing credit facilities, in whole or in part, the Corporation may issue debt securities prior to the

Acquisition Closing Date to fund a portion of the Purchase Price. See “Consolidated Capitalization”.

In addition to customary Purchase

Price adjustments for a transaction of this nature, the Purchase and Sale Agreement provides that the Purchase Price shall be decreased on a dollar-for-dollar basis by

the sum of any cash dividends, returns of capital or other cash distributions of profits declared or paid by the Acquired Business to Enbridge or its affiliates in respect of operations from the Effective Date to the Acquisition Closing Date, and

shall be increased on a dollar-for-dollar basis by the amount of any capital contributions made by Enbridge or its affiliates after the Effective Date until the Acquisition Closing Date, as well as interest that accrues on the cash portion of the

Purchase Price, as adjusted, from the Effective Date until the Acquisition Closing Date.

S-14

USE OF PROCEEDS

The net proceeds of the Offering (excluding any Dividend Equivalent Payments and interest and other income that may be earned on the Escrowed Funds) are

estimated to be approximately $1,068,536,000 after deducting the Underwriters’ Fee and the expenses of the Offering. If the Over-Allotment Option is exercised in full, the net proceeds of the Offering (excluding any Dividend Equivalent Payments

and interest and other income that may be earned on the Escrowed Funds) are estimated to be approximately $1,228,966,400 after deducting the Underwriters’ Fee and the expenses of the Offering. The net proceeds of the Offering will be used to

fund a portion of the Purchase Price. The expenses of the Offering will be paid from the general funds of the Corporation.

The Corporation expects to

fund the remaining portion of the Purchase Price with borrowings under the Corporation’s existing credit facilities and cash on hand. In lieu of drawing on its existing credit facilities, in whole or in part, the Corporation may issue debt

securities prior to the Acquisition Closing Date to fund a portion of the Purchase Price. See “Consolidated Capitalization”.

The

Escrowed Funds, being the Proceeds and any Earned Interest, will, from the Offering Closing Date until the earlier of the delivery of the Escrow Release Notice and Direction and the Termination Time, be held in escrow by the Subscription Receipt

Agent and deposited or invested, as applicable, pursuant to the terms of the Subscription Receipt Agreement in short-term obligations of, or guaranteed by, the Government of Canada, corporate commercial paper which is rated “A-1 (high)” by S&P Global Ratings or an equivalent rating from any other designated rating organization (as defined in National Instrument 44-101 –

Short Form Prospectus Distributions), guaranteed investment certificates of a Canadian Schedule I bank, or in one or more interest-bearing trust accounts to be maintained by the Subscription Receipt Agent as specified in the Subscription

Receipt Agreement, provided that Dividend Equivalent Payments may be made from the Escrowed Funds. See “Details of the Offering”.

If the

Escrow Release Notice and Direction is delivered prior to the Termination Time, the Escrowed Funds, less the Escrowed Underwriters’ Fee and any amounts required to satisfy any unpaid Dividend Equivalent Payments, will be released by the

Subscription Receipt Agent to or as directed by the Corporation and will be used to fund a portion of the Purchase Price.

If the Escrow Release Notice

and Direction is not delivered on or prior to the Termination Time, the Subscription Receipt Agent will pay to each holder of Subscription Receipts, no earlier than the third business day following the Termination Date, the applicable Termination

Payment. The Termination Payment will be made from the balance of the Escrowed Funds at the Termination Time, provided that if the balance of the Escrowed Funds at the Termination Time is insufficient to cover the aggregate amount of the Termination

Payments payable to the holders of Subscription Receipts, pursuant to the Subscription Receipt Agreement, Pembina will be required to pay to the Subscription Receipt Agent, as agent on behalf of the holders of Subscription Receipts, the deficiency

between the amount of Escrowed Funds at the Termination Time and the aggregate of the Termination Payments due to the holders of Subscription Receipts. See “Details of the Offering”. Any remaining Escrowed Funds after the payment of

the Termination Payments shall be paid by the Subscription Receipt Agent to the Corporation.

