As filed with the Securities and Exchange Commission on December 14, 2023

Registration No. 333-________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CUMBERLAND PHARMACEUTICALS INC.

(Exact name of registrant as specified in its charter)

| | | | | |

Tennessee

(State or other jurisdiction of

incorporation or organization) | 62-1765329

(IRS Employer

Identification No.)

|

1600 West End Avenue, Suite 1300

Nashville, Tennessee 37203

(615) 255-0068 | John Hamm

Chief Financial Officer Cumberland Pharmaceuticals Inc.

1600 West End Avenue, Suite 1300

Nashville, Tennessee 37203

(615) 255-0068 |

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices) | (Name and address, including zip code, and telephone

number, including area code, of agent for service) |

With copies to:

Tonya Mitchem Grindon, Esq.

Nathanael P. Kibler, Esq.

Baker, Donelson, Bearman, Caldwell & Berkowitz, PC

1600 West End Ave, Suite 2000

Nashville, Tennessee 37203

615-726-5600

Approximate date of commencement of proposed sale of securities to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462 (c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and emerging growth company in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☐

Non-accelerated filer ☒ Smaller reporting company ☒

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated December 14, 2023

PROSPECTUS

$100,000,000

CUMBERLAND PHARMACEUTICALS INC.

Common Stock

Preferred Stock

Warrants

Debt Securities

Units

__________________________

We may offer and sell, from time to time in one or more offerings, up to $100,000,000 in the aggregate of common stock, preferred stock, or warrants to purchase our common stock or preferred stock, debt securities and/or units consisting of two or more of those classes or series of securities and securities that may be convertible or exchangeable to other securities covered hereby, at prices and on terms that we will determine at the time of the offering. Preferred stock and debt securities may be convertible into preferred stock, common stock, or debt securities. We refer to our common stock, preferred stock, debt securities, warrants, and units hereunder collectively as the “securities.”

Each time we sell securities, to the extent required by applicable law, we will provide a supplement to this prospectus that contains specific information about the offering and the terms of the securities being offered. The supplement may also add, update or change information contained in this prospectus. You should carefully read this prospectus, all prospectus supplements and all other documents incorporated by reference in this prospectus before you invest in our securities.

We will offer the securities in amounts, at prices and on terms to be determined by market conditions at the time of the offerings. The securities may be offered separately or together in any combination.

We may offer the securities directly or through underwriters, agents or dealers. The supplements to this prospectus will designate the terms of our plan of distribution. See the discussion under the heading “Plan of Distribution” for more information on the topic.

Our executive offices are located at 1600 West End Avenue, Suite 1300, Nashville, Tennessee 37203, and our telephone number is (615) 255-0068.

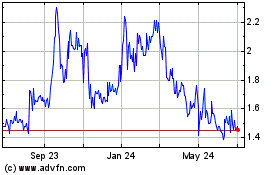

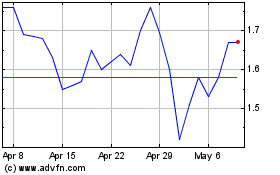

Our common stock trades on the Nasdaq Global Select Market under the symbol “CPIX.” On December 13, 2023, the closing price for our common stock, as reported by Nasdaq, was $1.72 per share.

__________________________

Investing in our securities involves risk. Please see “Risk Factors” beginning on page 2 for a discussion of certain risks that you should consider before investing in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus may not be used to consummate sales of securities unless accompanied by a prospectus supplement.

The date of this prospectus is December 14, 2023.

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission using a “shelf” registration process. Using this process, we may sell any combination of the securities described in this prospectus in one or more offerings up to a total dollar amount of $100,000,000.

Each time we use this prospectus to offer securities, we will provide a prospectus supplement that will describe the specific terms of the offering.

The prospectus supplement may also add to or update other information contained in this prospectus.

In making your investment decision, you should rely only on the information contained or incorporated by reference in this prospectus and any prospectus supplement we may authorize to be delivered to you. This prospectus incorporates important business and financial information about us that is not included in or delivered with this prospectus. You may obtain a copy of this information, without charge, as described in the “Where You Can Find More Information” section on page 20. We have not authorized anyone to provide you with any other information. If you receive any other information, you should not rely on it. You should not assume that the information appearing in this prospectus is accurate as of any date other than the date on the front cover of this prospectus. You should not assume that the information contained in the documents incorporated by reference in this prospectus is accurate as of any date other than the respective dates of those documents. Our business, financial condition, results of operations, reserves and prospects may have changed since that date.

We encourage you to read this entire prospectus together with the documents incorporated by reference into this prospectus before making a decision whether to invest in our securities.

RISK FACTORS

An investment in our securities involves a certain degree of risk. You should carefully consider the factors contained in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, under the heading “Risk Factors” and updated, if applicable, in our Quarterly Reports on Form 10-Q before investing in our securities. You should also consider similar information contained in any Annual Report on Form 10-K, Quarterly Report on Form 10-Q or other document filed by us with the Securities and Exchange Commission (the “SEC”) after the date of this prospectus before deciding to invest in our securities. If any of these risks were to occur, our business, financial condition or results of operations could be adversely affected. In that case, the trading price of our common stock or other securities could decline and you could lose all or part of your investment. When we offer and sell any securities pursuant to a prospectus supplement, we may include additional risk factors relevant to such securities in the prospectus supplement.

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS

Certain information included in this prospectus may be deemed to be forward-looking statements. Where any forward-looking statement includes a statement of the assumptions or bases underlying the forward-looking statement, we caution that, while we believe these assumptions or bases to be reasonable and made in good faith, assumed facts or bases almost always vary from the actual results, and the differences between assumed facts or bases and actual results can be material, depending upon the circumstances. Where, in any forward-looking statement, we express an expectation or belief as to future results, such expectation or belief is expressed in good faith and is believed to have a reasonable basis. We cannot assure you, however, that the statement of expectation or belief will result or be achieved or accomplished. These statements relate to analyses and other information which are based on forecasts of future results and estimates of amounts not yet determinable. These statements also relate to our future prospects, developments and business strategies. These forward-looking statements are identified by their use of terms and phrases such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “will,” and similar terms and phrases, or the negative of these words and phrases or similar words or phrases, which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions.

Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods which may be incorrect or imprecise and we may not be able to realize them. We do not guarantee that the transactions and events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements:

•The possible or assumed future results of operations, including the accuracy of our estimates regarding expenses, future revenues, capital requirements and needs for additional financing;

•Changes in national or regional economic conditions, including changes in interest rates and the availability and the cost of capital to us;

•Our competitive position and competitors, including the size and growth potential of the markets for our products and product candidates;

•The success, cost and timing of our product acquisition and development activities and clinical trials; and our ability to successfully commercialize our product candidates;

•Product efficacy or safety concerns, whether or not based on scientific evidence, resulting in product withdrawals, recalls, regulatory action on the part of the FDA (or international counterparts) or declining sales;

•The performance of our third-party suppliers and manufacturers which impacts our supply chain and could create business shutdowns or product shortages; and the retention of key scientific and management personnel;

•Challenges to our patents and the introduction of generic versions of our products and product candidates, which could negatively impact our ability to commercialize and sell our products and product candidates and decrease sales a result of a market exclusivity;

•Changes in reimbursement available to us, including changes in Medicare and Medicaid payment levels and availability of third-party insurance coverage and the effects of future legislation or regulations, including changes to regulatory approval of new products, licensing and patent rights, environmental protection and possible drug re-importation legislation;

•Interruptions and breaches of our computer and communications systems, and those of our vendors, including computer viruses, hacking and cyber-attacks, that could impair our ability to conduct business and communicate internally and with our customers, or result in the theft of trade secrets or other misappropriation of assets, or otherwise compromise privacy of sensitive information belonging to us, our customers or other business partners;

•Global events including the rising rate of inflation, volatility in financial markets, and the ongoing conflicts in Eastern Europe and the Middle East; and

•Issuance of new or revised accounting standards by the Financial Accounting Standards Board and the SEC.

We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or otherwise. If one or more of these risks or uncertainties materialize, or if underlying assumptions prove incorrect, our actual results may vary materially from those expected, estimated or projected.

OUR COMPANY

In this prospectus, “Cumberland,” “we,” “our,” and “us” refer to Cumberland Pharmaceuticals Inc., a Tennessee corporation.

Cumberland is a Tennessee corporation. Our principal executive offices are located at 1600 West End Avenue, Suite 1300, Nashville, Tennessee 37203. Our telephone number is (615) 255-0068. We maintain a website at www.cumberlandpharma.com, which contains information about us. Our website and the information contained on it and connected to it will not be deemed incorporated by reference into this prospectus. We were incorporated in 1999 and have been headquartered in Nashville, Tennessee since inception. During 2009, we completed an initial public offering of our common stock, which is listed on Nasdaq Global Market under the symbol “CPIX.”

Cumberland is a specialty pharmaceutical company focused on the acquisition, development and commercialization of branded prescription products. Our primary target markets are hospital acute care, gastroenterology and rheumatology. These medical specialties are characterized by relatively concentrated prescriber bases that we believe can be penetrated effectively by small, targeted sales forces. Cumberland is dedicated to providing innovative products that improve quality of care for patients and address poorly met medical needs. We promote our approved products through our hospital and field sales forces in the United States and are establishing a network of international partners to register and provide our medicines to patients in their countries.

Our portfolio of FDA approved brands includes:

▪Acetadote® (acetylcysteine) Injection, for the treatment of acetaminophen poisoning;

▪Caldolor® (ibuprofen) Injection for the treatment of pain and fever;

▪Kristalose® (lactulose) for Oral Solution, a prescription laxative, for the treatment of chronic and acute constipation;

▪Omeclamox®-Pak, (omeprazole, clarithromycin, amoxicillin) for the treatment of Helicobacter pylori (H. pylori) infection and related duodenal ulcer disease;

▪Sancuso® (granisetron) transdermal, for the prevention of nausea and vomiting in patients receiving certain types of chemotherapy treatment;

▪Vaprisol® (conivaptan) Injection, to raise serum sodium levels in hospitalized patients with euvolemic and hypervolemic hyponatremia; and

▪Vibativ® (telavancin) Injection, for the treatment of certain serious bacterial infections including hospital-acquired and ventilator-associated bacterial pneumonia, as well as complicated skin and skin structure infections.

In addition to these commercial brands, we have Phase II clinical programs underway evaluating our ifetroban product candidates for patients with cardiomyopathy associated with (1) Duchenne Muscular Dystrophy (“DMD”), a fatal, genetic neuromuscular disease and (2) Systemic Sclerosis (“SSc”) or scleroderma, a debilitating autoimmune disorder characterized by fibrosis of the skin and internal organs.

Cumberland has built core competencies in the acquisition, development and commercialization of pharmaceutical products in the United States – and we believe we can leverage this existing infrastructure to support our continued growth both domestically and internationally. Our management team consists of pharmaceutical industry veterans with experience in business development, product development, regulatory, manufacturing, sales, marketing and finance. Our business development team identifies, evaluates, and negotiates product acquisition, licensing and co-promotion agreements. Our product development team creates proprietary formulations, manages our clinical studies, prepares our FDA submissions and staffs our medical call center. Our quality and manufacturing professionals oversee the manufacturing, release and shipment of our products. Our marketing and sales organization is responsible for our commercial activities, and we work closely with our distribution partners to ensure the availability and delivery of our products.

Cumberland’s growth strategy involves maximizing the success of our existing brands while continuing to build a portfolio of differentiated products. We currently feature seven products approved by the FDA in the United States. We are also continuing to establish international partnerships to bring our medicines to patients in other countries. Additionally, we look for opportunities to expand our products into additional patient populations through clinical trials, new presentations and our support of select, investigator-initiated studies. We actively pursue opportunities to acquire additional marketed products, as well as late-stage development product candidates in our target medical specialties. Our clinical team is developing a pipeline of new product candidates largely to address poorly met medical needs.

Furthermore, we are supplementing these activities with the earlier-stage drug development at Cumberland Emerging Technologies (“CET”), our majority-owned subsidiary. CET partners with academic research institutions to identify and support the progress of promising new product candidates, which Cumberland could further develop and commercialize.

USE OF PROCEEDS

Unless otherwise specified in a prospectus supplement accompanying this prospectus, we expect to use the net proceeds from the sale of our securities for general corporate purposes, which may include, among other things, the financing of capital expenditures, acquisitions and additions to our working capital. The actual application of proceeds from the sale of any particular tranche of securities issued hereunder will be described in the applicable prospectus supplement relating to such tranche of securities.

DESCRIPTION OF CAPITAL STOCK

Our authorized capital consists of 120,000,000 shares of stock at no par value. Of the authorized capital, 100,000,000 shares are authorized to be issued as common stock and 20,000,000 shares are authorized to be issued as preferred stock. Our issued and outstanding shares of common stock as of December 13, 2023 consisted of 14,904,786 shares which were held by 179 shareholders of record, which excludes shareholders whose shares are held in nominee or street name by brokers. To date, there are no issued and outstanding shares of preferred stock.

The following description of our capital stock summarizes general terms and provisions that apply to our capital stock. Since this is only a summary, it does not contain all of the information that may be important to you. The summary is subject to and qualified in its entirety by reference to our Fourth Amended and Restated Charter and our Second Amended and Restated Bylaws, which are incorporated by reference into this prospectus. See “Where You Can Find More Information.”

