false

0001043961

0001043961

2023-12-14

2023-12-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE

ACT OF 1934

Date of report (Date of earliest event reported):

December 14, 2023

PRECIPIO,

INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware |

|

001-36439 |

|

91-1789357 |

| (State of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

4 Science Park, New Haven,

CT 06511

(Address of principal

executive offices) (Zip Code)

(203) 787-7888

(Registrant's telephone

number, including area code)

Not

Applicable

(Former name, former address and former fiscal year, if changed

since last report date)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

|

|

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class |

Ticker symbol(s) |

Name of each exchange on which

registered |

| Common Stock, $0.01 par value per share |

PRPO |

Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange

Act of 1934.

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 |

Regulation FD Disclosure |

On December 14, 2023,

the Company issued a press release in which the Company’s management shared its thoughts on 2023, and provided look ahead to 2024.

The press release is furnished as Exhibit 99.1 and incorporated herein by reference.

Forward-Looking Statements

The information in this Current Report on Form 8-K, including Exhibit

99.1 attached hereto, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall

it be deemed subject to the requirements of amended Item 10 of Regulation S-K, nor shall it be deemed incorporated by reference into any

filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof,

regardless of any general incorporation language in such filing. The furnishing of this information hereby shall not be deemed an admission

as to the materiality of any such information. Statement in this report that are not strictly historical in nature constitute “forward-looking

statements.” Such forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause actual

results to be materially different from any results expressed or implied by such forward-looking statements. Risk factors that may cause

actual results to differ are discussed in the Company’s SEC filings. All forward-looking statements are qualified in their entirety

by this cautionary statement. The Company is providing this information as of this date and does not undertake any obligation to update

any forward-looking statements contained in this report as a result of new information, future events or otherwise.

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

PRECIPIO, INC. |

| |

|

| |

|

| |

By: |

/s/ Ilan Danieli |

| |

Name: |

Ilan Danieli |

| |

Title: |

Chief Executive Officer |

Exhibit 99.1

Precipio Management

Shares Thoughts on 2023, and Looks Ahead To 2024

NEW HAVEN, CT, Globenewswire

– (December 14, 2023) – Management of specialty cancer diagnostics company Precipio, Inc. (NASDAQ:

PRPO) shares thoughts and reflections looking back at 2023, and forward to 2024.

At the start of 2023,

management set three goals, all focused on achieving cash flow breakeven going forward:

| 1. | Target #1: For the pathology division, reaching estimated annualized revenues of $14M, which was

expected to enable the division to achieve cash flow breakeven based on its cost structure. |

| 2. | Target #2: For the products division, reaching estimated annualized revenues of $8M, which was

expected to enable the division, and therefore the entire company, to achieve cash flow breakeven based on the company cost structure

at the time. |

| 3. | Target #3: Maintaining or improving the company’s cost structure, to ensure that Target #1

and Target #2 do not have to be increased. |

On our last shareholders

call on November 20, 2023, management announced that the company had achieved two of its three goals: it achieved Target #1, surpassing

$3.75M in pathology division revenues in Q3 (equivalent to estimated annualized revenues of $14M); it also exceeded Target #3

through substantial cost reduction initiatives, resulting in a significant reduction in the company’s cash burn from $2.5M/quarter

in Q3-2022, to $1M/quarter in Q3-2023.

As a direct outcome of

achieving Target #1 and #3, the company’s Target #2 for the products division to enable the division, and therefore the entire company

to achieve cash flow breakeven based on the current cost structure - is $6M instead of $8M. As disclosed in our recent 10Q filing for

Q3-2023, the company reached ~$0.85M in product revenue for the third quarter.

In Q3-2023 the company

reported $4.5M in quarterly revenues for the pathology and products divisions, a 50% YoY increase to approximately $18.5M in annualized

run-rate revenues. In 2024, if the company achieves a growth rate of ~50% and maintains the current cost structure, the company could

reach ~$30M in annual run-rate revenue, which would likely result in positive cash flow during the second half of 2024. Management hopes

that the market will reward such performance with a higher revenue multiple than the current 0.5x revenue multiple implied in the company

market cap and share price.