S-15

CONSOLIDATED CAPITALIZATION

There have been no material changes in the share and loan capital of the Corporation, on a consolidated basis, since September 30, 2023 other than the

repayment of approximately $358 million of indebtedness under Pembina’s unsecured $1.5 billion revolving credit facility. The following table summarizes our consolidated capitalization as at September 30, 2023, both actual and on a

pro forma basis to give effect to (i) the Offering (assuming no exercise of the Over-Allotment Option); (ii) the payment of the Purchase Price (assuming no adjustments to the Purchase Price pursuant to the Purchase and Sale Agreement) funded

from the net proceeds of the Offering, borrowings under the Corporation’s existing credit facilities and cash on hand; and (iii) the completion of the Acquisition.

|

|

|

|

|

|

|

|

|

| |

|

As at September 30, 2023 |

|

| |

|

Actual |

|

|

Pro Forma(1) |

|

| |

|

(millions of $) |

|

| Cash and Cash Equivalents(2) |

|

|

86 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Indebtedness |

|

|

|

|

|

|

|

|

| Senior Credit Facilities(3)(4)(5)(6) |

|

|

854 |

|

|

|

2,752 |

|

| Senior Notes(7) |

|

|

9,100 |

|

|

|

9,100 |

|

| Subordinated Hybrid Notes(8) |

|

|

600 |

|

|

|

600 |

|

|

|

|

|

|

|

|

|

|

| Total Indebtedness |

|

|

10,554 |

|

|

|

12,452 |

|

|

|

|

|

|

|

|

|

|

| Shareholders’ Equity |

|

|

|

|

|

|

|

|

| Common Shares(9) |

|

|

15,764 |

|

|

|

16,834 |

|

| Class A Preferred Shares(10) |

|

|

2,201 |

|

|

|

2,201 |

|

| Deficit |

|

|

(2,733 |

) |

|

|

(2,733 |

) |

| Accumulated Other Comprehensive Loss |

|

|

340 |

|

|

|

340 |

|

|

|

|

|

|

|

|

|

|

| Total Shareholders’ Equity |

|

|

15,572 |

|

|

|

16,642 |

|

|

|

|

|

|

|

|

|

|

| Total Capitalization |

|

|

26,212 |

|

|

|

29,094 |

|

|

|

|

|

|

|

|

|

|

Notes:

| (1) |

Based on (i) the issuance of 26,000,000 Subscription Receipts pursuant to the Offering for net proceeds of

approximately $1,068,536,000, after deducting the Underwriters’ Fee of $44,564,000 and estimated expenses of the Offering of $1 million and excluding any Earned Interest and the payment of any Dividend Equivalent Payment,

(ii) borrowings under the Corporation’s existing credit facilities and cash on hand to fund the remaining approximately $2 billion of the Purchase Price; and (iii) the assumption of $327 million of indebtedness, representing

Enbridge’s proportionate share of the indebtedness of Alliance. If the Over-Allotment Option is exercised in full, the net proceeds from the Offering will be approximately 1,228,966,400, after deducting the Underwriters’ fee of $51,248,600

and estimated expenses of the Offering and excluding any Earned Interest and the payment of any Dividend Equivalent Payment. The expenses of the Offering will be paid from the general funds of the Corporation. |

| (2) |

Includes cash of approximately $15 million of the Acquired Business as at September 30, 2023.

|

| (3) |

All debt amounts as at September 30, 2023 represent the outstanding principal balances of such debt

obligations. |

| (4) |

Pembina’s credit facilities as at September 30, 2023 consisted of: (i) an unsecured

$1.5 billion revolving credit facility, which includes a $750 million accordion feature and which matures in June 2028; (ii) an unsecured $1.0 billion sustainability-linked revolving credit facility, which matures in June 2027; (iii)

an unsecured US$250 million non-revolving term loan, which matures in May 2025; and (iv) a $50 million operating facility, which matures in June 2024 and is typically renewed on an annual basis.