Common Stock

For all matters submitted to a vote of shareholders, holders of common stock are entitled to one vote for each share registered in his or her name on our books, and they do not have cumulative voting rights. Each share of the common stock is entitled to share equally with each other share of common stock in dividends from sources legally available therefore, when, as, and if declared by the board of directors and, upon our liquidation or dissolution, whether voluntary or involuntary, to share equally in the assets that are available for distribution to the holders of the common stock. We have not paid any cash dividends since our inception. Holders of our common stock have no preemptive, subscription, redemption or conversion rights. The board of directors is authorized to issue additional shares of common stock within the limits authorized by our Fourth Amended and Restated Charter and without shareholder action.

Preferred Stock

Shares of preferred stock may be issued from time to time in one or more classes or series, each such class or series to be so designated as to distinguish the shares thereof from the shares of all other series and classes. The board of directors is authorized to divide preferred stock into classes or series and to fix and determine the relative rights, preferences, qualifications and limitations of the shares of any class or series so established. The number of shares of Preferred Stock the Company may offer is up to 20,000,000 and those shares can be one or more classes or series.

The Company has designated 3 million shares of Preferred Stock as Series A (“Series A”), but none of which is issued and outstanding. A summary of the terms of the Series A is set forth below:

▪Currently there are 3 million shares of Series A designated,

▪with a liquidation value of $3.25,

▪dividend rate on parity with the common stock,

▪voting rights equal to one vote per share,

▪not redeemable or subject to a sinking fund;

▪the price at which the preferred stock will be issued will be set by the Company;

The rights, preferences, qualifications, limitations and restrictions on the remaining shares of Preferred Stock shall be set by the Company prior to issuance and those terms of any new series or classes of preferred stock will be filed with the SEC. The Company will determine whether the preferred stock is convertible or exchangeable for any other securities, and the terms of any such conversion. All other rights, preferences, qualifications, limitations and restrictions of the preferred stock shall be established by the Company before issuance and filed with the SEC.

If we offer to sell preferred stock, our board of directors is authorized to designate and issue shares of preferred stock in one or more series without shareholder approval. Our board of directors would have discretion to determine the rights, preferences, privileges and restrictions, including voting rights, dividend rights, conversion rights, redemption privileges and liquidation preferences, of each series of preferred stock.

The terms, conditions and provisions of the Series A Preferred Stock are described in Exhibit 4.2.

It is not possible to state the actual effect of the issuance of any shares of preferred stock upon the rights of holders of our common stock until the board of directors determines the specific rights of the holders of the preferred stock. However, these effects might include:

▪restricting dividends on the common stock;

▪diluting the voting power of the common stock;

▪impairing the liquidation rights of the common stock; and

▪delaying or preventing a change in control of our company.

Transfer Agent or Registrar

Continental Stock Transfer & Trust Company is the transfer agent and registrar of our common stock.

Listing

Our common stock is listed on Nasdaq Global Market under the symbol “CPIX.” On December 13, 2023, the closing price for our common stock, as reported on Nasdaq, was $1.72 per share.

DESCRIPTION OF WARRANTS

We may issue warrants for the purchase of common stock or preferred stock. Warrants may be issued independently or together with common stock or preferred stock offered by any prospectus supplement and may be attached to or separate from any such offered securities. Series of warrants may be issued under a separate warrant agreement entered into between us and a bank or trust company, as warrant agent, all as will be set forth in the prospectus supplement relating to the particular issue of warrants. The warrant agent would act solely as our agent in connection with the warrants and would not assume any obligation or relationship of agency or trust for or with any holders of warrants or beneficial owners of warrants.

The following summary of certain provisions of the warrants does not purport to be complete and is subject to, and is qualified in its entirety by reference to, all provisions of the warrant agreements.

Reference is made to the prospectus supplement relating to the particular issue of warrants offered pursuant to such prospectus supplement for the terms of and information relating to such warrants, including, where applicable:

▪number of shares of common stock or preferred stock purchasable upon the exercise of warrants to purchase common stock or preferred stock and the price at which such number of shares of common stock or preferred stock may be purchased upon such exercise;

▪the date on which the right to exercise such warrants shall commence and the date on which such right shall expire;

▪United States federal income tax consequences applicable to such warrants;

▪the amount of warrants outstanding as of the most recent practicable date; and

▪any other terms of such warrants.

Warrants will be issued in registered form only. The exercise price for warrants will be subject to adjustment in accordance with the applicable prospectus supplement.

Each warrant will entitle the holder thereof to purchase such number of shares of common stock or preferred stock at such exercise price as shall in each case be set forth in, or calculable from, the prospectus supplement relating to the warrants, which exercise price may be subject to adjustment upon the occurrence of certain events as set forth in such prospectus supplement. After the close of business on the expiration date, or such later date to which such expiration date may be extended by us, unexercised warrants will become void. The place or places where, and the manner in which, warrants may be exercised shall be specified in the prospectus supplement relating to such warrants.

Prior to the exercise of any warrants to purchase common stock or preferred stock, holders of such warrants will not have any of the rights of holders of common stock or preferred stock, as the case may be, purchasable upon such exercise, including the right to receive payments of dividends, if any, on the common stock purchasable upon such exercise, or to exercise any applicable right to vote.

DESCRIPTION OF DEBT SECURITIES

This section describes the general terms of debt securities to which any prospectus supplement may relate. A prospectus supplement will describe the terms relating to any debt securities to be offered in greater detail, and may provide information that is different from this prospectus. If the information in the prospectus supplement differs with respect to the particular debt securities being offered from this prospectus, you should rely on the information in the prospectus supplement. The debt securities may be issued from time to time in one or more series. The particular terms of each series that are offered by a prospectus supplement will be described in the prospectus supplement.

We may conduct a portion of our operations through subsidiaries. Unless the debt securities are guaranteed by our subsidiaries as described below, the rights of our company and our creditors, including holders of the debt securities, to participate in the assets of any subsidiary upon the latter’s liquidation or reorganization will be subject to the prior claims of the subsidiary’s creditors, except to the extent that we may ourselves be a creditor with recognized claims against such subsidiary.

The debt securities will be either our senior debt securities or our subordinated debt securities. The senior debt securities and the subordinated debt securities will be issued under separate indentures among us, and any domestic subsidiaries that become guarantors of the debt securities (and are added as co-registrants to the registration statement of which this prospectus supplement forms a part), and a trustee that meets certain requirements and is selected by us (the “Trustee”). Senior debt securities will be issued under a “Senior Indenture” and subordinated debt securities will be issued under a “Subordinated Indenture.” Together, the Senior Indenture and the Subordinated Indenture are called “Indentures.”

We have summarized selected provisions of the Indentures below. The summary is not complete and is qualified in its entirety by express reference to the provisions of the Indentures. The form of each Indenture has been filed with the SEC as an exhibit to the registration statement of which this prospectus is a part, and you should read the Indentures for provisions that may be important to you. In the summary below, we have included references to article or section numbers of the applicable Indenture so that you can easily locate these provisions. Whenever we refer in this prospectus or in the prospectus supplement to particular article or sections or defined terms of the Indentures, those article or sections or defined terms are incorporated by reference herein or therein, as applicable. The Indentures will be subject to and governed by certain provisions of the Trust Indenture Act of 1939, and we refer you to the Indentures and the Trust Indenture Act for a statement of such provisions. Capitalized terms used in the summary have the meanings specified in the Indentures.