We would like to remind

shareholders to expect more quarter-to-quarter volatility in pathology division revenue than in product division revenue. The pathology

division revenues are more prone to fluctuations because they are driven by individual physician behaviors, patient testing frequency,

and unique testing orders for their patient testing, as opposed to laboratories using our products that have relatively consistent testing

volumes.

In addition, in the products

division, we are focusing on larger accounts to maximize our selling effectiveness, and therefore, sales growth in that division is likely

to come in spurts rather than slow steady increases as might be more likely to occur in the pathology division. Therefore, we are more

focused on meeting our product division goals. We expect Q4-2023 revenues to be approximately $3.2-$3.5M, and end 2023 with estimated

revenues for the year of approximately $14.5M, an increase of approximately 50% from $9.8M year-end revenues of 2022.

“In 2023 we set

aggressive goals, and as of Q3, we have met two of the three goals. In doing so, we have significantly altered the company’s cost

structure. The team’s primary focus is on reaching and exceeding the product division revenue goals, and getting the company to

breakeven as quickly as possible”, said Ilan Danieli, CEO. “Furthermore, as we continue to grow our share of this $400M+ HemeScreen

market, and disrupt the diagnostic market by bringing these (and other) tests to the point-of-care, we believe we are facing a huge opportunity

to build a significant business.”

About Precipio

Precipio has built a platform designed to eradicate

the problem of misdiagnosis by harnessing the intellect, expertise and technology developed within academic institutions and delivering

quality diagnostic information to physicians and their patients worldwide, as well as proprietary products that serve laboratories worldwide.

Through its collaborations with world-class academic institutions specializing in cancer research, diagnostics and treatment, Precipio

offers a new standard of diagnostic accuracy enabling the highest level of patient care. For more information, please visit www.precipiodx.com.

Please follow us on LinkedIn, X @PrecipioDx

and on Facebook.

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended. All statements contained in this press release that do not relate to matters of historical fact should be considered

forward-looking statements, including, without limitation, statements regarding the targets set herein and related timing.

Except for historical information, statements

about future volumes, sales, growth, costs, cost savings, margins, earnings, earnings per share, diluted earnings per share, cash flows,

plans, objectives, expectations, growth or profitability are forward-looking statements based on management’s estimates, beliefs,

assumptions and projections. Words such as “could,” “may,” “expects,” “anticipates,” “will,”

“targets,” “goals,” “projects,” “intends,” “plans,” “believes,”

“seeks,” “estimates,” “predicts,” and variations on such words, and similar expressions that reflect

our current views with respect to future events and operational, economic and financial performance, are intended to identify such forward-looking

statements. These forward-looking statements are only predictions based on management’s current expectations. These statements are

neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual

results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied

by the forward-looking statements, including, but not limited to, the important factors discussed under the caption “Risk Factors”

in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, Quarterly Report on Form 10-Q for the three months ended

September 30, 2023, and our other reports filed with the U.S. Securities and Exchange Commission. Any such forward-looking statements

represent management’s estimates as of the date of this press release only. While we may elect to update such forward-looking statements

at some point in the future, except as required by law, we disclaim any obligation to do so, even if subsequent events cause our views

to change. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date

of this press release.

Inquiries:

investors@precipiodx.com

+1-203-787-7888

Ext. 523

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

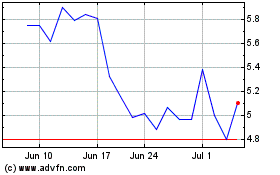

Precipio (NASDAQ:PRPO)

Historical Stock Chart

From Mar 2024 to Apr 2024

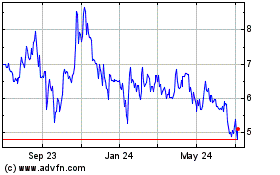

Precipio (NASDAQ:PRPO)

Historical Stock Chart

From Apr 2023 to Apr 2024