As at December 12, 2023, Pembina had approximately $157 million drawn on such credit facilities, leaving approximately $3.4 billion of unutilized credit facilities. |

S-16

| (5) |

Includes approximately $327 million, representing Pembina’s proportionate share of the indebtedness of

Alliance, which, prior to completion of the Acquisition, represented indebtedness of equity accounted investees of Pembina and was not included in Pembina’s consolidated indebtedness. |

| (6) |

In lieu of drawing on its existing credit facilities, in whole or in part, the Corporation may issue debt

securities prior to the Acquisition Closing Date to fund the remaining portion of the Purchase Price. |

| (7) |

As at December 13, 2023, the Corporation had outstanding senior unsecured medium term notes in

the aggregate principal amount of $9,100 million, consisting of: (i) $450 million aggregate principal amount of 4.75% Medium Term Notes, Series 3, which will mature on April 30, 2043; (ii) $600 million aggregate principal amount

of 4.81% Medium Term Notes, Series 4, which will mature on March 25, 2044; (iii) $550 million aggregate principal amount of 3.54% Medium Term Notes, Series 5, which will mature on February 3, 2025; (iv) $600 million aggregate

principal amount of 4.24% Medium Term Notes, Series 6, which will mature on June 15, 2027; (v) $600 million aggregate principal amount of 3.71% Medium Term Notes, Series 7, which will mature on August 11, 2026; (vi) $650 million

aggregate principal amount of 2.99% Medium Term Notes, Series 8, which will mature on January 22, 2024; (vii) $550 million aggregate principal amount of 4.74% Medium Term Notes, Series 9, which will mature on January 21, 2047; (viii)

$650 million aggregate principal amount of 4.02% Medium Term Notes, Series 10, which will mature on March 27, 2028; (ix) $800 million aggregate principal amount of 4.75% Medium Term Notes, Series 11, which will mature on

March 26, 2048; (x) $650 million aggregate principal amount of 3.62% Medium Term Notes, Series 12, which will mature on April 3, 2029; (xi) $700 million aggregate principal amount of 4.54% Medium Term Notes, Series 13, which will

mature on April 3, 2049; (xii) $600 million aggregate principal amount of 3.31% Medium Term Notes, Series 15, which will mature on February 1, 2030; (xiii) $400 million aggregate principal amount of 4.67% Medium Term Notes,

Series 16, which will mature on May 28, 2050; (xiv) $500 million aggregate principal amount of 3.53% Medium Term Notes, Series 17, which will mature on December 10, 2031; (xv) $500 million aggregate principal amount of 4.49%

Medium Term Notes, Series 18, which will mature on December 10, 2051; and (xvi) $300 million aggregate principal amount of 5.72% Medium Term Notes, Series 19, which will mature on June 22, 2026. |

| (8) |

As at December 13, 2023, the Corporation had outstanding $600 million aggregate principal amount of

4.80% Fixed-to-Fixed Rate Subordinated Notes, Series 1, which will mature on January 25, 2081. |

| (9) |

As at December 13, 2023, the Corporation had 549,369,624 Common Shares and 10,828,295 options to

purchase Common Shares (“Options”) outstanding. The Options are held by employees of Pembina, of which 8,332,544 were exercisable as of December 13, 2023. The Options have exercise prices ranging from $26.83 to $49.78

and expire from December 2023 to October 2030. |

| (10) |

The terms of the Class A Preferred Shares of Pembina (the “Class A Preferred Shares”)

provide that the number of Class A Preferred Shares which may be issued and outstanding at any time shall be limited to a maximum of 254,850,850. As at December 13, 2023, the Corporation had 10,000,000 Series 1 Class A

Preferred Shares, 6,000,000 Series 3 Class A Preferred Shares, 10,000,000 Series 5 Class A Preferred Shares, 10,000,000 Series 7 Class A Preferred Shares, 9,000,000 Series 9 Class A Preferred Shares, 8,000,000 Series 15

Class A Preferred Shares, 6,000,000 Series 17 Class A Preferred Shares, 8,000,000 Series 19 Class A Preferred Shares, 14,971,870 Series 21 Class A Preferred Shares, 1,028,130 Series 22 Class A Preferred Shares, 10,000,000