General

We may offer debt securities under this prospectus. The Indentures do not limit the aggregate amount of debt securities, and we may issue debt securities up to the aggregate principal amount which may be authorized from time to time by the board of directors. The Indentures provide that debt securities in separate series may be issued thereunder from time to time without limitation as to aggregate principal amount. We may specify a maximum aggregate principal amount for the debt securities of any series (Section 301). We will determine the terms and conditions of the debt securities, including the maturity, principal and interest, but those terms must be consistent with the Indenture. The debt securities will be our unsecured obligations.

The subordinated debt securities will be subordinated in right of payment to the prior payment in full of all of our Senior Debt as described under “—Subordination of Subordinated Debt Securities” and in the prospectus supplement applicable to any subordinated debt securities. If the prospectus supplement so indicates, the debt securities will be convertible into our common stock (Section 301).

The applicable prospectus supplement will set forth the price or prices at which the debt securities to be offered will be issued and will describe the following terms of such debt securities:

(1) the designation, aggregate principal amount and authorized denominations of the debt securities;

(2) whether the debt securities are senior debt securities or subordinated debt securities and, if subordinated debt securities, the related subordination terms;

(3) any limit on the aggregate principal amount of the debt securities;

(4) the dates on which the principal of the debt securities will be payable;

(5) the interest rate that the debt securities will bear and the interest payment dates for the debt securities;

(6) the places where payments on the debt securities will be payable;

(7) any terms upon which the debt securities may be redeemed, in whole or in part, at our option;

(8) any sinking fund or other provisions that would obligate us to repurchase or otherwise redeem the debt securities;

(9) the portion of the principal amount, if less than all, of the debt securities that will be payable upon declaration of acceleration of the Maturity of the debt securities;

(10) whether the debt securities are defeasible;

(11) any addition to or change in the Events of Default;

(12) whether the debt securities are convertible into our common stock and, if so, the terms and conditions upon which conversion will be effected, including the initial conversion price or conversion rate and any adjustments thereto and the conversion period;

(13) any addition to or change in the covenants in the Indenture applicable to the debt securities; and

(14) any other terms of the debt securities not inconsistent with the provisions of the Indenture (Section 301).

Senior Debt Securities

The senior debt securities will be our direct-unsecured obligations and will constitute senior indebtedness (in each case as defined in the applicable Supplemental Indenture) ranking on a parity with all of our other unsecured and unsubordinated indebtedness.

Subordination of Subordinated Debt Securities

The indebtedness evidenced by the subordinated debt securities will, to the extent set forth in the Subordinated Indenture with respect to each series of subordinated debt securities, be subordinate in right of payment to the prior payment in full of all of our Senior Debt, including the senior debt securities, and it may also be senior in right of payment to all of our Subordinated Debt (Article Twelve of the Subordinated Indenture). The prospectus supplement relating to any subordinated debt securities will summarize the subordination provisions of the Subordinated Indenture applicable to that series including:

▪the applicability and effect of such provisions upon any payment or distribution respecting that series following any liquidation, dissolution or other winding-up, or any assignment for the benefit of creditors or other marshaling of assets or any bankruptcy, insolvency or similar proceedings;

▪the applicability and effect of such provisions in the event of specified defaults with respect to any Senior Debt, including the circumstances under which and the periods in which we will be prohibited from making payments on the subordinated debt securities; and

▪the definition of Senior Debt applicable to the subordinated debt securities of that series and, if the series is issued on a senior subordinated basis, the definition of Subordinated Debt applicable to that series.

▪The prospectus supplement will also describe as of a recent date the approximate amount of Senior Debt to which the subordinated debt securities of that series will be subordinated.

The failure to make any payment on any of the subordinated debt securities by reason of the subordination provisions of the Subordinated Indenture described in the prospectus supplement will not be construed as preventing the occurrence of an Event of Default with respect to the subordinated debt securities arising from any such failure to make payment.

The subordination provisions described above will not be applicable to payments in respect of the subordinated debt securities from a defeasance trust established in connection with any legal defeasance or covenant defeasance of the subordinated debt securities as described under “—Legal Defeasance and Covenant Defeasance.”

Form, Exchange and Transfer

The debt securities of each series will be issuable only in fully registered form, without coupons, and, unless otherwise specified in the applicable prospectus supplement, only in denominations of $1,000 and integral multiples thereof (Section 302).

At the option of the Holder, subject to the terms of the applicable Indenture and the limitations applicable to Global Securities, debt securities of each series will be exchangeable for other debt securities of the same series of any authorized denomination and of a like tenor and aggregate principal amount (Section 305).

Subject to the terms of the applicable Indenture and the limitations applicable to Global Securities, debt securities may be presented for exchange as provided above or for registration of transfer (duly endorsed or with the form of transfer endorsed thereon duly executed) at the office of the Security Registrar or at the office of any transfer agent designated by us for such purpose. No service charge will be made for any registration of transfer or exchange of debt securities, but we may require payment of a sum sufficient to cover any tax or other governmental charge payable in that connection. Such transfer or exchange will be effected upon the Security Registrar or such transfer agent, as the case may be, being satisfied with the documents of title and identity of the person making the request. The Security Registrar and any other transfer agent initially designated by us for any debt securities will be named in the applicable prospectus supplement (Section 305). We may at any time designate additional transfer agents or rescind the designation of any transfer agent or approve a change in the office through which any transfer agent acts, except that we will be required to maintain a transfer agent in each Place of Payment for the debt securities of each series (Section 1002).

If the debt securities of any series (or of any series and specified tenor) are to be redeemed in part, we will not be required to (1) issue, register the transfer of or exchange any debt security of that series (or of that series and specified tenor, as the case may be) during a period beginning at the opening of business 15 days before the day of mailing of a notice of redemption of any such debt security that may be selected for redemption and ending at the close of business on the day of such mailing or (2) register the transfer of or exchange any debt security so selected for redemption, in whole or in part, except the unredeemed portion of any such debt security being redeemed in part (Section 305).

Global Securities

Some or all of the debt securities of any series may be represented, in whole or in part, by one or more Global Securities that will have an aggregate principal amount equal to that of the debt securities they represent. Each Global Security will be registered in the name of a Depositary or its nominee identified in the applicable prospectus supplement, will be deposited with such Depositary or nominee or its custodian and will bear a legend regarding the restrictions on exchanges and registration of transfer thereof referred to below and any such other matters as may be provided for pursuant to the applicable Indenture.

Notwithstanding any provision of the Indentures or any debt security described in this prospectus, no Global Security may be exchanged in whole or in part for debt securities registered, and no transfer of a Global Security in whole or in part may be registered, in the name of any person other than the Depositary for such Global Security or any nominee of such Depositary unless:

(1) the Depositary has notified us that it is unwilling or unable to continue as Depositary for such Global Security or has ceased to be qualified to act as such as required by the applicable Indenture, and in either case we fail to appoint a successor Depositary within 90 days;

(2) an Event of Default with respect to the debt securities represented by such Global Security has occurred and is continuing and the Trustee has received a written request from the Depositary to issue certificated debt securities; or

(3) other circumstances exist, in addition to or in lieu of those described above, as may be described in the applicable prospectus supplement.

All debt securities issued in exchange for a Global Security or any portion thereof will be registered in such names as the Depositary may direct (Sections 205 and 305).

As long as the Depositary, or its nominee, is the registered holder of a Global Security, the Depositary or such nominee, as the case may be, will be considered the sole owner and Holder of such Global Security and the debt securities that it represents for all purposes under the debt securities and the applicable Indenture (Section 308). Except in the limited circumstances referred to above, owners of beneficial interests in a Global Security will not be entitled to have such Global Security or any debt securities that it represents registered in their names, will not receive or be entitled to receive physical delivery of certificated debt securities in exchange for those interests and will not be considered to be the owners or Holders of such Global Security or any debt securities that is represents for any purpose under the debt securities or the applicable Indenture. All payments on a Global Security will be made to the Depositary or its nominee, as the case may be, as the Holder of the security. The laws of some jurisdictions require that some purchasers of debt securities take physical delivery of such debt securities in definitive form. These laws may impair the ability to transfer beneficial interests in a Global Security.

Ownership of beneficial interests in a Global Security will be limited to institutions that have accounts with the Depositary or its nominee (“Participants”) and to persons that may hold beneficial interests through Participants. In connection with the issuance of any Global Security, the Depositary will credit, on its book-entry registration and transfer system, the respective principal amounts of debt securities represented by the Global Security to the accounts of its Participants. Ownership of beneficial interests in a Global Security will be shown only on, and the transfer of those ownership interests will be effected only through, records maintained by the Depositary (with respect to Participants’ interests) or any such Participant (with respect to interests of persons held by such Participants on their behalf). Payments, transfers, exchanges and other matters relating to beneficial interests in a Global Security may be subject to various policies and procedures adopted by the Depositary from time to time. None of us, the Subsidiary Guarantors, the

Trustees or our agents, the Subsidiary Guarantors or the Trustees will have any responsibility or liability for any aspect of the Depositary’s or any Participant’s records relating to, or for payments made on account of, beneficial interests in a Global Security, or for maintaining, supervising or reviewing any records relating to such beneficial interests.

Payment and Paying Agents

Unless otherwise indicated in the applicable prospectus supplement, payment of interest on a debt security on any Interest Payment Date will be made to the Person in whose name such debt security (or one or more Predecessor Securities) is registered at the close of business on the Regular Record Date for such interest (Section 307).

Unless otherwise indicated in the applicable prospectus supplement, principal of and any premium and interest on the debt securities of a particular series will be payable at the office of such Paying Agent or Paying Agents as we may designate for such purpose from time to time, except that at our option payment of any interest on debt securities in certificated form may be made by check mailed to the address of the Person entitled thereto as such address appears in the Security Register. Unless otherwise indicated in the applicable prospectus supplement, the corporate trust office of the Trustee under the Senior Indenture in the City of New York will be designated as sole Paying Agent for payments with respect to senior debt securities of each series, and the corporate trust office of the Trustee under the Subordinated Indenture in the City of New York will be designated as the sole Paying Agent for payment with respect to subordinated debt securities of each series. Any other Paying Agents initially designated by us for the debt securities of a particular series will be named in the applicable prospectus supplement. We may at any time designate additional Paying Agents or rescind the designation of any Paying Agent or approve a change in the office through which any Paying Agent acts, except that we will be required to maintain a Paying Agent in each Place of Payment for the debt securities of a particular series (Section 1002).

All money paid by us to a Paying Agent for the payment of the principal of or any premium or interest on any debt security which remain unclaimed at the end of two years after such principal, premium or interest has become due and payable will be repaid to us, and the Holder of such debt security thereafter may look only to us for payment (Section 1003).

Consolidation, Merger and Sale of Assets

We may not consolidate with or merge into, or transfer, lease or otherwise dispose of all or substantially all of our assets to, any Person (a “successor Person”), and may not permit any Person to consolidate with or merge into us, unless:

(1) the successor Person (if any) is a corporation, partnership, trust or other entity organized and validly existing under the laws of any domestic jurisdiction and assumes our obligations on the debt securities and under the Indentures including the due and punctual payment of the principal of, any premium on, and any interest on, all of the outstanding debt securities and the performance of every covenant applicable to be performed or observed by us;

(2) immediately before and after giving pro forma effect to the transaction, no Event of Default, and no event which, after notice or lapse of time or both, would become an Event of Default, has occurred and is continuing;

(3) we deliver to the trustee an officer’s certificate and an opinion of counsel, each stating that such consolidation, merger, conveyance or transfer and such Supplemental Indenture comply with the foregoing provisions relating to such transaction; and

(4) several other conditions, including any additional conditions with respect to any particular debt securities specified in the applicable prospectus supplement, are met (Section 801).

Events of Default

Unless otherwise specified in the prospectus supplement, each of the following will constitute an Event of Default under the applicable Indenture with respect to debt securities of any series:

(1) failure to pay principal of or any premium on any debt security of that series when due, whether or not, in the case of subordinated debt securities, such payment is prohibited by the subordination provisions of the Subordinated Indenture;

(2) failure to pay any interest on any debt securities of that series when due, continued for 30 days, whether or not, in the case of subordinated debt securities, such payment is prohibited by the subordination provisions of the Subordinated Indenture;

(3) failure to deposit any sinking fund payment, when due, in respect of any debt security of that series, whether or not, in the case of subordinated debt securities, such deposit is prohibited by the subordination provisions of the Subordinated Indenture;

(4) failure to perform or comply with the provisions described under “—Consolidation, Merger and Sale of Assets”;

(5) failure to perform any of our other covenants in such Indenture (other than a covenant included in such Indenture solely for the benefit of a series other than that series), continued for 60 days after written notice has been given by the applicable Trustee, or the Holders of at least 25% in principal amount of the Outstanding debt securities of that series, as provided in such Indenture; and

(6) certain events of bankruptcy, insolvency or reorganization affecting us or any Significant Subsidiary.

If an Event of Default (other than an Event of Default with respect to Cumberland Pharmaceuticals Inc. described in clause (6) above) with respect to the debt securities of any series at the time Outstanding occurs and is continuing, either the applicable Trustee or the Holders of at least 25% in principal amount of the Outstanding debt securities of that series by notice as provided in the Indenture may declare the principal amount of the debt securities of that series (or, in the case of any debt security that is an Original Issue Discount Security, such portion of the principal amount of such debt security as may be specified in the terms of such debt security) to be due and payable immediately. If an Event of Default with respect to Cumberland Pharmaceuticals Inc. described in clause (6) above with respect to the debt securities of any series at the time Outstanding occurs, the principal amount of all the debt securities of that series (or, in the case of any such Original Issue Discount Security, such specified amount) will automatically, and without any action by the applicable Trustee or any Holder, become immediately due and payable. After any such acceleration, but before a judgment or decree based on acceleration, the Holders of a majority in principal amount of the Outstanding debt securities of that series may, under certain circumstances, rescind and annul such acceleration if all Events of Default, other than the non-payment of accelerated principal (or other specified amount), have been cured or waived as provided in the applicable Indenture (Section 502). For information as to waiver of defaults, see “—Modification and Waiver” below.

A default under other indebtedness of the Company will not be a default under the Indentures and a default under one series of debt securities will not necessarily be a default under another series. Any additions, deletions or other changes to the Events of Default which will apply to a series of debt securities will be described in the prospectus supplement relating to such series of debt securities.

Under the Indentures, the trustee must give to the holders of each series of debt securities notice of all uncured defaults known to it with respect to such series within 90 days after such a default occurs (the term default to include the events specified above without notice or grace periods). However, except in the case of default in the payment of principal of, any premium on, or any interest on any of the debt securities, or default in the payment of any sinking or purchase fund installment or analogous obligations, the trustee shall be protected in withholding such notice if it in good faith determines that the withholding of such notice is in the interests of the holders of the debt securities of such series (Section 602).

Subject to the provisions of the Indentures relating to the duties of the Trustees in case an Event of Default has occurred and is continuing, each Trustee will be under no obligation to exercise any of its rights or powers under the applicable Indenture at the request or direction of any of the Holders, unless such Holders have offered to such Trustee reasonable indemnity (Section 603). Subject to such provisions for the indemnification of the Trustees, the Holders of a majority in principal amount of the Outstanding debt securities of any series will have the right to direct the time, method and place of conducting any proceeding for any remedy available to the Trustee or exercising any trust or power conferred on the Trustee with respect to the debt securities of that series (Section 512).

No Holder of a debt security of any series will have any right to institute any proceeding with respect to the applicable Indenture, or for the appointment of a receiver or a trustee, or for any other remedy thereunder, unless:

(1) such Holder has previously given to the Trustee under the applicable Indenture written notice of a continuing Event of Default with respect to the debt securities of that series;

(2) the Holders of at least 25% in principal amount of the Outstanding debt securities of that series have made written request, and such Holder or Holders have offered reasonable indemnity, to the Trustee to institute such proceeding as trustee; and

(3) the Trustee has failed to institute such proceeding, and has not received from the Holders of a majority in principal amount of the Outstanding debt securities of that series a direction inconsistent with such request, within 60 days after such notice, request and offer (Section 507).

However, such limitations do not apply to a suit instituted by a Holder of a debt security for the enforcement of payment of the principal of or any premium or interest on such debt security on or after the applicable due date specified in such debt security or, if applicable, to convert such debt security (Section 508).

We will be required to furnish to each Trustee annually a statement by certain of our officers as to whether or not we, to their knowledge, are in default in the performance or observance of any of the terms, provisions and conditions of the applicable Indenture and, if so, specifying all such known defaults (Section 1004).

Modification and Waiver

We and the trustee may, without the consent of the holders of the debt securities, enter into one or more Supplemental Indentures for, among others, one or more of the following purposes, provided that in the case of clauses (2), (3), (4) and (6), the interests of the holders of debt securities would not be adversely affected:

(1) to evidence the succession of another corporation to us, and the assumption by such successor of our obligations under the applicable Indenture and the debt securities of any series;

(2) to add covenants by us, or surrender any of our rights conferred by the applicable Indenture, for the benefit of the holders of debt securities of any or all series;

(3) to cure any ambiguity, omission, defect or inconsistency in or make any other provision with respect to questions arising under the applicable Indenture;

(4) to establish the form or terms of any series of debt securities, including any subordinated securities;

(5) to evidence and provide for the acceptance of any successor trustee with respect to one or more series of debt securities or to facilitate the administration of the trusts thereunder by one or more trustees in accordance with the applicable Indenture; and

(6) to provide any additional Events of Default (Section 901).

Modifications and amendments of an Indenture may be made by us, the Subsidiary Guarantors, if applicable, and the applicable Trustee with the consent of the Holders of a majority in principal amount of the Outstanding debt securities of each series affected by such modification or amendment; provided, however, that no such modification or amendment may, without the consent of the Holder of each Outstanding debt security affected thereby:

(1) change the Stated Maturity of the principal of, or any installment of principal of or interest on, any debt security;

(2) reduce the principal amount of, or any premium or interest on, any debt security;

(3) reduce the amount of principal of an Original Issue Discount Security or any other debt security payable upon acceleration of the Maturity thereof;

(4) change the place or currency of payment of principal of, or any premium or interest on, any debt security;

(5) impair the right to institute suit for the enforcement of any payment due on or any conversion right with respect to any debt security;

(6) modify the subordination provisions in the case of subordinated debt securities, or modify any conversion provisions, in either case in a manner adverse to the Holders of the subordinated debt securities;

(7) reduce the percentage in principal amount of Outstanding debt securities of any series, the consent of whose Holders is required for modification or amendment of the Indenture;

(8) reduce the percentage in principal amount of Outstanding debt securities of any series necessary for waiver of compliance with certain provisions of the Indenture or for waiver of certain defaults; or

(9) modify such provisions with respect to modification, amendment or waiver (Section 902).

The Holders of a majority in principal amount of the Outstanding debt securities of any series may waive compliance by us with certain restrictive provisions of the applicable Indenture (Section 1009). The Holders of a majority in principal amount of the Outstanding debt securities of any series may waive any past default under the applicable Indenture, except a default in the payment of principal, premium or interest and certain covenants and provisions of the Indenture which cannot be amended without the consent of the Holder of each Outstanding debt security of such series (Section 513).

Each of the Indentures provides that in determining whether the Holders of the requisite principal amount of the Outstanding debt securities have given or taken any direction, notice, consent, waiver or other action under such Indenture as of any date:

(1) the principal amount of an Original Issue Discount Security that will be deemed to be Outstanding will be the amount of the principal that would be due and payable as of such date upon acceleration of maturity to such date;

(2) if, as of such date, the principal amount payable at the Stated Maturity of a debt security is not determinable (for example, because it is based on an index), the principal amount of such debt security deemed to be Outstanding as of such date will be an amount determined in the manner prescribed for such debt security; and

(3) the principal amount of a debt security denominated in one or more foreign currencies or currency units that will be deemed to be Outstanding will be the United States-dollar equivalent, determined as of such date in the manner prescribed for such debt security, of the principal amount of such debt security (or, in the case of a debt security described in clause (1) or (2) above, of the amount described in such clause).

Certain debt securities, including those owned by us or any of our other Affiliates, will not be deemed to be Outstanding (Section 101). Except in certain limited circumstances, we will be entitled to set any day as a record date for the purpose of determining the Holders of Outstanding debt securities of any series entitled to give or take any direction, notice, consent, waiver or other action under the applicable Indenture, in the manner and subject to the limitations provided in the Indenture. In certain limited circumstances, the Trustee will be entitled to set a record date for action by Holders. If a record date is set for any action to be taken by Holders of a particular series, only persons who are Holders of Outstanding debt securities of that series on the record date may take such action. To be effective, such action must be taken by Holders of the requisite principal amount of such debt securities within a specified period following the record date. For any particular record date, this period will be 180 days or such other period as may be specified by us (or the Trustee, if it set the record date), and may be shortened or lengthened (but not beyond 180 days) from time to time (Section 104).

Satisfaction and Discharge

Each Indenture will be discharged and will cease to be of further effect as to all Outstanding debt securities of any series issued thereunder, when:

(1) either:

(a) all Outstanding debt securities of that series that have been authenticated (except lost, stolen or destroyed debt securities that have been replaced or paid and debt securities for whose payment money has theretofore been deposited in trust and thereafter repaid to us) have been delivered to the Trustee for cancellation; or

(b) all outstanding debt securities of that series that have not been delivered to the Trustee for cancellation have become due and payable or will become due and payable at their Stated Maturity within one year or are to be called for redemption within one year under arrangements satisfactory to the Trustee and in any case we have irrevocably deposited with the Trustee as trust funds money in an amount sufficient, without consideration of any reinvestment of interest, to pay the entire indebtedness of such debt securities not delivered to the Trustee for cancellation, for principal, premium, if any, and accrued interest to the Stated Maturity or redemption date;

(2) we have paid or caused to be paid all other sums payable by us under the Indenture with respect to the debt securities of that series; and

(3) we have delivered an Officers’ Certificate and an Opinion of Counsel to the Trustee stating that all conditions precedent to satisfaction and discharge of the Indenture with respect to the debt securities of that series have been satisfied (Article Four).

Legal Defeasance and Covenant Defeasance

If and to the extent indicated in the applicable prospectus supplement, we may elect, at our option at any time, to have the provisions of Section 1502, relating to defeasance and discharge of indebtedness, which we call “legal defeasance” or Section 1503, relating to defeasance of certain restrictive covenants applied to the debt securities of any series, or to any specified part of a series, which we call “covenant defeasance” (Section 1501).

Legal Defeasance. The Indentures provide that, upon our exercise of our option (if any) to have Section 1502 applied to any debt securities, we will be discharged from all our obligations, and, if such debt securities are subordinated debt securities, the provisions of the Subordinated Indenture relating to subordination will cease to be effective, with respect to such debt securities (except for certain obligations to convert, exchange or register the transfer of debt securities, to replace stolen, lost or mutilated debt securities, to maintain paying agencies and to hold moneys for payment in trust) upon the deposit in trust for the benefit of the Holders of such debt securities of money or United States Government Obligations, or both, which, through the payment of principal and interest in respect thereof in accordance with their terms, will provide money in an amount sufficient to pay the principal of and any premium and interest on such debt securities on the respective Stated Maturities in accordance with the terms of the applicable Indenture and such debt securities. Such defeasance or discharge may occur only if, among other things:

(1) we have delivered to the applicable Trustee an Opinion of Counsel to the effect that we have received from, or there has been published by, the United States Internal Revenue Service a ruling, or there has been a change in tax law, in either case to the effect that Holders of such debt securities will not recognize gain or loss for federal income tax purposes as a result of such deposit and legal defeasance and will be subject to federal income tax on the same amount, in the same manner and at the same times as would have been the case if such deposit and legal defeasance were not to occur;

(2) no Event of Default or event that with the passing of time or the giving of notice, or both, shall constitute an Event of Default shall have occurred and be continuing at the time of such deposit or, with respect to any Event of Default described in clause (6) under “—Events of Default,” at any time until 121 days after such deposit;

(3) such deposit and legal defeasance will not result in a breach or violation of, or constitute a default under, any agreement or instrument to which we are a party or by which we are bound;

(4) in the case of subordinated debt securities, at the time of such deposit, no default in the payment of all or a portion of principal of (or premium, if any) or interest on any of our Senior Debt shall have occurred and be continuing, no event of default shall have resulted in the acceleration of any of our Senior Debt and no other event of default with respect to any of our Senior Debt shall have occurred and be continuing permitting after notice or the lapse of time, or both, the acceleration thereof; and

(5) we have delivered to the Trustee an Opinion of Counsel to the effect that such deposit shall not cause the Trustee or the trust so created to be subject to the Investment Company Act of 1940 (Sections 1502 and 1504).

Covenant Defeasance. The Indentures provide that, upon our exercise of our option (if any) to have Section 1503 applied to any debt securities, we may omit to comply with certain restrictive covenants (but not to conversion, if applicable), including those that may be described in the applicable prospectus supplement, the occurrence of certain Events of Default, which are described above in clause (5) (with respect to such restrictive covenants) and clause (6) (with respect only to Significant Subsidiaries) under “Events of Default” and any that may be described in the applicable prospectus supplement, will not be deemed to either be or result in an Event of Default and, if such debt securities are subordinated debt securities, the provisions of the Subordinated Indenture relating to subordination will cease to be effective, in each case with respect to such debt securities. In order to exercise such option, we must deposit, in trust for the benefit of the Holders of such debt securities, money or United States Government Obligations, or both, which, through the payment of principal and interest in respect thereof in accordance with their terms, will provide money in an amount sufficient to pay the principal of and any premium and interest on such debt securities on the respective Stated Maturities in accordance with the terms of the applicable Indenture and such debt securities. Such covenant defeasance may occur only if we have delivered to the applicable Trustee an Opinion of Counsel that in effect says that Holders of such debt securities will not recognize gain or loss for federal income tax purposes as a result of such deposit and covenant defeasance and will be subject to federal income tax on the same amount, in the same manner and at the same times as would have been the case if such deposit and covenant defeasance were not to occur, and the requirements set forth in clauses (2), (3), (4) and (5) above are satisfied. If we exercise this option with respect to any debt securities and such debt securities were declared due and payable because of the occurrence of any Event of Default, the amount of money and United States Government Obligations so deposited in trust would be sufficient to pay amounts due on such debt securities at the time of their respective Stated Maturities but may not be sufficient to pay amounts due on such debt securities upon any acceleration resulting from such Event of Default. In such case, we would remain liable for such payments (Sections 1503 and 1504).

If we exercise either our legal defeasance or covenant defeasance option, any Subsidiary Guarantees will terminate (Section 1304).

Notices

Notices to Holders of debt securities will be given by mail to the addresses of such Holders as they may appear in the Security Register (Sections 101 and 106).

Title

We, the Subsidiary Guarantors, the Trustees and any agent of us, the Subsidiary Guarantors or a Trustee may treat the Person in whose name a debt security is registered as the absolute owner of the debt security (whether or not such debt security may be overdue) for the purpose of making payment and for all other purposes (Section 308).

Governing Law

The Indentures and the debt securities will be governed by, and construed in accordance with, the law of the State of New York (Section 112).

DESCRIPTION OF UNITS

We may issue units comprised of common stock, preferred stock, warrants and other securities in any combination. We may issue units in such amounts and in as many distinct series as we wish. This section outlines certain provisions of the units that we may issue. If we issue units, they will be issued under one or more unit agreements to be entered into between us and a bank or other financial institution, as unit agent. The information described in this section may not be complete in all respects and is qualified entirely by reference to the unit agreement with respect to the units of any particular series. The specific terms of any series of units offered will be described in the applicable prospectus supplement. If so described in a particular supplement, the specific terms of any

series of units may differ from the general description of terms presented below. We urge you to read any prospectus supplement related to any series of units we may offer, as well as the complete unit agreement and unit certificate that contain the terms of the units. If we issue units, forms of unit agreements and unit certificates relating to such units will be incorporated by reference as exhibits to the registration statement, which includes this prospectus.

Each unit that we may issue will be issued so that the holder of the unit is also the holder of each security included in the unit. Thus, the holder of a unit will have the rights and obligations of a holder of each included security. The unit agreement under which a unit is issued may provide that the securities included in the unit may not be held or transferred separately, at any time or at any time before a specified date. The applicable prospectus supplement may describe:

▪the designation and terms of the units and of the securities comprising the units, including whether and under what circumstances those securities may be held or transferred separately;

▪any provisions of the governing unit agreement;

▪the price or prices at which such units will be issued;

▪the applicable U.S. federal income tax considerations relating to the units;

▪any provisions for the issuance, payment, settlement, transfer or exchange of the units or of the securities comprising the units; and

▪any other terms of the units and of the securities comprising the units.

The provisions described in this section, as well as those described under "Description of Common Stock", "Description of Preferred Stock," and "Description of Warrants" will apply to the securities included in each unit, to the extent relevant and as may be updated in any prospectus supplements.

Issuance in Series

We may issue units in such amounts and in as many distinct series as we wish. This section summarizes terms of the units that apply generally to all series. Most of the financial and other specific terms of your series will be described in the applicable prospectus supplement.

Unit Agreements

We will issue the units under one or more unit agreements to be entered into between us and a bank or other financial institution, as unit agent. We may add, replace or terminate unit agents from time to time. We will identify the unit agreement under which each series of units will be issued and the unit agent under that agreement in the applicable prospectus supplement.

The following provisions will generally apply to all unit agreements unless otherwise stated in the applicable prospectus supplement:

Modification without Consent

We and the applicable unit agent may amend any unit or unit agreement without the consent of any holder:

▪to cure any ambiguity in any provisions of the governing unit agreement that differ from those described below;

▪to correct or supplement any defective or inconsistent provision; or

▪to make any other change that we believe is necessary or desirable and will not adversely affect the interests of the affected holders in any material respect.

We do not need any approval to make changes that affect only units to be issued after the changes take effect. We may also make changes that do not adversely affect a particular unit in any material respect, even if they adversely affect other units in a material respect. In those cases, we do not need to obtain the approval of the holder of the unaffected unit; we need only obtain any required approvals from the holders of the affected units.

Modification with Consent

We may not amend any particular unit or a unit agreement with respect to any particular unit unless we obtain the consent of the holder of that unit, if the amendment would:

▪impair any right of the holder to exercise or enforce any right under a security included in the unit if the terms of that security require the consent of the holder to any changes that would impair the exercise or enforcement of that right; or

▪reduce the percentage of outstanding units or any series or class the consent of whose holders is required to amend that series or class, or the applicable unit agreement with respect to that series or class, as described below.

Any other change to a particular unit agreement and the units issued under that agreement would require the following approval:

▪If the change affects only the units of a particular series issued under that agreement, the change must be approved by the holders of a majority of the outstanding units of that series; or

▪If the change affects the units of more than one series issued under that agreement, it must be approved by the holders of a majority of all outstanding units of all series affected by the change, with the units of all the affected series voting together as one class for this purpose.

These provisions regarding changes with majority approval also apply to changes affecting any securities issued under a unit agreement, as the governing document.

In each case, the required approval must be given by written consent.

Unit Agreements Will Not Be Qualified under Trust Indenture Act

No unit agreement will be qualified as an indenture, and no unit agent will be required to qualify as a trustee, under the Trust Indenture Act. Therefore, holders of units issued under unit agreements will not have the protections of the Trust Indenture Act with respect to their units.

Mergers and Similar Transactions Permitted; No Restrictive Covenants or Events of Default

The unit agreements will not restrict our ability to merge or consolidate with, or sell our assets to, another corporation or other entity or to engage in any other transactions. If at any time we merge or consolidate with, or sell our assets substantially as an entirety to, another corporation or other entity, the successor entity will succeed to and assume our obligations under the unit agreements. We will then be relieved of any further obligation under these agreements.

The unit agreements will not include any restrictions on our ability to put liens on our assets, including our interests in our subsidiaries, nor will they restrict our ability to sell our assets. The unit agreements also will not provide for any events of default or remedies upon the occurrence of any events of default.

Governing Law

The unit agreements and the units will be governed by New York law.

Form, Exchange and Transfer

We will issue each unit in global—i.e., book-entry—form only. Units in book-entry form will be represented by a global security registered in the name of a depositary, which will be the holder of all the units represented by the global security. Those who own beneficial interests in a unit will do so through participants in the depositary's system, and the rights of these indirect owners will be governed solely by the applicable procedures of the depositary and its participants. We will describe book-entry securities, and other terms regarding the issuance and registration of the units in the applicable prospectus supplement.

Each unit and all securities comprising the unit will be issued in the same form.

If we issue any units in registered, non-global form, the following will apply to them:

The units will be issued in the denominations stated in the applicable prospectus supplement. Holders may exchange their units for units of smaller denominations or combined into fewer units of larger denominations, as long as the total amount is not changed.

Holders may exchange or transfer their units at the office of the unit agent. Holders may also replace lost, stolen, destroyed or mutilated units at that office. We may appoint another entity to perform these functions or perform them ourselves.

Holders will not be required to pay a service charge to transfer or exchange their units, but they may be required to pay for any tax or other governmental charge associated with the transfer or exchange. The transfer or exchange, and any replacement, will be made only if our transfer agent is satisfied with the holder's proof of legal ownership. The transfer agent may also require an indemnity before replacing any units.